Hong Kong Cold Chain Market Outlook to 2029

By Market Structure, By Applications, By Type of Storage, By Type of Transportation, and By End-User Industry

- Product Code: TDR0201

- Region: Asia

- Published on: June 2025

- Total Pages: 80

Report Summary

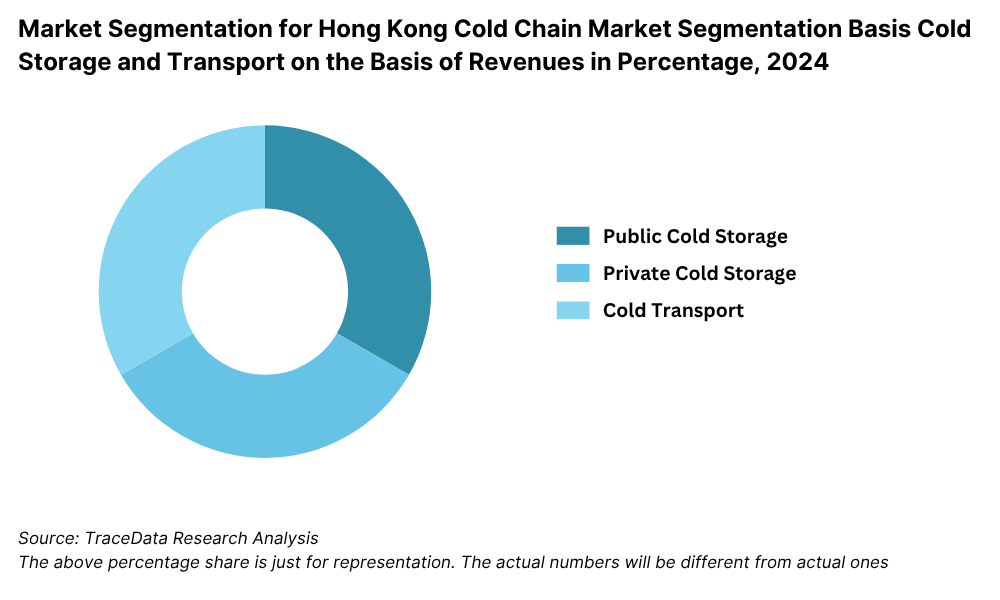

The report titled “Hong Kong Cold Chain Market Outlook to 2029 - By Market Structure, By Applications, By Type of Storage, By Type of Transportation, and By End-User Industry” provides a comprehensive analysis of the cold chain market in Hong Kong. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, by market segment, product type, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Hong Kong Cold Chain Market Overview and Size

The Hong Kong cold chain market reached a valuation of HKD 9.8 Billion in 2023, driven by the growing demand for perishable food products, rising pharmaceutical imports, and the need for efficient temperature-controlled logistics. The market is characterized by major players such as Kerry Logistics Network, LF Logistics, SF Express, Swire Cold Storage, and DHL Supply Chain. These companies are recognized for their expansive warehousing capabilities, advanced technology adoption, and integrated transportation services.

In 2023, Kerry Logistics launched a new state-of-the-art cold storage facility equipped with IoT-based temperature monitoring systems to strengthen their cold chain service portfolio. The strategic location of Hong Kong as a global logistics hub continues to make it a critical point for cold chain operations, especially serving both the Greater Bay Area and international markets.

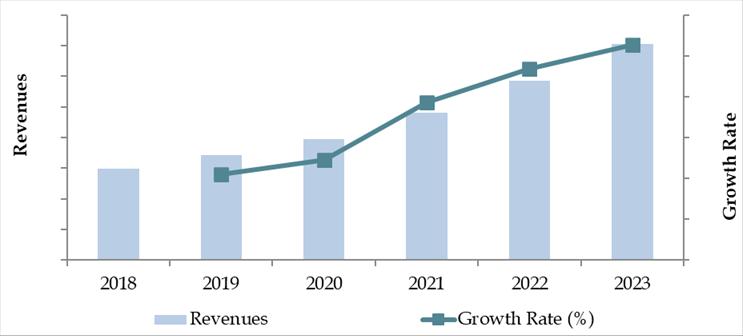

Market Size for Hong Kong Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2024

What Factors are Leading to the Growth of Hong Kong Cold Chain Market:

Rising Pharmaceutical Demand: The surge in demand for biologics, vaccines, and temperature-sensitive pharmaceutical products has significantly boosted the need for specialized cold chain logistics. In 2023, pharmaceutical cold chain logistics accounted for approximately 30% of the total cold chain revenue in Hong Kong, reflecting the sector’s critical role in healthcare supply chains.

