Brazil Fire Protection Market Outlook to 2030

By Solution Type, By Suppression Medium, By Detection & Control Technology, By End-User Industry, By Project/Route-to-Market, and By Region

- Product Code: TDR0372

- Region: Central and South America

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Brazil Fire Protection Market Outlook to 2030 – By Solution Type, By Suppression Medium, By Detection & Control Technology, By End-User Industry, By Project/Route-to-Market, and By Region” provides a comprehensive analysis of the fire protection industry in Brazil. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and detailed market segmentation. It further discusses trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Brazil fire protection market. The report concludes with future market projections based on solution demand, suppression media, technology adoption, industry verticals, regional expansion, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions for stakeholders operating in the Brazil Fire Protection Market.

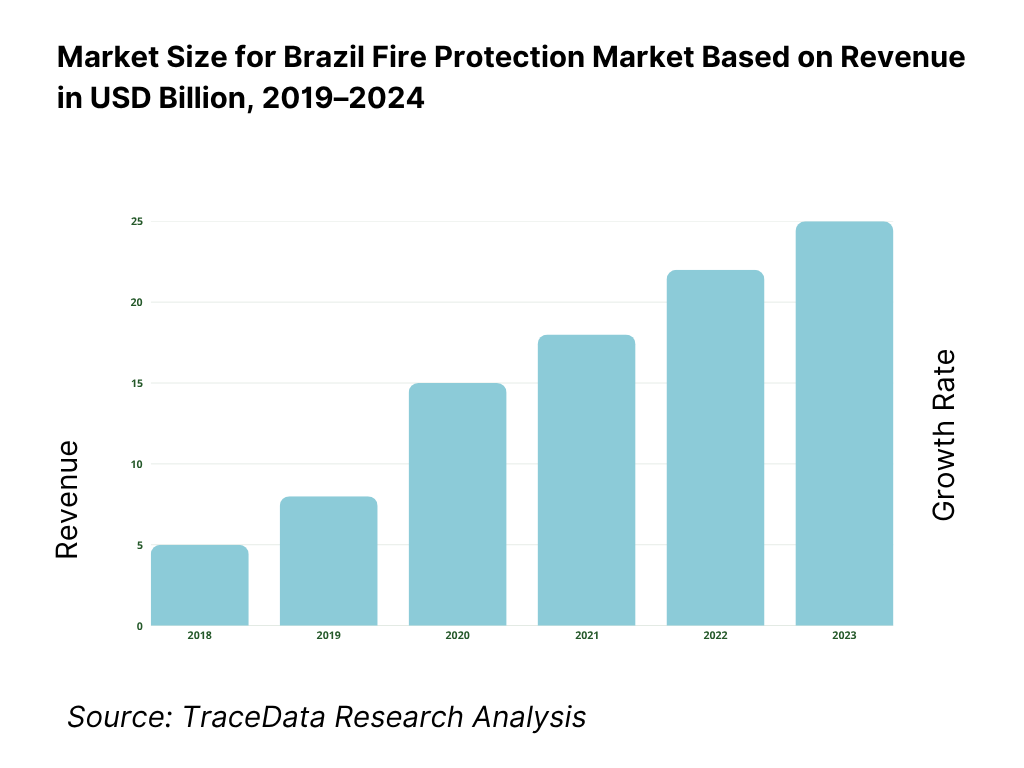

Brazil Fire Protection Market Overview and Size

The Brazil fire protection market is valued at USD 1,704.3 million in 2024. This size is driven by large volumes of industrial and commercial infrastructure expansion, retrofit of aging facilities, rising regulatory enforcement on fire safety, and accelerated adoption of advanced suppression and detection technologies such as IoT-enabled systems.

Key metropolitan centers such as São Paulo, Rio de Janeiro, and Belo Horizonte dominate demand because they host the bulk of Brazil’s industrial facilities, high-rise commercial buildings, large logistics hubs, and data centers. Their dominance is reinforced by concentrated capital investment, stricter municipal fire codes, and denser infrastructure networks which require more advanced fire protection solutions.

What Factors are Leading to the Growth of the Brazil Fire Protection Market:

Energy & industrial scale creating high-risk assets that demand certified protection: Brazil’s hydrocarbons sector remains a core driver, with oil production reaching 3.4 million barrels/day in 2024, of which 2.6 million barrels/day came from pre-salt fields. Crude exports stood at 1.7 million barrels/day, placing significant fire-protection obligations on refineries, FPSOs, storage terminals, and pipelines. At the same time, Brazil’s port logistics system handled 1.32 billion tonnes of waterborne cargo in 2024, concentrating fire exposure in bulk cargo yards, fuel depots, and maritime terminals. This industrial and maritime intensity necessitates widespread deployment of foam-deluge systems, clean-agent suppression, hydrant networks, and alarm panels built to ABNT/INMETRO standards.

