Australia IPL Hair Removal Devices Market Outlook to 2035

By Device Type, By End-Use Setting, By Technology Configuration, By Distribution Channel, and By Region

- Product Code: TDR0486

- Region: Global

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Australia IPL Hair Removal Devices Market Outlook to 2035 – By Device Type, By End-Use Setting, By Technology Configuration, By Distribution Channel, and By Region” provides a comprehensive analysis of the Intense Pulsed Light (IPL) hair removal devices market in Australia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; technology and product trends, regulatory and compliance landscape, buyer-level demand profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the Australian IPL hair removal ecosystem.

The report concludes with future market projections based on aesthetic procedure penetration, consumer preference shifts toward non-invasive treatments, clinic expansion dynamics, at-home beauty device adoption, regulatory evolution, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the Australia IPL hair removal devices market through 2035.

Australia IPL Hair Removal Devices Market Overview and Size

The Australia IPL hair removal devices market is valued at approximately ~USD ~ million, representing the supply of light-based hair reduction systems used across professional clinical settings and home-use consumer environments. IPL devices operate by delivering broad-spectrum light energy to hair follicles, causing thermal damage that inhibits regrowth over repeated sessions. These systems are positioned as a non-invasive, relatively low-downtime alternative to laser hair removal, with wide applicability across skin and hair types when used under appropriate protocols.

Market demand in Australia is underpinned by the country’s high aesthetic awareness, strong per-capita spending on personal grooming and cosmetic services, and a mature network of dermatology clinics, medical spas, beauty clinics, and cosmetic chains. Professional IPL devices are widely used in regulated clinical environments for hair reduction, photorejuvenation, pigmentation correction, and vascular treatments, while compact home-use IPL devices are increasingly adopted by consumers seeking privacy, cost savings, and convenience.

Metropolitan regions such as New South Wales, Victoria, and Queensland account for the majority of IPL device demand due to higher population density, concentration of aesthetic clinics, and stronger discretionary spending patterns. Tier-1 cities drive premium and professional-grade device uptake, while suburban and regional markets are emerging as growth pockets for mid-range clinic systems and direct-to-consumer home-use IPL devices supported by e-commerce and retail expansion.

What Factors are Leading to the Growth of the Australia IPL Hair Removal Devices Market:

Rising demand for non-invasive aesthetic procedures strengthens device adoption: Australian consumers increasingly prefer non-surgical and minimally invasive aesthetic solutions that offer visible results with limited recovery time. Hair removal remains one of the most frequently requested cosmetic procedures, particularly among women aged 20–45 and an expanding male grooming segment. IPL devices address this demand by enabling repeatable, clinic-based treatments with lower procedural discomfort and broader treatment versatility compared to single-wavelength laser systems. This sustained procedural demand directly supports replacement cycles and new device installations across clinics and med-spas.

Expansion of aesthetic clinics, cosmetic chains, and franchise models accelerates installed base growth: Australia has witnessed steady growth in dermatology clinics, laser and skin clinics, and multi-location aesthetic chains offering standardized treatment menus. These operators favor IPL platforms due to their multi-application capability, allowing hair removal, skin rejuvenation, acne treatment, and pigmentation management using a single system. The scalability of IPL devices across multiple outlets, combined with predictable consumable and maintenance costs, supports faster rollout across expanding clinic networks.

Growing penetration of home-use IPL devices reshapes consumer behavior: At-home IPL hair removal devices are gaining traction among Australian consumers due to rising price sensitivity toward clinic sessions, preference for privacy, and improved safety and efficacy of newer consumer-grade systems. Advances in skin tone sensors, energy control algorithms, and compact device design have increased consumer confidence. Retailers, pharmacies, and online platforms actively promote home-use IPL devices as long-term cost-saving alternatives, contributing to incremental market expansion beyond professional channels.

Which Industry Challenges Have Impacted the Growth of the Australia IPL Hair Removal Devices Market:

Regulatory scrutiny and compliance requirements increase entry barriers and slow product launches: IPL hair removal devices in Australia are subject to oversight by the Therapeutic Goods Administration (TGA), with professional systems classified as medical devices and home-use products governed under strict consumer safety frameworks. Compliance requirements related to electrical safety, energy output limits, labeling, clinical claims, and operator usage guidelines increase time-to-market and certification costs. For international manufacturers, adapting global IPL platforms to meet Australia-specific regulatory expectations can delay launches and restrict rapid portfolio refresh cycles. These dynamics disproportionately impact smaller or price-driven brands and limit aggressive market expansion by new entrants.

Variability in treatment outcomes across skin and hair types influences consumer confidence and clinic economics: IPL technology, while versatile, is inherently dependent on skin tone, hair color, and treatment protocol adherence. In a diverse population such as Australia’s, clinics face challenges in delivering consistent outcomes across different patient profiles. Suboptimal results or higher session counts can lead to consumer dissatisfaction, reputational risk for clinics, and pressure on pricing. This variability also affects clinic-level return on investment, as operators must balance realistic treatment expectations, repeat session economics, and competitive pricing against laser-based alternatives that may offer more predictable outcomes for specific indications.

