Australia Auto Finance Market Outlook to 2029

By Market Structure, By Lenders, By Type of Vehicles Financed, By Loan Tenure, By Consumer Demographics, and By Region

- Product Code: TDR0129

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Australia Auto Finance Market Outlook to 2029 - By Market Structure, By Lenders, By Type of Vehicles Financed, By Loan Tenure, By Consumer Demographics, and By Region” provides a comprehensive analysis of the auto finance market in Australia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on loan disbursement, by market, product types, region, cause and effect relationships, and success case studies highlighting major opportunities and challenges.

Australia Auto Finance Market Overview and Size

The Australian auto finance market reached a valuation of AUD 130 Billion in 2023, driven by increasing demand for vehicle ownership, favorable interest rates, and a growing inclination towards electric vehicles. The market is characterized by major financial institutions such as Commonwealth Bank, Westpac, ANZ, NAB, Macquarie Bank, and auto-financing firms like Toyota Finance, BMW Financial Services, and Volkswagen Financial Services. These entities dominate the auto financing landscape, offering diverse financing options for new and used vehicles.

In 2023, approximately 85% of new vehicle purchases were financed through loans or leasing, reflecting the strong role of financial services in Australia’s automotive sector. The preference for structured financing options continues to rise due to affordability concerns and flexible payment structures. Sydney and Melbourne are key markets due to their high vehicle demand and extensive automotive infrastructure.

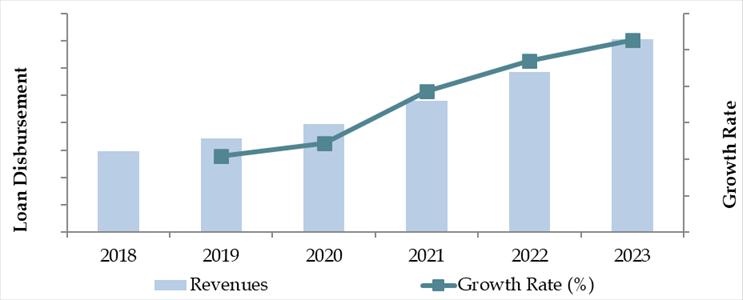

Market Size for Australia Auto Finance Industry Size on the Basis of Loan Disbursement in USD Billion, 2018-2024

What Factors are Leading to the Growth of the Australia Auto Finance Market?

Economic Factors: The rise in disposable income, coupled with low-interest rates on auto loans, has encouraged vehicle financing. In 2023, auto loan interest rates in Australia averaged around 6.5%, making financing more accessible to middle-income consumers.

Growing EV Market: With the increasing government push towards electric vehicle (EV) adoption, financing institutions have introduced special loan schemes for EV buyers. EV loans grew by 30% in 2023, with incentives such as lower interest rates and extended repayment periods.

Digitalization: The rise of online auto financing platforms has improved accessibility for consumers. In 2023, approximately 55% of auto loans were processed through digital channels, reflecting a major shift towards fintech solutions in the lending industry.

Which Industry Challenges Have Impacted the Growth of the Australia Auto Finance Market?

Credit Approval Barriers: Strict lending criteria imposed by financial institutions have resulted in around 28% of auto loan applications being rejected in 2023, particularly impacting first-time buyers and individuals with lower credit scores.

Interest Rate Volatility: Although interest rates have been relatively low, fluctuations in the Reserve Bank of Australia’s policy rates impact loan affordability. In 2023, auto loan rates varied between 5.8% and 7.2%, affecting consumer confidence in long-term financing commitments.

Rising Vehicle Costs: Increasing vehicle prices, especially for electric and hybrid models, have made financing a necessity rather than an option. New vehicle prices in Australia rose by 12% in 2023, leading to higher loan amounts and extended repayment periods.

What are the Regulations and Initiatives Which Have Governed the Market?

Consumer Credit Regulations: The National Consumer Credit Protection Act (NCCP) mandates responsible lending practices, ensuring that lenders assess borrowers’ ability to repay loans. In 2023, approximately 78% of auto loan applications met the responsible lending criteria, reflecting a high compliance rate within the industry.

EV Loan Incentives: The Australian government has introduced subsidies and tax benefits to promote electric vehicle financing. In 2023, EV loans accounted for 15% of total auto finance disbursements, a figure expected to grow as more incentives take effect.

Lender Licensing Requirements: Auto finance providers must comply with Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) standards. In 2023, new licensing requirements led to a 10% consolidation in the lender market, favoring larger financial institutions.

