Australia In Vitro Diagnostics (IVD) Market Outlook to 2030

By Technology, By Application, By End User, By Testing Location, and By Region

- Product Code: TDR0223

- Region: Asia

- Published on: August 2025

- Total Pages: 80

Report Summary

The report titled “Australia In Vitro Diagnostics (IVD) Market Outlook to 2030 – By Technology, By Application, By End User, By Testing Location, and By Region” provides a comprehensive analysis of the diagnostics industry in Australia. The report covers an overview and genesis of the market, overall market size in terms of revenue and test volumes, and detailed market segmentation. It examines key trends and developments, the regulatory and reimbursement landscape, customer-level profiling, industry issues and challenges, and a competitive landscape including competition scenario, cross-comparison of leading players, opportunities and bottlenecks, and detailed company profiling of major IVD suppliers. The report concludes with future market projections based on testing volumes, technology adoption, geographic demand shifts, cause-and-effect relationships, and success case studies, highlighting the major growth opportunities and cautionary factors for stakeholders across Australia’s diagnostic ecosystem.

Australia In Vitro Diagnostics Market Overview and Size

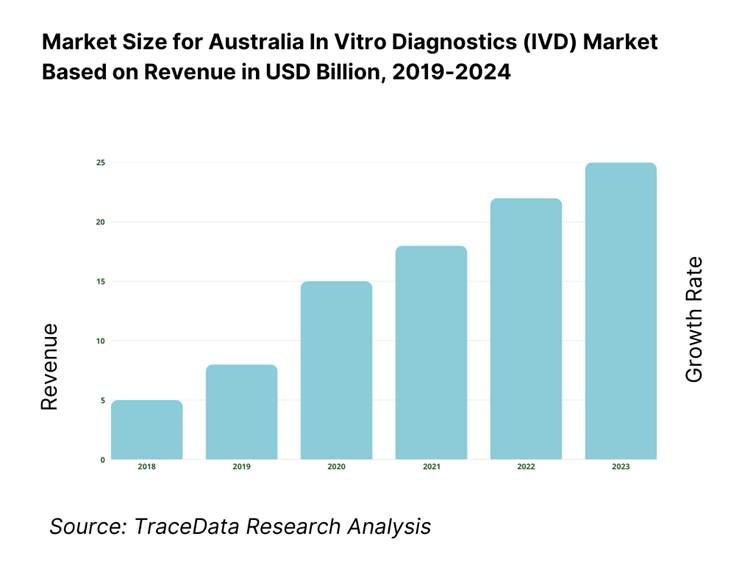

The Australia in vitro diagnostics (IVD) market is valued at USD 2.00 billion as of 2023, based on recent refined datasets from reliable industry forecasts. This substantial market size is propelled by rising prevalence of chronic conditions, increasing governmental healthcare investments—USD 98.82 billion allocated in 2022–23—and technological advancements in diagnostics. The combination of disease burden, public healthcare funding, and innovation has firmly anchored market expansion.

The IVD market in Australia is particularly concentrated in cities such as Sydney and Melbourne, with spillover into Queensland. Dense healthcare infrastructure, high laboratory capacity, and strong biotech clusters—especially around Melbourne—provide the backbone for dominance in these regions. Queensland benefits from public‑health emphasis on tropical disease surveillance and early point‑of‑care deployments. As a result, these metropolitan and regional centers shape market dynamics.

What Factors are Leading to the Growth of the Australia In Vitro Diagnostics Market:

Screening participation rates: Population-scale screening pipelines keep test volumes high across Australia’s IVD ecosystem. The National Bowel Cancer Screening Program sent 6,279,905 invitations and recorded 2,616,787 completed kits over its most recent two-year reporting window, feeding substantial faecal immunochemical test throughput into accredited labs. BreastScreen services delivered 1,808,271 screens, providing a steady flow of cytology and histopathology workups. Cervical screening remained active, with 268,000 HPV tests processed in a single quarter, sustaining molecular assay demand. Capacity is underpinned by public networks such as NSW Health Pathology, which operates 60 laboratories and 150+ collection centres and performs 100,000+ investigations daily. AIHW’s latest health report confirms intensive diagnostic use in 2024, with millions of Australians interacting with pathology services.

