Cambodia Auto Finance Market Outlook to 2029

By Market Structure, By Loan Providers, By Vehicle Type, By Loan Tenure, By Consumer Age Group, and By Region

- Product Code: TDR0120

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled “Cambodia Auto Finance Market Outlook to 2029 – By Market Structure, By Loan Providers, By Vehicle Type, By Loan Tenure, By Consumer Age Group, and By Region.” provides a comprehensive analysis of the auto finance market in Cambodia. The report covers an overview and genesis of the industry, overall market size in terms of loan disbursements, market segmentation, trends and developments, regulatory landscape, customer profiling, challenges, and comparative landscape, including competition scenario, cross-comparison, opportunities, bottlenecks, and company profiling of major players in the auto finance sector. The report concludes with future market projections based on loan disbursements, by market, vehicle type, region, key drivers, and success case studies highlighting significant opportunities and risks.

Cambodia Auto Finance Market Overview and Size

The Cambodia auto finance market reached a valuation of USD 4.5 Billion in 2023, driven by increasing vehicle ownership, rising disposable income, and a growing preference for auto loans. With a significant share of vehicle purchases being financed, key players such as ACLEDA Bank, AMK Microfinance, Sathapana Bank, ABA Bank, and Wing Bank are leading the market through competitive loan offerings, digital lending platforms, and strong branch networks.

In 2023, digital loan application platforms saw a 30% increase in adoption, indicating a shift towards more technology-driven financing solutions. Phnom Penh and Siem Reap are key markets due to their expanding middle class and rapid urbanization, leading to higher demand for vehicles and auto financing solutions.

Market Size for Cambodia Auto Finance Industry on the Basis of Loan Disbursements in value in USD Billion, 2018-2024

What Factors are Leading to the Growth of Cambodia Auto Finance Market?

Economic Factors: The rising cost of vehicles and increasing fuel prices have contributed to a higher reliance on auto financing solutions. In 2023, approximately 70% of all car purchases in Cambodia were financed, as buyers seek affordability through structured loan repayments. The expanding financial sector and government initiatives to improve credit accessibility further support this growth.

Growing Middle Class: With a growing middle-income population, more consumers are looking to own private vehicles through financing solutions rather than outright purchases. Over the past five years, Cambodia’s middle-class segment has expanded by 15%, leading to greater demand for auto loans. The availability of flexible financing options with lower interest rates has enabled many first-time car buyers to enter the market.

Digitalization and Financial Inclusion: The rise of digital lending platforms has transformed Cambodia's auto finance market, making loans more accessible and transparent. In 2023, around 45% of auto loan applications were processed online, showcasing a shift towards digital banking solutions. Leading financial institutions have launched mobile apps and online portals to simplify the loan approval process, increasing customer convenience and driving market growth.

Which Industry Challenges Have Impacted the Growth of Cambodia Auto Finance Market?

Limited Credit Access and High Interest Rates: A significant barrier to auto financing in Cambodia is limited access to credit and high interest rates, particularly for lower-income consumers and first-time borrowers. Approximately 40% of potential car buyers face difficulties in securing auto loans due to stringent credit requirements from banks and microfinance institutions. High-interest rates—ranging between 8% and 15% per annum—also discourage consumers from opting for auto financing, restricting overall market growth.

Rising Vehicle Prices and Loan Affordability: The increasing cost of vehicles has made auto loans less affordable for many consumers. Between 2018 and 2023, the average price of new vehicles in Cambodia increased by 25%, leading to higher loan amounts and longer repayment periods. This trend has resulted in a higher loan default rate, with an estimated 8% of auto loans facing repayment issues in 2023, creating concerns for lenders and financial institutions.

Lack of Financial Literacy and Awareness: A significant portion of Cambodia’s population remains unfamiliar with auto financing options, leading to hesitation in taking auto loans. Studies indicate that about 35% of prospective car buyers do not fully understand loan terms, interest rates, or repayment structures, resulting in lower demand for financing services. Financial illiteracy continues to be a major challenge for lenders in expanding their customer base.

