Australia Mining Industry Outlook to 2029

By Market Structure, By Commodities, By Methods of Extraction, By Technological Adoption, By Environmental Impacts, and By Region

- Product Code: TDR0115

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled "Australia Mining Industry Outlook to 2029 - By Market Structure, By Commodities, By Methods of Extraction, By Technological Adoption, By Environmental Impacts, and By Region" provides a comprehensive analysis of the mining industry in Australia. The report covers an overview and genesis of the industry, the overall market size in terms of revenue and production, market segmentation; trends and developments, regulatory landscape, industry-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Australian mining sector. The report concludes with future market projections based on production and revenue, by market segment, commodity type, region, cause-and-effect relationships, and success case studies highlighting the major opportunities and challenges.

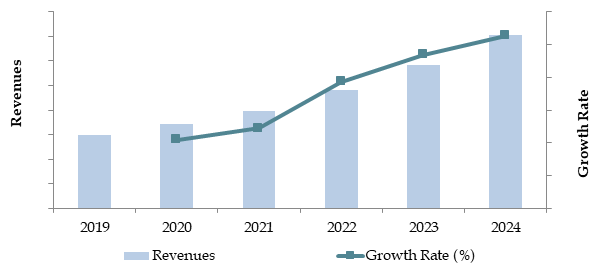

Australia Mining Industry Overview and Size

The Australian mining industry reached a valuation of AUD 390 billion in 2023, driven by the increasing global demand for minerals, favorable geological conditions, and Australia's position as a leading exporter of key resources such as iron ore, coal, and lithium. The market is characterized by major players such as BHP, Rio Tinto, Fortescue Metals Group, and Newcrest Mining. These companies are recognized for their advanced extraction technologies, global export networks, and sustainable mining initiatives.

In 2023, Rio Tinto introduced a fully autonomous truck fleet across its Pilbara iron ore operations, reflecting a major shift toward digital transformation and efficiency in mining. Western Australia and Queensland remain key regions due to their vast mineral reserves and supportive mining infrastructure.

Market Size for Australia Mining Industry on the Basis of Revenues in USD Billion, 2018-2024

What Factors are Leading to the Growth of Australia Mining Industry:

Global Demand for Minerals: Australia's abundant reserves of critical minerals such as iron ore, lithium, and rare earths are in high demand globally, particularly in emerging markets like India and China. In 2023, Australia supplied 60% of the world's lithium, driven by the global shift towards renewable energy and electric vehicles (EVs).

Technological Advancements: The adoption of advanced technologies such as automation, artificial intelligence, and drone monitoring has significantly increased operational efficiency and safety in mining operations. For example, autonomous trucks and drills have reduced labor costs and improved productivity across major mining sites.

Government Support and Regulatory Frameworks: The Australian government has implemented favorable mining policies, including tax incentives, infrastructure development, and streamlined environmental approvals. This has encouraged both domestic and international investments in the sector. In 2023, the government allocated AUD 500 million towards developing critical mineral processing facilities, ensuring Australia's competitive edge in the global mining market.

Which Industry Challenges Have Impacted the Growth of the Australia Mining Industry

Environmental Concerns and Regulations: Environmental regulations and compliance requirements are a major challenge for the mining industry in Australia. In 2023, approximately 35% of mining operations faced delays or higher costs due to compliance with stricter environmental standards. These regulations aim to reduce the ecological footprint of mining activities, but they also impose additional operational hurdles, particularly for smaller operators.

Resource Depletion: The depletion of easily accessible high-grade mineral deposits has resulted in increased extraction costs. This has forced companies to explore and operate in more remote and geologically challenging areas. Between 2018 and 2023, the average cost of mineral extraction rose by 14%, reflecting the growing difficulty of maintaining production levels.

Labor Shortages: A persistent shortage of skilled workers has impacted the efficiency and growth of the mining sector. In 2023, 45% of mining firms reported difficulties in hiring qualified personnel, particularly in remote regions. This labor gap has also increased wage pressures and operational delays.

What are the Regulations and Initiatives Which Have Governed the Market

Environmental Protection Frameworks: The Australian government enforces strict environmental guidelines, including mandatory environmental impact assessments for new projects and rehabilitation obligations for closed mines. In 2023, compliance with these frameworks resulted in a 25% increase in investment in green initiatives by mining companies.

Indigenous Land Agreements: Regulations require mining companies to negotiate agreements with Indigenous communities to access mining sites on traditional lands. In 2023, nearly 65% of mining projects were under such agreements, promoting equitable benefit-sharing and local community engagement.

