Brazil Toys and Games Market Outlook to 2029

By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region

- Product Code: TDR0047

- Region: Asia

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled "Brazil Toys and Games Market Outlook to 2029 - By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region " provides an in-depth analysis of the Brazilian toys and games industry. The report covers an overview and genesis of the industry, the overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, consumer profiling, challenges, and a competitive landscape including competition scenario, opportunities, and key players’ profiling in the market. The report concludes with future market projections based on sales revenue, product types, age groups, and success stories highlighting the major opportunities and challenges.

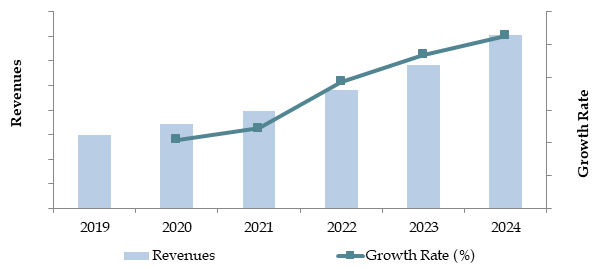

Brazil Toys and Games Market Overview and Size

The Brazil toys and games market reached a valuation of BRL 25 billion in 2023, fueled by increasing consumer expenditure on children’s entertainment, a rising young population, and growing demand for educational and interactive products. The market is dominated by key players such as Estrela, Hasbro, Mattel, and Grow. These companies are recognized for their strong brand presence, broad distribution networks, and innovative product lines designed to appeal to both children and parents.

In 2023, Estrela launched a new line of eco-friendly educational toys to cater to the growing demand for sustainable products, aiming to capture the environmentally conscious segment of the market. São Paulo and Rio de Janeiro are key regions, driven by high population density and higher disposable incomes, contributing significantly to the market's overall growth trajectory.

Market Size for Brazil Toys and Games Industry on the Basis of Revenue in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Brazil Toys and Games Market:

Economic Recovery: Brazil’s economic recovery post-pandemic has led to increased consumer spending on non-essential items such as toys and games. In 2023, toys and games experienced a 15% growth in sales as parents resumed purchasing entertainment products for their children. The recovery has particularly impacted urban areas where disposable income levels are higher.

Growing Young Population: Brazil’s large young population, which makes up a significant portion of the market, continues to drive demand for toys and games. In 2023, children aged 0-14 represented around 21% of the total population, pushing demand for both traditional toys and educational games. This demographic shift has led to increased sales in age-appropriate toys that aid in learning and development.

Rise in Digital Gaming: With increasing digitalization, more Brazilian consumers are turning to digital and video games. In 2023, around 30% of total toy and game sales came from video games, driven by the growing availability of affordable gaming consoles and mobile game apps. The expansion of e-commerce has also facilitated easier access to a wide range of games, enhancing consumer convenience and contributing to market growth.

Which Industry Challenges Have Impacted the Growth for Brazil Toys and Games Market:

Quality and Safety Concerns: Concerns regarding the safety and quality of toys remain a significant challenge in the Brazilian market. Approximately 40% of Brazilian parents are hesitant to purchase toys due to worries about the use of harmful materials and a lack of safety certifications. This issue has created a trust gap between consumers and manufacturers, potentially deterring many buyers from making purchases, particularly in lower-priced segments.

Regulatory Hurdles: Stringent safety regulations imposed by Brazilian authorities can limit the availability of certain imported toys, as all products must comply with the country’s safety and quality standards. In 2023, around 15% of toys imported to Brazil were delayed or rejected due to non-compliance with local safety standards. These regulations, while necessary for consumer protection, often lead to higher costs for manufacturers and distributors, limiting market growth.

High Production Costs: The high cost of raw materials and manufacturing in Brazil impacts the pricing of toys, particularly those produced domestically. As a result, Brazilian-made toys can be more expensive compared to imported alternatives, which are often produced at a lower cost in countries with cheaper labor. This price disparity can negatively affect local manufacturers’ competitiveness in the market.

What are the Regulations and Initiatives which have Governed the Market:

Toy Safety Standards: The Brazilian government enforces strict toy safety regulations through its National Institute of Metrology, Standardization, and Industrial Quality (INMETRO). All toys sold in Brazil must comply with INMETRO's safety standards, which include testing for small parts, toxic materials, and other hazards. In 2023, approximately 80% of toys passed the certification on their first attempt, reflecting the high compliance rate within the market.

