Germany Auto Finance Market Outlook to 2029

By Market Structure, By Loan Providers, By Vehicle Type, By Loan Tenure, By Interest Rates, and By Region

- Product Code: TDR0121

- Region: Europe

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled “Germany Auto Finance Market Outlook to 2029 - By Market Structure, By Loan Providers, By Vehicle Type, By Loan Tenure, By Interest Rates, and By Region” provides a comprehensive analysis of the auto finance market in Germany. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and a comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the auto finance sector. The report concludes with future market projections based on loan disbursement, market segments, regions, and success case studies highlighting major opportunities and challenges.

Germany Auto Finance Market Overview and Size

The Germany auto finance market was valued at USD 44.0 billion in 2024 and is projected to reach USD 65.42 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period. This growth is driven by increasing demand for vehicle ownership, a growing preference for flexible financing options, and the expansion of digital lending platforms. The market is characterized by key players such as Volkswagen Bank GmbH, Mercedes-Benz Bank AG, Banque PSA Finance S.A., Bank11 für Privatkunden und Handel GmbH, and Süd-West-Kreditbank Finanzierung GmbH, which dominate the sector through extensive financial product offerings and customer-centric services.

In 2023, Volkswagen Financial Services introduced a new AI-powered loan approval system to streamline customer applications and enhance processing efficiency. This initiative aligns with the growing trend of digital transformation in the German financial sector. Cities such as Berlin, Munich, and Hamburg are key hubs for auto finance due to their high population density, strong automotive culture, and robust banking infrastructure.

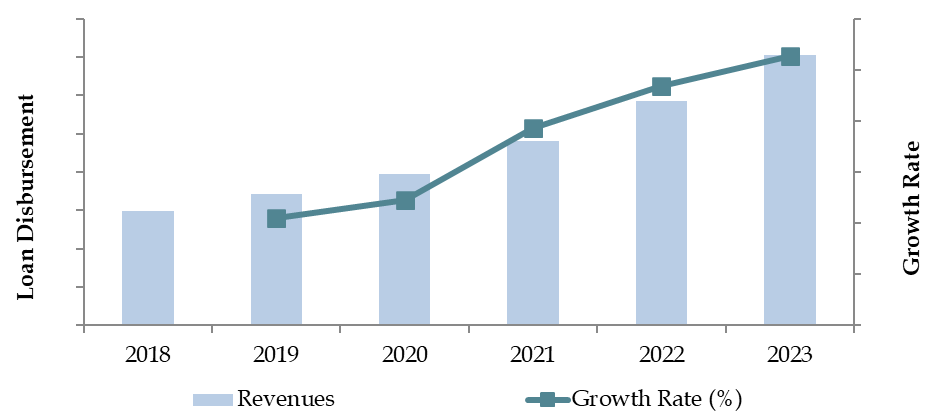

Market Size for Germany Auto Finance Industry Based on Loan Disbursement Value in USD Billion, 2018-2023

Key Factors Driving Growth in the Germany Auto Finance Market

Economic Factors: The increasing cost of vehicle ownership and rising inflation have made auto financing a crucial enabler for car buyers. In 2023, approximately 70% of new vehicle purchases in Germany were financed through loans or leasing, reflecting a strong demand for credit options. Consumers are increasingly favoring flexible loan tenures and low-interest financing solutions, making auto finance providers more competitive in offering attractive rates.

Rise in Leasing and Subscription Models: The German market has seen a rise in car leasing and subscription services, which accounted for 35% of total auto finance transactions in 2023. This shift is driven by younger consumers who prefer mobility solutions over ownership, as well as businesses looking for tax-efficient leasing options. Companies such as Sixt Leasing and ALD Automotive are leading the way in offering innovative financing alternatives to meet changing customer needs.

Digitalization in Auto Finance: The expansion of online lending platforms and digital auto finance services has transformed how consumers access car loans. In 2023, about 50% of auto loan applications in Germany were submitted online, indicating a growing preference for digital transactions. Auto finance firms are increasingly adopting AI-driven risk assessment tools, instant approval systems, and app-based financing solutions to cater to tech-savvy customers.

