Australia Waxing Devices Market Outlook to 2030

By Product Type, By Application, By End-User, By Distribution Channel, and By Region

- Product Code: TDR0230

- Region: Asia

- Published on: August 2025

- Total Pages: 80

Report Summary

The report titled “Australia Waxing Devices Market Outlook to 2030 – By Product Type, By Application, By End-User, By Distribution Channel, and By Region” provides a comprehensive analysis of the waxing devices market in Australia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and detailed market segmentation across product types, applications, end-users, distribution channels, and regional demand. It further outlines key trends and developments, the regulatory landscape governing cosmetic safety and device imports, and provides in-depth consumer-level profiling that explores purchasing patterns, brand loyalty, and usage frequency. The report concludes with future market projections based on product adoption trends, regional dynamics, consumer behavior shifts, and success case studies, offering a clear perspective on major opportunities and potential cautions for stakeholders in the Australia Waxing Devices Market.

Australia Waxing Devices Market Overview and Size

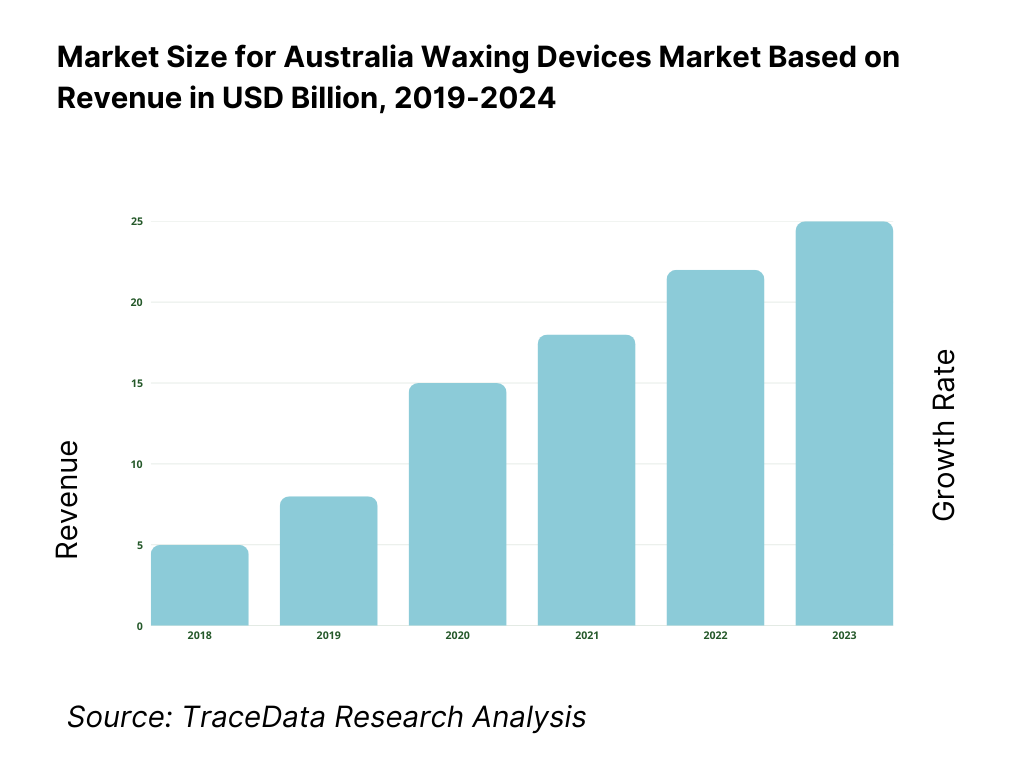

The Australia waxing devices market is valued at approximately USD 164.86 million, reflecting the hair removal wax segment in 2024. The device portion, specifically IPL and energy‑based tools, is estimated at around AUD 150 million for 2023. Demand is driven primarily by rising household disposable incomes and consumers’ increasing preference for at-home grooming convenience, fostered by online retail expansion. Urban beauty-conscious households and salon chains increasingly adopt advanced waxing technologies, elevating market revenues.

Key Australian urban centres, especially Sydney and Melbourne, dominate this market thanks to higher household incomes, robust beauty and wellness infrastructures, and dense salon networks. These cities cultivate early adoption of premium, tech-enabled waxing devices and refills, whereas Brisbane and Perth also contribute significantly due to rising urbanization and regional income growth. Strong e-commerce penetration further reinforces these hubs as market leaders in device demand.