Rising competition from laser-based systems and alternative hair removal modalities pressures device utilization: IPL remains widely used, advances in diode, alexandrite, and Nd:YAG laser technologies have intensified competition within the professional hair removal segment. Laser systems increasingly position themselves as faster, more targeted, and clinically superior for certain skin and hair profiles. As premium clinics upgrade to laser-only platforms, some IPL systems face reduced utilization or repositioning toward multi-treatment use rather than hair removal alone. This competitive overlap can slow replacement cycles for standalone IPL hair removal devices and compress margins in price-sensitive clinic segments.

What are the Regulations and Initiatives which have Governed the Market:

Therapeutic Goods Administration (TGA) regulations governing safety, performance, and clinical use: IPL hair removal devices sold in Australia must comply with TGA medical device regulations, which cover product registration, risk classification, electrical and optical safety, manufacturing quality systems, and post-market surveillance. Professional IPL systems are typically required to demonstrate compliance with international standards for light-based therapeutic devices, while ensuring appropriate safeguards for patient use. These regulations shape product design, documentation requirements, and distributor responsibilities, directly influencing cost structures and competitive positioning in the Australian market.

Consumer safety standards and usage restrictions for home-use IPL devices: Home-use IPL hair removal devices are regulated to ensure safe operation by non-professional users. Requirements related to maximum permissible energy levels, skin tone detection mechanisms, instructional labeling, and warning disclosures limit the technical parameters of consumer devices. While these measures protect end-users, they also constrain performance differentiation and place greater emphasis on marketing, brand trust, and perceived safety rather than raw efficacy. Compliance with these standards is critical for retail distribution through pharmacies, electronics chains, and online marketplaces.

Advertising guidelines and claims substantiation influencing marketing practices: Marketing and promotional activities for IPL hair removal devices in Australia are governed by advertising standards that restrict exaggerated or unsubstantiated clinical claims. Manufacturers and clinics must ensure that claims related to permanent hair reduction, treatment efficacy, and safety are supported by evidence and aligned with approved device indications. These guidelines shape how IPL solutions are positioned to consumers, limiting aggressive performance claims and reinforcing a more conservative, compliance-driven marketing environment across both professional and home-use segments.

