Australia Medical Supplies Market Outlook to 2035

By Product Category, By Distribution Channel, By Delivery Model, By End-User, and By Region

- Product Code: TDR0404

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Australia Medical Supplies Market Outlook to 2035 – By Product Category, By Distribution Channel, By Delivery Model, By End-User, and By Region” provides a comprehensive analysis of the medical supplies industry in Australia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and compliance landscape, healthcare-provider and procurement-level profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Australia medical supplies market. The report concludes with future market projections based on demographic aging, chronic disease burden, hospital and aged-care capacity expansion, infection prevention and clinical safety priorities, home healthcare penetration, procurement modernization, digitization of ordering and inventory workflows, cause-and-effect relationships, and success case illustrations highlighting the major opportunities and cautions.

Australia Medical Supplies Market Overview and Size

The Australia medical supplies market is valued at ~USD ~ billion (i.e. ~USD ~ billion). This reflects the combined demand for consumable and semi-durable medical supplies, including personal protective equipment (PPE), wound care products, syringes and needles, surgical disposables, diagnostic and sample collection consumables, sterilization and infection control products, incontinence and patient hygiene supplies, infusion and catheter-related disposables, and general patient-care consumables used across hospitals, clinics, aged-care facilities, home healthcare, and community health environments. The market is anchored by Australia’s mature healthcare infrastructure, universal health coverage and high utilization of hospital services, strict clinical quality and infection control standards, and a growing shift toward outpatient and home-based care models that require consistent supply availability beyond hospital settings.

New South Wales, Victoria, and Queensland dominate the Australia medical supplies market, supported by the concentration of public and private hospital networks, specialist clinics, ambulatory and day surgery centers, diagnostic chains, and large aged-care portfolios. Metropolitan corridors such as Sydney, Melbourne, Brisbane, Perth, and Adelaide account for a significant share of institutional procurement driven by high procedure volumes, centralized procurement groups, and standardized tendering practices. Regional and rural markets contribute steady recurring demand through community health centers, small hospitals, remote clinics, aged-care homes, and homecare providers where consumables and hygiene-related products are critical for ongoing patient support. The market exhibits recurring demand characteristics, as medical supplies are typically high-frequency consumables with regulated usage protocols and predictable replenishment cycles, often purchased through annual or multi-year supply agreements, group purchasing contracts, and framework arrangements with compliance-driven product specifications and service-level expectations.

What Factors are Leading to the Growth of the Australia Medical Supplies Market:

Aging population and chronic disease burden drive sustained consumption of consumable medical supplies.:

Australia’s aging demographic profile structurally increases healthcare utilization across inpatient, outpatient, and long-term care settings. Older populations typically require more frequent monitoring, higher medication administration intensity, wound management support, respiratory and mobility assistance, and longer-duration care pathways. This expands baseline consumption of syringes, needles, dressings, bandages, incontinence supplies, diagnostic consumables, and infection control products. Chronic diseases such as diabetes, cardiovascular conditions, COPD, kidney disorders, and cancer further sustain recurring demand for testing consumables, wound care, infusion-related disposables, and patient care items. As healthcare delivery increasingly shifts toward continuity-of-care models and chronic condition management, the medical supplies market benefits from stable and long-duration demand tied to structural health trends.

High procedural throughput and expansion of ambulatory care increase single-use consumption intensity.:

Australia’s hospital system and expanding ambulatory ecosystem generate significant single-use medical supply demand due to strict safety and infection control protocols. Increasing day surgeries, outpatient procedures, diagnostic testing volumes, and short-stay admissions elevate per-procedure consumption of sterile disposables, drapes, gowns, gloves, syringes, specimen collection items, and wound closure consumables. As health systems optimize bed capacity and shift procedures to day surgery centers and outpatient clinics, supply intensity remains high but becomes more distributed across a wider range of care settings. This supports growth in both large-scale institutional procurement and decentralized distribution networks serving clinics and ambulatory providers.

