Belgium Auto Finance Market Outlook to 2029

By Vehicle Type (New and Used Cars), By Type of Lenders (Banks, Captives, NBFCs), By Type of Loan (New Car Loan, Used Car Loan, Refinance), By Tenure of Loan, By Type of Consumer (Salaried, Self-employed, Corporate Fleet), and By Region

- Product Code: TDR0163

- Region: Europe

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Belgium Auto Finance Market Outlook to 2029 - By Vehicle Type (New and Used Cars), By Type of Lenders (Banks, Captives, NBFCs), By Type of Loan (New Car Loan, Used Car Loan, Refinance), By Tenure of Loan, By Type of Consumer (Salaried, Self-employed, Corporate Fleet), and By Region” provides a comprehensive analysis of the auto finance market in Belgium. The report covers an overview and genesis of the industry, overall market size in terms of credit disbursed and loan volume, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on total credit disbursed, by vehicle type, lender type, region, and includes cause and effect relationships and success case studies highlighting the key opportunities and watchouts.

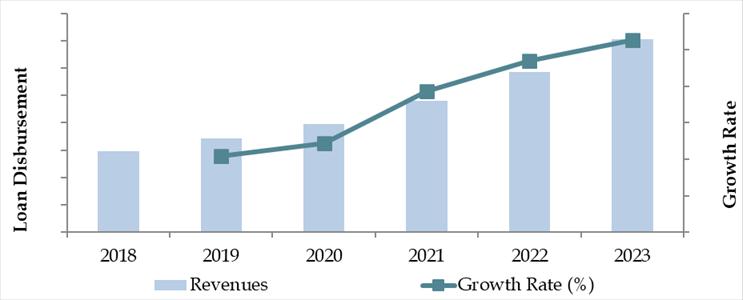

Belgium Auto Finance Market Overview and Size

The Belgium auto finance market reached an estimated valuation of EUR 8.7 Billion in terms of total credit disbursed in 2023, fueled by rising vehicle ownership rates, favorable interest rates, and a growing preference for installment-based payment models. The market is driven by major players such as BNP Paribas Fortis, KBC Autolease, AlphaCredit, Belfius Auto Credit, and AXA Bank, known for offering diverse loan products, competitive rates, and seamless digital application processes.

In 2023, BNP Paribas Fortis enhanced its digital lending platform, enabling real-time approvals and improved customer interaction. Brussels, Antwerp, and Ghent remain key auto finance hubs due to high vehicle density and well-established banking infrastructure.

Market Size for Belgium Auto Finance Industry on the Basis of Loan Disbursed, 2018–2023

What Factors are Leading to the Growth of Belgium Auto Finance Market:

Economic Stability and Low-Interest Rates: Belgium’s stable economic conditions and historically low interest rates have made vehicle financing more accessible. In 2023, more than 70% of new car buyers opted for financing options, driven by attractive loan offers and fixed-rate products.

Digital Transformation in Lending: The rise of fintech and digitized banking services has significantly transformed the auto finance landscape. Over 50% of loan applications in 2023 were processed through digital platforms, indicating strong adoption of online channels for both application and approval processes.

Shift Towards Used Cars and Green Mobility: As environmental consciousness grows and taxation on high-emission vehicles increases, more consumers are turning to used cars and electric vehicles, often financed through tailored loan products. Used car loans now account for approximately 35% of total auto loans in Belgium, a figure that is expected to rise with the EU’s push toward sustainability.

Which Industry Challenges Have Impacted the Growth for Belgium Auto Finance Market

Stringent Credit Approval Standards: Despite Belgium's robust financial infrastructure, many potential borrowers, especially self-employed individuals and new immigrants, face difficulties in obtaining auto loans due to strict credit assessment protocols. In 2023, approximately 31% of loan applications were declined due to insufficient credit history or documentation, limiting access for a segment of the population.

