Hungary Auto Finance Market Outlook to 2029

By Vehicle Type (New and Used), By Finance Provider (Banks, NBFCs, OEMs), By Tenure, By Type of Buyer (Individual and Corporate), and By Region

- Product Code: TDR0145

- Region: Europe

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Hungary Auto Finance Market Outlook to 2029 – By Vehicle Type (New and Used), By Finance Provider (Banks, NBFCs, OEMs), By Tenure, By Type of Buyer (Individual and Corporate), and By Region” provides a comprehensive analysis of the auto finance industry in Hungary. The report covers the genesis and overview of the market, overall market size in terms of disbursed loan value, segmentation by various parameters, key trends and developments, regulatory landscape, customer-level profiling, challenges faced, and a comparative landscape including the competition scenario, market opportunities, and key player profiles. The report concludes with market projections through 2029 based on disbursed loan value and key influencing factors such as economic trends, vehicle demand, and regulatory developments.

Hungary Auto Finance Market Overview and Size

The Hungary auto finance market reached an estimated loan disbursal value of HUF 950 Billion in 2023, fueled by increasing car ownership, rising disposable income, and expanding credit availability. The market features a mix of banks, non-banking financial companies (NBFCs), and OEM financing arms. Prominent players include OTP Bank, CIB Bank, Merkantil Bank, and Porsche Finance Group Hungary, all of which offer various loan and leasing products tailored to consumer needs.

In 2023, Merkantil Bank introduced a digital auto loan pre-approval system, improving loan processing time and transparency for customers. Budapest and other major urban centers such as Debrecen and Szeged are key hotspots for auto financing, owing to higher urban incomes and concentrated vehicle sales.

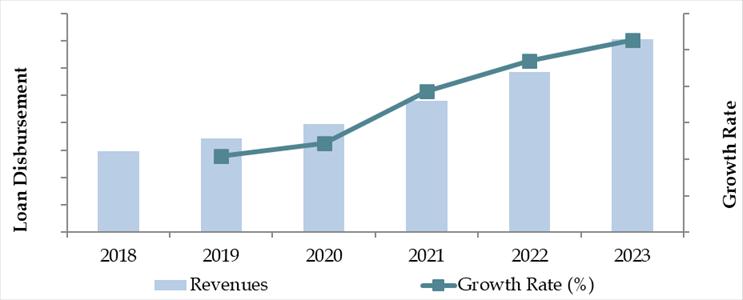

Market Size for Hungary Auto Finance Industry on the Basis of Loan Disbursal (HUF Billion), 2018–2024

What Factors are Leading to the Growth of the Hungary Auto Finance Market:

Favorable Credit Environment: Interest rates in Hungary remained relatively stable between 2020–2023, fostering increased consumer borrowing. Affordable EMIs and flexible financing terms have made auto ownership more accessible, contributing to a surge in financed car sales. By 2023, nearly 70% of new car sales and 45% of used car sales were backed by some form of financing.

Government Incentives: Programs encouraging electric vehicle (EV) purchases through subsidies and low-interest financing have also supported the auto finance market. These incentives, paired with Hungary's goal to transition toward greener transport, are pushing lenders to diversify their offerings for hybrid and electric vehicles.

Rising Demand for Used Cars: The used vehicle segment has witnessed an uptrend, driven by affordability and increased import of second-hand cars from Germany and other EU nations. Financing options for used vehicles have expanded, with some lenders offering specialized products targeting this growing market. In 2023, used cars accounted for 63% of all auto finance disbursements in Hungary.

Which Industry Challenges Have Impacted the Growth of the Hungary Auto Finance Market

High Interest Rate Volatility: Although interest rates remained favorable in early 2023, Hungary’s fluctuating inflation levels and central bank policy adjustments have led to periodic spikes in auto loan interest rates. This volatility creates uncertainty for borrowers, especially for long-term financing. Around 28% of prospective car buyers postponed loan decisions in 2023 due to concerns over unpredictable rate changes.

Credit Accessibility for Young and Low-Income Borrowers: Stringent lending criteria imposed by banks and financial institutions have limited access to auto loans for young adults and low-income segments. Data from industry sources show that nearly 35% of rejected loan applications in 2023 came from individuals aged between 21–30, primarily due to insufficient credit history or unstable income profiles.

Used Vehicle Financing Constraints: While demand for used cars is increasing, some lenders remain cautious in extending credit for older vehicles due to higher default risk and lower collateral value. In 2023, only 52% of used car transactions in Hungary were financed, compared to 85% of new car purchases. This disparity has limited growth in the second-hand auto finance segment.