What are the Regulations and Initiatives that have Governed the Market?

Central Bank Guidelines on Auto Loans: The National Bank of Cambodia (NBC) has established regulations to ensure responsible lending practices among banks and microfinance institutions. Lenders are required to assess borrowers’ debt-to-income ratios and ensure that auto loans do not exceed 50% of an individual's monthly income. This regulation aims to reduce loan defaults but also limits the ability of lower-income individuals to secure vehicle financing.

Government-Backed Loan Programs: To improve access to vehicle financing, the Cambodian government has partnered with financial institutions to introduce subsidized auto loan programs. These programs offer lower interest rates and extended repayment periods for specific borrower groups, such as public sector employees and first-time car buyers. As a result, auto loan approvals under these programs increased by 18% in 2023, indicating positive growth in financial inclusion.

Digitalization of Auto Loan Services: In response to increasing digital adoption, Cambodia’s financial sector has accelerated the development of digital loan platforms. Many banks and microfinance institutions now offer online loan applications, instant credit scoring, and automated approvals. In 2023, nearly 45% of auto loan applications were processed online, reducing processing times and improving customer convenience.

Cambodia Auto Finance Market Segmentation

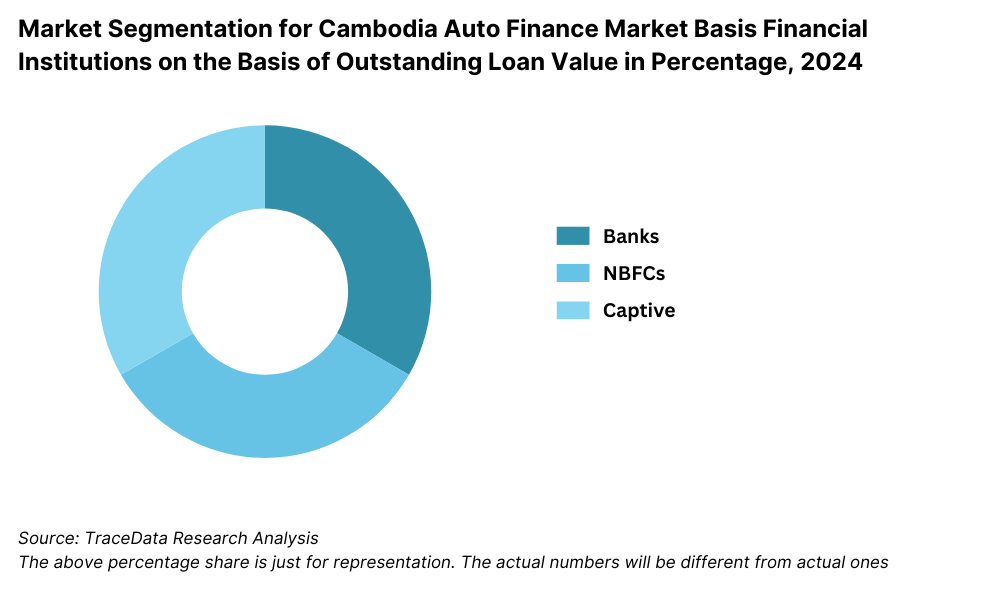

By Market Structure: Banking Institutions dominate the market due to their extensive branch networks, lower interest rates, and trust among consumers. They offer structured loan products, making them the preferred choice for salaried individuals and established businesses. Non-Banking Financial Institutions (NBFIs) hold a significant share by catering to individuals who may not meet the strict credit requirements of banks. These institutions provide more flexible financing solutions, albeit at higher interest rates. Digital Lending Platforms are gaining popularity as consumers shift towards online financial services. These platforms offer quick loan approvals and paperless processing, enhancing accessibility, particularly among younger buyers.

