Australia Video Conferencing Market Outlook to 2030

By Component Type, By Deployment Model, By End User, By Use Case, By Distribution Channel, and By Region

- Product Code: TDR0229

- Region: Asia

- Published on: August 2025

- Total Pages: 80

Report Summary

The report titled “Australia Video Conferencing Market Outlook to 2030 – By Component Type, By Deployment Model, By End User, By Use Case, By Distribution Channel, and By Region” provides a comprehensive analysis of the video conferencing industry in Australia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and detailed market segmentation. It further analyses emerging trends and developments, the regulatory landscape impacting conferencing platforms and hardware, customer-level profiling across enterprises, government, education, and healthcare, as well as the issues and challenges faced by market participants. The competitive landscape is assessed in depth, including competition scenario, cross-comparison of global and regional players, opportunities and bottlenecks for vendors and channel partners, and detailed company profiling of major participants in the Australian video conferencing market. The report concludes with future market projections based on enterprise adoption volumes, deployment models, regional expansion, cause-and-effect relationships such as the impact of digital infrastructure rollouts (NBN, 5G), and success case studies highlighting the major opportunities and cautions for vendors, distributors, and end users in the market.

Australia Video Conferencing Market Overview and Size

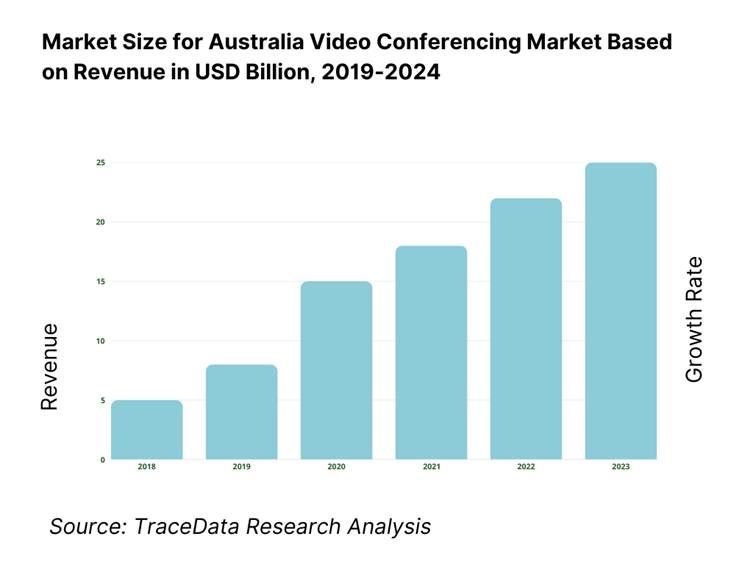

The Australia video conferencing market is valued at approximately USD 49.65 million, derived from Asia‑Pacific video conferencing equipment data, reflecting robust investment in room systems, peripherals, and related infrastructure. This market is propelled by increasing adoption of hybrid and remote working models across enterprises, governments, and educational institutions, supported by enhancements in broadband and NBN infrastructure. Additionally, the rollout and usage of AI-enabled features—such as automated transcription, noise cancellation, and meeting summarization—are spurring demand for upgraded conferencing setups.

Major urban centres—particularly Sydney, Melbourne, and Brisbane—dominate the Australia video conferencing market, due to their concentration of corporate headquarters, government agencies, universities, and healthcare hubs. Greater internet infrastructure, higher availability of managed services, and greater willingness to invest in advanced room solutions make these cities the largest adopters. Meanwhile, remote and regional areas, while growing, lag due to bandwidth and infrastructure disparities.

What Factors are Leading to the Growth of the Australia Video Conferencing Market:

Hybrid-work penetration: Hybrid work directly fuels the Australia video conferencing market by expanding the pool of employees who regularly meet online. Australia counted 14,458,600 people in employment, with monthly hours worked reaching 1,962 million, reinforcing the scale of collaboration needs across the economy. Hybrid work is entrenched: the national statistician records that 36% of employed people “usually worked from home,” while major connectivity rails are in place—34,000,000 mobile services and 29,800,000 prepaid/postpaid mobile plans in service connect workers on the move, and 8,630,000+ premises are connected to the NBN. These hard metrics underpin sustained demand for meeting platforms, calling integrations, and room systems.

