Australia EEG Machines Market Outlook to 2035

By Product Type, By Channel Count, By End-Use Setting, By Application, and By Region

- Product Code: TDR0482

- Region: Global

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Australia EEG Machines Market Outlook to 2035 – By Product Type, By Channel Count, By End-Use Setting, By Application, and By Region” provides a comprehensive analysis of the electroencephalography (EEG) devices market in Australia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and reimbursement landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Australia EEG machines market. The report concludes with future market projections based on neurological disease burden, expansion of diagnostic infrastructure, adoption of advanced neuro-monitoring technologies, public and private healthcare investment, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

Australia EEG Machines Market Overview and Size

The Australia EEG machines market is valued at approximately ~USD ~ million, representing revenues generated from the sale and installation of electroencephalography systems used for recording and monitoring electrical activity of the brain. EEG systems in Australia range from conventional and portable EEG machines to advanced video EEG, ambulatory EEG, and high-density EEG systems, typically comprising amplifiers, electrodes, head caps, data acquisition units, and integrated software platforms for signal processing and clinical interpretation.

The market is anchored by Australia’s well-established healthcare infrastructure, increasing neurological disease prevalence, expanding diagnostic and monitoring needs in epilepsy, sleep disorders, traumatic brain injury, and neurodegenerative conditions, and rising adoption of EEG in both hospital and outpatient settings. EEG systems play a critical role across neurology departments, sleep laboratories, intensive care units, and research institutions, supported by Australia’s strong clinical standards and growing emphasis on early diagnosis and long-term neurological care.

Public hospitals form the backbone of EEG demand in Australia, driven by state-level healthcare funding, tertiary care networks, and centralized procurement mechanisms. Private hospitals, diagnostic chains, and specialist neurology clinics are increasingly contributing to incremental demand, particularly for advanced EEG systems that support long-term monitoring, video integration, and ambulatory use. Academic and research institutions also represent a steady demand segment, leveraging EEG systems for neuroscience research, clinical trials, and brain–computer interface development.

Geographically, demand is concentrated in New South Wales and Victoria, reflecting population density, concentration of tertiary hospitals, and presence of leading neurological care centers. Queensland represents a growing market supported by healthcare infrastructure expansion and rising chronic disease burden, while Western Australia and South Australia show stable demand driven by public hospital upgrades and replacement cycles. Regional and remote healthcare facilities increasingly adopt portable and ambulatory EEG systems to improve access to neurological diagnostics outside metropolitan centers.

What Factors are Leading to the Growth of the Australia EEG Machines Market:

Rising burden of neurological and sleep-related disorders strengthens diagnostic demand: Australia faces a growing prevalence of neurological conditions such as epilepsy, dementia, Parkinson’s disease, stroke-related complications, and sleep disorders, driven by an aging population and increased awareness of brain health. EEG remains a foundational diagnostic and monitoring tool for many of these conditions, particularly epilepsy diagnosis, seizure classification, and sleep disorder evaluation. As clinical guidelines increasingly emphasize early detection and longitudinal monitoring, healthcare providers are expanding EEG capacity across hospitals and diagnostic centers, directly supporting market growth.

Expansion of critical care and long-term monitoring capabilities accelerates EEG adoption: EEG systems are increasingly used beyond routine diagnostics, particularly in intensive care units for continuous EEG monitoring of critically ill patients with altered consciousness, traumatic brain injury, or post-surgical complications. Australian hospitals are investing in video EEG and continuous monitoring solutions to support better clinical decision-making and improve patient outcomes. These applications favor higher-value EEG systems with advanced software, real-time analytics, and integration with hospital information systems, driving both volume and value growth in the market.

Technological advancements and shift toward portable and ambulatory EEG systems improve accessibility: Advancements in EEG hardware miniaturization, wireless connectivity, and signal processing software have expanded the use of portable and ambulatory EEG systems across Australia. These systems enable extended monitoring in outpatient or home settings, reducing hospital stay requirements and improving patient convenience. The ability to deploy EEG in regional and remote areas aligns with Australia’s healthcare access objectives, making portable EEG solutions increasingly attractive to public health networks and private diagnostic providers.

Which Industry Challenges Have Impacted the Growth of the Australia EEG Machines Market:

High capital cost of advanced EEG systems and budget constraints within public healthcare networks impact procurement pace: While EEG machines are a critical diagnostic and monitoring tool, advanced systems such as video EEG, high-density EEG, and continuous EEG platforms require significant upfront investment in hardware, software licenses, and supporting IT infrastructure. Public hospitals in Australia typically operate under fixed annual capital budgets and centralized procurement cycles, which can delay equipment upgrades or restrict purchases to replacement-only scenarios. Budget prioritization toward acute care equipment, imaging modalities, and surgical infrastructure can limit near-term EEG procurement, particularly in smaller hospitals and regional facilities.

