Egypt Auto Finance Market Outlook to 2029

By Vehicle Type (New vs. Used), By Lender Type (Banks, NBFCs, Captives), By Tenure, By Interest Rate, By Region, and By Consumer Demographics

- Product Code: TDR0154

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Egypt Auto Finance Market Outlook to 2029 - By Vehicle Type (New vs. Used), By Lender Type (Banks, NBFCs, Captives), By Tenure, By Interest Rate, By Region, and By Consumer Demographics” provides a comprehensive analysis of the auto finance ecosystem in Egypt. The report covers the overview and genesis of the industry, market size and evolution, market segmentation by lender types and vehicle types, emerging trends, government regulations, customer profiling, key challenges, competitive landscape, and benchmarking of leading players in the market. It concludes with future projections for the market based on credit disbursed and outstanding loan portfolio, key macroeconomic indicators, and success case studies indicating the major opportunities and risks in the sector.

Egypt Auto Finance Market Overview and Size

The Egypt Auto Finance Market was valued at EGP 28 Billion in 2023, driven by a combination of rising vehicle demand, increased consumer access to credit, and favorable government incentives for financial inclusion. The market is supported by a mix of players including banks (such as Banque Misr, CIB, and QNB Alahli), non-banking financial companies (e.g., Contact Financial, Aman, Drive Finance), and captive finance arms (such as Nissan Egypt Finance and GB Auto Drive). These players leverage strong dealer networks, digital onboarding platforms, and customized loan products to expand reach and penetration.

In 2023, Contact Financial led innovations by launching an AI-driven credit scoring platform aimed at improving loan approval rates for underserved segments. Major urban hubs like Cairo, Giza, and Alexandria remain the largest auto finance markets due to their population concentration and robust vehicle ownership base.

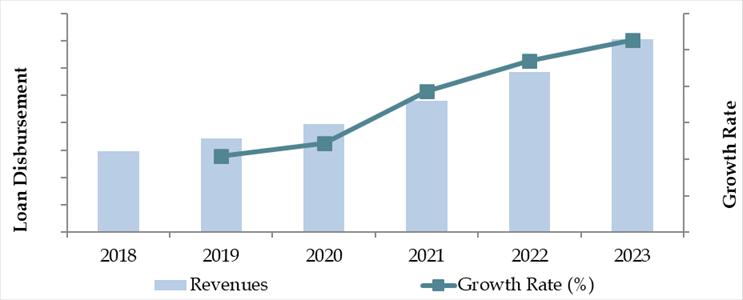

Market Size for Egypt Auto Finance Industry Size on the Basis of Credit Disbursements in USD Billion, 2018-2024

What Factors are Leading to the Growth of Egypt Auto Finance Market

Macroeconomic Stability and Urbanization: Egypt's stable GDP growth of 4.2% in 2023 and continued urban migration are boosting vehicle demand. With over 43% of the population residing in urban areas, access to transport and car ownership is increasingly critical, driving financing needs.

High Vehicle Prices and Inflation: Due to currency devaluation and global supply chain constraints, new vehicle prices have surged by over 20% in recent years. As a result, consumers are turning to financing options to spread out costs. In 2023, around 68% of car purchases in Egypt were financed, up from 59% in 2020.

Government Push for Financial Inclusion: The Central Bank of Egypt (CBE) has introduced policies encouraging banks and fintechs to expand lending to underserved populations. Auto finance has become a key product for increasing credit penetration, especially in Tier 2 cities.

Which Industry Challenges Have Impacted the Growth for Egypt Auto Finance Market

Credit Risk and Delinquency Concerns: One of the major barriers in the Egypt auto finance sector is the high perceived risk of borrower default, especially in the used car segment. In 2023, approximately 27% of lenders reported an increase in delinquencies, particularly in the microfinance and informal lending space. This has made many financial institutions cautious in extending credit, particularly to first-time or subprime borrowers.

