Bahrain Auto Finance Market Outlook to 2029

By Market Structure, By Lenders, By Vehicle Type, By Loan Tenure, By Interest Rate, By Consumer Demographics, and By Region

- Product Code: TDR0140

- Region: Middle East

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Bahrain Auto Finance Market Outlook to 2029 – By Market Structure, By Lenders, By Vehicle Type, By Loan Tenure, By Interest Rate, By Consumer Demographics, and By Region” provides a comprehensive analysis of the auto finance market in Bahrain. The report covers an overview and genesis of the industry, the overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and competitive landscape, including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the auto finance market. The report concludes with future market projections based on loan disbursement, vehicle financing trends, lender strategies, and case studies highlighting key opportunities and challenges.

Bahrain Auto Finance Market Overview and Size

The Bahrain auto finance market reached a valuation of BHD 1.2 Billion in 2023, driven by the increasing demand for vehicles, an expanding middle class, and a growing trend toward vehicle ownership. The market is characterized by major financial institutions and auto finance providers such as Bank of Bahrain and Kuwait (BBK), Al Salam Bank, and Bahrain Islamic Bank, which offer a range of vehicle financing options.

In 2023, the average loan tenure for auto finance in Bahrain was approximately 5 years, with interest rates ranging between 3% and 6%, depending on the type of loan and consumer profile. These figures reflect the growing accessibility of auto finance solutions in the country, enabling consumers to afford vehicles with manageable monthly payments.

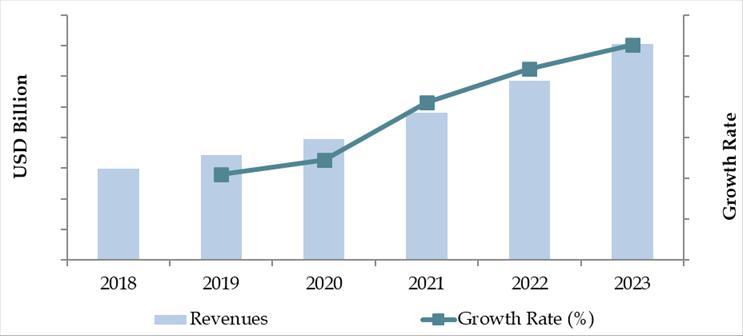

Market Size for Bahrain Auto Finance Industry on the Basis of Credit Disbursed in USD Billion, 2018-2024

What Factors are Leading to the Growth of Bahrain Auto Finance Market

Economic Factors: Bahrain’s stable economic growth and the rising costs of new vehicles have led many consumers to opt for auto financing solutions. In 2023, auto finance accounted for approximately 50% of all vehicle purchases in Bahrain. The availability of low-interest rates and flexible payment terms have encouraged consumers to take loans for both new and used cars.

Expanding Middle Class and Rising Disposable Income: The growing middle class in Bahrain, along with the increasing disposable income, has led to higher vehicle ownership. In recent years, the middle-income population has grown by 7%, which has contributed significantly to the rise in demand for auto loans. These consumers are seeking affordable and convenient financing options to make vehicle ownership accessible.

Digitalization of Auto Financing: The growing adoption of digital platforms has significantly transformed the auto finance market in Bahrain. In 2023, 45% of auto loan applications were processed online, up from 25% in 2020. Digital platforms offer easy loan comparison tools, online approvals, and seamless application processes, making it convenient for consumers to access financing without visiting physical bank branches.

Which Industry Challenges Have Impacted the Growth for Bahrain Auto Finance Market

High Default Rates and Risk Management: The rising number of loan defaults in the auto finance sector poses a significant challenge for lenders. In 2023, the non-performing loan (NPL) rate for auto finance in Bahrain was reported at 8%, reflecting the challenges lenders face in managing credit risk. Economic fluctuations and unemployment rates among certain consumer groups have contributed to an increase in defaults, making financial institutions more cautious in lending.

Regulatory and Compliance Costs: The regulatory framework for auto financing in Bahrain is becoming increasingly stringent, particularly with respect to consumer protection and loan transparency. In 2023, banks reported a 15% increase in compliance-related costs as they were required to adhere to stricter regulations set by the Central Bank of Bahrain (CBB). These regulations, while ensuring fairness in lending, impose additional costs on lenders, which could impact loan terms and interest rates, thus limiting market growth.

