Denmark Auto Finance Market Outlook to 2029

By Loan Tenure, By Type of Vehicle Financed (New vs. Used), By Lender Type (Banks, NBFCs, OEMs, Online Platforms), By Consumer Age Group, and By Region

- Product Code: TDR0164

- Region: Europe

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Denmark Auto Finance Market Outlook to 2029 – By Loan Tenure, By Type of Vehicle Financed (New vs. Used), By Lender Type (Banks, NBFCs, OEMs, Online Platforms), By Consumer Age Group, and By Region” provides a comprehensive analysis of the auto finance market in Denmark. The report covers an overview and genesis of the industry, overall market size in terms of credit disbursed, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on credit disbursed, by type of vehicle, lender, consumer profile, region, cause and effect relationship, and success case studies highlighting major opportunities and cautions.

Denmark Auto Finance Market Overview and Size

The Denmark auto finance market reached a valuation of DKK 45 Billion in 2023, driven by growing car ownership, strong digital infrastructure, and increasing adoption of electric vehicles (EVs). The market features prominent players such as Santander Consumer Bank, Nordea Finance, AL Finans, Resurs Bank, and Toyota Financial Services. These companies have established a robust presence through competitive financing rates, digital loan application platforms, and customized offerings for new and used vehicles.

In 2023, Santander Consumer Bank introduced an AI-powered loan approval system, reducing application-to-disbursement time by over 40%. Copenhagen and Aarhus emerged as key financing hubs, supported by higher urban car ownership and a growing preference for EVs, incentivized by government subsidies.

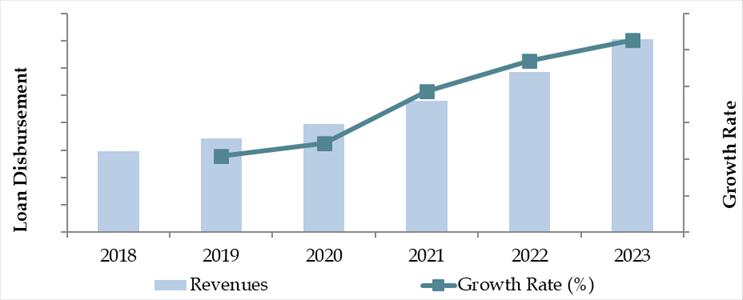

Market Size for Denmark Auto Finance Industry on the Basis of Loan Disbursed, 2018–2023

What Factors are Leading to the Growth of Denmark Auto Finance Market:

Green Transition & EV Incentives: Denmark’s strong push towards electrification is driving vehicle sales, particularly EVs, which comprised 38% of new car sales in 2023. Government subsidies and tax incentives for EVs have led to increased demand for financing, as consumers seek structured loan solutions to purchase higher-priced electric vehicles.

High Car Ownership Costs: With high upfront costs and taxes associated with car purchases in Denmark, financing solutions offer an attractive way for consumers to manage expenses. In 2023, over 70% of vehicle purchases were supported by some form of auto financing, highlighting the market’s maturity and financial prudence among Danish consumers.

Digital Transformation: The digitization of auto finance has accelerated due to advanced fintech integrations. Nearly 55% of all auto loan applications in Denmark were submitted online in 2023. Lenders are leveraging AI, open banking APIs, and digital ID verification systems to streamline approvals and personalize loan terms.

Which Industry Challenges Have Impacted the Growth for Denmark Auto Finance Market

Stringent Credit Assessment & Approval Process: Danish financial institutions follow conservative lending practices, which often result in prolonged credit approval times and high rejection rates for applicants with low or unstable incomes. In 2023, nearly 28% of auto loan applications were declined due to insufficient credit scores or lack of proper documentation, limiting access for younger or freelance workers.

High Vehicle Taxes & Registration Fees: Despite financing availability, Denmark’s high vehicle registration taxes (often up to 150% of the car’s base price) significantly inflate the cost of car ownership. This dissuades potential buyers from seeking loans, especially for new or luxury vehicles, creating a bottleneck for market expansion in high-ticket segments.