Interest Rate Volatility: With policy rates fluctuating between 18–20% in 2023 due to inflation control measures by the Central Bank of Egypt (CBE), borrowing costs have remained high. This deters low- and middle-income consumers from opting for auto loans. In fact, about 34% of potential buyers dropped their loan applications in 2023 due to unaffordable EMIs triggered by rising interest rates.

Limited Penetration in Rural and Tier-2 Regions: Despite growing demand, auto finance availability outside of major cities like Cairo and Alexandria remains low. In 2023, nearly 70% of total disbursements were concentrated in just three governorates, indicating a significant urban skew. Lack of branch infrastructure and limited digital literacy continue to limit rural penetration.

What are the Regulations and Initiatives Which Have Governed the Market

Credit Bureau Integration and Scoring System: The Egyptian Credit Bureau (i-Score) has mandated comprehensive credit checks for all loan applicants to standardize risk assessment. By 2023, over 95% of loans issued by licensed NBFCs and banks were linked to i-Score, helping lenders improve portfolio quality and reduce defaults.

Interest Rate Caps and Consumer Protection: The Financial Regulatory Authority (FRA) has implemented caps on interest rates for licensed NBFCs to ensure consumer affordability and prevent predatory lending. As of 2023, the maximum allowable rate stood at 25% annually for auto loans, depending on tenure and borrower profile.

Incentives for Green Vehicles and Local Assemblers: As part of Egypt Vision 2030, the government has initiated policies to encourage local automotive manufacturing and EV adoption. This includes tax rebates for local assemblers, 0% customs duties on EV imports, and financing subsidies for green vehicles. In 2023, these programs contributed to a 4.5% share of EVs in total financed car sales, up from 2.8% in 2021.

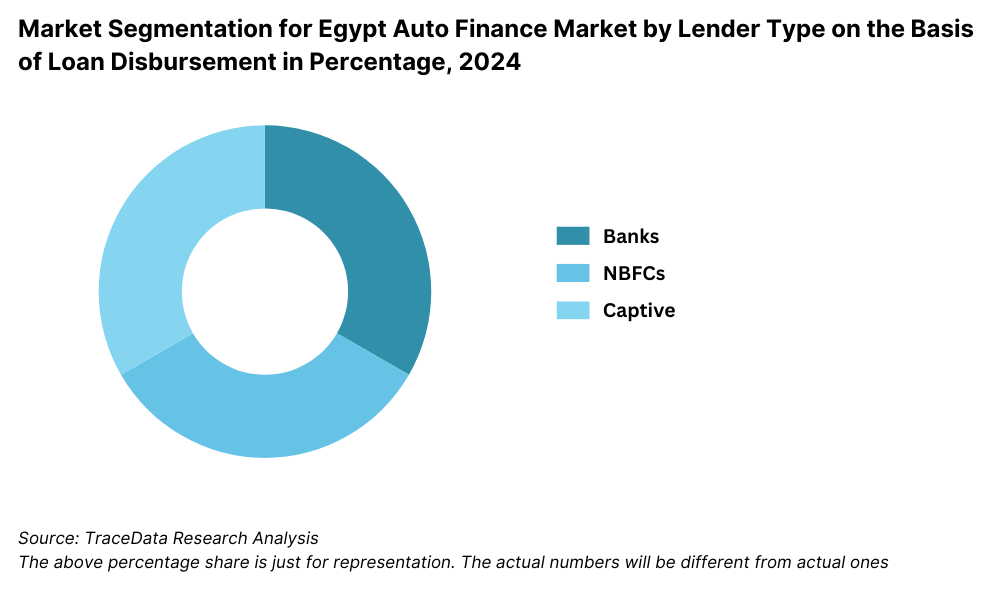

Egypt Auto Finance Market Segmentation

By Market Structure: Banks dominate the Egypt auto finance market due to their well-established credibility, competitive interest rates, and widespread physical and digital presence. Major players like Banque Misr and CIB attract salaried and prime borrowers by offering bundled products and longer tenures.

