Germany Dyes & Pigments Market Outlook to 2030

By Product Chemistry, By Form, By Functional Properties, By End-Use Industry, and By Region

- Product Code: TDR0374

- Region: Europe

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Germany Dyes & Pigments Market Outlook to 2030 - By Product Chemistry, By Form, By Functional Properties, By End-Use Industry, and By Region” provides a comprehensive analysis of the dyes & pigments market in Germany. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the dyes & pigments market. The report concludes with future market projections based on chemistry classes, product forms, end-use sectors, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

Germany Dyes & Pigments Market Overview and Size

The Germany dyes & pigments market is estimated at USD 1,584.1 million in 2024. Demand is driven by downstream consumption in automotive coatings, specialty inks, high-end plastics, and textile coloration, along with regulatory tailwinds pushing towards premium, low-emission pigment formulations. The 2024 projection of ~ USD 1,630-1,650 million further reflects ongoing incremental adoption of high-performance and eco-friendly pigment grades.

The market leadership in Germany is concentrated in industrial hubs such as Leverkusen, Ludwigshafen, Dormagen, and Bitterfeld, owing to proximity to chemical clusters, feedstock supply (ancillary aromatics, TiO₂), strong R&D infrastructure, and advanced logistics. In Europe, Germany competes with France and the UK, but Germany’s strength lies in its integration of pigments into R&D-intensive industries like automotive and specialty coatings.

What Factors are Leading to the Growth of the Germany Dyes & Pigments Market:

Deep manufacturing base that absorbs colorants across coatings, plastics and inks: Germany’s industrial backbone continues to generate a consistent pull for pigments across automotive coatings, construction materials, masterbatch and printing inks. Manufacturing value added stands at USD 838.89 billion, up from USD 760.96 billion, underscoring the country’s large transformation base that continually consumes colorants for durable goods, packaging, and engineering components. Machinery and chemical products together account for a major share of German exports, reflecting robust downstream sectors that require precise color performance and compliance. This manufacturing intensity directly sustains demand for high-performance inorganic, organic and effect pigments, fostering a strong domestic pigment ecosystem.

Export engine with chemicals among top outbound goods supporting local pigment producers: Foreign trade acts as a structural growth enabler for Germany’s colorant industry. Chemical products represent a large portion of total exports, alongside motor vehicles and machinery—industries that are inherently pigment-intensive. Germany’s total monthly export value exceeds €130 billion, reflecting the scale of goods requiring coatings, inks and plastics coloration for global markets. This export orientation drives innovation in color consistency, durability and heat stability as German pigment producers support international standards across automotive, packaging and construction products. It reinforces Germany’s position as both a pigment manufacturer and a formulation hub for Europe.

Mobility fleet turnover and premium finishes sustaining coatings-grade pigment usage: Automotive manufacturing and vehicle refinishing represent one of Germany’s strongest pigment demand drivers. Annual new passenger car registrations total approximately 2.82 million, demonstrating a large, continuously renewing vehicle base. Each new and refinished vehicle demands multiple coating layers using high-spec pigments for color depth, weather resistance and gloss retention. In addition, the growth of electric mobility creates new applications for functional blacks, reflective coatings and plastics colorants in EV components and housings. This combination of vehicle production scale and aesthetic innovation sustains long-term pigment consumption in coatings and engineered plastics.

Which Industry Challenges Have Impacted the Growth of the Germany Dyes & Pigments Market:

Elevated industrial electricity costs pressure pigment production and dispersion operations: Pigment manufacturing processes—calcination, grinding, and dispersion—are highly energy-intensive, making the sector sensitive to Germany’s electricity tariffs. Industrial power prices average €0.16 per kWh, one of the highest levels among OECD nations. Persistent high input costs compress margins and reduce competitiveness against lower-energy-cost producers abroad. Energy remains a decisive factor for domestic expansion projects, compelling pigment plants to invest in process efficiency, waste-heat recovery, and renewable integration to maintain operational viability within the German cost environment.

Industrial output softness in chemicals dampens short-term call-offs: Cyclical weakness in Germany’s chemical production has reduced near-term pigment orders. Industrial output in chemicals has contracted periodically as manufacturers adjust to global demand fluctuations and raw-material price shifts. A decline in chemical intermediate output by over 2 % month-on-month in late 2024 highlights the volatility affecting pigment value chains. This softness delays new formulation approvals, reduces pigment throughput at distributors, and increases idle capacity across dispersion and finishing units until export momentum normalizes.