What Factors are Leading to the Growth of the Australia Waxing Devices Market:

Increasing Demand for At-home Grooming: Australia’s installed base of potential at-home groomers is large and digitally enabled, creating a ready pool of buyers for waxing devices. The resident population reached 27,400,013, while 34,000,000 mobile services were in operation—supporting discovery, purchase and use of DIY grooming products. Online retailing provides convenient fulfilment for heavy, heat-assisted wax warmers and refills; Australian online retail turnover in a single month was 4,411,200,000. Household healthcare outlays also create headroom for routine self-care: national health goods and services spending totalled 252,500,000,000, or 9,597 per person, supporting recurring consumables like strips, cartridges and post-wax skin care. These hard numbers indicate a wide, connected shopper base, robust fulfilment infrastructure and recurring spend categories that align with continued uptake of at-home waxing kits and accessories.

Rise in Disposable Income of Millennial and Gen Z Women: Higher female earnings in mid-career roles are a practical catalyst for premium DIY grooming purchases and replenishment cycles. Median hourly earnings for women stood at 38.90, while weekly cash earnings in higher-income occupational cohorts—where many millennial women cluster—were 2,100 for managers and 1,827 for professionals (all figures in AUD). Australia’s female consumer base itself is substantial within a population of 27,400,013, and digital shopping channels are ubiquitous with 34,000,000 mobile services in operation, ensuring frictionless basket building for wax devices and ancillaries. Higher mid-career earnings plus near-universal mobile access shorten the path from awareness to checkout for device upgrades (faster heaters, low-temp wax), contributing to steady category throughput for retailers serving female professionals.

Growing Male Grooming Trends: Male participation in routine grooming is increasingly supported by Australia’s retail footprint and employment base in relevant channels. “Pharmaceutical and Other Store-Based Retailing”—the chemist-led channel that ranges razors, depilatories and men’s grooming—employed 230,500 people, ensuring broad physical access to male-skewing pre/post-hair-removal products. At the same time, chemists and beauty specialists are embedded within a population of 27,400,013, with rapid product discovery enabled by 34,000,000 mobile services. Online retailing adds long-tail range—monthly online turnover reached 4,411,200,000—so men can trial hard-to-find hypoallergenic waxes and device formats suited to dense or coarse hair. The retail workforce scale, national population base and digital purchasing capacity together underpin growing male adoption of tidy-up and maintenance routines, where warmers, precision applicators and pre-/post-wax care complement barbershop or gym-aligned self-care habits.

Which Industry Challenges Have Impacted the Growth of the Australia Waxing Devices Market:

Rising Skin Sensitivity Concerns: Sensitive-skin prevalence and allergy risk demand better formulations, clear labelling and education for waxing use. Emergency departments recorded 13,273 presentations linked to asthma and allergic diseases in one large Australian region—evidence that acute allergy workloads remain material. Nationally, health spending reached 252,500,000,000, or 9,597 per person, signalling meaningful outlays on treatments that include dermatitis management. Product Safety Australia enforces the cosmetics labelling standard to help consumers avoid allergens, with a dedicated Consumer Goods (Cosmetics) Information Standard 2020 entry. AICIS also monitors cosmetic chemical introductions; 7,341 introducers were registered, underscoring the volume of ingredients requiring compliance. Together, acute allergy workloads, sizeable health outlays and a large regulated chemical pipeline reinforce the need for hypoallergenic waxes, gentler temperatures and clear after-care guidance in the waxing device category.

Growing Competition from Alternate Hair-Removal Methods: Professional and medical-grade options create credible substitutes for waxing, drawing share from repeat home use. The Medical Board of Australia reports 676 registered dermatology specialists—clinical leaders who underpin availability of laser- and light-based procedures nationwide. The Australasian College of Dermatologists also cites 661 Fellows and 129 trainees, expanding procedural capacity and patient advice across public/private settings. These clinician counts sit within a health workforce that has risen by 184,000 registered professionals over the last decade, increasing access to specialist services that can substitute for waxing in certain use-cases (e.g., longer-interval hair reduction). With consumers able to research and book via 34,000,000 mobile services, the discovery funnel for clinic-based options remains wide. Waxing device brands must therefore position on immediacy, privacy, lower barrier to entry and suitability for diverse hair/skin types to maintain relevance versus durable alternatives.

Consumer Awareness and Training Gap: Safe and effective waxing requires basic technique knowledge—temperature control, test patching and post-care. Yet formal training largely targets professionals, not household users. Australia had 311,760 active apprentice/trainee contracts, with “Other Services” (including hairdressing and beauty services) prominently represented in small business training pipelines, while home users receive no formal instruction. Chemical stewardship also remains complex: 7,341 companies registered with AICIS to introduce industrial chemicals, and 6 introduction categories apply—rules that influence ingredient availability, labelling and risk communications. With 34,000,000 mobile services enabling instant purchases, the education gap can translate into improper heating, over-exfoliation and allergen exposure. Structured quick-start guides, QR-linked micro-tutorials and AICIS-aligned ingredient disclosures are therefore critical for category safety and satisfaction.