Australia IPL Hair Removal Devices Market Segmentation

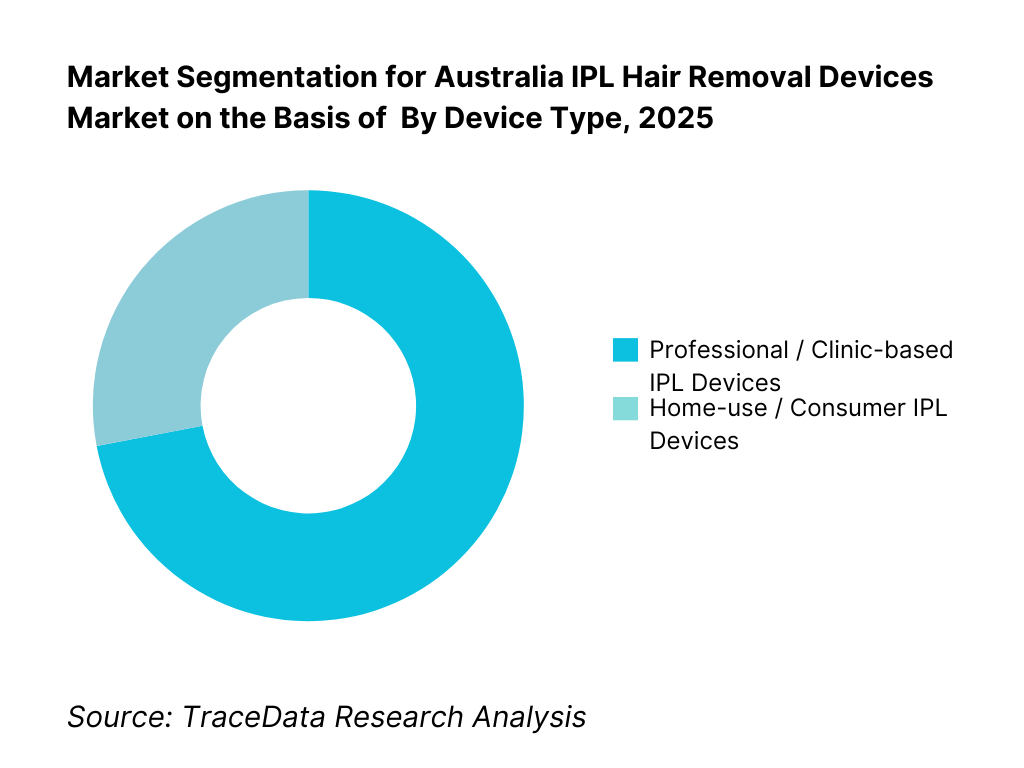

By Device Type: Professional clinic-based IPL systems hold dominance. This is because Australia has a well-established network of dermatology clinics, laser & skin clinics, and medical spas where IPL systems are deployed for high-volume, repeat aesthetic procedures. Professional IPL devices offer higher energy output, faster treatment times, multi-application capability (hair removal, pigmentation, vascular lesions, photorejuvenation), and better clinical control compared to consumer devices. Clinics also favor IPL platforms due to their versatility and ability to generate multiple revenue streams from a single capital asset. While home-use IPL devices are growing rapidly, professional systems continue to account for the majority of market value due to higher unit pricing and institutional purchasing behavior.

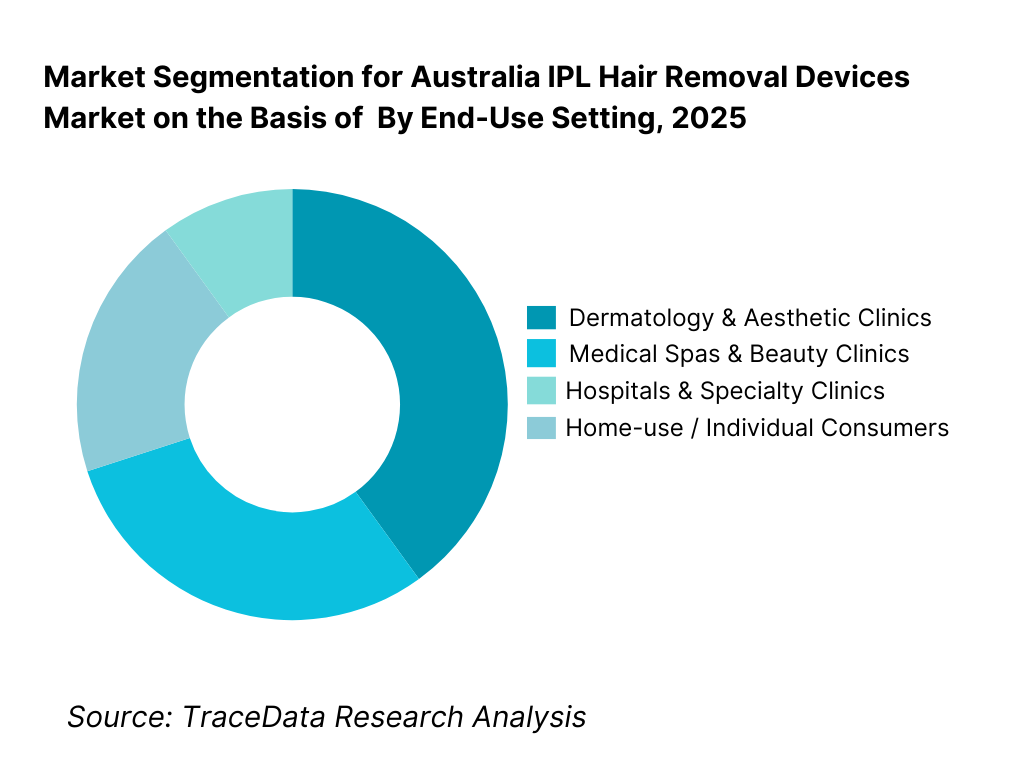

By End-Use Setting: Dermatology and aesthetic clinics dominate demand. Dermatology clinics, laser clinics, and aesthetic centers represent the largest end-use segment, driven by consistent procedural volumes, higher consumer trust in clinical treatments, and bundled service offerings. These facilities prioritize device reliability, safety certifications, after-sales service, and treatment versatility. Medical spas and beauty clinics also contribute meaningfully, particularly in metro and suburban markets. Home-use adoption is expanding among cost-conscious and privacy-seeking consumers, but remains supplementary to clinic-based treatments rather than a complete replacement.