Tight environmental compliance adds mandatory steps and plant-level investments: German air-emission and wastewater standards impose strict quantitative limits on chemical sites handling pigments and dyes. Wastewater discharge for colorant plants must keep adsorbable organic halogens (AOX) below 1 mg/L and nickel concentrations under 0.5 mg/L, while TA Luft sets stringent particulate and VOC emission limits. Compliance requires continuous monitoring systems, secondary containment, and advanced filtration infrastructure. Meeting these numeric thresholds raises capital intensity for pigment producers but also drives technology upgrades in water reuse and cleaner process chemistry.

What are the Regulations and Initiatives which have Governed the Market:

REACH registration obligations for substances placed on the EU/EEA market: Under the European Union’s REACH framework, manufacturers and importers of substances exceeding 1 tonne per year must register with the European Chemicals Agency. Registration includes comprehensive data on toxicology, exposure and safe-use parameters. For pigment producers, REACH compliance determines market access and shapes R&D priorities for new chromophores. Continuous updates to restrictions—especially on azo compounds and heavy-metal pigments—require ongoing dossier maintenance and substitution programs to ensure uninterrupted supply to downstream users.

TA Luft (Technical Instructions on Air Quality Control) for permitting and emissions: TA Luft establishes baseline emission controls governing industrial sites, including pigment kilns, dryers, and dispersion units. It specifies modelling and threshold requirements for particulates, nitrogen oxides, and volatile organics, which must be met before operational permits are granted. For pigment facilities, TA Luft compliance entails detailed atmospheric dispersion modelling and stack-emission verification, forming an essential part of expansion and modernization planning across German chemical clusters.

AwSV & WGK classification for substances hazardous to water: The AwSV ordinance and Water Hazard Classes (WGK 1–3) framework classify and regulate substances according to their potential environmental risk. Pigments, auxiliaries, and solvents handled in German facilities must be stored within compliant containment systems corresponding to their WGK rating. The regulation mandates certified inspections, documentation, and secondary barriers for hazardous liquids, directly influencing plant layout and capital design for dispersion and preparation units.

Germany Dyes & Pigments Market Segmentation

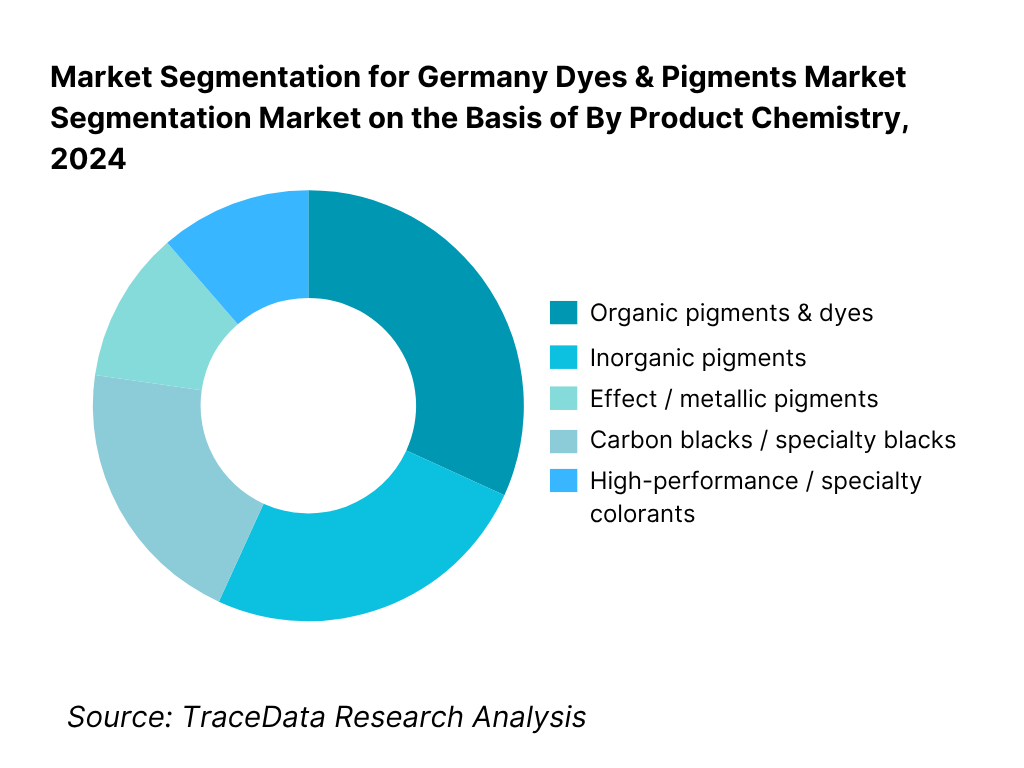

By Product Chemistry: The inorganic pigments sub-segment holds dominant share in the Germany market owing to their widespread use in coatings, plastics, and construction. Inorganic pigments (e.g. iron oxides, TiO₂-based, chromates, CICP) offer superior opacity, light stability, cost efficiency, and long service life — all attributes valued by automotive and industrial coating formulators. Many applications such as architectural paints and specialist coatings continue to rely on robust inorganic grades. Further, regulatory pressures for durable, low-maintenance coatings favor the stability of inorganic pigments.