Australia Auto Finance Market Segmentation

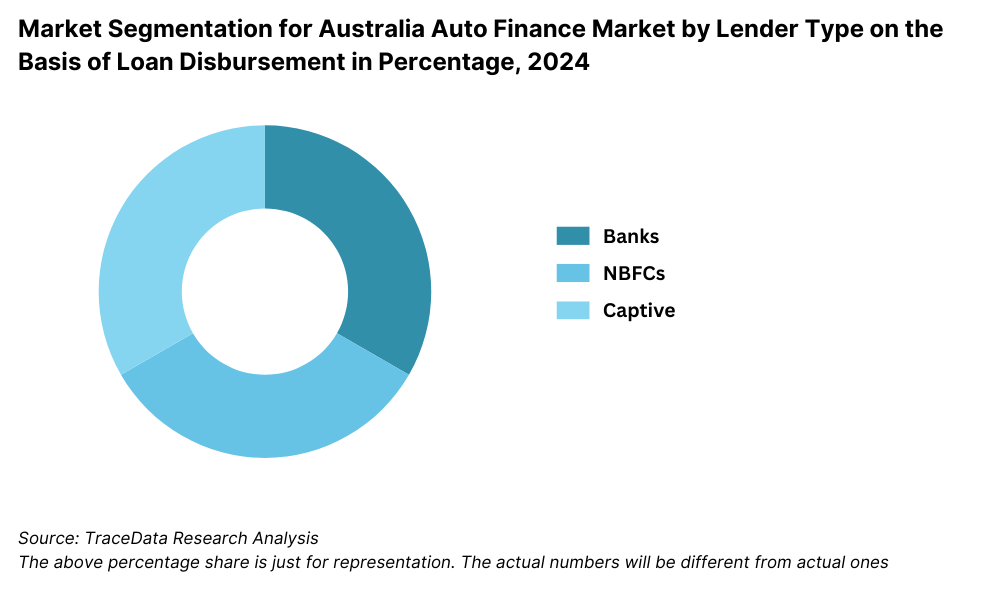

By Lender Type: Banks dominate Australia's auto finance sector, handling 70% of loan disbursements, while non-banking financial companies (NBFCs) and fintech lenders account for the remaining share. NBFCs offer flexible loan structures, and fintech companies provide digital-first financing solutions, contributing to a diversified market that meets various consumer financing needs across different demographic segments.

By Loan Tenure: The 3-5 year loan tenure remains the most preferred, accounting for 65% of total auto loans in Australia. Short-term loans (less than 3 years) comprise 20%, appealing to those seeking quicker repayment, while long-term loans (over 5 years) make up 15%, often chosen for lower monthly installments despite higher interest costs.

