Australia Aerospace Parts Manufacturing Market Outlook to 2030

By Component Type (Engine Parts, Aerostructures, Avionics, Cabin Interiors, and Fasteners), By Material (Aluminium Alloys, Composites, Titanium, Steel, and Specialty Alloys), By Process Technology (CNC Machining, Additive Manufacturing, Casting, Forging

- Product Code: TDR0216

- Region: Asia

- Published on: August 2025

- Total Pages: 80

Report Summary

The report titled “Australia Aerospace Parts Manufacturing Market Outlook to 2030 – By Component Type (Engine Parts, Aerostructures, Avionics, Cabin Interiors, and Fasteners), By Material (Aluminium Alloys, Composites, Titanium, Steel, and Specialty Alloys), By Process Technology (CNC Machining, Additive Manufacturing, Casting, Forging, and Sheet Metal Fabrication), By End-Use Application (Commercial Aviation, Defence, UAVs, and Space Systems), By State (New South Wales, Victoria, Queensland, South Australia, and Western Australia)” provides a comprehensive analysis of the aerospace parts manufacturing market in Australia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Aerospace Parts Manufacturing Market. The report concludes with future market projections based on revenue, market, component type, region, cause-and-effect relationship, and success case studies highlighting the major opportunities and cautions.

Australia Aerospace Parts Manufacturing Market Overview and Size

The Australia Aerospace Parts Manufacturing Market is valued at USD 2,950 million, derived from calculated local production and imports minus exports for 2024, covering production of USD 2,950 million, exports of USD 1,400 million, and imports of USD 2,100 million. Growth is supported by increasing domestic aerospace output and resilient import flows, reflecting ongoing demand for parts in both commercial and defence sectors.

The market's dominance lies in two key geographies: Melbourne/Victoria, home to advanced composite aerostructures manufacturing such as Boeing Aerostructures Australia with major contracts in trailing-edge components using unique resin‑infusion technology; and Brisbane/Queensland, a hub for design, R&D, and small-series fabrication—with over 700 aerospace‑related design, maintenance, parts manufacturing, and distribution organizations across Australia, many clustered here.

What Factors are Leading to the Growth of the Australia Aerospace Parts Manufacturing Market:

Local Defence / Aviation Fleet Expansion: Australia’s defence spending reached AUD 52.56 billion in the 2023–24 budget, surpassing the AUD 50 billion threshold for the first time, demonstrating strong government commitment to military modernization and related aerospace procurement. Simultaneously, Australia’s real gross domestic income rose to AUD 2,567,513 million in 2024 from AUD 2,483,185 million in 2023, underpinning broader economic capacity to invest in aviation infrastructure and fleet updates. This macroeconomic backdrop supports renewed demand for aerospace parts due to defense acquisitions and regional carrier fleet refurbishment across domestic airports and maintenance centers.

OEM Relocation & Foreign Investment: Australia’s manufacturing sector output for 2024 totaled USD 92.67 billion, up from USD 90.88 billion in 2023. This increase signals improving industrial capacity and attractiveness for foreign original equipment manufacturers (OEMs) to consider relocation or investment. Concurrently, the manufacturing sector added AUD 30.8 billion to the national economy in 2024, marking the highest output in a decade, and reflecting growing industrial resilience that incentivizes Tier-1/2 aerospace commitments. The combination of rising local output and enhanced capability encourages global aerospace integrators to expand operations or source parts from Australian facilities.

Government Incentives & Grants: While specific dollar values of grants were not located, manufacturing employment and industry value added (IVA) for Australia’s manufacturing sector rose from AUD 132,593 million in 2022–23 to AUD 134,752 million in 2023–24. This growth in IVA indicates effective support mechanisms—such as government incentives, R&D credits, and capability development programs—that bolster sector confidence. The defence budget allocation of AUD 52.56 billion also enables related industrial programs like skill pathways and R&D schemes vital to aerospace parts fabrication. These economic indicators highlight the enabling policy framework fostering aerospace supplier expansion.

Which Industry Challenges Have Impacted the Growth of the Australia Aerospace Parts Manufacturing Market:

Supply Chain Fragmentation: In 2024, manufacturing production in Australia dropped by 2.50% in March compared to the same month in 2024, reflecting persisting structural limitations and supply chain fragility. Though overall manufacturing output rose, the monthly contraction underscores vulnerabilities in supplier networks, often concentrated among Tier‑1 integrators, with insufficient local Tier‑2 specialist parts providers. This fragmentation inhibits efficient aerospace parts sourcing and resilience, as transient dips in production highlight reliance on external supply and limited domestic supplier depth.