Which Industry Challenges Have Impacted the Growth of the Australia Medical Supplies Market:

Price-led procurement and tender-driven buying compress margins in commodity consumable segments:

Public healthcare procurement is heavily tender-driven, emphasizing cost efficiency and standardization for high-volume consumables. Categories such as gloves, basic dressings, syringes, and general disposables often face strong price competition, particularly where clinical differentiation is limited and products can be substituted across approved brands. Margin pressure increases during periods of cost inflation in raw materials and freight, especially when contract pricing is fixed for multi-year terms. Suppliers must balance pricing competitiveness with service reliability, lead time performance, and compliance documentation, while ensuring business sustainability under aggressive procurement conditions. This creates a segmented market where larger players compete on scale, while specialized providers differentiate through product performance, service layers, and clinical education support.

Import dependence and upstream supply chain risks create continuity and lead-time vulnerabilities:

A significant share of Australia’s medical supplies are imported, making the market sensitive to international manufacturing disruptions, geopolitical shocks, global freight volatility, and currency movements. While domestic distribution infrastructure is mature, upstream shocks can impact availability, lead times, and buffer inventory requirements. Hospitals and aged-care operators increasingly demand supply assurance and continuity planning, pushing distributors to invest in multi-sourcing strategies, larger inventory holdings, and alternate supplier qualification processes. These actions strengthen resilience but increase working capital needs and operational complexity for suppliers.

Regulatory compliance, traceability expectations, and quality governance increase operational overhead:

Medical supplies distributed in Australia require robust compliance readiness, labeling and documentation controls, and consistent quality management. Buyers increasingly expect traceability, batch-level documentation, and audit-readiness, especially for products that impact infection control and clinical outcomes. This raises operating costs for suppliers due to quality assurance processes, regulatory monitoring, complaint handling, and post-market vigilance requirements. Smaller suppliers can find compliance burdens challenging, while larger suppliers must continuously invest in systems, training, and documentation workflows.

What are the Regulations and Initiatives which have Governed the Market:

Medical product compliance and safety governance frameworks shape supplier qualification and portfolio credibility:

Medical supplies in Australia must comply with defined quality and safety frameworks that influence product registration, labeling standards, and market access conditions. Hospitals and institutional buyers typically require documented compliance, traceability support, and supplier audit readiness, particularly for sterile and infection control-linked categories. These governance requirements increase the importance of structured quality systems, vendor qualification processes, and product documentation maturity.

Aged-care and clinical quality standards reinforce recurring demand for hygiene, wound care, and patient support supplies: Quality and safety expectations across aged-care and long-term care environments reinforce ongoing demand for patient hygiene products, incontinence supplies, PPE, wound management materials, and infection prevention consumables. As the aged-care sector faces higher scrutiny around clinical governance and resident outcomes, operators increasingly prioritize standardized supply protocols and consistent product quality, strengthening recurring procurement cycles in non-hospital segments.