Which Industry Challenges Have Impacted the Growth of the Germany Auto Finance Market?

Rising Interest Rates and Inflation: The German auto finance market has been significantly impacted by rising interest rates, which have increased borrowing costs for consumers. In 2023, the average interest rate for auto loans rose by 1.8%, making financing more expensive and discouraging some buyers from taking loans. Higher inflation rates have also reduced consumer purchasing power, leading to a 12% decline in loan applications compared to the previous year.

Stricter Regulatory Compliance: Regulations surrounding consumer credit, data privacy, and vehicle emissions have added complexity to the auto finance industry. The introduction of stricter EU lending regulations in 2023 required auto finance companies to adopt more rigorous credit checks, resulting in a 9% increase in loan rejection rates. Additionally, the push for green financing means that traditional auto loans for internal combustion engine (ICE) vehicles are facing higher scrutiny and lower incentives.

Increased Competition from Fintech and Digital Lenders: The emergence of fintech startups and digital lenders has disrupted the traditional auto finance market. Companies offering instant loan approvals, AI-based risk assessment, and flexible payment models have gained traction, drawing customers away from traditional banks and OEM-affiliated finance providers. In 2023, digital lenders accounted for 22% of total auto loan disbursements, a 5% increase from 2022, signaling a shift in consumer preferences towards faster and more transparent financing solutions.

What Are the Regulations and Initiatives Governing the Market?

EU Consumer Credit Directive Compliance: Germany follows the European Union’s Consumer Credit Directive (CCD), which imposes strict guidelines on loan transparency, interest rate disclosures, and consumer protection policies. As of 2023, all auto finance providers must ensure clear loan terms, fair credit scoring mechanisms, and responsible lending practices to prevent predatory lending. This has led to an increase in documentation requirements, slightly slowing down loan approval processes.

Green Auto Loan Incentives: The German government has introduced incentives for green auto loans, encouraging consumers to finance electric vehicles (EVs) and hybrid cars through lower interest rates and tax benefits. In 2023, green auto loans accounted for 15% of total vehicle financing, supported by government-backed subsidy programs. This initiative is expected to drive further adoption of sustainable auto financing solutions in the coming years.

Digital Finance and Open Banking Regulations: Germany has embraced open banking regulations, allowing auto finance providers to access consumer financial data with consent, enabling better risk assessments and faster loan approvals. The implementation of PSD2 (Payment Services Directive 2) has facilitated seamless digital transactions and AI-based underwriting models. As a result, over 50% of auto loan applications in Germany were processed digitally in 2023.