Limited Financing Options for Used Cars: Despite a growing demand for used vehicles, access to financing for used car purchases remains relatively limited in Bahrain. Around 30% of auto finance consumers in 2023 faced difficulties securing loans for used cars due to stricter credit policies and higher interest rates compared to new car loans. This has slowed the growth of the used car financing segment and created a barrier for a large portion of the market, especially among lower-income individuals.

What are the Regulations and Initiatives Which Have Governed the Bahrain Auto Finance Market

Central Bank of Bahrain (CBB) Regulatory Oversight: The Central Bank of Bahrain (CBB) is responsible for regulating and overseeing all financial institutions, including auto lenders, to ensure fair lending practices. The CBB has established guidelines for transparency in loan terms, interest rates, and consumer protection measures, ensuring that consumers are fully informed about the conditions of their auto loans. These regulations aim to protect consumers from predatory lending practices and ensure financial institutions maintain stable and sustainable lending practices.

Vehicle Financing and Consumer Protection Laws: Bahrain has implemented specific laws under the Consumer Protection Directorate to safeguard consumers from unfair lending practices. These laws require auto finance providers to offer clear disclosures on loan terms, interest rates, and the total cost of financing. In 2023, 85% of lenders in Bahrain reported full compliance with these consumer protection regulations, ensuring a more transparent and consumer-friendly financing environment.

Sharia-Compliant Financing Regulations: A significant portion of the auto finance market in Bahrain involves Islamic financing, which is governed by Sharia law. The Bahrain Islamic Banking Code sets specific standards for Murabaha and Ijarah financing contracts to ensure that they comply with Islamic principles. These regulations focus on prohibiting interest (Riba) and promoting ethical financing practices. As of 2023, 35% of all auto loans in Bahrain were Islamic finance-based, reflecting the strong consumer demand for Sharia-compliant products.

Bahrain Auto Finance Market Segmentation

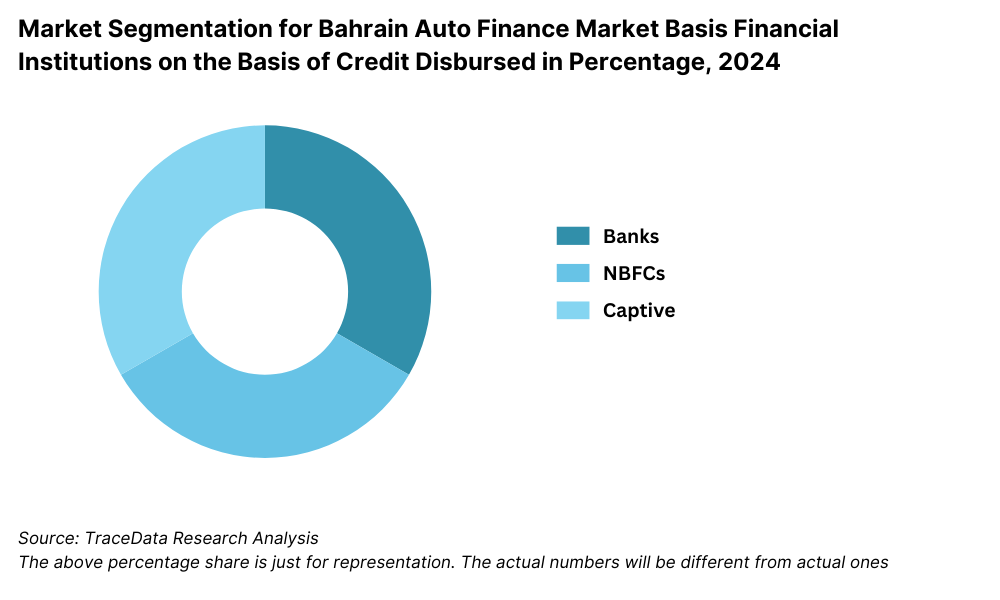

By Market Structure: The Bahrain auto finance market is primarily segmented into traditional bank lenders, Islamic financial institutions, and non-banking financial companies (NBFCs). Banks dominate the market due to their wide reach, established customer base, and diversified lending products. Islamic financial institutions hold a significant share, offering Sharia-compliant auto financing products such as Murabaha and Ijarah, appealing to consumers seeking ethical financing options. NBFCs have been increasing their market share by providing flexible loan packages and specialized services for individuals with less conventional credit profiles.