Growth in Fresh Food Imports: Hong Kong’s heavy reliance on imported fresh food has amplified the demand for robust cold storage and transportation solutions. Imports of seafood, dairy, fruits, and meat products grew by 8% year-on-year in 2023, directly contributing to higher cold chain market revenues.

Technological Advancements: Automation, IoT-based real-time tracking, and blockchain technologies are being increasingly adopted to improve cold chain integrity and transparency. In 2023, approximately 35% of cold chain operators in Hong Kong incorporated IoT tracking devices into their operations, leading to improved efficiency and lower spoilage rates.

Which Industry Challenges Have Impacted the Growth for Hong Kong Cold Chain Market

High Operating Costs: One of the major challenges in the Hong Kong cold chain market is the high cost of operation, including electricity, maintenance, and real estate. According to industry estimates, energy costs alone account for nearly 40% of total cold storage operational expenses. This significant overhead has made it difficult for small and mid-sized players to remain profitable, limiting market competitiveness.

Limited Space Availability: Given Hong Kong’s dense urban environment, there is a critical shortage of land and facilities suitable for cold storage expansion. In 2023, it was estimated that warehouse rental rates in Hong Kong were among the highest in Asia, with an average cold storage rental cost of HKD 85–90 per square foot annually. This scarcity has led to intense competition for space, driving up costs and limiting capacity expansion.

Talent Shortage: The industry faces a shortage of skilled labor specializing in cold chain logistics and temperature-sensitive handling. Recent surveys indicated that over 30% of companies operating in the cold chain sector reported difficulties in recruiting and retaining qualified staff. This talent gap impacts operational efficiency and service quality, hindering the sector's growth potential.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety Ordinance: Under the Hong Kong Food Safety Ordinance, all food importers, distributors, and storage providers must ensure proper temperature control and hygienic practices during transportation and storage. Non-compliance can lead to heavy penalties, and in 2023, about 12% of inspected cold chain facilities faced fines due to minor breaches in safety protocols.

Logistics and Supply Chain Development Initiatives: The Hong Kong government has launched several programs to improve logistics efficiency, including grants for technology upgrades such as RFID and IoT-based monitoring systems. In 2023, nearly 25% of cold chain operators applied for these grants to enhance real-time temperature monitoring and warehouse automation.

Promotion of Green Logistics: To meet carbon neutrality goals by 2050, the government encourages green logistics practices, including the use of electric refrigerated trucks and eco-friendly cold storage facilities. As of 2023, around 15% of the cold chain fleet in Hong Kong had transitioned to electric or hybrid vehicles, supported by subsidy schemes and low-interest financing options.

Hong Kong Cold Chain Market Segmentation

By Market Structure: Organized players dominate the Hong Kong cold chain market due to their advanced infrastructure, strict adherence to international food safety standards, and integration of technology like RFID tracking and real-time temperature monitoring. Major logistics providers and cold storage companies operate highly efficient, large-scale warehouses and offer comprehensive end-to-end solutions. Meanwhile, unorganized players hold a smaller share, mainly comprising small cold storage facilities and independent transporters who face challenges in scaling operations and meeting stringent regulatory requirements.

