Hungary Cold Chain Market Outlook to 2029

By Service Type (Cold Storage and Cold Transportation), By Temperature Type (Chilled and Frozen), By End User Industry (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, and Others), and By Region

- Product Code: TDR0279

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Hungary Cold Chain Market Outlook to 2029 – By Service Type (Cold Storage and Cold Transportation), By Temperature Type (Chilled and Frozen), By End User Industry (Pharmaceuticals, Dairy, Meat & Seafood, Fruits & Vegetables, and Others), and By Region” provides a comprehensive analysis of the cold chain logistics industry in Hungary. The report covers the industry overview and genesis, market size in terms of revenue, detailed segmentation, trends and developments, regulatory environment, customer-level profiling, key issues and challenges, competitive landscape, cross comparison, growth opportunities and bottlenecks, and company profiling of major players operating in Hungary’s cold chain sector. The report concludes with future market projections through 2029 based on revenue, segmented by service type, end-user, temperature, and regional performance, along with success case studies to highlight major opportunities and potential cautions.

Hungary Cold Chain Market Overview and Size

The Hungary cold chain market reached a valuation of HUF 138 Billion in 2023, driven by rising demand in pharmaceutical and perishable food sectors, increasing consumer preference for frozen and chilled goods, and stringent EU food safety and healthcare regulations. The market is characterized by prominent players such as Waberer’s, Nagel Hungaria, Kühne + Nagel, Hűtőházak Zrt., and Interfrigo. These companies are noted for their strong distribution networks, temperature-controlled infrastructure, and specialization in both domestic and cross-border cold chain services.

In 2023, Waberer’s initiated a major expansion of its cold storage facilities in the Budapest logistics zone, aiming to enhance supply reliability for pharmaceutical and frozen food companies. Key logistics hubs such as Budapest, Debrecen, and Szeged continue to drive demand, owing to their strategic location, connectivity, and concentration of food processing and pharmaceutical industries.

%2C%202019-2024.png)

What Factors are Leading to the Growth of Hungary Cold Chain Market:

Expansion in Pharma and Biotech: Hungary’s strategic role in Europe’s pharmaceutical manufacturing and export sector has boosted demand for temperature-controlled logistics. Cold chain services are critical for vaccine distribution, biotech materials, and high-value medications. Between 2020 and 2023, pharma-related cold chain shipments grew by 14% annually.

Surge in Frozen and Processed Food Demand: Changing consumer habits and rising preference for ready-to-eat and frozen foods have significantly contributed to cold chain growth. In 2023, frozen food sales rose by 11% compared to 2022, driving the need for frozen storage and last-mile refrigerated delivery in urban centers.

EU Food Safety and Logistics Standards: Hungary, being part of the EU, strictly adheres to food safety regulations that mandate proper temperature control throughout the supply chain. This compliance need has accelerated cold chain investments by both domestic and international logistics firms.

Which Industry Challenges Have Impacted the Growth for Hungary Cold Chain Market

High Operating Costs: One of the major challenges in Hungary’s cold chain market is the high cost associated with energy consumption and refrigerated infrastructure maintenance. Electricity prices in Hungary rose by over 25% between 2021 and 2023, significantly impacting cold storage operators’ margins. These costs have deterred small and medium-sized players from expanding capacity or entering the market, limiting overall market scalability.

Infrastructure Limitations in Tier-2 Cities: While Budapest and a few major cities have relatively modern cold chain facilities, many rural and semi-urban regions still face inadequate infrastructure. A 2023 logistics survey reported that 42% of perishable goods in remote regions face delays or temperature excursions due to limited last-mile refrigerated transport. This infrastructure gap restricts service expansion beyond urban hubs.

Workforce Shortage and Training Gaps: The cold chain sector in Hungary also grapples with a shortage of trained personnel in temperature-sensitive logistics and warehouse operations. According to industry estimates, nearly 30% of logistics firms cite manpower shortages as a key bottleneck. Lack of skilled technicians and drivers trained to handle perishable goods affects efficiency and increases operational risks.

What are the Regulations and Initiatives which have Governed the Market

EU Cold Chain Compliance Standards: Hungary, as an EU member, complies with stringent food safety and pharmaceutical transport regulations such as the EU Regulation No. 852/2004 (food hygiene) and GDP (Good Distribution Practice) guidelines for pharmaceuticals. In 2023, over 80% of audited cold storage units in Hungary passed compliance audits, indicating high adherence to EU cold chain standards.

National Food Chain Safety Office (NÉBIH) Guidelines: The National Food Chain Safety Office actively monitors and regulates cold storage facilities and transport practices, especially for meat, dairy, and frozen products. Inspections focus on temperature logs, hygiene, and traceability. In 2022, over 1,200 inspections were conducted, resulting in 180 fines for non-compliance, underlining the government’s emphasis on food safety.

