Finland Cold Chain Market Outlook to 2029

By Market Structure (Organized and Unorganized), By Temperature Type (Chilled and Frozen), By End Users (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, and Others), By Ownership (3PL and Owned), and By Region

- Product Code: TDR0271

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Finland Cold Chain Market Outlook to 2029 – By Market Structure (Organized and Unorganized), By Temperature Type (Chilled and Frozen), By End Users (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, and Others), By Ownership (3PL and Owned), and By Region” provides a comprehensive analysis of the cold chain logistics market in Finland. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, key challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Finnish cold chain sector. The report concludes with future market projections based on revenue, end-user industries, regional demand clusters, and success case studies highlighting growth levers and market limitations.

Finland Cold Chain Market Overview and Size

The Finland cold chain market was valued at EUR 17 million in 2023, driven by growing demand for temperature-controlled logistics in pharmaceuticals, increasing frozen food consumption, and rising export-import trade across Europe. Major players in the market include Posti Group, DB Schenker, DHL Supply Chain, Kuehne+Nagel, and Transval. These companies have strong capabilities in cold storage warehousing, temperature-controlled trucking, and last-mile refrigerated delivery services.

In 2023, DB Schenker expanded its cold chain capacity in southern Finland by launching a new refrigerated distribution center to cater to growing demand from the pharmaceutical and food retail sectors. The Helsinki metropolitan region remains the most prominent cold chain hub due to its concentration of healthcare institutions, large retail chains, and seaport access.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of Finland Cold Chain Market:

Rising Pharmaceutical Demand: With Finland's aging population and expanding biotech industry, the demand for temperature-sensitive medicines, vaccines, and biologics is rapidly increasing. In 2023, pharmaceutical logistics accounted for nearly 28% of the total cold chain market revenue, supported by stringent EU GDP compliance requirements.

Export-Oriented Seafood Industry: Finland’s seafood exports, particularly frozen fish to European markets like Germany and France, necessitate a robust cold chain infrastructure. Seafood and meat collectively contributed over 20% to cold chain logistics demand in 2023.

Growth in Frozen & Ready-to-Eat Foods: The adoption of frozen and ready-to-eat food products has surged, especially in urban households with dual-income consumers. Between 2020 and 2023, the frozen food category grew by over 15%, boosting demand for chilled and frozen logistics.

Which Industry Challenges Have Impacted the Growth for Finland Cold Chain Market

High Energy Costs and Operational Expenses: Finland’s cold chain operators face some of the highest energy prices in the EU, significantly impacting operating margins. Refrigeration systems account for over 50% of total energy usage in cold storage. According to industry estimates, energy costs rose by nearly 18% in 2023 compared to the previous year, leading many smaller logistics providers to scale down operations or pass on costs to customers.

Workforce Shortages and Skill Gaps: The Finnish logistics industry is grappling with a shortage of trained personnel in refrigerated transportation and warehouse management. A 2023 survey by the Finnish Transport and Logistics Association (SKAL) found that 41% of cold chain firms identified skilled labor availability as their top operational concern, especially in rural and remote regions.

Infrastructure Constraints in Remote Regions: While urban areas like Helsinki, Tampere, and Turku have well-developed cold storage and last-mile infrastructure, northern and eastern Finland face significant infrastructure bottlenecks. Harsh winters and limited road access often lead to delivery delays and spoilage, particularly in the case of perishable goods like dairy and fresh produce.

What are the Regulations and Initiatives which have Governed the Market

EU GDP Compliance for Pharmaceutical Logistics: All entities handling pharmaceutical products must comply with the EU’s Good Distribution Practice (GDP) regulations. These guidelines require precise temperature controls (typically 2–8°C), GPS monitoring, and full traceability. As of 2023, over 85% of pharmaceutical cold chain shipments in Finland were compliant with GDP standards, highlighting strong industry alignment.

National Food Safety Authority (Ruokavirasto) Guidelines: Finland’s food safety authority enforces strict cold chain compliance for perishable food products. These include real-time temperature logging, vehicle cleanliness standards, and shock-proof packaging requirements. In 2023, Ruokavirasto conducted over 3,500 inspections, of which 92% passed without any major violations.

