Australia Offshore Wind Energy Market Outlook to 2029

By Market Structure, By Developers, By Installed Capacity, By Turbine Size, By Project Development Stage, and By Region

- Product Code: TDR0117

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled "Australia Offshore Wind Energy Market Outlook to 2029 - By Market Structure, By Developers, By Installed Capacity, By Turbine Size, By Project Development Stage, and By Region" provides a comprehensive analysis of the offshore wind energy market in Australia. The report covers an overview and genesis of the industry, overall market size in terms of installed capacity and investment, market segmentation; trends and developments, regulatory landscape, stakeholder profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the offshore wind energy market. The report concludes with future market projections based on installed capacity, market segmentation, regions, cause and effect relationships, and success case studies highlighting the major opportunities and cautions.

Australia Offshore Wind Energy Market Overview and Size

The Australia offshore wind energy market reached a valuation of AUD 2.5 Billion in 2023, driven by increasing government initiatives to adopt renewable energy, the abundance of natural wind resources, and advancements in offshore wind technology. The market is characterized by major players such as BlueFloat Energy, Oceanex Energy, Macquarie’s Green Investment Group, and Iberdrola. These companies are recognized for their strategic project developments, technological innovation, and partnerships with local communities to establish large-scale offshore wind farms.

In 2023, BlueFloat Energy launched two new offshore wind projects off the coast of Victoria and New South Wales, aiming to generate a combined capacity of 2.5 GW. This initiative aligns with the Australian Government’s goal to achieve 82% renewable energy generation by 2030. Key regions driving growth in the offshore wind market include Victoria, New South Wales, and Tasmania, due to favorable wind conditions and supportive infrastructure development.

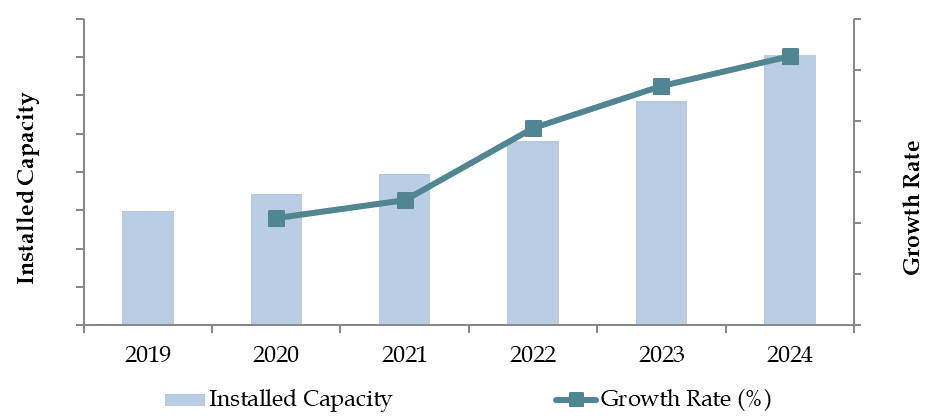

Market Size for Australia Offshore Wind Energy Market in Terms of Installed Capacity, 2018-2023

What Factors are Leading to the Growth of Australia Offshore Wind Energy Market:

Policy Support: Australia’s National Offshore Petroleum Titles Administrator (NOPTA) and recent amendments to the Offshore Electricity Infrastructure Act have provided regulatory clarity and facilitated approvals for new offshore wind projects. The Australian government also announced AUD 1 Billion in funding through the Clean Energy Finance Corporation (CEFC) to support the development of offshore wind farms.

Abundant Resources: With over 35,000 km of coastline and consistently high wind speeds, Australia is uniquely positioned to harness offshore wind energy. Wind speeds in key areas average 8-10 m/s, making them ideal for efficient turbine operation and high energy output.

Energy Transition Goals: The growing emphasis on reducing greenhouse gas emissions and phasing out coal-based energy sources has accelerated the transition towards renewable energy. In 2023, offshore wind accounted for 15% of new renewable energy capacity additions in Australia, reflecting its pivotal role in achieving a sustainable energy mix.

Which Industry Challenges Have Impacted the Growth for Australia Offshore Wind Energy Market

High Initial Capital Costs: The offshore wind energy sector requires significant upfront investments for project development, installation, and grid integration. In 2023, initial costs accounted for approximately 60% of total project expenditures, making financing a major hurdle, particularly for smaller developers and emerging markets.

Grid Infrastructure Limitations: Australia’s existing grid infrastructure is not fully equipped to support large-scale offshore wind energy projects. Studies in 2023 revealed that approximately 40% of proposed offshore wind projects faced delays due to the lack of offshore-to-onshore grid connections, increasing project timelines and costs.