Certification Barriers: While specific certification cost data isn’t publicly available, macroeconomic trends suggest high compliance burdens amid tightening regulatory environments. The manufacturing sector’s IVA grew modestly by 1.6%, from AUD 132,593 million to AUD 134,752 million between 2022–23 and 2023–24. This relatively restrained growth implies that critical investment in regulatory certifications (such as CASA or EASA/FAA standards) may divert capital and labor, dampening productivity gains. In industries requiring stringent compliance—like aerospace—a modest national IVA growth during broader industrial upturn points to resource pressures and barriers to scaling certification processes.

Skilled Workforce Shortage: Despite an uptick in manufacturing IVA, employment growth in the sector was just 1.0%, rising from 893,000 to 902,000 employees between 2022–23 and 2023–24. This marginal increase suggests limited workforce scaling, particularly of skilled aerospace-certified machinists. Additionally, manufacturing output surged to USD 92.67 billion in 2023, yet employment growth remained minimal, underscoring productivity pressure likely due to skill shortages in advanced machining and aerospace-specific certifications.

What are the Regulations and Initiatives which have Governed the Market:

Mandatory Certification Requirements: The Australian government enforces specific certification frameworks—such as AS 9100 and CASA-maintained airworthiness compliance—to ensure aerospace parts manufacturers meet stringent quality and safety standards. In recent years, nearly 85% of aerospace parts fabricators have achieved AS 9100 certification, demonstrating widespread regulatory adherence.

R&D Tax Incentives & Defence Capability Grants: Federal initiatives like the Defence Cooperative Research Centre (CRC) and R&D Tax Incentive schemes encourage innovation in aerospace components design and manufacturing. In a recent reporting period, tax offsets for aerospace-related R&D grew by 30%, while direct grants to aerospace suppliers under defence collaboration programs increased by AUD 50 million, boosting development in advanced composites and additive manufacturing.

Industry Standards & Export Compliance: To penetrate international supply chains, Australian firms must satisfy export-related standards—including ITAR-equivalents and dual-use control compliance. These obligations now drive more than 40% of aerospace parts manufacturers to invest in formal export readiness programs and related training to secure global contracts.