Competitive Landscape in Australia IPL Hair Removal Devices Market

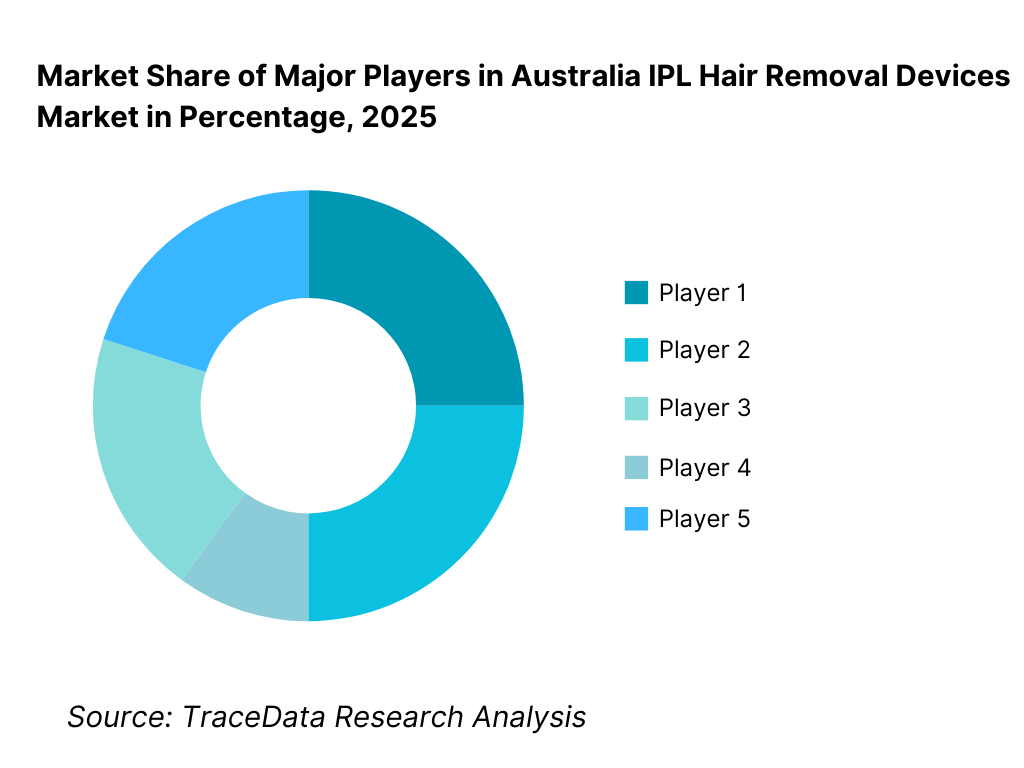

The Australia IPL hair removal devices market exhibits moderate concentration, characterized by the presence of global aesthetic device manufacturers with strong regulatory compliance, clinical validation, and established distributor networks. Market leadership is driven by technology reliability, safety credentials, multi-application versatility, brand credibility among clinicians, and strength of after-sales service and training support.

While international brands dominate the professional segment, the home-use IPL market is more fragmented and competitive, with consumer electronics and beauty-device brands competing aggressively on price, design, and marketing. Clinics tend to favor established brands due to reputational risk, regulatory scrutiny, and the importance of consistent treatment outcomes.

Key Players Operating in the Australia IPL Hair Removal Devices Market

Name | Founding Year | Original Headquarters |

Lumenis | 1966 | Yokneam, Israel |

Cynosure | 1991 | Westford, Massachusetts, USA |

Alma Lasers | 1999 | Caesarea, Israel |

Cutera | 1998 | Brisbane, California, USA |

Candela Medical | 1970 | Marlborough, Massachusetts, USA |

Philips | 1891 | Amsterdam, Netherlands |

Braun | 1921 | Frankfurt, Germany |

Silk’n | 2006 | Tel Aviv, Israel |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Lumenis: Lumenis continues to maintain a strong position in Australia’s professional IPL segment due to its clinical heritage, strong physician acceptance, and emphasis on multi-application platforms. The company’s IPL systems are widely used in dermatology-led practices where safety, treatment consistency, and brand credibility are critical procurement factors.

Cynosure: Cynosure’s IPL offerings benefit from integration with broader aesthetic portfolios, enabling clinics to standardize equipment sourcing from a single vendor. Its competitive strength lies in device performance stability, training support, and appeal to multi-location clinic chains seeking operational consistency.

Alma Lasers: Alma differentiates through modular platforms that combine IPL with complementary technologies, allowing clinics to expand service offerings without purchasing multiple standalone systems. This positioning resonates strongly with mid-sized aesthetic clinics focused on maximizing equipment utilization and ROI.

Candela Medical: Candela’s IPL systems are positioned at the premium end of the market, emphasizing clinical validation, robust cooling systems, and treatment precision. The brand is particularly strong among dermatologist-led practices and premium aesthetic centers where outcome reliability outweighs upfront capital cost.

Philips and Braun (Home-use Segment): These brands dominate the consumer IPL category through strong retail penetration, high consumer trust, and aggressive marketing. Their competitive advantage lies less in technical superiority and more in brand familiarity, safety perception, and widespread availability through pharmacies and electronics retailers.

What Lies Ahead for Australia IPL Hair Removal Devices Market?