Germany Auto Finance Market Segmentation

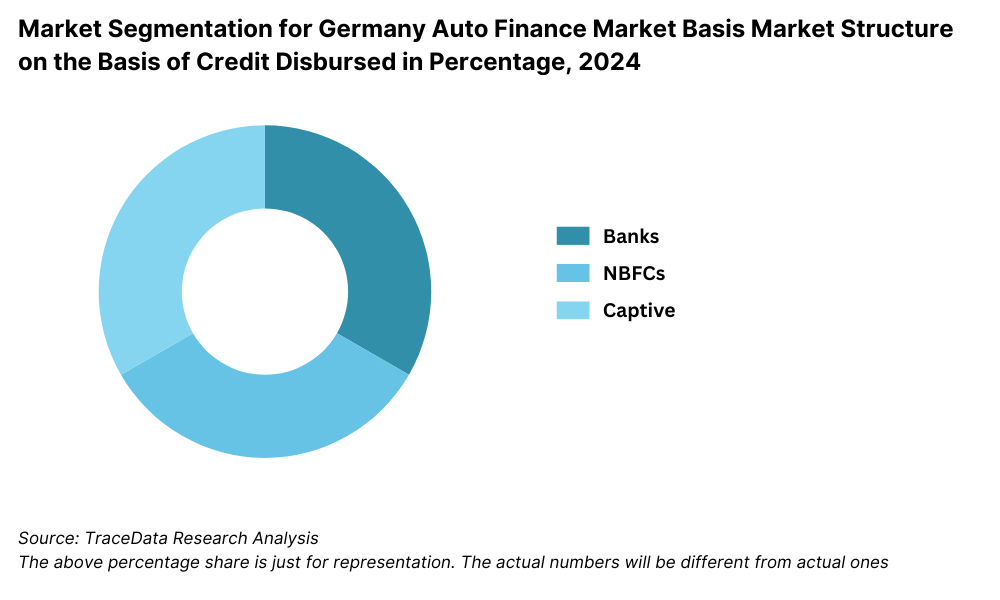

By Market Structure: The Germany auto finance market is largely dominated by traditional financial institutions such as banks and OEM-affiliated financial services, with a growing presence of digital lenders and fintech platforms. OEM-affiliated finance companies such as Volkswagen Financial Services, BMW Bank, and Daimler Mobility lead the market, offering tailored financing solutions for new car buyers and leasing customers. The rise of online platforms and mobile apps providing instant loan approvals and flexible payment terms has contributed to an increase in consumer adoption of these services. Digital lenders are becoming increasingly competitive, offering low-interest loans and streamlined application processes.