NBN fibre footprint: The NBN’s expanding fibre footprint is a foundational driver because enterprise-grade video needs low-latency, high-throughput access. Nationally, 8,630,000+ premises are connected to the NBN, including 2,660,000 on FTTP after 430,000 copper-to-fibre upgrades were delivered, taking total FTTP upgrades to 805,000. Higher speed adoption is visible in 2,770,000 premises on 100 Mbps-and-above plans. Beyond fibre, the fixed-wireless refresh now enables faster speeds for 700,000+ regional premises, and the footprint made available by fixed wireless is “around 800,000 premises.” These scale metrics reduce jitter and packet loss in business video, enabling room-to-desktop interactivity and HD/4K use cases.

5G coverage: Mobile broadband is becoming a credible failover and primary access for branch and home offices running video. Regulators report 34,000,000 mobile services in operation and 29,800,000 prepaid/postpaid plans, with 50+ MVNOs increasing competitive access. Population coverage for 5G reached 89% and is rising as rural coverage is extended through public programs; the Mobile Black Spot Program has 1,156 base stations activated and plans for “up to 1,400” new sites. For field-based teams and commuters, these figures mean higher uplink stability for live video, smoother screen-share, and more resilient softphone/video workflows as 3G sunsets and spectrum is refarmed.

Which Industry Challenges Have Impacted the Growth of the Australia Video Conferencing Market:

Rural bandwidth variability: Regional users disproportionately rely on non-fibre access where congestion and backhaul can degrade meeting quality. Fixed wireless services in operation climbed to 921,000, and NBN fixed wireless accounts for about 5% of NBN users; while upgrades expanded faster speeds to 700,000+ premises, latency and peak-hour contention still vary across geographies. Government programs are addressing last-mile gaps—1,156 Mobile Black Spot sites are live with up to 1,400 planned—but heterogeneous access types (fixed wireless, satellite, and varied 4G/5G cells) continue to produce uneven uplink performance, driving demand for SD-WAN, QoS, and adaptive codecs in rural video deployments.

Data sovereignty concerns: Boards and CISOs elevate requirements for Australian data handling in collaboration tools because incident volumes remain high. The privacy regulator received 1,113 notifiable data breach reports in the year, while privacy complaints totaled 3,215. The national cyber authority handled 36,700+ calls to its Cyber Security Hotline and responded to 1,100+ cyber incidents, underscoring the operational environment for enterprises. These concrete volumes push procurement to prioritise platforms with Australian data residency options, strong auditing, and robust identity controls, and they encourage government-aligned configurations for recording storage, transcripts, and meeting artifacts.

Multi-vendor interoperability: Enterprises must integrate conferencing with a complex carrier and access landscape. Australia runs 3 nationwide MNOs plus 50 MVNOs, 34,000,000 mobile services, and multiple NBN technologies at scale—ACCC/ACMA show technology splits including FTTP (~2,000,000 services), FTTN (~2,928,000), FTTC (~1,060,000), HFC (~2,002,000), fixed wireless (~405,000 NBN) and satellite (~89,000), all requiring careful QoS, SBC, and SIP/RTC mappings. This multiplicity complicates voice/video handoff, dial-out routing, and room-system compatibility across meeting vendors, especially where enterprises retain legacy H.323/SIP endpoints alongside cloud video.

What are the Regulations and Initiatives which have Governed the Market:

Privacy Act (APPs): Australia’s Privacy Act is structured around 13 Australian Privacy Principles that cover collection, use, disclosure, security, access, and correction of personal information. For video platforms that capture meeting recordings, chat logs, and biometrics (e.g., voice), governance must map these data flows to APP requirements such as APP 11 (security) and APP 13 (correction). Regulatory activity is material: the privacy regulator received 3,215 privacy complaints in the reporting year, signaling heightened enforcement attention. Vendors and buyers should align consent flows, retention schedules, and data residency to these statutory controls when deploying across corporate and public-sector environments.