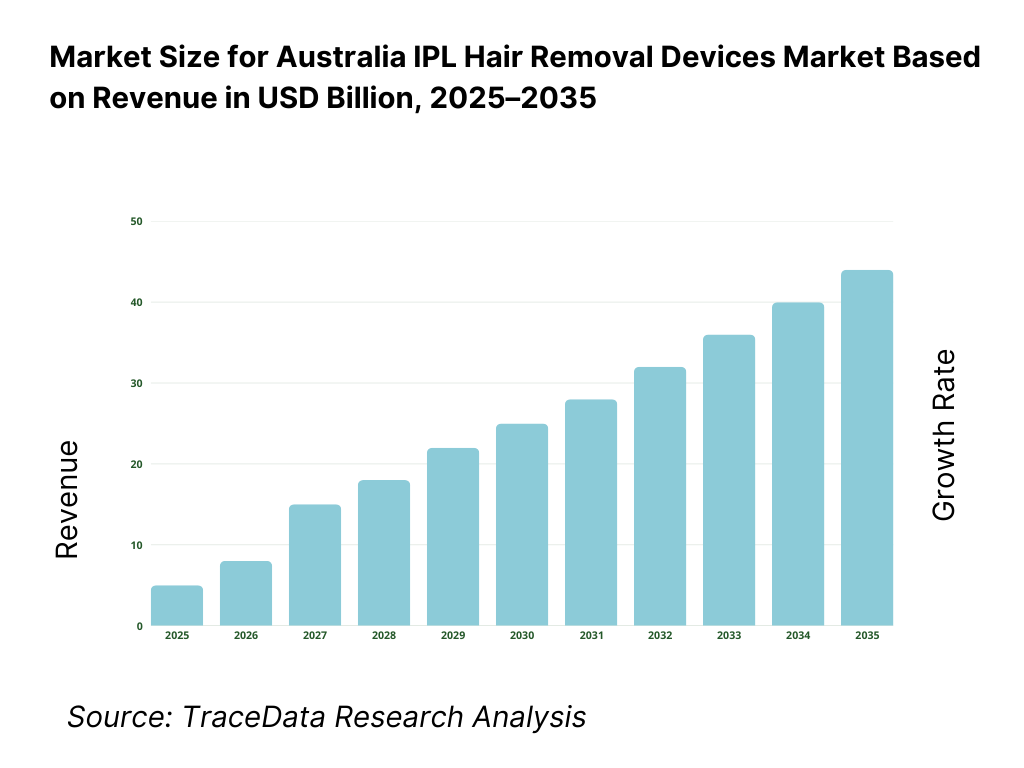

The Australia IPL hair removal devices market is expected to expand steadily by 2035, supported by sustained demand for non-invasive aesthetic procedures, continued growth of dermatology and laser clinic networks, and rising consumer adoption of at-home grooming technologies. Growth momentum is further enhanced by increasing male grooming participation, higher preference for convenience-led beauty solutions, and the proliferation of multi-service aesthetic clinics that rely on device-based treatment portfolios for recurring revenue. As providers and consumers increasingly seek predictable outcomes, safety assurance, and cost-effective long-term hair reduction alternatives, IPL platforms will remain a core modality across both professional and home-use settings through 2035.

Transition Toward Multi-Application, Higher-Precision Professional IPL Platforms: The future of the Australia IPL market will see a continued move from basic hair removal-only platforms toward multi-application, higher-precision systems designed for broader dermatology and aesthetic use-cases. Clinics increasingly demand platforms that can deliver hair reduction alongside pigmentation correction, photorejuvenation, acne management, and vascular indications using interchangeable filters and optimized pulse configurations. This shift will favor suppliers offering robust cooling, consistent fluence delivery, and safer treatment protocols for diverse skin tones, enabling clinics to maximize equipment utilization and improve return on capital.

Growing Emphasis on Clinic Standardization and Scalable Multi-Location Treatment Models: Large laser clinic chains and multi-site aesthetic operators are expected to expand their footprint in metro and high-income suburban corridors. These operators prioritize standardization of protocols, operator training systems, and consistent patient outcomes across locations. IPL platforms that support preset treatment parameters, structured user workflows, and reliable maintenance cycles will benefit from this scaling trend. Through 2035, this will strengthen the role of established international brands and authorized distributors that can provide end-to-end support including installation, compliance documentation, training, and servicing across multiple sites.

Acceleration of Home-Use IPL Adoption and Consumer Behavior Shift Toward Self-Managed Treatments: At-home IPL devices are expected to gain stronger penetration through 2035 as consumers increasingly prioritize privacy, convenience, and long-term cost savings compared to repeated clinic sessions. Product improvements such as skin tone sensors, safety interlocks, better ergonomic design, and simplified treatment guidance will reinforce consumer confidence. Retail and e-commerce channels will continue to expand category awareness through aggressive promotions and bundling strategies, gradually widening IPL adoption beyond urban core users into suburban and regional households.

Increased Influence of Safety, Regulatory Compliance, and Claims Discipline on Market Structure: Regulatory oversight will remain a structural shaping factor for the Australian IPL market. Stronger scrutiny on device safety, advertising claims, and clinical usage standards will favor brands that invest in compliance, evidence-backed performance narratives, and formal training ecosystems. This will act as a quality filter, reducing the viability of low-cost, unverified imports and tightening market access for smaller brands. Clinics will increasingly use compliance credentials and safety positioning as part of their consumer trust narrative, making regulatory discipline a competitive advantage rather than a constraint.