Environmental Concerns: The potential impact of offshore wind farms on marine ecosystems and biodiversity poses challenges in obtaining environmental approvals. Reports indicate that around 25% of planned projects have been delayed or modified due to concerns over marine wildlife, particularly migratory bird species and fish populations.

Regulatory Uncertainty: While Australia has recently introduced regulations for offshore wind energy, inconsistencies in permitting processes and zoning laws across states have created uncertainty. Developers often face lengthy approval processes, with some projects taking up to three years to secure necessary permits.

What Are the Regulations and Initiatives Which Have Governed the Market

Offshore Electricity Infrastructure Act: Implemented in 2021, this act provides a framework for licensing and regulating offshore electricity projects. The act established the Offshore Infrastructure Registrar, which oversees licensing and compliance. In 2023, this framework facilitated the approval of three major offshore wind projects totaling 4.2 GW in capacity.

Designated Renewable Energy Zones (REZs): The Australian government has identified and allocated specific regions as Renewable Energy Zones to streamline project approvals and infrastructure development. Notably, the Gippsland region in Victoria and the Hunter region in New South Wales are designated as key zones for offshore wind energy development.

Clean Energy Finance Corporation (CEFC) Funding: The CEFC has allocated AUD 1 billion to support offshore wind projects, focusing on early-stage development and grid integration. In 2023, two projects received funding under this initiative, accelerating progress toward Australia’s renewable energy targets.

Mandatory Environmental Assessments: All offshore wind projects are required to conduct comprehensive environmental impact assessments (EIAs) to minimize disruption to marine ecosystems. In 2023, approximately 70% of proposed projects underwent EIAs, ensuring alignment with environmental protection standards.

Australia Offshore Wind Energy Market Segmentation

By Market Structure: The market is divided into Established Developers and Emerging Players. Established developers dominate the market due to their access to capital, technical expertise, and established partnerships with government and local stakeholders. These companies often have proven track records and established supply chains, which are critical in mitigating risks associated with large-scale offshore wind projects. Emerging players are gaining momentum by focusing on innovative technologies like floating wind farms and smaller, community-focused projects, which offer flexibility and lower initial costs.

By Installed Capacity: Projects in the 300-500 MW range dominate due to their optimal balance between scalability and feasibility. These medium-scale projects are easier to finance and faster to deploy compared to large-scale developments. Larger projects, exceeding 1 GW, are gaining traction due to government backing and significant private investments. These projects aim to meet Australia’s growing energy demand while advancing decarbonization goals.

By Turbine Size: Turbines with a capacity of 6-8 MW are the most commonly used due to their proven performance and cost efficiency. These turbines are ideal for projects in shallow to moderate water depths.

Larger turbines, such as those exceeding 12 MW, are increasingly deployed in newer projects to maximize energy output. These are especially prevalent in floating offshore wind projects where high efficiency is crucial to justify the higher costs.

%2C%202023.png)

Competitive Landscape in Australia Offshore Wind Energy Market

The Australian offshore wind energy market is relatively nascent but rapidly evolving, with key players leading project developments and technology innovation. The market includes a mix of established global energy companies and emerging local developers. Companies such as BlueFloat Energy, Oceanex Energy, Macquarie Green Investment Group, Iberdrola, and Copenhagen Offshore Partners have been pivotal in driving growth and advancing the industry.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Ørsted | 2006 | Fredericia, Denmark |

Equinor | 2007 | Stavanger, Norway |

Oceanex Energy | 2020 | Sydney, Australia |

Skyborn Renewables | 2022 | Sydney, Australia |

DP Energy | 1996 | Cork, Ireland |

RWE Renewables | 2019 | Essen, Germany |

Goldwind Australia | 2009 | Sydney, Australia |

Flotation Energy | 2018 | Edinburgh, Scotland |

Copenhagen Energy | 2012 | Copenhagen, Denmark |

Iberdrola Australia | 2020 | Sydney, Australia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

BlueFloat Energy: A leader in floating offshore wind projects, BlueFloat Energy announced two new projects in Victoria and New South Wales in 2023, adding a combined capacity of 2.5 GW. The company also focuses on fostering partnerships with local communities to ensure socio-economic benefits for the regions involved.

Oceanex Energy: Specializing in large-scale fixed-bottom projects, Oceanex Energy is developing Australia’s first offshore wind farm off the coast of New South Wales with an expected capacity of 1.2 GW. In 2023, the company secured a significant partnership with an international turbine manufacturer to advance the project.