What are the Regulations and Initiatives that have Governed the Market

Consumer Credit Law and Oversight: The Hungarian government enforces strict regulations under the Consumer Credit Act to ensure transparency in auto loan agreements. Financial institutions must disclose the Annual Percentage Rate (APR), repayment terms, and penalties in a standardized format. In 2023, the Financial Supervisory Authority reported a 92% compliance rate across audited institutions.

Incentives for Electric Vehicle Financing: To accelerate the adoption of electric and low-emission vehicles, Hungary offers subsidies for both vehicle purchases and associated loan interest reductions. These policies are primarily aimed at promoting green finance products. In 2023, EV-related auto loans grew by 18% YoY, driven by state-backed incentives and reduced VAT for qualifying vehicles.

Regulation of Leasing Agreements: The government has established guidelines for vehicle leasing contracts, including maximum interest caps and mandatory consumer protections. Leasing, particularly among corporate buyers, constitutes nearly 40% of all financed auto transactions in Hungary. Regulatory clarity has helped stabilize this segment and foster growth in fleet financing.

Hungary Auto Finance Market Segmentation

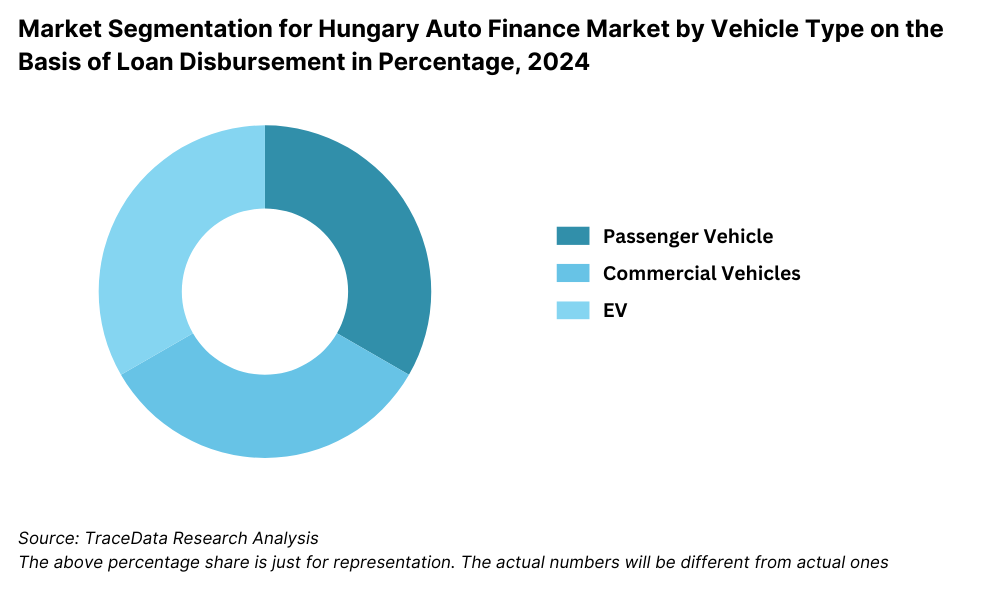

By Vehicle Type: New vehicles dominate the financing market due to attractive OEM-backed loan schemes, lower perceived risk, and higher availability of promotional offers from dealerships. Financing for used vehicles is growing steadily, driven by rising demand for affordable mobility and expanding offerings by banks and NBFCs. However, used vehicle loans often come with higher interest rates and shorter tenures, which makes them less popular among risk-averse consumers.

