Bulgaria Auto Finance Market Outlook to 2029

By Market Structure, By Lenders, By Types of Vehicles Financed, By Age of Borrowers, By Loan Tenure, and By Region

- Product Code: TDR0144

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Bulgaria Auto Finance Market Outlook to 2029 - By Market Structure, By Lenders, By Types of Vehicles Financed, By Age of Borrowers, By Loan Tenure, and By Region” provides a comprehensive analysis of the auto finance market in Bulgaria. The report covers an overview and genesis of the industry, overall market size in terms of loan disbursals, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on outstanding loan value, by lender type, vehicle type, borrower demographics, and regional insights, as well as success case studies highlighting key opportunities and market risks.

Bulgaria Auto Finance Market Overview and Size

The Bulgaria auto finance market was valued at BGN 3.6 Billion in 2023, driven by the rising demand for private vehicle ownership, favorable interest rates, and increasing digitalization of financial services. The market is characterized by the presence of key financial institutions and auto finance specialists such as UniCredit Bulbank, DSK Bank, BNP Paribas Personal Finance Bulgaria, and LeasePlan Bulgaria. These players offer competitive loan packages, flexible repayment options, and have adapted rapidly to digitized loan application and approval processes.

In 2023, UniCredit Bulbank launched an AI-driven financing platform to streamline vehicle loan applications, enabling faster approvals and reducing the turnaround time for loan disbursement. Sofia and Plovdiv are leading regions in terms of auto loan demand, due to higher income levels and vehicle density.

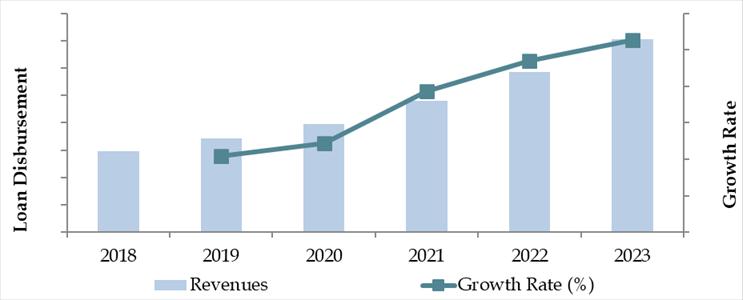

Market Size for Bulgaria Auto Finance Industry on the Basis of Loan Disbursals (in BGN), 2018–2024

What Factors are Leading to the Growth of Bulgaria Auto Finance Market:

Economic Accessibility: New vehicle prices in Bulgaria have risen by over 15% since 2020, pushing many consumers towards financing options. In 2023, nearly 70% of new car purchases were financed through auto loans or leasing agreements, making financing a critical enabler of vehicle ownership.

Millennial Car Buyers: The demand for auto finance is surging among younger consumers (ages 25–40), who increasingly prefer flexible financing options such as balloon payments and lease-to-own plans. Over 45% of borrowers in 2023 were under the age of 40, indicating a generational shift in borrowing patterns.

Digitization of Lending: Around 50% of auto loan applications in Bulgaria in 2023 were submitted via online platforms, reflecting strong digital adoption. Fintech companies and traditional banks are investing in user-friendly apps and online portals to cater to digitally savvy consumers.

Which Industry Challenges Have Impacted the Growth for Bulgaria Auto Finance Market

Credit Accessibility and Approval Rates: A significant barrier in the Bulgarian auto finance market is the difficulty faced by consumers in securing credit approval, particularly among self-employed individuals and those with irregular incomes. In 2023, around 33% of loan applications were rejected due to poor credit scores or insufficient documentation. This limits vehicle ownership, especially for younger and lower-income consumers.

Used Vehicle Loan Risk: Financing for older and used vehicles poses a higher risk for lenders due to depreciation and uncertain vehicle conditions. In 2023, nearly 40% of auto finance providers avoided issuing loans for vehicles over 10 years old, which narrowed options for cost-sensitive buyers and slowed market growth in the used car segment.

Limited Financial Literacy: A lack of understanding of financial products and loan terms among consumers has led to misinformed decisions and delinquencies. Surveys indicate that over 45% of consumers do not fully understand their loan agreements, including interest rate structures and penalties, contributing to a rising trend in loan defaults.

What are the Regulations and Initiatives which have Governed the Market

EU Lending Compliance Standards: Bulgaria’s auto finance sector operates under European Union lending and consumer protection regulations, which mandate transparency in loan agreements, pre-contractual disclosures, and borrower rights. In 2023, over 90% of lenders implemented standardized credit terms and disclosures to comply with the EU Consumer Credit Directive.