Australia Medical Supplies Market Segmentation

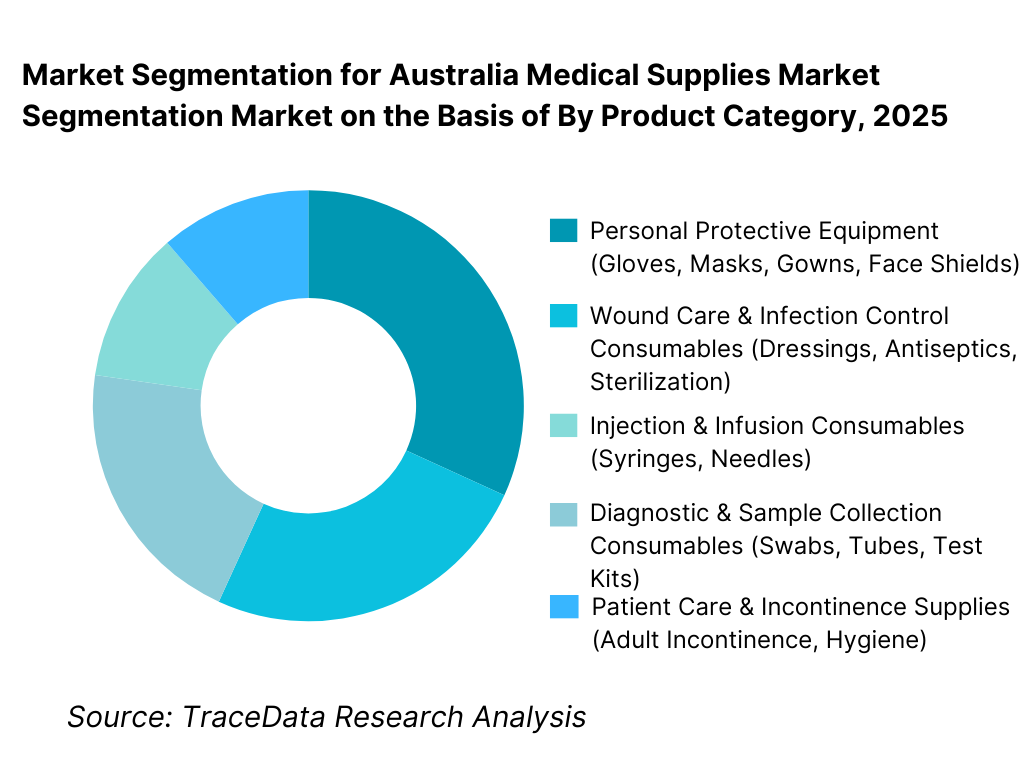

By Product Category: Consumables hold dominance.

This is because the medical supplies market is primarily driven by single-use items and high-replacement-frequency consumables required for routine patient care, infection control, diagnostics, and clinical procedures. Infection prevention protocols and clinical safety guidelines structurally elevate consumption of PPE, sterile disposables, wound dressings, and injection supplies across hospitals and outpatient settings. Diagnostic and sample collection consumables remain critical due to high testing volumes in both pathology and point-of-care settings. Patient care and incontinence-related supplies form a large recurring demand pool driven by aged care and home healthcare expansion, while semi-durable items contribute a smaller but stable share through periodic replacement cycles.

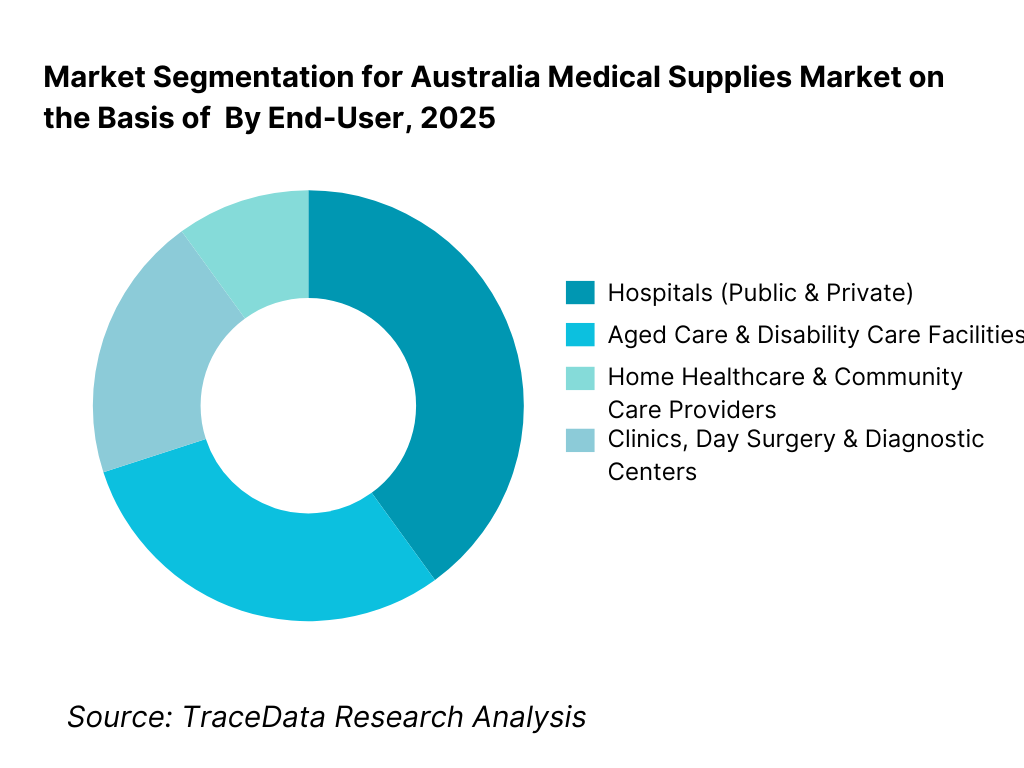

By End-User: Hospitals and aged care dominate the market.