Shortage of trained neurophysiology professionals constrains effective utilization of EEG capacity: EEG systems require skilled technologists for electrode placement, calibration, data acquisition, and preliminary analysis, along with neurologists trained in EEG interpretation. In Australia, shortages of qualified neurophysiology technologists and uneven distribution of specialists across metropolitan and regional areas can constrain EEG throughput even when equipment is available. These workforce limitations reduce utilization rates, extend diagnostic wait times, and can dampen the perceived return on investment for healthcare providers considering capacity expansion.

Operational complexity and data management requirements increase adoption barriers for advanced EEG solutions: Modern EEG systems generate large volumes of high-frequency data, particularly in long-term and continuous monitoring applications. Managing data storage, cybersecurity, interoperability with hospital information systems, and compliance with clinical documentation standards adds operational complexity. Hospitals must ensure compatibility with electronic medical records, secure remote access for neurologists, and compliance with privacy and data governance requirements. These factors can slow adoption of newer EEG platforms, especially in facilities with legacy IT infrastructure.

What are the Regulations and Initiatives which have Governed the Market:

Medical device regulatory oversight and conformity assessment requirements governing safety and performance: EEG machines supplied in Australia must comply with regulatory requirements overseen by the Therapeutic Goods Administration (TGA), including inclusion in the Australian Register of Therapeutic Goods (ARTG). Manufacturers must demonstrate compliance with applicable international standards covering electrical safety, electromagnetic compatibility, software validation, and clinical performance. These requirements ensure patient safety and device reliability but also influence time-to-market, documentation burden, and compliance costs for suppliers entering or expanding within the Australian EEG market.

Healthcare quality standards and clinical guidelines shaping EEG usage and care pathways: National safety and quality standards for healthcare delivery, along with clinical guidelines issued by professional bodies, influence how EEG systems are specified and deployed across hospitals and diagnostic centers. Requirements related to patient consent, infection control, clinical documentation, and diagnostic accuracy shape operational protocols for EEG testing. In epilepsy care, sleep medicine, and critical care neurology, guideline-driven practices reinforce the role of EEG while also standardizing expectations around equipment capability, recording duration, and data quality.

Public healthcare funding structures and procurement frameworks influencing purchasing decisions: Australia’s publicly funded healthcare system relies on state-level health departments and hospital networks to manage capital equipment procurement. These frameworks emphasize value-for-money assessments, supplier qualification, service support capability, and lifecycle cost considerations rather than unit price alone. While such procurement structures support transparency and standardization, they can extend decision timelines and favor established vendors with strong local service presence, influencing competitive dynamics and market entry strategies for EEG manufacturers.