Notifiable Data Breaches scheme: The mandatory breach scheme drives incident response readiness for collaboration stacks. The regulator recorded 1,113 notifiable data breach reports in the year, with 595 in the second half alone. For video conferencing deployments that integrate calendars, identity stores, and contact directories, these concrete reporting volumes reinforce the need for auditable logs, rapid revocation, and secure guest workflows to contain lateral movement risk. Incident-reporting thresholds in the scheme compel organisations to evaluate meeting add-ons (bots, apps, and storage connectors) within their privacy impact assessments and to ensure supplier contracts address notification timeframes and information-sharing protocols.

ACSC ISM & Essential Eight: Security baselines used by government and critical-infrastructure buyers shape procurement of video platforms and endpoints. The cyber authority’s posture report shows only 15% of Commonwealth entities reached overall Essential Eight Maturity Level 2 after the 2024 model update, while operational signal remains strong with 118 alerts/advisories published, 36,700+ hotline calls, and 1,100+ incidents handled. For conferencing, this means endpoints, clients, and gateways must support patching cadence, MFA, application hardening, macro controls, and backups consistent with the Essential Eight and ISM controls, and suppliers should provide configuration guides that map features to these controls.

Australia Video Conferencing Market Segmentation

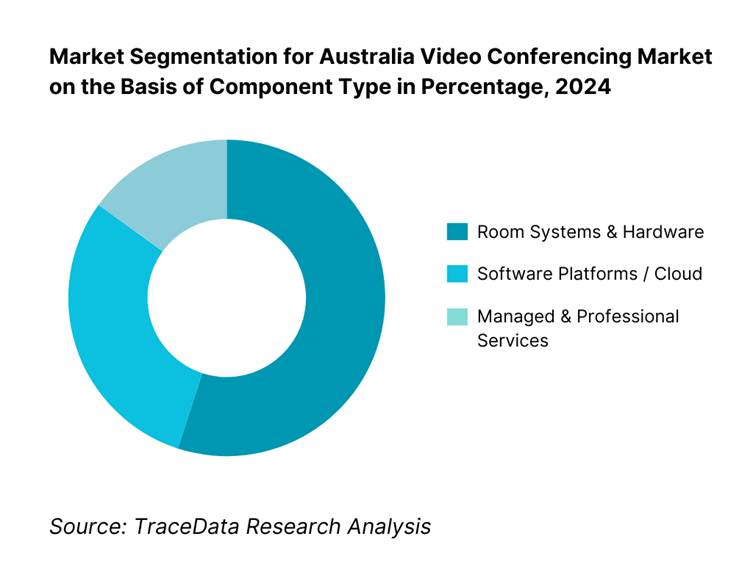

By Component Type: The market is segmented into room hardware, software platforms, and managed services. The Room Systems & Hardware segment dominates, attributable to the pressing need for physical in-room endpoints—especially as organisations retrofit boardrooms and huddle rooms to support hybrid meetings. Demand for high-quality cameras, codecs, microphones, and displays remains strong as enterprises prioritise seamless in-person/remote collaboration. Meanwhile, software and cloud adoption continue to grow, fuelled by subscription models and endpoint compatibility. Managed and professional services account for 15 %, as many organisations outsource installation, integration, maintenance, and AI‑feature enablement to channel partners and MSPs.