Hospitals account for the largest share due to high procedure intensity, strict infection control norms, and centralized procurement frameworks. Aged-care and disability care environments represent a major and growing segment due to high recurring consumption of hygiene, incontinence, wound care, and PPE products, supported by long-term care needs and quality compliance expectations. Clinics and diagnostic centers contribute steadily through routine procedures and high testing volumes, while home healthcare continues to expand as decentralized care models grow and patients increasingly manage conditions at home using recurring consumables.

Competitive Landscape in Australia Medical Supplies Market

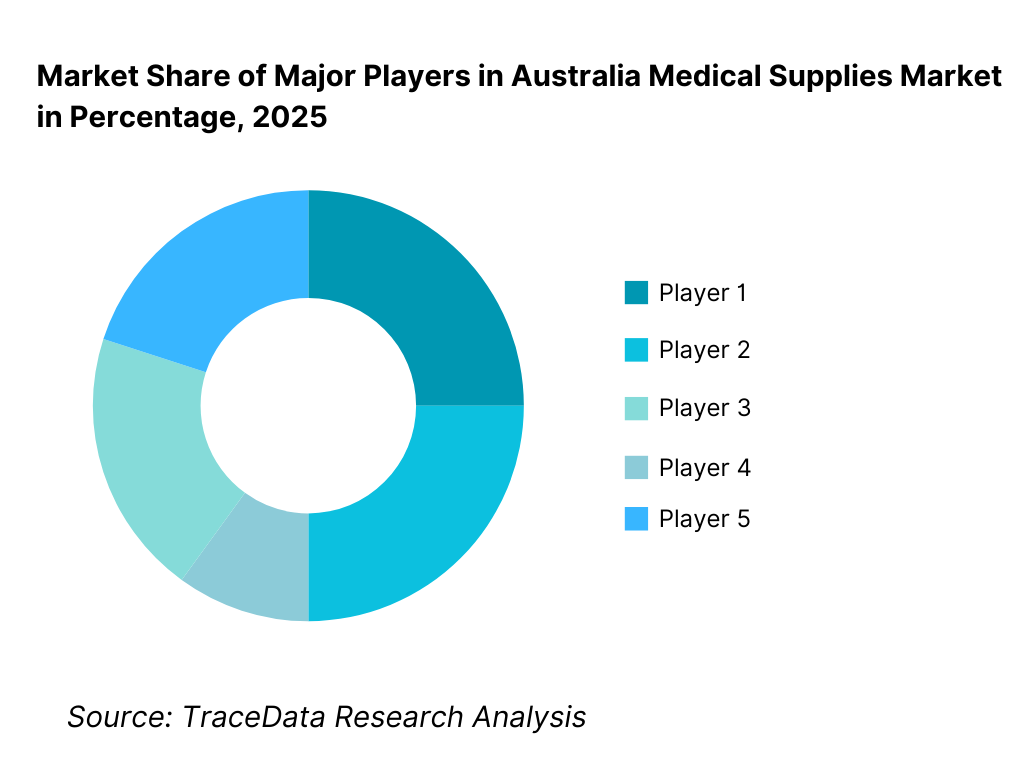

The Australia medical supplies market exhibits moderate concentration, led by global medical supply manufacturers and large-scale distributors with strong institutional relationships and nationwide delivery capability. Market leadership is driven by breadth of product portfolio, compliance maturity, reliability of supply continuity, ability to support tender requirements, and distribution strength across metro and regional areas. Organized players increasingly differentiate through digital ordering platforms, inventory and replenishment support, demand forecasting, and integrated supply solutions for hospitals and large aged-care operators, while smaller players compete through niche categories, specialized clinical products, and localized service responsiveness.