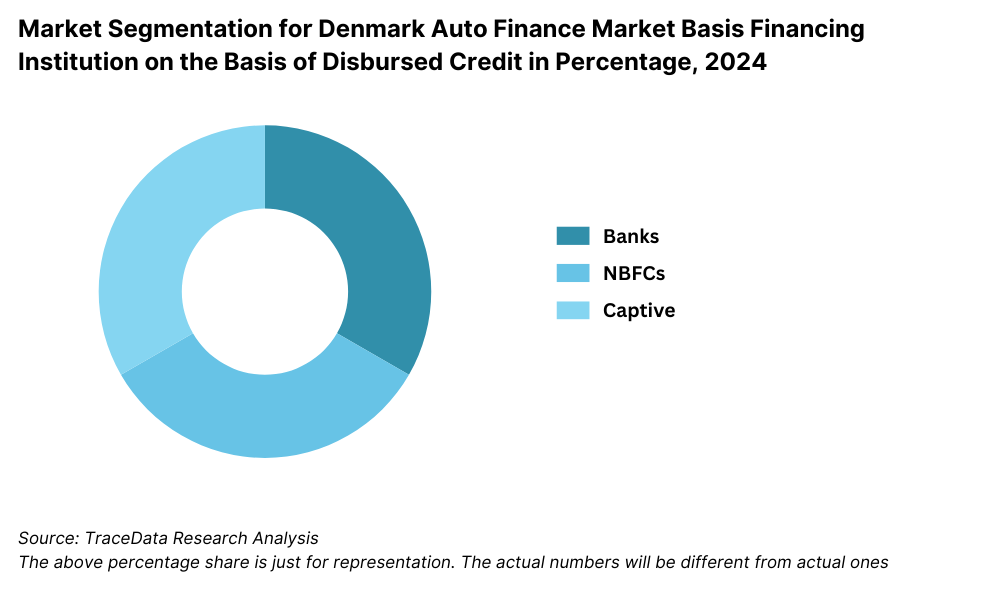

Limited Penetration of Non-Banking Financial Companies (NBFCs): Unlike some European markets, NBFCs have a relatively minor footprint in Denmark’s auto finance landscape. In 2023, they accounted for less than 10% of total auto loans, limiting competitive pressure and consumer options. The dominance of traditional banks may restrict product innovation and flexibility in loan structures.

What are the Regulations and Initiatives which have Governed the Market

Green Tax Reform: As part of Denmark’s climate strategy, a new tax scheme implemented in 2021 favors electric and plug-in hybrid vehicles. Auto loans for EVs are often bundled with green incentives, such as lower interest rates or longer repayment terms, to encourage environmentally friendly car financing. By 2023, this policy helped EVs account for 47% of newly financed vehicles.

Digital Identity & Open Banking Compliance: Denmark enforces strict digital identity verification (NemID/MitID) and PSD2-based open banking regulations, which streamline and secure digital lending processes. These tools have made it easier for lenders to assess consumer creditworthiness in real-time, reducing fraud and improving loan origination speeds.

Consumer Credit Act & Transparency Rules: The Danish Consumer Credit Act mandates full transparency in lending terms, including APR disclosure, prepayment rights, and standardized loan contracts. This regulatory framework boosts borrower confidence and protects consumers from predatory lending practices. In 2023, consumer satisfaction with auto financing agreements rose to 85%, as reported by the Danish Competition and Consumer Authority.

Denmark Auto Finance Market Segmentation

By Loan Tenure: The majority of consumers in Denmark prefer loan tenures of 36 to 60 months, as they provide a balance between manageable monthly payments and interest accumulation. Shorter tenures (12–24 months) are more common among higher-income individuals purchasing compact or electric vehicles, seeking faster loan clearance and interest savings. Longer tenures (above 60 months) are typically chosen for more expensive vehicles or by buyers opting for flexible lease-to-own arrangements.

By Type of Vehicle Financed: New vehicles dominate the financing landscape, making up a majority share due to the strong push toward electric vehicles (EVs) supported by government incentives. However, financing for used vehicles is rapidly growing, particularly among young consumers and those in rural regions seeking affordability. In 2023, used vehicle financing grew by 12% YoY, driven by price sensitivity and broader lender acceptance.