Australia EEG Machines Market Segmentation

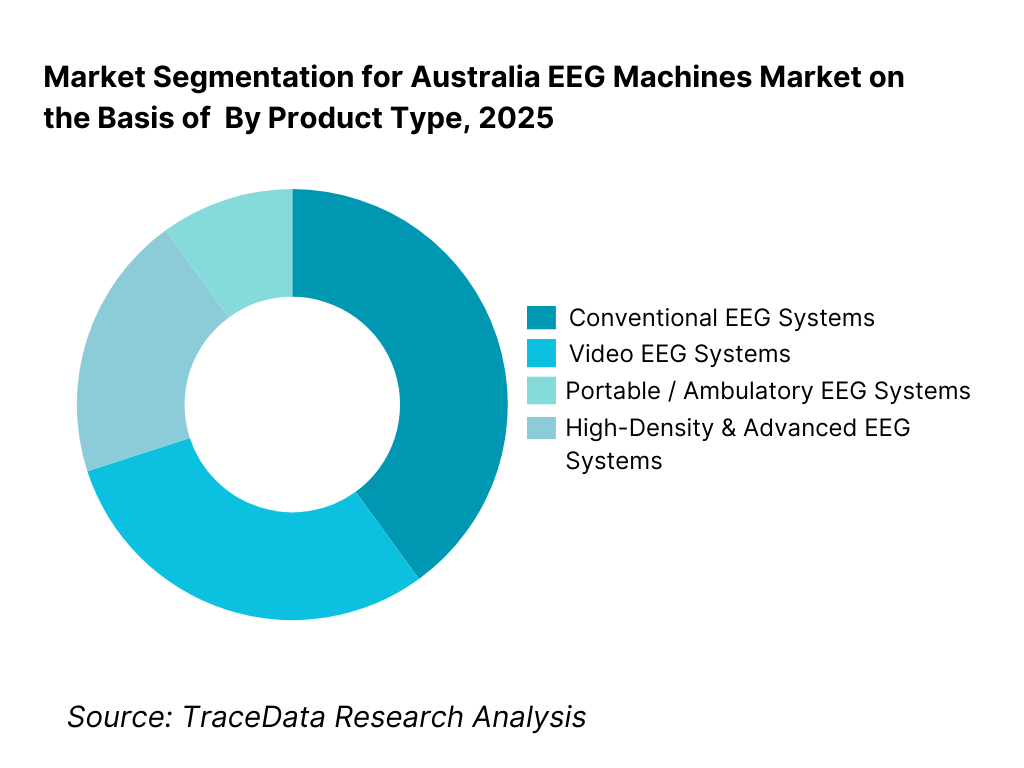

By Product Type: The conventional and video EEG systems segment holds dominance in the Australia EEG machines market. This is because public and private hospitals continue to rely heavily on standard EEG and video EEG setups for epilepsy diagnosis, seizure classification, and inpatient neurological evaluation. Video EEG systems are particularly important in tertiary hospitals and epilepsy monitoring units, where synchronized video and EEG data are required for accurate clinical interpretation. While portable and ambulatory EEG systems are growing rapidly due to outpatient and home-based monitoring needs, conventional and video EEG systems continue to anchor volume demand due to their central role in hospital-based neurology services.

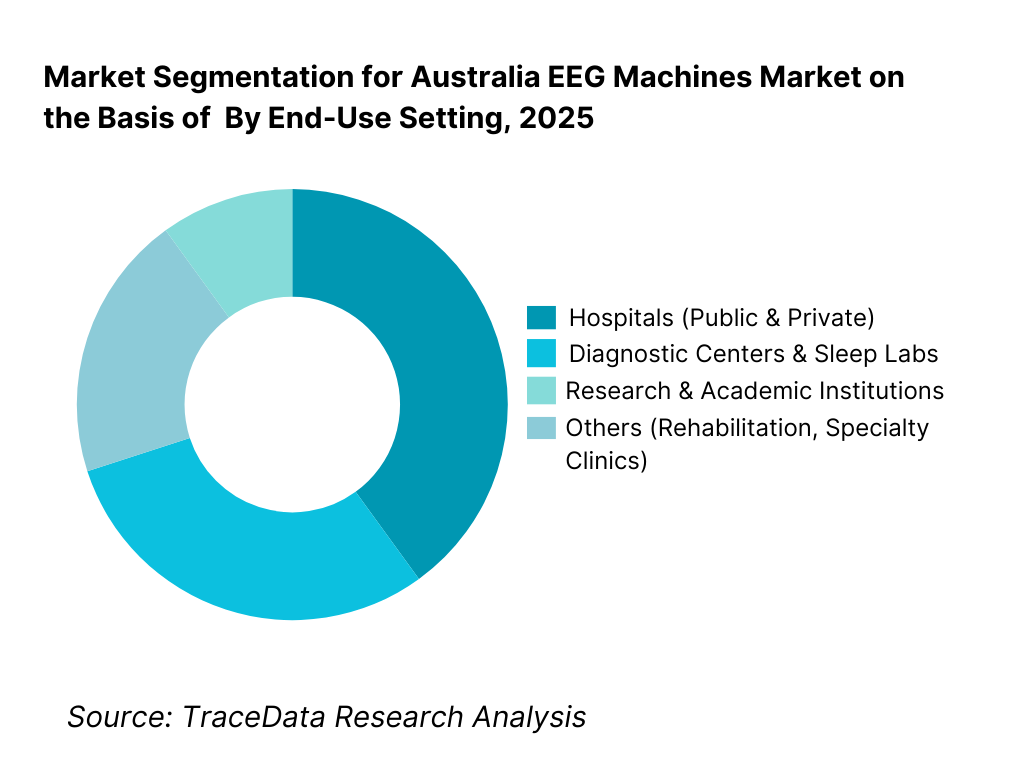

By End-Use Setting: Hospitals dominate the Australia EEG machines market, driven by centralized neurology departments, intensive care units, and publicly funded diagnostic services. Public hospitals account for a significant share of installations due to structured procurement cycles and replacement-driven demand, while private hospitals increasingly invest in advanced EEG capabilities to support specialized neurology and sleep services. Diagnostic centers and sleep laboratories represent a growing segment, particularly for ambulatory EEG and sleep-related studies, while research and academic institutions contribute steady but smaller-volume demand focused on advanced and high-density EEG systems.