What are the Regulations and Initiatives which have Governed the Market:

Device Import (customs & industrial chemical introductions): Waxing devices and consumables enter Australia through a regulated chemicals and product-safety regime that affects importers’ obligations. Under the Australian Industrial Chemicals Introduction Scheme (AICIS), 7,341 introducers (importers/manufacturers) were registered, each required to lodge an annual declaration across 6 introduction categories (e.g., exempted, reported, assessed). AICIS’ cost-recovery statement notes higher-than-forecast top-tier introducers in 2023–24, signalling a busy pipeline of chemical entries relevant to wax formulas (rosin derivatives, esters, fragrance allergens). These figures frame the importer’s compliance load in addition to Australian Border Force tariff/quarantine procedures, and they justify robust supplier vetting for heaters, cartridges and after-care liquids shipped D2C or via chemist chains.

Cosmetic Product Safety (labelling & consumer law): Product Safety Australia enforces one mandatory cosmetics standard—the Consumer Goods (Cosmetics) Information Standard 2020—requiring full ingredient disclosure at point of sale, a critical safeguard where allergens (e.g., fragrances, resins) are present. The standard is referenced and guided in TGA materials here, assisting businesses to determine classification and ensure correct labelling/claims. The ACCC underscores that unsafe or incorrectly labelled products can be recalled or banned under Australian Consumer Law. In parallel, AICIS maintains oversight of cosmetic ingredient introductions with 7,341 registered introducers, ensuring label transparency is anchored to a regulated chemicals registry. These numeric compliance anchors shape pack copy, online ingredient disclosure and consumer guidance across waxing kits.

TGA Regulations (therapeutic boundary & clinical ecosystem): Most wax warmers and strips are cosmetics or consumer electricals; however, therapeutic boundary decisions matter when adjacent devices (e.g., IPLs) are marketed for medical indications. The TGA provides explicit guidance for determining if a product is cosmetic or therapeutic here and references the cosmetics information standard here. Clinical ecosystem capacity also frames substitute pathways: the Medical Board of Australia lists 676 registered dermatology specialists, while the Australasian College of Dermatologists cites 661 Fellows and 129 trainees—numbers that indicate robust availability of practitioner-delivered alternatives and the need for clear device claims to avoid entering therapeutic territory. For waxing brands, maintaining cosmetic classification and compliant advertising while monitoring TGA boundaries is a tangible governance requirement supported by these workforce and guidance statistics.