Import Regulations on Toys: Brazil has strict regulations governing the import of toys, including the requirement for all imported products to undergo safety testing and certification by INMETRO. Imported toys must meet the same safety standards as locally manufactured products. In 2023, toy imports saw a decline of 10% due to increased enforcement of these regulations, impacting the availability of certain international brands.

Government Initiatives for Educational Toys: To promote child development and education, the Brazilian government has introduced programs that support the adoption of educational toys in schools and homes. These initiatives include tax exemptions for locally produced educational toys and partnerships with public schools to incorporate educational play into the curriculum. In 2023, these programs contributed to a 12% rise in the sales of educational toys in Brazil.

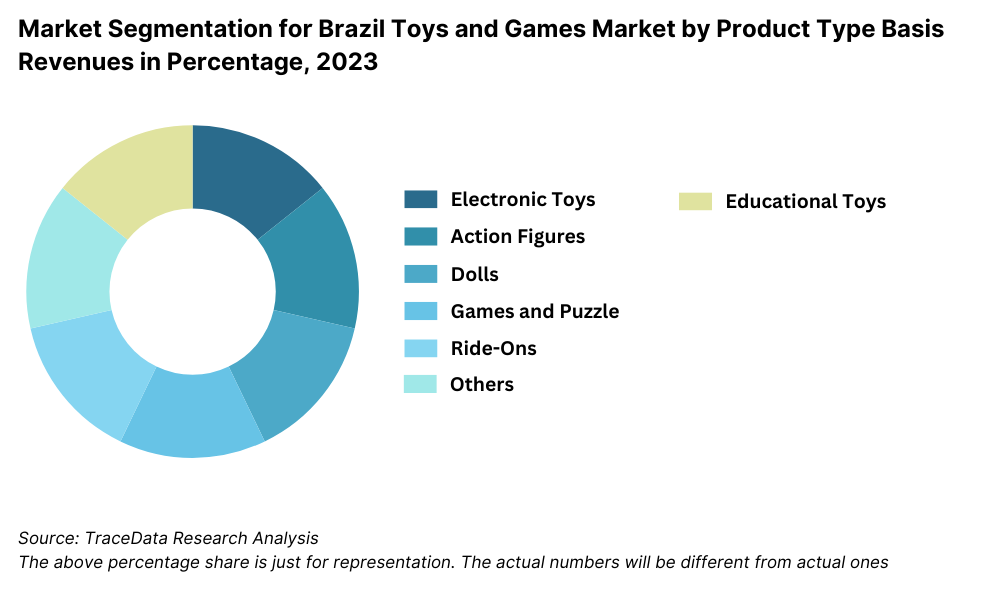

Brazil Toys and Games Market Segmentation

By Market Structure: The Brazilian toys and games market is primarily dominated by large retail chains and online marketplaces, which hold significant market share due to their nationwide reach, diverse product offerings, and strong relationships with both international and local manufacturers. Specialty toy stores, though smaller in number, have a strong foothold in premium and niche toy segments. Local manufacturers also play a critical role, particularly in the educational and eco-friendly toy categories, where they capitalize on the growing demand for sustainability.

By Product Type: Traditional toys such as dolls, action figures, and puzzles continue to dominate the market. However, the growing popularity of digital and video games has significantly shifted market dynamics, with video games accounting for approximately 35% of total toy and game sales in 2023. Educational toys are also gaining traction, driven by increased demand for products that promote learning and development.

By Age Group: The 3-8 years age group represents the largest segment of toy consumers in Brazil, driven by parents' increasing interest in educational and interactive toys. Products for the 9-14 years age group are seeing rapid growth, particularly in the video games and digital entertainment categories, as children in this age range increasingly shift towards gaming consoles and mobile games.

Competitive Landscape in Brazil Toys and Games Market

The Brazil toys and games market is moderately concentrated, with a few dominant players alongside a growing number of new entrants and local manufacturers. Major international and local brands, such as Estrela, Hasbro, Mattel, and Grow, hold a significant share of the market. However, the rise of new companies and digital platforms like Mercado Livre and Amazon Brazil has provided consumers with a wider array of choices and access to diverse product lines.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Estrela | 1937 | São Paulo, Brazil |

Ri Happy | 1988 | São Paulo, Brazil |

Tectoy | 1987 | São Paulo, Brazil |

Grow | 1972 | São Paulo, Brazil |

Candide | 1969 | São Paulo, Brazil |

Brinquedos Bandeirante | 1952 | São Paulo, Brazil |

Some of the recent competitor trends and key information about competitors include:

Estrela: As one of Brazil’s largest toy manufacturers, Estrela recorded a 10% growth in sales in 2023, driven by the launch of its eco-friendly toy line. The company has capitalized on its strong local brand presence and is focusing on sustainability to capture market share among environmentally conscious consumers.