Disease prevalence indices: Enduring burdens from chronic and oncological diseases translate directly into sustained IVD demand. ABS reports 1.3 million Australians living with diabetes, a population needing routine HbA1c, lipid, renal and microalbumin assays. AIHW records 165,000 new cancer cases, supporting high volumes of tumour marker testing, surgical histopathology and companion diagnostics. Hospital activity also signals case complexity: AIHW notes 12.6 million hospitalisations and 8.8 million emergency department presentations in 2022–23, creating continuous demand for biochemistry, haematology and microbiology across inpatient and outpatient pathways. Together, these disease loads anchor day-to-day test utilisation and justify investment in higher-throughput immunoassay and molecular platforms across Australian laboratories.

MBS pathology utilisation per 1,000 population: Medicare data show the diagnostic backbone of Australia’s health system runs through pathology. AIHW reports 160.1 million Medicare-subsidised pathology services delivered to 17.4 million people, with an average 11.3 services per patient. In the same reporting year, AIHW also states 438 pathology tests per 100 people—an intensity equivalent to 4,380 per 1,000 population. Using ABS estimated resident population of 26,638,544, total activity equates to about 6,009 services per 1,000 residents—illustrating how frequently Australians rely on funded pathology in routine care, chronic disease monitoring and acute admissions. These figures underscore why reagent supply, LIS uptime and sample logistics are mission-critical for the IVD market.

Which Industry Challenges Have Impacted the Growth of the Australia In Vitro Diagnostics Market:

Price compression vs MBS fee schedule: Policy settings around Medicare rebates shape the revenue envelope for IVD providers. MBS policy updates confirm multiple change points, including 1 July 2023 and 1 July 2024 amendments to pathology listings, while the 2024–25 Budget papers state annual indexation will only be reintroduced from 1 July 2025 for selected groups (P1, P4, P5, P6, P8). The Royal College of Pathologists of Australasia notes that several core groups—P2 (Chemical Pathology), P3 (Microbiology) and P7 (Genetics)—are excluded from indexation and that some groups had not been indexed “in over two decades”, tightening revenue levers even as test volumes remain high. The imbalance between frequent CPI and wage-cost movements and selective indexation leaves limited room for margin recovery in commoditised, high-volume assays.

Tender-driven margin pressure: State procurement centralisation and the scale of public delivery intensify price competition for consumables, platforms and reference-lab services. HealthShare NSW acts as the system’s central hub for tendering and contracting, pooling demand across Local Health Districts. Within this footprint, NSW Health Pathology runs 60 laboratories and 150+ collection centres, executing 100,000+ investigations daily—volumes that enable aggressive benchmarking of unit costs across suppliers. Nationally, AIHW reports 12.6 million hospitalisations in 2022–23, of which public hospitals provided 7.5 million; such scale favours panel contracts, ceiling prices, rebate schedules and KPI-linked performance terms that compress supplier margins while requiring strict quality and turnaround adherence.

Workforce shortages of scientists/pathologists: Staffing tightness constrains throughput expansion and specialised test availability. Jobs and Skills Australia lists 32,100 people employed as Medical Laboratory Scientists—stretched across biochemistry, haematology, microbiology and transfusion services—and only 2,800 employed pathologists (ANZSCO 253915), an absolute headcount that must cover tissue pathology, cytology, haematology, microbiology and subspecialties. With Australia’s estimated resident population at 27,204,809, that translates to roughly one pathologist per 9,700 residents, before considering leave, training and research commitments. Persistent hiring gaps in regional networks (e.g., NSW and SA public pathology footprints with 60 and 19 laboratories respectively) compound reliance on overtime and locums, stretching quality-assurance workloads and accreditation maintenance.

What are the Regulations and Initiatives which have Governed the Market:

TGA IVD Classification & ARTG Listing Requirements: The Therapeutic Goods Administration (TGA) regulates all commercial in vitro diagnostic devices through a risk-based classification system (Class 1–4 IVDs). Sponsors must include approved devices in the Australian Register of Therapeutic Goods (ARTG) before supply. In 2023, over 7,500 IVD entries were active in the ARTG, ensuring compliance with performance evaluation, labelling, and post-market surveillance obligations. This framework safeguards test quality and reliability across clinical settings.

NATA/RCPA Laboratory Accreditation Standards: All medical testing laboratories in Australia must meet ISO 15189 standards under the National Association of Testing Authorities (NATA) and the Royal College of Pathologists of Australasia (RCPA) accreditation program. Accreditation is mandatory for Medicare-funded testing. In 2023, more than 1,200 laboratory facilities were accredited under this scheme, covering public, private, and regional service providers, ensuring uniform quality control, external quality assurance (EQA), and traceability in diagnostic workflows.