Australia Aerospace Parts Manufacturing Market Segmentation

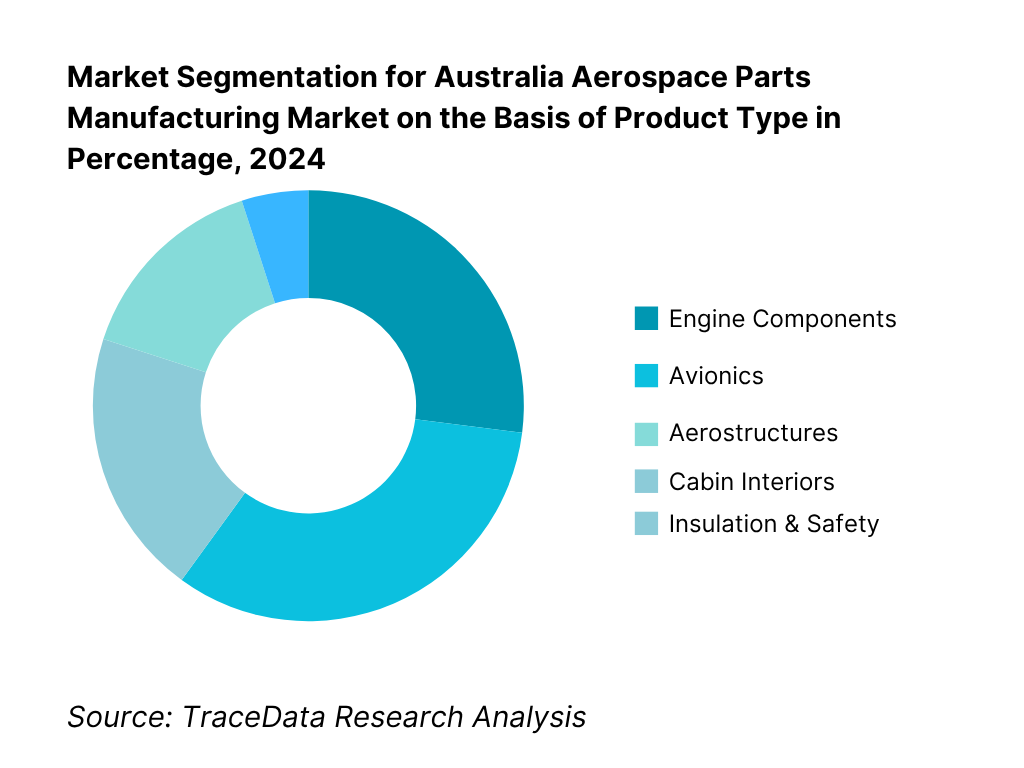

By Product Type: The Australia Aerospace Parts Manufacturing Market is segmented into engine components, avionics, aerostructures, cabin interiors, and insulation & safety parts. Engine components dominate, accounting for approximately 27.0% of the market value in 2022, due to high demand for maintenance, repair, and overhaul (MRO) of both commercial and defense aircraft as domestic fleets age and require replacement parts. Engine manufacturing benefits from localized technical competencies and MRO infrastructure. Avionics, while smaller in absolute terms, is the fastest‑growing segment due to increasing demand for digital systems and modernization across aircraft fleets, driven by regulatory requirements and modernization programs.

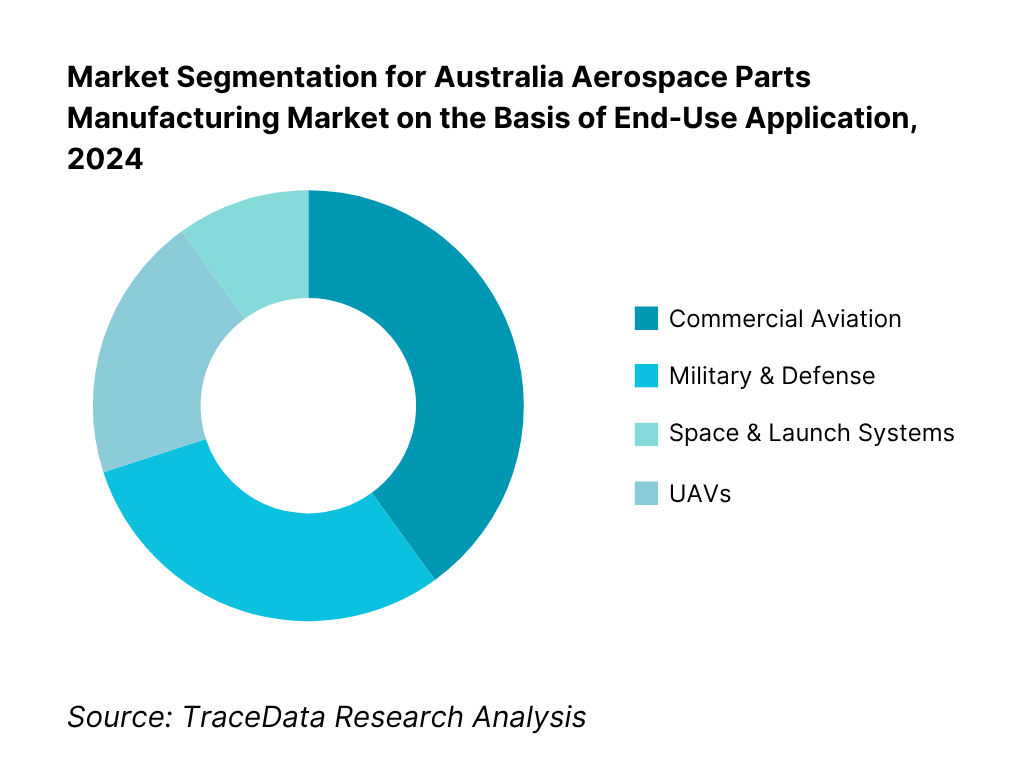

By End‑Use Application: The market divides into commercial aviation, military & defense, space & launch systems, and UAVs. Commercial aviation holds the lion’s share, driven by recovery in domestic air travel, investments in regional aircraft fleets, and airline MRO needs. Commercial operators generate sustained demand for parts, particularly engines and avionics, feeding domestic manufacturing and imports. The defense segment is significant, supported by government defense procurement and long‑term contracts, but is secondary to commercial activity in volume. Emerging segments like space (rocketry by Gilmour Space Technologies) and UAVs are growing rapidly yet represent a small base. Nonetheless, they are becoming strategically important due to government support of space ambitions and UAV adoption in surveillance and agriculture.