Bank of Bulgaria Guidelines: The Bulgarian National Bank (BNB) regularly issues lending caps and debt service ratio limits to control household debt. In 2022, BNB imposed a maximum 60% debt-to-income ratio for auto loans, which had a cooling effect on subprime borrowing and risk exposure.

Green Financing Programs: The Bulgarian government, in collaboration with the EU, has launched green vehicle financing incentives. These include interest rate subsidies and partial loan guarantees for electric and hybrid vehicles. In 2023, green auto loans grew by 22%, signaling a positive shift toward sustainable mobility.

Bulgaria Auto Finance Market Segmentation

By Market Structure: The auto finance market in Bulgaria is primarily dominated by banks and captive finance arms of automakers, thanks to their credibility, access to low-cost capital, and wide distribution networks through dealership tie-ups. Independent financial institutions and fintech lenders are also growing rapidly, especially among younger borrowers seeking fast, online loan approvals. Captive finance companies—such as those affiliated with brands like Renault, Volkswagen, and Toyota—are gaining traction due to their promotional offers, lower interest rates, and integrated dealership financing.

By Vehicle Type Financed:New vehicles account for the largest share of auto loan disbursals in Bulgaria, as manufacturers and banks offer better financing terms on new car purchases, including extended repayment periods and lower down payments. However, the financing of used cars has steadily increased, especially among young professionals and lower-middle-income consumers. Leasing and hire-purchase agreements are more common in the new car segment, while personal installment loans dominate the used car financing segment.

.png)

By Loan Tenure: Loan tenures ranging from 36 to 60 months are most popular, offering a balance between manageable monthly payments and total interest paid. Shorter tenures (less than 36 months) are preferred by high-income groups or corporate clients, while longer tenures (over 60 months) are common among budget-conscious buyers seeking affordability.

Competitive Landscape in Bulgaria Auto Finance Market

The Bulgaria auto finance market is moderately consolidated, with a mix of traditional banks, captive finance companies, leasing firms, and emerging fintech players. The sector has seen growing competition with the entry of digital-first lenders and the expansion of mobile-based financial services, providing consumers with greater flexibility, accessibility, and speed in auto loan approvals.

| Company Name | Founding Year | Original Headquarters |

| DSK Leasing (OTP Group) | 2005 | Sofia, Bulgaria |

| UniCredit Leasing Bulgaria | 2001 | Sofia, Bulgaria |

| Allianz Bank Bulgaria | 1997 | Sofia, Bulgaria |

| Porsche Leasing BG EOOD | 2004 | Sofia, Bulgaria |

| Ayvens Bulgaria (formerly ALD Automotive) | 2023 (rebranded) | Sofia, Bulgaria |

| Leasing Finance EAD | 2004 | Sofia, Bulgaria |

| ProCredit Bank Bulgaria | 2001 | Sofia, Bulgaria |

| TBI Bank | 2002 | Sofia, Bulgaria |

| Deutsche Leasing Bulgaria | 2007 | Sofia, Bulgaria |

| Mogo Bulgaria | 2017 | Sofia, Bulgaria |

Some of the recent competitor trends and key information about competitors include:

UniCredit Bulbank: A leading player in Bulgaria’s auto finance sector, UniCredit Bulbank introduced an AI-powered loan approval system in 2023 that cut processing times by 40%. The bank also expanded its dealership partnerships nationwide, increasing its market share in both new and used car financing.

DSK Bank: One of the oldest financial institutions in Bulgaria, DSK Bank reported a 12% year-on-year increase in auto loan disbursals in 2023. The bank’s strength lies in its competitive fixed interest rate offers and widespread physical branch presence, particularly effective in semi-urban and rural areas.

BNP Paribas Personal Finance Bulgaria: Focused primarily on installment financing and digital credit, BNP Paribas Personal Finance has gained traction among young borrowers. In 2023, over 65% of its auto finance contracts were initiated online, showing a strong push toward digitization and customer self-service platforms.

Eurolease Auto: A dominant player in the used car leasing space, Eurolease Auto offers flexible terms and vehicle upgrade options. In 2023, the company partnered with multiple car dealers to provide bundled finance and warranty packages, boosting its appeal in the second-hand market.

LeasePlan Bulgaria: Specializing in operational leasing for corporate clients, LeasePlan saw a 9% rise in fleet leasing in 2023, driven by demand from logistics and service companies. Their recent shift toward offering green vehicle financing packages has also attracted sustainability-focused clients.