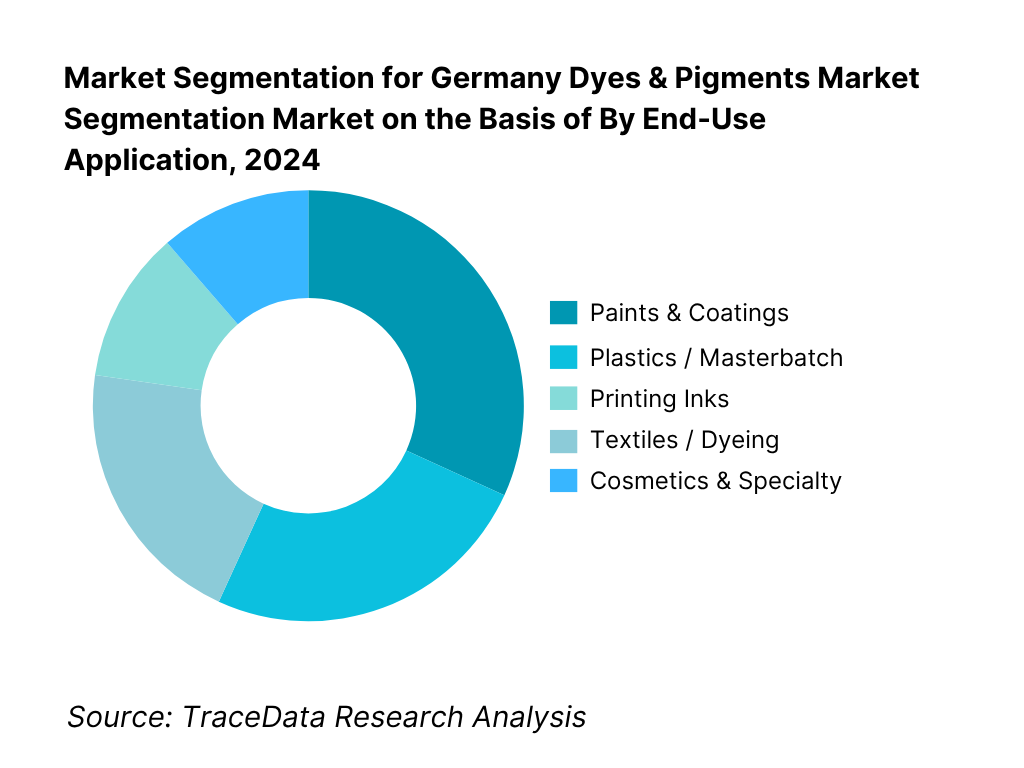

By End-Use Application: Paints & coatings represent the highest share among the end uses of dyes & pigments in Germany. This dominance stems from continual demand in automotive OEM and refinish, industrial protective coatings, and architectural/coatings segments. High growth in electro-mobility, renewable energy structures (wind turbines) and infrastructure coatings pushes demand. Coatings require stable pigments with long durability and consistency, favoring established pigment suppliers. The necessity for VOC-compliant and lightfast pigments also concentrates demand in pigments for coatings rather than dyes.