EU Cohesion Fund & Investment Grants: To modernize logistics infrastructure, Hungary has leveraged EU Cohesion Funds and national subsidies to support cold chain expansion projects. Between 2020 and 2023, over HUF 9 billion was allocated for upgrading cold storage and transport fleets. These incentives primarily benefit logistics hubs and exporters handling food and pharma goods under controlled temperatures.

Hungary Cold Chain Market Segmentation

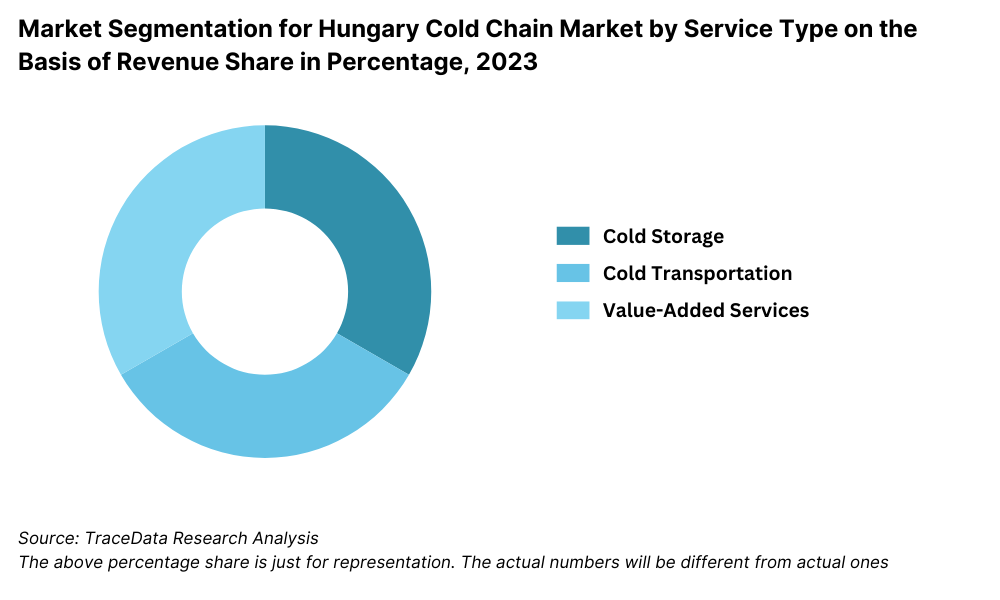

By Service Type: Cold storage services dominate the market, primarily due to the rising demand from food processing units, supermarkets, and pharmaceutical manufacturers. These facilities are essential for storing frozen meat, dairy, and vaccines under strict temperature controls. Cold transportation holds a significant share as well, particularly for intercity and cross-border logistics. Key players are investing in expanding reefer truck fleets and container-based solutions to serve Hungary’s export markets in Central and Eastern Europe.

By Temperature Type: Frozen cold chain logistics represents a major segment due to Hungary's large processed food and meat export base, where products require deep-freeze conditions. Chilled logistics is steadily growing, supported by increasing consumption of dairy products, fresh produce, and ready-to-eat meals. In 2023, frozen cold chain services were estimated to command a higher share, especially in cross-border trade and large urban distribution centers.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

By End User Industry: The food and beverage sector (including meat, dairy, frozen vegetables, and ready meals) is the largest contributor to Hungary’s cold chain demand. In 2023, it accounted for the highest share due to the country’s strong agri-food processing industry and export demand. The pharmaceutical sector follows next, with growing needs for biologics, vaccines, and temperature-sensitive APIs (Active Pharmaceutical Ingredients). Fruits & vegetables and food service industries are emerging demand segments as e-commerce grocery and quick commerce players expand their presence.

