France Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Logistics Segments (Road, Rail, Air, and Sea), By End-Users (Retail, Automotive, FMCG, Healthcare, E-commerce), By Type of Warehousing (Bonded, Cold Storage, General), and By Region

- Product Code: TDR0273

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “France Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Logistics Segments (Road, Rail, Air, and Sea), By End-Users (Retail, Automotive, FMCG, Healthcare, E-commerce), By Type of Warehousing (Bonded, Cold Storage, General), and By Region” provides a comprehensive analysis of the logistics and warehousing industry in France. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, emerging trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the France Logistics and Warehousing Market. The report concludes with future market projections based on revenue, by segments, region, cause-and-effect relationships, and success case studies highlighting key opportunities and concerns.

France Logistics and Warehousing Market Overview and Size

The France logistics and warehousing market reached a valuation of EUR 57.5 Billion in 2023, driven by the country's strategic location in Western Europe, increasing cross-border trade within the EU, growth in e-commerce, and the modernization of supply chain infrastructure. Key players such as Geodis, DB Schenker, XPO Logistics, Bolloré Logistics, and DSV dominate the market with well-integrated services in freight transportation, supply chain solutions, and warehousing.

In 2023, Geodis launched automated warehousing solutions integrated with AI and IoT to enhance supply chain efficiency. Paris, Lyon, and Marseille are prominent logistics hubs due to their dense industrial base, strong connectivity, and large consumer markets.

%2C%202024%E2%80%932030%20(1).png)

What Factors are Leading to the Growth of France Logistics and Warehousing Market

Strategic Geographic Location: France serves as a critical gateway between Northern and Southern Europe. Proximity to Germany, Spain, and Italy allows efficient intra-European trade, supporting demand for third-party logistics (3PL) and cross-docking services.

E-commerce and Last-Mile Delivery Boom: The rise of online shopping, especially post-COVID-19, has surged demand for last-mile delivery and micro-fulfillment centers. As of 2023, France had over 60 million internet users, and e-commerce logistics accounted for nearly 18% of total logistics spending.

Automation and Smart Warehousing: Companies are investing in robotics, autonomous vehicles, and warehouse management systems (WMS) to enhance operational efficiency. Around 45% of new warehousing facilities in 2023 incorporated semi or full automation.

Which Industry Challenges Have Impacted the Growth for France Logistics and Warehousing Market

Rising Operational Costs: One of the most pressing challenges is the steady increase in fuel, labor, and real estate costs. As of 2023, logistics firms reported an average 12% YoY rise in operating expenses, driven primarily by higher energy costs and wage pressures. These cost burdens significantly impact margins, especially for SMEs.

Driver Shortage and Labor Constraints: France faces an acute shortage of qualified truck drivers and warehouse operators. According to the French Road Transport Federation, the country was short of approximately 55,000 drivers in 2023. This talent gap leads to shipment delays, higher salary demands, and underutilization of logistics capacity.

Infrastructure Bottlenecks: Despite having an advanced network, certain regional hubs—especially in the south and northeast—experience congestion and warehousing constraints. In a 2023 industry survey, 38% of companies cited infrastructure limitations as a key bottleneck to scaling their logistics operations, particularly around Marseille and Strasbourg.

What are the Regulations and Initiatives which have Governed the Market

Decarbonization Mandates and Emission Norms: France has committed to reducing GHG emissions by 40% by 2030 (compared to 1990 levels). The logistics sector is under pressure to adopt cleaner technologies, including Euro 6 engines and electric fleets. In 2023, 25% of urban delivery vehicles in France were electric or hybrid, up from 17% in 2021.

Logistics Zoning and Urban Access Regulations: Major cities like Paris and Lyon enforce Low Emission Zones (LEZs) restricting diesel freight vehicles. By 2024, freight vehicles older than Euro 4 standards will be banned in LEZs. These rules require companies to invest in cleaner fleets or reroute deliveries.