Macquarie Green Investment Group: Known for its financial expertise, Macquarie has invested over AUD 500 million in offshore wind projects across Victoria and Tasmania. The company’s strategic role in securing funding and stakeholder support has accelerated the development of key projects in 2023.

Iberdrola: A global renewable energy leader, Iberdrola entered the Australian market in 2021 and now oversees multiple offshore projects, including a 1.5 GW development off the coast of South Australia. The company reported a 20% increase in its Australian renewable energy portfolio in 2023.

Copenhagen Offshore Partners: Renowned for its technical expertise, Copenhagen Offshore Partners is spearheading a 1 GW project in Gippsland, Victoria. In 2023, the company adopted advanced floating turbine technology, positioning itself as a pioneer in deep-water offshore wind solutions.

What Lies Ahead for Australia Offshore Wind Energy Market?

The Australia offshore wind energy market is projected to witness substantial growth by 2029, with an expected robust CAGR during the forecast period. This growth will be driven by increasing government commitments to renewable energy, advancements in offshore wind technology, and growing private-sector investments.

Expansion of Floating Wind Farms: Floating wind farms are poised to become a key focus area, leveraging Australia’s deep-water coastal regions. Technological advancements in floating turbines and foundations are expected to reduce costs and expand the scope of offshore wind projects beyond shallow waters. Pilot projects, such as those in Tasmania, are likely to pave the way for commercial-scale deployments.

Integration with Hydrogen Production: Offshore wind farms are anticipated to play a crucial role in green hydrogen production, aligning with Australia’s hydrogen energy roadmap. The synergy between wind energy and hydrogen production could unlock new revenue streams and accelerate renewable energy adoption. Projects integrating offshore wind with hydrogen production facilities, such as those planned in Western Australia, are expected to gain traction.

Technological Advancements: Innovations in turbine design, such as larger rotors and higher-capacity models exceeding 15 MW, are expected to improve energy yields and lower the levelized cost of electricity (LCOE). Additionally, the adoption of digital twin technologies for real-time monitoring and predictive maintenance will enhance operational efficiency and reliability.

Future Outlook and Projections for Australia Offshore Wind Energy Market on the Basis of Installed Capacity, 2024-2029

Australia Offshore Wind Energy Market Segmentation

- By Market Structure:

- Established Developers

- Emerging Players

- Fixed-Bottom Offshore Wind Farms

- Floating Offshore Wind Farms

- Private Sector

- Public Sector

- Hybrid Wind-Hydrogen Projects

- By Installed Capacity:

- <300 MW

- 300-500 MW

- 500-1,000 MW

- 1,000 MW

- By Turbine Size:

- 6-8 MW

- 8-12 MW

- 12 MW+

- By Project Development Stage:

- Feasibility and Design Phase

- Permitting and Approvals Phase

- Construction Phase

- Operational Phase

- By Region:

- Victoria

- New South Wales

- Tasmania

- Western Australia

- South Australia

Players Mentioned in the Report:

- Ørsted

- Equinor

- Oceanex Energy

- Skyborn Renewables

- DP Energy

- RWE Renewables

- Goldwind Australia

- Flotation Energy

- Copenhagen Energy

- Iberdrola Australia

Key Target Audience:

- Offshore Wind Developers

- Renewable Energy Investors

- Technology Providers (e.g., turbine manufacturers)

- Regulatory Bodies (e.g., National Offshore Petroleum Titles Administrator)

- Environmental and Marine Conservation Organizations

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process: Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for Australia Offshore Wind Energy Market