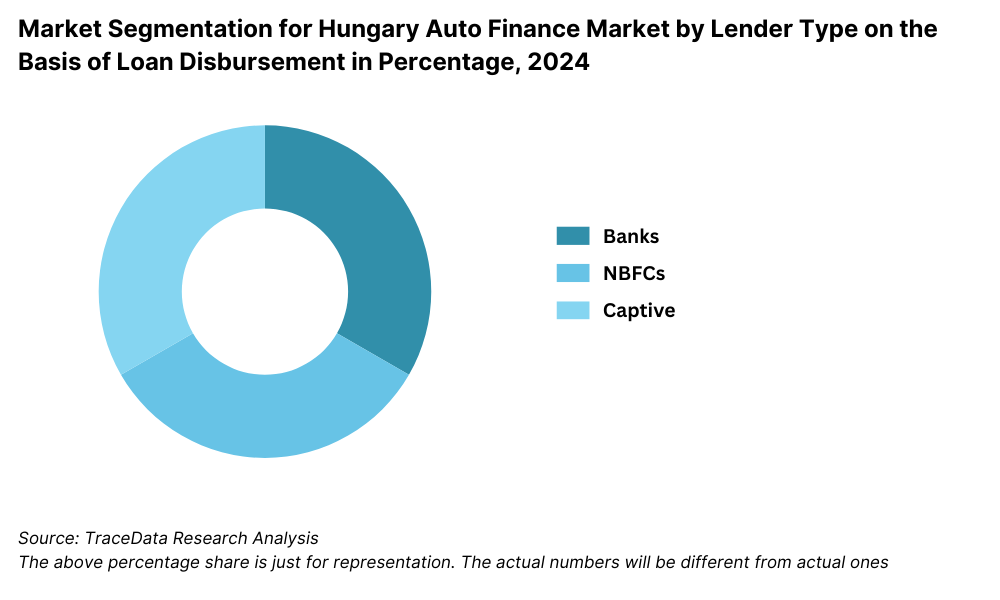

By Finance Provider: Banks continue to lead the auto finance market due to their competitive interest rates, extensive branch networks, and high consumer trust. OTP Bank, CIB Bank, and K&H Bank are major players. NBFCs have grown their presence by catering to customers with limited credit history, offering faster processing times and less stringent documentation. OEM financing arms like Porsche Finance and Toyota Financial Services are also gaining ground with tailor-made offers and bundled insurance.

By Type of Buyer: Individual buyers account for the majority of financing transactions, largely due to personal mobility needs and urban expansion. Corporate and fleet buyers, while smaller in volume, represent higher-value loans with structured lease and fleet financing solutions. Leasing is especially common in urban business hubs like Budapest, where corporate fleets are a preferred mobility solution.

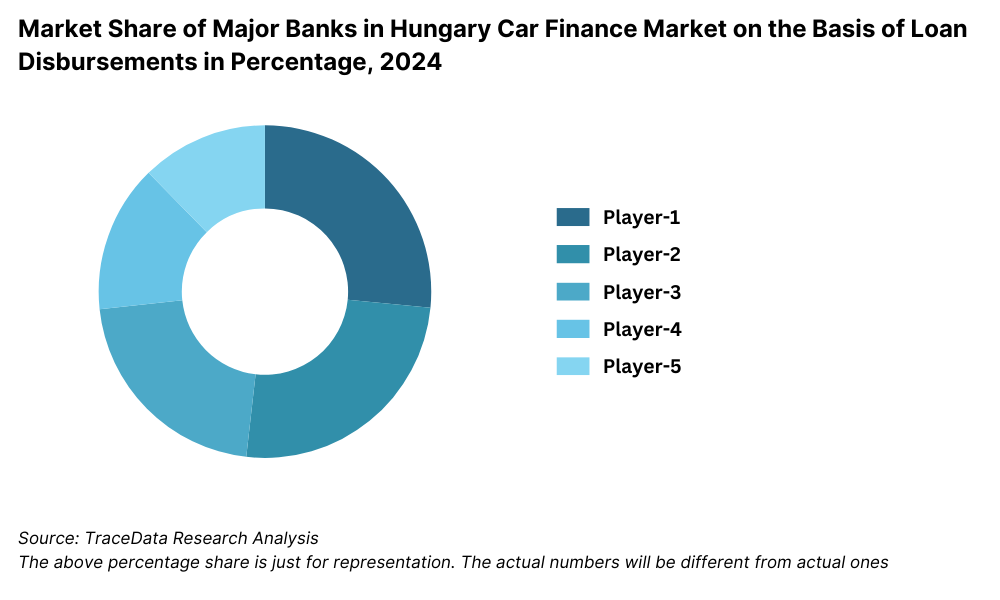

Competitive Landscape in Hungary Auto Finance Market

The Hungary auto finance market is moderately concentrated, with key financial institutions and OEM-backed financiers dominating the landscape. The rise of digital lending platforms and fintech startups has started to reshape the competitive dynamics, offering faster approval processes and enhanced customer experiences. Major banks, leasing companies, and vehicle manufacturers’ financing arms continue to play a pivotal role in shaping the market.