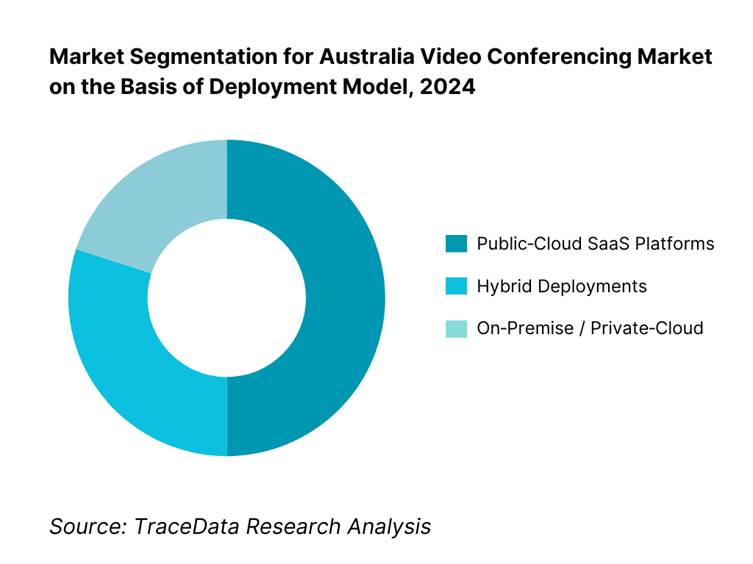

By Deployment Model: Public‑cloud SaaS platforms dominate with around 50 % market share, driven by ease of deployment, scalability, and lower upfront costs. Organisations increasingly favor cloud‑native conferencing services that integrate seamlessly with enterprise workflows and allow rapid feature updates. Hybrid models, encompassing a blend of cloud and on‑premise hosting, hold approximately 30 %. This reflects demand for flexibility: enterprises retain sensitive data on‑site while leveraging cloud reach. On‑Premise / Private‑Cloud options account for about 20 %, largely chosen by government, defence, and highly regulated sectors seeking data sovereignty, tight compliance, and control over latency-sensitive communication systems.

Competitive Landscape in Australia Video Conferencing Market

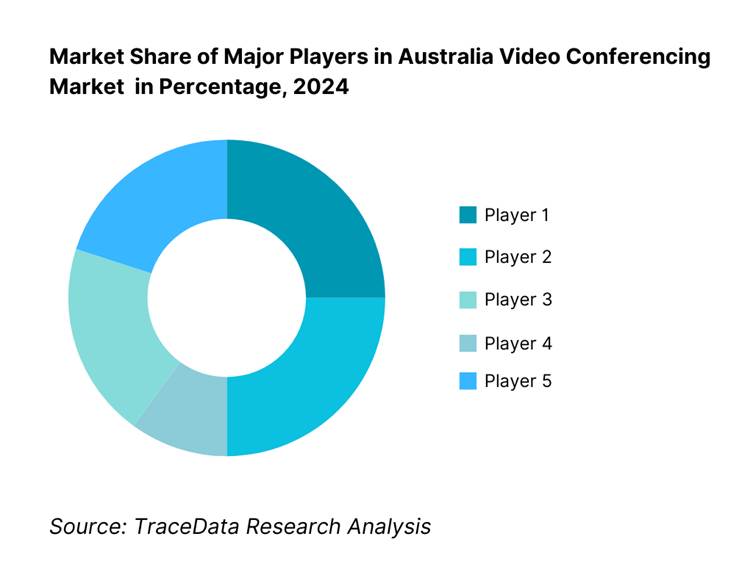

The Australia video conferencing market is shaped by a mix of global platform vendors, hardware specialists, and local channel partners. Prominent players like Microsoft (Teams), Zoom, Cisco (Webex), Google Meet, and Pexip each wield considerable influence through integrated platforms and partner ecosystems, while hardware leaders such as Logitech, Poly (HP), Crestron, Barco, and Barco’s ClickShare Conference contribute strong room system offerings. This consolidation underscores the market’s reliance on a core group of competitors with both global R&D strength and local execution.

Name | Founding Year | Headquarters |

Microsoft (Teams) | 1975 | Redmond, USA |

Zoom Video | 2011 | San Jose, USA |

Cisco (Webex) | 1984 | San Jose, USA |

Google (Google Meet) | 1998 | Mountain View, USA |

Pexip | 2012 | Oslo, Norway |

RingCentral | 1999 | Belmont, USA |

GoTo (GoTo Meeting) | 2003 | Boston, USA |

8x8 (Meet) | 1987 | Campbell, USA |

Vonage (Video API) | 2001 | Holmdel, USA |

Amazon (Chime) | 1994 | Seattle, USA |

Telstra (Collaboration) | 1975 | Melbourne, Australia |

Logitech (Rally/MeetUp) | 1981 | Lausanne, Switzerland |

HP | Poly | 1961 |

Crestron (Flex) | 1972 | Rockleigh, USA |

Barco (ClickShare) | 1934 | Kortrijk, Belgium |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Microsoft (Teams): Microsoft has strengthened its position in Australia by integrating advanced AI features such as intelligent meeting recap and real-time translation in Teams. In 2024, the company expanded its local data center capacity to meet government and enterprise data residency requirements, boosting adoption in highly regulated sectors.