Export Policies and Trade Agreements: Export restrictions and international trade agreements significantly influence the Australian mining industry. For instance, free trade agreements with China, India, and Japan have provided tariff relief for major commodities like iron ore and LNG. These agreements supported a 7% growth in export revenue in 2023.

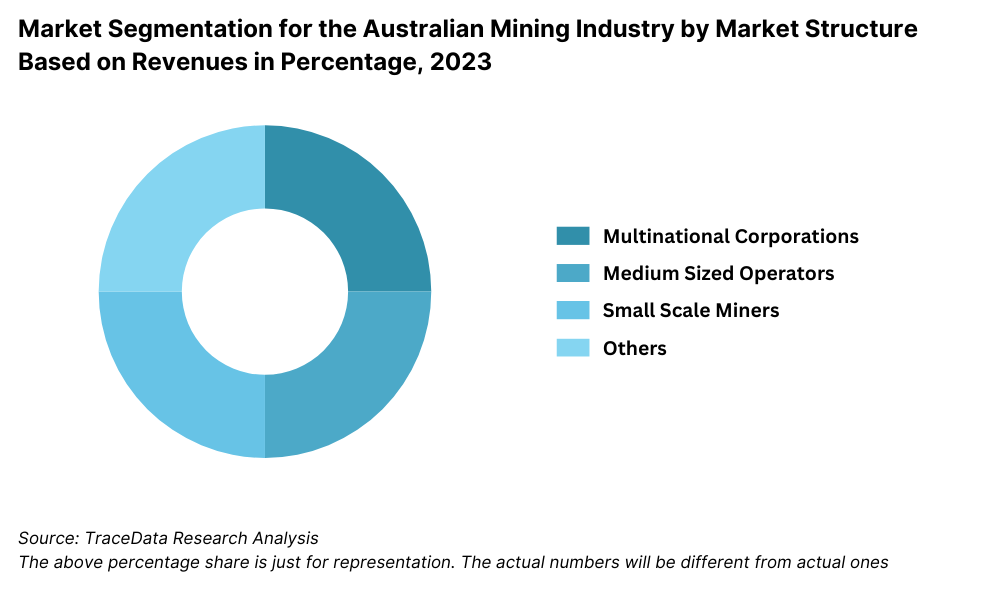

Australia Mining Industry Segmentation

By Market Structure: Large multinational corporations dominate the Australian mining industry due to their ability to leverage advanced technology, economies of scale, and access to capital for large-scale operations. Companies like BHP and Rio Tinto lead the market, focusing on key commodities like iron ore and coal. Medium-sized firms and smaller operators also play a crucial role, particularly in niche segments like gold and rare earth minerals. These companies often cater to specific regional markets or commodities with emerging demand.