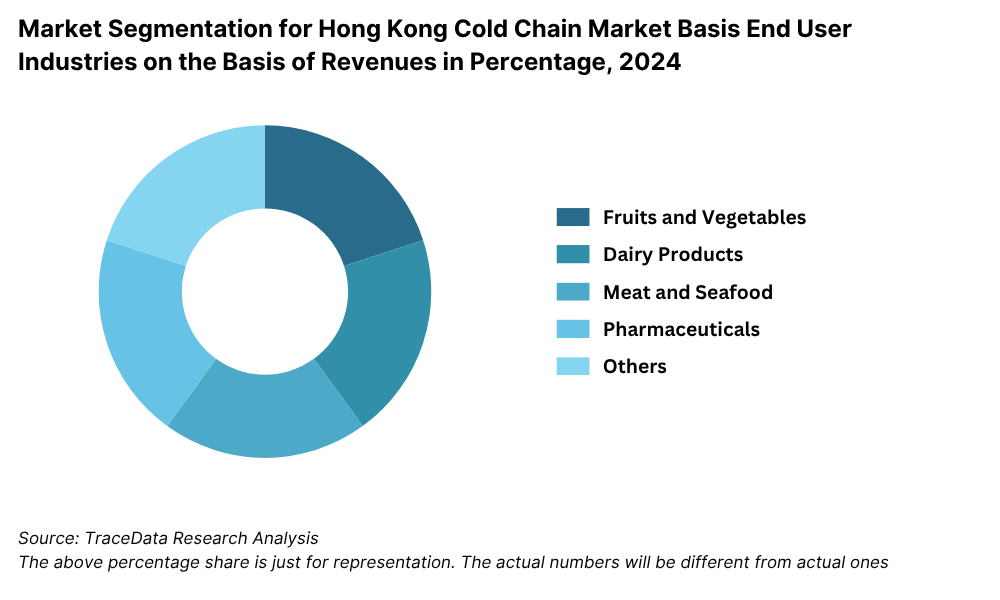

By Application: Food and beverage products constitute the largest segment within the Hong Kong cold chain market, driven by high per capita consumption of frozen and fresh foods and strong imports of seafood, dairy, and fruits. Pharmaceutical cold chain logistics is the second-largest segment, especially critical after the pandemic, with increasing demand for temperature-sensitive vaccines, biologics, and healthcare products. The demand for cold chain services in the chemical sector remains comparatively lower but is steadily rising due to specialized storage requirements.

By Type of Storage: Refrigerated warehouses account for the major share of the market as they serve bulk storage needs for importers, wholesalers, and large retailers. These warehouses are increasingly being upgraded with automation, smart sensors, and energy-efficient refrigeration systems. Cold rooms (smaller capacity) are also gaining traction among small-scale distributors and specialty stores for localized inventory management.

Competitive Landscape in Hong Kong Cold Chain Market

The Hong Kong cold chain market is moderately concentrated, with a few major players leading the sector. However, the growing demand for advanced cold storage and temperature-controlled logistics has encouraged the entry of specialized firms and the expansion of regional logistics providers, offering clients a wider range of cold chain solutions. Companies such as Swire Cold Storage, Kerry Logistics, SF Express, DB Schenker, and Lineage Logistics dominate the market.

Company Name | Founding Year | Original Headquarters |

Kerry Logistics Network Limited | 1981 | Hong Kong SAR, China |

SF Express (Cold Chain Division) | 1993 | Shenzhen, China (HK operations) |

HAVI Logistics (Hong Kong) | 1974 | Downers Grove, Illinois, USA |

Yusen Logistics (Hong Kong) Ltd. | 1955 (HK: ~1970s) | Tokyo, Japan |

DHL Global Forwarding (Hong Kong) | 1969 (HK: ~1970s) | Bonn, Germany |

Kuehne + Nagel (Hong Kong) Ltd. | 1890 (HK: ~1970s) | Schindellegi, Switzerland |

DB Schenker (Hong Kong) Ltd. | 1872 (HK: ~1970s) | Essen, Germany |

Agility Logistics (Hong Kong) | 1979 (HK: ~2000s) | Kuwait City, Kuwait |

Maersk Hong Kong Ltd. (Cold Chain) | 1904 (HK: ~1980s) | Copenhagen, Denmark |

FedEx Express (Hong Kong) | 1971 (HK: ~1980s) | Memphis, USA |

UPS Hong Kong | 1907 (HK: ~1988) | Atlanta, USA |

TSL Cold Chain Logistics Co., Ltd. | 1996 | Hong Kong SAR, China |

Foodwise Logistics Ltd. | 2003 | Hong Kong SAR, China |

Great Ocean Logistics (HK) Ltd. | 2001 | Hong Kong SAR, China |

Frigologistics HK Ltd. | 2010 | Hong Kong SAR, China |

Some of the recent competitor trends and key information about competitors include:

Swire Cold Storage: A long-established player in Hong Kong’s cold chain sector, Swire Cold Storage operates multiple state-of-the-art refrigerated warehouses and expanded its footprint in 2023 by adding a new high-capacity automated cold storage facility in Tsing Yi, helping meet the growing demand for frozen food imports.