Urban concentration and building stock volume elevating code-driven installations: Brazil’s urban population reached 177.5 million residents out of 203.1 million, underscoring a heavily verticalized economy dependent on high-rise residential towers, hospitals, shopping malls, and commercial complexes. The World Bank lists Brazil’s total population at 211,998,573 in 2024, reinforcing the scale of occupancy and evacuation challenges. IBGE’s census data indicates around 75 million housing units, a significant portion requiring fire approvals from state brigades before occupancy (AVCB/CLCB). This massive building stock, especially concentrated in São Paulo and Rio de Janeiro, creates sustained demand for sprinklers, alarms, emergency voice systems, and passive firestopping to comply with national codes.

Power system expansion and critical-infrastructure electrification requiring integrated fire & life safety: Brazil’s installed power generation capacity stood at 203.8 GW in 2024, reflecting continuous grid expansion. Wind power contributed 95.8 TWh with a capacity of 28,682 MW, demonstrating the rising complexity of distributed generation. This expansion brings more substations, converter stations, battery energy storage units, and wind turbine nacelles into scope for engineered fire safety. The National System Operator’s monitoring shows industrial and commercial demand in the thousands of GWh monthly, each requiring fire-safe transformers, switchgear, and control rooms. This scale ensures long-term investment in detection, smoke management, and suppression solutions integrated into critical infrastructure.

Which Industry Challenges Have Impacted the Growth of the Brazil Fire Protection Market:

Fragmented permitting across thousands of jurisdictions elongates time-to-compliance: Brazil has 5,568 municipalities plus the Federal District, each with its own permitting rules layered on top of state fire-brigade regulations. For example, in São Paulo all buildings must obtain an AVCB or CLCB license via the Via Fácil Bombeiros system before operation. This fragmented framework forces OEMs and integrators to adapt documentation, hydraulic designs, and technical specifications multiple times across projects. For national clients like logistics networks, retail chains, and healthcare groups, multi-site rollouts become slower and costlier, as every state and municipality requires unique inspections, approvals, and renewals.

Environmental licensing disruptions have directly curtailed energy operations: In 2024, strikes at Brazil’s environmental agency disrupted licensing, reducing oil production by as much as 200,000 barrels/day during the peak of the dispute. Fire-protection vendors linked to these projects experienced EPC schedule delays, stalled procurement, and postponed pre-commissioning of suppression and detection systems. Even when injunctions allowed selective resumption of transmission projects, the backlog highlighted how sensitive the market is to licensing cycles. This creates uncertainty for suppliers managing inventory of imported systems like deluge valves, foam concentrates, and detection panels, as project mobilization can be halted abruptly.

High fire weather exposure stretches resources and elevates compliance scrutiny: Brazil recorded 278,299 wildfire hotspots in 2024, putting immense pressure on state brigades and emergency services. Monthly fluctuations were extreme, with one August showing 68,635 hotspots compared to just 18,451 in the same period a year earlier. For industrial operators, this heightened fire risk raises scrutiny from insurers and regulators, pushing mandatory inspections of pumps, hydrants, water reservoirs, and foam reserves. Facilities in wildland-urban interface zones, ports, and logistics hubs are particularly vulnerable, leading to increased compliance burdens for diesel-generator rooms, tank farms, conveyor belts, and other high-risk assets.

What are the Regulations and Initiatives which have Governed the Market:

NR-23 (Fire Protection) — national occupational rule enforced in all workplaces: NR-23 establishes nationwide requirements for fire prevention, evacuation, firefighting equipment, and training. It obliges employers to provide adequate extinguishers, alarms, signage, and emergency plans suitable for their risk category. Originally created under Portaria 3.214/1978 and continually updated, it provides the baseline framework for compliance in workplaces. State fire brigades apply NR-23 alongside their own regulations when granting occupancy permits, meaning all businesses must meet both federal and state-level requirements to operate legally.

INMETRO Portaria 486/2010 and Portaria 108/2022 — compulsory conformity for extinguishers: These ordinances govern the conformity assessment program for fire extinguishers in Brazil. They define technical requirements, product markings, sampling rules, and surveillance measures. Extinguishers must carry the INMETRO conformity mark to be legally sold or serviced, ensuring traceability and product reliability. Service providers must also be certified under these schemes, aligning maintenance and recharging practices with national safety standards. This mandatory conformity protects end-users and guarantees that only tested and approved extinguishers are deployed in industrial, commercial, and residential settings.