Competitive Landscape in Germany Dyes & Pigments Market

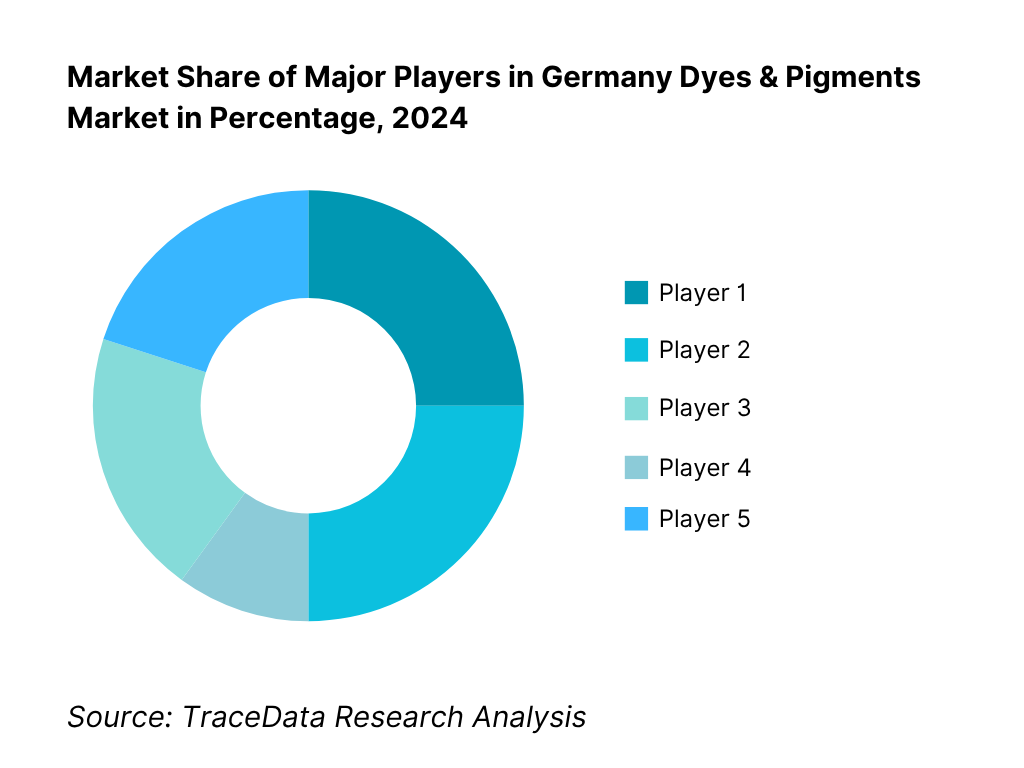

The Germany dyes & pigments space is moderately concentrated with vertically integrated chemical firms and specialized pigment houses. The dominance of established players is driven by regulatory compliance, legacy client relationships in coatings and automotive, technical formulation support, and capital barriers to entry.

Name | Founding Year | Original Headquarters |

LANXESS (Inorganic Pigments) | 2004 | Cologne, Germany |

Heubach Group | 1806 | Langelsheim, Germany |

ECKART GmbH (ALTANA Group) | 1876 | Hartenstein, Germany |

Kronos (Titan) GmbH | 1916 | Leverkusen, Germany |

Merck Surface Solutions | 1668 | Darmstadt, Germany |

Sun Chemical (DIC Corporation) | 1818 | Parsippany, USA |

DyStar Colours Deutschland GmbH | 1995 | Frankfurt, Germany |

Venator Materials | 1878 | Duisburg, Germany |

Orion Engineered Carbons GmbH | 1862 | Frankfurt, Germany |

Schlenk Metallic Pigments GmbH | 1879 | Roth, Germany |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

LANXESS (Inorganic Pigments): A dominant player in Germany’s pigment ecosystem, LANXESS has increased its output of sustainable iron oxide and CICP pigments through energy-efficient kilns at its Krefeld-Uerdingen and Ningbo sites. The company introduced its Colortherm® Yellow 5 line designed for heat-stable polymer coloration, aligning with EU decarbonization goals and expanding its automotive coatings portfolio.

Heubach Group: Following its merger with Clariant’s pigments business, Heubach has emerged as one of the largest global suppliers of organic and inorganic pigments headquartered in Germany. In 2024, it focused on developing low-carbon pigment dispersions and bio-based formulations under the EcoLine™ series, catering to increasing demand for sustainable and REACH-compliant products across coatings and plastics industries.

ECKART GmbH (ALTANA Group): ECKART, a leading metallic and effect pigment specialist, expanded its ultra-fine aluminum and pearlescent pigments portfolio for automotive and decorative coatings. In 2024, it launched the SYMIC® F 4000 series, enhancing color depth and sparkle effects for OEM finishes. The company continues to invest in digital color-matching platforms to streamline color visualization for clients.

Kronos (Titan) GmbH: Kronos remains a cornerstone of Germany’s titanium dioxide pigment industry. The company implemented process upgrades at its Leverkusen facility to lower specific energy consumption and waste output. It also introduced high-opacity KRONOS® 9900 grades for powder coatings and engineered plastics, addressing stringent whiteness and dispersion requirements from European coating formulators.

Merck Surface Solutions: Merck’s pigments division has been active in expanding its effect pigments and functional colorants portfolio, emphasizing pearlescent pigments for cosmetics, automotive, and industrial coatings. In 2024, Merck invested in digital visualization tools through its “Effect Pigments Digital Studio”, enabling customers to simulate pigment effects virtually, thereby accelerating design cycles in coatings and packaging.