Kerry Logistics: As a leading integrated logistics company, Kerry Logistics reported a 12% increase in cold chain revenue in 2023, driven by strong growth in the food & beverage and pharmaceutical sectors. Their focus on end-to-end cold chain logistics, including last-mile delivery, has been a major competitive advantage.

SF Express: Primarily known for its express delivery services, SF Express has heavily invested in cold chain capabilities in Hong Kong, with a 20% year-over-year growth in refrigerated parcel delivery services in 2023. The company's strength lies in its extensive regional network and technological innovation for real-time temperature tracking.

DB Schenker: DB Schenker has expanded its cold chain services by introducing specialized solutions for pharmaceutical and life sciences sectors. In 2023, they launched "MedChain" services in Hong Kong, offering GDP-compliant (Good Distribution Practices) cold chain logistics for medical goods, positioning themselves strongly in the healthcare segment.

Lineage Logistics: Entering the Hong Kong market aggressively through acquisitions, Lineage Logistics expanded its Asia-Pacific operations by acquiring a major cold storage facility in 2022. In 2023, the company continued its push by focusing on sustainability initiatives, such as adopting solar energy systems across its facilities.

What Lies Ahead for Hong Kong Cold Chain Market?

The Hong Kong cold chain market is projected to experience steady growth by 2029, exhibiting a healthy CAGR during the forecast period. This expansion is expected to be driven by rising demand for frozen and fresh food imports, the booming pharmaceutical sector, and technological advancements in cold storage and logistics infrastructure.

Expansion of Pharmaceutical Cold Chain: With increasing healthcare demands and the expansion of biologics and vaccine distribution, the pharmaceutical segment of the cold chain market is expected to grow rapidly. By 2029, pharmaceutical cold storage is anticipated to account for a larger share of the overall market, driven by the need for strict temperature control and regulatory compliance.

Adoption of Advanced Technologies: The use of IoT sensors, AI-based predictive analytics, and blockchain for real-time tracking and temperature monitoring will become mainstream. These technologies will enhance operational efficiency, improve product traceability, and minimize losses due to temperature deviations, making Hong Kong's cold chain operations more resilient and reliable.

Development of Sustainable Cold Chain Solutions: Environmental sustainability is becoming a critical focus. Players are increasingly adopting energy-efficient refrigeration technologies, solar-powered warehouses, and electric refrigerated transport vehicles. These initiatives are expected to align with Hong Kong’s broader carbon neutrality goals, attracting eco-conscious businesses and investors.

Increased Investments in Cold Storage Infrastructure: Owing to limited existing capacity and rising demand, significant investments are projected in building new cold storage facilities and upgrading existing ones. Automated cold storage warehouses with vertical stacking and robotics will gain prominence, maximizing efficiency in space-constrained Hong Kong.

Hong Kong Cold Chain Market Segmentation

• By Market Structure:

o Organized Cold Storage Providers

o Independent Cold Storage Operators

o Integrated Logistics Service Providers

o Third-Party Logistics (3PL) Providers

o Cold Transportation Companies

o Unorganized Local Operators

• By Application:

o Food and Beverages (Frozen Foods, Dairy, Meat, Seafood, Fruits and Vegetables)

o Pharmaceuticals (Vaccines, Biologics, Medicines)

o Chemicals (Temperature-Sensitive Industrial Chemicals)

o Others (Cosmetics, Specialty Products)

• By Type of Storage:

o Refrigerated Warehouses

o Cold Rooms

o Blast Freezers

o Chillers

• By Type of Transportation:

o Refrigerated Trucks

o Refrigerated Vans

o Refrigerated Containers

o Air Cargo Cold Chain

• By End-User Industry:

o Retail Chains and Supermarkets

o Foodservice (Hotels, Restaurants, Catering)

o Pharmaceutical and Healthcare Companies

o Importers and Exporters

o E-commerce Grocery Platforms

Players Mentioned in the Report:

- Bedrock Cold Chain Logistics

- Yusen Logistics (Hong Kong)

- Yamato Logistics (Cool TA-Q-BIN)

- AFL Logistics (Cold Chain Services)