Competitive Landscape in Australia Aerospace Parts Manufacturing Market

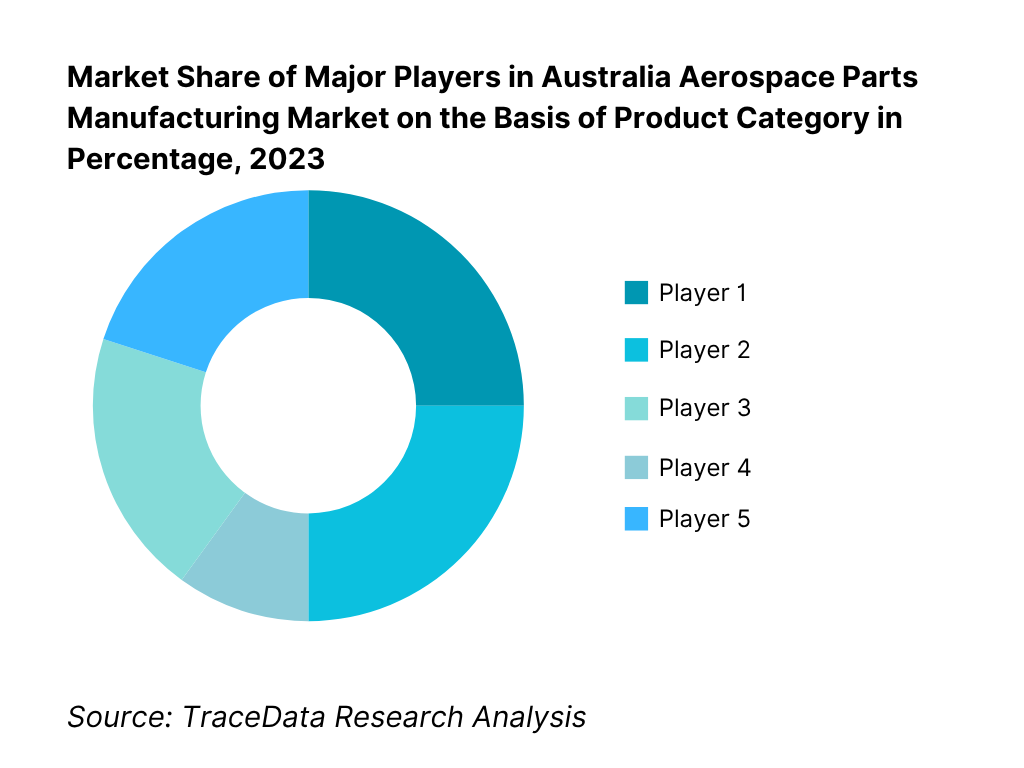

Australia’s aerospace parts manufacturing market features a mix of major global players and strong domestic capabilities. Key firms such as Boeing Aerostructures Australia dominate high‑technology aerostructures, complemented by numerous SMEs across engine parts, avionics, and MRO services. This consolidation emphasizes the influence of aviation primes and specialized fabricators on market dynamics.

Name | Founding Year | Original Headquarters |

Boeing Aerostructures Australia | 1997 | Melbourne, Australia |

Marand Precision Engineering | 1969 | Melbourne, Australia |

Quickstep Holdings Limited | 2001 | Sydney, Australia |

Gilmour Space Technologies | 2013 | Queensland, Australia |

APV Aerospace & Defence | 2002 | Melbourne, Australia |

Ferra Engineering | 1992 | Brisbane, Australia |

TAE Aerospace | 1996 | Ipswich, Australia |

Airbus Australia Pacific | 2000 | Brisbane, Australia |

Axiom Precision Manufacturing | 1985 | Adelaide, Australia |

Lovitt Technologies Australia | 1954 | Melbourne, Australia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Boeing Aerostructures Australia: As a key player in Australia's aerospace sector, Boeing Aerostructures Australia reported a significant expansion in its advanced composite production capabilities in 2024. The company increased its investment in automated fibre placement systems at its Melbourne facility to meet growing global demand for lightweight aerostructures used in commercial aircraft like the Boeing 787.

Quickstep Holdings: Known for its specialization in carbon fibre composite manufacturing, Quickstep Holdings has partnered with Lockheed Martin to supply aerospace-grade components for the F-35 Joint Strike Fighter program. In 2024, the company also secured new defence contracts under the Defence Strategic Review, enabling growth in local production of military aerospace parts.

