Canada Auto Finance Market Outlook to 2029

By Market Structure (Bank, NBFCs, Captive), By Type of Vehicle Financed, By New vs. Used, By Region, and By Consumer Demographics

- Product Code: TDR0160

- Region: North America

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Canada Auto Finance Market Outlook to 2029 - By Market Structure (Bank, NBFCs, Captive), By Type of Vehicle Financed, By New vs. Used, By Region, and By Consumer Demographics” provides a comprehensive analysis of the auto finance industry in Canada. This report covers an overview and evolution of the industry, overall market size in terms of loan disbursement and outstanding portfolio, market segmentation, trends and developments, regulatory framework, customer profiling, challenges, and the competitive landscape including cross comparisons, key players’ positioning, opportunities, and bottlenecks. The report concludes with forward-looking projections up to 2029 based on disbursement value, market structure, vehicle type, region, and successful strategies by market leaders.

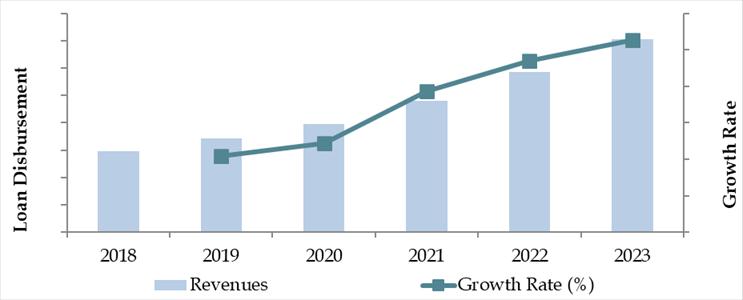

Canada Auto Finance Market Overview and Size

The Canadian auto finance market reached a valuation of CAD 145 Billion in outstanding auto loans as of 2023, driven by high private vehicle ownership, rising demand for vehicle financing, and evolving digital lending solutions. Prominent players include TD Auto Finance, Scotiabank, RBC Royal Bank, Ford Credit Canada, Honda Financial Services, and Carfinco, each offering varied financing options across new and used vehicles.

In 2023, digital transformation initiatives such as instant loan approvals, AI-based credit scoring, and end-to-end digital journeys became key differentiators in the Canadian auto finance space. Urban centers like Toronto, Vancouver, and Calgary are dominant contributors owing to higher new car sales, better internet penetration, and a robust auto dealership ecosystem.

Market Size for Canada Auto Finance Industry on the Basis of Credit Disbursed in USD Billion, 2018-2023

What Factors are Leading to the Growth of Canada Auto Finance Market:

Rising Vehicle Ownership Costs: The rising prices of new vehicles and limited public transportation options in suburban and rural Canada have increased the demand for financing solutions. In 2023, around 82% of vehicle purchases were financed, showcasing the integral role of auto finance in enabling car ownership.

Increasing Penetration of Used Car Financing: Used car financing is becoming increasingly prevalent, especially among millennials and Gen Z buyers. In 2023, financing penetration for used vehicles crossed 52%, owing to greater trust in certified pre-owned programs and favorable used car inventory conditions.

Government Incentives and EV Financing: Federal and provincial programs like the iZEV program and Clean BC Go Electric are providing subsidies and financing incentives for EV purchases. This has boosted financing for electric vehicles, with EV loan volumes growing by 28% YoY in 2023.

Which Industry Challenges Have Impacted the Growth for Canada Auto Finance Market

Interest Rate Volatility: The tightening monetary policy by the Bank of Canada led to increased borrowing costs in 2022 and 2023. As a result, the average auto loan interest rate rose from 5.3% in 2021 to 6.2% in 2023. This shift has discouraged some consumers from financing vehicles, especially within the subprime segment, where rates can exceed 9%.

Subprime Credit Risk and Loan Defaults: Subprime borrowers in Canada face restricted access to credit due to heightened risk aversion by lenders. As of 2023, subprime auto loans represented just 14% of total disbursements, a drop from 18% in 2020. Lenders are increasingly cautious, driven by rising delinquencies in certain provinces, especially in Alberta and Newfoundland.