Australia IPL Hair Removal Devices Market Segmentation

By Device Type

• Professional / Clinic-based IPL Devices

• Home-use / Consumer IPL Devices

By Technology Configuration

• Standalone IPL Platforms (Hair removal-focused)

• Multi-Application IPL Systems (Filters for pigmentation, rejuvenation, vascular)

• IPL + RF Hybrid Platforms

• Advanced Pulse Modulation / Cooling-Enhanced Systems

By Distribution Channel

• Direct Sales & Authorized Distributor Model

• Retail & Pharmacy Chains

• E-commerce Platforms / D2C Brand Websites

• Clinic Chain Procurement / Bulk Purchase Programs

By End-Use Setting

• Dermatology & Aesthetic Clinics

• Medical Spas & Beauty Clinics

• Hospitals & Specialty Clinics

• Home-use / Individual Consumers

By Region

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia

• Tasmania & Northern Territory

Players Mentioned in the Report:

• Lumenis

• Cynosure

• Alma Lasers

• Cutera

• Candela Medical

• Philips (Home-use Segment)

• Braun (Home-use Segment)

• Silk’n (Home-use Segment)

• Regional aesthetic device distributors, laser clinic chains, and pharmacy / retail-led consumer device brands

Key Target Audience

• Professional aesthetic device manufacturers and distributors

• Dermatology clinics, laser clinics, and aesthetic clinic chains

• Medical spas, beauty clinic operators, and franchise networks

• Retailers and pharmacies selling home-use beauty devices

• E-commerce platforms and D2C consumer device brands

• Regulatory compliance teams, training providers, and device servicing partners

• Investors and strategic buyers evaluating growth in Australian aesthetic services

• Marketing teams in aesthetics and consumer beauty device categories

Time Period:

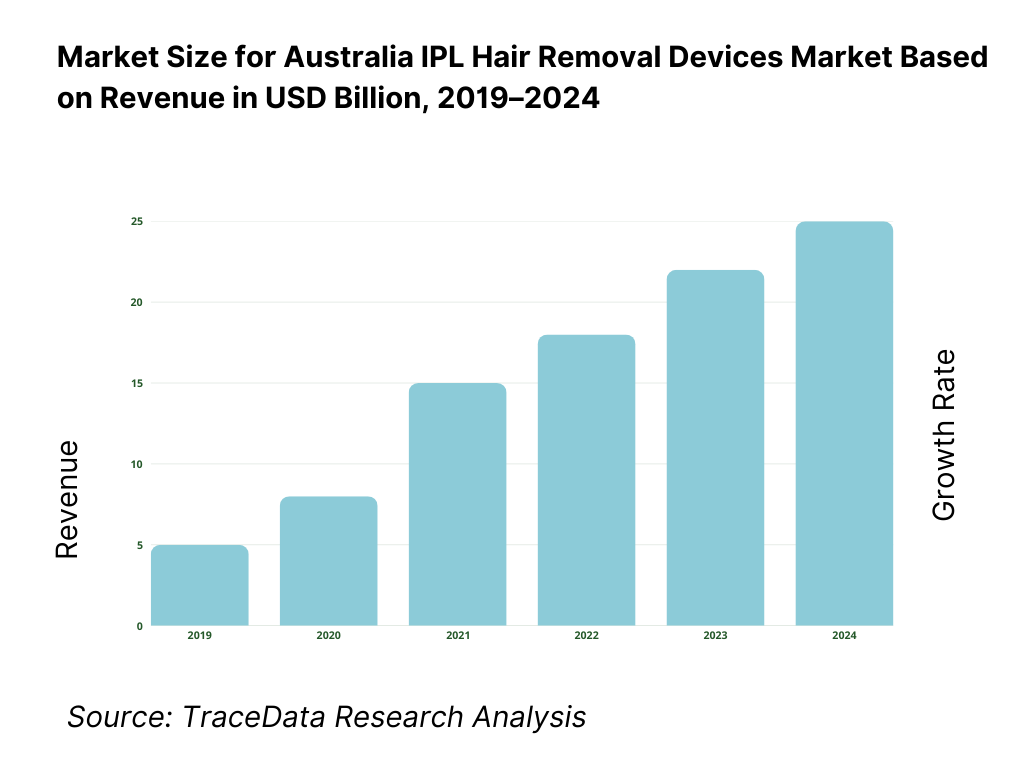

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for IPL Hair Removal Devices including professional clinic-based systems, home-use consumer devices, distributor-led models, retail and e-commerce channels with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for IPL Hair Removal Devices Market including device sales, consumables and handpieces, service and maintenance contracts, training and certification, and replacement or upgrade cycles