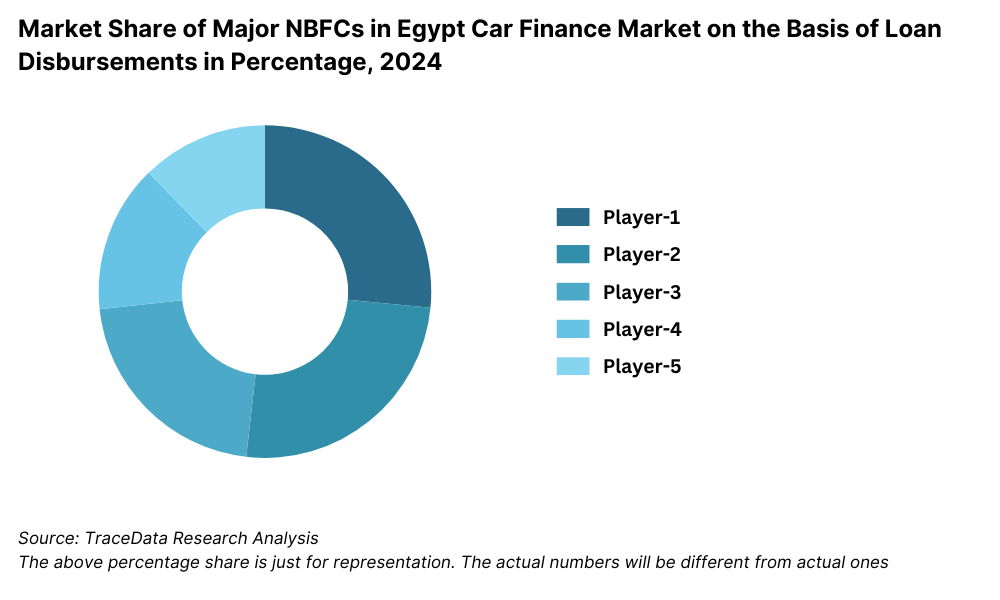

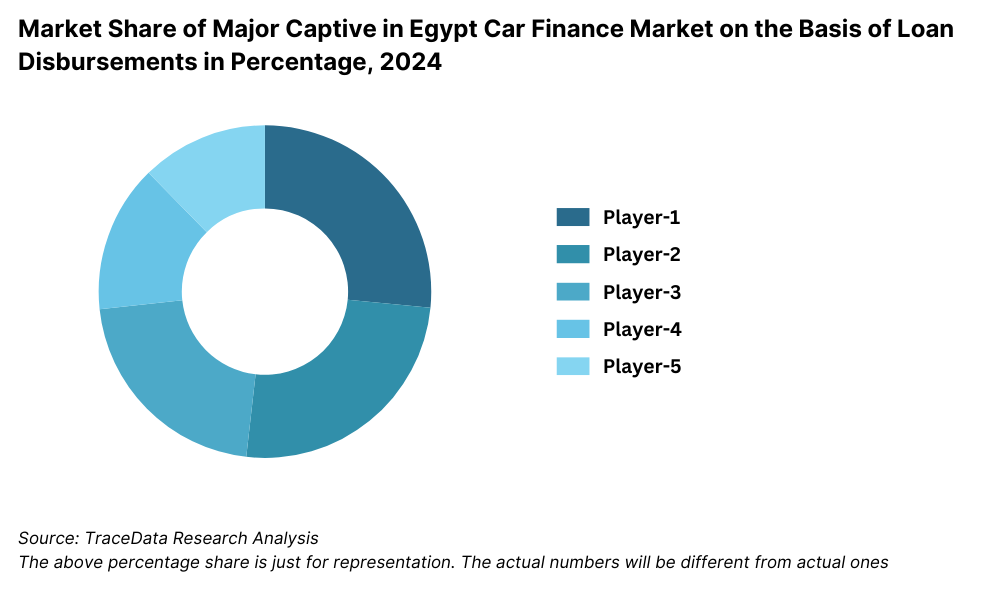

NBFCs, on the other hand, have gained significant traction in recent years by serving self-employed, gig workers, and underserved credit segments. They offer faster loan disbursement, simplified documentation, and are highly active in financing used vehicles. Captive finance companies such as GB Auto Drive and Nissan Finance also hold a niche but growing share, especially for new vehicle purchases through their dealer networks.