Supply Chain Disruptions and Vehicle Inventory Shortage: Ongoing global semiconductor shortages and production lags in the automotive sector have affected new vehicle availability. This has led to higher vehicle prices and delays, thereby affecting loan processing volumes for new cars. Many lenders have shifted focus to used vehicle financing to mitigate this slowdown.

What are the Regulations and Initiatives which have Governed the Market:

Federal Oversight through OSFI and Provincial Regulators: The Office of the Superintendent of Financial Institutions (OSFI) ensures financial soundness among federally regulated lenders. Provinces also enforce consumer protection acts that regulate loan disclosures, interest caps, and default policies. As of 2023, over 90% of auto loan contracts are compliant with fair lending disclosures, ensuring transparency for consumers.

Consumer Credit Reporting Reforms: Amendments in credit reporting practices by Equifax and TransUnion have enhanced borrower profiling, especially around payment history for auto loans. These changes, implemented in 2022, have improved credit access for near-prime borrowers, especially in Ontario and British Columbia.

Green Vehicle Incentives Linked to Financing: Canada’s Incentives for Zero-Emission Vehicles (iZEV) program has stimulated auto loan activity for EVs. In 2023, over CAD 600 million worth of EV loans were disbursed, supported by rebates up to CAD 5,000 and low-interest financing schemes. Lenders are increasingly aligning offerings with the government’s zero-emission goals, which mandate 100% EV sales by 2035.

Canada Auto Finance Market Segmentation

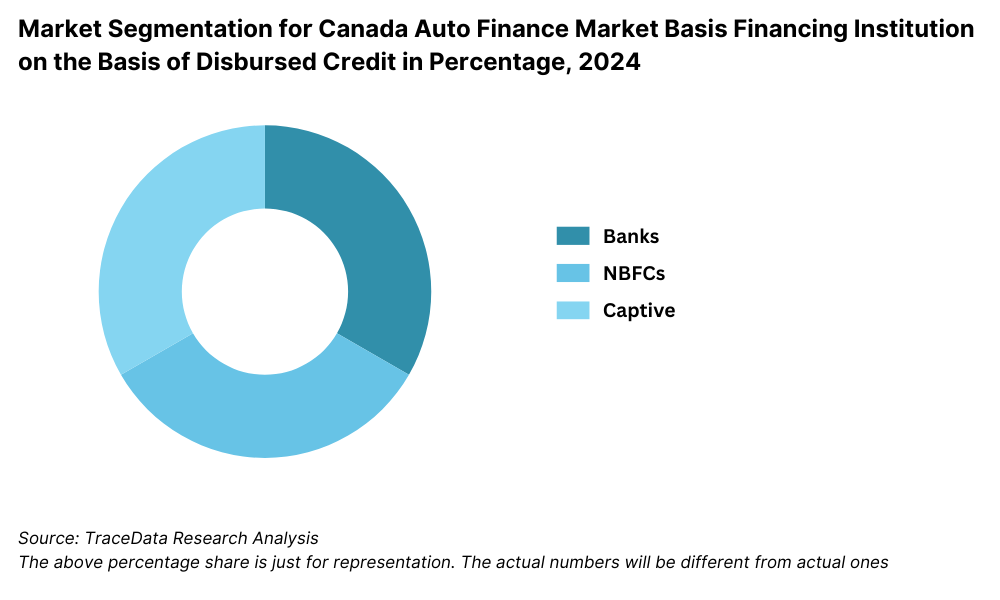

By Market Structure: Banks dominate the Canadian auto finance market owing to their widespread branch network, strong customer trust, and competitive interest rates. Major banks such as TD, Scotiabank, and RBC offer pre-approved loans, bundled banking products, and superior underwriting capabilities, making them the first choice for most prime customers. Captive finance companies hold a significant share, especially in new vehicle financing, as they provide customized loan offers, promotional interest rates, and loyalty programs through automakers like Toyota, Ford, and Honda. NBFCs and alternative lenders play a crucial role in financing used vehicles and subprime segments where traditional banks are cautious.