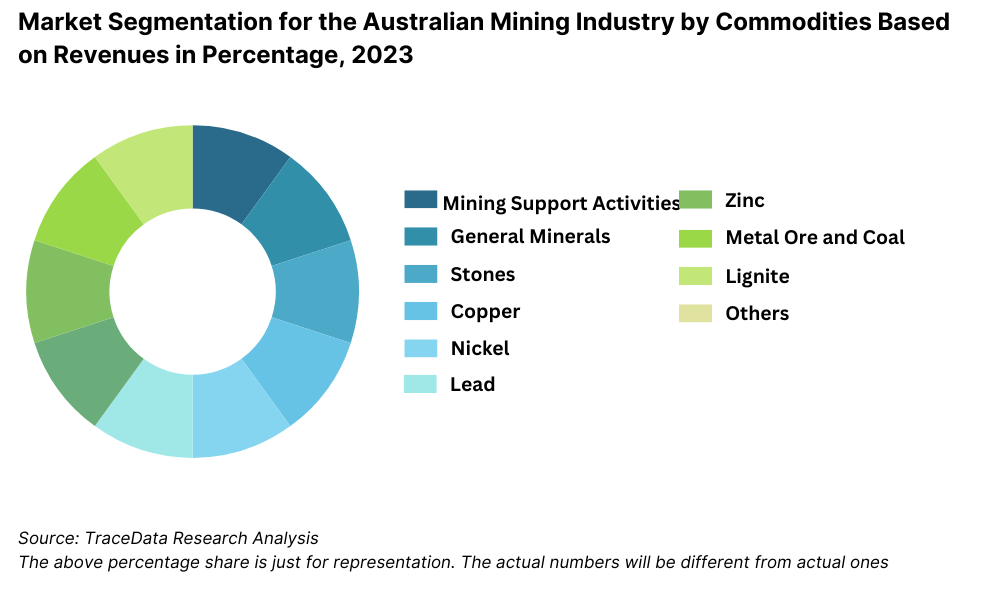

By Commodity: Iron ore is the leading commodity, driven by high demand from China and other Asian countries. In 2023, iron ore contributed approximately 45% to the total mining revenue. Coal follows closely, with a significant share in both thermal and metallurgical segments, supported by strong exports to India and Japan. Lithium and other battery minerals are emerging as key growth drivers due to the global push for renewable energy and electric vehicles.

By Extraction Methods: Open-pit mining remains the most widely used extraction method due to its cost efficiency and suitability for large-scale operations, especially for iron ore and coal. Underground mining is significant for commodities like gold and copper, which are often located at deeper levels. In 2023, open-pit mining accounted for approximately 65% of the total mineral output.

Competitive Landscape in the Australia Mining Industry

The Australian mining industry is highly concentrated, with major players such as BHP, Rio Tinto, Fortescue Metals Group, and Newcrest Mining dominating the market. However, the industry also includes a diverse mix of medium-sized operators and smaller firms specializing in niche commodities such as rare earth minerals, lithium, and gold.

Key Companies in the Australian Mining Industry

Company Name | Establishment Year | Headquarters |

|---|---|---|

BHP Group | 1885 | Melbourne, Australia |

Rio Tinto | 1873 | London, UK |

Fortescue Metals Group | 2003 | Perth, Australia |

Newcrest Mining | 1966 | Melbourne, Australia |

South32 | 2015 | Perth, Australia |

Evolution Mining | 2011 | Sydney, Australia |

OZ Minerals | 2008 | Adelaide, Australia |

Iluka Resources | 1998 | Perth, Australia |

Mineral Resources | 1993 | Perth, Australia |

Whitehaven Coal | 1999 | Sydney, Australia |

Some recent competitor trends and key information about major players include:

BHP: As one of the world’s largest mining companies, BHP reported a revenue of AUD 90 billion in 2023, driven by strong performance in iron ore and coal. The company has heavily invested in renewable energy projects, with a target to achieve net-zero emissions by 2050. Its adoption of autonomous mining equipment has improved operational efficiency by 18%.

Rio Tinto: Rio Tinto recorded a 20% increase in lithium production in 2023, aligning with growing demand for battery minerals. The company is also investing in carbon-neutral initiatives, such as hydrogen-powered vehicles for mining operations. Its innovative "SafeMine" project has significantly reduced workplace incidents, enhancing its reputation for safety and sustainability.

Fortescue Metals Group: Fortescue Metals Group reported a 15% increase in iron ore shipments in 2023, capitalizing on strong demand from Asian markets. The company is aggressively expanding its green hydrogen division, with plans to become a global leader in renewable energy solutions for mining.

Newcrest Mining: Known for its gold and copper operations, Newcrest achieved record gold production in 2023, with a focus on its flagship Cadia mine. The company is investing in advanced ore processing technologies, reducing operational costs by 12%.

South32: South32 diversified its portfolio by increasing its stake in manganese and nickel operations, critical for electric vehicle batteries. The company reported a 10% revenue growth in 2023, driven by these high-demand commodities. Its focus on reducing water consumption in mining operations has earned recognition for environmental stewardship.

.png)

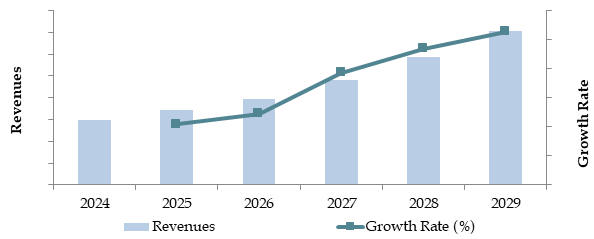

What Lies Ahead for the Australia Mining Industry?

The Australian mining industry is projected to maintain steady growth through 2029, driven by increasing global demand for key minerals, technological advancements, and a shift toward sustainable practices. This growth is expected to reflect a healthy CAGR during the forecast period, supported by robust export markets and domestic policy incentives.

Shift Toward Battery Minerals and Renewable Resources: The growing global focus on renewable energy and electric vehicles is anticipated to drive increased demand for battery minerals such as lithium, cobalt, and nickel. Australia, with its rich reserves of these minerals, is well-positioned to meet this demand. In 2023, lithium exports saw a 25% increase, a trend expected to continue as countries prioritize energy transitions.