National Screening Program Protocols and Reporting: Government-led screening initiatives, such as the National Bowel Cancer Screening Program, National Cervical Screening Program, and BreastScreen Australia, set mandatory testing protocols, reporting standards, and connectivity requirements with national registries. In 2023, these programs collectively processed over 4.7 million screening tests, with laboratories required to meet specific turnaround times, HPV assay standards, and FIT kit handling protocols. These initiatives not only drive steady test volumes but also ensure uniformity and accuracy in results delivery across the country.

Australia In Vitro Diagnostics Market Segmentation

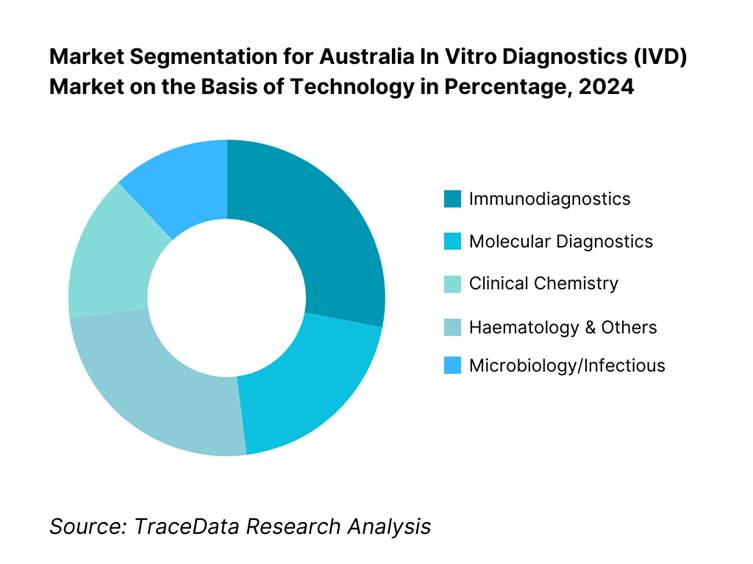

By Technology: By 2024, immunodiagnostics accounted for 28.4% of market revenue, owing to entrenched use in routine hormone assays, cardiac markers, and infectious disease tests. Their prevalence in standard lab workflows and wide clinical applicability sustain leadership.

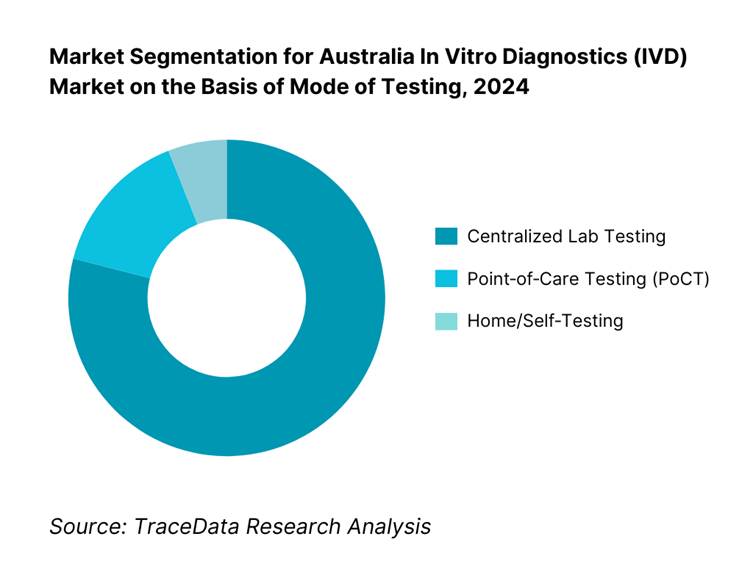

By Mode of Testing: Centralized labs held 79.1% of market share in 2024, benefitting from economies of scale, high throughput, and Medicare bulk‑billing incentives that reimburse nearly all out-of-hospital testing. Meanwhile, PoCT is fast‑growing but smaller in absolute share.