| Name | Founding Year | Original Headquarters |

| OTP Bank Auto Loan | 1949 | Budapest, Hungary |

| K&H Bank Auto Finance | 1987 | Budapest, Hungary |

| UniCredit Bank Hungary Auto Loan | 1990 (Hungary) | Milan, Italy |

| Erste Bank Hungary Auto Loan | 1997 (Hungary) | Vienna, Austria |

| Raiffeisen Bank Hungary Auto Finance | 1995 (Hungary) | Vienna, Austria |

| Mercedes-Benz Leasing Hungary | 2000 | Stuttgart, Germany |

| Volkswagen Financial Services Hungary | 1993 | Braunschweig, Germany |

| Toyota Financial Services Hungary | 2001 | Toyota City, Japan |

| BMW Financial Services Hungary | 2000 | Munich, Germany |

| Merkantil Bank (OTP Group) | 1992 | Budapest, Hungary |

| CIB Lízing (Leasing, part of CIB Bank) | 1979 | Budapest, Hungary |

| MKB Euroleasing | 1994 | Budapest, Hungary |

Some of the recent competitor trends and key information about competitors include:

OTP Bank: As the largest commercial bank in Hungary, OTP remains a dominant player in auto financing. In 2023, OTP expanded its digital loan services, launching an instant car loan approval feature that reduced processing time by 40%. The bank financed over 55,000 vehicles, with a growing share in the used car segment.

Merkantil Bank: A subsidiary of OTP Group, Merkantil specializes in vehicle financing. In 2023, it introduced a pre-approved financing tool integrated with several online car listing platforms, which significantly boosted loan applications. Merkantil remains a market leader in both personal and fleet auto loans.

CIB Bank: CIB has strengthened its position by offering competitive leasing packages and green auto finance options. The bank reported a 17% increase in electric vehicle financing in 2023, driven by demand for hybrid and low-emission vehicles in urban areas.

Porsche Finance Group Hungary: Focused on financing for Volkswagen Group brands (VW, Audi, Škoda, SEAT), Porsche Finance grew its market share by launching bundled services in 2023 that included insurance and maintenance. It is the preferred financier for premium vehicle buyers in Hungary.

FinAuto: A digital-first fintech entrant, FinAuto gained traction among young consumers by offering fully online car loans with AI-based risk assessment. In 2023, the startup reported a 60% YoY growth in disbursed loans, especially for used and budget vehicles.

What Lies Ahead for Hungary Auto Finance Market?

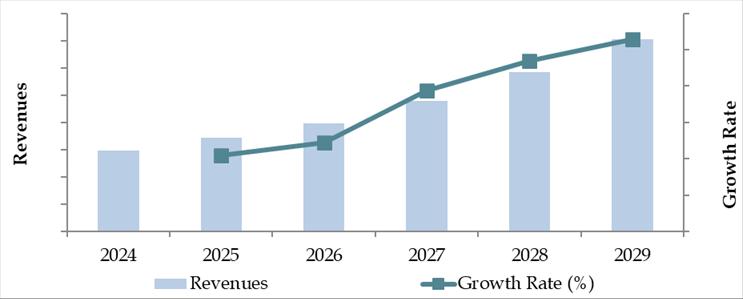

The Hungary auto finance market is projected to grow steadily through 2029, driven by expanding car ownership, rising middle-class incomes, and enhanced access to digital lending solutions. The market is expected to exhibit a moderate but stable CAGR over the forecast period, supported by favorable macroeconomic trends and ongoing innovation in financial services.

Rising Demand for Electric Vehicle Financing: With the Hungarian government committing to green mobility targets, the financing of electric and hybrid vehicles is expected to gain momentum. Financial institutions are anticipated to launch more tailored loan products and interest rate subsidies for eco-friendly vehicles. By 2029, EV loans are expected to account for a significantly higher share of overall auto finance disbursements.

Expansion of Digital and Instant Loan Platforms: Digital transformation will continue to reshape the market. By 2029, a majority of auto loan applications are expected to be initiated and approved through online platforms. Fintech startups and traditional banks alike will likely invest in AI-powered credit scoring models and instant KYC tools, significantly reducing the average loan processing time.

Increased Penetration of Used Vehicle Financing: As the used car market in Hungary matures, financial institutions are expected to relax restrictions and improve loan offerings for used vehicles. This will include longer repayment periods, lower down payments, and warranty-linked financing. The move is projected to attract budget-conscious consumers and increase the share of used car loans in the overall market.

Customized Financing Products for Different Segments: The market will likely witness a rise in customized financing options designed for various customer segments such as first-time buyers, gig economy workers, and SMEs. These segmented loan products are expected to enhance loan affordability and improve penetration across Hungary’s diverse consumer base.