Adoption of Advanced Technologies: The integration of automation, artificial intelligence, and big data analytics in mining operations is expected to enhance productivity and reduce costs. Technologies like autonomous trucks and real-time ore tracking systems are becoming standard across large-scale operations, improving safety, efficiency, and output reliability.

Emphasis on Sustainability: Mining companies are increasingly adopting sustainable practices, including carbon-neutral operations, renewable energy usage, and responsible waste management. The push for sustainability is being supported by government policies and investor demands. By 2029, it is estimated that 35% of mining operations will fully transition to renewable energy sources.

Expansion of Indigenous Partnerships: Collaborative agreements with Indigenous communities are expected to grow, ensuring equitable resource sharing and local development. This trend aligns with corporate social responsibility initiatives and regulatory requirements, strengthening industry-community relations.

Future Outlook and Projections for Australia Mining Industry on the Basis of Revenues in USD Billion, 2024-2029

Australia Mining Industry Segmentation

- By Market Structure:

- Large Multinational Corporations

- Medium-Sized Operators

- Small and Independent Operators

- Mining Services Companies

- State-Owned Enterprises

- By Commodity:

- Mining Support Activities

- General Minerals

- Stones

- Copper, Nickel, Lead, and Zinc

- Metal Ore

- Coal, Lignite, and Anthracite

- By Extraction Method:

- Open-Pit Mining

- Underground Mining

- Placer Mining

- In-Situ Leaching

- By End-Use Industry:

- Energy (Thermal Coal, Uranium)

- Construction (Iron Ore, Limestone)

- Manufacturing (Nickel, Copper)

- Technology (Lithium, Rare Earths)

- By Region:

- Western Australia

- Queensland

- New South Wales

- South Australia

- Northern Territory

- Tasmania

Players Mentioned in the Report

- BHP Group

- Rio Tinto

- Fortescue Metals Group

- Newcrest Mining

- South32

- Evolution Mining

- OZ Minerals

- Iluka Resources

- Mineral Resources

- Whitehaven Coal

Key Target Audience

- Mining Companies

- Equipment Manufacturers

- Government Regulatory Bodies (e.g., Department of Industry, Science and Resources)

- Technology and Automation Providers

- Environmental Advocacy Groups

- Research and Development Institutions

Time Period

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for the Australia Mining Industry

4.3. Business Model Canvas for the Australia Mining Industry

4.4. Resource Extraction and Supply Chain Analysis

4.5. Technology Integration in Value Chain Processes

5.1. Production Volumes by Key Commodities, 2018-2024

5.2. Mining Revenue Contribution by Commodity, 2018-2024

5.3. Export Contribution of the Mining Industry to Australia's Economy, 2024

5.4. Number of Active Mining Sites in Australia by Region

8.1. Revenues, 2018-2024

8.2. Production Volumes, 2018-2024

9.1. By Market Structure (Multinational Corporations, Medium-Sized Operators, and Small-Scale Miners), 2023-2024P

9.2. By Commodity (Mining Support Activities, General Minerals, Stones, Copper, Nickel, Lead, and Zinc, Metal Ore and Coal, Lignite, and Anthracite), 2023-2024P

9.3. By Extraction Method (Open-Pit Mining, Underground Mining, Placer Mining), 2023-2024P

9.4. By Region (Western Australia, Queensland, New South Wales, South Australia, Northern Territory, Tasmania), 2023-2024P

10.1. Key Export Markets and Geopolitical Considerations

10.2. Global Demand Trends for Minerals and Metals

10.3. Industrial Usage and Value Chain Applications

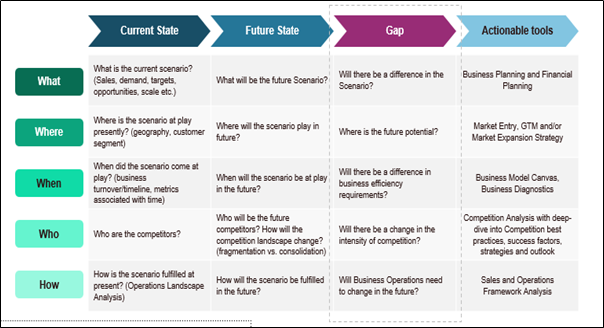

10.4. Gap Analysis Framework

11.1. Trends and Developments for the Australia Mining Industry

11.2. Growth Drivers for the Australia Mining Industry

11.3. SWOT Analysis for the Australia Mining Industry

11.4. Issues and Challenges for the Australia Mining Industry

11.5. Government Regulations for the Australia Mining Industry

12.1. Market Size and Future Potential for Automation in Mining Industry, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross-Comparison of Leading Mining Technology Companies Basis Operational and Financial Variables

