France Auto Finance Market Outlook to 2029

By Market Structure, By Lender Type, By Vehicle Type (New vs. Used), By Financing Tenure, By Age Group of Borrowers, and By Region

- Product Code: TDR0166

- Region: Europe

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “France Auto Finance Market Outlook to 2029 – By Market Structure, By Lender Type, By Vehicle Type (New vs. Used), By Financing Tenure, By Age Group of Borrowers, and By Region” provides a comprehensive analysis of the auto finance market in France. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on loan disbursements, by lender type, vehicle category, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

France Auto Finance Market Overview and Size

The France auto finance market was valued at EUR 28 Billion in 2023, driven by the rebound in vehicle sales post-pandemic, increased consumer inclination toward financing options, and rising digitalization of loan disbursement processes. The market is dominated by major financial institutions such as BNP Paribas Personal Finance, Crédit Agricole Consumer Finance, Société Générale, and manufacturers’ captive finance arms like RCI Banque and PSA Finance. These institutions are known for their tailored loan offerings, flexible repayment structures, and integration with digital sales platforms.

In 2023, PSA Finance introduced a fully digital financing portal that allows instant loan approvals and integration with dealerships' online inventory. This move was aimed at enhancing the customer journey and tapping into the growing online automotive retail trend. Major urban hubs such as Paris, Lyon, and Marseille remain key markets due to higher car ownership rates and extensive dealer networks.

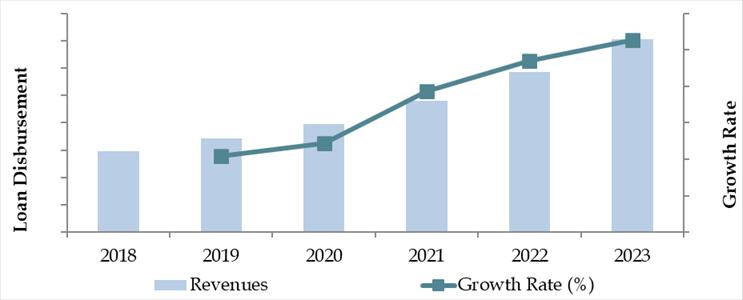

Market Size for France Auto Finance Industry on the Basis of Loan Disbursed, 2018–2023

What Factors are Leading to the Growth of France Auto Finance Market:

Economic Recovery & Incentives: Following the economic slowdown during the COVID-19 pandemic, government stimulus packages and subsidies for vehicle purchases—especially for electric vehicles (EVs)—have boosted the demand for auto loans. In 2023, government-backed low-interest loan schemes contributed to over 20% of new auto finance contracts.

Shift to Used Vehicles: With inflationary pressure and environmental awareness, consumers are increasingly opting for used and hybrid vehicles. Financing for used vehicles now accounts for nearly 45% of total auto finance contracts, indicating a rising trend of affordability-conscious car ownership.

Digital Lending Platforms: Digital transformation across the lending ecosystem has significantly accelerated loan approvals and enhanced customer accessibility. As of 2023, approximately 35% of all auto loans in France were initiated via online channels, supported by AI-driven credit scoring and paperless verification systems.

Which Industry Challenges Have Impacted the Growth for France Auto Finance Market:

Credit Accessibility for Lower Income Groups: Despite market growth, 28% of applicants in the subprime segment were denied auto loans in 2023 due to high debt-to-income ratios and stricter lending policies post-COVID. This has created a financing gap for blue-collar and gig economy workers.

Rising Interest Rate Volatility: With inflationary pressures in Europe, 2022 and 2023 saw fluctuating interest rates, impacting both lender risk and consumer confidence. Around 35% of consumers postponed car financing decisions due to uncertainty around monthly payment affordability.

Regulatory Compliance Burden: Financial institutions face complex regulatory requirements under EU directives, particularly in credit scoring transparency and borrower protection. Compliance costs increased by 11% YoY in 2023, squeezing margins especially for smaller lenders.

What are the Regulations and Initiatives which have Governed the Market:

Consumer Credit Directive (CCD) Compliance: The French auto finance sector operates under the EU’s CCD, which mandates clear disclosure of loan terms, total cost of credit, and right to withdrawal. In 2023, 97% of lenders were compliant, improving transparency and trust in the sector.

Green Finance and Low-Emission Incentives: The government provides eco-loans with zero interest for electric and hybrid vehicle purchases. In 2023, over EUR 1.2 Billion in green auto loans were disbursed, contributing to France’s goal of phasing out internal combustion engine sales by 2035.

Ban on Balloon Payments Without Clarity: From 2022, the French financial regulator required all balloon payment plans to include detailed breakdowns and projected residual values. This measure helped reduce mis-selling and improved consumer understanding, especially in the used car finance segment.

France Auto Finance Market Segmentation

By Market Structure: The bank-led financing structure dominates the market, largely due to the established reputation, lower interest rates, and deep branch network of traditional banks like BNP Paribas, Crédit Agricole, and Société Générale. These institutions are trusted by consumers, especially older buyers and rural populations, who prefer in-person interactions and standardized loan processes. Captive finance companies, operated by vehicle manufacturers such as Stellantis Financial Services and Renault Financial Services, also hold a significant market share. These players offer attractive bundled offers such as low-rate loans, lease deals, and maintenance packages, especially at the point of sale in dealerships.