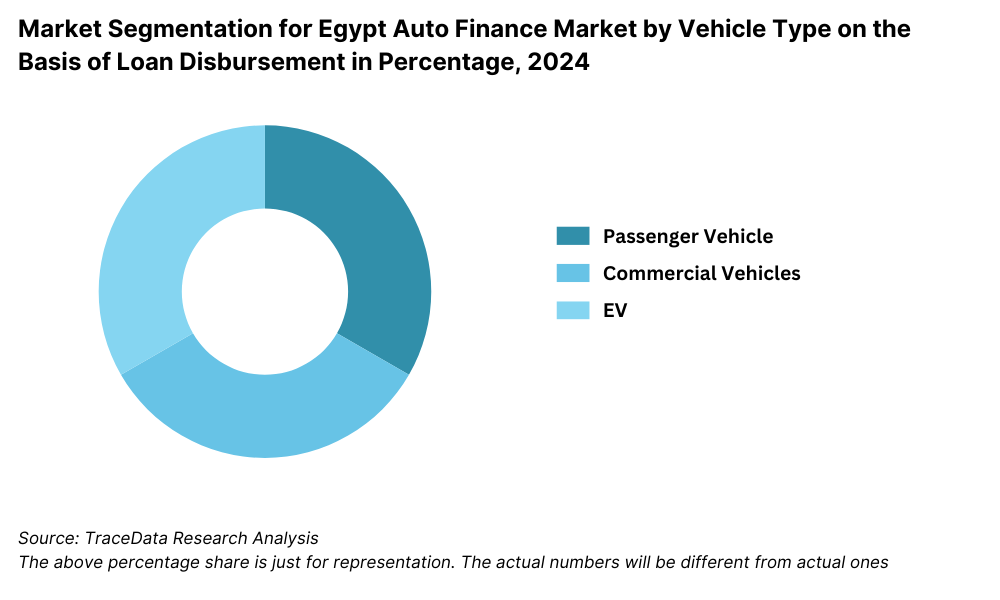

By Vehicle Type: New car financing dominates the market, accounting for a larger share of disbursements due to the stronger resale value, structured dealership arrangements, and manufacturer tie-ups with financiers. Used car financing, while growing, faces challenges such as lack of standardized vehicle valuation and greater perceived credit risk. However, it is expanding rapidly, particularly in semi-urban and Tier-2 cities.

By Loan Tenure: Loan tenure of 4–5 years is the most common as it offers a balance between affordable EMIs and manageable interest burden. Shorter tenure loans (1–3 years) are often selected by high-income buyers or those availing used car financing. Longer tenure loans (6–7 years) are occasionally offered for new high-end vehicles with strong residual value.