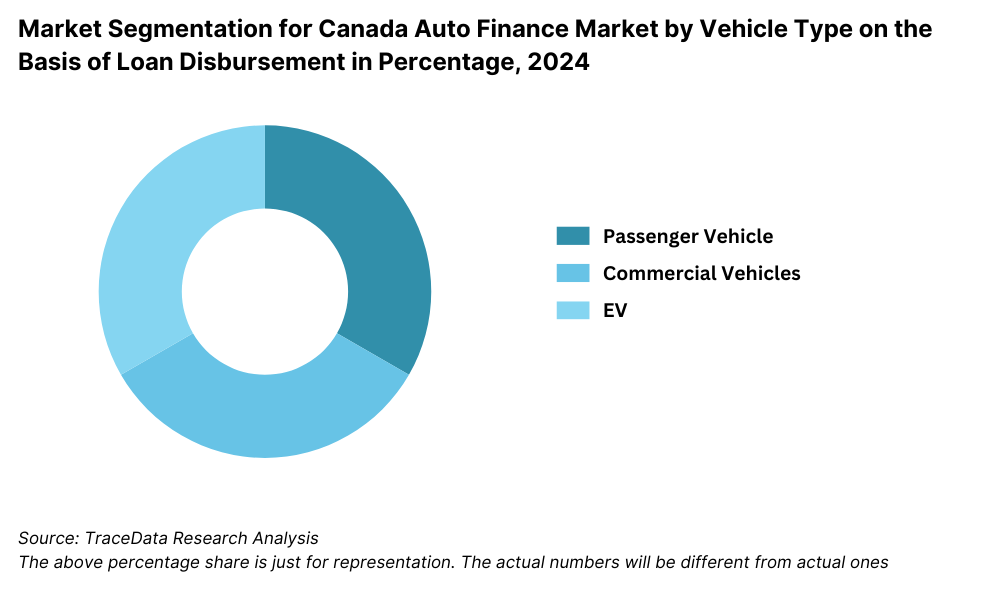

By Vehicle Type: New vehicles continue to account for the majority of auto finance disbursements, largely due to promotions, extended warranties, and low APRs offered by OEMs and their captives. However, used vehicle financing is on the rise, driven by price-conscious buyers, improved reconditioning standards, and digital marketplaces. In 2023, the used vehicle finance segment witnessed strong momentum in Quebec and Alberta, especially among first-time car buyers.

By Loan Tenure: Longer loan tenures (61–84 months) are preferred by Canadian consumers to keep monthly payments lower amidst rising vehicle prices. In 2023, nearly 68% of financed vehicles had loan durations above 60 months. This shift has also been supported by lenders who are willing to extend terms without significantly increasing interest rates, particularly for prime borrowers.