What Lies Ahead for Germany Dyes & Pigments Market?

From 2025 onward, the Germany dyes & pigments market is poised for moderate but innovation-led expansion, supported by demand for higher-performance, low-toxicity colorants in automotive, specialty coatings, and packaging. As downstream industries—especially EV, lightweight plastics, and premium coatings—seek advanced pigment systems, pigment suppliers will emphasize differentiation over scale.

Hybrid Pigment Supply & Service Models: The future will see a blended model of direct supply and on-site pigment service support (e.g. micro-dispersion labs, mobile color labs, satellite blending units). Large pigment firms will invoke hybrid strategies—central manufacturing plus decentralized pigment compounding nodes near major OEM or coating clusters—to reduce logistics cost and improve response time.

Outcome-Driven Pigment Partnerships: Formulators and OEMs will increasingly insist on pigments that deliver defined performance metrics—lightfastness hours, heat stability, migration thresholds, gloss retention over cycles. Pigment makers will partner in KPIs, embedding testing protocols, benchmarking, and feedback loops. Contracts may move toward pay-for-performance pigment agreements rather than simple supply.

Sector-Tailored Pigment Solutions: As coatings in EV, aerospace, renewable power, and smart-packaging require unique pigment performance, suppliers will develop sector-specific lines (e.g. UV-stable effect pigments for solar trackers, conductive blacks for battery packs, heat-resistant pigments for engine compartments). This verticalization will intensify as clients demand “fit-for-purpose” coloration rather than catalog products.

Digital & AI-Powered Formulation Tools: AI, machine learning, and digital twin simulation tools will become essential in pigment matching, predictive stability modeling, and color forecasting across substrates. Predictive analytics on fade, dispersion, and interaction effects will allow pigment houses to pre-qualify formulations and minimize lab trial cycles, accelerating customer adoption and reducing development costs.

Germany Dyes & Pigments Market Segmentation

By Product Type (In Value %)

Inorganic Pigments (Iron Oxides, Titanium Dioxide, CICP, Ultramarine)

Organic Pigments (Azo, Phthalocyanine, Anthraquinone, DPP, Perylene)

Dyes (Reactive, Disperse, Vat, Acid, Solvent)

Effect Pigments (Metallic, Pearlescent, Interference, Holographic)

Functional / High-Performance Pigments (IR-Reflective, Conductive, Thermochromic, Anti-Corrosive)

By Form (In Value %)

Powder Pigments

Presscake Pigments

Granules / Microbeads

Dispersions & Preparations

Masterbatch / Pelletized Formulations

By End-Use Industry (In Value %)

Paints & Coatings (Automotive, Architectural, Industrial)

Plastics & Masterbatch

Printing Inks (Packaging, Digital, Commercial)

Textiles (Garments, Technical Textiles)

Cosmetics & Personal Care

By Function / Property (In Value %)

Color Strength / Opacity

Lightfastness & Weather Resistance

Heat Stability

Chemical & Solvent Resistance

Migration Resistance (Food & Cosmetic Grade)

By Region (In Value %)

North Rhine-Westphalia

Bavaria

Hesse

Lower Saxony / Saxony-Anhalt

Baden-Württemberg

Players Mentioned in the Report:

LANXESS (Inorganic Pigments)

ECKART / ALTANA (Effect & Metallic Pigments)

Heubach Group

Kronos (TiO₂ & functional pigments)

Sachtleben / Venator

Merck Surface Solutions (effect pigments)

Sun Chemical / DIC

DyStar

Clariant

Archroma

Ferro Corporation

Tronox

Orion Engineered Carbons

Vibrantz Technologies

Schlenk Metallic Pigments

Key Target Audience

Specialty chemicals investors and venture capital firms (colorant / pigment startups)

Private equity firms focused on chemical sector consolidations

Coatings & paint manufacturers (OEM and aftermarket)