4. 3 Business Model Canvas for IPL Hair Removal Devices Market covering device manufacturers, authorized distributors, clinics and aesthetic centers, retail partners, e-commerce platforms, and service providers

5. 1 Global IPL Device Manufacturers vs Regional Distributors and Local Brands including professional aesthetic device OEMs and consumer IPL brands operating in Australia

5. 2 Investment Model in IPL Hair Removal Devices Market including R&D investments, regulatory compliance spend, distributor network development, and marketing and brand-building investments

5. 3 Comparative Analysis of IPL Device Distribution by Direct-to-Clinic and Retail or E-commerce Channels including distributor partnerships and pharmacy or electronics retail integration

5. 4 Consumer Aesthetic and Grooming Budget Allocation comparing clinic-based hair removal treatments versus home-use IPL devices and other grooming alternatives with average spend per consumer per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by device type and by end-use setting

8. 3 Key Market Developments and Milestones including device approvals, technology upgrades, clinic network expansion, and major brand launches

9. 1 By Market Structure including global manufacturers, regional distributors, and local or niche brands

9. 2 By Device Type including professional clinic-based devices and home-use consumer devices

9. 3 By Technology Configuration including standalone IPL systems, multi-application IPL platforms, and hybrid IPL-based systems

9. 4 By End-Use Setting including dermatology clinics, aesthetic clinics, medical spas, hospitals, and home-use consumers

9. 5 By Consumer Demographics including age groups, income levels, and gender segments

9. 6 By Distribution Channel including direct sales, authorized distributors, retail pharmacies, electronics stores, and e-commerce

9. 7 By Usage Frequency including high-volume clinic usage and periodic home-use treatments

9. 8 By Region including New South Wales, Victoria, Queensland, Western Australia, South Australia, and Rest of Australia

10. 1 Consumer and Clinic Landscape and Cohort Analysis highlighting clinic chains, independent clinics, and home-use adopters

10. 2 Device Selection and Purchase Decision Making influenced by safety, efficacy, price, brand trust, and regulatory compliance

10. 3 Utilization and ROI Analysis measuring treatment volumes, device payback period, and replacement cycles

10. 4 Gap Analysis Framework addressing unmet needs in affordability, treatment consistency, and access across regions

11. 1 Trends and Developments including growth of non-invasive aesthetics, home-use IPL innovation, and multi-application platforms

11. 2 Growth Drivers including rising aesthetic awareness, clinic expansion, male grooming adoption, and e-commerce penetration

11. 3 SWOT Analysis comparing global device technology leadership versus regional distribution strength and local market adaptation

11. 4 Issues and Challenges including regulatory compliance costs, competition from laser technologies, and outcome variability

11. 5 Government Regulations covering medical device compliance, consumer safety standards, and advertising guidelines in Australia

12. 1 Market Size and Future Potential of home-use IPL devices and consumer grooming electronics

12. 2 Business Models including direct-to-consumer sales, retail-led distribution, and bundled beauty device offerings

12. 3 Delivery Models and Type of Solutions including online platforms, pharmacy chains, electronics retailers, and subscription-based consumable models

15. 1 Market Share of Key Players by revenues and installed base

15. 2 Benchmark of 15 Key Competitors including global professional IPL manufacturers, consumer IPL brands, and regional distributors

15. 3 Operating Model Analysis Framework comparing professional clinic-focused models, consumer retail-led models, and hybrid approaches

15. 4 Gartner Magic Quadrant positioning global leaders and emerging challengers in aesthetic and beauty devices

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through technology differentiation versus price-led mass consumer strategies

16. 1 Revenues with projections

17. 1 By Market Structure including global manufacturers, regional distributors, and local brands

17. 2 By Device Type including professional and home-use IPL devices

17. 3 By Technology Configuration including standalone and multi-application systems

17. 4 By End-Use Setting including clinics and home-use consumers

17. 5 By Consumer Demographics including age and income groups

17. 6 By Distribution Channel including direct, retail, and e-commerce

17. 7 By Usage Frequency including regular clinic treatments and periodic home-use

17. 8 By Region including New South Wales, Victoria, Queensland, Western Australia, South Australia, and Rest of Australia