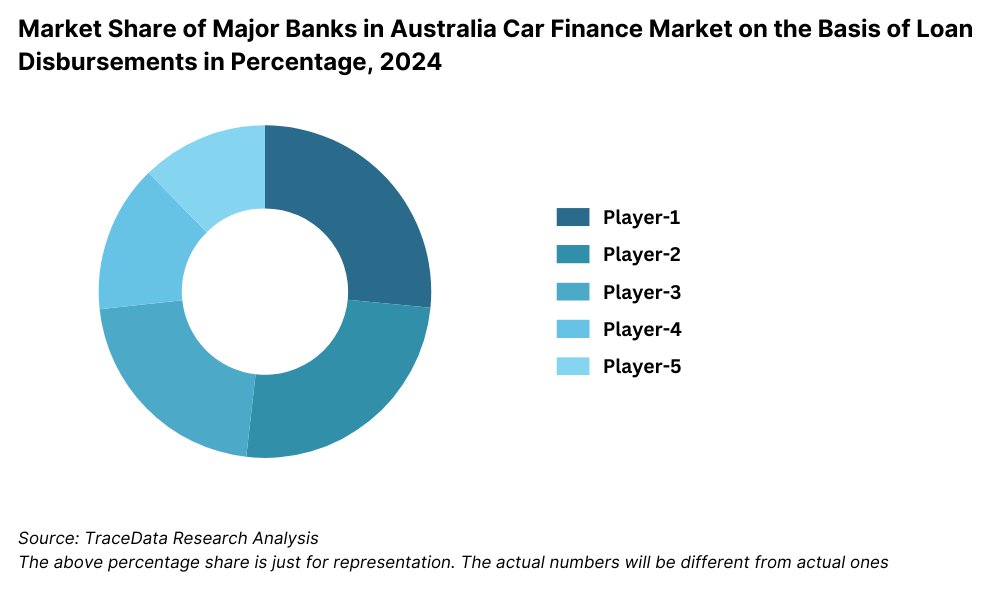

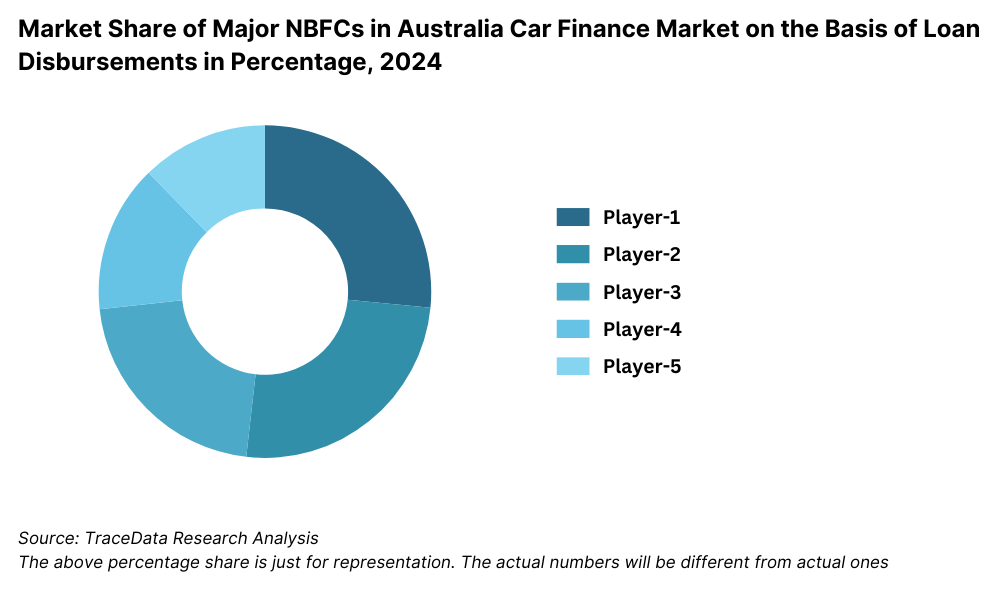

Competitive Landscape in Australia Auto Finance Market

The Australian auto finance market is relatively concentrated, with major financial institutions and specialized lenders playing a dominant role. However, the emergence of fintech companies and digital lending platforms has diversified the competitive landscape, offering consumers more choices and innovative financing solutions. These institutions cater to a broad spectrum of customers, from high-income individuals seeking luxury vehicle financing to budget-conscious buyers opting for structured instalment plans.

| Name | Founding Year | Original Headquarters |

| ANZ Car Loan (Australia and New Zealand Banking Group) | 1835 | Melbourne, Australia |

| Commonwealth Bank Car Loan | 1911 | Sydney, Australia |

| Westpac Auto Finance | 1817 | Sydney, Australia |

| National Australia Bank (NAB) Auto Loan | 1858 | Melbourne, Australia |

| Macquarie Leasing (Macquarie Group) | 1969 | Sydney, Australia |

| Latitude Financial Services Auto Loan | 2015 | Melbourne, Australia |

| Toyota Financial Services Australia | 1982 | Toyota City, Japan |

| BMW Financial Services Australia | 1988 | Munich, Germany |

| Volkswagen Financial Services Australia | 1949 | Braunschweig, Germany |

| Pepper Money Car Loan | 2000 | Sydney, Australia |

| RACV Car Loan (Royal Automobile Club of Victoria) | 1903 | Melbourne, Australia |

| RACQ Car Loan (Royal Automobile Club of Queensland) | 1905 | Brisbane, Australia |

| St. George Bank Car Loan | 1937 | Sydney, Australia |

| Bankwest Auto Loan | 1895 | Perth, Australia |

Some of the recent competitor trends and key information about competitors include:

Commonwealth Bank: One of Australia’s largest banks, it recorded AUD 45 billion in auto loan disbursements in 2023, leveraging its vast customer base and strong financial position. The bank's widespread branch network and competitive interest rates continue to attract customers nationwide.

Westpac: Focuses on green auto financing, with 20% of its new loans in 2023 dedicated to EV financing, showing a significant shift toward sustainability initiatives. Westpac has also introduced customized financing solutions to cater to the growing demand for hybrid and electric vehicles.

ANZ: Has strengthened its partnership with car dealerships, boosting its auto loan segment by 18% in 2023 through dealer-based financing. By offering seamless financing at the point of sale, ANZ has significantly improved accessibility and convenience for customers looking to purchase new or used vehicles.