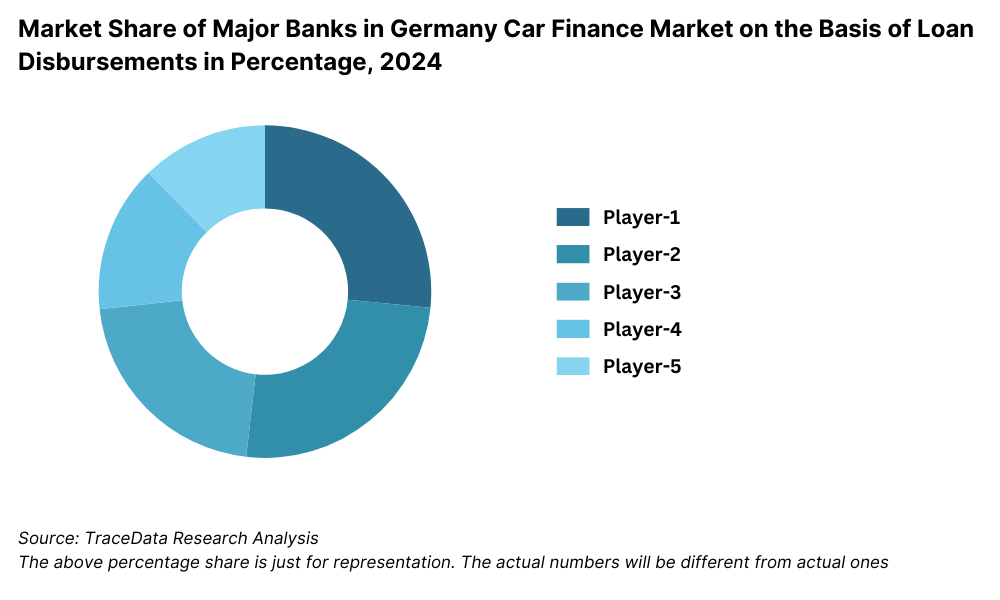

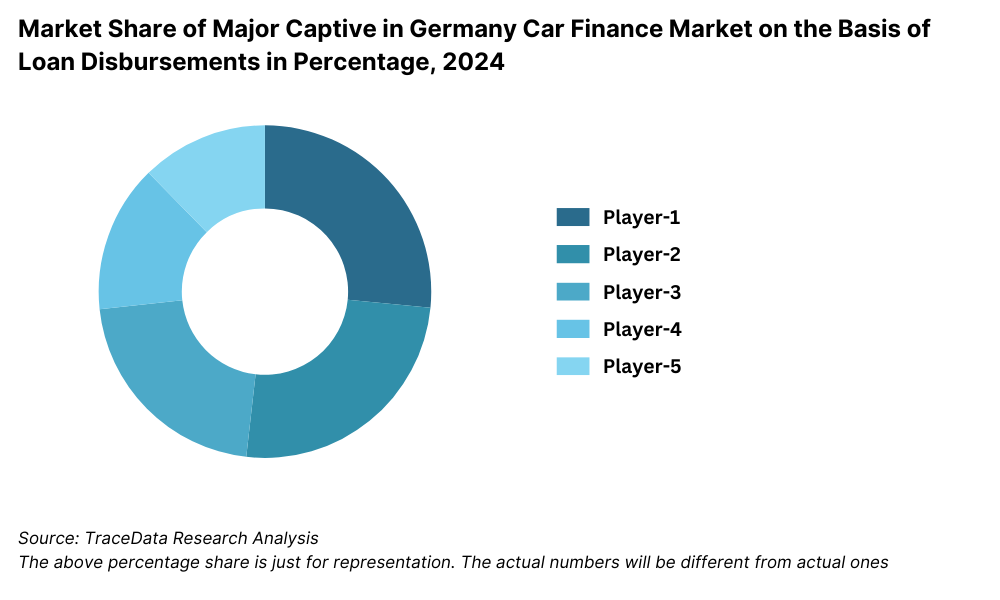

By Loan Provider: Traditional banks continue to hold the largest share in the German auto finance market, but captives and fintech platforms are gaining ground. Key players such as Volkswagen Financial Services, BMW Bank, and Mercedes-Benz Bank are the top OEM-affiliated providers. However, fintech firms like Smava and Finanzcheck have surged in popularity due to their transparent digital processes and competitive interest rates. In 2023, Volkswagen Financial Services held a market share of 24%, followed by BMW Bank at 18% and Santander Consumer Bank at 15%.

By Vehicle Type: In the Germany auto finance market, new car financing continues to dominate, driven by consumer interest in the latest models and technology. Leasing options for luxury and high-performance vehicles such as BMW, Mercedes-Benz, and Audi also make up a significant portion of financing transactions. On the other hand, used car financing has been gaining popularity, with a preference for vehicles in the 3-5 year age range offering a balance between cost and condition. The growing trend of electric vehicles (EVs) is also affecting market dynamics, as green auto loans are being introduced to support the transition to more sustainable mobility solutions.

.png)

Competitive Landscape in Germany Auto Finance Market

The Germany auto finance market is highly competitive, with a mix of traditional banks, OEM-affiliated financial services, and emerging digital lenders. The market is dominated by major financial institutions, but fintech startups and alternative financing platforms are rapidly gaining ground. Key players include Volkswagen Financial Services, BMW Bank, Daimler Mobility, Santander Consumer Bank, Deutsche Bank Auto Finance, and fintech disruptors like Smava and Finanzcheck.

Name | Founding Year | Original Headquarters |

|---|---|---|

Volkswagen Financial Services | 1949 | Braunschweig, Germany |

BMW Financial Services | 1988 | Munich, Germany |

Mercedes-Benz Financial Services | 1990 | Stuttgart, Germany |

Porsche Financial Services | 1988 | Bietigheim-Bissingen, Germany |

Santander Consumer Bank Germany | 1957 | Madrid, Spain |

Deutsche Bank Auto Finance | 1870 | Frankfurt, Germany |

Commerzbank Auto Finance | 1870 | Frankfurt, Germany |

ING Germany Auto Loan | 1965 | Frankfurt, Germany |

Siemens Financial Services | 1997 | Munich, Germany |

UniCredit Bank (HypoVereinsbank Auto Loan) | 1998 | Munich, Germany |

Recent Competitor Trends and Key Insights

Volkswagen Financial Services: As the largest auto finance provider in Germany, Volkswagen Financial Services held a 24% market share in 2023, financing a wide range of new and used vehicles. The company introduced an AI-powered risk assessment system in 2023, reducing loan processing times by 30%, making it a preferred choice for fast and efficient financing.