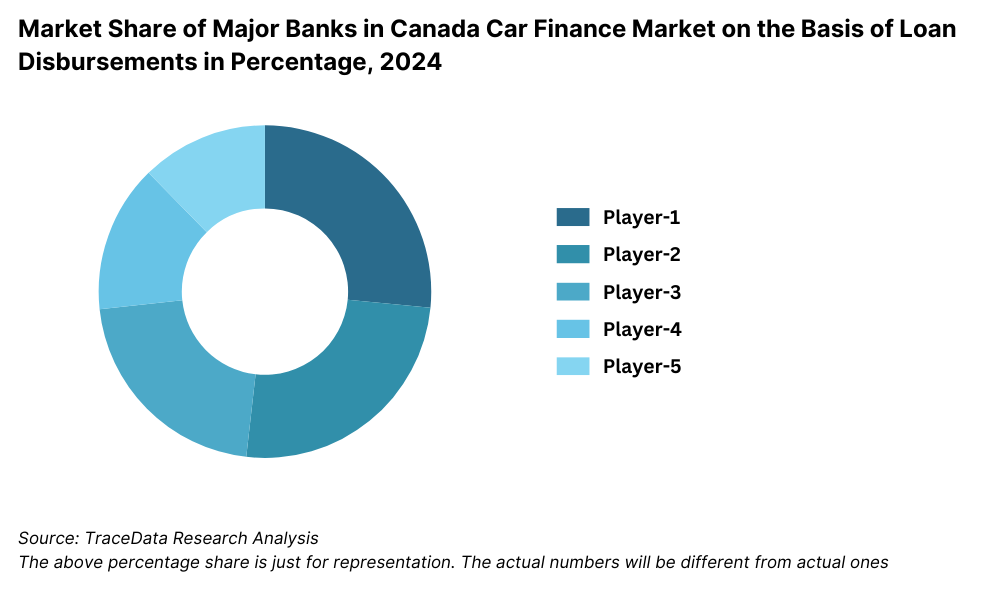

Competitive Landscape in Canada Auto Finance Market

The Canada auto finance market is moderately concentrated, with a mix of major national banks, captive finance companies, and specialized non-bank lenders (NBFCs). In recent years, the growth of online lending platforms and digital financing intermediaries such as Canada Drives, Clutch, and CarDoor has added diversity and accessibility to the market, enhancing customer experience and expanding reach, particularly in the used vehicle segment.

| Company Name | Founding Year | Original Headquarters |

| TD Auto Finance | 1955 | Toronto, Ontario |

| RBC Royal Bank | 1864 | Halifax, Nova Scotia |

| Scotiabank | 1832 | Halifax, Nova Scotia |

| BMO Bank of Montreal | 1817 | Montreal, Quebec |

| Ally Financial | 1919 | Detroit, Michigan, USA |

| Canada Drives | 2010 | Vancouver, British Columbia |

| AutoCapital Canada | 2012 | Toronto, Ontario |

| Honda Canada Finance Inc. | 1987 | Markham, Ontario |

| Hyundai Capital Canada | 2014 | Toronto, Ontario |

| Equirex Leasing Corp. | 1996 | Oakville, Ontario |

Some of the recent competitor trends and key information about competitors include:

TD Auto Finance: One of the top auto lenders in Canada, TD reported a strong growth in digital loan applications, with over 60% of its applications being processed digitally in 2023. The bank has focused on integrating auto finance services with its core banking platforms to increase cross-selling opportunities and retention.

Scotiabank Auto Finance: Known for its extensive dealership network partnerships, Scotiabank expanded its auto finance portfolio by 8.5% in 2023, backed by strong disbursement in Ontario and British Columbia. It remains a key player in the new vehicle finance space, especially for prime borrowers.

Ford Credit Canada: The captive arm of Ford has seen increasing traction in financing for electric and hybrid models, offering low APR promotional rates for EVs. In 2023, Ford Credit financed nearly 30% of all Ford-branded vehicle sales in Canada.

Honda Financial Services: In 2023, Honda Financial Services introduced flexible leasing programs for certified pre-owned vehicles, which helped increase their used car finance penetration by 12% year-on-year.

Canada Drives: As a leading digital platform for end-to-end car buying and financing, Canada Drives experienced a 25% increase in financed transactions in 2023, especially for used cars. Their ability to pre-qualify customers online and deliver vehicles to their doorstep has made them highly popular among younger consumers.

What Lies Ahead for Canada Auto Finance Market?

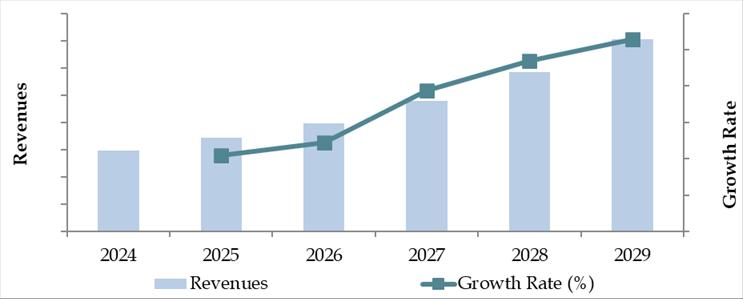

The Canada auto finance market is projected to grow steadily through 2029, with a moderate yet stable CAGR driven by increasing vehicle ownership needs, rising demand for flexible financing options, and the acceleration of digital lending channels. While the market will face economic uncertainties, innovation and structural evolution in lending practices are expected to sustain growth momentum.