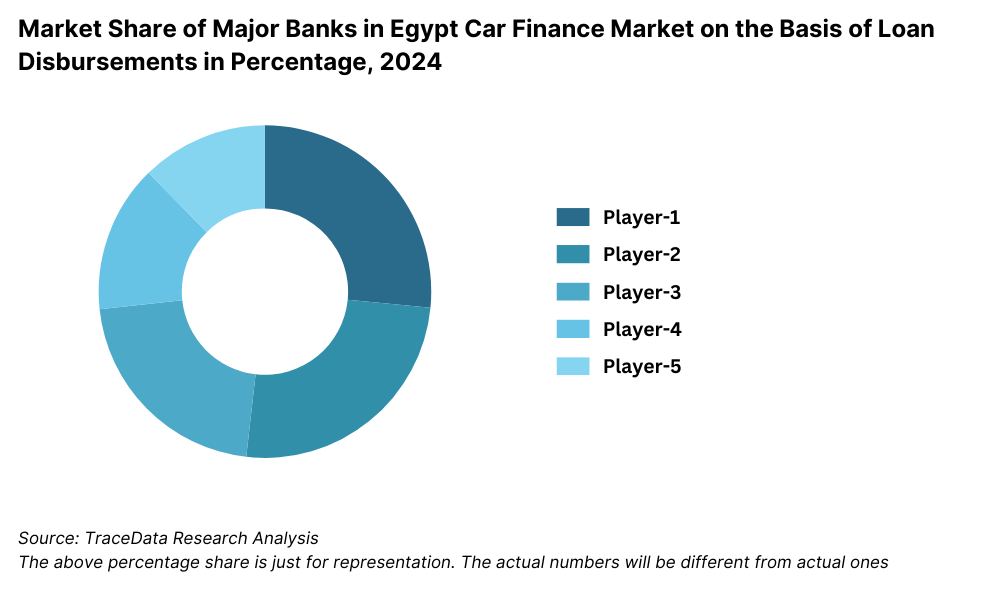

Competitive Landscape in Egypt Auto Finance Market

The Egypt auto finance market is moderately concentrated, with a few major banks and non-banking financial institutions dominating the lending landscape. However, the sector has seen increasing diversification in recent years, with the rise of fintech-based NBFCs and the expansion of captive financing arms linked to leading automobile OEMs. Players such as Banque Misr, Contact Financial, Aman, QNB Alahli, Drive Finance, GB Auto Drive, and Nissan Egypt Finance are key stakeholders offering structured credit options, digital onboarding, and flexible tenure-based schemes to improve customer acquisition.

| Company Name | Founding Year | Original Headquarters |

| GB Auto (Ghabbour Group) | 1940 | Cairo, Egypt |

| Al Mansour Automotive | 1975 | Cairo, Egypt |

| Contact Financial Holding | 2018 | Cairo, Egypt |

| Al Tawfeek Leasing Company (A.T. Lease) | 2004 | Cairo, Egypt |

| Banque Misr | 1920 | Cairo, Egypt |

| Commercial International Bank (CIB) | 1975 | Cairo, Egypt |

| Banque du Caire | 1952 | Cairo, Egypt |

| HSBC Egypt | 1982 | London, UK |

| EFG Hermes (EFG Holding) | 1984 | Cairo, Egypt |

| Easy Lease (El Sewedy Group) | 2021 | Giza, Egypt |

Some of the recent competitor trends and key information about competitors include:

Banque Misr: As one of the largest public banks in Egypt, Banque Misr disbursed over EGP 6.2 billion in auto loans in 2023, holding a significant share in new vehicle financing. The bank’s recent tie-up with EV manufacturers is part of a broader strategy to support sustainable mobility solutions.

Contact Financial: A pioneer in NBFC-based vehicle lending, Contact Financial saw 20% YoY growth in its auto finance segment in 2023. The firm launched AI-based credit scoring tools to onboard self-employed and gig economy borrowers faster, improving underwriting efficiency.

Aman Financial Services: Backed by Raya Holding, Aman is a key fintech NBFC leveraging a mobile-first approach to offer microloans for used cars. In 2023, Aman expanded to 12 new governorates and reported a 35% increase in disbursed volumes, especially among first-time borrowers.

Drive Finance: Focused on mid-tier used car buyers, Drive Finance reported strong traction in secondary cities, contributing to 18% of the used car financing volume in 2023. Their low-doc approval model and dealer integration system have enabled faster turnaround times.

QNB Alahli: Known for premium vehicle financing, QNB Alahli continued to cater to affluent segments with competitive rates and bundled insurance products. The bank reported a 12% increase in loan books linked to electric and hybrid vehicle categories.

GB Auto Drive: The captive financing arm of GB Auto has helped boost financing penetration among Hyundai and Chery buyers. In 2023, GB Auto Drive recorded EGP 1.8 billion in auto finance disbursements, focusing primarily on new car sales through its OEM dealership network.

Nissan Egypt Finance: Launched to support Nissan’s local sales network, this captive lender offered exclusive 0% interest schemes on select models during 2023, helping Nissan increase its retail financing share by 9%.