Rising Interest Rate Volatility: While interest rates remained relatively low until 2022, the recent economic fluctuations and inflationary pressures have led to modest rate hikes. These rate increases have reduced affordability for borrowers, with about 18% of consumers delaying car purchases or opting for smaller loan amounts.

Limited Penetration in Rural Areas: Major auto finance institutions have concentrated their services in urban centers such as Brussels and Antwerp. Rural and semi-urban populations often face limited access to auto financing options, leading to under-penetration in regions like Wallonia and Limburg. In 2023, rural regions accounted for only 12% of total financed car purchases.

What are the Regulations and Initiatives which have Governed the Market

AFM Consumer Credit Regulations: Belgium’s financial regulator, the FSMA (Financial Services and Markets Authority), enforces strict rules for auto financing, including transparency in loan terms, APR disclosures, and borrower risk assessments. In 2023, compliance audits revealed that 92% of institutions met these standards, reflecting a well-regulated but complex lending environment.

Green Mobility Financing Incentives: The government has rolled out special incentives to promote the financing of low-emission and electric vehicles (EVs). These include reduced VAT rates, eco-loan schemes, and subsidies for EV charging infrastructure. As a result, EV loan applications grew by 28% in 2023, supported by favorable government-backed financing options.

Used Vehicle Financing Rules: To safeguard consumers, regulators require additional documentation and vehicle history disclosures for used car loans. Financial institutions must conduct value assessments and ensure vehicle compliance with safety standards before loan approval. In 2023, this led to the rejection of about 15% of used car loan applications, primarily due to incomplete vehicle histories or valuation inconsistencies.

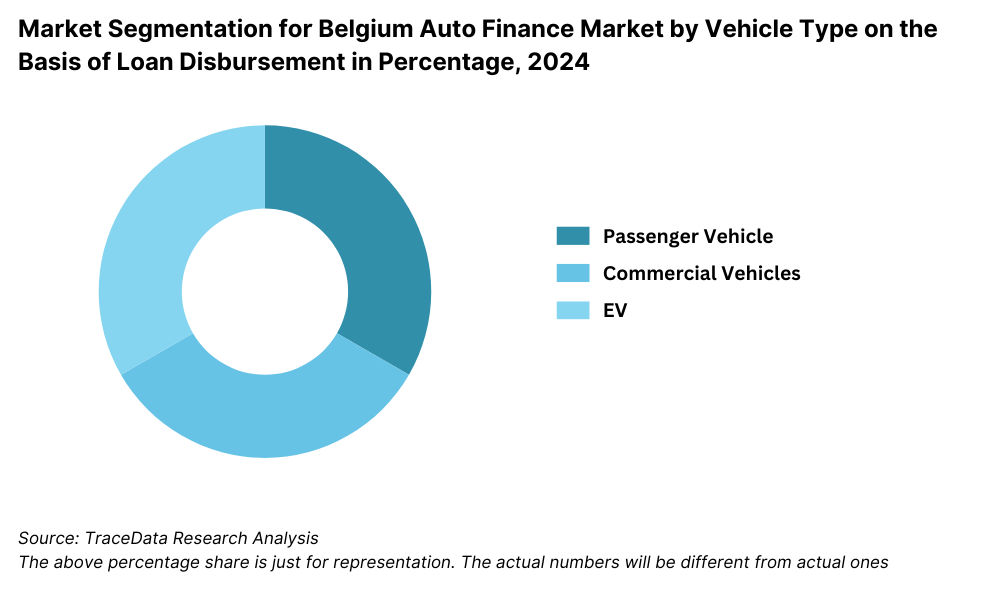

Belgium Auto Finance Market Segmentation

By Vehicle Type: New car financing holds a dominant share in Belgium’s auto finance market, as many consumers prefer the security, manufacturer warranties, and better financing options associated with new vehicles. However, used car financing is rapidly gaining traction, especially among cost-conscious consumers and young professionals entering the workforce. In 2023, used car loans accounted for nearly 35% of the overall auto finance volume, with banks and NBFCs introducing tailored products specifically for pre-owned vehicles.