- Tahuhu Cold Chain Logistics

- Chevalier Cold Storage & Logistics

- Sunlight Logistics (Cold‑Chain Warehousing)

- China Resources Logistics (Shatin Cold Storage)

- Kerry Cold Store / Kerry Warehouse

- Brilliant Cold Storage Management

- Dragon Crown Group

- Daido Group (Cold Storage)

- HK Ice & Cold Storage

- Real Cool Cold Storage

- Yue Tai Cold Storage

- Asia Life Co. Ltd. (Cold Storage)

- Max Cold Storage Services

- Go Fresh Co. (Cold Storage Services)

- Dal Chong Hong (DCH Logistics – cold chain)

- KLN Logistics (formerly Kerry Logistics Network, cold chain services)

Key Target Audience:

• Cold Storage Facility Operators

• Cold Chain Logistics Companies

• Food and Beverage Importers/Exporters

• Pharmaceutical Companies

• E-commerce Grocery Companies

• Government Regulatory Bodies (e.g., Hong Kong Food and Environmental Hygiene Department)

• Research and Development Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. Hong Kong Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. Hong Kong Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities, 2023-2024P

10.3. Hong Kong Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. Hong Kong Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. Hong Kong Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. Hong Kong Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in Hong Kong Cold Chain Market

12.2. Issues and Challenges in Hong Kong Cold Chain Market

12.3. Decision Making Parameters for End Users in Hong Kong Cold Chain Market

12.4. SWOT Analysis of Hong Kong Cold Chain Industry

12.5. Government Regulations and Associations in Hong Kong Cold Chain Market

12.6. Macroeconomic Factors Impacting Hong Kong Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in Hong Kong Cold Chain Market

16.2. Competition Scenario in Hong Kong Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2023) and Employee Base) for Major Players in Hong Kong Cold Chain Market

16.4. Company Profiles of Major Companies in Hong Kong Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

18.4. Recommendation

18.5. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Hong Kong Cold Chain Market. Basis this ecosystem, we will shortlist leading 5–6 players in the country based upon their financial information, warehouse capacity, fleet size, and service offerings.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like revenue generation, cold storage capacities, logistics operations, rental pricing, service costs, and customer base across different cold chain segments. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Hong Kong Cold Chain Market companies and end-users (importers, exporters, supermarkets, pharmaceutical companies). This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom-to-top approach is undertaken to evaluate cold storage volumes, utilization rates, and transportation fleet sizes for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers or industry collaborators. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of value chain dynamics, pricing structures, operational challenges, and service differentiation.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis along with detailed market size modeling exercises is undertaken to assess the sanity of market estimations. Cross-validation against import/export volume data, warehouse occupancy rates, and industry benchmarks ensures the robustness of the final projections.

FAQs

1. What is the potential for the Hong Kong Cold Chain Market?

The Hong Kong cold chain market is poised for significant growth, with expectations of achieving a healthy CAGR through 2029. This growth is fueled by rising demand for fresh and frozen food imports, expanding pharmaceutical and healthcare logistics needs, and the adoption of advanced cold storage technologies. Hong Kong’s strategic position as a global logistics hub further strengthens its potential in becoming a major player in the Asia-Pacific cold chain sector.

2. Who are the Key Players in the Hong Kong Cold Chain Market?

The Hong Kong Cold Chain Market features several key players, including Swire Cold Storage, Kerry Logistics, and SF Express. These companies dominate the market due to their robust infrastructure, advanced technology adoption, and comprehensive cold chain solutions. Other notable players include DB Schenker, Lineage Logistics, and Yusen Logistics.

3. What are the Growth Drivers for the Hong Kong Cold Chain Market?

The primary growth drivers include the increasing consumption of perishable food products, a rising focus on healthcare and pharmaceutical logistics, and the growing demand for e-commerce grocery delivery services. Additionally, technological advancements such as IoT-enabled temperature monitoring and blockchain traceability are enhancing operational efficiency, further accelerating market expansion.

4. What are the Challenges in the Hong Kong Cold Chain Market?

The Hong Kong Cold Chain Market faces several challenges, including high operational and real estate costs, limited land availability for cold storage expansion, and a shortage of skilled labor specializing in temperature-sensitive logistics. Additionally, stringent regulatory requirements for food safety and pharmaceutical compliance add complexity and cost to cold chain operations.