By Loan Providers: Commercial Banks lead the sector, offering competitive interest rates and longer repayment periods. These institutions dominate the financing landscape due to their established reputation and access to financial resources. Microfinance Institutions (MFIs) play a crucial role in providing auto loans to lower-income consumers and small business owners. While their interest rates are higher, they offer more flexible terms that appeal to borrowers who do not qualify for traditional bank loans. Auto Dealership Financing is a growing segment where dealers partner with financial institutions to provide on-the-spot loan approvals.

By Vehicle Type: New Vehicles account for the majority of financed vehicles due to lower risk, better loan terms, and higher resale value. Consumers prefer financing new cars because of attractive interest rates and dealership incentives. Used Vehicles financing is growing, particularly among cost-conscious buyers who seek affordable alternatives. However, these loans often come with higher interest rates and shorter repayment periods due to depreciation concerns.

Competitive Landscape in Cambodia Auto Finance Market

The Cambodia auto finance market is relatively competitive, with a mix of banks, microfinance institutions (MFIs), and digital lending platforms driving loan disbursements. While traditional banks continue to dominate, MFIs and fintech lenders are increasingly capturing market share by offering more flexible and accessible financing options. Key players include ACLEDA Bank, ABA Bank, Sathapana Bank, AMK Microfinance, Wing Bank, and Prince Bank, all of which play a crucial role in providing auto loans across Cambodia.

| Name | Founding Year | Original Headquarters |

|---|---|---|

| ACLEDA Bank Auto Loan | 1993 | Phnom Penh, Cambodia |

| Prasac Microfinance Institution | 1995 | Phnom Penh, Cambodia |

| Hattha Bank (formerly Hattha Kaksekar Microfinance) | 1994 | Phnom Penh, Cambodia |

| AMK Microfinance | 2003 | Phnom Penh, Cambodia |

| Toyota Tsusho Finance Cambodia | 2015 | Phnom Penh, Cambodia |

| Sathapana Bank Auto Loan | 1995 | Phnom Penh, Cambodia |

| Hong Leong Bank Cambodia | 2013 | Kuala Lumpur, Malaysia |

| Wing Bank Cambodia | 2008 | Phnom Penh, Cambodia |

| KB Kookmin Bank Cambodia | 2009 | Seoul, South Korea |

| Canadia Bank Auto Financing | 1991 | Phnom Penh, Cambodia |

Some of the recent competitor trends and key information about competitors include:

ACLEDA Bank: The largest bank in Cambodia, ACLEDA reported a 20% increase in auto loan disbursements in 2023, fueled by its strong nationwide branch network and low-interest loan offerings. The bank’s digitized loan approval process has significantly improved efficiency, reducing approval time by 30%.

ABA Bank: A leading player in the digital banking sector, ABA saw a 25% growth in online auto loan applications in 2023, reflecting the increasing shift towards digital lending solutions. The bank's competitive interest rates and streamlined loan processing have made it a top choice for salaried employees and business owners.

Sathapana Bank: Specializing in personal and auto loans, Sathapana recorded a 15% rise in auto financing in 2023, driven by its targeted lending programs for young professionals. The bank’s partnerships with car dealerships have provided consumers with bundled financing offers, improving affordability.

AMK Microfinance: As a major MFI in Cambodia, AMK saw a 30% increase in auto loan disbursements in rural areas, where traditional banking services are limited. The company's focus on small-scale auto loans has helped low-income customers access vehicle financing despite limited credit history.

Wing Bank: A fast-growing digital financial institution, Wing Bank experienced a 35% rise in mobile-based auto loan applications in 2023. The bank's instant loan processing system and AI-driven credit assessments have enhanced accessibility, particularly for self-employed individuals.

Prince Bank: One of Cambodia's newer financial players, Prince Bank recorded a 12% increase in vehicle loan approvals in 2023, focusing on premium car financing and high-net-worth individuals. The bank's competitive edge lies in customized loan packages tailored to affluent customers.

What Lies Ahead for Cambodia Auto Finance Market?

The Cambodia auto finance market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by rising vehicle demand, increasing urbanization, digital transformation in financial services, and improved credit access for middle-income consumers.