By Lender Type: Traditional banks such as Nordea and Danske Bank dominate the market due to trust, established loan processing infrastructure, and competitive rates. OEM finance arms, including Toyota Financial Services and VW Financial Services, are gaining traction by bundling vehicle and loan offers with promotions and servicing packages. Online lending platforms are emerging players, popular among tech-savvy consumers seeking fast approvals and fully digital loan journeys.

Competitive Landscape in Denmark Auto Finance Market

The Denmark auto finance market is moderately consolidated, with a few major banks and OEM-backed financial institutions leading the sector. However, the rise of digital lenders and fintech-driven platforms has started to reshape the competitive dynamics, offering faster approval processes, flexible loan structures, and digital-first experiences. Key players include Santander Consumer Bank, Nordea Finance, AL Finans, Resurs Bank, Toyota Financial Services, and Basisbank.

| Company Name | Founding Year | Original Headquarters |

| Santander Consumer Bank AS | 1857 | Santander, Spain |

| Volkswagen Semler Finans DK | 2021 | Brøndby, Denmark |

| CA Auto Finance Danmark A/S | 1925 | Turin, Italy |

| Nordania Leasing | 1985 | Copenhagen, Denmark |

| Ayvens (ALD Automotive/LeasePlan) | 1963 | Paris, France / Amsterdam, Netherlands |

| Blue Finance Denmark | 2018 | Aarhus, Denmark |

| Bondora Denmark | 2008 | Tallinn, Estonia |

| Sun Finance | 2017 | Riga, Latvia |

| Deutsche Leasing (via DNB Finans) | 1962 | Bad Homburg, Germany |

| DLL Group | 1969 | Eindhoven, Netherlands |

| Toyota Financial Services | 1982 | Nagoya, Japan |

| Resurs Bank | 2001 | Helsingborg, Sweden |

| Nykredit | 1985 | Copenhagen, Denmark |

Some of the recent competitor trends and key information about competitors include:

Santander Consumer Bank: One of the largest players in Denmark’s auto financing market, Santander recorded a 13% increase in auto loan originations in 2023. The bank’s AI-based credit assessment tools and green loan options for EVs have strengthened its position among environmentally conscious borrowers.

Nordea Finance: Known for its personalized financing packages, Nordea Finance reported a 10% rise in new car financing in 2023, especially among corporate and fleet buyers. Their strong integration with dealership networks enhances customer experience with fast-tracked approvals.

AL Finans: A subsidiary of the Alm. Brand Group, AL Finans specializes in flexible financing for both private and business customers. The company introduced subscription-based vehicle financing models in 2023, aimed at younger drivers and short-term users.

Resurs Bank: Operating across the Nordic region, Resurs Bank has been expanding its digital lending footprint in Denmark. In 2023, online loan applications made up 70% of its total auto finance requests, reflecting its digital-forward strategy.

Toyota Financial Services: With a focus on promoting hybrid and electric vehicles, Toyota Financial Services has bundled low-interest loans with maintenance packages. In 2023, nearly 40% of financed Toyota cars in Denmark were EVs or hybrids, largely driven by dealership-led campaigns.

Basisbank: A challenger bank in the Danish finance space, Basisbank provides competitive auto loan offerings primarily through digital channels. In 2023, the bank saw a 22% growth in used car loan financing, fueled by rapid online onboarding and instant credit checks.

What Lies Ahead for Denmark Auto Finance Market?

The Denmark auto finance market is projected to experience steady and sustainable growth through 2029, supported by the country’s transition to electric mobility, digital innovation in financial services, and increasing consumer demand for flexible financing models. The market is expected to register a moderate CAGR during the forecast period, driven by policy support, evolving consumer preferences, and advancements in fintech.

Acceleration of Electric Vehicle Financing: As Denmark advances toward its goal of phasing out fossil-fueled car sales by 2030, the financing of electric vehicles is set to become a major growth driver. Loan packages tailored specifically for EVs, featuring lower interest rates, tax benefits, and bundled charging solutions, will likely gain traction among both private and corporate buyers.