Public Investment in Green Logistics: The French government has allocated EUR 1.7 billion under France Relance for logistics modernization, including support for modal shift (from road to rail or inland waterways), automation of warehousing, and AI-driven supply chain optimization. In 2023 alone, over 180 logistics SMEs benefited from modernization grants.

France Logistics and Warehousing Market Segmentation

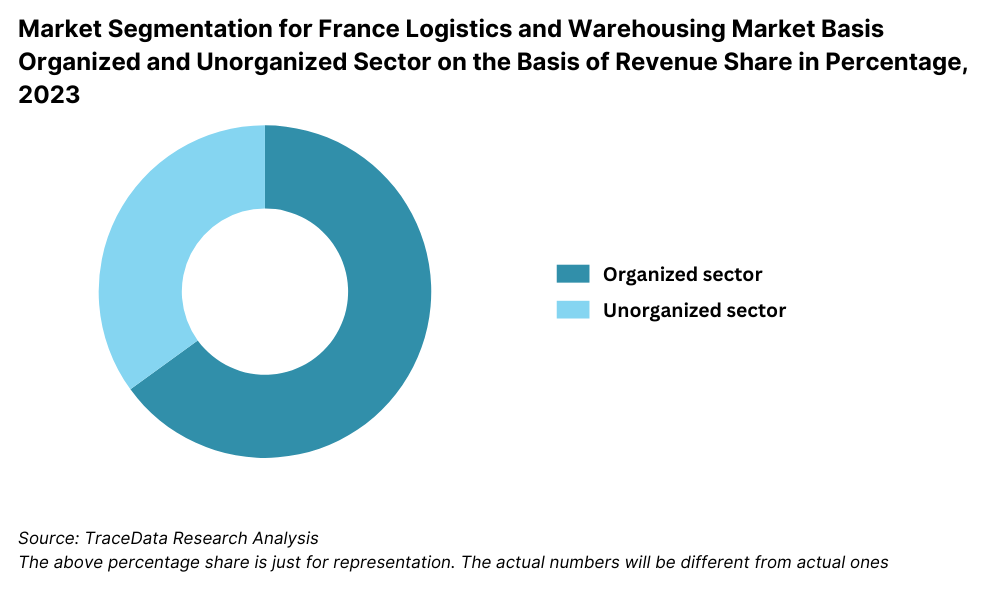

By Market Structure: The organized sector dominates the French logistics and warehousing market due to its superior infrastructure, compliance with European Union standards, and the ability to provide integrated end-to-end solutions. Major 3PL players, including Geodis, DB Schenker, and XPO Logistics, offer value-added services such as real-time tracking, inventory optimization, and automation, making them the preferred choice for large manufacturers and retailers. The unorganized or fragmented segment, comprising small-scale local operators and standalone warehouses, still holds a significant share in rural and semi-urban regions where logistics needs are simpler and cost is a key factor.