Sustainable Transport Incentives: The Finnish government, aligned with the EU Green Deal, provides incentives for adopting low-emission refrigerated vehicles and energy-efficient cold storage solutions. In 2022–23, grants and tax credits worth over EUR 20 million were disbursed to logistics firms investing in hybrid/electric refrigerated fleets and solar-powered warehouses.

Finland Cold Chain Market Segmentation

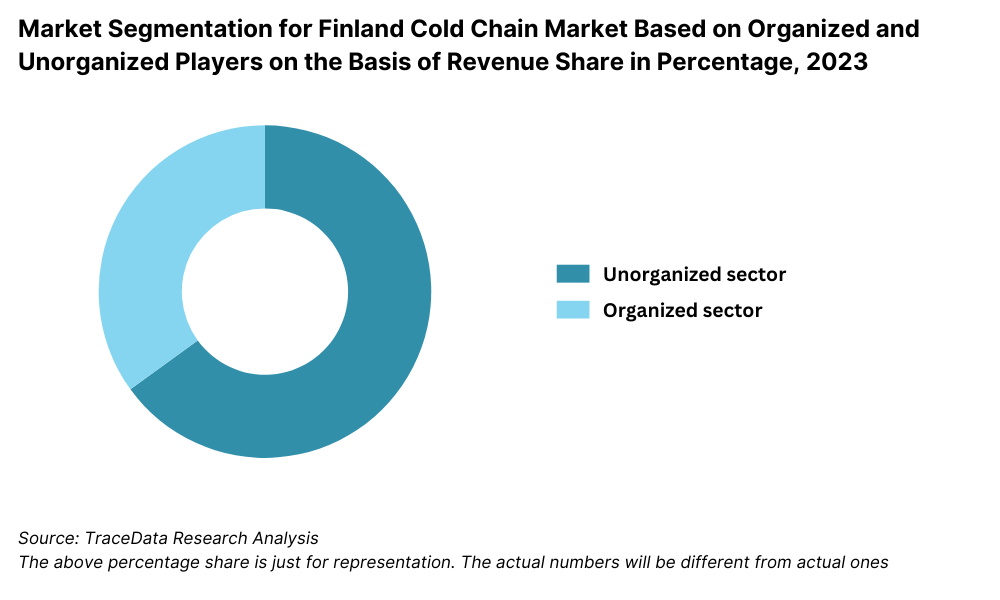

By Market Structure: Organized players dominate Finland’s cold chain market owing to their adherence to EU regulations, strong technological infrastructure, and ability to provide end-to-end temperature-controlled solutions. These players offer value-added services like real-time tracking, warehouse automation, and compliance with GDP and HACCP standards, making them the preferred partners for pharmaceuticals, food chains, and exporters. Unorganized players, though still operational in certain rural areas or niche segments like short-distance dairy or fish distribution, face challenges related to compliance, efficiency, and scalability.

By Temperature Type: Frozen logistics forms a major part of Finland’s cold chain, primarily driven by seafood exports, frozen ready-to-eat meals, and meat products. These require temperatures below -18°C and longer storage durations. Chilled logistics, on the other hand, supports perishable food like dairy, bakery items, fresh produce, and pharmaceuticals, requiring 2°C to 8°C handling. Growth in the pharmaceutical sector has significantly raised the share of chilled logistics in recent years.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

By End User Industry: Pharmaceuticals lead the demand for cold chain services due to stringent regulatory requirements and Finland’s growing role as a biopharma and vaccine logistics hub. The meat & seafood segment also holds a significant share, given Finland's reliance on seafood processing and frozen meat exports. Dairy, fruits & vegetables, and bakery products are steadily growing in demand, supported by rising supermarket penetration and health-conscious consumers preferring fresh and organic produce.