Expansion of Digital Lending Platforms: The integration of AI, machine learning, and open banking APIs is expected to redefine loan underwriting and customer experience. By 2029, a significant portion of auto financing is anticipated to occur entirely online, with automated credit scoring and real-time loan offers becoming the norm.

Rise of Flexible Financing Models: Subscription-based ownership models, lease-to-own schemes, and short-term financing options are likely to see rising adoption, particularly among younger consumers and urban residents who prefer flexibility over traditional ownership. This shift will push lenders to diversify their offerings and incorporate more customer-centric financing plans.

Increased Competition from Fintechs: The market will likely witness greater competition from digital-first fintech players, offering faster approvals and personalized interest rates based on real-time data. These entrants are expected to drive innovation in credit scoring, customer onboarding, and payment management, challenging the dominance of traditional banks.

Future Outlook and Projections for Denmark Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Denmark Auto Finance Market Segmentation

- By Loan Tenure:

o 12–24 Months

o 25–36 Months

o 37–60 Months

o 60+ Months - By Type of Vehicle Financed:

o New Vehicles

o Used Vehicles

o Electric Vehicles (EVs)

o Plug-in Hybrid Electric Vehicles (PHEVs)

o Luxury Cars

o Commercial Vehicles - By Lender Type:

o Traditional Banks

o Non-Banking Financial Companies (NBFCs)

o Online Lending Platforms

o OEM Captive Finance Arms

o Leasing & Subscription Providers - By Consumer Age Group:

o 18–24

o 25–34

o 35–44

o 45–60

o 60+ - By Region:

o Copenhagen

o Aarhus

o Odense

o Aalborg

o Rest of Denmark

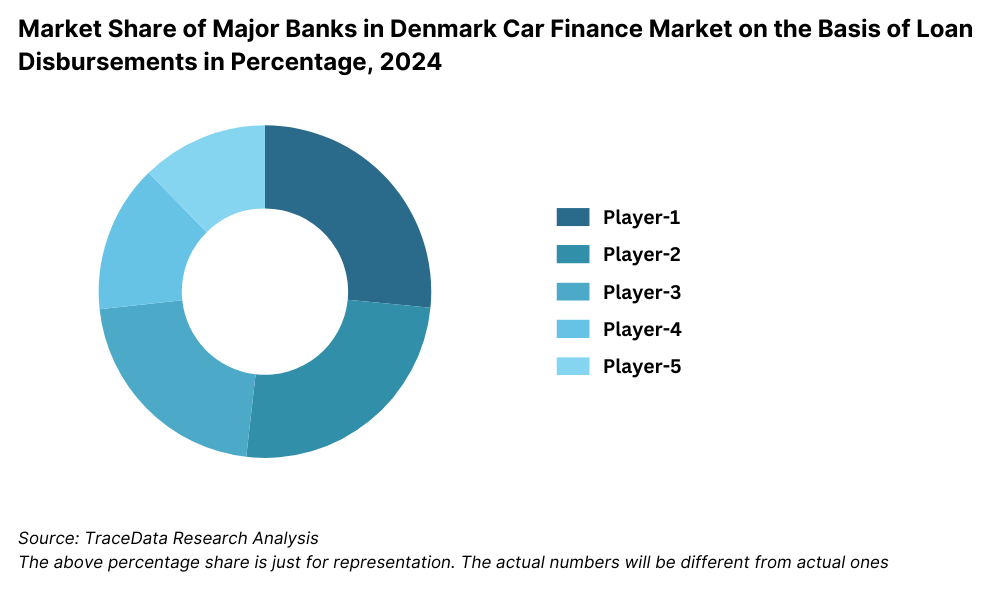

Players Mentioned in the Report (Banks):