Shift Towards Electric Vehicle (EV) Financing: With the Cambodian government promoting green energy initiatives, demand for electric vehicle loans is expected to increase significantly. Government incentives, including reduced registration fees and tax exemptions, will make EV financing more attractive, encouraging lenders to introduce low-interest loan products tailored for EV buyers.

Expansion of Digital Auto Loan Platforms: The rise of digital banking and fintech solutions will continue transforming the auto finance sector. By 2029, over 60% of auto loans are expected to be processed digitally, thanks to AI-driven loan approvals, instant credit assessments, and paperless documentation. This will improve loan accessibility, particularly for younger and tech-savvy borrowers.

Increased Availability of Flexible Loan Products: Financial institutions are likely to introduce customized loan offerings, such as zero down-payment schemes, extended repayment periods, and salary-based installment plans. These initiatives will cater to a broader consumer base, including self-employed individuals and gig economy workers, making vehicle ownership more affordable.

Growth in Used Car Financing: With the rising cost of new vehicles, used car financing is expected to witness significant growth, particularly among first-time car buyers and cost-conscious consumers. Lenders will adapt by offering lower interest rates and extended loan tenures for certified pre-owned vehicles, making used car purchases more attractive.

Future Outlook and Projections for Cambodia Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Source: TraceData Research Analysis

Cambodia Auto Finance Market Segmentation

- By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Finance Platforms

- Credit Unions

- Peer-to-Peer (P2P) Lending Platforms

- Captive Finance Companies

- Microfinance Institutions

- By Type of Vehicles Financed:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Luxury Vehicles

- Used Vehicles

- By Loan Tenure:

- <3 years

- 3-5 years

- 5-7 years

- 7-9 years

- 9 years

- By Interest Rates:

- Fixed Interest Rate Loans

- Variable Interest Rate Loans

- Zero Interest Loans

- By Region:

- Phnom Penh

- Siem Reap

- Battambang

- Sihanoukville

- Other Provinces

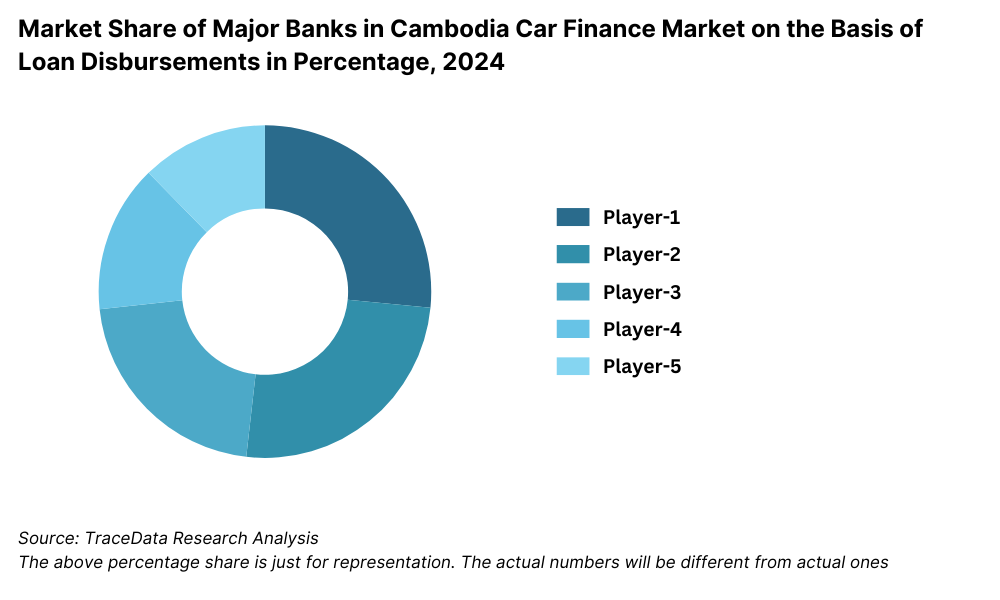

Players Mentioned in the Report (Banks):