Competitive Landscape in Australia In Vitro Diagnostics Market

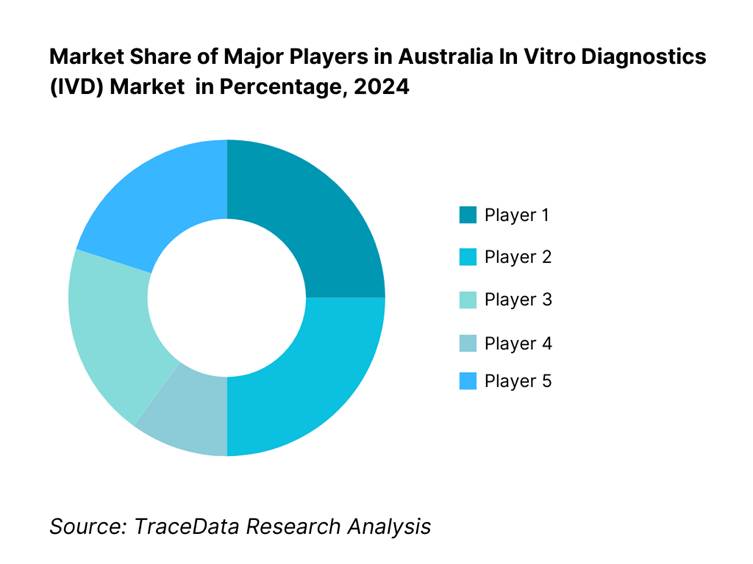

The Australia in vitro diagnostics (IVD) market is relatively consolidated, with a handful of multinational corporations and strong domestic players dominating supply across public and private pathology networks. Global leaders such as Roche Diagnostics, Abbott, Siemens Healthineers, and Danaher (Beckman Coulter and Cepheid) maintain extensive installed bases and nationwide service coverage. At the same time, innovative Australian companies like Genetic Signatures and SpeeDx, alongside niche molecular and point-of-care solution providers, are expanding their presence. This blend of established global suppliers and agile local innovators is diversifying product menus, technology adoption, and service models across the country’s diagnostic ecosystem.

Name | Founding Year | Headquarters |

Roche Diagnostics | 1896 | Basel, Switzerland |

Abbott Diagnostics | 1888 | Abbott Park, Illinois, USA |

Siemens Healthineers | 1847 | Erlangen, Germany |

Danaher Corporation | 1984 | Washington, D.C., USA |

Becton, Dickinson and Company | 1897 | Franklin Lakes, New Jersey, USA |

bioMérieux | 1963 | Marcy-l'Étoile, France |

Sysmex Corporation | 1968 | Kobe, Japan |

QIAGEN | 1984 | Hilden, Germany |

Thermo Fisher Scientific | 2006 | Waltham, Massachusetts, USA |

Genetic Signatures | 2008 | Sydney, Australia |

SpeeDx | 2009 | Sydney, Australia |

Hologic | 1985 | Marlborough, Massachusetts, USA |

QuidelOrtho | 1979 | San Diego, California, USA |

Illumina | 1998 | San Diego, California, USA |

Bio-Rad Laboratories | 1952 | Hercules, California, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Roche Diagnostics: Strengthening its molecular diagnostics leadership in Australia, Roche launched expanded respiratory and multiplex infectious disease panels through its Cobas platform in 2023, targeting public hospital networks under state tender agreements.

Abbott Diagnostics: Abbott expanded its i-STAT Alinity point-of-care ecosystem across regional and remote clinics in 2023, supporting rapid cardiovascular and metabolic testing aligned with the Australian Medicare Benefits Schedule for PoCT HbA1c and troponin.

Siemens Healthineers: In 2024, Siemens Healthineers completed major automation track installations at several core labs in Victoria and New South Wales, enhancing throughput and reducing sample turnaround times for public pathology networks.

Danaher Corporation (Beckman Coulter & Cepheid): Cepheid accelerated its GeneXpert cartridge supply for remote Aboriginal and Torres Strait Islander health services in 2023, focusing on rapid STI, TB, and respiratory testing in collaboration with state health departments.

Genetic Signatures: The Sydney-based company expanded its EasyScreen syndromic testing menu in 2024, including new panels for enteric and respiratory pathogens, while securing additional ARTG listings to broaden domestic sales channels.

What Lies Ahead for Australia In Vitro Diagnostics (IVD) Market?