- Danske Bank

- Jyske Bank

- Nordea Bank Danmark

- Sydbank

- Spar Nord Bank

- Arbejdernes Landsbank

- Nykredit Bank

- DLR Kredit

- Saxo Bank

- Ringkjøbing Landbobank

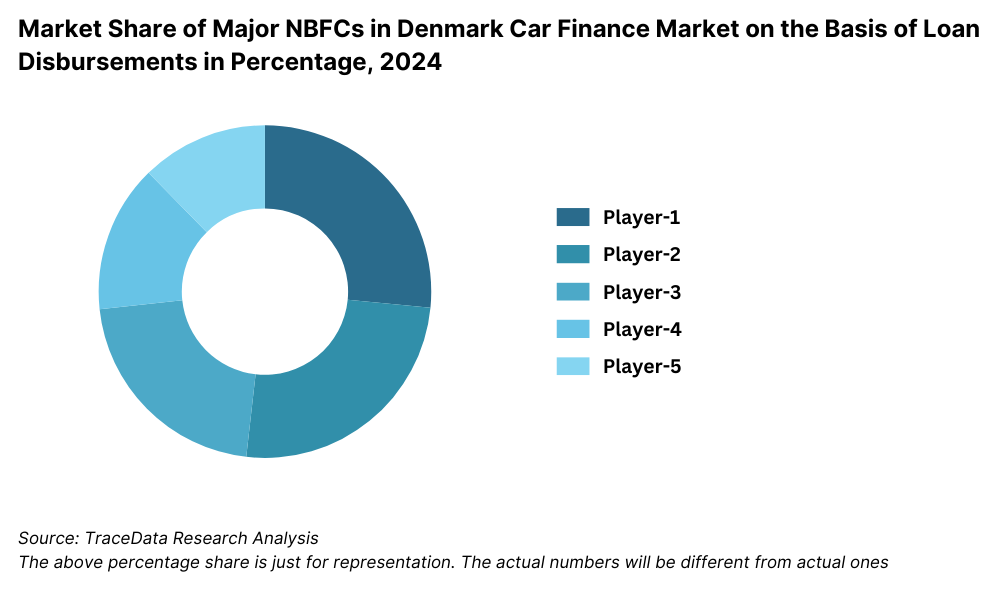

Players Mentioned in the Report (NBFCs):

- · Basisbank

- · Facit Bank

- · Resurs Bank

- · Bank Norwegian

- · Lendo

- · Digi Finans

- · Mybanker

- · GoLoan

- · Ferratum

- · Acceptlån

Players Mentioned in the Report (Captive):

- · Volkswagen Financial Services Denmark

- · Toyota Financial Services Denmark

- · BMW Financial Services Denmark

- · Mercedes-Benz Financial Services Denmark

- · Ford Credit Denmark

- · Hyundai Capital Denmark

- · Nissan Finance Denmark

- · Stellantis Financial Services Denmark

Key Target Audience

- Automotive Finance Companies

- Traditional and Digital Banks

- OEM-Linked Financing Institutions

- Fintech Auto Loan Providers

- Regulatory Authorities (e.g., Danish Financial Supervisory Authority)

- Automobile Dealership Networks

- Research and Economic Policy Institutions

Time Period

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Denmark by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Denmark Car Finance Market

11.2. Growth Drivers for Denmark Car Finance Market

11.3. SWOT Analysis for Denmark Car Finance Market

11.4. Issues and Challenges for Denmark Car Finance Market

11.5. Government Regulations for Denmark Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Denmark Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Denmark Car Finance Market, 2024