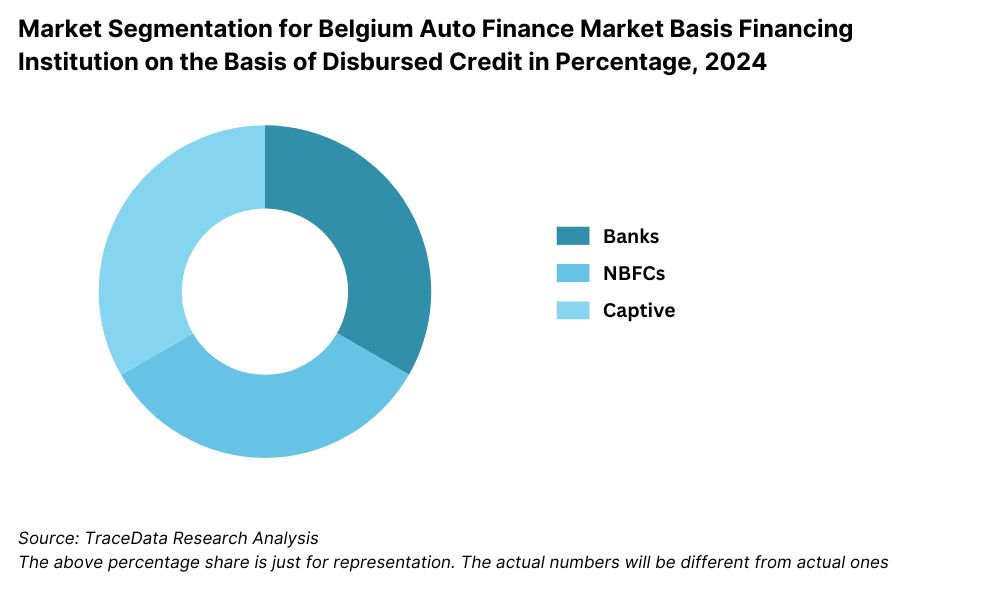

By Type of Lender: Banks continue to dominate the market, accounting for a significant share due to their wide branch network, low-interest rate offerings, and strong brand trust. Captive finance arms of automakers (like Volkswagen D’Ieteren Finance and Stellantis Financial Services) also command a notable share, especially in new car financing. Non-Banking Financial Companies (NBFCs) and fintech players are steadily growing in the used car financing segment by providing faster approvals and more flexible terms.

By Loan Tenure: The most preferred loan tenure in Belgium falls between 48 to 60 months, balancing affordability with manageable monthly installments. However, younger buyers and EV customers are increasingly opting for shorter tenures (24–36 months) due to lower maintenance costs and favorable trade-in options.