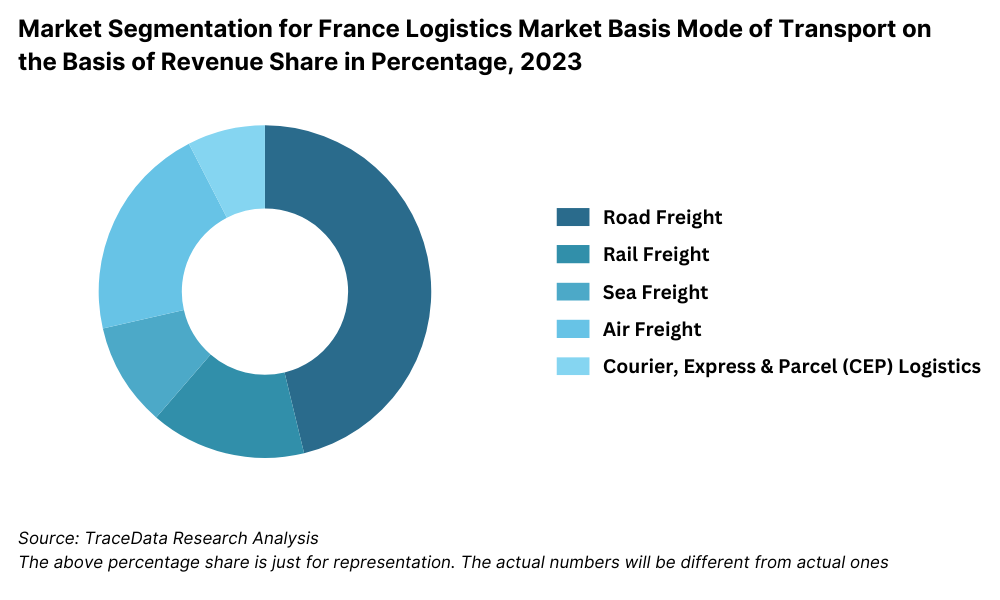

By Mode of Transport: Road transport is the most dominant mode in France’s logistics sector, driven by the country’s extensive motorway network and the demand for quick intra-country deliveries. In 2023, road logistics accounted for a major share of domestic freight volume.

Rail freight is experiencing renewed interest due to its sustainability, especially for bulk and long-haul cargo. The government’s push for modal shift has supported rail transport's growth.

Sea freight, especially through ports like Le Havre and Marseille, handles a large volume of international trade, while air freight is used for high-value and time-sensitive goods, with Paris CDG Airport being a key hub.

By Type of Warehousing:General warehousing (dry storage) forms the backbone of the market, used by sectors such as retail, automotive, and electronics for storing non-perishable goods. Cold storage warehouses are gaining traction, especially from pharmaceuticals, food & beverage, and agri-exports. In 2023, the demand for temperature-controlled logistics rose by over 10%, driven by vaccine logistics and online grocery orders. Bonded warehouses, primarily located in port cities and near customs zones, serve as critical nodes for international trade and value-added services such as packaging and labeling for re-exports.