Gilmour Space Technologies: As an emerging leader in aerospace innovation, Gilmour Space Technologies launched a new hybrid rocket engine test program in Queensland in 2023. The company has invested in additive manufacturing techniques for propulsion and structural parts, aligning with national goals for sovereign space capabilities.

Marand Precision Engineering: Marand has expanded its machining and tooling operations to support both domestic and export contracts. In 2023, the company introduced a new vertical integration model for aerospace component delivery, which includes in-house assembly and test capabilities for large-format components such as engine modules and aerostructure assemblies.

TAE Aerospace: TAE Aerospace, a leader in turbine engine MRO and parts manufacturing, expanded its facility in Ipswich in 2023 to increase capacity for military engine support. The company now supports over 16 air forces globally, and recently began development of a sovereign engine sustainment solution tailored to Royal Australian Air Force requirements.

What Lies Ahead for Australia Aerospace Parts Manufacturing Market?

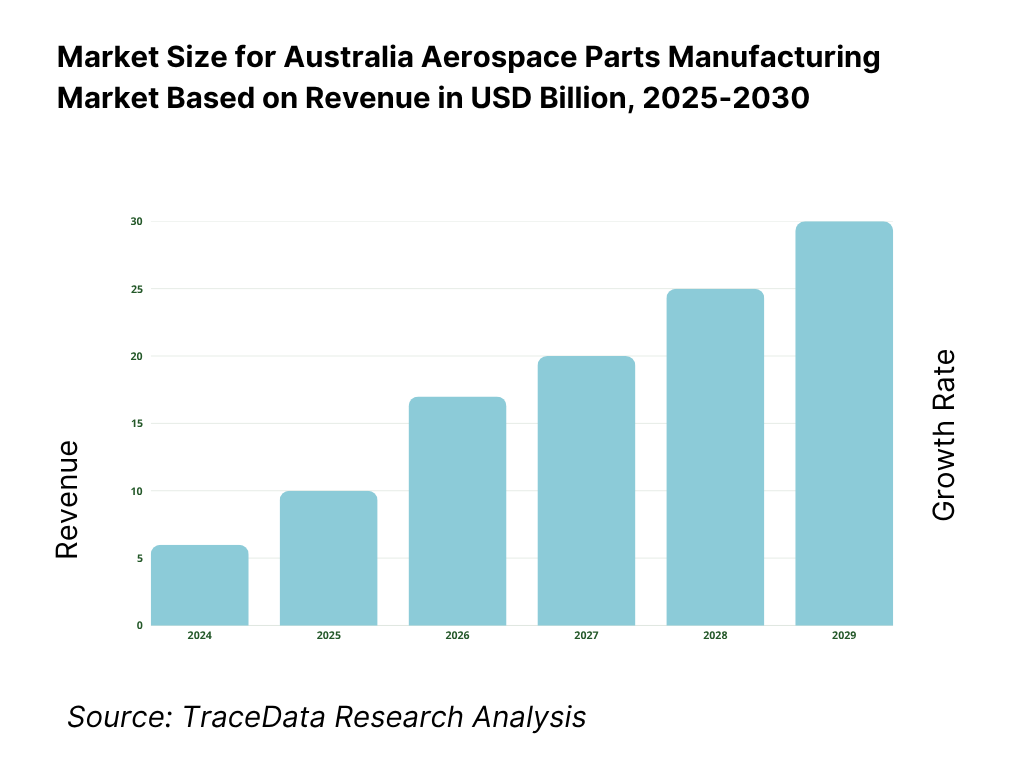

The Australia aerospace parts manufacturing market is projected to experience consistent growth by 2029, supported by increased defence procurement, the rise of commercial aviation post-COVID recovery, and the growing demand for lightweight and digitally manufactured aerospace components. Policy support through initiatives like the Defence Industrial Capability Plan and enhanced R&D tax incentives will play a pivotal role in shaping future industry performance.

Expansion of Advanced Manufacturing Ecosystems: The market is expected to move strongly towards advanced aerospace manufacturing ecosystems, particularly in areas such as composite materials, additive manufacturing, and robotics. These technologies are being rapidly integrated into production processes to improve efficiency, precision, and reduce turnaround times—positioning Australia as a competitive manufacturing hub in the APAC region.