Name | Founding Year | Original Headquarters |

|---|---|---|

Medline Industries | 1966 | Illinois, USA |

B. Braun | 1839 | Melsungen, Germany |

3M (Health Care / Medical Supplies) | 1902 | Minnesota, USA |

Cardinal Health | 1971 | Ohio, USA |

Smith & Nephew | 1856 | London, United Kingdom |

Ansell | 1893 | Melbourne, Australia |

Henry Schein | 1932 | New York, USA |

McKesson | 1833 | Virginia, USA |

Becton, Dickinson and Company (BD) | 1897 | New Jersey, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Medline Industries: Medline continues to strengthen its position through breadth of consumables, strong institutional supply programs, and focus on continuity assurance for high-frequency categories. The company’s advantage lies in portfolio depth across PPE, patient care, and procedure-related disposables, supported by structured contracting models and consistent fulfillment performance.

B. Braun: B. Braun remains relevant due to strong clinical credibility and focus on infusion, injection, and procedure-related disposables where quality, compliance documentation, and clinician trust are critical. Its positioning is strongest in settings where clinical risk management and product performance have high weight in procurement decisions.

Ansell: Ansell maintains strong relevance in PPE and infection prevention categories, driven by quality assurance, scale capabilities, and broad penetration that supports stable procurement relationships as healthcare facilities maintain elevated baseline PPE consumption.

3M (Health Care / Medical Supplies): 3M continues to sustain relevance through infection prevention and clinically differentiated categories where performance attributes and brand trust influence buyer preference, enabling resilience even in price-sensitive procurement environments.

BD (Becton, Dickinson and Company): BD remains a major player in injection and infusion supplies, reinforced by standardized usage in hospital workflows, consistent product quality, and strong regulatory readiness across critical consumable categories.

What Lies Ahead for Australia Medical Supplies Market?

The Australia Medical Supplies Market is expected to expand steadily by 2035, supported by demographic aging, sustained healthcare utilization, increasing chronic disease management needs, and continued emphasis on infection prevention and clinical safety across hospitals, aged-care environments, and community care models. Growth momentum is further reinforced by the expansion of decentralized care settings, including home healthcare and outpatient services, which increases demand for reliable distribution networks, digital procurement workflows, and consistent product standardization beyond hospital procurement systems. As healthcare systems pursue efficiency and resilience, suppliers that deliver continuity assurance, compliance-ready documentation, and integrated supply programs will strengthen their competitiveness in long-term contracts and multi-site customer portfolios.

Transition Toward Integrated Supply Partnerships and Vendor Consolidation in Institutional Procurement: Buyers will increasingly prefer fewer, larger supplier partnerships to reduce procurement complexity and improve continuity assurance. Suppliers offering broader portfolios and stronger national distribution will gain advantage, while niche suppliers will need to differentiate on clinically specialized categories or high responsiveness.

Growing Emphasis on Supply Chain Resilience, Multi-Sourcing, and Local Buffering Strategies: Resilience requirements—stockholding expectations, alternate sourcing plans, and continuity guarantees—will increasingly be embedded into tenders and contracts, increasing value pools for suppliers that invest in inventory buffering and diversified sourcing.

Integration of Digital Ordering, Inventory Visibility, and Automated Replenishment Workflows: Digital transformation will accelerate through e-procurement adoption, automated inventory systems, and traceability tools. Suppliers providing integration, usage analytics, and forecasting support will improve customer stickiness and renewal strength.

.png)

Australia Medical Supplies Market Segmentation

By Product Category

• Personal Protective Equipment (Gloves, Masks, Gowns, Face Shields)

• Wound Care & Infection Control Consumables (Dressings, Antiseptics, Sterilization Consumables)

• Injection & Infusion Consumables (Syringes, Needles, IV Disposables, Cannulas)

• Diagnostic & Sample Collection Consumables (Swabs, Tubes, Test Consumables)

• Patient Care & Incontinence Supplies (Adult Incontinence, Hygiene Supplies, Catheter Consumables, Patient Care Items)

By Distribution Channel

• Direct Manufacturer to Hospital/Group Purchasing

• National Distributors and Medical Supply Wholesalers

• Hospital Procurement Panels and Framework Suppliers

• Retail Pharmacy and Consumer Health Channels (Selected Categories)