INMETRO Portaria 179/2010 — mandatory certification for equipment in explosive atmospheres (Ex): Portaria 179/2010 requires all electrical and electronic equipment used in explosive atmospheres to be certified by an INMETRO-accredited body. This includes installations in oil & gas facilities, FPSOs, chemical plants, mills, and grain silos where flammable gases, vapors, or dusts are present. The ordinance defined compliance deadlines for commercialization and ties even replacement and repair components to the same conformity scheme. This regulation directly shapes procurement of detectors, alarm panels, cabling, junction boxes, and suppression controllers for Brazil’s most critical hazardous environments.

Brazil Fire Protection Market Segmentation

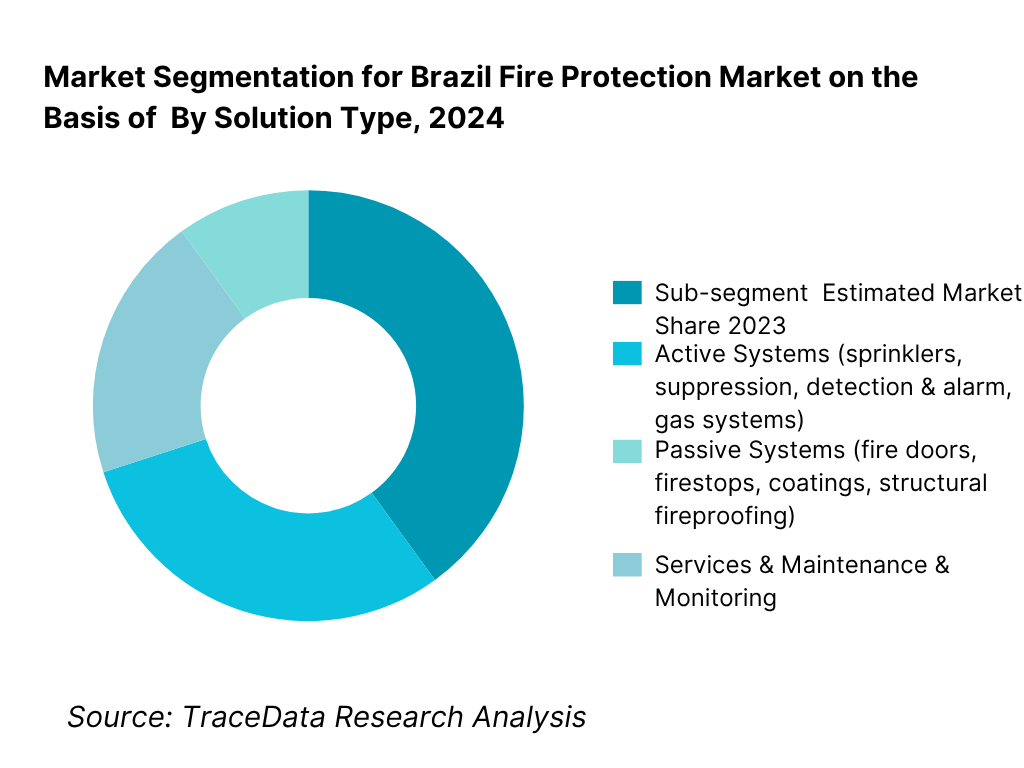

By Solution Type: The Brazil fire protection market is segmented into Active Systems, Passive Systems, and Services/Monitoring. Among these, Active Systems command the largest share (around 65 %) because most regulatory and insurance mandates require installation of automatic suppression (sprinklers, detection) in industrial, commercial, and high-rise buildings. The enforcement of ABNT NBR codes and push to modernize older installations drives the replacement and upgrade of active systems. Moreover, active systems generate higher margins and recurring revenue potential (via commissioning, testing, servicing), making them more attractive for OEMs and integrators.