BMW Bank: Specializing in premium vehicle financing and leasing, BMW Bank saw a 12% increase in leasing contracts in 2023, driven by growing demand for subscription-based car ownership models. The bank also expanded its green auto loan segment, offering lower interest rates for electric and hybrid BMW models.

Daimler Mobility: Focused on luxury and fleet financing, Daimler Mobility reported a 20% increase in electric vehicle (EV) financing in 2023, supported by government incentives and lower interest rate schemes. The company's subscription-based financing model has gained traction, particularly among urban professionals and corporate clients.

Santander Consumer Bank: One of Germany’s leading banks in used car financing, Santander Consumer Bank financed over 150,000 vehicle loans in 2023. The bank’s partnership with independent dealerships has strengthened its market presence, making it a key player in the non-OEM auto finance space.

Deutsche Bank Auto Finance: With a strong presence in the luxury vehicle financing market, Deutsche Bank has focused on personalized loan offerings for high-net-worth individuals (HNWIs). The bank reported a 10% growth in EV financing loans, aligning with Germany’s push toward sustainable mobility.

Smava (Fintech Disruptor): A rising force in digital auto lending, Smava has captured 8% of Germany’s online auto loan market. Known for its instant loan approval system and competitive interest rates, Smava’s customer base grew by 35% in 2023, reflecting a shift towards digital-first financial solutions.

Finanzcheck (Online Auto Loan Marketplace): Finanzcheck, an online loan comparison platform, facilitated over 200,000 auto loans in 2023, connecting borrowers with multiple lenders. The platform’s data-driven approach has improved loan approval rates by 15%, making it a preferred choice for tech-savvy consumers.

What Lies Ahead for Germany Auto Finance Market?

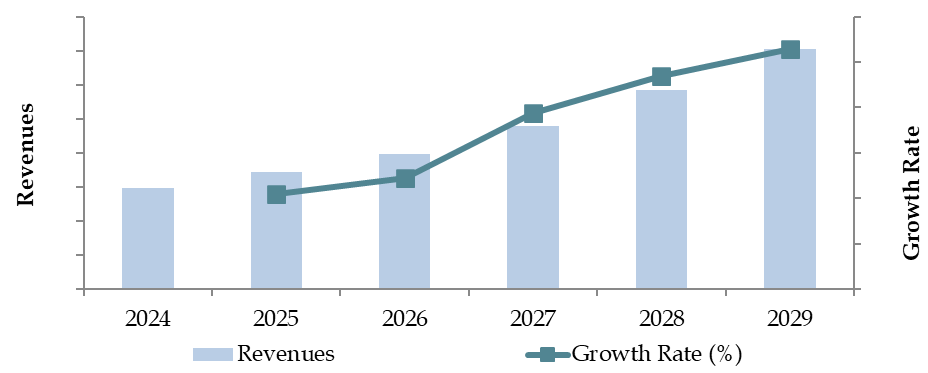

The Germany auto finance market is projected to grow steadily through 2029, with a CAGR of 6.9%, driven by digital transformation, EV adoption, and changing consumer preferences. The market will continue to evolve as new financial models, sustainability incentives, and fintech disruptions reshape the lending landscape.

Rise of Electric Vehicle (EV) Financing: As Germany pushes toward a carbon-neutral future, the demand for EV auto financing is expected to rise significantly. In 2023, green auto loans made up 15% of total auto financing, and this number is anticipated to double by 2029 due to government subsidies, tax exemptions, and lower interest rate schemes for EVs. Banks and financial institutions are expected to expand their EV financing portfolios, making green auto loans a key driver of growth in the coming years.

Digital Lending and AI-Driven Auto Financing: The shift towards online auto loan applications and AI-powered risk assessment models is set to accelerate. By 2029, an estimated 70% of auto loan approvals will be processed through digital platforms, reducing approval times and improving customer experiences. Fintech startups and traditional lenders alike are expected to integrate big data analytics and AI-driven underwriting models to enhance loan accessibility, affordability, and fraud detection mechanisms.