TBI Bank: An emerging digital lender, TBI Bank has made a mark with its “Buy Now, Pay Later” auto finance options. With quick digital KYC and pre-approval tools, TBI grew its auto loan portfolio by 18% in 2023, particularly among first-time car buyers and freelancers.

What Lies Ahead for Bulgaria Auto Finance Market?

The Bulgaria auto finance market is projected to grow steadily through 2029, driven by improving economic conditions, rising consumer demand for personal mobility, and continued digital transformation in the lending space. The market is expected to exhibit a healthy CAGR, supported by innovation in financial services and evolving customer expectations.

Expansion of Green Vehicle Financing: With EU-backed sustainability goals and Bulgaria’s increasing focus on environmental initiatives, green auto finance products are expected to surge. More banks and leasing companies are likely to introduce preferential loan rates for electric and hybrid vehicles, supported by subsidies and tax incentives from both the Bulgarian government and European institutions.

Rise of Fintech-Driven Lending Models: The growth of digital-first and app-based auto finance platforms is expected to redefine customer experience. Fintechs will play a larger role by offering instant approvals, customized loan offers, and flexible repayment options. These platforms will especially appeal to millennials and gig economy workers seeking speed, convenience, and personalization.

Adoption of AI and Predictive Analytics: Lenders are increasingly incorporating AI, machine learning, and predictive risk modeling to improve credit assessments and reduce defaults. By 2029, these tools are expected to become standard across the industry, enabling more accurate borrower profiling, fraud detection, and dynamic interest rate setting based on risk tiers.

Growth in Used Vehicle Financing: The financing of used vehicles is expected to grow significantly, particularly in rural and semi-urban areas. With new car prices on the rise and inflation impacting consumer budgets, more people will turn to affordable second-hand cars, creating a strong secondary market for loans and leasing.

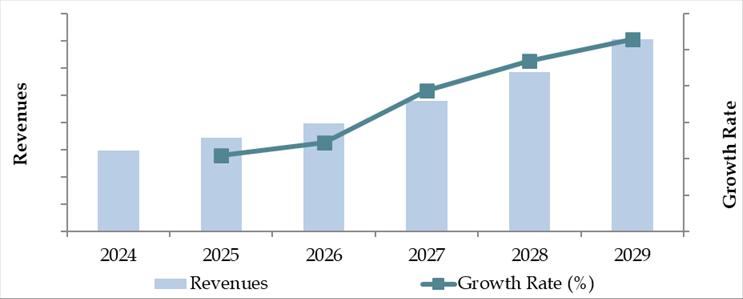

Future Outlook and Projections for Bulgaria Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Bulgaria Auto Finance Market Segmentation

By Market Structure:

Commercial Banks

Captive Finance Companies

Leasing Companies

Peer-to-Peer Lending Platforms

Fintech-Based Lenders

Organized Financial Institutions

Informal/Unorganized Lenders

By Vehicle Type Financed:

New Passenger Vehicles

Used Passenger Vehicles

New Commercial Vehicles

Used Commercial Vehicles

Electric Vehicles (EVs)

Hybrid Vehicles

By Loan Tenure:

Less than 36 Months

36–60 Months

Above 60 Months

By Age of Borrower:

18–24

25–40

41–60

60+

By Employment Type of Borrower:

Salaried Individuals

Self-Employed Professionals

SMEs/Business Owners

Freelancers/Gig Workers

By Region:

Sofia

Plovdiv

Varna

Burgas

Ruse

Stara Zagora

Other Rural and Semi-Urban Areas

Players Mentioned in the Report (Banks):

- DSK Bank

- UniCredit Bulbank

- United Bulgarian Bank (UBB)

- Eurobank Bulgaria (Postbank)

- First Investment Bank (Fibank)

- Central Cooperative Bank

- Allianz Bank Bulgaria

- ProCredit Bank Bulgaria

- Bulgarian Development Bank

- International Asset Bank (iBank)

Players Mentioned in the Report (NBFCs):

- DSK Leasing

- OTP Leasing

- Deutsche Leasing Bulgaria

- Allianz Leasing

- TBI Bank

- BNP Paribas Personal Finance Bulgaria

- UniCredit Leasing

- UBB Interlease

- Eurolease Auto

- Mogo Bulgaria

Players Mentioned in the Report (Captive):