Competitive Landscape in France Logistics and Warehousing Market

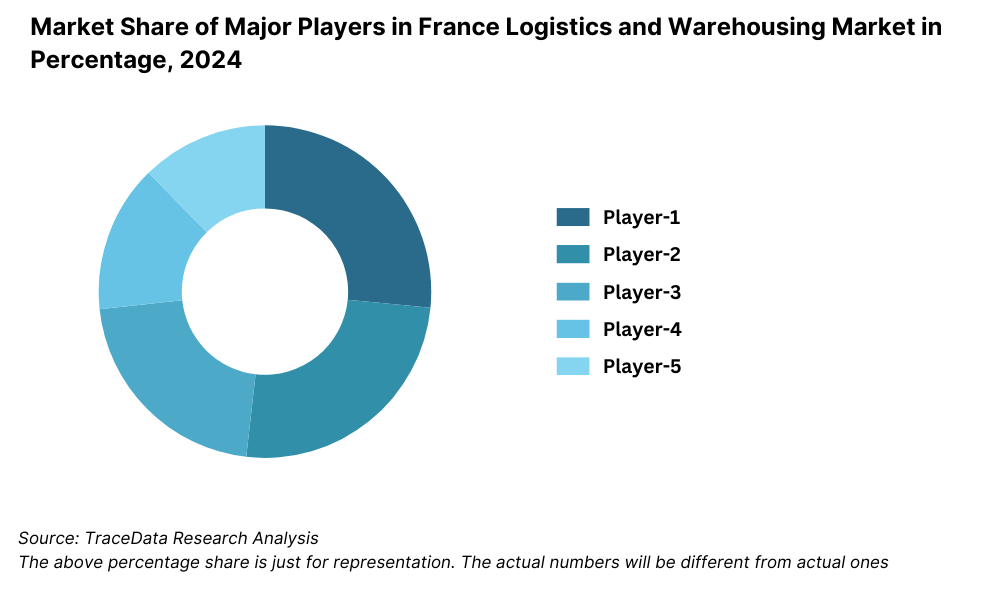

The France logistics and warehousing market is moderately concentrated, with a few leading multinational and domestic players commanding significant market share. However, the rise of tech-driven logistics startups and specialized warehousing providers has added diversity to the competitive landscape. Established players such as Geodis, DB Schenker, Bolloré Logistics, XPO Logistics, and DSV continue to lead the market, while new entrants and mid-sized firms bring innovation and specialized solutions.

Company | Establishment Year | Headquarters |

Geodis | 1904 | Levallois-Perret, France |

DB Schenker | 1872 | Essen, Germany (France Ops) |

Bolloré Logistics | 1822 | Puteaux, France |

XPO Logistics | 2000 | Lyon, France |

DSV | 1976 | Hedehusene, Denmark (France Ops) |

Some of the recent competitor trends and key information about competitors include:

Geodis: As a global logistics provider headquartered in France, Geodis expanded its robotics-enabled warehouse facilities across Île-de-France and Auvergne-Rhône-Alpes in 2023. The company recorded a 12% increase in warehousing capacity and launched new sustainable transport services using biogas and electric trucks.

DB Schenker: The French division of DB Schenker reported significant growth in rail-road intermodal freight, benefiting from EU-backed green logistics initiatives. In 2023, the company handled over 18 million freight tonnes in France, with increased demand from the automotive and pharmaceutical sectors.

Bolloré Logistics: With its strong presence in maritime freight, Bolloré invested in port logistics infrastructure in Le Havre and Marseille, facilitating higher throughput. The company also introduced AI-driven inventory systems in its bonded warehouses, improving operational efficiency by up to 22%.

XPO Logistics: XPO expanded its last-mile delivery network across major French cities, partnering with several e-commerce firms. Its urban logistics hubs in Paris and Lille grew by 19% in capacity in 2023, supporting faster turnaround and reduced delivery times.

DSV: While not headquartered in France, DSV’s French operations have grown significantly. The company focused on cold chain logistics, especially for pharma and food sectors, and expanded temperature-controlled warehouse capacity by 30,000 sqm in 2023.

What Lies Ahead for France Logistics and Warehousing Market?

The France logistics and warehousing market is projected to grow steadily through 2029, supported by structural reforms in the logistics ecosystem, a shift toward sustainable freight solutions, and ongoing digitization. A stable CAGR is expected as firms invest in innovation, supply chain visibility, and network expansion to meet growing demand from sectors such as e-commerce, pharma, and retail.

Expansion of Green Logistics Solutions: France's commitment to achieving carbon neutrality by 2050 will significantly shape the logistics landscape. The market is expected to see a surge in electric delivery fleets, solar-powered warehouses, and multimodal transport systems. By 2029, over 40% of last-mile delivery vehicles in urban areas are projected to be electric or low-emission, supporting cleaner logistics operations.

Rise of Smart Warehousing: The integration of AI, robotics, IoT, and warehouse management systems (WMS) is set to transform warehousing operations. Automated picking, inventory tracking, and real-time analytics will reduce errors, cut costs, and increase throughput. By 2029, more than 60% of large warehousing facilities in France are expected to adopt smart technologies.

E-commerce and Urban Logistics Growth: With continued growth in e-commerce, particularly in grocery and fast fashion segments, demand for urban logistics hubs and micro-fulfillment centers is expected to rise. Cities like Paris, Lyon, and Toulouse will see significant investments in last-mile delivery networks, same-day delivery services, and localized warehousing.

Increased Investment in Rail and Inland Waterways: The French government’s push for modal shift from road to rail and inland waterways will reshape freight movement. Strategic investment in rail terminals, intermodal corridors, and river ports like the Seine and Rhône will support sustainable bulk cargo transport, reducing road congestion and emissions.