4.3. Business Model Canvas for Offshore Wind Projects

4.4. Project Development and Decision-Making Processes

5.1. Growth in Renewable Energy Investments in Australia, 2018-2024

5.2. Offshore Wind Capacity as a Percentage of Total Renewable Energy, 2023-2024

5.3. Offshore Wind Farm Projects by Phase (Feasibility, Construction, Operational)

8.1. Installed Capacity (MW), 2018-2024

8.2. Investment Value (AUD), 2018-2024

9.1. By Installed Capacity (MW Ranges), 2023-2024P

9.2. By Turbine Size (6-8 MW, 8-12 MW, >12 MW), 2023-2024P

9.3. By Region (Victoria, New South Wales, Tasmania, Others), 2023-2024P

9.4. By Project Development Stage (Feasibility, Construction, Operational), 2023-2024P

9.5. By Technology (Fixed-Bottom vs. Floating Offshore Wind), 2023-2024P

10.1. Stakeholder Landscape and Analysis

10.2. Renewable Energy Demand Growth and Trends

10.3. Gap Analysis for Energy Transition Goals

11.1. Trends and Developments for Australia Offshore Wind Energy Market

11.2. Growth Drivers for Offshore Wind in Australia

11.3. SWOT Analysis for Australia Offshore Wind Energy Market

11.4. Issues and Challenges for Offshore Wind Projects

11.5. Regulatory Framework Governing Offshore Wind Projects

12.1. Market Size and Future Potential for Floating Offshore Wind Projects, 2018-2029

12.2. Innovations and Revenue Models

12.3. Cross-Comparison of Floating Wind Technology Providers Basis Operational and Financial Variables

13.1. Investment Penetration and Trends in Offshore Wind Financing, 2018-2029

13.2. Key Players in Offshore Financing: Public vs. Private Investments

13.3. Financing Structures for Large-Scale Wind Farms

13.4. Role of Clean Energy Finance Corporation (CEFC)

13.5. Investment Flow Analysis, 2018-2024P

Market Share of Major EPC Contractors in Australia Offshore Wind Energy Market Basis Revenues, 2023

16.1. Benchmark of Key Competitors in Australia Wind Energy Market Basis Operational and Financial Variables

16.2. SWOT Analysis for Key Players

16.3. Operating Model Analysis Framework

16.4. Market Positioning and Strategic Insights

16.5. Gartner Magic Quadrant

16.6. Bowmans Strategic Clock for Competitive Advantage

17.1. Installed Capacity (MW), 2025-2029

17.2. Investment Value (AUD), 2025-2029

18.1. By Installed Capacity (MW Ranges), 2025-2029

18.2. By Turbine Size (6-8 MW, 8-12 MW, >12 MW), 2025-2029

18.3. By Region (Victoria, New South Wales, Tasmania, Others), 2025-2029

18.4. By Technology (Fixed-Bottom vs. Floating Offshore Wind), 2025-2029

18.5. By Project Development Stage (Feasibility, Construction, Operational), 2025-2029

19.1. Strategic Recommendations for Stakeholders

19.2. Policy Interventions to Drive Market Growth

19.3. Investment Opportunities in Emerging Technologies and Regions

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: Identify all demand-side and supply-side entities in the Australia Offshore Wind Energy Market. This includes government bodies, developers, turbine manufacturers, and financial institutions. Shortlist 5-6 leading companies based on project portfolio, financial health, and technological expertise.

Data Sourcing: Utilize industry reports, government publications, and proprietary databases to gather information on market structure, key players, and installed capacity. Desk research helps outline market dynamics and identify critical stakeholders.

Step 2: Desk Research

Comprehensive Secondary Research: Conduct exhaustive desk research referencing proprietary databases, government reports, press releases, and market analyses. This process provides insights into the market size, growth drivers, competitive landscape, and regulatory frameworks. Key areas include installed capacity, turbine sizes, and project timelines.

Company-Level Analysis: Examine annual reports, financial statements, and announcements from key companies. This approach helps assess revenue streams, project investments, and operational details.

Step 3: Primary Research

Stakeholder Interviews: Conduct in-depth interviews with executives, engineers, and government officials. These interviews aim to validate hypotheses, confirm market data, and gather unique insights on operational challenges and project strategies.

Validation Process: Perform disguised interviews by engaging companies under the guise of potential investors or collaborators. This ensures unbiased validation of project timelines, financial data, and market practices.

Step 4: Sanity Check

- Market Modeling and Analysis: Use bottom-up and top-down approaches to cross-verify market size projections. Perform scenario analyses to assess market dynamics under different policy and investment scenarios.

FAQs

1. What is the Potential for the Australia Offshore Wind Energy Market?

The Australia offshore wind energy market is expected to grow significantly, reaching a projected installed capacity of 10 GW by 2029. The market’s growth is fueled by strong government support, advancements in turbine technology, and increasing private-sector investments.

2. Who are the Key Players in the Australia Offshore Wind Energy Market?

Key players include BlueFloat Energy, Oceanex Energy, Macquarie Green Investment Group, Iberdrola, and Copenhagen Offshore Partners. These companies lead the market with advanced technologies, strategic project developments, and strong partnerships.

3. What are the Growth Drivers for the Australia Offshore Wind Energy Market?

Primary growth drivers include favorable government policies, abundant wind resources, advancements in floating wind technology, and the integration of offshore wind farms with green hydrogen production. The designation of Renewable Energy Zones also supports project development.

4. What are the Challenges in the Australia Offshore Wind Energy Market?

Challenges include high initial capital costs, limited grid infrastructure, regulatory hurdles, and environmental concerns. Additionally, supply chain constraints and the nascent stage of floating wind technology pose significant barriers to rapid expansion.