Acceleration in EV Financing: As Canada progresses toward its target of 100% zero-emission vehicle sales by 2035, the financing of electric vehicles is set to rise significantly. Financial institutions and captives are expected to roll out green auto loan products with lower interest rates, deferred EMIs, and bundled insurance to encourage EV adoption. Provinces like British Columbia and Quebec will likely lead this shift.

Rise of AI-Powered Loan Underwriting: The integration of AI and machine learning into credit assessment and loan underwriting is expected to improve approval speed and reduce fraud risk. By 2029, over 60% of auto loans may be processed using AI-based decisioning engines, allowing lenders to expand access to near-prime and underserved borrowers.

Expansion of Digital-First Lenders: Digital lending platforms such as Canada Drives, Clutch, and CarDoor are projected to increase their market share, especially in the used car finance segment. These platforms are expected to account for 25% of total used car loan disbursements by 2029, driven by consumer preference for convenience, transparency, and end-to-end online journeys.

Increased Penetration in Rural and Underserved Markets: Auto finance providers are expected to strengthen their outreach in rural regions and smaller provinces through mobile loan origination, localized partnerships with dealerships, and remote documentation tools. This will help unlock untapped demand and drive geographic expansion.

Future Outlook and Projections for Canada Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Canada Auto Finance Market Segmentation

• By Market Structure:

o Banks (e.g., TD, Scotiabank, RBC)

o Captive Finance Companies (e.g., Ford Credit, Toyota Financial Services, Honda Financial Services)

o Non-Banking Financial Companies (e.g., Carfinco, iA Auto Finance)

o Digital-First Fintech Lenders (e.g., Canada Drives, Clutch, CarDoor)

o Credit Unions and Cooperative Lenders

o Peer-to-Peer Auto Lending Platforms

• By Type of Vehicle Financed:

o New Passenger Vehicles

o Used Passenger Vehicles

o Light Commercial Vehicles

o Electric Vehicles (EVs)

o Hybrid Vehicles

o Luxury and Premium Vehicles

• By Loan Tenure:

o Less than 36 Months

o 37–60 Months

o 61–72 Months

o 73–84 Months

o 85+ Months

• By Consumer Segment:

o Prime Borrowers (Credit Score >700)

o Near-Prime Borrowers (Credit Score 600–699)

o Subprime Borrowers (Credit Score <600)

o First-Time Vehicle Owners

o Immigrant and New-to-Credit Consumers

• By Age of Consumer:

o 18–24 Years

o 25–34 Years

o 35–44 Years

o 45–54 Years

o 55+ Years

• By Province / Region:

o Ontario

o Quebec

o British Columbia

o Alberta

o Saskatchewan & Manitoba

o Atlantic Canada (Nova Scotia, New Brunswick, PEI, Newfoundland & Labrador)

o Northern Territories (Yukon, NWT, Nunavut)

Players Mentioned in the Report (Banks):

- Royal Bank of Canada (RBC)

- Toronto-Dominion Bank (TD Canada Trust)

- Bank of Nova Scotia (Scotiabank)

- Bank of Montreal (BMO)

- Canadian Imperial Bank of Commerce (CIBC)

- National Bank of Canada

- Laurentian Bank of Canada

- Canadian Western Bank

- ATB Financial

Players Mentioned in the Report (NBFCs):

- Mogo

- Clearco

- Ledn

- ZayZoon

- Flexiti

- Financeit

- FundThrough

- Pine

- Axis Auto Finance

- AutoCapital Canada

- Canada Drives

- Carfinco

- iA Auto Finance

- Carma Auto Finance

Players Mentioned in the Report (Captive):

- Ford Credit Canada

- GM Financial Canada

- Toyota Credit Canada

- Honda Canada Finance

- BMW Financial Services Canada

- Mercedes-Benz Financial Services Canada

- Volkswagen Credit Canada

- Hyundai Capital Canada

- Kia Finance Canada

- Nissan Canada Finance

- Subaru Financial Services Canada

- John Deere Financial Canada

- PACCAR Financial Canada

Key Target Audience:

• Auto Finance Providers (Banks, NBFCs, Captives)

• Digital Auto Lending Platforms

• Automotive Dealership Groups

• Vehicle Manufacturers (OEMs)