%2C%202024%E2%80%932030.png)

France Logistics and Warehousing Market Segmentation

• By Market Structure:

Organized Logistics Providers

Unorganized / Independent Operators

3PL (Third-Party Logistics) Companies

In-house Logistics (Retailers, Manufacturers)

Contract Logistics Providers

Freight Forwarders

Express and Parcel Service Providers

• By Mode of Transport:

Road Freight

Rail Freight

Sea Freight

Air Freight

Multimodal Transport

• By Type of Warehousing:

General Warehousing

Cold Storage Warehousing

Bonded Warehousing

E-commerce Fulfillment Centers

Urban Micro-Fulfillment Centers

Automated/Semi-Automated Warehouses

• By End-User Industry:

Retail and FMCG

Automotive

Pharmaceuticals and Healthcare

E-commerce and Last-Mile Delivery

Chemicals and Industrial Goods

Food and Beverage

Agriculture and Agri-Exports

• By Region:

Île-de-France (Paris Region)

Auvergne-Rhône-Alpes

Hauts-de-France

Nouvelle-Aquitaine

Provence-Alpes-Côte d'Azur

Grand Est

Occitanie

Normandy

Players Mentioned in the Report:

Geodis

DB Schenker

Bolloré Logistics

XPO Logistics

DSV

FM Logistic

Stef Group

Dachser France

Kuehne + Nagel France

ID Logistics

Key Target Audience:

3PL and Contract Logistics Providers

Warehouse Developers and Operators

E-commerce Companies

Transportation and Freight Companies

Government and Regulatory Bodies (e.g., French Ministry of Transport)

Cold Chain and Pharmaceutical Logistics Firms

Industrial and Retail Supply Chain Managers

Infrastructure Investment Firms

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for France Logistics and Warehousing Market

4.3. Business Model Canvas for France Logistics Market

4.4. Demand Decision-Making Process (Retailers, Manufacturers, E-commerce)

4.5. Supply Decision-Making Process (3PLs, Freight Operators, Warehouse Providers)

5.1. Freight Transport Volume by Mode in France (Road, Rail, Sea, Air), 2018-2024

5.2. Logistics Spending as % of GDP in France, 2018-2024

5.3. Warehousing Stock in Major Logistics Zones, 2018-2024

5.4. Number of Logistics Companies by Region and Size Tier

8.1. Revenues, 2018-2024

8.2. Transported Tonnage and Warehousing Capacity, 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Mode of Transport (Road, Rail, Air, Sea), 2023-2024P

9.3. By Type of Warehousing (General, Cold Storage, Bonded), 2023-2024P

9.4. By End-User Industry (Retail, Automotive, Pharma, FMCG, E-commerce), 2023-2024P

9.5. By Region (Île-de-France, Hauts-de-France, PACA, Auvergne-Rhône-Alpes, etc.), 2023-2024P

9.6. By Facility Automation Level (Manual, Semi-Automated, Fully Automated), 2023-2024P

10.1. Customer Landscape and Logistics Needs

10.2. Customer Journey and Selection Criteria for 3PLs

10.3. Pain Point Analysis and Unmet Needs

10.4. Gap Analysis Framework

11.1. Trends and Developments for France Logistics and Warehousing Market

11.2. Growth Drivers for France Logistics and Warehousing Market

11.3. SWOT Analysis for France Logistics and Warehousing Market

11.4. Issues and Challenges for France Logistics and Warehousing Market

11.5. Government Regulations and Incentives

12.1. Market Size and Future Potential of Cold Chain and E-fulfillment Centers, 2018-2029

12.2. Business Models and Use Cases

12.3. Cross-Comparison of Leading Cold Chain and Urban Fulfillment Providers

13.1. Major Investments in Infrastructure Projects (Rail, Ports, Warehouses)

13.2. Trends in Logistics Real Estate and Facility Leasing

13.3. Public-Private Partnerships and Government Schemes

16.1. Benchmark of Key Competitors Including Overview, Strategy, Services, Revenues, Facility Footprint, Technology Adoption