Zoom Video: Zoom recorded notable growth in enterprise subscriptions in Australia, driven by hybrid work demand. The company has launched AI Companion, offering meeting summarization and smart note-taking, which has gained traction among professional services and education customers.

Cisco (Webex): Cisco has increased its focus on secure collaboration by achieving IRAP certification in Australia, making Webex suitable for federal and state government use. It also enhanced integrations with Telstra to deliver Webex solutions optimized for Australian enterprises.

Google (Google Meet): Google expanded Meet’s integration with Google Workspace and added advanced noise cancellation features. It has gained popularity among education institutions in Sydney and Melbourne, supported by strong uptake of Chromebooks in classrooms.

Pexip: Pexip has built a niche by catering to government and defense clients in Australia, emphasizing interoperability with legacy systems (SIP/H.323) and secure video environments. In 2024, Pexip expanded its reseller network in Australia to serve public sector demand for data sovereignty.

What Lies Ahead for Australia Video Conferencing Market?

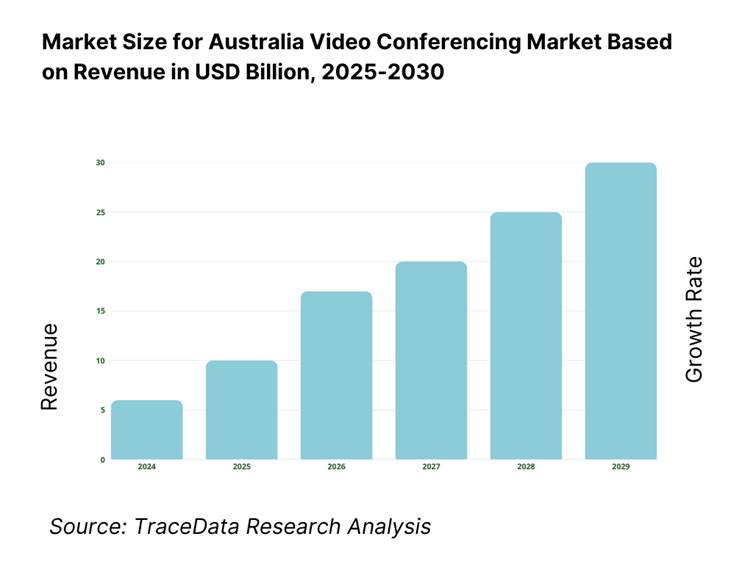

The Australia video conferencing market is expected to expand steadily towards 2029, supported by the country’s accelerating digital infrastructure, widespread adoption of hybrid work practices, and strong government focus on data security and sovereign hosting. Growing reliance on remote collaboration across healthcare, education, and government institutions will continue to reinforce the strategic importance of video conferencing in Australia’s digital economy.

Rise of Hybrid Meeting Models: The future of video conferencing in Australia will be defined by hybrid meeting models, where in-person and remote participants engage seamlessly. Large enterprises and government agencies are increasingly investing in room systems, huddle spaces, and AI-powered cameras to ensure equitable participation. This shift is driven by the need to maintain productivity across distributed workforces while maximizing investments in physical office spaces.

Focus on Secure and Compliant Platforms: As Australian organisations face heightened cybersecurity risks and regulatory scrutiny, secure and compliant platforms will dominate procurement decisions. Vendors with IRAP-certified hosting, ACSC Essential Eight alignment, and Privacy Act-compliant data handling will find increased traction. This focus ensures that sensitive information in government, healthcare, and financial services is protected while enabling efficient collaboration.

Expansion of Vertical-Specific Use Cases: Sector-specific adoption will intensify, with healthcare driving telehealth consultations, education institutions expanding virtual classrooms, and the public sector deepening inter-departmental collaboration. Each vertical is expected to demand customised conferencing solutions tailored to its compliance, workflow, and accessibility needs, thereby expanding solution providers’ opportunities for specialisation.