Hasbro: Hasbro reported a 20% increase in sales in Brazil in 2023, driven primarily by its extensive line of licensed toys, such as action figures based on popular movie franchises. The company’s strong brand partnerships and expansive retail network have solidified its market position.

Mattel: Known for iconic brands like Barbie and Hot Wheels, Mattel saw a 15% rise in sales in 2023, largely attributed to its successful digital marketing campaigns and focus on interactive and educational toys. The company is also expanding its e-commerce presence to tap into the growing online shopping trend in Brazil.

Grow: Specializing in board games and puzzles, Grow experienced an 18% boost in sales in 2023 as more Brazilian families turned to home entertainment options. The company’s emphasis on educational games has resonated with parents seeking alternatives to screen-based entertainment for their children.

Mercado Livre: As the leading e-commerce platform in Latin America, Mercado Livre saw a 30% increase in toy sales in 2023, driven by its wide product range, competitive pricing, and easy access for consumers across Brazil. The platform’s logistics network has made it a preferred choice for buyers seeking convenience and fast delivery.

Amazon Brazil: Amazon Brazil’s toy segment grew by 25% in 2023, with the company focusing on expanding its inventory of digital games and international brands. Its Prime membership program, offering fast shipping and exclusive discounts, has helped the company capture a larger market share in the toys and games sector.

.png)

What Lies Ahead for Brazil Toys and Games Market?

The Brazil toys and games market is projected to grow steadily by 2029, with a strong compound annual growth rate (CAGR) expected during the forecast period. This growth will likely be driven by economic recovery, increasing consumer spending, and the rising demand for educational and interactive toys.

Shift Towards Digital Gaming: As Brazilian consumers increasingly adopt digital lifestyles, there is expected to be a substantial rise in demand for digital and video games. The expansion of high-speed internet and the growing availability of gaming consoles and mobile games will likely push this trend forward. Digital games are projected to account for an even larger share of the market by 2029, with tech-savvy younger generations leading the charge.

Growth of Educational Toys: The demand for educational toys that support cognitive and motor skill development is expected to grow, driven by parents' increasing focus on educational products for their children. This trend is anticipated to be particularly strong in urban areas, where higher income levels support spending on premium educational toys.

Integration of Sustainable Practices: With growing awareness around environmental sustainability, there is likely to be a rise in demand for eco-friendly toys. Manufacturers are expected to shift towards using recyclable materials and sustainable production methods, with many companies already introducing eco-friendly product lines. This trend is anticipated to resonate with environmentally conscious consumers, particularly in higher-income segments.

Expansion of E-commerce: The growth of e-commerce platforms such as Mercado Livre and Amazon Brazil is expected to accelerate the market’s expansion. Consumers will increasingly turn to online shopping for convenience, wider product selection, and competitive pricing. The increasing use of digital platforms for toy purchases will drive sales, particularly in remote and underserved regions.

Future Outlook and Projections for Brazil Toys and Games Market on the Basis of Revenue, 2024-2029

Source: TraceData Research Analysis

Brazil Toys and Games Market Segmentation

By Market Structure:

Organized Retail Chains

Online Retailers

Independent Toy Stores

Unorganized Sector

By Product Type:

Educational Toys

Action Figures

Dolls

Outdoor Games

Puzzles and Board Games

Electronic Toys

By Age Group:

0-2 years

3-5 years

6-12 years

13 years and above

By Distribution Channel:

Specialty Stores

Online Channels

Hypermarkets/Supermarkets

• By Region:

o Southeast Brazil

o Northeast Brazil

o South Brazil

o Central-West Brazil

o North Brazil

Players Mentioned in the Report:

- Mattel Inc.

- Hasbro Inc.

- LEGO Group

- Spin Master Ltd.

- Takara Tomy Co. Ltd

- MGA Entertainment Inc.

- Manufatura de Brinquedos Estrela S.A.

- Grow Jogos e Brinquedos S.A.

- Candide Industria E Comercio Ltda.