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Freight Volumes and Warehousing Demand, 2025-2029

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Mode of Transport (Road, Rail, Air, Sea), 2025-2029

18.3. By Type of Warehousing (General, Cold, Bonded), 2025-2029

18.4. By Region, 2025-2029

18.5. By End-User Industry, 2025-2029

18.6. By Facility Automation Level, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the France Logistics and Warehousing Market. Based on this ecosystem mapping, we shortlisted 5–6 leading logistics providers and warehousing operators in the country based on criteria such as revenue, fleet size, warehousing capacity, industry coverage, and technology adoption.

Sourcing was done using industry reports, company filings, logistics trade associations (such as TLF), government publications, and proprietary databases to compile initial market intelligence and ecosystem structure.

Step 2: Desk Research

A rigorous secondary research process was undertaken using a variety of public and private databases to understand overall market trends and performance. This included reviewing industry publications, EU logistics policy papers, market research portals, and transport ministry data.

We analyzed company-level financials, service capabilities, infrastructure data, and technology investments, sourcing from annual reports, earnings calls, sustainability disclosures, and logistics magazines. This step aimed to build a quantitative and qualitative foundation for market sizing, segmentation, and trend identification.

Step 3: Primary Research

We conducted in-depth interviews with key stakeholders across France’s logistics ecosystem, including C-suite executives of 3PL firms, warehouse managers, retail supply chain heads, cold chain experts, and infrastructure planners.

These interviews validated desk research hypotheses, captured granular insights on operational models, pricing benchmarks, cost drivers, capacity utilization, warehousing automation, and helped triangulate market size.

A bottom-to-top approach was applied to calculate aggregated warehousing space and logistics service revenues across key players.

We also used disguised customer interviews to verify claims made in interviews and analyze actual service offerings, lead times, rate cards, and network strength from the customer's perspective.

Step 4: Sanity Check

Top-down and bottom-up triangulation was performed to validate volume estimates and revenue generation across warehousing, transport, and 3PL service lines.

This included developing a market size model based on macroeconomic indicators (such as trade value, e-commerce penetration, and industrial output), benchmarking against EU peers, and reconciling multiple data points for a robust market forecast.

FAQs

1. What is the potential for the France Logistics and Warehousing Market?

The France logistics and warehousing market holds significant growth potential, reaching a valuation of EUR 57.5 Billion in 2023. This growth is fueled by France's central location in Europe, increasing demand for efficient supply chain services, and a booming e-commerce sector. The market is further supported by government investments in green logistics and infrastructure modernization, positioning France as a key logistics hub in the EU.

2. Who are the Key Players in the France Logistics and Warehousing Market?

The market includes several major domestic and international players such as Geodis, DB Schenker, Bolloré Logistics, XPO Logistics, and DSV. These firms are recognized for their vast network coverage, integrated service offerings, and investments in automation and sustainability. Other notable contributors include FM Logistic, ID Logistics, Stef Group, and Kuehne + Nagel France.

3. What are the Growth Drivers for the France Logistics and Warehousing Market?

Key growth drivers include the rapid expansion of e-commerce, the shift toward eco-friendly transportation, and increasing investments in smart warehousing technologies. The government’s push for modal shifts (from road to rail/waterways) and the rise of cold chain logistics in pharma and food sectors are also accelerating market growth.

4. What are the Challenges in the France Logistics and Warehousing Market?

The market faces several challenges such as rising operational costs, including fuel and labor expenses, as well as a shortage of skilled labor in both warehousing and transport. Urban delivery restrictions under Low Emission Zones (LEZs), infrastructure constraints in certain regions, and compliance with evolving EU environmental regulations are additional hurdles that operators must navigate.