Plastic compounds & masterbatch producers

Automotive OEMs and Tier 1 coating specifiers

Packaging & printing ink houses

Cosmetics & personal care colorant divisions

Government and regulatory bodies / agencies

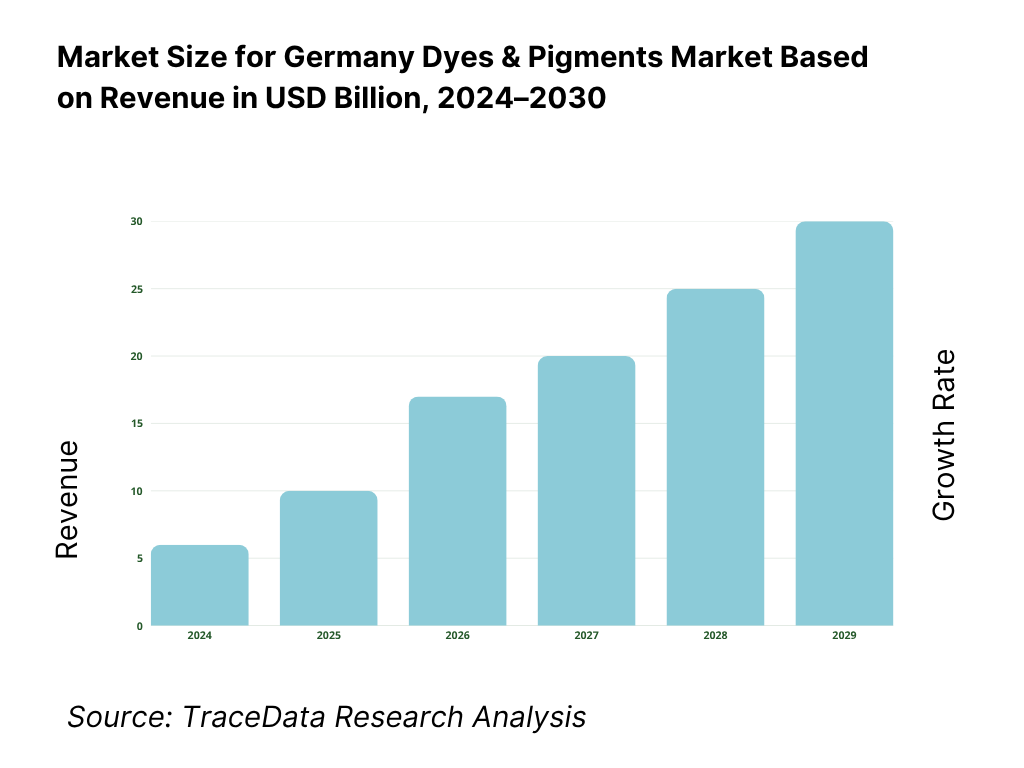

Time Period:

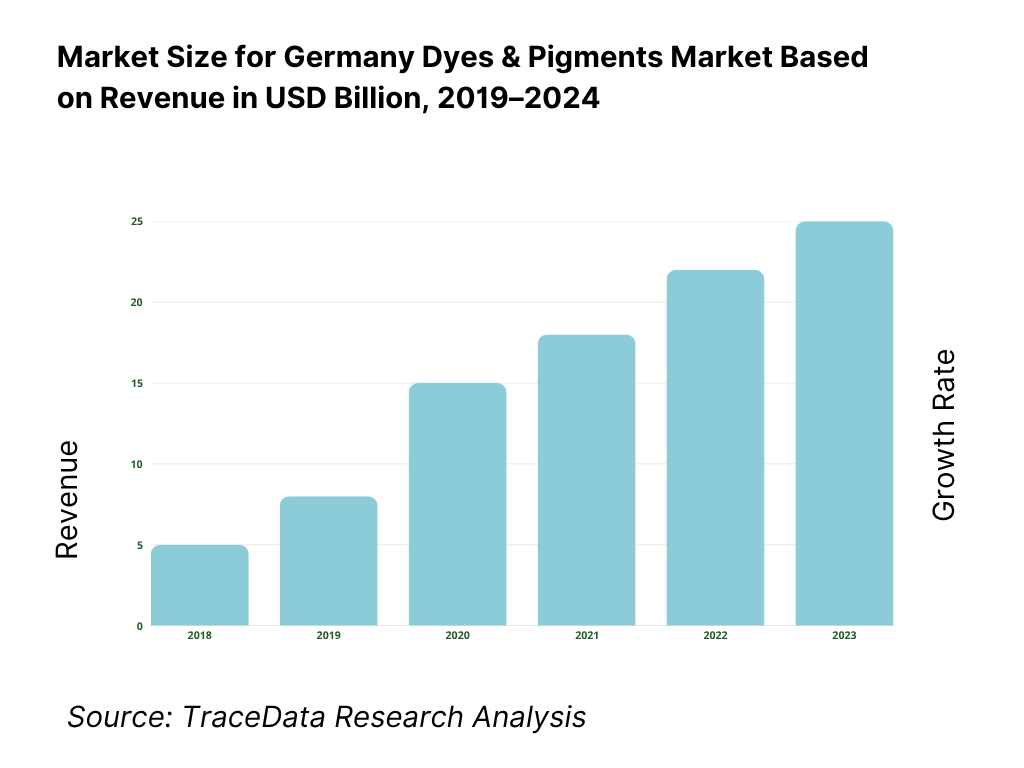

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis (Direct Sales, Toll Manufacturing, Licensing, Distribution Model)-margins, preference, strengths & weaknesses