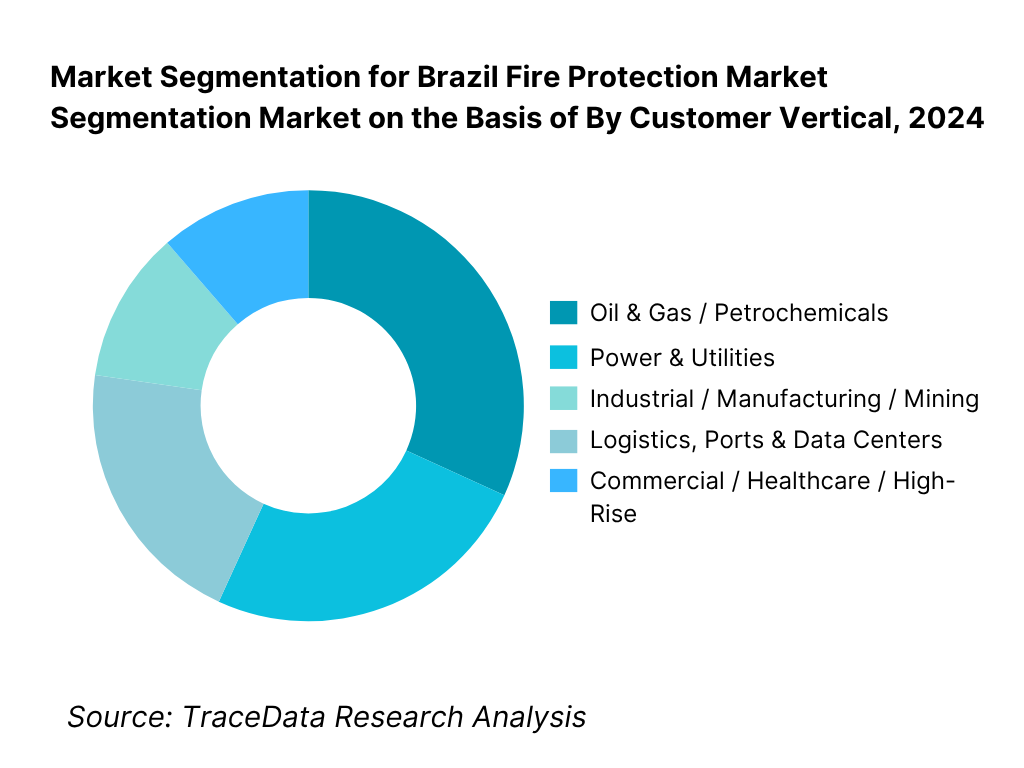

By Customer Vertical: The Brazil fire protection market is segmented into Oil & Gas / Petrochemicals, Power & Utilities, Industrial / Manufacturing / Mining, Logistics / Ports / Data Centers, Commercial / Healthcare / High-Rise, and Others. The Oil & Gas / Petrochemicals vertical dominates (about 25 %) because these installations demand the highest safety margins, complex suppression systems, and frequent upgrades. Regulatory oversight, asset risk, and insurance premiums force high levels of fire protection sophistication. The Logistics, Ports & Data Centers vertical is a fast-growing share (circa 20 %) driven by e-commerce expansion and the criticality of uptime—a fire event is extremely costly in these operations.