Competitive Landscape in Australia EEG Machines Market

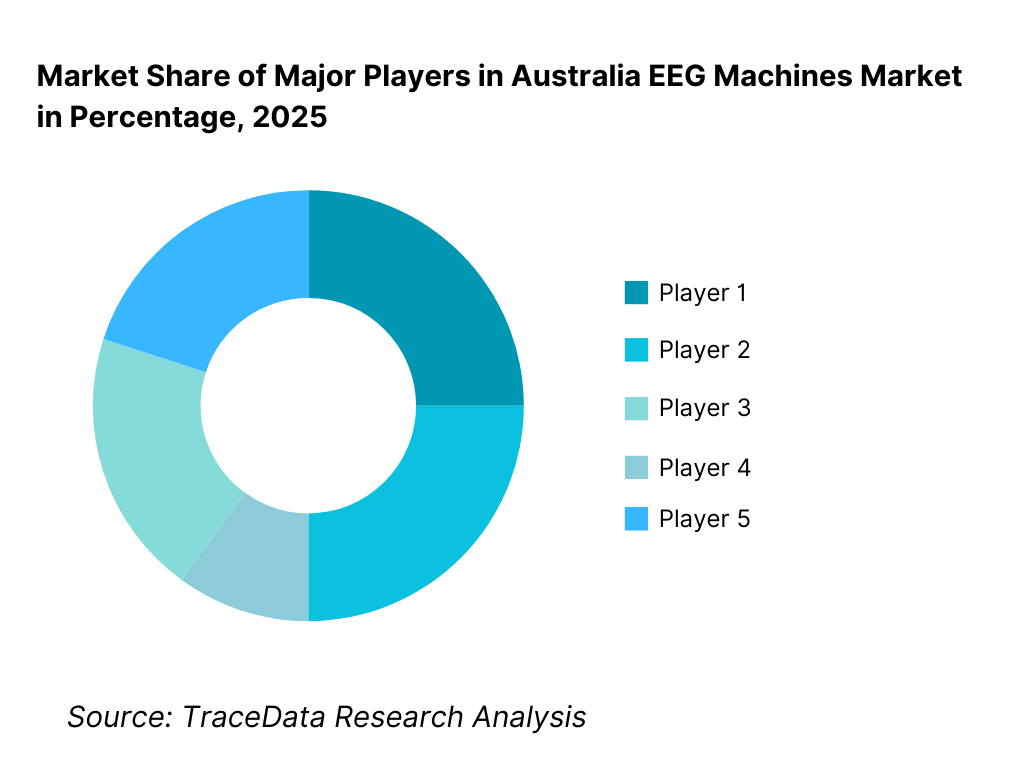

The Australia EEG machines market exhibits moderate concentration, characterized by the presence of large global neurodiagnostic equipment manufacturers supported by local subsidiaries, distributors, and service partners. Competitive differentiation is driven by clinical reliability, signal quality, software sophistication, integration with hospital IT systems, local service capability, and long-term maintenance support. Established multinational players dominate tertiary hospital and public-sector tenders due to strong regulatory compliance track records and installed base advantages, while smaller and specialized vendors compete in portable, ambulatory, and niche research-focused EEG applications.

Name | Founding Year | Original Headquarters |

Natus Medical | 1987 | California, USA |

Nihon Kohden | 1951 | Tokyo, Japan |

Philips Healthcare | 1891 | Amsterdam, Netherlands |

Compumedics | 1987 | Melbourne, Australia |

GE HealthCare | 1892 | Chicago, USA |

Cadwell Industries | 1979 | Washington, USA |

Micromed | 1982 | Veneto, Italy |

Brain Products | 1993 | Munich, Germany |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Natus Medical: Natus maintains a strong position in Australian hospitals through its comprehensive EEG and video EEG portfolio, combined with robust clinical software and long-standing relationships with neurology departments. The company benefits from a large installed base, which supports repeat sales through upgrades, service contracts, and expansion of monitoring capacity in tertiary care centers.

Nihon Kohden: Nihon Kohden competes on signal quality, system reliability, and strong performance in critical care and continuous EEG monitoring environments. Its systems are widely used in ICUs and advanced neurology units, where real-time monitoring and integration with patient monitoring platforms are key decision factors.

Compumedics: As an Australia-headquartered company, Compumedics holds a strategic advantage in the local market through strong brand recognition, proximity to customers, and deep expertise in sleep and neurodiagnostics. The company is particularly competitive in sleep labs, ambulatory EEG, and combined sleep–neurology applications, benefiting from increasing demand for outpatient and long-term monitoring solutions.

Philips Healthcare: Philips leverages its broader hospital ecosystem presence to position EEG systems as part of integrated neurology and patient monitoring solutions. Its competitive strength lies in interoperability, enterprise-level IT integration, and appeal to large hospital networks seeking standardized platforms across departments.