Expansion of Subscription and Leasing Models: Consumer preferences are shifting toward flexibility over ownership, leading to an increase in car leasing and subscription services. By 2029, leasing is expected to account for nearly 45% of financed vehicles, up from 35% in 2023. Younger consumers, urban professionals, and corporate buyers are showing a strong preference for short-term leasing and subscription-based vehicle financing.

Growth in Used Car Financing: As new vehicle prices continue to rise and inflation impacts disposable income, the used car financing market is expected to expand. In 2023, used car financing accounted for 30% of all auto loans, and this figure is projected to increase to 40% by 2029. Digital financing platforms are making pre-owned car loans more accessible, providing better interest rates and flexible repayment plans, which will further fuel growth in this segment.

Future Outlook and Projections for Germany Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Germany Auto Finance Market Segmentation

- • By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Finance Platforms

- Credit Unions

- Peer-to-Peer (P2P) Lending Platforms

- Captive Finance Companies

- Microfinance Institutions

- By Type of Vehicles Financed:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Luxury Vehicles

- Used Vehicles

- By Loan Tenure:

- <3 years

- 3-5 years

- 5-7 years

- 7-9 years

- 9 years

- By Interest Rates:

- Fixed Interest Rate Loans

- Variable Interest Rate Loans

- Zero Interest Loans

• By Consumer Profile:

- First-Time Buyers

- High-Net-Worth Individuals (HNWIs)

- Corporate and Fleet Buyers

- Used Car Buyers

- EV and Hybrid Buyers

• By Region:

- Northern Germany (Hamburg, Bremen, Lower Saxony)

- Southern Germany (Bavaria, Baden-Württemberg)

- Central Germany (Hesse, Thuringia)

- Western Germany (North Rhine-Westphalia, Saarland, Rhineland-Palatinate)

- Eastern Germany (Saxony, Brandenburg, Mecklenburg-Vorpommern)

Players Mentioned in the Report (Banks):

- Deutsche Bank

- Santander Consumer Bank

- Commerzbank

- UniCredit Bank (HypoVereinsbank)

- DZ Bank

- KfW Bank

- KT Bank

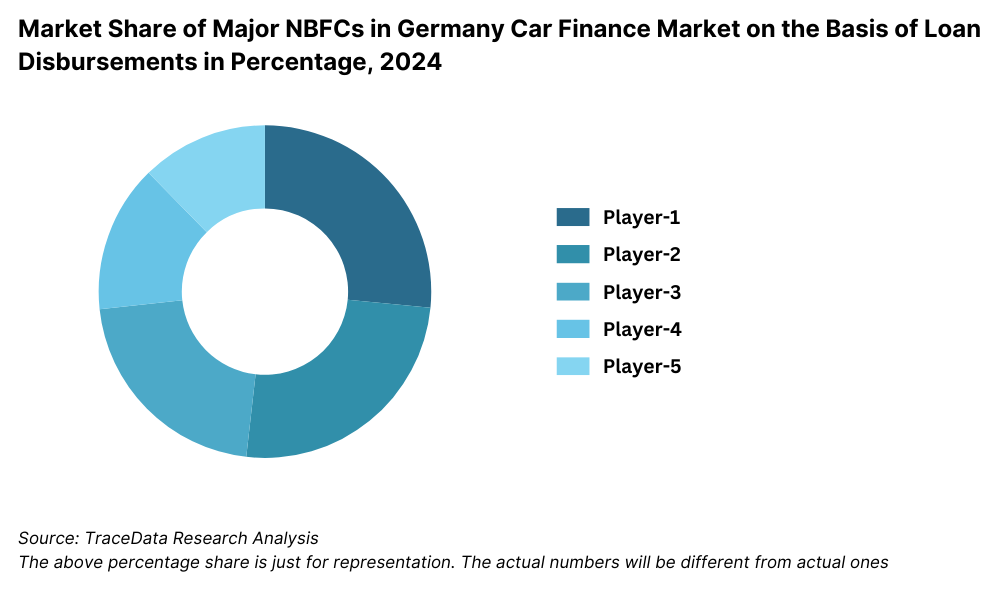

Players Mentioned in the Report (NBFCs):