Competitive Landscape in Brazil Fire Protection Market

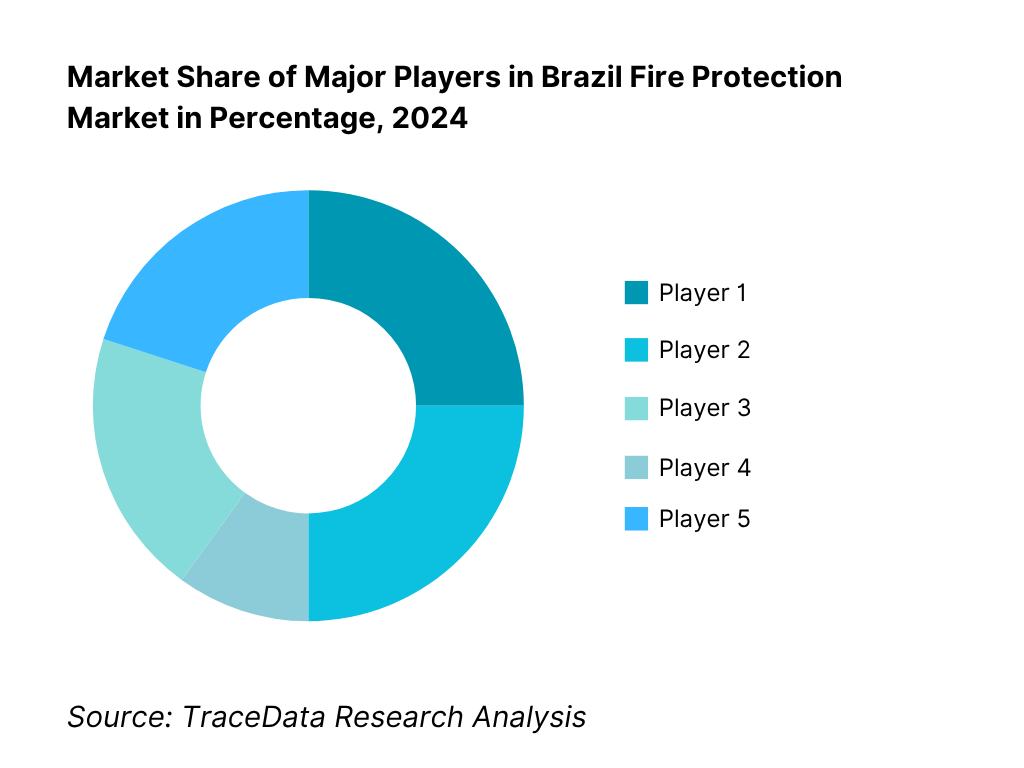

The Brazil fire protection market is moderately consolidated, with a few large global and regional players dominating high-value projects, and numerous local players serving retrofit, smaller-scale, and regional needs. These leading players combine strong certification credentials, regional service networks, and deep project references, giving them dominance in design-bid-build and EPC tenders.

Name | Founding Year | Original Headquarters |

Johnson Controls (Tyco) | 1885 | Milwaukee, USA |

Honeywell | 1906 | Wabash, USA |

Siemens (Cerberus) | 1847 | Berlin, Germany |

Bosch Building Technologies | 1886 | Stuttgart, Germany |

Carrier (Kidde/Edwards) | 1915 | Newark, USA |

Eaton (Cooper) | 1911 | Bloomfield, USA |

Minimax Viking | 1902 | Berlin, Germany |

Victaulic | 1919 | London, United Kingdom |

Hilti | 1941 | Schaan, Liechtenstein |

Sika | 1910 | Zurich, Switzerland |

Dräger | 1889 | Lübeck, Germany |

Apollo Fire Detectors | 1980 | Havant, United Kingdom |

Hochiki | 1918 | Tokyo, Japan |

NAFFCO | 1991 | Dubai, United Arab Emirates |

Intelbras | 1976 | São José, Brazil |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Johnson Controls (Tyco): As one of the largest fire protection solution providers in Brazil, Johnson Controls expanded its local assembly and parts stocking facilities in São Paulo in 2024. The company emphasized growth in clean-agent systems and smart detection, reflecting rising demand from oil & gas, logistics, and data center verticals.

Honeywell: Known for its strong portfolio of detection and alarm systems, Honeywell Brazil launched enhanced IoT-enabled detectors and cloud-based monitoring tools in 2024. The company’s focus has been on integrating fire safety with broader building management solutions, targeting commercial high-rise and healthcare sectors.

Siemens (Cerberus): Siemens strengthened its presence in Brazil through partnerships with local integrators to deliver advanced detection and alarm systems. In 2024, it rolled out expanded service coverage in Belo Horizonte and Rio de Janeiro, highlighting its strategic intent to serve industrial parks and critical infrastructure hubs.

Bosch Building Technologies: Bosch invested in expanding its detection and voice alarm (PA/VA) systems in Brazil, with new deployments in hospitals and shopping centers in 2024. The company’s push into intelligent evacuation solutions and compliance with ABNT standards reinforces its competitive advantage.

Minimax Viking: Specializing in suppression systems, Minimax Viking grew its petrochemical and industrial projects portfolio in Brazil. In 2024, the firm reported higher demand for water-mist and foam-based systems, driven by increased fire safety requirements at refineries, logistics hubs, and ports.

What Lies Ahead for Brazil Fire Protection Market?