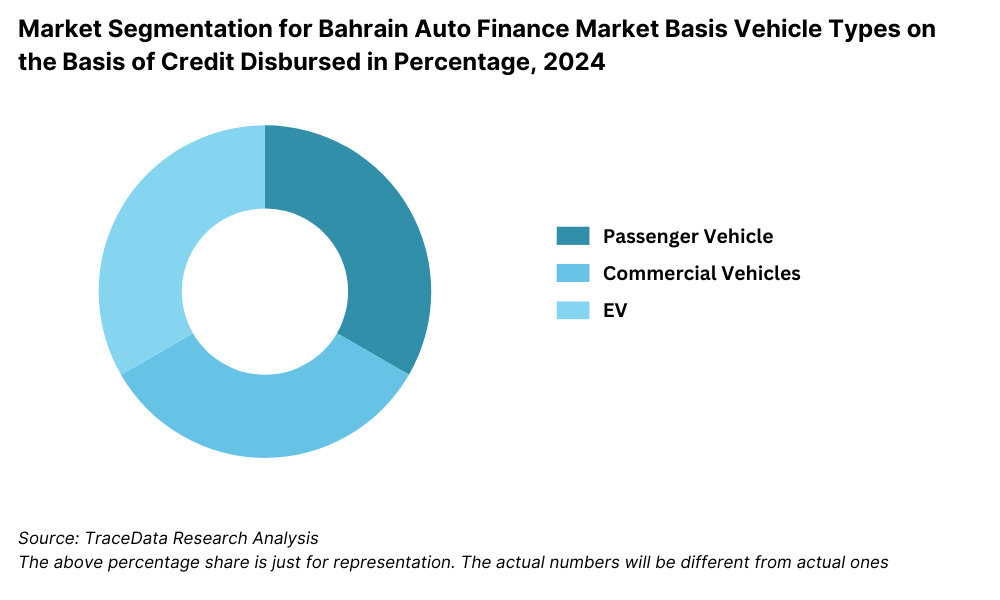

By Vehicle Type: In Bahrain, new cars dominate the auto finance market, making up the largest portion of total auto loans. This is driven by the increasing demand for modern vehicles, lower interest rates, and easier financing terms for new cars. However, used cars are also growing in popularity as consumers look for more cost-effective financing options. The commercial vehicle finance segment is smaller but has seen steady growth, driven by businesses in need of transportation solutions.

By Loan Tenure: In Bahrain, auto loan tenures generally range from 1 to 7 years. The most popular tenure is 3 to 5 years, as it offers a balanced monthly payment structure while ensuring that the borrower is not tied to long-term commitments. Short-term loans (1-3 years) are also growing in popularity due to quicker repayment and lower overall interest costs, especially among affluent consumers. Meanwhile, long-term loans (5-7 years) cater to consumers seeking lower monthly installments.