Leveraging AI and Analytics in Meetings: Artificial intelligence and advanced analytics will shape the next wave of video conferencing adoption. Features such as real-time transcription, automated meeting summaries, translation, and participant sentiment analysis will become standard expectations. These tools will not only enhance meeting efficiency but also generate actionable insights for enterprises, improving collaboration ROI and ensuring more inclusive communication across diverse teams.

Australia Video Conferencing Market Segmentation

By Component Type

Room Systems & Hardware

Software Platforms / Cloud Solutions

Peripherals & Accessories

Managed & Professional Services

Connectivity Add-Ons

By Deployment Model

Public-Cloud SaaS

Hybrid Deployment

On-Premise / Private-Cloud

Sovereign / IRAP-Certified Hosting

By End User

Large Enterprises

Small & Medium Businesses (SMBs)

Government & Public Sector Agencies

Education Institutions

Healthcare Providers

Professional Services Firms

By Use Case / Application

Internal Team Collaboration

Client & External Communication

Telehealth & Virtual Care

Remote & Hybrid Learning

Townhalls & Webinars

Field & Remote Operations

By Region

New South Wales

Victoria

Queensland

Western Australia

South Australia

Australian Capital Territory

Tasmania & Northern Territory

Players Mentioned in the Report:

Microsoft (Teams)

Zoom Video Communications

Cisco (Webex)

Google (Google Meet)

Pexip

RingCentral (Video)

GoTo (GoTo Meeting)

8x8 (8x8 Work/Meet)

Amazon (Chime)

Vonage (Video API)

Telstra (Adaptive Collaboration / Webex)

Logitech (Rally/MeetUp)

HP | Poly (Poly Studio)

Crestron (Flex)

Barco (ClickShare Conference)

Key Target Audience

Enterprise CIOs / Heads of Collaboration Platforms

IT Procurement Heads at Government Departments (e.g., DTA, NCIS, state agencies)

Healthcare IT Directors

Education Technology Leaders (universities and TAFEs)

Telcos and Managed Service Providers

Room Technology and AV Managers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies

Time Period:

Historical Period: 2019-2024

Base Year: 2025

- Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Australia Country Overview (Population Overview, GDP, Inflation Rate, and other Key Facts)

4.2. Australia Population Analysis (Population by gender, regions, age, nationality, and other key facts)

5.1. Positioning of Video Conferencing Platforms in Australia (Global Leaders, Regional Players, and Local Telco Bundles)

5.2. Revenue Streams for Australia Video Conferencing Market

5.3. Business Model Canvas for Australia Video Conferencing Market

5.4. Decision-Making Process Undertaken by Enterprises Before Adopting Video Conferencing Solutions

6.1. Enterprise Spend on IT, Collaboration, and Communication in Australia, 2024

6.2. Number of Video Conferencing Enabled Meeting Rooms in Australia by Location

9.1. Revenues, 2019-2024

9.2. Number of Paid Subscriptions, 2019-2024

9.3. Number of Licensed Meeting Rooms, 2019-2024

10.1. By Market Structure (Cloud, On-Premise, Hybrid, Sovereign Hosted), 2023-2024P

10.2. By Pricing Model (Mass Market, Enterprise, Premium Government), 2023-2024P

10.3. By Region, 2023-2024P

10.4. By Revenue Stream (Licensing, Hardware Sales, Managed Services, Connectivity Add-ons), 2023-2024P

11.1. Customer Landscape and Cohort Analysis

11.2. Customer Journey and Decision-Making

11.3. Need, Desire, and Pain Point Analysis

11.4. Gap Analysis Framework

11.5. By Consumer Age Group (Workforce 18-34, 35-54, 55+), 2023-2024P

11.6. By Enterprise Size (SMBs, Medium, Large, Public Sector), 2023-2024P

11.7. By Licensing Duration (Monthly, Quarterly, Annually), 2023-2024P

11.8. By Use Case Motivation (Internal Collaboration, Client Communication, Telehealth, Education, Events), 2023-2024P

11.9. By Male and Female Workforce Utilisation in Hybrid Work, 2023-2024P

12.1. Trends and Developments for Australia Video Conferencing Market

12.2. Growth Drivers for Australia Video Conferencing Market

12.3. SWOT Analysis for Australia Video Conferencing Market

12.4. Issues and Challenges for Australia Video Conferencing Market

12.5. Government Regulations for Australia Video Conferencing Market

13.1. Market Size and Future Potential for Online Video Conferencing Market Based on Subscriptions and Usage Volumes, 2019-2030