By Type of Financing: Vehicle loans remain the most popular option, especially for used vehicles, due to greater consumer control and full ownership at the end of term. In contrast, leasing options (including operational and financial leases) are rapidly growing, particularly among younger consumers and corporate clients, thanks to lower upfront costs, flexibility, and tax benefits. In 2023, leasing accounted for around 42% of new car finance deals in urban regions.

By Vehicle Type: New vehicles account for a higher share of financed value, driven by structured dealership financing and promotional offers from OEMs. However, used vehicle financing has been growing steadily, especially in suburban and rural areas where affordability plays a major role. In 2023, around 38% of total financed vehicles were used cars, a trend bolstered by digital used car platforms and peer-to-peer lending options.

Competitive Landscape in France Auto Finance Market

The France auto finance market is moderately concentrated, with a mix of traditional banks, captive finance arms of automobile manufacturers, and emerging digital lending platforms. Established players continue to dominate due to their strong brand equity and wide distribution networks, while new entrants and fintech disruptors are gaining traction with tech-savvy consumers seeking faster, more flexible financing options.

| Company Name | Founding Year | Original Headquarters |

| Mobilize Financial Services | 1974 | Paris, France |

| CA Auto Bank | 1925 | Turin, Italy |

| Banque Stellantis France | 1979 | Paris, France |

| Cetelem (BNP Paribas Personal Finance) | 1953 | Paris, France |

| Crédit Agricole Consumer Finance | 2010 | Massy, France |

| Société Générale Consumer Finance | 1999 | Paris, France |

| Carrefour Banque | 1981 | Massy, France |

| Orange Bank | 2017 | Montreuil, France |

| Mercedes-Benz Financial Services France | 2000 | Montigny-le-Bretonneux, France |

| Toyota Financial Services France | 2000 | Nagoya, Japan |

Some recent competitor trends and key highlights include:

Crédit Agricole Consumer Finance: One of the largest players in the French auto finance sector, the company financed over €10 billion worth of auto loans in 2023. It has recently partnered with several EV manufacturers to support green auto loans with subsidized interest rates.

BNP Paribas Personal Finance: With a growing focus on used vehicle loans, BNP Paribas launched a digital loan approval system that reduced average processing time by 35%. The platform saw an 18% year-on-year increase in consumer auto loan applications in 2023.

Société Générale (CGI Finance): Known for its strong dealership partnerships, CGI Finance expanded its footprint in the luxury car leasing segment, recording a 22% increase in financing for premium brands such as BMW and Audi.

Stellantis Financial Services: The captive finance arm of Stellantis has expanded flexible leasing programs, including mileage-based subscription models, aimed at urban drivers. These offerings are now available in over 80% of Stellantis dealerships across France.

Renault Financial Services: In 2023, Renault launched a fully digital loan platform for its Zoe and Megane EV models, offering instant pre-approvals. Over 35% of their new car financing was processed digitally within the first six months of launch.

Younited Credit: As a digital-only lending platform, Younited Credit has gained significant traction among younger borrowers. It grew its auto finance portfolio by 40% in 2023, driven by a fully online experience and AI-powered credit scoring tools.

_pF2O9qq.png)

What Lies Ahead for France Auto Finance Market?

The France auto finance market is expected to grow steadily through 2029, supported by economic recovery, digitization, and the transition to electric mobility. The sector is projected to register a healthy CAGR during the forecast period.

Acceleration of Electric Vehicle Financing: With France aiming to ban the sale of internal combustion engine cars by 2035, demand for EV financing is set to surge. Government-backed green loans and low-interest EV-specific finance products will drive significant market activity in this segment.

Expansion of Digital Lending Ecosystems: The future of auto finance in France will be shaped by AI, open banking, and API integrations. Real-time credit decisions, automated underwriting, and personalized loan offers will redefine customer experience and reduce friction in the lending process.

Rise in Flexible Financing Models: Subscription-based models, flexible leasing, and mileage-based repayment options are expected to grow, especially among urban millennials. These offerings provide greater financial agility and align with the shift toward usage-based mobility.

Used Vehicle Finance Growth: The aging vehicle fleet in France and rising prices of new cars will push more consumers toward used vehicle financing. Lenders are likely to expand offerings in this area, including certified pre-owned loan products with bundled insurance and service contracts.