Competitive Landscape in Bahrain Auto Finance Market

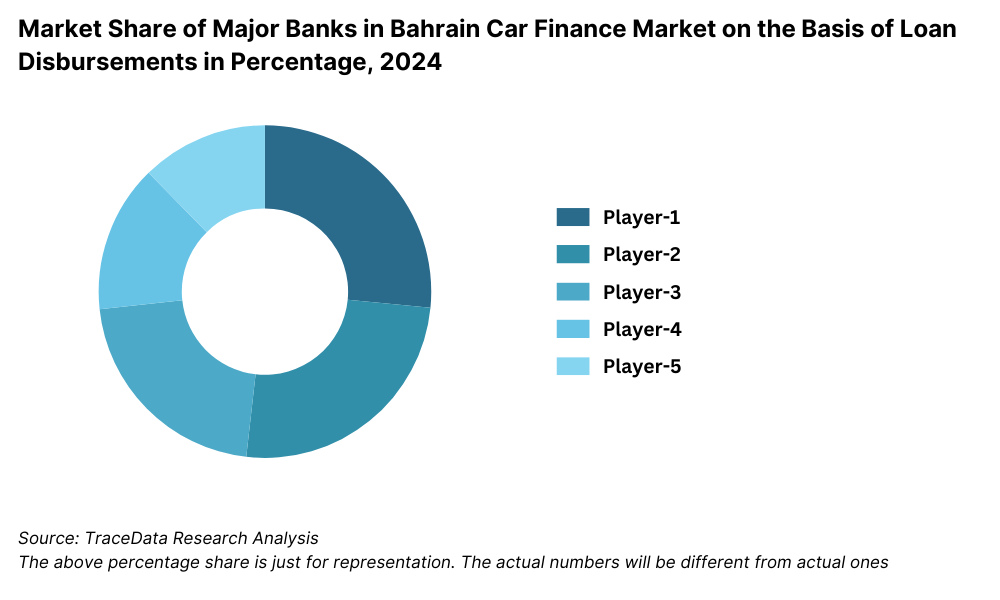

The Bahrain auto finance market is relatively concentrated, with a few key players, such as major banks, Islamic financial institutions, and non-banking financial companies, leading the industry. However, the expansion of digital platforms and new entrants has diversified the market, offering consumers more choices and flexible financing options. Key players in the market include National Bank of Bahrain (NBB), Bahrain Islamic Bank (BisB), Kuwait Finance House (KFH), Ahli United Bank (AUB), and Al Salam Bank, with digital finance platforms gradually gaining ground.

| Name | Founding Year | Original Headquarters |

|---|---|---|

| National Bank of Bahrain (NBB) Auto Loan | 1957 | Manama, Bahrain |

| Bank of Bahrain and Kuwait (BBK) Auto Loan | 1971 | Manama, Bahrain |

| Gulf International Bank (GIB) Auto Finance | 1975 | Manama, Bahrain |

| Al Salam Bank Auto Financing | 2006 | Manama, Bahrain |

| Khaleeji Commercial Bank Auto Finance | 2004 | Manama, Bahrain |

| Ithmaar Bank Auto Finance | 1984 | Manama, Bahrain |

| Bahrain Islamic Bank (BisB) Auto Loan | 1979 | Manama, Bahrain |

| Ahli United Bank (AUB) Auto Loan | 2000 | Manama, Bahrain |

| Toyota Financial Services Bahrain | 1982 | Toyota City, Japan |

| CrediMax Bahrain (Auto Finance Services) | 1999 | Manama, Bahrain |

Some of the Recent Competitor Trends and Key Information about Competitors:

National Bank of Bahrain (NBB): As one of the largest banks in Bahrain, NBB offers a variety of auto loan products, including personalized financing plans for new and used vehicles. In 2023, the bank saw a 10% growth in auto loan disbursements, driven by its competitive interest rates and quick approval process. NBB has also improved its digital auto loan application process, allowing customers to apply online and receive approvals within hours.

Bahrain Islamic Bank (BisB): BisB is known for its Sharia-compliant financing products and has a strong presence in the Islamic auto finance sector. In 2023, BisB recorded a 15% increase in the number of Islamic auto loans issued, with Murabaha financing being the most popular option. BisB's focus on ethical lending and low-interest rates has made it a popular choice for consumers seeking financial solutions aligned with their values.

Kuwait Finance House (KFH): KFH has been a leader in Islamic auto financing in Bahrain, specializing in Ijarah and Murabaha contracts. In 2023, KFH reported a 20% growth in Islamic auto loan applications. The bank's efforts to expand its digital platform have led to a rise in online auto loan applications, offering quick processing and approval for customers. Its focus on flexible terms and competitive rates has allowed it to maintain a strong position in the market.

Ahli United Bank (AUB): AUB offers a variety of auto financing options, with a focus on affordable loan tenures and competitive interest rates. In 2023, AUB expanded its presence in Bahrain's auto loan market by partnering with several car dealerships to provide exclusive financing packages. AUB has also seen a significant increase in digital auto loan applications, growing by 18% in 2023.

Al Salam Bank: Al Salam Bank has grown its auto finance portfolio by focusing on affordable financing options and expanding its digital finance channels. In 2023, the bank saw a 12% growth in auto loan applications and has been attracting a wider customer base by offering customized loan packages and lower interest rates. The bank has also seen an uptick in Islamic auto financing due to its Sharia-compliant products.

What Lies Ahead for Bahrain Auto Finance Market?