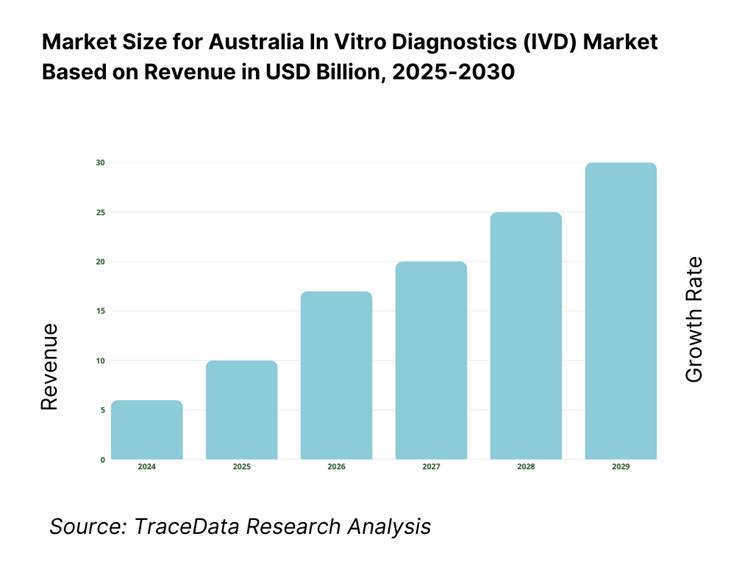

The Australia IVD market is expected to maintain steady expansion through 2030, driven by sustained public healthcare investment, advances in diagnostic technologies, and the growing demand for faster, more accurate testing in both centralized laboratories and point-of-care settings. Increased focus on precision medicine, integration of AI-based diagnostics, and government-backed screening initiatives will be pivotal in shaping the next phase of market growth.

Rise of Decentralized and Connected Diagnostics: The future of Australia’s IVD industry is poised for a shift towards decentralized testing models, including expanded point-of-care and self-testing solutions. Connectivity between devices and centralized lab systems will enable real-time reporting, improve access in rural and remote regions, and reduce patient turnaround times.

Focus on Clinical Utility and Outcome-Based Testing: Healthcare providers are increasingly demanding evidence of clinical utility from diagnostic platforms, with an emphasis on tests that directly inform treatment pathways. This approach ensures that investments in IVD solutions translate into measurable improvements in patient outcomes and system efficiency.

Expansion of Specialized Testing Programs: There is likely to be rising demand for specialized testing in oncology, antimicrobial resistance (AMR) surveillance, and genetic screening. National cancer screening programs and infectious disease control efforts will continue to drive uptake of high-complexity assays in both public and private laboratories.

Integration of AI, Automation, and Advanced Analytics: AI-powered image analysis, automated laboratory workflows, and predictive analytics are expected to gain traction, supporting both efficiency and diagnostic accuracy. These technologies will help laboratories manage increasing test volumes, address workforce shortages, and improve turnaround performance while enhancing quality assurance.

Australia In Vitro Diagnostics (IVD) Market Segmentation

By Technology

Clinical Chemistry

Immunoassays (ELISA, CLIA, RIA)

Molecular Diagnostics (PCR, NAAT, NGS, Isothermal Amplification)

Hematology

Coagulation

Microbiology & Infectious Disease Testing (culture, ID/AST, syndromic panels)

Urinalysis

Point-of-Care Testing (PoCT)

Self-Testing / OTC Diagnostics

By Application

Infectious Diseases (respiratory, STIs, GI infections, TB, HIV)

Oncology & Companion Diagnostics

Cardiac & Metabolic Disorders

Endocrinology (thyroid, fertility, hormone monitoring)

Diabetes Management

Women’s Health & Prenatal Screening

Transplantation & HLA Typing

Antimicrobial Resistance (AMR) & Antimicrobial Stewardship (AMS)

Genetic & Genomic Testing

By End User

Public Hospital Pathology Networks

Private Pathology Providers

Day Hospitals & Specialist Clinics

General Practitioner Clinics & Aboriginal Community Controlled Health Services

Pharmacies

Home-based Testing Services

By Testing Location

Central Core Laboratories

Hub Laboratories (satellite processing centres)

Near-Patient / Ward-based Testing

Community Collection Centres

Home & Self-Testing

By Region / State

New South Wales (NSW)

Victoria (VIC)

Queensland (QLD)

Western Australia (WA)

South Australia (SA)

Tasmania (TAS)

Australian Capital Territory (ACT)

Northern Territory (NT)