Future Outlook and Projections for France Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

France Auto Finance Market Segmentation

• By Market Structure:

o Traditional Banks

o Captive Finance Companies

o FinTech & Digital Lenders

o Dealer-Led Financing

o Peer-to-Peer Lending

o Credit Unions

o Government-Backed Loan Programs

• By Type of Lenders:

o Crédit Agricole Consumer Finance

o BNP Paribas Personal Finance

o Société Générale (CGI Finance)

o Stellantis Financial Services

o Renault Financial Services

o Younited Credit

o Cofidis

• By Type of Financing:

o Vehicle Loans

o Operational Leasing

o Financial Leasing

o Subscription Models

o Balloon Payment Plans

• By Vehicle Type:

o New Vehicles

o Used Vehicles

o Electric Vehicles (EVs)

o Hybrid Vehicles

o Commercial Vehicles

• By Age of Vehicle:

o 0–2 Years

o 3–5 Years

o 6–10 Years

o 10+ Years

• By Consumer Segment:

o First-Time Buyers

o Urban Professionals

o Families

o Small Businesses

o Corporate Fleets

• By Region:

o Île-de-France

o Auvergne-Rhône-Alpes

o Nouvelle-Aquitaine

o Provence-Alpes-Côte d'Azur

o Hauts-de-France

o Grand Est

Players Mentioned in the Report (Banks):

- Crédit Agricole

- Société Générale

- BNP Paribas

- BPCE

- La Banque Postale

- Caisse Fédérale de Crédit Mutuel

Players Mentioned in the Report (NBFCs):

- Cetelem (BNP Paribas Personal Finance)

- Cofidis

- Cofinoga

- Floa Bank

- Younited Credit

- Carrefour Banque

- Orange Bank

- Capitole Finance-Tofinso

Players Mentioned in the Report (Captive):

- Mobilize Financial Services (Renault Group)

- Banque Stellantis France

- Toyota France Management

- BMW Financial Services France

- Mercedes-Benz Financial Services France

- Volkswagen Financial Services France

- Ford Credit France

- Hyundai Capital France

Key Target Audience:

• Banks and Captive Finance Companies

• Online and Digital Lending Platforms

• Automobile Dealerships

• Regulatory Bodies (e.g., Autorité de Contrôle Prudentiel et de Résolution - ACPR)

• Automotive Leasing and Subscription Providers

• Credit Rating Agencies

• Research and Policy Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in France by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for France Car Finance Market

11.2. Growth Drivers for France Car Finance Market

11.3. SWOT Analysis for France Car Finance Market

11.4. Issues and Challenges for France Car Finance Market

11.5. Government Regulations for France Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in France Car Finance Market, 2024

17.2. Market Share of Key NBFCs in France Car Finance Market, 2024

17.3. Market Share of Key Captive in France Car Finance Market, 2024

17.4. Benchmark of Key Competitors in France Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities within the France Auto Finance Market. This includes traditional banks, captive finance companies, digital lenders, dealerships, and end-consumers. Based on this mapping, we shortlist the top 5–6 key players in the country using parameters such as financing volume, product offerings, and market reach.

Sourcing is performed through industry publications, financial databases, automotive sector reports, and regulatory filings to develop a foundational understanding of the market landscape.

Step 2: Desk Research

A thorough desk research process is conducted using a variety of secondary sources, including proprietary databases, industry whitepapers, press releases, and annual financial statements. We analyze key variables such as total financing volume, loan distribution by vehicle type, interest rates, consumer demographics, and regional activity.

This is complemented by a review of strategic initiatives, digital transformation trends, and evolving product offerings within auto finance.

Step 3: Primary Research

We conduct in-depth interviews with stakeholders across the France Auto Finance Market including C-level executives, branch managers, fintech founders, automotive dealers, and financial analysts. These interviews validate the insights gathered through desk research and offer firsthand perspectives on growth trends, operational challenges, and competitive dynamics.

As part of our validation approach, disguised interviews are conducted wherein our researchers pose as potential borrowers. This allows us to test pricing models, approval processes, and user experiences. These insights help us triangulate the financial data shared in public disclosures and align it with real-world customer interactions.

Step 4: Sanity Check

- We employ both top-down and bottom-up modeling techniques to verify overall market estimates. Cross-validation is conducted by comparing derived figures with publicly available data, industry averages, and information provided during expert interviews.

FAQs

1. What is the potential for the France Auto Finance Market?

The France Auto Finance Market reached a valuation of EUR 48.3 Billion in 2023 and is projected to grow steadily through 2029. The sector is set to benefit from the rising demand for electric vehicles, increasing digital loan penetration, and evolving consumer expectations around flexible financing. The market's growth is further supported by government-backed green finance programs and France’s nationwide push toward sustainable mobility.

2. Who are the Key Players in the France Auto Finance Market?

The market is led by a mix of banks and manufacturer-owned finance companies including Crédit Agricole Consumer Finance, BNP Paribas Personal Finance, Société Générale (CGI Finance), Stellantis Financial Services, Renault Financial Services, and emerging digital platforms like Younited Credit. These players dominate due to their large networks, diverse financing options, and strong brand equity.

3. What are the Growth Drivers for the France Auto Finance Market?

Key growth drivers include increased vehicle ownership among younger consumers, digitization of loan processes, government incentives for electric and hybrid vehicle financing, and the rise of flexible leasing and subscription models. France's national EV transition strategy and low-interest loan programs for eco-friendly vehicles have also provided significant momentum to the market.

4. What are the Challenges in the France Auto Finance Market?

Challenges include limited credit access for low-income and subprime borrowers, interest rate volatility, and the growing regulatory compliance burden. Additionally, the market faces disruption risks from fintechs and evolving consumer behavior, requiring traditional players to quickly adapt through digital transformation and personalized offerings.