GE HealthCare: GE HealthCare remains relevant in the EEG market by aligning neurodiagnostics with its broader diagnostic imaging and monitoring portfolio. The company benefits from existing hospital relationships, procurement familiarity, and service infrastructure, particularly in large public and private hospital systems.

What Lies Ahead for Australia EEG Machines Market?

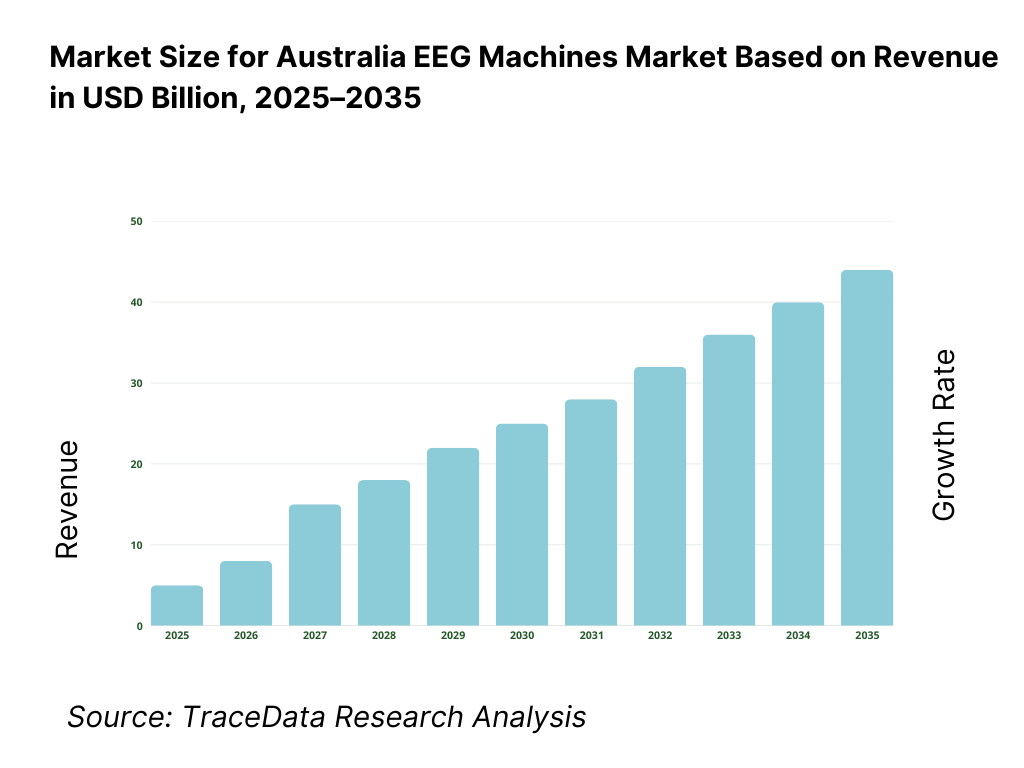

The Australia EEG machines market is expected to expand steadily through 2035, supported by rising neurological disease burden, growing emphasis on early diagnosis and long-term monitoring, and continued investment in hospital and diagnostic infrastructure across public and private healthcare systems. Growth momentum is reinforced by increasing utilization of EEG in epilepsy management, sleep medicine, critical care neurology, and neurodegenerative disease assessment. As healthcare providers prioritize diagnostic accuracy, patient safety, and continuity of care, EEG systems will remain a foundational neurodiagnostic modality across inpatient, outpatient, and ambulatory settings.

Transition Toward Advanced, Long-Term, and High-Resolution EEG Monitoring Solutions: The future of the Australia EEG machines market will see a shift from basic routine EEG systems toward advanced solutions such as video EEG, continuous EEG, and high-density EEG platforms. These systems support complex clinical use cases including epilepsy surgery evaluation, ICU neuro-monitoring, and advanced neuroscience research. Demand will increasingly favor systems that deliver higher signal fidelity, synchronized video integration, and extended recording durations, enabling deeper clinical insight and improved diagnostic confidence. Suppliers offering scalable platforms that can evolve with clinical needs will capture higher-value demand.

Growing Adoption of Portable and Ambulatory EEG to Expand Access Beyond Hospitals: Ambulatory and portable EEG systems are expected to see strong growth as healthcare delivery models shift toward outpatient and home-based monitoring. These systems help reduce hospital stays, improve patient comfort, and extend diagnostic reach into regional and remote areas. Australia’s focus on improving healthcare access outside metropolitan centers will support adoption of compact, wireless, and cloud-enabled EEG solutions that allow remote review by neurologists and centralized reporting models.