Players Mentioned in the Report:

Roche Diagnostics

Abbott Laboratories (Diagnostics)

Siemens Healthineers

Danaher Corporation (Beckman Coulter, Cepheid)

Becton, Dickinson & Company (BD)

bioMérieux

Sysmex

QIAGEN

Thermo Fisher Scientific

Genetic Signatures (Australia)

SpeeDx (Australia)

Hologic

QuidelOrtho

Illumina

Bio-Rad Laboratories

Key Target Audience

Chief Medical Officers / Chief Laboratory Officers at public and private pathology networks

Healthcare Investment and Venture Capital Firms (e.g., Quadrant, OneVentures)

Government and Regulatory Bodies (e.g., TGA, Department of Health and Aged Care)

State Procurement Agencies (e.g., HealthShare NSW, HealthShare Victoria)

Corporate Strategy Teams at IVD manufacturers and distributors

Private Equity Healthcare Funds focusing on diagnostic assets

Hospital Network Procurement Directors

Public Health Program Directors

Time Period:

Historical Period: 2019-2024

Base Year: 2025

- Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Public Pathology Networks (NSW Health Pathology, PathWest, SA Pathology, Pathology Queensland, etc.)

3.2. Private Laboratory Groups (Sullivan Nicolaides, Douglass Hanly Moir, Australian Clinical Labs, Sonic Healthcare, etc.)

3.3. Distributors and Sponsors (Local IVD Sponsors, ARTG License Holders)

3.4. Regulatory Bodies (TGA, NATA/RCPA, NPAAC)

3.5. Technology Providers & OEMs

3.6. Procurement Agencies (HealthShare NSW, HSV, QLD Health Procurement)

4.1. Delivery Model Analysis for IVD Testing in Australia-Central Lab, Hub-and-Spoke, Near-Patient, PoCT, Self-Testing [Margins, Adoption Rates, Turnaround Time Strengths/Weaknesses, Infrastructure Costs]

4.2. Revenue Streams for Australia IVD Market-Reagent Sales, Instrument Capital Sales, Managed Service Agreements, Reagent-Rental Models, Service & Maintenance, Software Licenses

4.3. Business Model Canvas for Australia IVD Market-Value Proposition, Customer Segments, Key Activities, Revenue Model, Cost Structure, Key Partners, Customer Relationships

5.1. Public vs Private Pathology Market Share [By Volume, By Revenue, By Technology]

5.2. Investment Models in Australia IVD Market [State-Funded, Private Capital, Public-Private Partnerships]

5.3. Comparative Analysis of Test Funnel Processes in Public vs Private Labs [From Collection to Reporting, TAT Benchmarks, Connectivity Standards]