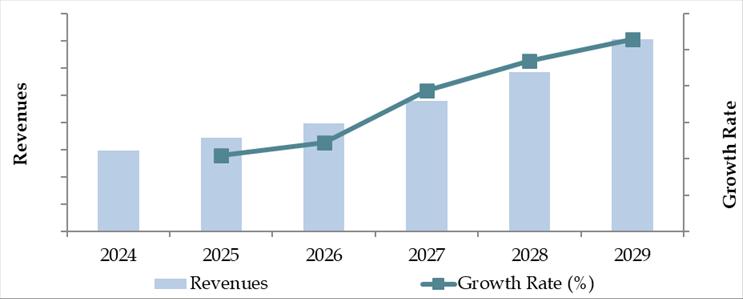

The Bahrain auto finance market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by favorable economic conditions, increasing vehicle ownership, and rising demand for digital and flexible financing options.

Shift Towards Electric Vehicles (EVs): As Bahrain continues to embrace sustainability and the government promotes green initiatives, there is an anticipated increase in both the availability and demand for electric vehicles (EVs). With government incentives such as tax exemptions and subsidized loans for EVs, the auto finance market is expected to see a growing share of financing dedicated to EV purchases. This trend is likely to gain momentum, especially with the increasing consumer awareness of environmental sustainability.

Integration of Technology in Auto Finance: The integration of advanced technologies such as artificial intelligence (AI) and big data analytics in the vehicle assessment, loan approval, and pricing processes is expected to streamline the auto finance experience. These technologies will provide consumers with more accurate, transparent, and timely information, making the loan application process faster and more user-friendly. Additionally, digital platforms and mobile banking apps are expected to dominate the market, enhancing customer convenience and boosting the adoption of online auto finance applications.

Rise of Sharia-Compliant Financing: As the demand for Islamic finance continues to grow, Bahrain's auto finance market will see a steady rise in Sharia-compliant auto financing products. These products, such as Murabaha and Ijarah, are expected to dominate the market, especially among Muslim consumers. The increasing shift toward ethical and interest-free financing options will lead to greater market diversification and attract more consumers who prioritize religious compliance in their financial decisions.

Expansion of Digital Auto Financing: The growing preference for digital channels will further reshape the auto finance landscape in Bahrain. By 2029, it is expected that more than 50% of auto loan applications will be processed online. Mobile-based financing platforms, online loan approval systems, and digital marketplaces will provide consumers with easier access to a wider range of auto loan products. This trend will enhance market transparency, improve customer engagement, and streamline the loan approval process, driving overall market growth.

Future Outlook and Projections for Bahrain Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Bahrain Auto Finance Market Segmentation

• By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Finance Platforms

- Credit Unions

- Peer-to-Peer (P2P) Lending Platforms

- Captive Finance Companies

- Microfinance Institutions

• By Lender Type:

- National Banks

- Islamic Banks

- Private Sector Banks

- Non-Banking Financial Institutions

- Fintech Platforms

• By Vehicle Type:

- New Cars

- Used Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

• By Loan Tenure:

- Short-Term Loans (1-3 years)

- Mid-Term Loans (3-5 years)

- Long-Term Loans (5-7 years)

• By Interest Rate Type:

- Fixed-Rate Loans

- Variable-Rate Loans

• By Age of Vehicle:

- New (0-2 years)

- 3-5 years

- 6-10 years

- 10+ years

• By Consumer Demographics:

- First-Time Buyers

- Repeat Buyers

- Expatriates

- Business/Commercial Buyers

• By Region:

- Manama

- Riffa

- Muharraq

- Sitra

- Southern Governorate

Players Mentioned in the Report (Banks):

- Al Salam Bank

- Bahrain Islamic Bank (BisB)

- Bank of Bahrain and Kuwait (BBK)

- National Bank of Bahrain (NBB)

- Al Baraka Islamic Bank

- Ahli United Bank (AUB)

- State Bank of India (Bahrain)

- Arab Bank

- National Bank of Kuwait (NBK)

- Khaleeji Commercial Bank

- HSBC Bahrain

- Standard Chartered Bank

Players Mentioned in the Report (NBFCs):

- Bahrain Credit

- National Finance House (NFH)

- Mawarid Finance

Players Mentioned in the Report (Captive):