13.2. Business Model and Revenue Streams

13.3. Cross Comparison of Leading Online Video Conferencing Platforms (Microsoft, Zoom, Cisco, Google, Pexip, RingCentral, GoTo, 8x8, Vonage, Amazon, Telstra, Logitech, Poly, Crestron, Barco) based on: Company Overview, Revenue Streams, Subscriptions, Operating Regions, Number of Enterprise Clients, Features, Pricing Details, and Other Variables

16.1. Market Share of Major Organized Players in Australia Video Conferencing Market Basis Revenues, Number of Clients, and Licensed Meeting Rooms, 2024

16.2. Benchmark of Key Competitors in Australia Video Conferencing Market Including Variables Such as Company Overview, USP, Business Strategies, Strength, Weakness, Number of Subscribers, Enterprise Clients, Revenue Stream, Sales and Marketing Strategy, Partner Network, Pricing Details and Others

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant (or equivalent UCaaS/Meetings Quadrant)

16.5. Bowmans Strategic Clock for Competitive Advantage

16.6. Pricing Analysis of Major Players in Australia Video Conferencing Market

17.1. Revenues, 2025-2030

17.2. Number of Paid Subscriptions, 2025-2030

17.3. Number of Licensed Meeting Rooms, 2025-2030

18.1. By Market Structure (Cloud, On-Premise, Hybrid, Sovereign Hosted), 2025-2030

18.2. By Pricing Model (Mass Market, Enterprise, Premium Government), 2025-2030

18.3. By Region, 2025-2030

18.4. By Revenue Stream (Licensing, Hardware Sales, Managed Services, Connectivity Add-ons), 2025-2030

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Australia Video Conferencing Market. On the demand side, include large enterprises, mid-market and SMBs; federal, state and local government agencies; higher-education and K-12 institutions; healthcare networks and private clinics; professional services, BFSI, mining/energy, and retail. On the supply side, cover platform vendors (e.g., Teams, Zoom, Webex, Google Meet, Pexip), room hardware/peripherals (Logitech, HP | Poly, Crestron, Barco), cloud/hosting (AWS, Azure, GCP), telcos (e.g., Telstra) and SIP/PSTN providers, AV integrators/MSPs/distributors, and ISV ecosystem partners (security, transcription, analytics, scheduling). Based on this map, shortlist 5–6 leading providers in Australia using local financials, paid seat/room footprint, data residency/IRAP posture, channel reach, and enterprise/public-sector client base. Sourcing is conducted through government portals and notices (e.g., AusTender), company disclosures, partner directories, procurement frameworks, and multiple secondary and proprietary databases to collate industry-level information.

Step 2: Desk Research

Engage in exhaustive desk research using diverse secondary and proprietary datasets to build a granular market baseline for Australia. Aggregate insights on revenues by component (platform, room systems, services), deployment mix (public cloud, hybrid, on-prem/private), vertical adoption, room counts by size, device attach rates, PSTN/SIP add-ons, AI feature uptake, and support tiers/SLAs. Examine company-level data via annual reports, investor decks, press releases, IRAP/ISO attestations, privacy policies, local DC/PoP announcements, Teams/Zoom/Webex certified-device lists, and telco bundle catalogs. Cross-reference with government procurement records (framework agreements, panels), university and hospital tender notices, and regulatory publications (ACSC/ISM guidance, DTA hosting rules, Privacy Act/APP references). This forms the foundational understanding of the market structure, pricing architectures, channel dynamics, and compliance requirements in Australia.