Integration of EEG Data with Digital Health Platforms and Hospital IT Ecosystems: Through 2035, EEG systems will increasingly be evaluated on their ability to integrate seamlessly with electronic medical records, picture archiving systems, and hospital information platforms. Buyers will prioritize solutions that support secure data storage, interoperability, remote access, and analytics-enabled review workflows. Vendors that invest in software usability, cybersecurity, and compliance with evolving data governance standards will strengthen their competitive position, particularly in large hospital networks and public-sector procurement.

Expansion of Replacement and Upgrade Cycles Across Mature Healthcare Facilities: A significant share of future demand will be driven by replacement of aging EEG equipment and upgrades to more advanced platforms rather than purely greenfield installations. Many Australian hospitals operate established EEG infrastructure that requires modernization to support newer clinical protocols and digital workflows. Replacement-driven demand will benefit suppliers with strong local service networks, proven system reliability, and long-term maintenance support capabilities.

Australia EEG Machines Market Segmentation

By Product Type

• Conventional EEG Systems

• Video EEG Systems

• Portable / Ambulatory EEG Systems

• High-Density & Advanced EEG Systems

By Channel Count

• Low Channel (8–16 Channel)

• Mid Channel (21–32 Channel)

• High Channel (64 Channel and Above)

By End-Use Setting

• Hospitals (Public & Private)

• Diagnostic Centers & Sleep Laboratories

• Research & Academic Institutions

• Specialty Clinics & Rehabilitation Centers

By Application

• Epilepsy Diagnosis & Monitoring

• Sleep Disorders & Polysomnography Support

• Critical Care & ICU Monitoring

• Neurodegenerative Disease Assessment

• Research & Cognitive Neuroscience

By Region

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia

• Rest of Australia

Players Mentioned in the Report:

• Natus Medical

• Nihon Kohden

• Philips Healthcare

• Compumedics

• GE HealthCare

• Cadwell Industries

• Micromed

• Brain Products

• Regional distributors, neurodiagnostic service providers, and hospital-focused system integrators

Key Target Audience

• EEG machine manufacturers and neurodiagnostic equipment suppliers

• Hospital networks and public healthcare procurement bodies

• Private hospitals, diagnostic chains, and sleep laboratories

• Neurology clinics and epilepsy monitoring centers

• Research institutions and neuroscience laboratories

• Healthcare IT and digital health solution providers

• Investors focused on medical devices and healthcare infrastructure

Time Period:

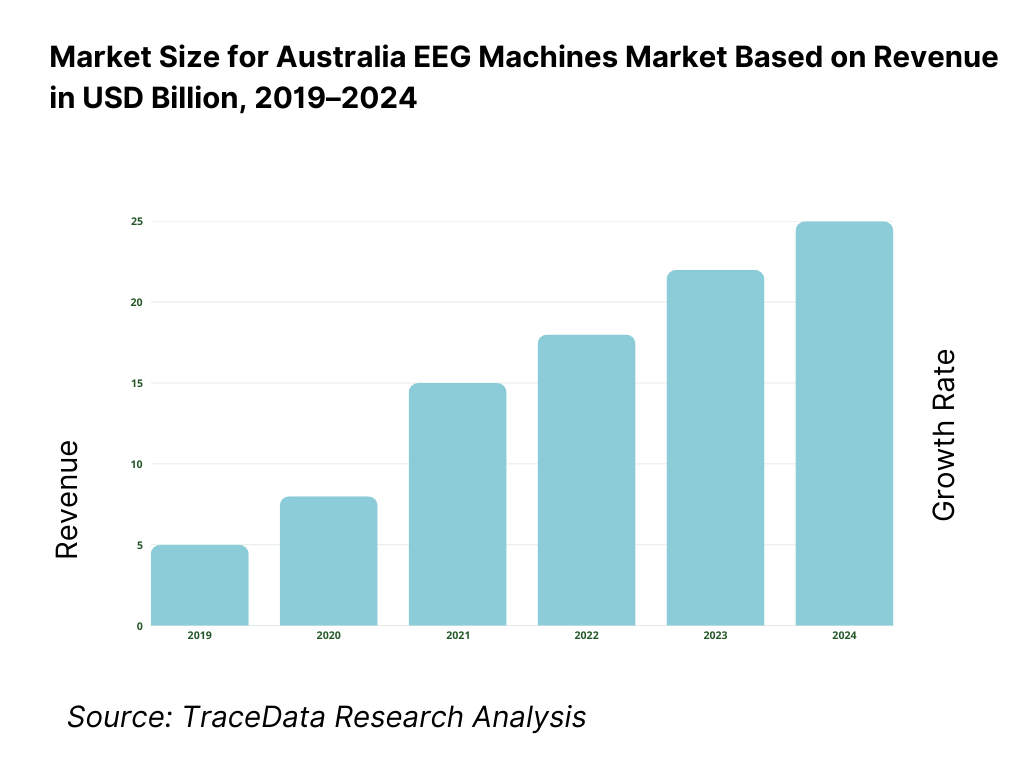

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for EEG Machines including direct OEM supply, distributor-led sales, hospital tender-based procurement, integrated diagnostic solutions, and research-oriented system deployments with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for EEG Machines Market including equipment sales, software licenses, consumables and electrodes, service and maintenance contracts, upgrades, and training services