• E-commerce and Digital B2B Ordering Platforms

By Delivery Model

• Centralized Institutional Procurement (Hospital Networks / Health Departments)

• Decentralized Facility-Level Procurement (Clinics, Aged Care, Community Providers)

• Contracted Supply Programs (Multi-year Supply Agreements with SLAs)

• Hybrid Models (Central Contract + Local Top-up Purchasing)

• Vendor-Managed Inventory / Replenishment-linked Models

By End-User

• Hospitals (Public and Private)

• Aged Care and Disability Care Facilities

• Clinics, Day Surgery Centers, and Diagnostic Chains

• Home Healthcare Providers and Community Health Services

• Emergency and Ambulance-linked Care Ecosystems

By Region

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia

• Tasmania, ACT, and Northern Territory (Combined)

Players Mentioned in the Report:

• Medline Industries

• B. Braun

• 3M (Health Care / Medical Supplies)

• Cardinal Health

• Smith & Nephew

• Ansell

• Henry Schein

• McKesson

• BD (Becton, Dickinson and Company)

• Other regional distributors, specialty wound care suppliers, infection control brands, and local procurement panel suppliers

Key Target Audience

• Medical supplies manufacturers and brand owners

• National and regional medical supply distributors and wholesalers

• Public and private hospital procurement teams and group purchasing bodies

• Aged-care operators and disability care service providers

• Clinics, day surgery chains, and diagnostic center networks

• Home healthcare providers and community health organizations

• E-procurement and healthcare inventory management technology providers

• Private equity and healthcare-focused investors assessing supply chain platforms

• Logistics providers specialized in regulated medical product distribution

Time Period:

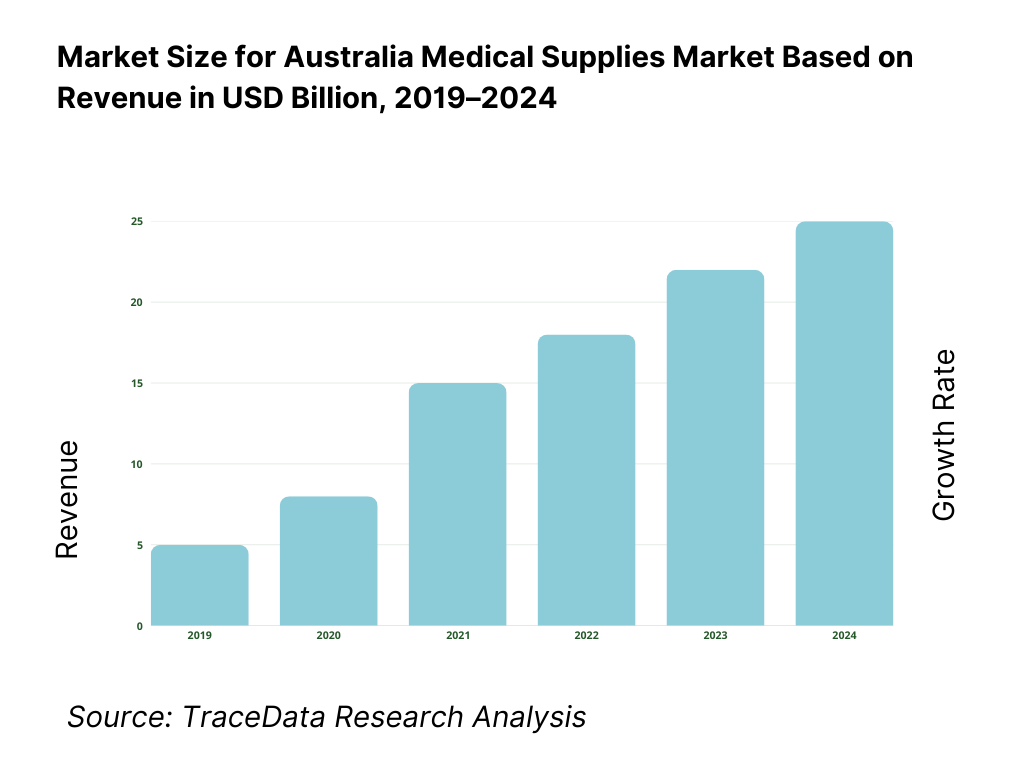

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Medical Supplies (Centralized Procurement, Distributor-led, Direct Supply, Digital B2B)-Margins, Preference, Strength & Weakness