Step 3: Primary Research

Conduct in-depth interviews with C-level and functional leaders across platform vendors, telcos, AV integrators/MSPs, and major end-users (CIOs, Heads of Collaboration/UC, Procurement Leads, CISOs) to validate hypotheses and quantify key metrics (paid seats vs MAUs, rooms licensed vs installed endpoints, device refresh cycles, attach rates for PSTN, webinar usage patterns, AI feature activation, support incidents per 1,000 users). Use a bottom-to-top approach to capture revenue contributions per player (by channel and vertical) and roll up to the market total. As part of validation, execute disguised interviews and solution walkthroughs (posing as prospective buyers) to corroborate operational claims (data residency, IRAP status, sovereign options, migration timelines, interop gateways, SBC/SIP routing practices, QoS/SD-WAN configurations, and field-service SLAs). Triangulate findings against secondary sources and procurement artifacts to confirm utilization, pricing constructs, and deployment realities.

Step 4: Sanity Check

Run top-down and bottom-up sizing in parallel and reconcile variances. Top-down: allocate vendor-reported regional revenues to Australia using disclosed geographies, local DC/PoP footprints, and channel mix, then apportion by component and vertical. Bottom-up: model installed base of meeting rooms by size (huddle/small/medium/large), estimated device densities and replacement cycles, paid host licenses, and per-room licensing; incorporate PSTN minute blocks and webinar add-ons where relevant. Perform sensitivity tests (± ranges on attach rates, utilization, replacement cadence) and outlier removal. Cross-validate with Australian procurement contract values, professional-services hours, and observable deployments in government/education/healthcare. Finalise the model only after logical consistency checks (e.g., rooms per 100 employees, support tickets per user, bandwidth prerequisites vs NBN/5G reach) and document assumptions, limitations, and data provenance for auditability.

FAQs

01 What is the potential for the Australia Video Conferencing Market?

The Australia Video Conferencing Market is positioned for sustained expansion, supported by the rapid adoption of hybrid work practices and ongoing digital transformation initiatives across public and private sectors. With over 14.4 million people employed and a large proportion engaged in remote or flexible work arrangements, the demand for secure and scalable collaboration platforms continues to rise. The market’s potential is further strengthened by widespread NBN fibre connectivity, increasing 5G population coverage of 89%, and significant investment in digital infrastructure by enterprises, education, and healthcare institutions.

02 Who are the Key Players in the Australia Video Conferencing Market?

The Australia Video Conferencing Market features several global and regional leaders, including Microsoft (Teams), Zoom Video Communications, Cisco (Webex), Google (Google Meet), and Pexip. These companies dominate due to their comprehensive platforms, enterprise-grade security features, and strong partner networks with telcos and managed service providers. Other notable players include RingCentral, GoTo, 8x8, Vonage, Amazon (Chime), Telstra, Logitech, HP | Poly, Crestron, and Barco, each contributing through either platforms, hardware, or integration services to serve diverse industry verticals in Australia.

03 What are the Growth Drivers for the Australia Video Conferencing Market?

The primary growth drivers include hybrid work penetration across enterprises and government, underpinned by macroeconomic fundamentals such as 1,962 million monthly hours worked nationwide and over 8.6 million premises connected to the NBN. The expansion of 5G networks with 34 million mobile services in operation further supports high-quality collaboration on the move. Digital-first strategies in healthcare, education, and financial services amplify adoption, while AI-enabled meeting features like transcription and summarization enhance productivity and ROI, cementing video conferencing as a core tool in Australia’s digital workplace ecosystem.

04 What are the Challenges in the Australia Video Conferencing Market?

The Australia Video Conferencing Market faces several challenges, primarily rural bandwidth variability, with over 921,000 fixed wireless services and satellite connections still prone to latency issues. Data sovereignty and compliance are critical, as evidenced by 1,113 notifiable data breaches reported nationally in a year, pushing organisations to demand local hosting and IRAP-certified solutions. Additionally, multi-vendor interoperability remains a barrier: with 34 million mobile services and multiple NBN technology types, ensuring seamless connectivity across devices and platforms is complex. These challenges necessitate continuous investment in infrastructure, security, and standards compliance.