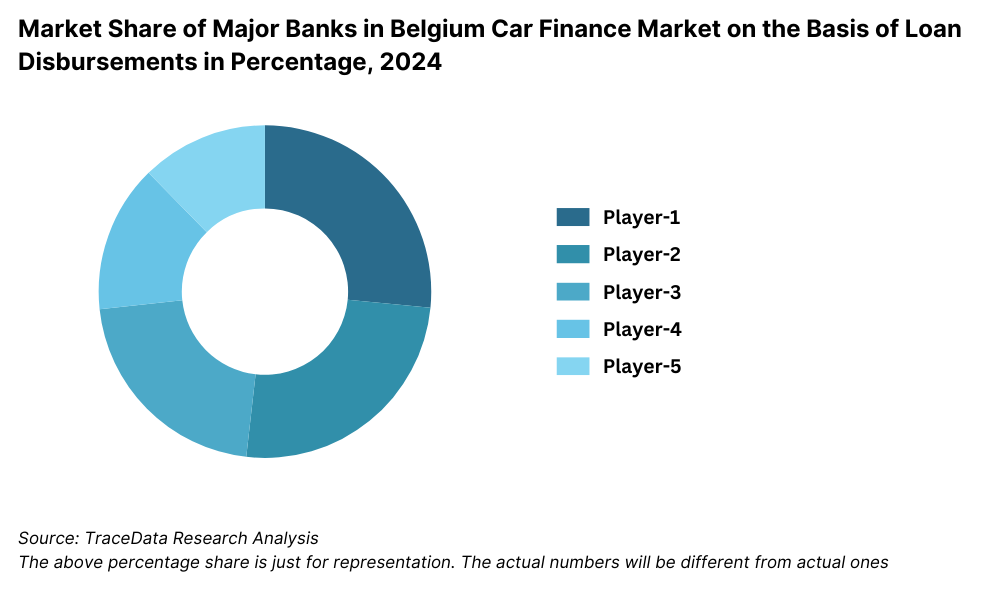

Competitive Landscape in Belgium Auto Finance Market

The Belgium auto finance market is moderately concentrated, with established banking institutions and captive finance arms dominating the sector. However, the rise of fintech lenders and leasing companies has diversified the competitive landscape. Leading players such as BNP Paribas Fortis, KBC Autolease, AlphaCredit, Belfius Auto Credit, AXA Bank, and Beobank are well-recognized for their extensive loan portfolios, digital lending platforms, and competitive interest rates.

| Company Name | Founding Year | Original Headquarters |

| BNP Paribas Fortis | 2009 | Brussels, Belgium |

| KBC Group | 1935 | Brussels, Belgium |

| CA Auto Bank | 2023 | Turin, Italy |

| Volkswagen Financial Services | 1983 | Braunschweig, Germany |

| Toyota Financial Services | 1982 | Nagoya, Japan |

| BMW Financial Services | 1991 | Munich, Germany |

| Arval Belgium | 1989 | Rueil-Malmaison, France |

| LeasePlan Belgium | 1963 | Amsterdam, Netherlands |

| Alphabet Belgium | 1997 | Munich, Germany |

| DLL Group | 1969 | Eindhoven, Netherlands |

| Axa Bank Belgium | 2007 | Brussels, Belgium |

| AlphaCredit | 1991 | Brussels, Belgium |

| Athlon Car Lease Belgium | 1916 | Almere, Netherlands |

Some of the recent competitor trends and key information about competitors include:

BNP Paribas Fortis: The bank strengthened its digital auto loan capabilities in 2023 by launching an AI-driven loan eligibility tool. With over EUR 2.5 billion in auto loans disbursed, it remains the market leader in both new and used car financing.

KBC Autolease: Known for its leasing and fleet management services, KBC Autolease expanded its green vehicle finance portfolio in 2023. The company saw a 22% year-over-year increase in EV-related lease contracts.

AlphaCredit: As a subsidiary of BNP Paribas Group, AlphaCredit continues to dominate the consumer credit space, offering highly customizable auto finance products. In 2023, it reported a 17% rise in digital loan applications, driven by its streamlined mobile platform.

Belfius Auto Credit: Focused on middle-income salaried individuals, Belfius expanded its auto loan offerings in 2023 with flexible repayment structures. The bank witnessed a 19% increase in auto loan disbursal during the year, particularly in Brussels and Liège.

AXA Bank: AXA Bank enhanced its sustainability offering by launching eco-bonuses for hybrid and electric car financing. In 2023, EV loans made up 14% of their total auto finance portfolio, reflecting growing environmental awareness among Belgian consumers.

Beobank: Targeting younger demographics, Beobank introduced an instant loan approval system via its mobile app. The platform achieved a 26% increase in loans to first-time car buyers in 2023, making it one of the fastest-growing players in the segment.

What Lies Ahead for Belgium Auto Finance Market?