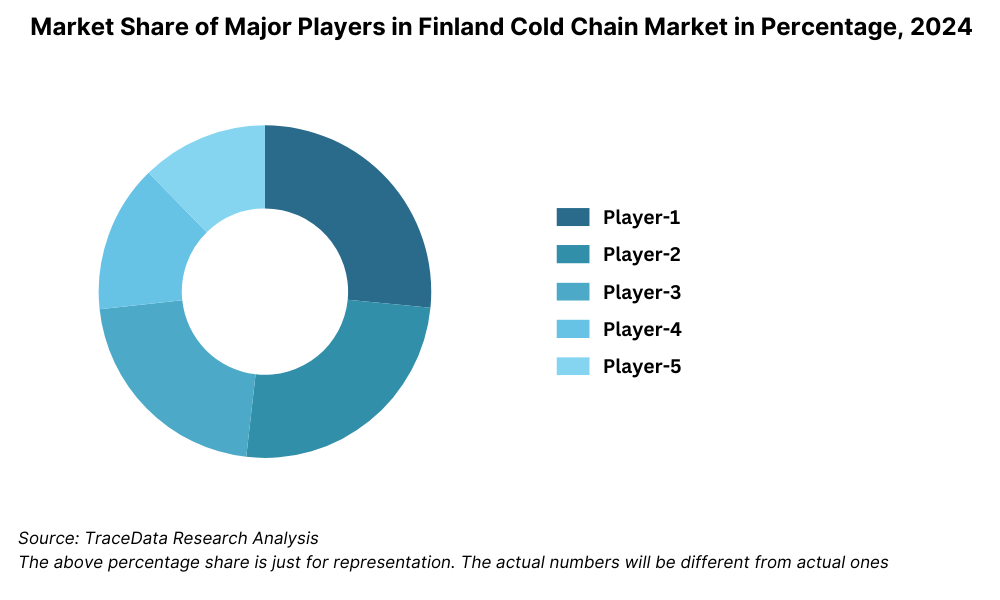

Competitive Landscape in Finland Cold Chain Market

The Finland cold chain market is moderately consolidated, with a mix of global logistics giants and strong domestic players offering integrated temperature-controlled storage and distribution solutions. The market has seen rapid modernization with digital transformation, investment in green logistics, and infrastructure expansion across key cities such as Helsinki, Tampere, and Turku. Major players include Posti Group, DB Schenker, DHL Supply Chain, Kuehne+Nagel, and Transval, among others.

Company | Establishment Year | Headquarters |

Posti Group | 1638 | Helsinki, Finland |

DB Schenker | 1872 | Helsinki, Finland (Nordic HQ) |

DHL Supply Chain | 1969 | Vantaa, Finland |

Kuehne+Nagel | 1890 | Espoo, Finland |

Transval | 1994 | Vantaa, Finland |

Some of the recent competitor trends and key information about competitors include:

Posti Group: As Finland’s national logistics operator, Posti has invested heavily in temperature-controlled last-mile delivery and green logistics. In 2023, the company introduced a new fleet of electric refrigerated vans, targeting emissions-free deliveries in urban zones. Posti currently manages over 70,000 m² of refrigerated warehouse space across Finland.

DB Schenker: The company expanded its pharmaceutical-grade cold chain capabilities in 2023 by opening a GDP-certified facility in southern Finland. It also integrated real-time IoT temperature monitoring in over 90% of its reefer fleet, helping improve auditability and reducing temperature excursion incidents.

DHL Supply Chain: Known for its strong global cold chain expertise, DHL invested in solar-powered cold storage near Helsinki-Vantaa Airport in 2023, designed to handle both food and pharmaceutical goods. DHL Finland also partnered with leading retail chains to provide chilled last-mile solutions for grocery e-commerce.

Kuehne+Nagel: Specializing in cross-border frozen logistics, Kuehne+Nagel plays a vital role in Finland’s meat and seafood exports to Western Europe. In 2023, the company handled over 50,000 tonnes of frozen goods and introduced blockchain-backed shipment traceability for pharma clients.

Transval: A key domestic logistics firm, Transval focuses on food and retail sector logistics. In 2023, it expanded its refrigerated cross-dock facility in Turku and upgraded warehouse automation for fresh produce distribution. The company’s commitment to energy-efficient operations is reflected in its use of CO2-based refrigeration systems.