- Porsche Finance Group Bulgaria

- Toyota Financial Services Bulgaria

- Volkswagen Financial Services Bulgaria

- BMW Financial Services Bulgaria

- Mercedes-Benz Financial Services Bulgaria

- Stellantis Financial Services Bulgaria

- Maruti Suzuki Smart Finance

Key Target Audience:

Commercial Banks and Leasing Companies

Auto Finance Aggregators and Marketplaces

Automotive Dealerships and OEMs

Regulatory Authorities (e.g., Bulgarian National Bank)

Financial Technology Providers

Automotive Associations and Research Institutions

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Bulgaria by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Bulgaria Car Finance Market

11.2. Growth Drivers for Bulgaria Car Finance Market

11.3. SWOT Analysis for Bulgaria Car Finance Market

11.4. Issues and Challenges for Bulgaria Car Finance Market

11.5. Government Regulations for Bulgaria Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Bulgaria Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Bulgaria Car Finance Market, 2024

17.3. Market Share of Key Captive in Bulgaria Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Bulgaria Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We mapped the ecosystem and identified all the demand-side and supply-side entities in the Bulgaria Auto Finance Market. Based on this ecosystem, we shortlisted the top 5–6 key players in the industry, including commercial banks, leasing firms, captive finance companies, and emerging fintech lenders, based on factors such as financial data, loan disbursal volumes, and customer base.

Sourcing for this step included extensive review of industry reports, financial publications, regulatory announcements, and data from proprietary and open-access databases to build a comprehensive desk research foundation and create an ecosystem blueprint.

Step 2: Desk Research

A thorough desk research process was conducted using secondary sources such as industry databases, annual reports, company websites, press releases, and regulatory filings. This enabled an in-depth analysis of market trends, auto loan volumes, interest rate trends, financing preferences, and regional growth drivers.

Desk research also focused on extracting insights related to vehicle financing trends (new vs. used), borrower demographics, lender competition, and loan product segmentation, as well as reviewing Bulgaria's regulatory and macroeconomic context.

Step 3: Primary Research

We conducted a series of in-depth interviews with C-level executives, credit managers, and dealership finance coordinators from banks, leasing companies, auto dealers, and fintech platforms operating in the Bulgaria auto finance sector.

These interviews aimed to validate market hypotheses, confirm secondary data points, and extract ground-level operational insights including average loan ticket size, default rates, customer preferences, and pricing strategies.

Our team also conducted disguised interviews, posing as potential clients to gather firsthand insights into loan approval procedures, interest structures, documentation requirements, and digital process adoption.

Step 4: Sanity Check

To ensure accuracy and data consistency, a top-down and bottom-up analysis was performed, incorporating market triangulation and model-based validation exercises.

- Market sizing was cross-verified using multiple data sources, financial disclosures, and inputs from primary interviews to confirm the reliability of volume estimates and projected growth trends through 2029.

FAQs

1. What is the potential for the Bulgaria Auto Finance Market?

The Bulgaria auto finance market holds significant growth potential, with the market reaching an estimated valuation of BGN 3.6 Billion in 2023. Growth is driven by rising vehicle ownership aspirations, increasing digitalization in banking and lending services, and the growing availability of tailored loan products. As more consumers seek affordable and flexible financing solutions, the market is poised to expand steadily through 2029, particularly in both urban and semi-urban areas.

2. Who are the Key Players in the Bulgaria Auto Finance Market?

The Bulgaria Auto Finance Market includes major players such as UniCredit Bulbank, DSK Bank, BNP Paribas Personal Finance Bulgaria, Eurolease Auto, LeasePlan Bulgaria, and TBI Bank. These institutions lead the market due to their extensive product portfolios, strong partnerships with dealerships, and increasingly digital customer interfaces. Emerging fintech lenders are also reshaping the landscape by offering quick, app-based loan services.

3. What are the Growth Drivers for the Bulgaria Auto Finance Market?

Key growth drivers include the rising cost of new vehicles, which is increasing demand for financing, along with a growing middle-class population that views car ownership as a necessity. The expansion of digital lending platforms, favorable interest rates, and government-backed green financing initiatives for electric vehicles are also major contributors. Additionally, consumer preference for convenience and customization in financial products is shaping new innovations in the sector.

4. What are the Challenges in the Bulgaria Auto Finance Market?

The market faces several challenges, including limited credit access for freelancers and gig workers, concerns over financing older or high-mileage used vehicles, and low financial literacy among first-time borrowers. Regulatory compliance with EU financial directives also imposes strict requirements on lenders. Additionally, the digital divide between urban and rural regions can hinder the adoption of online financing solutions in remote areas.