4.2. Revenue Streams for Australia Medical Supplies Market (Core Consumables, Infection Control, Procedure Disposables, Patient Care, Distribution Services, Value-added Inventory Programs)

4.3. Business Model Canvas for Australia Medical Supplies Market5.1. Global Manufacturers vs National Distributors vs Regional Specialty Suppliers

5.2. Investment Model in Australia Medical Supplies Market (Warehousing, Inventory, Compliance Systems, Logistics, Digital Ordering Platforms, QA Processes)

5.3. Comparative Analysis of Go-to-Market Models by Organized vs Niche Players (Tender-led, Clinical Differentiation-led, Service-led, Digital-led)

5.4. Medical Supplies Procurement Budget Allocation by Care Setting and Consumption IntensityHealthcare Utilization Growth, Aging & Chronic Disease Burden, Infection Control Intensity, Aged Care Expansion, Home Healthcare Penetration, Procurement Consolidation, Supply Chain Resilience Needs

Continuity Assurance vs Demand Criticality, Import Dependence vs Inventory Buffering, Regional Distribution Coverage vs Service Expectations, Tender Pricing vs Cost Inflation, Compliance Readiness vs Audit Requirements

8.1. Value (AUD Mn, USD Mn)

9.1. By Product Category

9.2. By Distribution Channel

9.3. By Delivery Model

9.4. By End-User

9.5. By Care Setting Intensity

9.6. By Technology Adoption

9.7. By Region10.1. Healthcare Provider Profiling and Buyer Cohort Analysis

10.2. Medical Supplies Procurement and Decision-Making Process (Panels, Tendering, Clinical Evaluation, Compliance, Cost, Supplier Track Record)

10.3. Cost-Benefit and ROI Analysis of Integrated Supply Contracts (Fill Rate, Stockouts, Compliance, Inventory Holding, Clinical Continuity)

10.4. Gap Analysis Framework11.1. Trends and Developments

11.2. Growth Drivers

11.3. SWOT Analysis

11.4. Issues and Challenges

11.5. Government Regulations and Compliance Environment12.1. Market Size and Future Potential of PPE and Infection Control Supplies in Australia

12.2. Business Models & Revenue Streams

12.3. Digital Delivery Models and Client Experience15.1. Market Share of Key Players

15.2. Benchmark of Key Competitors

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant-Positioning of Medical Supplies Distributors and Key Brands

15.5. Bowman’s Strategic Clock-Competitive Advantage Mapping6.1. Value (AUD Mn, USD Mn)

17.1. By Product Category

17.2. By Distribution Channel

17.3. By End-User

17.4. By Delivery Model

17.5. By Technology Adoption

17.6. By Region

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Australia Medical Supplies Market. On the demand side, entities include public hospital networks, private hospital groups, day surgery centers, specialist clinics, diagnostic chains, aged-care and disability care operators, home healthcare agencies, community health service providers, and emergency care ecosystems. Demand is further segmented by care setting intensity (acute inpatient, outpatient, long-term care, homecare), and by consumption drivers such as procedural volume, infection control intensity, chronic disease management needs, and patient hygiene requirements. On the supply side, we include global manufacturers and brand owners, national distributors and wholesalers, regional specialty suppliers, group purchasing and panel suppliers, logistics partners, and digital procurement platforms. From this mapped ecosystem, we shortlist 6–8 leading manufacturers/distributors and key specialty suppliers active in Australia based on institutional penetration, product portfolio depth, distribution footprint, compliance maturity, and ability to service multi-site contracts with continuity assurance.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Australia Medical Supplies Market. This involves reviewing healthcare utilization trends, hospital and aged-care capacity dynamics, procurement models, tender and panel structures, and category-level consumption logic across key care settings. We also examine supplier portfolio documents, product category positioning, distribution structures, warehousing and fulfillment models, and market narratives to understand competitive differentiation. Category-level demand is assessed by linking procedure intensity, infection control standards, and chronic care pathways to recurring consumable usage, while non-hospital demand is analyzed using care decentralization trends and homecare penetration patterns. This desk research aims to build a foundational understanding of value distribution across product categories and channels, along with the implied pricing, inventory, and service-level economics that shape supplier competitiveness.