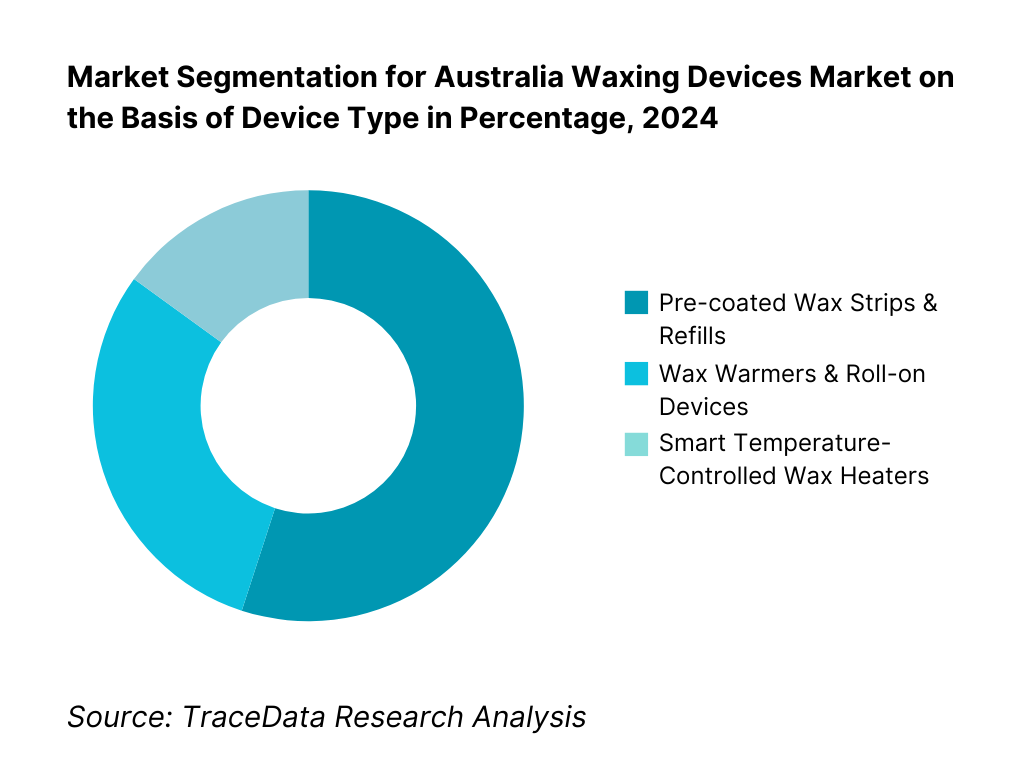

Australia Waxing Devices Market Segmentation

By Device Type: The market is divided into Wax Warmers & Roll-on Devices, Pre-coated Wax Strips & Refills, and Smart Temperature-Controlled Wax Heaters. In 2024, Pre-coated Wax Strips & Refills dominate, reflecting strong consumer preference for their ease of use and convenience, especially among home users who prioritize mess-free application and quick results. Pre-coated strips enjoy dominance due to their grab-and-go appeal, minimal mess, and suitability for at-home users. Mass availability via supermarkets and online platforms, coupled with strong brand loyalty to names like Veet, underpin their leadership. These strips suit a broad demographic—busy professionals and price-sensitive consumers—further reinforcing their market share advantage.

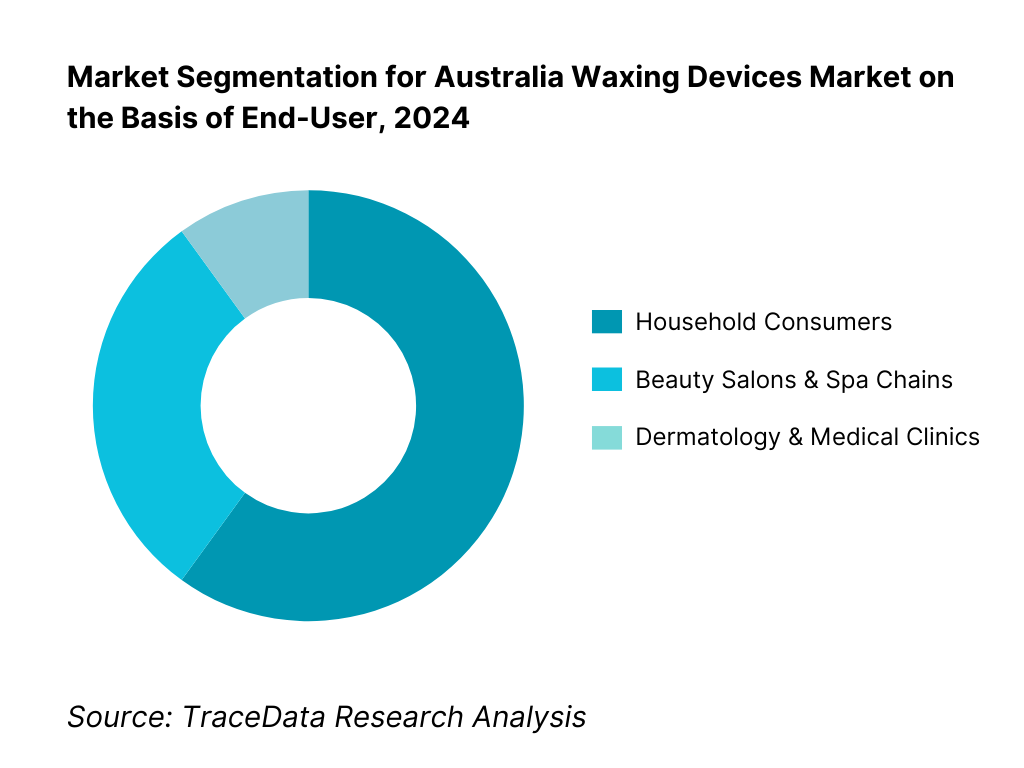

By End-User: The market is segmented into Household Consumers, Beauty Salons & Spa Chains, and Dermatology & Medical Clinics. Household Consumers hold the largest share, thanks to the surge in at-home grooming trends, affordability of devices, and the appeal of DIY treatments that fit modern lifestyle preferences. Household consumers lead due to increasing confidence in performing waxing independently, bolstered by digital tutorials and social media influence. Availability of reasonably priced kits and the convenience factor—especially during and post-pandemic—accelerated adoption. Meanwhile, salons maintain a steady share supported by professional-grade devices and service offerings, though they lag behind DIY user convenience.