5.4. Pathology Budget Allocation by Hospital Size / Health Network

8.1. Revenues, 2019-2024

8.2. Volume of Tests Processed, 2019-2024

9.1. By Market Structure (Public vs Private Pathology Labs)

9.2. By Technology (Clinical Chemistry, Immunoassays, Molecular Diagnostics, Haematology, Microbiology, PoCT)

9.3. By Application (Infectious Disease, Oncology, Cardiometabolic, Endocrinology, AMR/AMS)

9.3.1. By Type of Molecular Diagnostic Testing (PCR, NAAT, NGS)

9.3.2. By Type of Infectious Disease Testing (Respiratory, STIs, GI Panels, TB)

9.3.3. By Type of Oncology Testing (Companion Diagnostics, Liquid Biopsy, Tumour Profiling)

9.3.4. By Type of PoCT (HbA1c, CRP, Troponin, COVID-19 RATs)

9.4. By End-User (Public Hospital Labs, Private Labs, GP/ACCHS PoCT, Pharmacies, Home-Testing)

9.5. By Testing Location (Core Labs, Hub Labs, Near-Patient, Home/Self)

9.6. By Procurement Channel (State Tenders, Direct Purchase, Distributor Contracts)

9.7. By Open vs Proprietary Systems (Closed Analyser Ecosystems vs Open-Platform Devices)

9.8. By Region/State (NSW, VIC, QLD, WA, SA, TAS, ACT, NT)

10.1. Lab Client Landscape and Cohort Analysis (Public Networks, Private Groups, Specialist Clinics)

10.2. Decision-Making Process for IVD Procurement (Technical, Financial, Regulatory, TGA Compliance)

10.3. Testing Program Effectiveness and ROI Analysis (Screening Programs, PoCT Programs)

10.4. Diagnostic Gap Analysis Framework (Under-Tested Populations, Turnaround Delays, Regional Coverage Gaps)

11.1. Trends and Developments for Australia IVD Market [Syndromic Testing, Managed Equipment Services, AI Integration]

11.2. Growth Drivers [Aging Population, Screening Program Expansions, AMR Programs]

11.3. SWOT Analysis for Australia IVD Market

11.4. Issues and Challenges [Workforce Shortages, Tender Price Compression, Supply Chain Risks]

11.5. Government Regulations [TGA IVD Classes, ARTG Listing, NATA Accreditation, MBS Pathology Reimbursement]

12.1. Market Size and Future Potential for PoCT and Self-Testing Devices

12.2. Business Model and Revenue Streams in PoCT Supply

12.3. Delivery Models and Test Menu Offered (Primary Care, Pharmacies, Hospitals)

12.4. Cross-Comparison of Leading PoCT Players [Company Overview, ARTG Listings, Revenues, Installed Base, Menu Breadth, Service Network, Connectivity, Pricing]

15.1. Market Share of Key Players in Australia IVD Market (Revenue & Installed Base)

15.2. Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Installed Base, Revenues, Pricing, Technology Used, Test Menu, Major Clients, Tender Wins, Strategic Partnerships, Recent Developments]

15.3. Operating Model Analysis Framework (Public vs Private Lab Supply Models)

15.4. Gartner Magic Quadrant for IVD Suppliers in Australia

15.5. Bowmans Strategic Clock for Competitive Advantage in IVD Market

16.1. Revenues, 2025-2030

16.2. Projected Volume of Tests, 2025-2030

17.1. By Market Structure (Public vs Private Pathology Labs)

17.2. By Technology (Clinical Chemistry, Immunoassays, Molecular Diagnostics, Haematology, Microbiology, PoCT)

17.3. By Application (Infectious Disease, Oncology, Cardiometabolic, Endocrinology, AMR/AMS)

17.3.1. By Type of Molecular Diagnostic Testing

17.3.2. By Type of Infectious Disease Testing

17.3.3. By Type of Oncology Testing

17.3.4. By Type of PoCT

17.4. By End-User (Public Hospital Labs, Private Labs, GP/ACCHS PoCT, Pharmacies, Home Testing)

17.5. By Testing Location (Core Labs, Hub Labs, Near-Patient, Home/Self)

17.6. By Procurement Channel (State Tenders, Direct Purchase, Distributor Contracts)

17.7. By Open vs Proprietary Systems

17.8. By Region/State (NSW, VIC, QLD, WA, SA, TAS, ACT, NT)

Research Methodology

Step 1: Ecosystem Creation

We map the full Australia In Vitro Diagnostics (IVD) Market ecosystem across demand- and supply-side entities. Demand side includes public pathology networks (e.g., NSW Health Pathology, Pathology Queensland, SA Pathology, PathWest, ACT Health, NT Health), private laboratory groups and their collection-centre networks, day hospitals and specialist clinics, GP practices and Aboriginal Community Controlled Health Services (PoCT), pharmacies (self/near-patient testing), national screening program operators/registries, and payors (Department of Health and Aged Care via MBS). Supply side spans IVD OEMs and local sponsors/distributors, reagent and consumable makers, middleware/LIS vendors, service providers, logistics/cold-chain partners, and EQA/proficiency bodies. From this map we shortlist 5–6 leading suppliers based on Australia-specific criteria: ARTG breadth and TGA class coverage, installed analyser base and service density by state/territory, tender footprint with state procurement hubs, reliability KPIs (uptime/TAT support), and disclosed ANZ revenues where available. Sourcing draws on government portals, statutory databases, industry articles, multiple secondary repositories, and proprietary databases to collate ecosystem-level intelligence.

Step 2: Desk Research

We conduct exhaustive desk research using primary-source, audit-ready repositories to assemble market- and company-level evidence. Core datasets include: TGA’s ARTG for approved IVDs and sponsor obligations; MBS Online and departmental releases for item utilisation and policy updates; AIHW for health system activity and screening program outputs; ABS for population and labour statistics; NATA/RCPA directories for laboratory accreditation; state procurement portals (e.g., HealthShare NSW, HealthShare Victoria, Queensland Government QTenders) and AusTender for award histories; RCPAQAP for EQA participation categories; and company-filed annual reports/press releases for Australia-specific operations. We aggregate insights on installed bases, menu coverage, connectivity (HL7/FHIR), logistics requirements, staffing mix, and service models (managed service, reagent-rental, capital placements). This corpus becomes the foundation for segment sizing, competitive mapping, and value-chain diagnostics.