NAB: Introduced AI-driven credit assessments, reducing loan approval times by 30%, enhancing customer experience and increasing loan disbursement efficiency. The bank has also expanded its offerings to include flexible repayment options tailored to self-employed individuals and gig economy workers.

Macquarie Bank: Specializes in asset financing, with 40% of its total auto loans targeting commercial vehicle financing, supporting businesses and fleet operators. Macquarie’s expertise in high-value and specialized vehicle financing makes it a key player in the corporate auto lending sector.

What Lies Ahead for Australia Auto Finance Market?

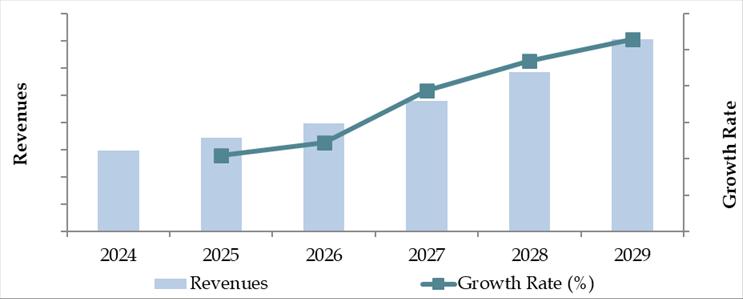

The Australian auto finance market is expected to experience steady growth by 2029, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period. This growth will be driven by favorable economic conditions, advancements in digital lending technologies, and increased adoption of electric vehicles (EVs).

Shift Towards Electric Vehicle Financing: With increasing government incentives and sustainability initiatives, auto financing for EVs is expected to rise significantly. Lenders are expected to introduce lower interest rates and extended repayment terms for eco-friendly vehicle financing, encouraging more consumers to switch to EVs.

Integration of Digital Technologies: AI-driven credit assessments, blockchain-based loan processing, and automation are transforming the lending landscape, reducing approval times and improving customer experience. Digital-first lenders and fintech companies are projected to gain a larger market share due to their user-friendly online platforms.

Expansion of Subscription-Based Financing Models: The demand for car subscription models is growing as consumers seek more flexible ownership options. Companies such as BMW Financial Services and Volkswagen Financial Services are expected to expand their subscription-based financing programs, allowing customers to upgrade vehicles periodically without traditional loan commitments.

Future Outlook and Projections for Australia Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Market Segmentation of Australia Auto Finance Market

- By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Lenders

- Public Sector Banks

- Private Sector Banks

- Microfinance Institutions

- Captive Finance Companies

- By Vehicle Type:

- New Vehicles

- Used Vehicles

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

- By Loan Tenure:

- <3 Years

- 3-5 Years

- 5-7 Years

- More than 7 Years

By Region:

o New South Wales

o Victoria

o Queensland

o Western Australia

o South Australia

o Tasmania

o Northern Territory

o Australian Capital Territory

Players Mentioned in the Report (Banks):

- Commonwealth Bank of Australia (CBA)

- Westpac Banking Corporation

- National Australia Bank (NAB)

- Australia and New Zealand Banking Group (ANZ)

- Macquarie Bank

- St.George Bank

- Bank of Queensland (BOQ)

- Bendigo and Adelaide Bank

- Suncorp Bank

- HSBC Australia

Players Mentioned in the Report (NBFCs):

- Latitude Financial Services

- Wisr

- Firstmac

- Pepper Money

- Liberty Financial

- Angle Auto Finance

- AFS (Australian Financial Services)

- Automotive Finance

- Stratton Finance

- Resimac Group

Players Mentioned in the Report (Captive):

- Toyota Finance Australia

- Ford Credit Australia

- Nissan Financial Services Australia

- Volkswagen Financial Services Australia

- Mercedes-Benz Financial

- BMW Australia Finance

- Honda Australia Finance

- Hyundai Capital Australia

- Mazda Finance Australia

- Subaru Finance

Key Target Audience:

• Banks and Financial Institutions

• Automotive Financing Companies

• Online Auto Finance Marketplaces

• Regulatory Bodies (e.g., APRA, ASIC)

• Research and Development Institutions

Time Period:

• Historical Period: 2018-2023

• Base Year: 2024

• Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Australia by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

8.3. Number of Vehicles Financed, 2018-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Australia Car Finance Market

11.2. Growth Drivers for Australia Car Finance Market

11.3. SWOT Analysis for Australia Car Finance Market

11.4. Issues and Challenges for Australia Car Finance Market

11.5. Government Regulations for Australia Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Australia Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Australia Car Finance Market, 2024