What Lies Ahead for Finland Cold Chain Market?

The Finland cold chain market is projected to experience steady growth through 2029, supported by advancements in cold storage technology, evolving consumer preferences, and stricter regulatory requirements for pharmaceutical and food-grade logistics. The market is expected to expand at a healthy CAGR, driven by rising demand from both domestic and international trade.

Expansion of Biopharma and Vaccine Logistics: As Finland continues to position itself as a Northern European hub for biopharmaceutical manufacturing and distribution, demand for ultra-cold and GDP-compliant logistics is set to rise. The expansion of clinical trials and biologic drug production will increase the need for highly specialized cold storage and transport capabilities.

Acceleration of Digital Cold Chain Solutions: The integration of IoT, AI-driven route optimization, and blockchain-backed traceability will transform how cold chain providers manage inventory and ensure temperature integrity. These digital advancements will enable predictive maintenance, real-time monitoring, and faster decision-making, boosting service reliability and regulatory compliance.

Growth in E-Grocery and Food Retail Logistics: Changing consumer behavior, especially the rise in online grocery shopping, is fueling demand for chilled and frozen last-mile delivery solutions. Retail chains are expected to increase investments in micro-fulfillment centers and refrigerated parcel lockers, especially in Helsinki, Tampere, and Turku, to support quicker delivery turnarounds.

Green Logistics and Energy Efficiency Focus: In line with Finland’s national carbon neutrality goals for 2035, cold chain providers are adopting low-emission trucks, solar-powered warehouses, and natural refrigerants (like CO₂ and ammonia). Government incentives and EU climate funding are expected to further support sustainability efforts in logistics infrastructure.

%2C%202024%E2%80%932030.png)

Finland Cold Chain Market Segmentation

• By Market Structure:

o Organized Sector

o Unorganized Sector

o Third-Party Logistics (3PL) Providers

o In-House/Owned Cold Chain Networks

• By Temperature Type:

o Chilled (2°C to 8°C)

o Frozen (Below -18°C)

o Ambient Controlled (15°C to 25°C) – for select pharma/chemical logistics

• By End-User Industry:

o Pharmaceuticals

o Dairy Products

o Meat & Seafood

o Fruits & Vegetables

o Frozen and Ready-to-Eat Meals

o Bakery and Confectionery

o Chemicals and Industrial Goods

• By Ownership:

o Owned (Retailers, Manufacturers)

o Third-Party Logistics (Contracted Cold Chain Providers)

• By Mode of Transport:

o Road

o Air

o Sea

o Rail

• By Region:

o Southern Finland (Helsinki, Espoo, Vantaa)

o Western Finland (Turku, Pori, Vaasa)

o Eastern Finland (Kuopio, Joensuu)

o Northern Finland (Oulu, Rovaniemi)

Players Mentioned in the Report:

• Posti Group

• DB Schenker

• DHL Supply Chain

• Kuehne+Nagel

• Transval

• Bring Logistics

• DSV Finland

• Pakkausjaloste Oy

Key Target Audience:

• Cold Chain Logistics Companies

• Pharmaceutical Manufacturers and Distributors

• Frozen Food Producers and Retailers

• Grocery Chains and E-Grocery Players

• Importers and Exporters of Perishables

• Government Regulatory Bodies (e.g., Finnish Food Authority, Finnish Medicines Agency)

• Cold Storage Infrastructure Providers

• IoT and Temperature Monitoring Solution Providers

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges that they face

4.2. Revenue Streams for Finland Cold Chain Market

4.3. Business Model Canvas for Finland Cold Chain Market

4.4. Buying Decision Making Process

4.5. Supply Decision Making Process

5.1. Temperature-Controlled Logistics Landscape in Finland, 2018-2024

5.2. Chilled vs Frozen Logistics Demand Share in Finland, 2018-2024

5.3. Pharmaceutical Cold Chain Volume Share in Overall Logistics Sector, 2024

5.4. Number of Cold Chain Warehouses in Finland by Region

8.1. Revenues, 2018-2024

8.2. Warehousing Capacity (in m²), 2018-2024

8.3. Volume Handled (in Tons), 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Temperature Type (Chilled, Frozen, Ambient), 2023-2024P