Future Outlook and Projections for Hungary Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Hungary Auto Finance Market Segmentation

- By Vehicle Type:

o New Vehicles

o Used Vehicles - By Finance Provider:

o Banks

o Non-Banking Financial Companies (NBFCs)

o OEM Financing Companies

o Fintech and Digital Lenders - By Type of Buyer:

o Individual Buyers

o Corporate Buyers

o Fleet Owners

o Leasing Companies - By Loan Tenure:

o Less than 36 Months

o 36–60 Months

o More than 60 Months - By Vehicle Fuel Type:

o Petrol

o Diesel

o Electric

o Hybrid - By Age of Vehicle (Used Vehicle Financing):

o 0–2 Years

o 3–5 Years

o 6–10 Years

o Above 10 Years - By Region:

o Central Hungary (Budapest and surroundings)

o Northern Great Plain

o Southern Great Plain

o Western Transdanubia

o Central Transdanubia

o Northern Hungary

Players Mentioned in the Report (Banks):

- OTP Bank

- K&H Bank

- UniCredit Bank Hungary

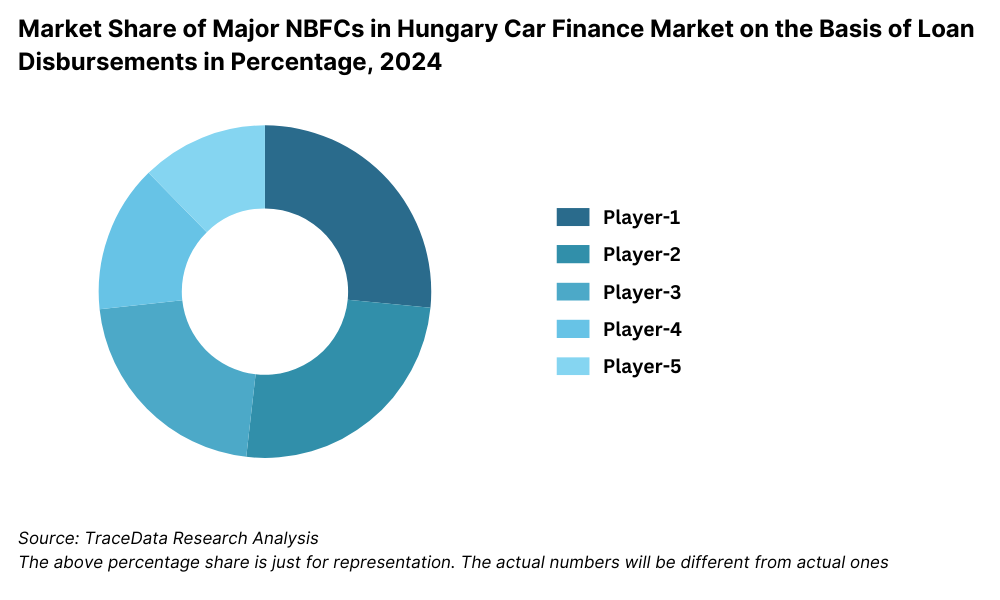

Players Mentioned in the Report (NBFCs):

- Merkantil Bank

- Merkantil Car Ltd.