• Credit Bureaus and Scoring Agencies

• Regulatory Bodies (e.g., OSFI, FCAC, Provincial Regulators)

• Research and Financial Consultancy Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Canada by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Canada Car Finance Market

11.2. Growth Drivers for Canada Car Finance Market

11.3. SWOT Analysis for Canada Car Finance Market

11.4. Issues and Challenges for Canada Car Finance Market

11.5. Government Regulations for Canada Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Canada Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Canada Car Finance Market, 2024

17.3. Market Share of Key Captive in Canada Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Canada Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Canada Auto Finance Market. This includes banks, captive finance companies, NBFCs, credit unions, fintech lenders, auto dealerships, and consumers.

Basis this ecosystem, we shortlist 5–6 leading financing entities in the country based on parameters such as loan disbursement volume, outstanding portfolio, client base, and regional presence.

Sourcing is conducted through industry reports, regulatory filings, government publications (e.g., OSFI, FCAC), news articles, and proprietary databases to collate macro-level and entity-level information.

Step 2: Desk Research

An extensive desk research phase is carried out by referencing secondary and proprietary databases. This helps build a foundational understanding of market size, segmentation, penetration, loan rates, credit profiles, and competitive landscape.

We analyze company-level data from annual reports, investor presentations, product brochures, digital lending case studies, and provincial market bulletins.

This step also involves benchmarking Canada’s auto finance trends with peer markets to identify best practices, structural nuances, and regulatory influences.

Step 3: Primary Research

We conduct in-depth interviews with senior executives, credit heads, and sales leaders across banks, NBFCs, auto dealerships, and digital lenders operating in the Canada Auto Finance Market. The objective is to validate desk research findings, authenticate quantitative estimates, and gather on-ground insights on market challenges, channel dynamics, and emerging trends.

Primary interviews include conversations with consumer-facing personnel and dealership financing staff to understand commission models, penetration rates, and buyer behavior patterns.

Disguised interviews are also carried out in which analysts pose as prospective borrowers to verify financing terms, interest structures, documentation processes, and turnaround times quoted in formal channels.

Step 4: Sanity Check

A comprehensive bottom-up and top-down analysis is undertaken to model the total addressable auto finance market in Canada.

Loan disbursement estimates are cross-validated using dealership sales data, vehicle registration statistics, and consumer credit penetration benchmarks.

An iterative triangulation approach is applied to ensure data consistency, identify outliers, and finalize projections for the forecast period 2024–2029.

FAQs

1. What is the potential for the Canada Auto Finance Market?

The Canada Auto Finance Market holds strong growth potential, with total outstanding auto loans reaching approximately CAD 145 Billion in 2023. This growth is being driven by a high level of vehicle ownership, evolving consumer preferences for flexible financing options, and the increasing digitization of the loan process. The market is expected to continue expanding steadily through 2029, supported by innovation in lending technologies and the rise in electric vehicle financing.

2. Who are the Key Players in the Canada Auto Finance Market?

Key players in the market include TD Auto Finance, Scotiabank Auto Finance, RBC Auto Finance, Ford Credit Canada, and Honda Financial Services. In the digital lending space, Canada Drives, Clutch, and CarDoor are rapidly gaining market share, particularly in the used vehicle financing segment. These players dominate through their strong financial backing, wide dealership networks, and customer-centric offerings.

3. What are the Growth Drivers for the Canada Auto Finance Market?

Primary growth drivers include increased vehicle prices, prompting more consumers to opt for financing, and the rising popularity of digital lending platforms, which offer convenience and transparency. Government incentives for electric vehicle financing, along with AI-powered credit scoring and loan approvals, are also enabling faster and broader access to credit. Additionally, the growing number of first-time buyers and newcomers to Canada contributes to the market’s expansion.

4. What are the Challenges in the Canada Auto Finance Market?

The market faces several challenges, including rising interest rates, which have made borrowing more expensive since 2022. Limited credit access for subprime borrowers and increased delinquency risks in certain regions also pose concerns. Additionally, inventory shortages of new vehicles due to global supply chain issues have impacted the volume of loan originations. Regulatory compliance and the need for tighter underwriting standards also challenge lenders aiming to expand aggressively.