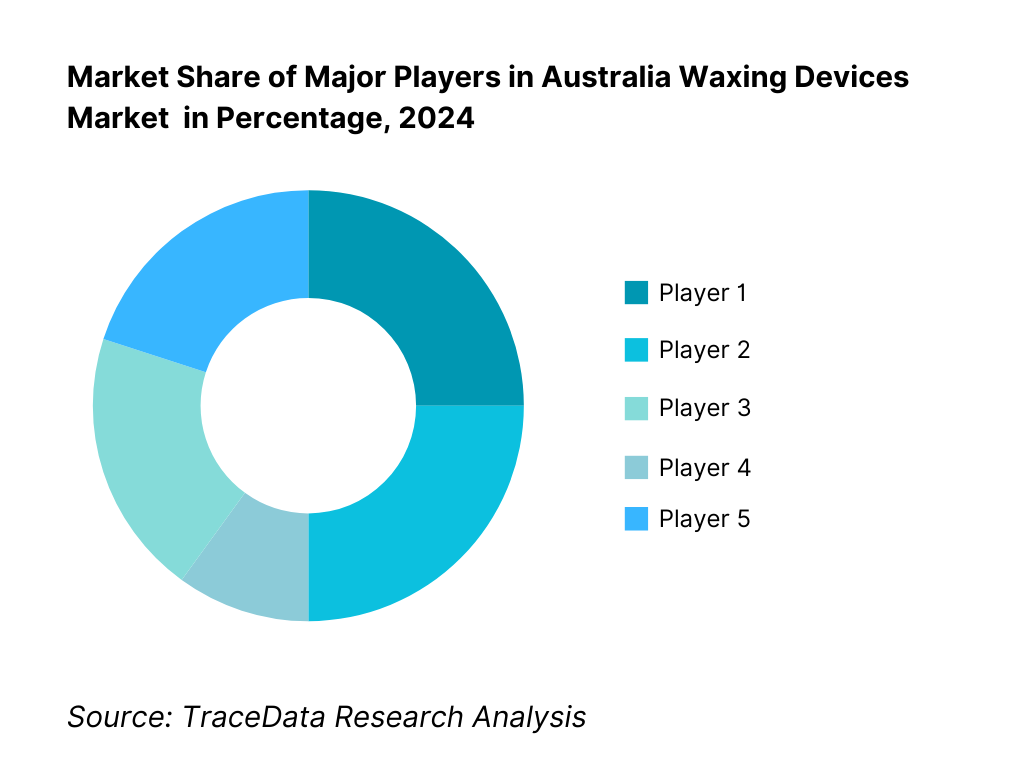

Competitive Landscape in Australia Waxing Devices Market

The Australia waxing devices market is relatively concentrated, with a few established global and domestic brands dominating the space. However, the entrance of emerging beauty startups and the expansion of specialized product lines, such as vegan and organic waxing kits, along with strong e-commerce platforms like Chemist Warehouse Online and Amazon, have diversified the market. This evolution is offering consumers a wider range of choices, from professional-grade salon devices to convenient at-home kits, while also driving more personalized and skin-friendly solutions tailored to Australia’s diverse consumer base.

Name | Founding Year | Headquarters |

Veet (Reckitt Benckiser) | 1923 | Slough, United Kingdom |

Nads | 1992 | Sydney, Australia |

GiGi | 1972 | California, USA |

Waxaway | 2005 | Melbourne, Australia |

Satin Smooth | 1960s | New Jersey, USA |

Clean + Easy | 1990 | Los Angeles, USA |

Parissa | 1983 | Vancouver, Canada |

Flamingo | 2018 | New York, USA |

KoluaWax | 2017 | Florida, USA |

Beauty Image | 1980 | Barcelona, Spain |

SurgiCare | 1987 | New Jersey, USA |

Bliss | 1996 | New York, USA |

Avon (Waxing Line) | 1886 | New York, USA |

Sally Hansen | 1946 | New York, USA |

Smooth Appeal | 1990s | London, United Kingdom |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Veet (Reckitt Benckiser): As a global leader in hair removal products, Veet has strengthened its presence in Australia by launching smart wax heater kits bundled with refill strips in 2024. The brand has also increased its focus on sustainable packaging and plant-based wax formulations to cater to eco-conscious consumers.

Nads: An Australian-origin brand, Nads expanded its natural wax strip range in 2024, highlighting vegan, cruelty-free formulations. The company has also leveraged strong online campaigns targeting Gen Z and millennials, boosting its brand relevance in the at-home waxing kits segment.

GiGi: Known for its salon-grade waxing solutions, GiGi introduced advanced cartridge-based systems designed for professional use in Australian salons. The company emphasized temperature-stable waxes to minimize skin irritation, catering to both men’s and women’s grooming markets.

Waxaway: A leading Australian at-home waxing brand, Waxaway rolled out travel-friendly waxing kits in 2024, aimed at female consumers seeking portability and convenience. Its strong pharmacy and online distribution network has helped the brand capture a growing share in the DIY segment.

Satin Smooth: A professional-focused waxing solutions provider, Satin Smooth enhanced its presence in Australia by introducing spa-specific waxing packages in 2024. These kits bundled warmers, cartridges, and after-care products, consolidating its popularity among beauty clinics and spa professionals.

What Lies Ahead for Australia Waxing Devices Market?

The Australia waxing devices market is expected to expand steadily over the coming years, supported by a rising preference for at-home grooming, increasing awareness of personal hygiene, and the continued growth of beauty and wellness consumption across urban centres. This outlook is reinforced by a strong e-commerce ecosystem, evolving consumer lifestyles, and expanding male participation in grooming, all of which create a favorable environment for sustained demand.