- Bank11 für Privatkunden und Handel GmbH

- Süd-West-Kreditbank Finanzierung GmbH

- Deutsche Leasing

- Consors Finanz

- CA Auto Bank

- Smava GmbH

- Auto Empire Trading GmbH

Players Mentioned in the Report (Captive):

- Volkswagen Financial Services

- Mercedes-Benz Bank

- BMW Bank

- Porsche Financial Services

- Audi Bank

- Ford Bank

- Opel Bank

- Toyota Kreditbank

- RCI Bank (Renault)

- FCA Bank Deutschland

Key Target Audience:

- Auto Finance Companies

- Traditional Banks and Lending Institutions

- OEM Financial Services Providers

- Fintech Startups and Digital Lending Platforms

- Government and Regulatory Bodies (e.g., BaFin, EU Consumer Credit Authorities)

- Leasing and Subscription-Based Car Ownership Platforms

- Electric Vehicle and Green Auto Loan Providers

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Germany by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Germany Car Finance Market

11.2. Growth Drivers for Germany Car Finance Market

11.3. SWOT Analysis for Germany Car Finance Market

11.4. Issues and Challenges for Germany Car Finance Market

11.5. Government Regulations for Germany Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Germany Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Germany Car Finance Market, 2024

17.3. Market Share of Key Captive in Germany Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Germany Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for Germany Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 finance providers in the country based upon their financial information, loan disbursement volume, and market share.

Sourcing is made through industry articles, multiple secondary sources, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like loan disbursement volume, market penetration, interest rates, digital financing adoption, and competition among players.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and regulatory filings. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Germany Auto Finance Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom-to-top approach is undertaken to evaluate loan disbursement volume for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of loan structures, interest rate variations, risk assessment processes, and digital financing trends.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity check process.

FAQs

1. What is the potential for the Germany Auto Finance Market?

The Germany Auto Finance Market is expected to witness substantial growth, reaching a projected valuation of USD 65.42 billion by 2029. This expansion is driven by increasing vehicle ownership demand, rising adoption of electric vehicles (EVs), and the growing preference for leasing and digital financing solutions. Additionally, government incentives for green auto loans and technological advancements in digital lending are expected to enhance the market’s potential.

2. Who are the Key Players in the Germany Auto Finance Market?

The Germany Auto Finance Market is dominated by major financial institutions, OEM-affiliated banks, and fintech platforms. Leading players include Volkswagen Financial Services, BMW Bank, Daimler Mobility, Santander Consumer Bank, and Deutsche Bank Auto Finance. These companies leverage their strong brand presence, extensive financing options, and automotive partnerships to maintain market dominance. Additionally, fintech disruptors such as Smava, Finanzcheck, and auxmoney are reshaping the industry with AI-driven risk assessment, instant loan approvals, and digital-first financing solutions.

3. What are the Growth Drivers for the Germany Auto Finance Market?

The Germany Auto Finance Market is experiencing significant growth due to multiple factors. Government incentives for EVs, the shift toward digital auto lending, and the increasing popularity of leasing and subscription-based models are among the key drivers. Additionally, the rise in used car financing is further fueling market expansion.

4. What are the Challenges in the Germany Auto Finance Market?

The Germany Auto Finance Market faces several challenges, including rising interest rates, regulatory hurdles, fintech competition, and evolving consumer preferences. Higher borrowing costs are making auto loans less affordable, while stricter lending regulations under the EU Consumer Credit Directive (CCD) have resulted in higher loan rejection rates. Moreover, the shift toward mobility-as-a-service solutions, such as car-sharing and rentals, is reducing demand for traditional auto loans.