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Australia IPL Hair Removal Devices Market across demand-side and supply-side entities. On the demand side, entities include dermatology clinics, laser and skin clinic chains, medical spas, beauty clinics, hospitals with dermatology or cosmetic departments, and home-use consumers purchasing devices for self-managed grooming. Demand is further segmented by treatment setting (clinic vs home), usage intensity (high-throughput clinics vs boutique centers), procedure mix (hair removal only vs multi-indication aesthetics), and purchasing model (direct capex purchase, distributor financing, leasing/rental, bundled service contracts). On the supply side, the ecosystem includes global aesthetic device OEMs, Australia-focused authorized distributors, clinic equipment resellers, service and maintenance partners, operator training providers, clinical protocol developers, retail and pharmacy chains, e-commerce platforms, and regulatory and compliance bodies governing medical devices, electrical safety, and marketing claims. From this mapped ecosystem, we shortlist 6–10 leading professional IPL system brands and a representative set of consumer IPL brands based on installed base visibility, distributor presence, service depth, regulatory readiness, and penetration across metro clinics and retail channels. This step establishes how value is created and captured across device manufacturing, distribution, compliance, training, servicing, and recurring clinic treatment monetization.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Australia IPL hair removal market structure, demand drivers, and segment behavior. This includes reviewing trends in non-invasive aesthetic procedures, clinic network expansion, consumer grooming spend patterns, and the relative adoption trajectory of IPL versus competing laser modalities. We assess buyer preferences around treatment outcomes, safety assurance, comfort, session frequency, and total cost of ownership for clinics. Company-level analysis includes review of professional device portfolios, multi-application platform capabilities, cooling systems, filter configurations, warranty and service packages, and distributor coverage models across Australia. We also examine the regulatory and compliance environment shaping product availability and marketing behavior, including device classification, safety compliance, usage guidance, and claims discipline across professional and home-use segments. The outcome of this stage is a comprehensive industry foundation that defines the segmentation logic and creates the assumptions needed for market estimation and future outlook modeling.

Step 3: Primary Research

We conduct structured interviews with professional IPL device distributors, clinic chain operators, independent dermatology and aesthetic clinics, laser technicians, practice managers, and retail channel stakeholders involved in home-use device sales. The objectives are threefold: (a) validate assumptions around demand concentration by region and end-use setting, (b) authenticate segment splits by device type, channel, and clinic format, and (c) gather qualitative insights on pricing behavior, replacement cycles, utilization rates, treatment protocol standardization, service responsiveness, and patient expectations. A bottom-to-top approach is applied by estimating the number of active treatment sites, device penetration per site type, and average device value across segments, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with distributors and clinics to validate field-level realities such as device selection criteria, training requirements, typical commercial terms, maintenance costs, downtime risks, and differences between advertised and achievable treatment throughput.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as growth in aesthetic clinic networks, household discretionary spend trends, penetration of home-use grooming devices, and competitive substitution from laser-based systems. Assumptions around regulatory tightening, claims enforcement, clinic economics, and consumer adoption thresholds are stress-tested to understand their impact on device demand. Sensitivity analysis is conducted across key variables including clinic expansion intensity, replacement cycle acceleration, home-use adoption velocity, distributor service capacity, and shifts in treatment modality preference. Market models are refined until alignment is achieved between supplier channel capacity, clinic installation patterns, and consumer purchase behavior, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Australia IPL Hair Removal Devices Market?

The Australia IPL hair removal devices market holds strong potential, supported by sustained demand for non-invasive aesthetic treatments, continued expansion of laser and skin clinic networks, and rising penetration of home-use grooming devices driven by convenience and cost-saving preferences. Professional IPL platforms will continue to remain relevant due to multi-application versatility and recurring clinic treatment volumes, while consumer IPL devices are expected to expand category reach into suburban and regional households. As safety expectations and outcome consistency become central buying criteria, compliant brands with strong service ecosystems are expected to capture higher-value growth through 2035.

02 Who are the Key Players in the Australia IPL Hair Removal Devices Market?

The market features a combination of global professional aesthetic device manufacturers operating through Australia-based authorized distributors, along with consumer electronics and home-use beauty device brands competing through retail, pharmacy, and e-commerce channels. Competition is shaped by regulatory readiness, device reliability, treatment versatility, training and servicing capability, and brand trust among clinics and consumers. Distributor depth and after-sales service performance play a central role in sustaining installed base strength in the professional segment, while retail reach and consumer marketing strength determine leadership in the home-use segment.

03 What are the Growth Drivers for the Australia IPL Hair Removal Devices Market?

Key growth drivers include rising preference for non-invasive aesthetic procedures, growing male grooming participation, clinic network expansion in metro and high-income suburban corridors, and increasing adoption of home-use IPL devices due to privacy and long-term cost advantages. Additional momentum comes from multi-application IPL platforms that enable clinics to monetize multiple indications using a single system, as well as category growth through e-commerce and pharmacy-led device promotion. The ability of IPL systems to offer repeatable treatments with broad aesthetic relevance continues to support adoption across both professional and consumer segments.

04 What are the Challenges in the Australia IPL Hair Removal Devices Market?

Challenges include regulatory compliance costs and approval timelines, variability in treatment outcomes across different skin and hair profiles, and intensifying competition from laser-based systems that position themselves as more targeted for certain patient segments. In the home-use segment, performance limitations driven by safety restrictions and the risk of unrealistic consumer expectations can lead to dissatisfaction and returns. For clinics, service downtime, training quality, and protocol consistency remain operational risks that can influence device replacement decisions and long-term brand loyalty.