Rise of At-Home and Hybrid Grooming Models: The future will likely be shaped by the growing appeal of at-home waxing kits alongside professional salon use. Consumers are embracing hybrid grooming habits, where DIY kits are used for regular maintenance and salons are engaged for specialized treatments, offering flexibility and cost-effectiveness.

Shift Towards Skin-Friendly and Organic Products: With increasing skin sensitivity concerns, demand will rise for hypoallergenic, vegan, and natural waxing solutions. Manufacturers are expected to focus on botanical ingredients and dermatologically tested products, ensuring safer options for a diverse consumer base.

Emergence of Men’s Grooming as a Growth Avenue: Men’s personal care is becoming mainstream in Australia, with waxing products tailored to male consumers gaining traction. Devices and wax types designed for coarse hair, coupled with targeted marketing, will expand the customer base and open new revenue streams.

Integration of Technology and Subscription Models: The adoption of smart temperature-controlled wax warmers and digital platforms for consumer engagement will strengthen market appeal. Subscription-based replenishment for wax refills and post-wax care products is anticipated to gain momentum, improving customer loyalty and recurring revenue.

Australia Waxing Devices Market Segmentation

By Product Type

Wax Warmers

Pre-coated Wax Strips

Roll-On Waxing Devices

Cartridge Waxing Systems

Smart Temperature-Controlled Wax Heaters

By Application

Facial Waxing

Body Waxing (arms, legs, back, chest)

Underarm Waxing

Bikini & Brazilian Waxing

Men’s Grooming Waxing (chest & back focus)

By End User

Household Consumers (DIY users)

Beauty Salons

Spa Chains

Dermatology Clinics

Beauty Academies & Training Institutes

By Distribution Channel

Online Retail

E-commerce Marketplaces (Amazon, eBay, Chemist Warehouse Online)

Direct-to-Consumer (Brand Websites)

Offline Retail

Supermarkets & Hypermarkets (Coles, Woolworths)

Pharmacies (Priceline, Chemist Warehouse)

Specialty Beauty Stores

Direct Sales & Distributors

By Region

New South Wales

Victoria

Queensland

Western Australia

South

Tasmania & Northern Territory

Players Mentioned in the Report:

Veet (Reckitt Benckiser)

Nads

GiGi

Waxaway

Satin Smooth

Clean + Easy

Parissa

Smooth Appeal

Flamingo

KoluaWax

Beauty Image

SurgiCare

Bliss

Avon (waxing product line)

Sally Hansen

Key Target Audience

Purchasing heads of Household Apparel & Personal Care Retail Chains

Spa & Salon Procurement Managers

Premium Beauty Device Distributors

E-commerce Retail Buyers (Health & Grooming category)

Multi-brand Retail Chain Category Heads

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (TGA, ACCC)

Male Grooming IP and Product Innovators

Time Period:

Historical Period: 2019-2024

Base Year: 2025

- Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Australia Country Overview (Population Overview, GDP, Inflation Rate and other Key Facts)

4.2. Australia Population Analysis (Population by gender, age cohorts, regions, household income levels, and other key facts relevant to grooming consumption)

5.1. Positioning of Waxing Devices in Australia (At-Home Kits, Professional Salon Devices, Specialty Wax Heaters)

5.2. Revenue Streams for Australia Waxing Devices Market (Device Sales, Wax Refills, Aftercare Products, Subscription Kits, Salon Supply Contracts)

5.3. Business Model Canvas for Australia Waxing Devices Market (Key Activities, Channels, Value Proposition, Cost Structure, Customer Segments)

5.4. Decision-Making Process undertaken by Consumers before Purchase (Product Choice, Brand Trust, Safety Concerns, Pricing and Reviews)