- Brinquedos Bandeirante S.A

Key Target Audience:

- Toy Manufacturers

- Retailers (Online and Offline)

- Parents and Educational Institutions

- Government Regulatory Bodies

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the Brazil Toys and Games Market

5.1. Population by Age Group

5.2. Estimated Time Spent by Age Group on Toys and Recreational Activities

5.3. Number of Distributors in Brazil for Toys and Games with their Contact Details

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Action Figures, Ride-Ons and others), 2023-2024P

9.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2023-2024P

9.4. By Distribution Channel (Specialty Stores, Hypermarkets/ Supermarkets, Online Channels), 2023-2024P

9.5. By Cities, 2023-2024P

9.6. By Price Range, 2023-2024P

9.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2023-2024P

10.1. Customer Segmentation and Profile

10.2. Customer Journey and Buying Decision Process

10.3. Key Motivations and Pain Points

10.4. Product Preferences and Buying Trends

11.1. Trends and Developments in Brazil Toys and Games Market

11.2. Growth Drivers for Brazil Toys and Games Market

11.3. SWOT Analysis for Brazil Toys and Games Market

11.4. Issues and Challenges for Brazil Toys and Games Market

11.5. Government Regulations for Brazil Toys and Games Market

12.1. Market Size and Future Potential for Online Toys and Games Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Toy Platforms Basis Operational and Financial Parameters

15.1. Market Share of Key Organized Brands in Brazil Toys and Games Market, FY2024

15.2. Market Share of Key Distributors in Brazil Toys and Games Market, FY2024

15.3. Benchmark of Key Competitors in Brazil Toys and Games Market Including Operational and Financial Parameters

15.4. Strength and Weakness Analysis

15.5. Operating Model Analysis Framework

15.6. Porters Five Forces Analysis for Competitor Strategy

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), 2025-2029

17.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2025-2029

17.4. By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels), 2025-2029

17.5. By Cities, 2025-2029

17.6. By Price Range, 2025-2029

17.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2025-2029

17.8. Recommendation and Strategic Insights

17.9. Opportunity Analysis for Brazil Toys and Games Market

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand and supply-side entities for the Brazil Toys and Games Market. Based on this ecosystem, we will shortlist 5-6 leading manufacturers and retailers based on their financial information, production capacity, and sales volume.

Sourcing is done through industry articles, various secondary, and proprietary databases to perform desk research and gather market-level data.

Step 2: Desk Research

We engage in comprehensive desk research by referencing diverse secondary and proprietary databases. This approach allows for a thorough market analysis, aggregating data such as sales revenue, number of market players, pricing, demand, and other variables. Additionally, we examine company-level data from press releases, annual reports, financial statements, and other documents to develop a detailed understanding of the market and its participants.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives and stakeholders from various companies in the Brazil Toys and Games Market. These interviews serve to validate market hypotheses, authenticate statistical data, and extract valuable operational insights. We use a bottom-to-top approach to assess sales volume for each player, aggregating the data to understand the overall market.

As part of the validation process, disguised interviews are conducted by approaching companies as potential customers. This method allows us to validate the operational and financial data shared by executives and cross-check it with secondary research. These interactions also provide a comprehensive view of revenue streams, the value chain, processes, pricing, and other market factors.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is conducted to ensure the accuracy and reliability of the data and market projections.

FAQs

01 What is the potential for the Brazil Toys and Games Market?

The Brazil toys and games market is expected to experience steady growth, reaching a valuation of BRL 25 billion in 2023. This growth is driven by factors such as an increasing young population, rising demand for educational and interactive toys, and the expanding digital gaming market. The market's potential is further enhanced by the rapid rise of e-commerce platforms, which provide consumers with easier access to a wide range of products.

02 Who are the Key Players in the Brazil Toys and Games Market?

The Brazil Toys and Games Market includes several key players such as Estrela, Hasbro, Mattel, and Grow. These companies lead the market due to their strong brand recognition, extensive distribution networks, and diverse product offerings. Notable international players, such as Lego and Funko, are also significant contributors to the market’s growth.

03 What are the Growth Drivers for the Brazil Toys and Games Market?

The primary growth drivers include Brazil’s large and growing young population, economic recovery, and increasing parental focus on educational toys. The rise in digital gaming, supported by the availability of gaming consoles and mobile games, also contributes to the market’s expansion. Additionally, the growth of e-commerce is making toys and games more accessible to consumers across the country.

04 What are the Challenges in the Brazil Toys and Games Market?

The Brazil Toys and Games Market faces several challenges, including concerns about the safety and quality of toys, particularly for lower-cost products. Regulatory challenges, such as compliance with INMETRO’s safety standards, can impact the availability of imported toys. Additionally, high production costs for local manufacturers and competition from cheaper imports pose significant barriers to market growth.