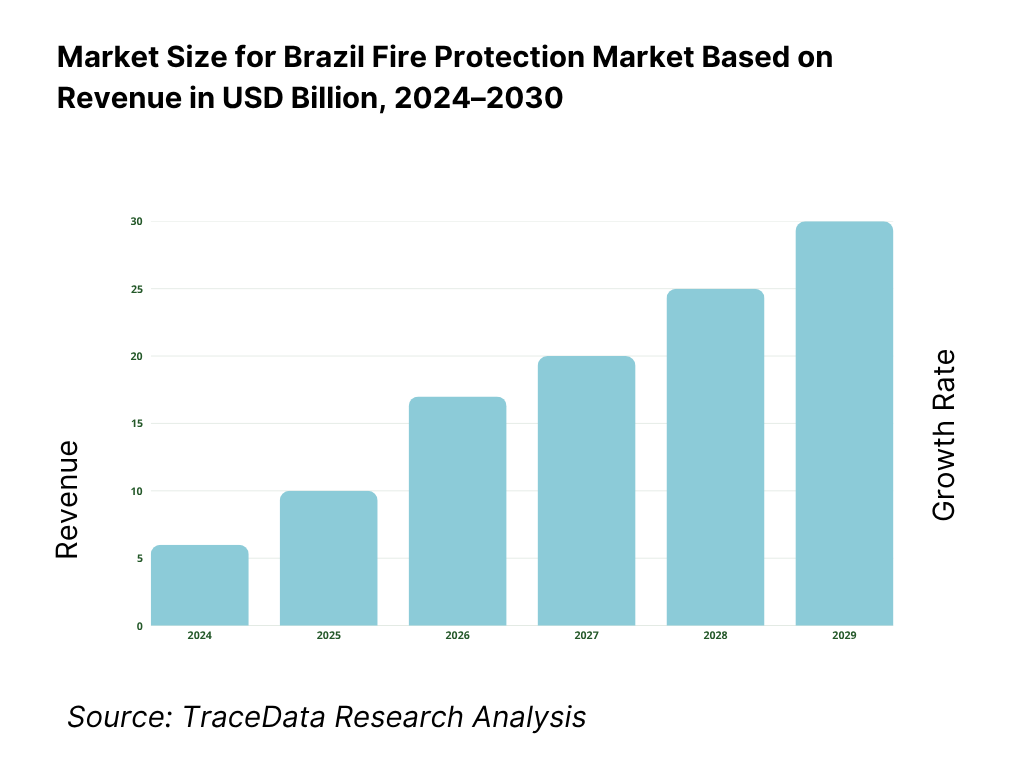

The Brazil fire protection market is projected to expand steadily through the end of the decade, supported by continuous industrial expansion, strict enforcement of ABNT/INMETRO standards, and rising investment in critical infrastructure resilience. Growth is expected to be reinforced by oil & gas safety requirements, rapid logistics build-outs, and urban verticalization, each of which necessitates reliable detection, suppression, and passive fire-protection systems.

Rise of Smart and Connected Fire Protection Systems: The next phase of the market will be characterized by a strong uptake of IoT-enabled fire detection and suppression systems. These solutions allow remote monitoring, predictive maintenance, and real-time alarm analytics, providing facility owners with higher uptime and reduced compliance risks. For high-value verticals such as data centers, airports, and industrial parks, smart systems will increasingly become the default standard.

Focus on Compliance-Driven Retrofitting: With state brigades tightening enforcement of fire codes and requiring periodic renewal of AVCB certificates, retrofitting of legacy plants, warehouses, and commercial towers will dominate demand. This retrofit wave will create opportunities not only for OEMs but also for local service contractors specializing in inspection, testing, and maintenance (ITM) and compliance documentation.

Expansion of Special Hazard Protection: Brazil’s large petrochemical, mining, and power sectors will continue to demand highly specialized fire-protection solutions such as foam deluge, water-mist, and clean-agent systems. As pre-salt oil production and cargo throughput rise, operators will seek advanced suppression for offshore platforms, refineries, ports, and conveyor facilities, making special hazard systems a growth hotspot.

Integration with Building Management and Safety Systems: The future will see tighter integration of fire protection with broader building management systems (BMS), security, and environmental controls. Facility managers will increasingly favor integrated dashboards that combine alarms, HVAC smoke control, evacuation PA/VA, and access control for streamlined operations and emergency readiness.

Brazil Fire Protection Market Segmentation

By Solution Type (In Value %)

Active Fire Protection Systems

Passive Fire Protection Systems

Services

By Suppression Medium (In Value %)

Water-based Systems

Foam-based Systems

Clean Agent & Gaseous Systems

Portable Extinguishers

By Detection & Control Technology (In Value %)

Conventional Fire Alarm Panels

Addressable Fire Alarm Panels

Aspirating / Very Early Smoke Detection (VESDA)

Linear Heat & Flame Detectors

Wireless / IoT-enabled Fire Detection Systems

Public Address / Voice Alarm (PA/VA) Systems

By End-User Industry (In Value %)

Oil & Gas & Petrochemicals

Power & Utilities

Industrial Manufacturing & Mining

Logistics, Ports & Airports

Commercial, Healthcare & High-Rise

Data Centers & Critical Facilities

By Distribution/Project Channel (In Value %)

EPC / Turnkey Contracts

System Integrators & Installers

OEM Direct (Key Accounts)

Distributors & Value-Added Resellers

Service & AMC Contracts

Players Mentioned in the Report:

Johnson Controls (Tyco)

Honeywell

Siemens (Cerberus)

Bosch Building Technologies

Carrier (Kidde / Edwards)

Eaton (Cooper)

Minimax Viking

Victaulic

Hilti (firestop, passive)

Sika (passive protection)

Dräger

Apollo Fire Detectors

Hochiki

NAFFCO

Intelbras

Key Target Audience

Asset Owners / Real Estate Developers (industrial parks, data centers, petrochemical plants)