4.2. Revenue Streams (product sales, licensing/royalties, formulation & technical service fees, custom/contract manufacturing)

4.3. Business Model Canvas for German Dyes & Pigments Market

5.1. Integrated Producers vs. Pure-play Pigment / Dye Specialists

5.2. Investment Models & Capital Intensity in Pigments (greenfield vs. retrofit vs. acquisitions)

5.3. Comparative Analysis of Procurement / Qualification Funnel in Private vs. Public / industrial clients (e.g. auto OEMs, infrastructure, government tenders)

5.4. Typical Corporate Pigment / Colorant Budget Allocation by Company Scale (large, mid, SME)

8.1. Revenue Trends (historical)

9.1. By Product Type / Chemistry (organic, inorganic, effect, carbon blacks, specialty)

9.2. By Form (powder, presscake, granule, dispersion, masterbatch)

9.3. By Functional Property (heat stability, lightfastness, opacity, migration resistance, conductivity)

9.4. By End-Use Industry (paints/coatings, inks, plastics, textiles, cosmetics)

9.5. By Company Size (large, mid, SMEs)

9.6. By Distribution Channel (direct, distributor, tolling)

9.7. By Custom vs. Standard Grades

9.8. By Region (Germany sub-regions / states or export vs. domestic split)

10.1. Customer Cohort Analysis & Segmentation (OEMs, formulators, industrial users)

10.2. Pigment / Dye Specification & Decision-Making Process

10.3. Product Performance & ROI / Total Cost of Ownership Evaluation

10.4. Gap Analysis Framework (customer needs vs. supply capability / technology)

11.1. Trends & Innovations (lead-free pigments, digital inks, nanotechnology, bio-based dyes)

11.2. Growth Drivers (regulations, sustainability demand, coating demand in EVs & renewable energy, packaging)

11.3. SWOT Analysis (strengths, weaknesses, opportunities, threats)

11.4. Issues & Challenges (cost volatility, regulatory burden, import competition, technological barriers)

11.5. Regulatory & Environmental Compliance (REACH, TA-Luft, water emissions, product safety)

12.1. Market Size & Future Potential for Digital Color Matching / E-commerce in Germany / EU

12.2. Business Models & Revenue Streams (subscription, licensing, print-on-demand colorants)

12.3. Delivery Models & Digital Services (cloud formulation, virtual shade labs)

15.1. Market Share of Key Players by Revenue

15.2. Benchmarking Key Competitors by: company profile, USPs, business strategies, number of plants, product portfolio, pricing structure, technology used, flagship colorants, major clients, alliances, recent developments

15.3. Operating Model Analysis Framework

15.4. Strategic Positioning Matrix / Quadrant Analysis

15.5. Strategic Advantage Models (e.g. cost leadership vs differentiation)

16.1. Revenue Projections

17.1. By Product Chemistry

17.2. By Form

17.3. By Functional Property

17.4. By End-Use Industry

17.5. By Company Size

17.6. By Channel

17.7. By Custom vs Standard Grades

17.8. By Region / Export vs Domestic

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete Germany Dyes & Pigments Market ecosystem, identifying both demand-side and supply-side entities. On the supply side, this includes pigment and dye manufacturers (organic, inorganic, effect, and functional), raw material suppliers (aromatic intermediates, TiO₂, Fe oxides), distributors, and tolling companies. On the demand side, the map spans coatings manufacturers, plastic compounders, printing ink producers, textile dyehouses, and cosmetics colorant formulators. Based on this mapping, we shortlist 5–6 major pigment producers active in Germany—such as LANXESS, Heubach, ECKART, Merck, and Kronos—evaluating them on parameters like installed capacities, sustainability initiatives, geographic reach, and end-user penetration. Data sourcing is conducted through industry publications (e.g., Verband der Chemischen Industrie—VCI reports), trade statistics from Destatis, and multiple secondary and proprietary chemical industry databases to collate verified information at an industry-wide level.