9.3. By Ownership Type (3PL and Owned), 2023-2024P

9.4. By End User (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, Others), 2023-2024P

9.5. By Region (Southern, Western, Eastern, Northern), 2023-2024P

9.6. By Mode of Transport (Road, Air, Sea, Rail), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Finland Cold Chain Market

11.2. Growth Drivers for Finland Cold Chain Market

11.3. SWOT Analysis for Finland Cold Chain Market

11.4. Issues and Challenges for Finland Cold Chain Market

11.5. Government Regulations for Finland Cold Chain Market

12.1. IoT, Blockchain and AI Adoption in Finland Cold Chain

12.2. Automation in Warehouses and Fleet Monitoring

12.3. Cross Comparison of Cold Chain Technology Providers (Company Overview, Coverage, Use Cases, Industry Served)

13.1. Green Initiatives and Low-Emission Infrastructure Trends

13.2. Government Incentives for Sustainable Logistics, 2023-2029

13.3. Sustainable Packaging and Refrigeration Trends

16.1. Benchmark of Key Competitors in Finland Cold Chain Market including variables such as Company Overview, USP, Business Strategies, Strength, Weakness, Business Model, Technology Stack, Warehouse Capacity, Fleet Size, Recent Developments

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Warehousing Capacity and Volume Handled, 2025-2029

18.1. By Market Structure (Organized and Unorganized Market), 2025-2029

18.2. By Temperature Type (Chilled, Frozen, Ambient), 2025-2029

18.3. By Ownership Type (3PL and Owned), 2025-2029

18.4. By End User Industry (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, Others), 2025-2029

18.5. By Region (Southern, Western, Eastern, Northern), 2025-2029

18.6. By Mode of Transport (Road, Air, Sea, Rail), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Finland Cold Chain Market. Basis this ecosystem, we will shortlist leading 5-6 players in the country based upon their financial information, warehousing capacity, and refrigerated fleet size.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like market size, end-user contribution, pricing models, volume handled by players, and technological integration. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Finland Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate volume handled for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of pricing models, value chain, warehouse operations, and technological capabilities.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Finland Cold Chain Market?

The Finland Cold Chain Market is poised for consistent growth, reaching a valuation of EUR 17 million in 2023. This growth is driven by increasing demand for temperature-controlled logistics across the pharmaceutical, food, and retail sectors. The market’s potential is further enhanced by rising frozen food consumption, Finland’s role in EU pharmaceutical trade, and the adoption of sustainable and energy-efficient cold storage solutions.

2. Who are the Key Players in the Finland Cold Chain Market?

The Finland Cold Chain Market features several key players, including Posti Group, DB Schenker, DHL Supply Chain, Kuehne+Nagel, and Transval. These companies dominate the market due to their robust cold storage infrastructure, compliance with GDP and HACCP standards, extensive fleet networks, and strong partnerships with end-user industries such as pharmaceuticals and frozen food processing.

3. What are the Growth Drivers for the Finland Cold Chain Market?

The primary growth drivers include increasing demand for biopharmaceuticals, growth in frozen and ready-to-eat foods, and rising online grocery adoption. Additionally, Finland’s commitment to carbon neutrality by 2035 is driving investments in green cold chain infrastructure. Technological advancements, such as IoT-based temperature monitoring and automated warehouses, are also enhancing efficiency and reliability across the supply chain.

4. What are the Challenges in the Finland Cold Chain Market?

The Finland Cold Chain Market faces several challenges, including high energy costs that significantly impact operating margins for cold storage providers. There are also labor shortages, particularly for trained personnel in refrigerated logistics. Moreover, infrastructure limitations in remote and northern regions pose challenges for last-mile delivery. Compliance with strict pharmaceutical and food safety regulations adds another layer of operational complexity and cost.