13.1. Carbon Emission Reduction Targets and Progress, 2018-2029

13.2. Adoption of Renewable Energy in Mining Operations

13.3. Sustainable Practices and Rehabilitation Efforts

13.4. Regulations and Incentives for Sustainable Mining

16.1. Market Share of Key Players in Australia Mining Industry Basis Revenues/Volume, 2023

16.2. Benchmark of Key Competitors in the Australia Mining Industry Basis Operational and Financial Variables

16.3. Strength and Weakness

16.4. Operating Model Analysis Framework

16.5. Gartner Magic Quadrant

16.6. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Production Volumes, 2025-2029

17.3. Export Volume, 2025-2029

18.1. By Market Structure (Multinational Corporations, Medium-Sized Operators, and Small-Scale Miners), 2025-2029

18.2. By Commodity (Mining Support Activities, General Minerals, Stones, Copper, Nickel, Lead, and Zinc, Metal Ore and Coal, Lignite, and Anthracite), 2025-2029

18.3. By Extraction Method (Open-Pit Mining, Underground Mining, Placer Mining), 2025-2029

18.4. By Region (Western Australia, Queensland, New South Wales, South Australia, Northern Territory, Tasmania), 2025-2029

18.5. By Sustainability Adoption (Net-Zero Operations, Renewable Energy Usage), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities within the Australia Mining Industry. This includes mining companies, equipment manufacturers, regulatory bodies, and downstream consumers of minerals. Based on this ecosystem, we shortlist the leading 5-6 mining companies in the country based on their financial performance, production capacity/volume, and market presence.

Data sourcing involves leveraging industry articles, secondary research, and proprietary databases to gather foundational insights about the market and its stakeholders.

Step 2: Desk Research

Conduct exhaustive desk research using secondary and proprietary databases to gain detailed market insights. This process involves analyzing key aspects such as production volumes, revenue trends, market segmentation, commodity demand, pricing levels, and regulatory factors.

Complement this analysis with an in-depth examination of company-level data, relying on press releases, financial reports, and other publicly available resources. The goal is to construct a comprehensive understanding of the market landscape and its key players.

Step 3: Primary Research

Conduct in-depth interviews with C-level executives, operational managers, and stakeholders representing various mining companies, equipment manufacturers, and regulatory authorities within the Australian mining ecosystem.

Use these interviews to validate hypotheses, authenticate secondary data, and gain operational insights into the industry. A bottom-to-top approach is used to assess the production volumes for individual players, which is then aggregated to derive overall market figures.

Employ disguised interviews, approaching companies as potential customers to validate the financial and operational information provided, while cross-referencing it against secondary data. This process provides a deeper understanding of revenue streams, pricing mechanisms, value chains, and market dynamics.

Step 4: Sanity Check

- Perform both top-down and bottom-up analyses to validate the market size, production figures, and key trends identified during research. Conduct modeling exercises to ensure the consistency and reliability of the data.

FAQs

1. What is the potential for the Australian Mining Industry?

The Australian mining industry is poised for significant growth, with revenue projected to exceed AUD 500 billion by 2029. This growth is fueled by rising global demand for minerals, increasing investments in battery minerals, and advancements in mining technology.

2. Who are the Key Players in the Australian Mining Industry?

Key players in the Australian mining industry include BHP, Rio Tinto, Fortescue Metals Group, and Newcrest Mining. These companies dominate the sector due to their vast production capacities, global export networks, and strong commitments to sustainability. Other notable players include South32 and Mineral Resources Limited.

3. What are the Growth Drivers for the Australian Mining Industry?

Primary growth drivers include the global push for renewable energy and electric vehicles, leading to increased demand for battery minerals such as lithium and nickel. Advanced technology adoption, supportive government policies, and Australia’s competitive advantage in mineral reserves further enhance industry growth.

4. What are the Challenges in the Australian Mining Industry?

The industry faces challenges such as stringent environmental regulations, rising operational costs due to resource depletion, workforce shortages, and global market volatility. Additionally, the need for greater collaboration with Indigenous communities and compliance with sustainability standards pose further complexities.