6.1. Household Expenditure on Personal Care and Grooming in Australia, 2024

6.2. Number of Salons and Spa Chains in Australia by Major Cities

9.1. Revenues, 2019-2024

9.2. Number of Waxing Device Units Sold, 2019-2024

9.3. Number of Salons/Professional Centers Using Waxing Devices, 2019-2024

10.1. By Product Type (Wax Warmers, Wax Strips, Roll-On Devices, Cartridges, Smart Devices), 2023-2024P

10.2. By Application (Facial, Body, Bikini/Brazilian, Underarm, Mens Grooming), 2023-2024P

10.3. By End-User (Households, Salons, Spas, Clinics, Academies), 2023-2024P

10.4. By Distribution Channel (Online, Pharmacies, Supermarkets, Beauty Stores, D2C), 2023-2024P

10.5. By Region (NSW, VIC, QLD, WA, SA, TAS/NT), 2023-2024P

11.1. Consumer Landscape and Cohort Analysis

11.2. Customer Journey and Decision-Making (Awareness †’ Trial †’ Repeat)

11.3. Need, Desire, and Pain Point Analysis (Convenience, Skin Safety, Cost, Effectiveness)

11.4. Gap Analysis Framework

11.5. By Age Group (18-34, 35-54, 55+), 2023-2024P

11.6. By Income Level (Low, Middle, High), 2023-2024P

11.7. By Purchase Frequency (Monthly, Quarterly, Annual Refill), 2023-2024P

11.8. By Consumer Motivation (Aesthetics, Hygiene, Professional Grooming, Lifestyle), 2023-2024P

11.9. By Male and Female, 2023-2024P

12.1. Trends and Developments for Australia Waxing Devices Market

12.2. Growth Drivers for Australia Waxing Devices Market

12.3. SWOT Analysis for Australia Waxing Devices Market

12.4. Issues and Challenges for Australia Waxing Devices Market

12.5. Government Regulations for Australia Waxing Devices Market (TGA, AICIS, ACCC compliance, Import Norms)

13.1. Market Size and Future Potential for Online Waxing Devices Market, 2019-2030

13.2. Business Model and Revenue Streams (Subscriptions, Bundled Kits, Auto-Replenishment)

13.3. Cross Comparison of Leading Online Waxing Platforms Based on Company Overview, Revenue Streams, Number of SKUs, Pricing, Consumer Reviews and Other Variables

16.1. Market Share of Major Players in Australia Waxing Devices Market Basis Revenues, Sales Volume and Consumer Reach, 2024

16.2. Benchmark of Key Competitors in Australia Waxing Devices Market Including Variables Such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Number of Products, Consumer Base, Online Penetration, R&D Investment, Marketing Strategy, and Recent Developments

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant for Australia Waxing Devices Market