Fire Protection OEMs and System Integrators

EPC Contractors in Brazil infrastructure and industrial sectors

Insurance & Risk Engineering Firms

Facility Management & Maintenance Companies

Investments & Venture Capitalist Firms

Government & Regulatory Bodies

Industrial Conglomerates

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Fire Protection Solutions (Turnkey EPC, System Integration, OEM Direct, Distributor-led, AMC/Service)-Margins, Preferences, Strengths & Weaknesses

4.2 Revenue Streams for Brazil Fire Protection Market (New system installation, retrofit, inspection/testing/maintenance, monitoring, spare parts, training)

4.3 Business Model Canvas for Fire Protection Market in Brazil

5.1 Freelance Fire Safety Engineers vs. Full-Time Integrators/Trainers (for brigades, ITM, and compliance)

5.2 Investment Models in Fire Protection (CAPEX-heavy EPC vs. OPEX service contracts; insurance-driven retrofits)

5.3 Comparative Analysis of Private vs. Public Projects (industrial plants, ports vs. hospitals, government complexes)

5.4 Fire Protection Budget Allocation by Company Size (Large enterprises, Medium, SMEs)

8.1 Revenues (Historic to Current Period)

9.1 By Market Structure (In-house fire brigades vs. Outsourced ITM & monitoring)

9.2 By Solution Type (Active systems, Passive systems, Services, Detection & Control)

9.3 By End-User Industry (Oil & Gas, Power & Utilities, Industrial/Mining, Logistics/Airports, Data Centers, Commercial & Healthcare)

9.4 By Company Size (Large Enterprises, Mid-sized, SMEs)

9.5 By Facility Type (hazardous, general, special hazard/data center)

9.6 By Mode of Contracting (Turnkey, Service AMC, Distributor-led)

9.7 By Open and Customized Programs (standard fire packages vs. bespoke engineered systems)

9.8 By Region (Southeast, South, Northeast, Center-West, North)

10.1 Corporate/Industrial Client Landscape and Cohort Analysis

10.2 Fire Safety Needs and Decision-Making Process (AHJ, insurers, engineering consultants)

10.3 ROI of Fire Protection Systems (insurance premium savings, downtime reduction, compliance assurance)

10.4 Gap Analysis Framework (regulatory codes vs. installed base)

11.1 Trends & Developments (IoT monitoring, BIM adoption, water-mist/clean-agent transitions, foam reformulation)

11.2 Growth Drivers (Industrial growth, insurance enforcement, data center expansion, regulatory compliance)

11.3 SWOT Analysis

11.4 Issues & Challenges (fragmented municipal codes, high CAPEX, import dependence, skilled labor shortage)

11.5 Government Regulations (ABNT NBR, INMETRO certification, AVCB approval process, NR-23, environmental standards for foams/agents)

12.1 Market Size and Future Potential for Smart/Connected Fire Protection Systems in Brazil

12.2 Business Models and Revenue Streams (remote monitoring, predictive maintenance, SaaS platforms)

12.3 Delivery Models and Types of Digital Solutions (IoT sensors, aspirating detection, cloud dashboards, AI alarm analytics)

15.1 Market Share of Key Players (by revenues, installed base)

15.2 Benchmark of Key Competitors-Company Overview, USP, Business Strategies, Business Model, Installed Base, Revenues, Pricing, Technology Used, Certifications, Major Clients, Strategic Tie-Ups, Marketing Strategy, Recent Developments

15.3 Operating Model Analysis Framework (OEM vs. EPC vs. Service Integrator)

15.4 Gartner Magic Quadrant Mapping for Brazil Fire Protection Vendors

15.5 Bowman’s Strategic Clock for Competitive Advantage

16.1 Revenues (Forecast Period)

17.1 By Market Structure (In-House vs. Outsourced)

17.2 By Solution Type (Active, Passive, Services, Detection)

17.3 By End-User Industry (Oil & Gas, Power, Industrial, Data Centers, Logistics, Commercial/Healthcare)

17.4 By Company Size

17.5 By Facility Type

17.6 By Mode of Contracting

17.7 By Open and Customized Programs

17.8 By Region

Research Methodology

Step 1: Ecosystem Creation

The first phase involves mapping the complete ecosystem of the Brazil Fire Protection Market, capturing both demand-side and supply-side stakeholders. On the supply side, this includes OEMs of sprinklers, detection systems, clean agents, and passive materials; distributors and value-added resellers; EPC contractors; system integrators; and local service providers engaged in inspection, testing, and maintenance. On the demand side, key entities include industrial and petrochemical operators, power and utility companies, logistics hubs, healthcare complexes, high-rise developers, and state fire brigades. From this ecosystem, we shortlist 5–6 leading companies in Brazil based on financial information, client base, and regional market coverage. Information sourcing is performed using industry articles, ABNT/INMETRO certification databases, public filings, and proprietary sources to collate credible industry-level insights.