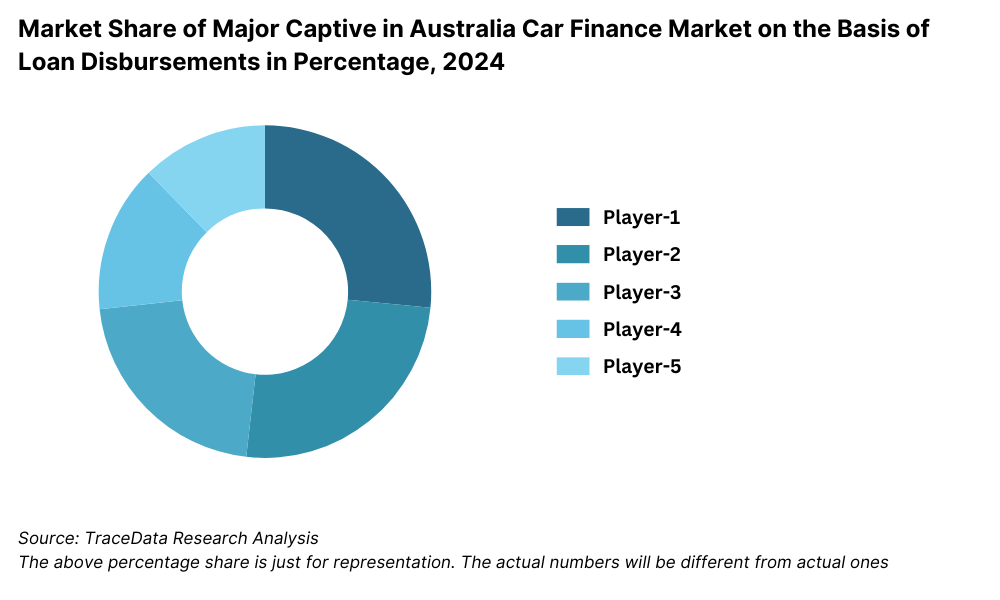

17.3. Market Share of Key Captive in Australia Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Australia Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Identify all demand-side and supply-side entities in the Australia Auto Finance Market. Shortlist major financial institutions and auto finance companies based on their financial information and loan disbursement volume.

Conduct initial research through industry articles, multiple secondary sources, and proprietary databases to gather industry-level insights.

Step 2: Desk Research

Conduct an exhaustive desk research process by referencing diverse secondary and proprietary databases. This helps analyze market trends, loan disbursement volumes, interest rates, and competitive landscapes.

Utilize company-level data, including press releases, annual reports, financial statements, and other relevant documents, to build a foundational understanding of market dynamics.

Step 3: Primary Research

Engage in in-depth interviews with C-level executives, financial analysts, and stakeholders from various Australian auto finance companies. The interviews serve to validate market hypotheses, authenticate statistical data, and extract valuable financial insights. A bottom-up approach is used to evaluate loan disbursement volume for each player, aggregating to the overall market.

Conduct disguised interviews by approaching companies as potential customers to validate operational and financial information shared by company executives.

Step 4: Sanity Check

- Conduct bottom-up and top-down analysis, along with market size modeling exercises, to cross-verify findings. Ensure data accuracy by correlating primary research insights with secondary data points to maintain a robust research methodology.

FAQs

1. What is the potential for the Australia Auto Finance Market?

The Australian auto finance market is expected to witness substantial growth, reaching a valuation of AUD 130 Billion in 2023. The increasing demand for affordable financing options, growing penetration of electric vehicles, and the expansion of digital lending platforms are key drivers propelling market expansion.

2. Who are the Key Players in the Australia Auto Finance Market?

The Australia Auto Finance Market is dominated by major players, including Commonwealth Bank, Westpac, ANZ, NAB, Macquarie Bank, Toyota Finance, BMW Financial Services, and Volkswagen Financial Services. These institutions offer a variety of financing solutions tailored to consumer and commercial vehicle buyers.

3. What are the Growth Drivers for the Australia Auto Finance Market?

Key growth drivers include low-interest rates, rising vehicle ownership, increased adoption of electric vehicles (EVs), and digitalization in financial services. The emergence of online lending platforms and fintech innovations has made auto financing more accessible and streamlined for consumers.

4. What are the Challenges in the Australia Auto Finance Market?

Challenges include stringent regulatory requirements, credit approval barriers, interest rate fluctuations, and increasing vehicle costs. Additionally, economic downturns can impact consumer purchasing power, leading to fluctuations in demand for auto loans.