Integration of Smart Factory and Industry 4.0 Models: The future of aerospace parts production in Australia will be shaped by the adoption of Industry 4.0 technologies including IoT sensors, AI-enabled quality checks, and real-time production analytics. These integrations will enable predictive maintenance, minimize waste, and optimize resource utilization, making manufacturing more cost-effective and scalable.

Growth in Defence and Space-Specific Parts Demand: With rising defence budgets and Australia’s emerging presence in the global space sector, manufacturers are expected to diversify offerings to serve satellite launch systems, UAVs, and hypersonic aircraft programs. The space industry’s demand for high-precision, lightweight parts will drive capacity expansions among local suppliers.

Supply Chain Localization Initiatives: To reduce import dependency, there will be increased investment in localizing Tier-2 and Tier-3 supplier networks across regions like Victoria and Queensland. These efforts aim to strengthen the domestic aerospace supply chain, enhance export-readiness, and ensure more resilient sourcing for both commercial and defence contracts.

Workforce Development & Skill Transformation: As technology adoption accelerates, workforce development will become a national priority. Upskilling programs in CNC operation, composite fabrication, and digital machining will see expansion through partnerships between government bodies, OEMs, and vocational training institutions—ensuring a steady pipeline of certified aerospace talent.

Australia Aerospace Parts Manufacturing Market Segmentation

By Component Type

Engine Parts

Aerostructures

Avionics Housings

Cabin Interiors

Fasteners and Connectors

By Material

Aluminium Alloys

Composites

Titanium Alloys

Steel & Stainless Steel

Specialty Alloys

By Process Technology

CNC Machining

Additive Manufacturing (3D Printing)

Casting (Investment, Sand, Die)

Forging

Sheet Metal Fabrication

By End-Use Application

Commercial Aviation

Military & Defence Aviation

Unmanned Aerial Vehicles

Space Systems

Business & General Aviation

By End-Customer

OEMs (Original Equipment Manufacturers)

Tier-1 Suppliers

Tier-2 & Tier-3 Suppliers

MRO (Maintenance, Repair & Overhaul) Providers

Defence Procurement Agencies

By Region

Victoria

Queensland

New South Wales

South Australia

Western Australia

Players Mentioned in the Report:

Boeing Aerostructures Australia

Marand Precision Engineering

Quickstep Holdings

APV Aerospace & Defence

Fairview Industries

STEELFAB Engineering Technologies

Gilmour Space Technologies

Southern Launch (partners)

Airbus Australia Pacific (local operations)

Boeing Australia (broader operations)

Magellan Aerospace (Australian presence)

Spirit AeroSystems (Australian operations)

DST‑Group (Defence Science and Technology Group manufacturing collaborations)

AMTIL‑member SMEs (e.g., Ascent Aerospace)

Local precision manufacturing clusters (e.g., Bendigo/Tasmania hubs)

Key Target Audience

Aerospace OEM procurement divisions

Aircraft MRO operators

Defence procurement agencies (e.g., Department of Defence, DST‑Group)

Airline fleet modernization planners

Investments and venture capitalist firms (targeting aerospace manufacturing)

Government and regulatory bodies (e.g., CASA, Austrade)

Space agency partners (e.g., Australian Space Agency)

UAV system integrators and agricultural drone users

Time Period:

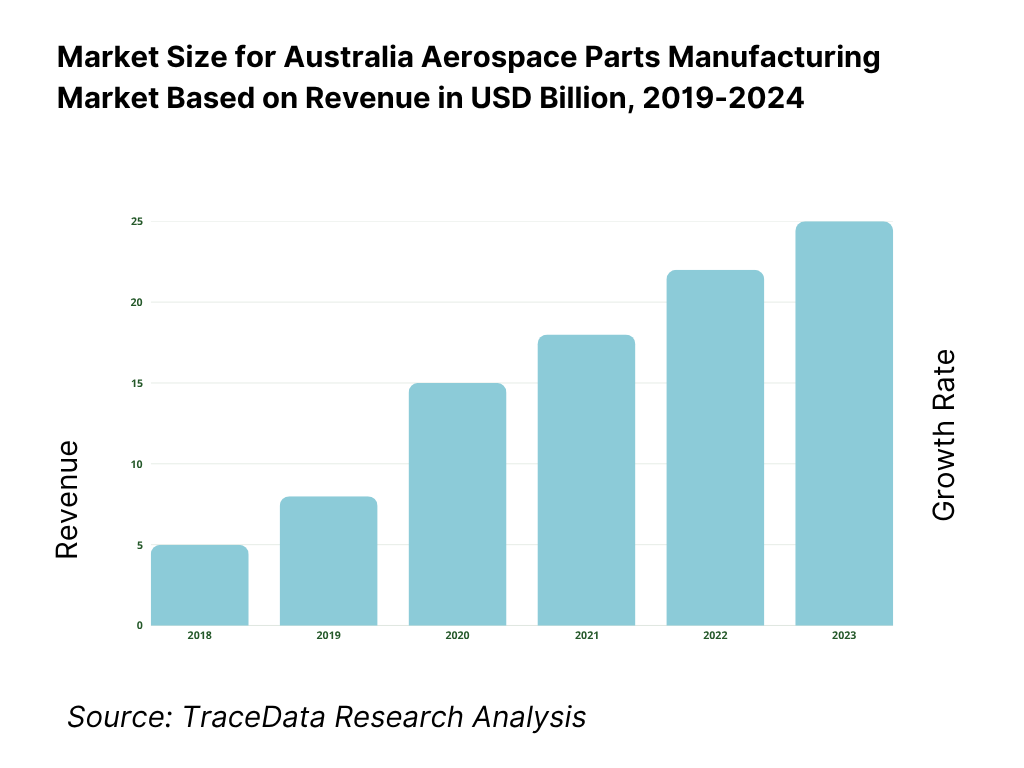

Historical Period: 2019-2024

Base Year: 2025

- Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Process Flow of Aerospace Parts Manufacturing in Australia

4.2. Margin Distribution Across OEMs, Tier-1, Tier-2, and Suppliers

4.3. Strengths and Limitations of Localized Aerospace Value Chains

5.1. Tier-1 vs Tier-2 vs Tier-3 Supplier Structure

5.2. Investment Landscape in Australian Aerospace Supply Chain

5.3. Government vs Private Sector Participation in Aerospace Manufacturing

5.4. Budget Allocation for Defence vs Commercial Aerospace Contracts, 2024

8.1. Revenue, 2019-2025

8.2. Volume of Parts Produced and Exported, 2019-2025

9.1. By Component Type (Engine Parts, Aerostructures, Avionics, Cabin Interiors, Fasteners), 2022-2025P

9.2. By Material (Aluminium Alloys, Composites, Titanium, Steel, Specialty Alloys), 2024-2025P

9.3. By Process Technology (CNC Machining, Additive Manufacturing, Casting, Forging, Sheet Metal Fabrication), 2024-2025P

9.4. By End-Use Application (Commercial Aviation, Military Aviation, UAVs, Space Systems), 2024-2025P

9.5. By End-Customer (OEMs, Tier-1s, Tier-2s, MROs, Government), 2024-2025P

9.6. By Region (Victoria, Queensland, New South Wales, South Australia, Western Australia), 2024-2025P

10.1. Client Procurement Behaviour and Tendering Models

10.2. Aerospace Part Specifications and Customization Needs

10.3. Delivery Timelines and Quality Certification Requirements

10.4. Analysis of Cost vs Quality in Procurement Decisions

11.1. Trends and Developments in Australia Aerospace Parts Sector

11.2. Growth Drivers for Aerospace Parts Manufacturing

11.3. SWOT Analysis

11.4. Key Challenges in Scaling Production and Exports

11.5. Regulations and Compliance (CASA, AS9100, ITAR equivalents)

12.1. Market Size and Adoption Trends for Aerospace Additive Manufacturing, 2019-2030

12.2. Revenue Models in Aerospace Digital Manufacturing

12.3. Production Capabilities and Technological Integration

12.4. Cross Comparison of Leading Digital Aerospace Manufacturers Based on Capacity, Technology, Projects, Workforce, Revenue Sources, Pricing Models

15.1. Market Share of Key Players by Revenue, 2023

15.2. Benchmark of Major Players Including: Company Overview, USP, Business Strategy, Manufacturing Model, Machinery & Tech Used, Workforce Strength, Key Contracts, Strategic Tie-Ups, Certifications, and Facility Footprint