- Maybank Cambodia

- CIMB Bank Cambodia

- Phnom Penh Commercial Bank (PPCBank)

- Cambodia Post Bank (CPBank)

- J Trust Royal Bank

- Foreign Trade Bank of Cambodia (FTB)

- SHINHAN Bank Cambodia

- Prince Bank

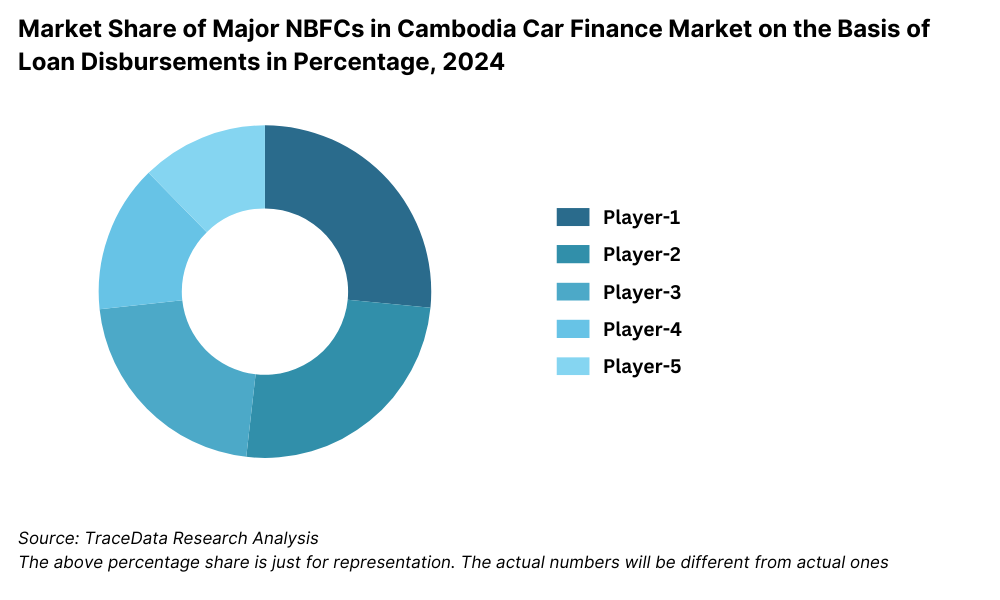

Players Mentioned in the Report (NBFCs):

- AEON Specialized Bank

- Hattha Bank Plc

- JACCS Finance (Cambodia) Plc

- Hong Leong Bank (Cambodia) Plc

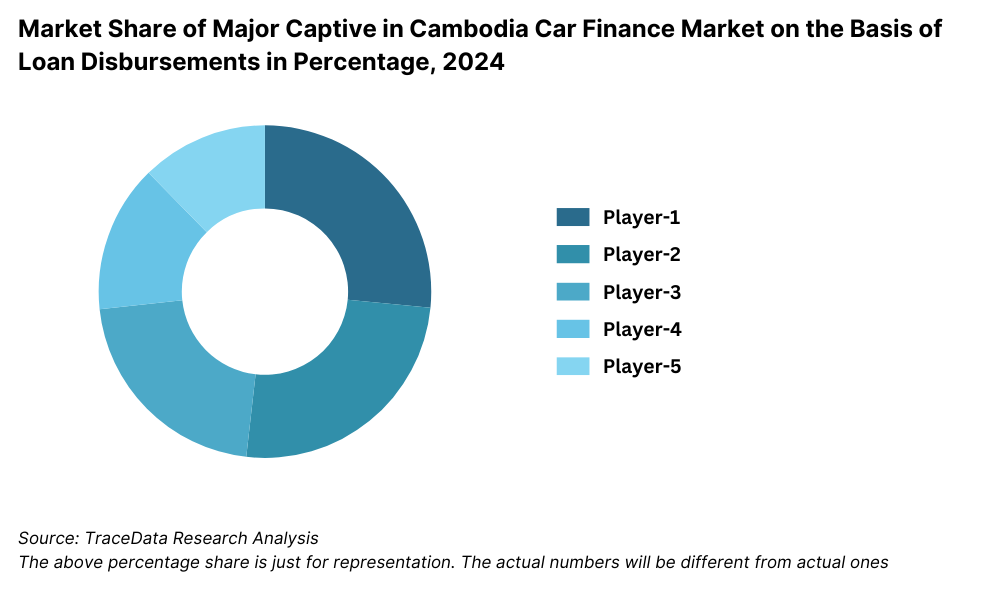

Players Mentioned in the Report (Captive):