Step 2: Desk Research

In the second phase, we conduct exhaustive desk research by leveraging secondary and proprietary databases. This includes collating industry-level insights such as the number of licensed system integrators, distribution footprints, certification compliance, and regional penetration. We examine critical variables like installed base, insurance-driven demand, service-contract volumes, and regulatory approvals. Company-level analysis is strengthened using annual reports, financial statements, government license databases, tender disclosures, and press releases, enabling a structured understanding of each player’s revenues, project track record, and after-sales capacity. The objective of this phase is to establish a foundational model of the market structure and competitor positioning before field validation.

Step 3: Primary Research

The third phase centers on structured primary research with senior executives, fire safety officers, facility managers, and regulatory officials in Brazil. We conduct in-depth interviews with OEMs, system integrators, EPC contractors, and key end-users across oil & gas, logistics, utilities, and healthcare sectors. These interactions validate market hypotheses, authenticate quantitative statistics, and extract insights on operational challenges, certification delays, and revenue streams. A bottom-up approach is applied, consolidating revenue contributions of each player and aggregating them to calculate overall market size. As part of the process, our team conducts disguised interviews under the pretext of potential clients, which allows for more candid disclosures around pricing, supply chains, project timelines, and service-level agreements, later corroborated against secondary datasets.

Step 4: Sanity Check

Finally, a sanity-check exercise is carried out using both top-down and bottom-up triangulation methods. Market sizing models are cross-verified by aligning macroeconomic indicators (e.g., construction activity, oil & gas production, installed power generation capacity, and number of high-rise buildings) with aggregated supplier-level revenues and service contracts. The iterative modeling ensures that estimates are internally consistent, validated by multiple data streams, and reconciled with ground-level realities. This dual-check framework confirms the robustness of the market size and growth trajectory calculations, providing a dependable output for strategic and investment decisions.

FAQs

01 What is the potential for the Brazil Fire Protection Market?

The Brazil Fire Protection Market is positioned for sustained growth, with the sector valued at approximately USD 1.53 billion in 2024. This potential is underpinned by the scale of Brazil’s industrial economy, which includes oil output of 3.4 million barrels/day and port cargo throughput of 1.32 billion tonnes in 2024, both requiring advanced fire safety systems. The market is further strengthened by rapid urban expansion, with 177.5 million residents living in urban areas, driving continuous demand for high-rise, healthcare, and commercial fire protection installations.

02 Who are the Key Players in the Brazil Fire Protection Market?

The Brazil Fire Protection Market features several leading players, including Johnson Controls (Tyco), Honeywell, Siemens (Cerberus), Bosch Building Technologies, and Carrier (Kidde/Edwards). These companies dominate through comprehensive product portfolios, strong certification compliance under ABNT/INMETRO, and extensive service networks. Other notable competitors include Eaton, Minimax Viking, Victaulic, Hilti, Sika, Dräger, Apollo Fire Detectors, Hochiki, NAFFCO, and Intelbras, each contributing to specialized verticals such as detection, suppression, passive protection, or regional service coverage.

03 What are the Growth Drivers for the Brazil Fire Protection Market?

The key growth drivers include Brazil’s industrial and energy expansion, anchored by 203.8 GW of installed power capacity and strong petrochemical investments, both requiring certified fire protection systems. The urban housing stock of over 75 million units, combined with vertical growth in São Paulo and Rio, drives demand for code-compliant sprinklers, detection, and passive fireproofing. Finally, regulatory enforcement from state fire brigades and ABNT/INMETRO conformity programs ensures that new builds and retrofits remain legally bound to implement certified fire safety solutions, reinforcing long-term market growth momentum.

04 What are the Challenges in the Brazil Fire Protection Market?

The Brazil Fire Protection Market faces key challenges such as fragmented permitting, with 5,568 municipalities each applying localized fire approval processes, creating delays and compliance inconsistencies. Environmental licensing disruptions have also impacted industrial projects, with IBAMA strikes causing oil output losses of up to 200,000 barrels/day in 2024, directly affecting project rollouts. Additionally, wildfire pressures are intensifying—278,299 hotspots were recorded in 2024—placing greater strain on brigades and insurers, while elevating the compliance burden on operators to maintain sufficient suppression capacity and fire resilience.