Step 3: Primary Research

We run structured interviews with C-suite and operational leaders across public networks and private labs (pathology directors, procurement leads, PoCT coordinators), IVD manufacturers (ANZ managing directors, service leaders, medical affairs), distributors/logistics partners, and policy stakeholders. Objectives: validate hypotheses from desk work, authenticate utilisation patterns and service levels, and capture operational details (installation timelines, middleware integrations, QC/EQA workflows, field-service coverage, training). A bottom-to-top approach estimates vendor revenues from installed bases and reagent pull-through coefficients at the assay family level; these are rolled up to market views and reconciled with utilisation from Medicare and screening programs. To further verify operating claims (lead times, SLAs, support scope), we perform blind-buyer exercises with multiple suppliers and labs, cross-checking responses against tender documents, accreditation records, and regulatory filings. Where feasible, we complement interviews with site walk-throughs of core labs, hub/satellite nodes, and PoCT hubs to observe workflow, automation, and TAT controls.

Step 4: Sanity Check

We execute top-down and bottom-up reconciliations to test internal consistency. Top-down anchors include Medicare pathology utilisation and AIHW screening/testing activity, adjusted for inpatient/outpatient mix and non-reimbursed testing. Bottom-up models aggregate volumes by modality (clinical chemistry, immunoassay, molecular, haematology, microbiology/ID-AST, coagulation, urinalysis, PoCT) using installed-base counts, average runs, and validated reagent-per-test factors. We triangulate with accreditation footprints (NATA/RCPA), procurement awards, and OEM service coverage by state. Sensitivity analyses probe key levers—menu mix shifts, automation adoption, and hub-and-spoke consolidation—and gap analyses flag any variance beyond tolerance bands, triggering targeted re-interviews or source re-checks. The output is a traceable, audit-ready dataset and narrative suitable for board-level decision-making and tender strategy.

FAQs

What is the potential for the Australia In Vitro Diagnostics (IVD) Market?

The Australia In Vitro Diagnostics (IVD) Market shows strong potential as healthcare systems deepen screening programs, expand precision oncology, and push diagnostics closer to the patient through point-of-care and connected home testing. Robust public funding, a high test-utilization culture, and continued digitalization of lab workflows underpin sustained demand across core lab and molecular modalities. Ongoing investments in automation, data connectivity, and quality frameworks further position the market for reliable long-term expansion.

Who are the key players in the Australia In Vitro Diagnostics (IVD) Market?

The Australia In Vitro Diagnostics (IVD) Market features global majors and innovative domestic firms. Leading suppliers include Roche Diagnostics, Abbott, Siemens Healthineers, Danaher (Beckman Coulter and Cepheid), BD, bioMérieux, Sysmex, QIAGEN, Thermo Fisher Scientific, Hologic, QuidelOrtho, Illumina, and Bio-Rad. Notable Australian players include Genetic Signatures and SpeeDx. These companies stand out for their broad test menus, installed analyzer bases, nationwide service coverage, and deep integration with public and private pathology networks.

What are the growth drivers for the Australia In Vitro Diagnostics (IVD) Market?

Key growth drivers include rising test intensity from chronic and infectious diseases, national screening programs (e.g., bowel and cervical), and accelerating adoption of molecular and syndromic panels. Investment in lab automation and middleware, wider use of point-of-care testing across primary care and remote communities, and expanding companion diagnostics in oncology all add momentum. Interoperability initiatives and analytics/AI for interpretation and workflow optimization further support performance and clinical utility.

What are the challenges in the Australia In Vitro Diagnostics (IVD) Market?

The market faces pricing pressure from selective Medicare Benefits Schedule indexation and large-scale state tenders, which compress margins while demanding high service levels. Workforce shortages among medical scientists and pathologists strain throughput and specialized coverage, especially in regional areas. Integration and interoperability gaps between LIS, middleware, and national digital health platforms can complicate deployments. Supply-chain resilience, QA/EQA compliance, and managing legacy analyzer footprints also remain ongoing operational hurdles.