- Toyota Financial Services Bahrain

- Nissan Financial Services Bahrain

- Ford Credit Bahrain

- Honda Finance Bahrain

- Mercedes-Benz Financial Services Bahrain

- BMW Financial Services Bahrain

Key Target Audience:

- Auto Financing Companies

- Car Dealerships (New & Used)

- Digital Auto Loan Platforms

- Regulatory Bodies (e.g., Central Bank of Bahrain)

- Automobile Manufacturers

- Consumers (Car Buyers and Leaseholders)

- Banks and Financial Advisors

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Bahrain by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Bahrain Car Finance Market

11.2. Growth Drivers for Bahrain Car Finance Market

11.3. SWOT Analysis for Bahrain Car Finance Market

11.4. Issues and Challenges for Bahrain Car Finance Market

11.5. Government Regulations for Bahrain Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Bahrain Car Finance Market, 2024

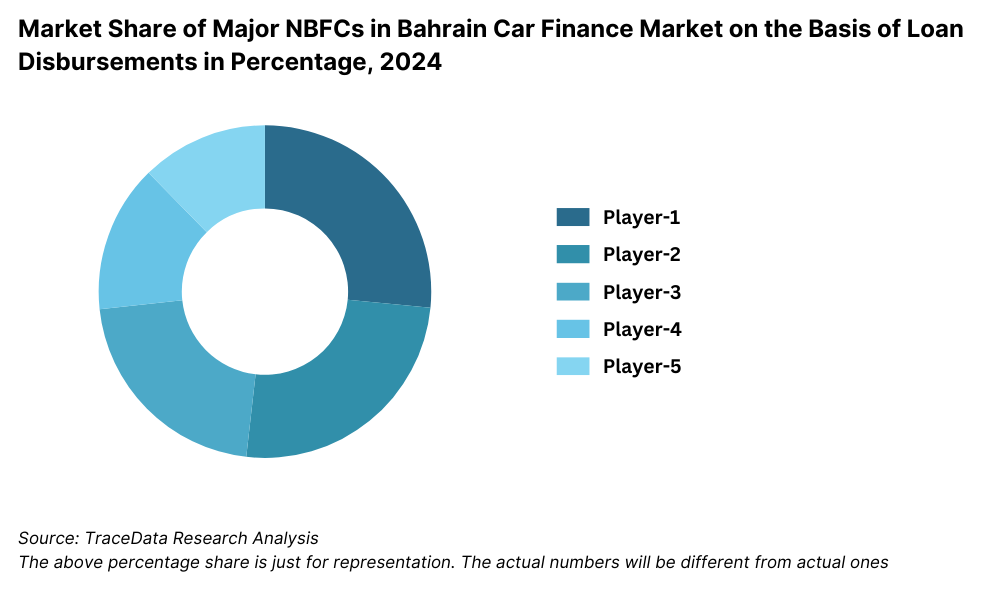

17.2. Market Share of Key NBFCs in Bahrain Car Finance Market, 2024

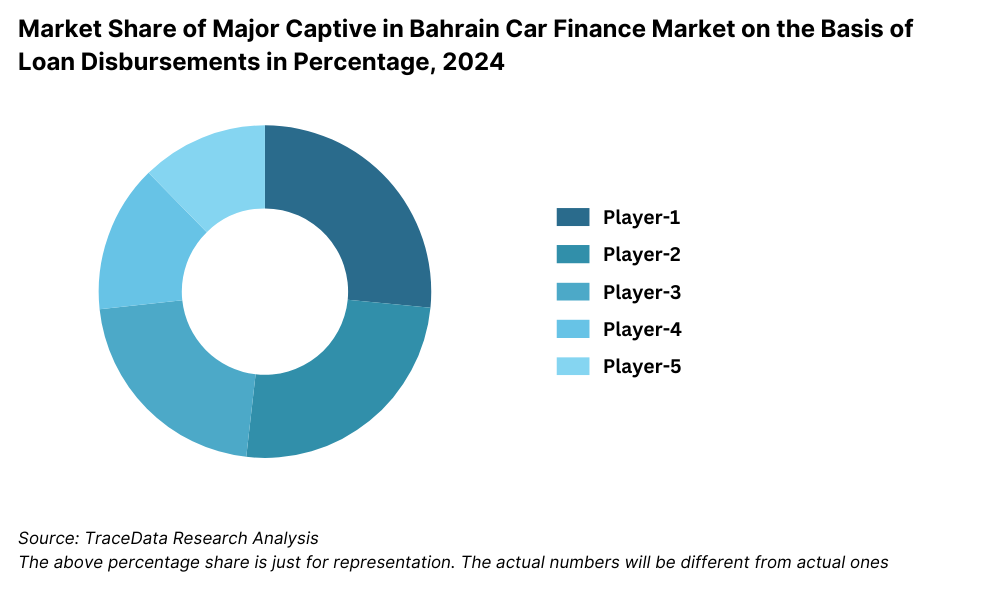

17.3. Market Share of Key Captive in Bahrain Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Bahrain Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities for the Bahrain Auto Finance Market. Based on this ecosystem, we will shortlist the leading 5-6 key players (including banks, Islamic financial institutions, and non-banking financial companies) by analyzing their financial information, market share, loan volume, and product offerings.

Data sourcing is conducted through industry reports, secondary research from public databases, financial reports, and proprietary sources to create a comprehensive market overview.

Step 2: Desk Research

The next step involves exhaustive desk research where we reference a wide range of secondary and proprietary databases, industry articles, market reports, and company-level information. This research process includes analyzing data related to market size, competition, and industry trends. We also delve into financial reports, press releases, and annual statements of leading companies to understand the market dynamics better. The data gathered is crucial in constructing an accurate and updated view of the market structure, demand drivers, and trends in Bahrain's auto finance landscape.

Step 3: Primary Research

To gain deeper insights, we conduct a series of in-depth interviews with C-level executives, key decision-makers, and other stakeholders representing banks, Islamic financing institutions, NBFCs, and auto finance platforms. This process helps validate the hypotheses from desk research and obtain qualitative data on industry trends, pricing strategies, consumer behavior, and operational insights.

We also employ a bottom-to-top approach in interviews to gauge the market share and sales volume of key players, which will be aggregated to estimate the total market size.