- Toyota Financial Services Cambodia

- Mercedes-Benz Financial Services Cambodia

- Ford Credit Cambodia

- Honda Leasing Cambodia

Key Target Audience:

- Commercial Banks and MFIs

- Automotive Financing Companies

- Auto Dealerships

- Digital Lending Platforms

- Regulatory Bodies (e.g., National Bank of Cambodia, Ministry of Economy and Finance)

- Financial Technology Firms

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Cambodia by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Cambodia Car Finance Market

11.2. Growth Drivers for Cambodia Car Finance Market

11.3. SWOT Analysis for Cambodia Car Finance Market

11.4. Issues and Challenges for Cambodia Car Finance Market

11.5. Government Regulations for Cambodia Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Cambodia Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Cambodia Car Finance Market, 2024

17.3. Market Share of Key Captive in Cambodia Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Cambodia Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for Cambodia Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 financial institutions in the country based upon their loan disbursement volume, financial performance, and market presence.

Sourcing is made through industry reports, regulatory documents, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like loan disbursement volume, number of financial institutions, interest rate trends, default rates, and consumer preferences.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and industry publications. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and key stakeholders representing various Cambodia Auto Finance Market companies, financial institutions, and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from industry representatives.

Bottom-to-top approach is undertaken to evaluate loan disbursement volume for each financial institution, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews, wherein we approach each company under the guise of potential borrowers. This approach enables us to validate the loan terms, approval process, interest rates, and financing trends shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide a comprehensive understanding of revenue streams, value chain, process, pricing, and risk assessment methods.

Step 4: Sanity Check

Bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess sanity check process.

Final data validation is performed through multiple sources, ensuring accuracy, reliability, and alignment with market trends.

FAQs

1. What is the potential for the Cambodia Auto Finance Market?

The Cambodia Auto Finance Market is poised for substantial growth, reaching a valuation of USD 4.5 Billion in 2023. This growth is driven by factors such as the increasing demand for vehicle ownership, rising disposable income, and improved access to financial services. The market’s potential is further bolstered by digital lending platforms, which facilitate quicker loan approvals and enhance accessibility for a wider consumer base.

2. Who are the Key Players in the Cambodia Auto Finance Market?

The Cambodia Auto Finance Market features several key players, including ACLEDA Bank, ABA Bank, Sathapana Bank, and AMK Microfinance. These institutions dominate the market due to their extensive loan offerings, large customer base, and digital banking advancements. Other notable players include Wing Bank and Prince Bank, which have leveraged technology-driven solutions to expand their presence in the auto financing sector.

3. What are the Growth Drivers for the Cambodia Auto Finance Market?

The primary growth drivers include economic factors, such as rising disposable income and increasing vehicle ownership, which are making auto loans more essential. The expansion of financial services, combined with the digitalization of banking, also contributes to the growing demand for auto financing in Cambodia. Additionally, government incentives for electric vehicles and the expansion of microfinance institutions have made it easier for consumers to access auto loans, enhancing Cambodia Auto Finance Market growth.

4. What are the Challenges in the Cambodia Auto Finance Market?

The Cambodia Auto Finance Market faces several challenges, including limited credit access and high interest rates, which make it difficult for lower-income consumers to secure financing. Regulatory challenges, such as strict loan approval requirements and increased scrutiny by the National Bank of Cambodia, can slow down loan disbursement. Additionally, economic uncertainties and rising vehicle prices have affected loan affordability, posing significant barriers to market growth.