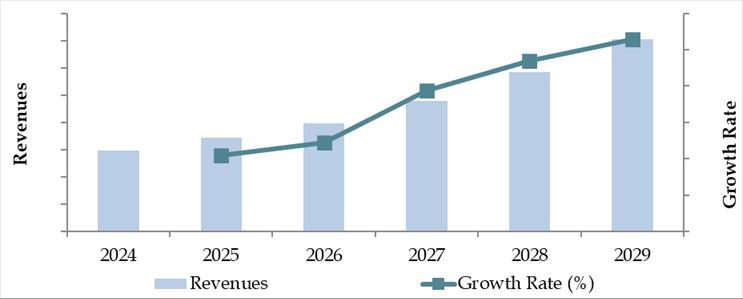

What Lies Ahead for Egypt Auto Finance Market?

The Egypt auto finance market is projected to witness steady growth through 2029, supported by rising vehicle demand, expanding middle-class population, and ongoing digital transformation within the financial services sector. The market is expected to register a healthy CAGR, particularly in the used car and Tier-2 city segments, as lenders diversify offerings and improve accessibility.

Expansion of Digital Lending Ecosystems: The increasing use of AI-powered credit scoring, digital KYC, and mobile-first application platforms will significantly enhance consumer access to financing. Lenders are expected to reduce approval timelines from several days to a few hours, especially for low-ticket and used vehicle loans.

Rising Penetration in Underserved Regions: By 2029, financial institutions and NBFCs are likely to expand into semi-urban and rural markets, where car ownership is still low but growing. Partnerships with local dealers, simplified documentation, and vernacular digital interfaces will play a critical role in driving credit penetration in these areas.

Growth of Green Vehicle Financing: As part of Egypt’s commitment to its Vision 2030 sustainability goals, demand for financing electric and hybrid vehicles is set to rise. Lenders offering preferential interest rates, longer tenures, and green vehicle incentives will see increasing uptake, particularly in the premium vehicle segment.

Increased Regulatory Oversight and Consumer Protection: The Financial Regulatory Authority (FRA) is expected to roll out stricter compliance frameworks around responsible lending and consumer transparency. This includes mandatory disclosure norms, capping of hidden charges, and greater supervision of informal lending entities. These steps will enhance market integrity and consumer trust.

Future Outlook and Projections for Egypt Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Egypt Auto Finance Market Segmentation

By Market Structure:

Banks

NBFCs (Non-Banking Financial Companies)

Captive Finance Companies

Fintech-based Lenders

Organized Sector

Unorganized/Informal Sector

Dealer-Tied Lending

Direct-to-Consumer Lending

By Vehicle Type:

New Vehicles

Used Vehicles

Electric Vehicles

Commercial Vehicles

By Loan Tenure:

Less than 3 Years

3–5 Years

6–7 Years

By Interest Rate Range:

Less than 15%

15–20%

Above 20%

By Consumer Demographics:

Salaried Professionals

Self-Employed & Gig Workers

First-Time Car Buyers

Repeat Buyers

By Age of Consumer:

18–30

31–45

46+

By Region:

Greater Cairo

Alexandria

Nile Delta

Upper Egypt

Suez Canal Region

Players Mentioned in the Report (Banks):

- Banque Misr

- National Bank of Egypt (NBE)

- Commercial International Bank (CIB)

- QNB Alahli

- Banque du Caire

- Arab African International Bank (AAIB)

- HSBC Egypt

- AlexBank

Players Mentioned in the Report (NBFCs):

- MNT-Halan

- Contact Financial Holding

- GB Lease

- EgyLease

- Al Tawfeek Leasing Company (AT Lease)

- Al Ahly Leasing Company

- Tamweel Group

- QNB Alahli Leasing

- EgyCredit

Players Mentioned in the Report (Captive):

- Toyota Financial Services Egypt

- Volkswagen Financial Services Egypt

- Mercedes-Benz Financial Services Egypt

- Nissan Finance Egypt

- Stellantis Financial Services Egypt

Key Target Audience

Banks & Financial Institutions

NBFCs and Digital Lenders

Automotive OEMs & Dealerships

Regulatory Bodies (e.g., FRA, CBE)