Additionally, disguised interviews are conducted where our research team approaches companies under the guise of potential customers. This technique provides additional validation for the operational and financial data gathered in earlier steps, confirming the accuracy of market assumptions.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis, combined with market size modeling exercises, is performed to ensure the validity of findings and projections. This check ensures the robustness of the data and eliminates any inconsistencies, providing confidence in the accuracy and reliability of the market forecasts.

FAQs

1. What is the potential for the Bahrain Auto Finance Market?

The Bahrain auto finance market is expected to experience steady growth, with a projected valuation of BHD 1.2 Billion by 2029. This growth is driven by factors such as an increasing demand for vehicle ownership, rising consumer confidence, and favorable lending terms offered by financial institutions. Additionally, the shift towards digital auto financing platforms, along with the growing availability of Sharia-compliant financing options, further enhances the market's potential.

2. Who are the Key Players in the Bahrain Auto Finance Market?

The Bahrain Auto Finance Market is dominated by major players including National Bank of Bahrain (NBB), Bahrain Islamic Bank (BisB), Kuwait Finance House (KFH), Ahli United Bank (AUB), and Al Salam Bank. These institutions have strong brand recognition, large customer bases, and a diverse range of auto financing products. The rise of digital platforms also plays a key role, offering new entrants in the market a chance to disrupt traditional finance offerings.

3. What are the Growth Drivers for the Bahrain Auto Finance Market?

The growth drivers for the Bahrain auto finance market include economic factors such as increasing disposable incomes, rising demand for both new and used vehicles, and more affordable financing options. The expansion of Islamic auto financing products has made loans more accessible to a broader segment of the population. Furthermore, the growing digitization of financial services, including mobile auto loan platforms and online application systems, is expected to boost consumer engagement and make financing more accessible.

4. What are the Challenges in the Bahrain Auto Finance Market?

The Bahrain Auto Finance Market faces several challenges, including the increasing default rates on auto loans due to economic fluctuations, which create a financial strain on lenders. Additionally, high interest rates and stricter credit policies can make vehicle financing less affordable for certain consumer segments. Regulatory challenges such as loan disclosure requirements and compliance costs for financial institutions also impact the market. The limited availability of financing options for used cars and increasing competition from digital platforms may also present challenges for traditional lenders.