Step 3: Primary Research

We conduct structured in-depth interviews with hospital procurement managers, clinical sourcing committees, aged-care procurement heads, distributor sales leaders, supply chain managers, and senior executives from major manufacturers and wholesalers active in Australia. The objectives are threefold: (a) validate market assumptions and hypotheses, (b) authenticate segmentation splits derived from desk research, and (c) extract qualitative and quantitative insights on tender structures, panel requirements, service-level expectations, pricing logic, inventory and replenishment models, compliance documentation needs, and supply continuity practices. A bottom-to-top approach is applied by estimating category-level consumption across major care settings and aggregating this across regions and buyer cohorts to derive the total market value. In selected cases, disguised interactions are conducted as prospective buyers to validate ordering processes, delivery timelines, stockout handling, substitution rules, and digital procurement workflows.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-bottom analytical approaches to cross-validate market value, segmentation splits, and forecast assumptions. Consumption estimates are reconciled with healthcare utilization indicators, care-setting expansion dynamics, and procurement patterns across public and private sectors. Pricing assumptions are benchmarked against observed tender structures, contract durations, and distribution cost-to-serve economics across metro and regional markets. Sensitivity testing is conducted across key variables—including aging-driven utilization growth, home healthcare penetration, procurement consolidation, infection control intensity, and supply chain risk buffering—so that forecasts remain robust under multiple scenarios. Market models are iteratively refined until alignment is achieved between demand-side consumption logic, procurement-led purchasing structures, and supplier-side distribution capacity, ensuring internal consistency of the final estimates.

FAQs

01 What is the potential for the Australia Medical Supplies Market?

The Australia Medical Supplies Market holds strong potential, anchored by demographic aging, chronic disease prevalence, high procedural throughput, and structurally recurring demand for consumable supplies governed by infection control and patient safety protocols. The market is well positioned to grow further as aged-care and home healthcare ecosystems expand, procurement shifts toward integrated and continuity-focused supply partnerships, and digital ordering and inventory tools improve transparency and replenishment efficiency across both institutional and decentralized care environments.

02 Who are the Key Players in the Australia Medical Supplies Market?

The Australia Medical Supplies Market features a mix of global manufacturers and large distributors with nationwide reach, alongside specialty suppliers focused on specific categories. Key players include Medline Industries, B. Braun, 3M (Health Care), Cardinal Health, Smith & Nephew, Ansell, Henry Schein, McKesson, and BD, along with other national wholesalers and regional specialty distributors that service hospitals, clinics, aged-care operators, and homecare providers. These companies compete on portfolio breadth, compliance readiness, supply reliability, distribution footprint, tender performance, and service-level capability.

03 What are the Growth Drivers for the Australia Medical Supplies Market?

Key growth drivers include an aging population and rising chronic disease burden that increase long-duration consumable usage, expanding ambulatory and outpatient procedure volumes that elevate single-use consumption, and a growing shift toward aged-care and homecare delivery models that expand demand beyond hospital procurement. Continued emphasis on infection control and clinical safety strengthens recurring consumption of PPE, sterilization and hygiene supplies, and procedure-related disposables. Procurement modernization and digital ordering workflows further support market expansion by improving replenishment efficiency and supplier consolidation potential.

04 What are the Challenges in the Australia Medical Supplies Market?

Challenges include price-led tendering and public procurement cost pressure that compress margins in commodity consumable categories, import dependence that increases vulnerability to global supply chain disruptions, and rising compliance and traceability expectations that increase operational overhead for suppliers. The market also faces distribution complexity due to fragmented demand across clinics, aged-care facilities, and homecare providers, requiring suppliers to balance service levels with distribution efficiency, particularly across regional and rural geographies.