4. 3 Business Model Canvas for EEG Machines Market covering OEMs, distributors, hospitals, diagnostic centers, research institutions, software providers, and service partners

5. 1 Global EEG Equipment Manufacturers vs Regional and Local Players including multinational neurodiagnostic companies, Australia-headquartered firms, and niche EEG solution providers

5. 2 Investment Model in EEG Machines Market including R&D investments, software platform development, clinical validation studies, and service network expansion

5. 3 Comparative Analysis of EEG System Deployment by Hospital-Based, Diagnostic Center-Based, and Ambulatory or Home-Based Monitoring Models

5. 4 Healthcare Diagnostic Budget Allocation comparing EEG spending versus other neurodiagnostic modalities with average spend per facility per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by product type and by application

8. 3 Key Market Developments and Milestones including regulatory approvals, technology upgrades, major hospital procurements, and product launches

9. 1 By Market Structure including global manufacturers, regional players, and local distributors

9. 2 By Product Type including conventional EEG, video EEG, portable or ambulatory EEG, and high-density EEG systems

9. 3 By Channel Count including low-channel, mid-channel, and high-channel EEG systems

9. 4 By End-Use Setting including hospitals, diagnostic centers, sleep laboratories, and research institutions

9. 5 By Application including epilepsy diagnosis, sleep disorders, critical care monitoring, neurodegenerative disease assessment, and research

9. 6 By Patient Setting including inpatient, outpatient, and ambulatory monitoring

9. 7 By Technology Type including wired, wireless, and cloud-enabled EEG systems

9. 8 By Region including New South Wales, Victoria, Queensland, Western Australia, South Australia, and Rest of Australia

10. 1 Healthcare Provider Landscape and Facility-Level Analysis highlighting tertiary hospitals, diagnostic chains, and specialty neurology centers

10. 2 EEG System Selection and Purchase Decision Making influenced by clinical accuracy, software capability, regulatory compliance, and service support

10. 3 Utilization and ROI Analysis measuring system usage rates, diagnostic throughput, and lifecycle value

10. 4 Gap Analysis Framework addressing diagnostic access gaps, technology limitations, and workforce constraints

11. 1 Trends and Developments including ambulatory EEG growth, digital integration, AI-enabled analysis, and long-term monitoring adoption

11. 2 Growth Drivers including aging population, rising neurological disorders, public healthcare investment, and diagnostic modernization

11. 3 SWOT Analysis comparing global OEM scale versus local service strength and clinical specialization

11. 4 Issues and Challenges including high equipment costs, skilled workforce shortages, data management complexity, and procurement delays

11. 5 Government Regulations covering medical device approval, clinical standards, data privacy, and healthcare procurement in Australia

12. 1 Market Size and Future Potential of EEG, sleep diagnostics, and related neuro-monitoring technologies

12. 2 Business Models including hospital-owned diagnostics, outsourced diagnostic services, and hybrid monitoring models

12. 3 Delivery Models and Type of Solutions including in-hospital EEG, ambulatory monitoring, and remote interpretation platforms

15. 1 Market Share of Key Players by revenues and by installed base

15. 2 Benchmark of 15 Key Competitors including global EEG OEMs, Australia-based manufacturers, and specialized neurodiagnostic solution providers

15. 3 Operating Model Analysis Framework comparing direct OEM-led models, distributor-centric models, and integrated diagnostic solution providers

15. 4 Gartner Magic Quadrant positioning global leaders and specialized challengers in neurodiagnostic equipment

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through technology differentiation versus cost-led positioning

16. 1 Revenues with projections

17. 1 By Market Structure including global manufacturers, regional players, and local distributors

17. 2 By Product Type including conventional, video, portable, and high-density EEG systems

17. 3 By Channel Count including low, mid, and high channel systems

17. 4 By End-Use Setting including hospitals, diagnostic centers, and research institutions

17. 5 By Application including clinical diagnostics and research

17. 6 By Patient Setting including inpatient, outpatient, and ambulatory monitoring

17. 7 By Technology Type including wired and wireless systems

17. 8 By Region including New South Wales, Victoria, Queensland, Western Australia, South Australia, and Rest of Australia