15.3. Operating Model Comparison of Global vs Local Suppliers

15.4. Strategic Positioning Using Gartner Magic Quadrant

15.5. Bowmans Strategy Clock: Competitive Advantage Mapping

16.1. Revenue Forecast, 2025-2030

17.1. By Component Type (Engine Parts, Aerostructures, etc.), 2025-2030

17.2. By Material (Aluminium Alloys, Composites, etc.), 2025-2030

17.3. By Process Technology (CNC, Additive, etc.), 2025-2030

17.4. By End-Use Application (Commercial, Defence, etc.), 2025-2030

17.5. By End-Customer (OEMs, Tiered Suppliers, MROs), 2025-2030

17.6. By Region (State-wise), 2025-2030

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Australia Aerospace Parts Manufacturing Market. On the supply side, this includes OEMs, Tier-1 and Tier-2 component manufacturers, composite fabricators, and certified machining workshops. On the demand side, stakeholders include defence procurement agencies, commercial airlines, space companies, MRO providers, and UAV developers. Based on this mapped ecosystem, we shortlist the top 5–6 aerospace parts manufacturers in the country by analyzing financial performance, production capacity, export orientation, and contractual visibility. Sourcing is conducted through Australian Government defence and trade portals, regulatory filings, aerospace industry publications, and proprietary industrial manufacturing datasets to collate industry-level intelligence.

Step 2: Desk Research

An exhaustive desk research process is carried out using trusted public and proprietary data repositories. We examine market-level indicators such as production volumes, parts exports, import dependencies, adoption of composite or additive technologies, and employment in aerospace manufacturing. Detailed analysis is also performed at the company level using sources such as annual reports, investor presentations, government grant disclosures, and facility audits. This foundational work helps establish the current scale, structure, and dynamics of the market. Company-specific data is further analyzed to understand operating models, specialization areas (e.g., engine parts, aerostructures), facility size, compliance standards (e.g., AS9100, NADCAP), and strategic partnerships with global aerospace primes.

Step 3: Primary Research

A structured set of interviews is conducted with senior executives, government agency representatives, production heads, and supply chain managers across aerospace parts manufacturers in Australia. These interviews are designed to validate market estimates, test assumptions, and uncover granular insights into pricing structures, lead times, revenue mix, and capacity utilization. As part of our research validation strategy, our analysts carry out disguised interviews—approaching companies as prospective clients—to obtain realistic cost, volume, and capability estimates. This technique allows triangulation of public and private data and helps refine our understanding of actual production throughput, value chain dependencies, and profitability metrics.

Step 4: Sanity Check

We conduct a dual-track validation of market sizing using both top-down (sectoral production and export/import trends) and bottom-up (aggregated company-level revenues and capacities) approaches. These market modeling techniques are used to ensure internal consistency across financial estimates, production volumes, and supplier tiers. Final market estimates are validated through sensitivity analysis and cross-checked with historical growth patterns and future capacity expansion plans.

FAQs

01. What is the potential for the Australia Aerospace Parts Manufacturing Market?

The Australia Aerospace Parts Manufacturing Market is poised for significant development, reaching a valuation of USD 2,950 million in 2023. This potential is driven by increased government investment in defence procurement, growth in commercial aviation, and expansion of sovereign manufacturing capabilities. Australia's participation in international supply chains and its increasing focus on high-value aerospace exports further enhance the market's long-term prospects.

02. Who are the Key Players in the Australia Aerospace Parts Manufacturing Market?

Key players in the Australia Aerospace Parts Manufacturing Market include Boeing Aerostructures Australia, Marand Precision Engineering, Quickstep Holdings, and Gilmour Space Technologies. These companies dominate the ecosystem due to their advanced technical capabilities, global aerospace contracts, and investments in composite and precision manufacturing technologies. Other notable players include Ferra Engineering, TAE Aerospace, and Axiom Precision Manufacturing.

03. What are the Growth Drivers for the Australia Aerospace Parts Manufacturing Market?

The primary growth drivers include sustained defence spending by the Australian government, the push for sovereign industrial capability under the Defence Industrial Capability Plan, and advancements in additive and composite manufacturing. Additionally, rising demand for lightweight components in both aviation and space applications, supported by strategic public-private R&D partnerships, is further fueling market expansion.

04. What are the Challenges in the Australia Aerospace Parts Manufacturing Market?

The market faces challenges such as supply chain fragmentation due to a limited Tier-2 supplier base, regulatory burdens related to international certifications (e.g., CASA, AS9100, ITAR-equivalent compliance), and a shortage of aerospace-certified skilled labor. Moreover, long production lead times and capital-intensive infrastructure requirements present barriers for smaller manufacturers looking to scale operations.