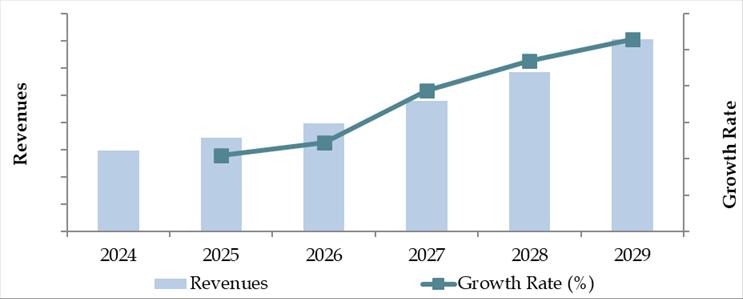

The Belgium auto finance market is projected to grow steadily through 2029, registering a moderate yet consistent CAGR, driven by economic resilience, digital transformation, and evolving mobility preferences. The increasing adoption of electric vehicles, supportive government policies, and enhanced digital loan solutions are expected to play a pivotal role in shaping the market's future.

Acceleration in Electric Vehicle Financing: With Belgium’s strong push toward green mobility and the EU’s carbon neutrality targets, the demand for financing electric and hybrid vehicles is set to rise significantly. Financial institutions are likely to roll out more green loan products with preferential rates and flexible repayment terms to support this transition. By 2029, EV loans are expected to constitute over 30% of all new auto finance disbursements.

Advancements in Digital Lending Ecosystems: The ongoing digitalization of the lending process — including real-time loan approvals, AI-based credit scoring, and end-to-end mobile application journeys — will continue to transform the consumer experience. This will lead to greater inclusion of younger and self-employed consumers, streamlining access to financing while improving underwriting accuracy and speed.

Expansion of Subscription and Mobility-as-a-Service (MaaS) Models: Urban consumers in cities like Brussels and Antwerp are increasingly shifting from traditional car ownership to flexible usage models such as auto subscriptions and leasing services. Auto finance providers are expected to adapt by developing tailored financial products for shared mobility, which will create new revenue streams and help diversify their loan portfolios.

Focus on Financial Inclusion and Customization: By 2029, the market is expected to witness greater customization of loan products, especially for underserved segments like freelancers, gig economy workers, and SMEs. This shift will be supported by alternative credit assessment models, enabling more inclusive access to vehicle finance for non-traditional borrowers.

Future Outlook and Projections for Belgium Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Belgium Auto Finance Market Segmentation

- By Vehicle Type:

o New Cars

o Used Cars

o Electric Vehicles

o Hybrid Vehicles - By Type of Lender:

o Banks

o Captive Finance Companies

o Non-Banking Financial Companies (NBFCs)

o Fintech Lenders - By Type of Loan:

o New Car Loan

o Used Car Loan

o Loan Refinance

o Lease-to-Own

o Balloon Payment Loans - By Tenure of Loan:

o Less than 24 Months

o 24–36 Months

o 36–60 Months

o More than 60 Months - By Type of Consumer:

o Salaried Individuals

o Self-Employed

o First-Time Buyers

o Corporate Fleets

o SMEs & Logistics Companies - By Region:

o Brussels-Capital Region

o Flanders

o Wallonia

o Antwerp

o Liège

o Ghent

Players Mentioned in the Report (Banks):

- · BNP Paribas Fortis

- · KBC Bank

- · ING Belgium

- · Belfius Bank

- · Argenta

- · Crelan

- · Beobank

- · AXA Bank Belgium

- · CPH Banque

- · VDK Bank

- · Triodos Bank

- · Bank J.Van Breda & C°

- · bpost banque

- · Hello Bank!