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Australia EEG Machines Market across demand-side and supply-side entities. On the demand side, entities include public and private hospitals, tertiary neurology centers, epilepsy monitoring units, diagnostic chains, sleep laboratories, intensive care units, rehabilitation centers, and academic and neuroscience research institutions. Demand is further segmented by care setting (inpatient, outpatient, ambulatory, and home-based monitoring), clinical application (routine diagnosis, long-term monitoring, critical care, sleep studies, and research), and procurement model (centralized public tenders, hospital network contracts, private procurement, and research grants). On the supply side, the ecosystem includes global EEG equipment manufacturers, Australia-headquartered neurodiagnostics companies, local distributors and service partners, software and analytics providers, electrode and consumables suppliers, hospital IT integration partners, and regulatory and compliance bodies. From this mapped ecosystem, we shortlist 6–10 leading EEG system providers based on installed base, regulatory approvals, product breadth, clinical adoption across hospitals, and service presence in Australia. This step establishes how value is created and captured across equipment supply, software licensing, system integration, training, maintenance, and upgrades.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Australia EEG machines market structure, demand drivers, and segment behavior. This includes reviewing neurological disease prevalence trends, epilepsy and sleep disorder diagnosis rates, ICU monitoring adoption, and healthcare infrastructure expansion across states. We assess public healthcare funding mechanisms, hospital replacement cycles, and private sector investment patterns influencing EEG procurement. Company-level analysis includes review of EEG product portfolios, channel count offerings, software capabilities, regulatory approvals, service models, and typical end-use settings. We also examine regulatory and compliance dynamics shaping the market, including medical device approval processes, clinical quality standards, and data governance requirements. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook development.

Step 3: Primary Research

We conduct structured interviews with EEG equipment manufacturers, local distributors, hospital biomedical engineering teams, neurologists, neurophysiology technologists, diagnostic center operators, and sleep lab administrators. The objectives are threefold: (a) validate assumptions around demand concentration across hospitals, diagnostic centers, and research institutions, (b) authenticate segment splits by product type, channel count, application, and end-use setting, and (c) gather qualitative insights on pricing behavior, procurement cycles, replacement frequency, service expectations, and barriers to adoption. A bottom-to-top approach is applied by estimating system installations, average selling prices, and upgrade cycles across key end-use segments and regions, which are aggregated to develop the overall market view. In selected cases, discreet buyer-style interactions are conducted with distributors and service providers to validate field-level realities such as tender timelines, installation lead times, training requirements, and post-installation support challenges.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand projections are reconciled with macro indicators such as population aging, neurological disease burden, hospital infrastructure budgets, and diagnostic service utilization trends. Assumptions around technology adoption, shift toward ambulatory EEG, and replacement-driven demand are stress-tested to assess their impact on market growth. Sensitivity analysis is conducted across key variables including public healthcare funding stability, workforce availability, and pace of digital health integration. Market models are refined until alignment is achieved between supplier capacity, distributor throughput, and end-user demand patterns, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Australia EEG Machines Market?

The Australia EEG machines market holds steady long-term potential, supported by rising prevalence of neurological and sleep-related disorders, increasing emphasis on early diagnosis and continuous monitoring, and sustained investment in hospital and diagnostic infrastructure. EEG remains a foundational neurodiagnostic modality across epilepsy care, critical care neurology, and sleep medicine. As healthcare delivery models evolve toward outpatient and ambulatory monitoring, the market is expected to expand through both capacity additions and replacement-driven upgrades through 2035.

02 Who are the Key Players in the Australia EEG Machines Market?

The market features a combination of global neurodiagnostic equipment manufacturers, Australia-headquartered technology providers, and specialized EEG vendors supported by local distributors and service partners. Competition is shaped by clinical reliability, software sophistication, regulatory compliance, installed base strength, and service responsiveness. Established players tend to dominate public hospital and tertiary care procurement, while specialized vendors compete in ambulatory, sleep, and research-focused applications.

03 What are the Growth Drivers for the Australia EEG Machines Market?

Key growth drivers include increasing neurological disease burden, expanding use of EEG in intensive care and long-term monitoring, growing adoption of portable and ambulatory EEG systems, and modernization of hospital diagnostic infrastructure. Additional momentum comes from digital health integration, improved data analytics, and growing demand for EEG in sleep medicine and neuroscience research. Public healthcare funding stability and structured replacement cycles further reinforce baseline demand.

04 What are the Challenges in the Australia EEG Machines Market?

Challenges include high capital cost of advanced EEG systems, shortages of trained neurophysiology personnel, and operational complexity associated with data management and system integration. Public procurement timelines can be lengthy, particularly for large hospital networks, while smaller facilities may face budget constraints that delay upgrades. Ensuring interoperability with hospital IT systems and compliance with evolving data governance standards also adds complexity for buyers and suppliers alike.