16.5. Bowmans Strategic Clock for Competitive Advantage

16.6. Pricing Analysis of Major Players in Australia Waxing Devices Market

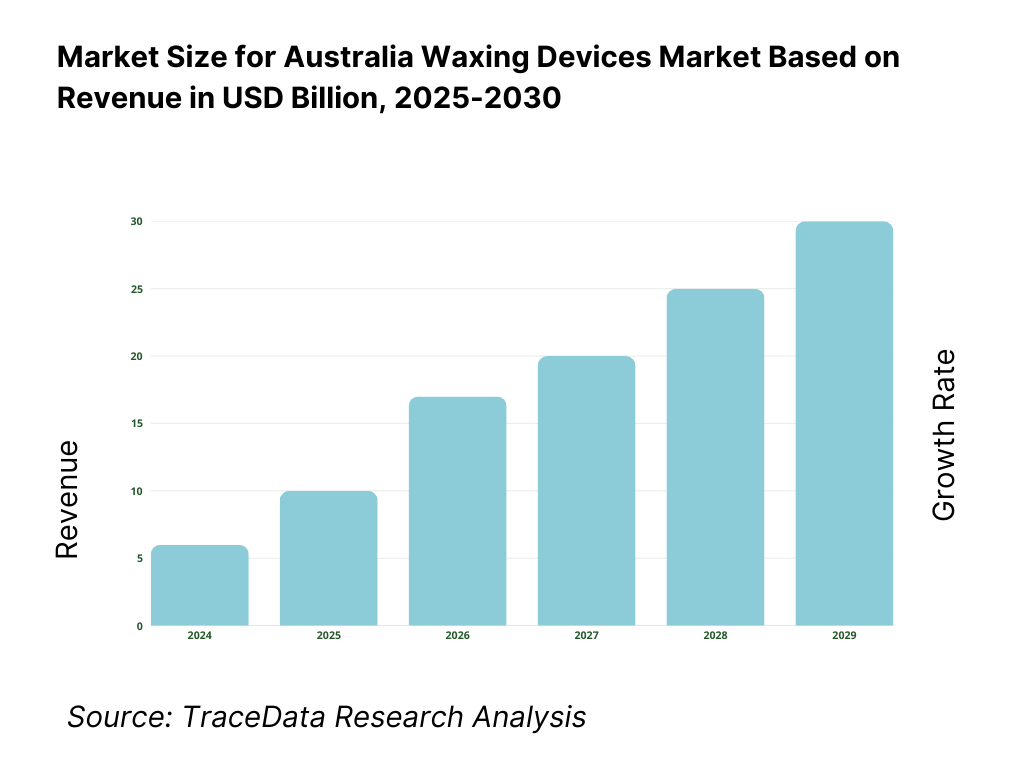

17.1. Revenues, 2025-2030

17.2. Number of Waxing Device Units Sold, 2025-2030

17.3. Number of Salons/Professional Centers Using Waxing Devices, 2025-2030

18.1. By Product Type, 2025-2030

18.2. By Application, 2025-2030

18.3. By End-User, 2025-2030

18.4. By Distribution Channel, 2025-2030

18.5. By Region, 2025-2030

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire ecosystem of the Australia Waxing Devices Market, identifying both demand-side entities (household consumers, salons, spa chains, dermatology clinics, e-commerce platforms, and retail chains) and supply-side entities (waxing device manufacturers, wax consumables producers, importers/distributors, and regulatory bodies such as TGA and ACCC). Based on this mapping, we shortlist 5–6 leading brands operating in the country—including Veet, Nads, GiGi, Waxaway, Satin Smooth, and Parissa—considering their financial information, market penetration, distribution footprint, and customer reach. Sourcing of these ecosystem insights is conducted using industry articles, government trade data, regulatory filings, and multiple secondary and proprietary databases to collate market-level information.

Step 2: Desk Research

The next stage involves extensive desk research by leveraging diverse secondary and proprietary databases. This process allows us to consolidate industry-level insights, such as market revenues, number of waxing device suppliers, regulatory compliance requirements, retail coverage, and adoption by households versus professional salons. We complement this with deep company-level analysis by examining press releases, corporate websites, import/export data, product launch announcements, financial statements (where available), and investor presentations. This comprehensive desk research creates a baseline understanding of the market structure, supply chains, pricing models, and consumer adoption trends across product categories.

Step 3: Primary Research

We then conduct in-depth interviews with stakeholders across the ecosystem, including procurement heads of salon chains, dermatologists, beauty retailers, e-commerce category managers, and executives from waxing device manufacturers and distributors. These discussions validate secondary findings, confirm demand-side adoption patterns, and provide operational insights on value chains, pricing benchmarks, replenishment cycles, and distribution challenges. A bottom-up approach is adopted to evaluate revenue contribution by each key player and aggregated into the overall market framework. As part of the validation strategy, disguised interviews are carried out by approaching companies as potential clients, allowing us to cross-check financial data, unit economics, and operational information against secondary databases. These sessions also reveal insights into consumer feedback, brand loyalty, and after-sales support, which are critical in a device-driven market.

Step 4: Sanity Check

Finally, we employ a bottom-to-top and top-to-bottom triangulation model to validate the market size and structure. Bottom-up estimations based on company revenues and unit sales are cross-verified with top-down indicators such as import volumes, retail channel sales, and household grooming expenditure data. This is followed by iterative market size modeling exercises to ensure alignment across all sources and consistency of the final output. This step ensures the robustness and reliability of the insights derived, providing clients with a comprehensive, fact-based, and validated assessment of the Australia Waxing Devices Market.

FAQs

01 What is the potential for the Australia Waxing Devices Market?

The Australia Waxing Devices Market holds strong potential, valued at over AUD 150 million in 2023, supported by rising consumer spending on personal care and grooming. This potential is reinforced by increasing adoption of at-home waxing solutions, the expansion of e-commerce platforms, and the growth of Australia’s urban middle class. The market’s potential is further enhanced by evolving beauty standards, the entry of global and domestic brands, and increasing male participation in grooming routines.

02 Who are the Key Players in the Australia Waxing Devices Market?

The Australia Waxing Devices Market features several leading brands, including Veet (Reckitt Benckiser), Nads, GiGi, Waxaway, and Satin Smooth. These players dominate due to their strong product portfolios, established brand recognition, and extensive retail and e-commerce presence. Other notable brands include Parissa, Flamingo, KoluaWax, Beauty Image, and Sally Hansen, which have strengthened their presence through niche positioning, innovation in wax formulations, and strategic partnerships with salons and distributors.

03 What are the Growth Drivers for the Australia Waxing Devices Market?

The primary growth drivers include Australia’s population of 27.4 million [ABS], with rising disposable incomes among millennials and Gen Z women boosting spending on personal care. The digital retail boom, with online retail turnover surpassing AUD 4.4 billion monthly [ABS], provides a robust channel for product sales. Social media influence, along with cultural shifts toward at-home grooming, supports demand for convenient and skin-friendly solutions. Additionally, the men’s grooming trend is expanding, presenting fresh opportunities for waxing device adoption across demographics.

04 What are the Challenges in the Australia Waxing Devices Market?

The Australia Waxing Devices Market faces challenges including rising consumer sensitivity to wax ingredients, with allergy-related emergency department visits numbering over 13,000 annually in some regions [BMJ Open]. Competition from alternatives such as IPL and laser treatments, supported by more than 670 registered dermatology specialists nationwide [Medical Board of Australia], creates substitute threats. Additionally, regulatory compliance under TGA and AICIS for cosmetic labelling and chemical introductions adds complexity for manufacturers and importers. Consumer education gaps also persist, as many households lack formal guidance on safe device use, leading to misuse risks.