- · Keytrade Bank

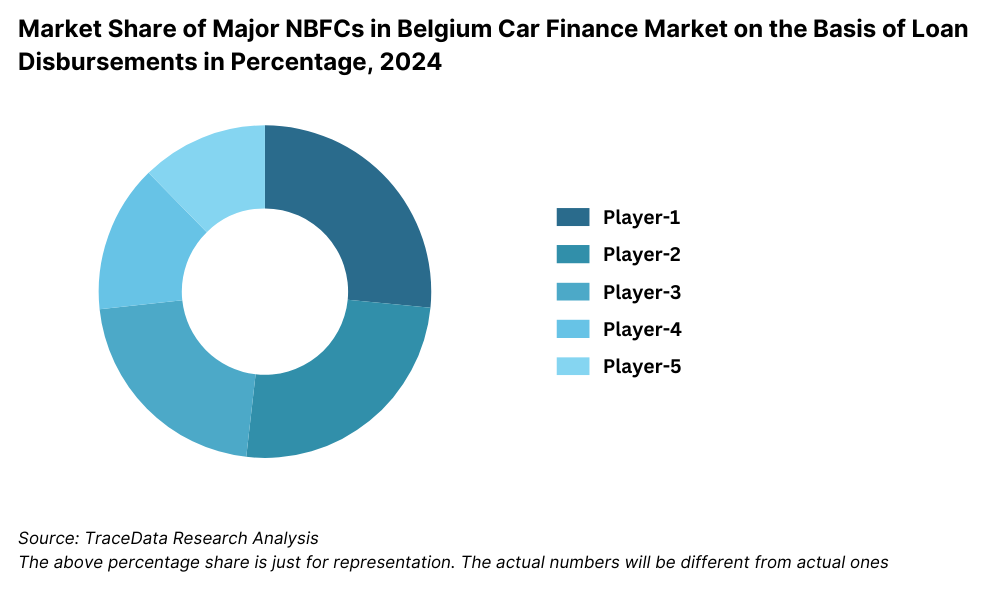

Players Mentioned in the Report (NBFCs):

- Santander Consumer Finance

- Record Credits

- Crédit Agricole Leasing & Factoring

- Drivalia

- Europabank

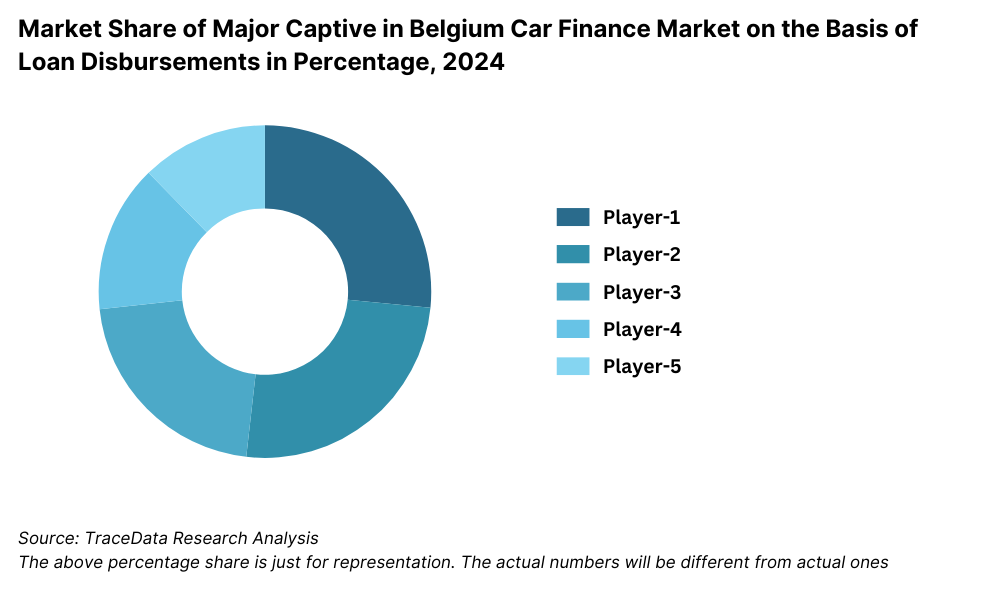

Players Mentioned in the Report (Captive):

- Volkswagen Financial Services Belgium

- Mercedes-Benz Financial Services Belgium

- BMW Financial Services Belgium

- Toyota Financial Services Belgium

- Ford Credit Belgium

- Nissan Finance Belgium

- Stellantis Financial Services Belgium

- CA Auto Bank

Key Target Audience:

- Auto Finance Companies

- Banks and Captive Lenders

- Car Dealership Networks

- Regulatory Authorities (e.g., FSMA – Financial Services and Markets Authority)

- Fintech Platforms

- Automotive Leasing & Subscription Providers

- Policy Makers and Government Agencies

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Belgium by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Belgium Car Finance Market

11.2. Growth Drivers for Belgium Car Finance Market

11.3. SWOT Analysis for Belgium Car Finance Market

11.4. Issues and Challenges for Belgium Car Finance Market

11.5. Government Regulations for Belgium Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Belgium Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Belgium Car Finance Market, 2024

17.3. Market Share of Key Captive in Belgium Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Belgium Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities relevant to the Belgium Auto Finance Market. Based on this ecosystem, we shortlist leading 5–6 financial institutions, lenders, and fintech players in the country based on their loan portfolios, disbursal volumes, customer base, and financial performance.

Sourcing is done through industry whitepapers, government publications, news articles, and multiple proprietary and secondary databases to perform a detailed desk study of the market.

Step 2: Desk Research

We then carry out an extensive desk research process by referencing a variety of secondary and proprietary data sources. This process allows us to extract macro and micro-level market insights, covering areas such as total credit disbursed, consumer financing trends, lender market shares, interest rate trends, and customer behavior.

Company-level assessments are also performed using data from press releases, annual reports, investor presentations, and regulatory filings. This helps build a strong foundational understanding of the operational structure, business models, and financial strategies of key market players.

Step 3: Primary Research

A series of in-depth interviews are conducted with C-level executives, credit managers, and product heads from major banks, NBFCs, captives, fintech firms, and auto dealerships. The goal is to validate key market assumptions, cross-check data points, and collect insights into pricing, default rates, consumer preferences, and technological adoption.

We also conduct disguised interviews by approaching institutions as potential customers to understand the actual loan process, terms, disbursal timeline, and pricing flexibility. This also helps verify any inconsistencies between public information and operational practices. These interactions help us construct a holistic picture of the auto finance value chain in Belgium.

Step 4: Sanity Check

- Both bottom-up and top-down market modeling techniques are employed to cross-validate market sizing, loan volume estimates, and segment-level forecasts. This ensures logical consistency and data triangulation across all sources and insights.

FAQs

1. What is the potential for the Belgium Auto Finance Market?

The Belgium auto finance market is set to experience steady growth, with total credit disbursals reaching approximately EUR 8.7 billion in 2023. The market’s potential is underpinned by favorable lending rates, a growing shift toward vehicle ownership, and rising demand for electric and hybrid vehicles. The continued digitization of financial services and government support for green mobility are also expected to fuel market expansion through 2029.

2. Who are the Key Players in the Belgium Auto Finance Market?

Key players in the Belgium auto finance market include BNP Paribas Fortis, KBC Autolease, AlphaCredit, Belfius Auto Credit, AXA Bank, and Beobank. These institutions dominate the landscape due to their strong loan portfolios, digital-first strategies, and competitive interest rates. Captive finance arms such as Volkswagen D’Ieteren Finance and Stellantis Financial Services also play a significant role, particularly in new vehicle financing.

3. What are the Growth Drivers for the Belgium Auto Finance Market?

Major growth drivers include the increasing penetration of electric vehicles, government incentives for green loans, and the rise of digital lending platforms offering seamless and fast loan approvals. Additionally, Belgium’s stable financial ecosystem, growing urban population, and expanding demand for flexible financing options like leasing and subscriptions are supporting market growth.

4. What are the Challenges in the Belgium Auto Finance Market?

Challenges include stringent credit approval requirements, which limit access for certain consumer groups such as freelancers and first-time borrowers. Rural under-penetration and interest rate volatility also pose obstacles. Additionally, the market faces regulatory complexities in areas such as data privacy and consumer protection, requiring financial institutions to maintain high compliance standards while innovating their offerings.