Credit Rating & Risk Assessment Agencies

Investors and Private Equity Firms

Market Research & Consulting Firms

Time Period

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Egypt by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Egypt Car Finance Market

11.2. Growth Drivers for Egypt Car Finance Market

11.3. SWOT Analysis for Egypt Car Finance Market

11.4. Issues and Challenges for Egypt Car Finance Market

11.5. Government Regulations for Egypt Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Egypt Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Egypt Car Finance Market, 2024

17.3. Market Share of Key Captive in Egypt Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Egypt Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities in the Egypt Auto Finance Market. This includes banks, NBFCs, captive finance companies, dealerships, OEMs, fintech lenders, and end-consumers.

Basis this ecosystem, we shortlisted leading 5–6 financial institutions and auto finance providers in Egypt based on criteria such as loan book size, disbursement volumes, digital outreach, and strategic partnerships.

Sourcing was conducted through industry reports, regulatory filings, automotive and financial publications, proprietary databases, and public disclosures to build an initial framework of the market landscape.

Step 2: Desk Research

Conducted exhaustive desk research using secondary and proprietary sources to capture macro-level and segment-specific insights.

The research encompassed data on loan disbursements, vehicle sales volumes, interest rates, tenure trends, financing penetration, market share of lenders, and regional demand distribution.

Additionally, we extracted and reviewed company-level data including annual reports, press releases, investor presentations, licensing data from the Financial Regulatory Authority (FRA), and Central Bank of Egypt updates.

This phase helped construct the foundational understanding of market evolution, competitive dynamics, and structural bottlenecks.

Step 3: Primary Research

Conducted in-depth interviews with CXOs, Business Heads, Risk Officers, Dealership Finance Managers, Fintech Product Leads, and Loan Processing Officers from leading banks, NBFCs, and captive lenders.

Also interviewed auto dealers and end-consumers to understand financing preferences, consumer pain points, loan application experience, and regional gaps in accessibility.

Interviews were designed to validate secondary data, triangulate market estimates, and provide granular insights into credit approval processes, NPA management, and digital financing adoption.

Disguised interviews were conducted with lenders and dealerships acting as prospective customers to validate pricing models, eligibility requirements, and turnaround time for loan approvals.

Step 4: Sanity Check

Conducted bottom-up modeling by aggregating credit disbursements at the lender and vehicle category level, mapped against vehicle sales volumes and financing penetration.

Simultaneously, a top-down approach was employed using GDP growth, household income data, and automotive sales projections to forecast the total addressable market.

- Both methods were reconciled through cross-validation techniques, ensuring robustness and accuracy of market sizing and forecast estimations.

FAQs

1. What is the potential for the Egypt Auto Finance Market?

The Egypt auto finance market is poised for substantial growth, reaching a valuation of EGP 28 Billion in 2023. This growth is driven by factors such as rising vehicle ownership, an expanding middle class, and the increasing need for structured credit access. The market's potential is further bolstered by digital lending platforms and government initiatives supporting financial inclusion and green mobility.

2. Who are the Key Players in the Egypt Auto Finance Market?

The Egypt Auto Finance Market features several key players, including Banque Misr, Contact Financial, and Aman Financial Services. These companies dominate the market due to their strong institutional presence, wide dealer networks, and tailored loan offerings. Other notable players include Drive Finance, QNB Alahli, GB Auto Drive, and Nissan Egypt Finance.

3. What are the Growth Drivers for the Egypt Auto Finance Market?

The primary growth drivers include economic factors, such as rising new car prices that encourage installment-based purchases, and a growing urban middle-income population. Financial inclusion programs led by the Central Bank of Egypt (CBE) and the Financial Regulatory Authority (FRA), along with digital innovation by fintechs, are also contributing to market growth.

4. What are the Challenges in the Egypt Auto Finance Market?

The Egypt Auto Finance Market faces several challenges, including interest rate volatility and credit risk concerns that restrict access to finance for some consumer segments. Regulatory compliance requirements, under-penetration in rural regions, and low financial literacy levels are additional barriers to growth in the sector.