- Merkantil Lease Ltd

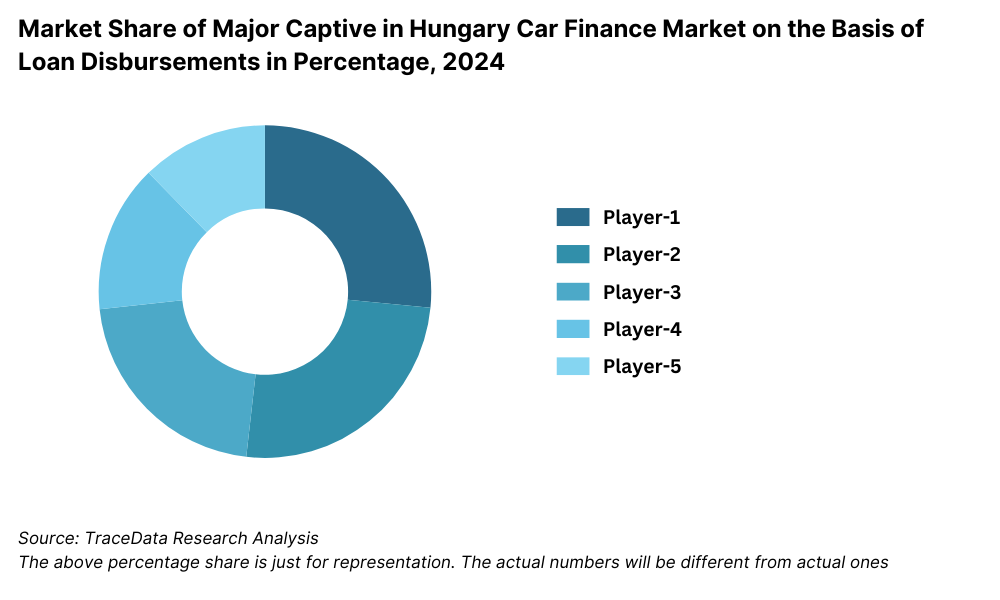

Players Mentioned in the Report (Captive):

- Porsche Bank Hungary

Key Target Audience:

- Commercial Banks and NBFCs

- OEM-Linked Financing Companies

- Automotive Dealerships

- Fintech and Digital Lending Platforms

- Government Regulatory Authorities (e.g., Hungarian National Bank)

- Auto Leasing and Fleet Management Firms

- Research and Consulting Firms

- Investors and Private Equity Firms

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Hungary by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Hungary Car Finance Market

11.2. Growth Drivers for Hungary Car Finance Market

11.3. SWOT Analysis for Hungary Car Finance Market

11.4. Issues and Challenges for Hungary Car Finance Market

11.5. Government Regulations for Hungary Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Hungary Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Hungary Car Finance Market, 2024

17.3. Market Share of Key Captive in Hungary Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Hungary Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities within the Hungary Auto Finance Market. Based on this ecosystem, we shortlist the top 5–6 financial institutions and auto financiers in the country using parameters such as loan portfolio size, customer base, interest rates, and service innovations.

Sourcing is conducted using industry articles, regulatory filings, syndicated research, and proprietary databases to perform desk research and compile macro- and micro-level information about the market.

Step 2: Desk Research

We engage in comprehensive desk research leveraging secondary and proprietary databases to construct a clear picture of the market landscape. This includes analyzing financial reports, industry whitepapers, publications from the Hungarian National Bank, automotive and leasing associations, and major player press releases.

The research focuses on identifying market size, disbursement value, interest rate trends, penetration of finance in new vs. used vehicles, competitive shares, and consumer behavior patterns related to loan preferences.

Step 3: Primary Research

A series of structured and semi-structured interviews are conducted with C-level executives, business development heads, product managers, and independent auto finance consultants in Hungary. These discussions help validate assumptions, gain ground-level operational insights, and cross-verify statistical models.

A bottom-to-top approach is employed to estimate market size through individual company-level disbursal volumes, while a top-down perspective supports macro validation.

Disguised interviews are also conducted with dealerships and financial service providers under the pretext of customer inquiries to validate financing options, interest rates, tenure flexibility, and buyer behavior insights.

Step 4: Sanity Check

- A combination of bottom-up and top-down modeling is used to conduct a sanity check of our derived market size and segmentation outputs. Triangulation across various data sources, including industry benchmarks and regulatory insights, ensures internal consistency and realistic forecasting.

FAQs

1. What is the potential for the Hungary Auto Finance Market?

The Hungary auto finance market is poised for steady growth, driven by increasing vehicle ownership rates, favorable economic conditions, and the expansion of digital lending platforms. The market's potential is further enhanced by government incentives promoting electric vehicle adoption and the rising demand for both new and used car financing.

2. Who are the Key Players in the Hungary Auto Finance Market?

The Hungary auto finance market features several key players, including OTP Bank, Merkantil Bank, CIB Bank, and Porsche Finance Group Hungary. These institutions dominate the market due to their extensive financial product offerings, strong customer relationships, and innovative digital services. Emerging fintech companies like FinAuto are also gaining traction by offering streamlined online loan application processes.

3. What are the Growth Drivers for the Hungary Auto Finance Market?

Primary growth drivers include the increasing affordability of vehicles through financing options, government initiatives supporting electric vehicle purchases, and the digital transformation of financial services. Additionally, the growing middle class and urbanization contribute to higher demand for personal vehicles, thereby boosting the auto finance sector.

4. What are the Challenges in the Hungary Auto Finance Market?

The market faces challenges such as interest rate volatility, which can affect borrowing costs, and stringent credit approval processes that may limit access for certain consumer segments. Additionally, economic fluctuations and regulatory changes can impact both lenders and borrowers, posing potential risks to market stability.