Step 2: Desk Research

An exhaustive desk research phase follows, referencing a broad range of secondary and proprietary sources to construct a granular understanding of the German dyes & pigments landscape. This process aggregates insights on production volumes (in tonnes), pigment classifications, trade balance data, and end-use demand trends. We review chemical safety documentation (REACH registrations), corporate filings, environmental disclosures, press releases, and sustainability reports of major pigment firms. Key focus areas include Germany’s share in EU pigment output, pigment export values, price evolution of feedstocks (aromatics, TiO₂), and compliance expenditures under TA Luft and AwSV regulations. This step builds the foundation for understanding market dynamics, operational models, and strategic differentiation among local and multinational players active in Germany.

Step 3: Primary Research

Following desk research, in-depth primary interviews are conducted with C-level and senior operational executives from pigment producers, chemical distributors, coating manufacturers, and regulatory experts. The interviews aim to validate quantitative estimates and enrich qualitative context—such as capacity utilization, export dependencies, technology adoption (calcination, dispersion, micronization), and color performance innovations. A bottom-to-top approach is employed to assess pigment producers’ revenue contributions and their aggregation into the total market. Additionally, disguised interviews are undertaken, where researchers pose as potential B2B clients to cross-verify data on pricing, pigment portfolios, and sustainability compliance costs. The process enables triangulation of operational information, validating it against corporate filings, product safety data sheets, and customs trade statistics. These interactions yield comprehensive insights into value chain structures, margins, technological intensity, regulatory costs, and emerging demand drivers within the German dyes & pigments market.

Step 4: Sanity Check

The final stage involves sanity testing through both top-down and bottom-up validation models. Market size modeling integrates production data (kt), domestic consumption ratios, and trade adjustments, cross-checked with end-use industry outputs from Destatis and Eurostat. The consistency of results is evaluated by benchmarking calculated pigment volumes and values against historical chemical industry indicators published by the Federal Statistical Office and the German Chemical Industry Association (VCI). Any discrepancies are reconciled through iterative recalibration of assumptions. This two-way verification ensures analytical coherence, statistical reliability, and transparency across all datasets used in estimating the Germany Dyes & Pigments Market.

FAQs

01 What is the potential for the Germany Dyes & Pigments Market?

The Germany Dyes & Pigments Market holds significant potential as one of Europe’s most advanced and innovation-driven chemical sub-sectors. The market was valued at approximately USD 1.58 billion, supported by strong consumption in coatings, plastics, inks, textiles, and specialty applications. Growth is underpinned by Germany’s robust manufacturing base and emphasis on sustainable industrial chemistry. The country’s ongoing transition toward green, lead-free, and low-VOC pigment systems—encouraged by both EU and national environmental policies—creates opportunities for innovation, high-margin pigment technologies, and circular colorant systems integrated into automotive, construction, and packaging industries.

02 Who are the Key Players in the Germany Dyes & Pigments Market?

The Germany Dyes & Pigments Market features globally recognized chemical manufacturers and specialty colorant companies. Key players include LANXESS (Inorganic Pigments), Heubach Group, ECKART (ALTANA Group), Merck Surface Solutions, and Kronos (Titan), each maintaining strong operational footprints within Germany. Other notable companies include DyStar, Sun Chemical (DIC Corporation), Venator (Sachtleben Pigments), Orion Engineered Carbons, and Schlenk Metallic Pigments. These firms dominate through their deep technical expertise, advanced R&D centers, and high-performance portfolios spanning inorganic, organic, effect, and functional pigment chemistries serving industrial coatings, plastics, and ink markets.

03 What are the Growth Drivers for the Germany Dyes & Pigments Market?

The primary growth catalysts include the expanding automotive and coatings industries, which rely heavily on color performance, heat stability, and durability; Germany registered over 2.81 million new passenger vehicles in the most recent full year (KBA), all requiring advanced colorant systems. In addition, the nation’s manufacturing value added reached USD 838.9 billion (World Bank), sustaining pigment demand across machinery, plastics, and printing inks. The European shift toward sustainable production—reinforced by REACH, Green Deal, and TA Luft regulations—drives the transition to lead-free, low-emission pigments and bio-based dyes, spurring investment in eco-compliant R&D and digital formulation platforms among pigment suppliers.

04 What are the Challenges in the Germany Dyes & Pigments Market?

Major challenges stem from high industrial energy costs, tight regulatory compliance, and import competition. Eurostat recorded industrial electricity prices averaging €0.1597 per kWh in late 2024, raising operational expenses for pigment calcination and dispersion processes. Compliance with REACH registration, TA Luft emission norms, and AwSV water-hazard classifications imposes additional technical documentation and permitting burdens. Furthermore, increasing imports of low-cost pigments from Asia intensify price pressure on domestic producers. Together, these challenges necessitate continued efficiency improvements, process automation, and innovation in sustainable and high-value pigment segments to maintain competitiveness in the German market.