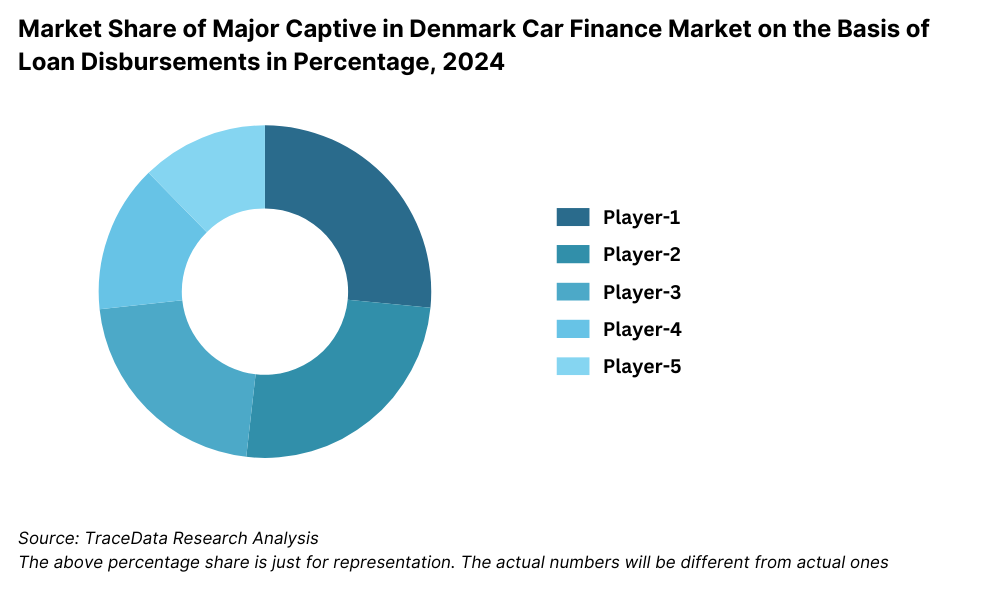

17.3. Market Share of Key Captive in Denmark Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Denmark Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Denmark Auto Finance Market. Based on this ecosystem, we shortlist leading 5–6 financial institutions and OEM-backed finance providers in the country using parameters such as loan disbursal volumes, market penetration, digital infrastructure, and product offerings.

Sourcing is conducted through industry articles, multiple secondary and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables a thorough analysis of the market, aggregating key industry-level insights. We delve into variables such as annual credit disbursals, market segmentation, loan tenures, consumer behavior trends, and competitive dynamics.

This is supplemented with detailed examinations of company-level data, leveraging sources such as investor presentations, press releases, annual reports, and financial filings. The objective is to construct a robust foundational understanding of the Denmark auto finance landscape and the financial institutions operating within it.

Step 3: Primary Research

A series of in-depth interviews is conducted with C-level executives, loan officers, auto dealers, fintech professionals, and end-consumers of auto finance products. These interviews help validate hypotheses, confirm statistical trends, and uncover detailed operational insights.

A bottom-to-top approach is undertaken to estimate credit disbursal volumes per lender, aggregating these figures to estimate overall market size.

Additionally, as part of our validation strategy, disguised interviews are conducted wherein researchers pose as potential customers. This helps verify claims made by companies regarding interest rates, approval times, repayment terms, and customer experience. These interviews also reveal critical aspects of the auto finance value chain, pricing models, and digital lending practices.

Step 4: Sanity Check

- A comprehensive top-to-bottom and bottom-to-top triangulation is carried out to ensure consistency and accuracy of findings. This includes rigorous market modeling exercises and data sanity checks to confirm the reliability of estimated market sizes and projections.

FAQs

1. What is the potential for the Denmark Auto Finance Market?

The Denmark auto finance market is poised for steady and sustainable growth, with a valuation of DKK 45 Billion in 2023. Growth is driven by the rising adoption of electric vehicles, increasing demand for flexible and digital-first financing solutions, and strong regulatory support for green mobility. The market’s potential is further supported by digital lending innovations and the expansion of consumer credit access across the country.

2. Who are the Key Players in the Denmark Auto Finance Market?

The Denmark Auto Finance Market features several key players, including Santander Consumer Bank, Nordea Finance, and AL Finans. These institutions lead the market through strong digital infrastructure, wide dealership integrations, and diverse loan product offerings. Other notable players include Resurs Bank, Toyota Financial Services, and Basisbank.

3. What are the Growth Drivers for the Denmark Auto Finance Market?

Key growth drivers include Denmark's transition to electric vehicles, which is being accelerated through tax incentives and green loans. The widespread use of digital platforms and fintech integrations in the lending process is enhancing user experience and expanding access. Additionally, the growing preference among younger consumers for subscription-based models and flexible financing terms is creating new market opportunities.

4. What are the Challenges in the Denmark Auto Finance Market?

The market faces several challenges, including a stringent credit approval process that limits financing access for gig economy workers or those with limited credit history. High vehicle taxes and registration costs also inflate the total cost of car ownership, discouraging loan uptake for certain vehicle segments. Furthermore, limited penetration of non-bank lenders reduces competition and innovation in loan structures, potentially hindering the diversification of consumer financing options.