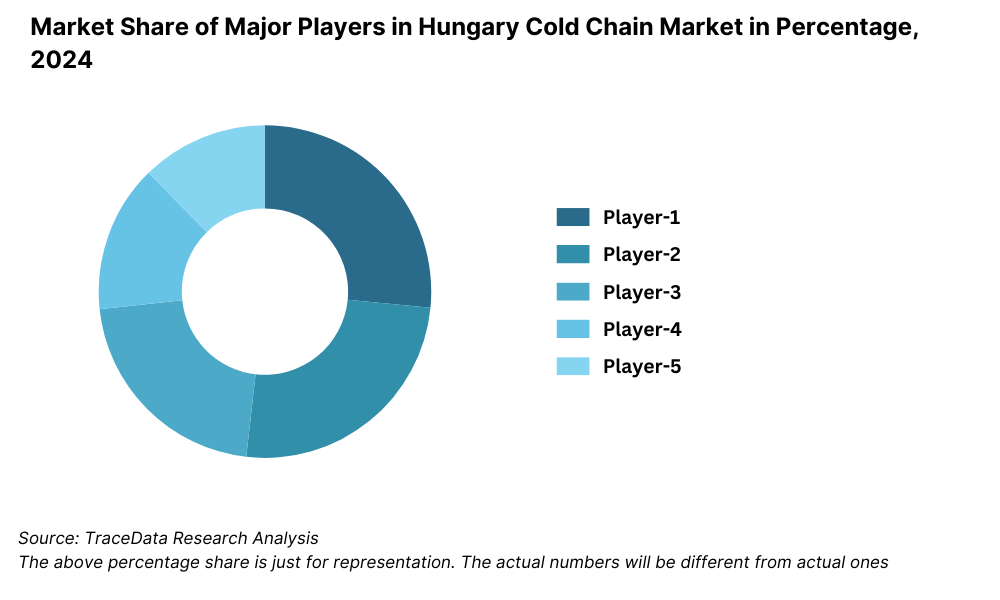

Competitive Landscape in Hungary Cold Chain Market

The Hungary cold chain market is moderately concentrated, with a mix of established domestic logistics providers and global players driving service innovation and infrastructure expansion. In recent years, the market has seen significant investment from foreign logistics firms as well as modernization by Hungarian companies to meet rising EU compliance standards. Key players include Waberer’s International, Nagel Hungaria, Hűtőházak Zrt., Kühne + Nagel, Interfrigo, and Cool Logistics Hungary.

Company | Establishment Year | Headquarters |

Waberer’s International | 1948 | Budapest, Hungary |

Nagel Hungaria | 1992 | Biatorbágy, Hungary |

Hűtőházak Zrt. | 2003 | Szekszárd, Hungary |

Kühne + Nagel | 1890 | Schindellegi, Switzerland |

Interfrigo | 1988 | Baja, Hungary |

Cool Logistics Hungary | 2010 | Budapest, Hungary |

Some of the recent competitor trends and key information about these players include:

Waberer’s International: One of Hungary’s largest logistics companies, Waberer’s significantly expanded its cold storage capabilities in 2023 by adding over 25,000 m² of temperature-controlled space in the Budapest logistics hub. The firm also launched AI-based route optimization tools to improve fuel efficiency for its refrigerated fleet.

Nagel Hungaria: A subsidiary of the Nagel-Group, the company is known for its specialized food logistics services. In 2023, Nagel Hungaria expanded its chilled and frozen warehousing operations near major food manufacturing zones in Győr and Debrecen, supporting both domestic distribution and export logistics.

Hűtőházak Zrt.: A key player in the frozen food storage market, Hűtőházak Zrt. serves major clients in meat and seafood exports. In 2023, the company upgraded its facilities with automated temperature monitoring systems and solar-powered backup cooling to enhance sustainability and operational resilience.

Kühne + Nagel: This global logistics giant operates in Hungary through specialized cold chain solutions for pharmaceuticals and high-value food items. In 2023, Kühne + Nagel saw double-digit growth in its Hungary pharma logistics division due to rising vaccine and biologic shipments.

Interfrigo: Known for its cross-border cold chain services, Interfrigo continues to invest in reefer rail transport across the Hungary-Serbia and Hungary-Romania corridors. In 2023, the company added 40 new refrigerated containers to support perishable exports.

Cool Logistics Hungary: Focused on last-mile refrigerated deliveries for food retailers and e-commerce platforms, the company saw 18% revenue growth in 2023. Its fleet expansion and digital tracking solutions have positioned it well to serve Budapest’s fast-growing urban food delivery segment.

What Lies Ahead for Hungary Cold Chain Market?

The Hungary cold chain market is projected to expand steadily through 2029, registering a healthy CAGR during the forecast period. This growth will be underpinned by the rise in pharmaceutical exports, increasing demand for frozen and ready-to-eat food, and continued alignment with EU regulatory standards for food and drug safety.

Expansion of Pharmaceutical Cold Chain Logistics: With Hungary becoming a key player in Central Europe's pharmaceutical manufacturing and distribution ecosystem, demand for specialized cold chain logistics for biologics, vaccines, and temperature-sensitive APIs is set to grow. By 2029, pharma is expected to account for a significantly larger share of cold chain logistics revenue, driven by Hungary’s rising exports and increased investment in biologics R&D.

Growth of Frozen Food and Quick Commerce: The consumption of frozen meals and chilled ready-to-cook items is rising, particularly in urban centers. The proliferation of quick commerce platforms and online grocery services is creating fresh demand for hyperlocal refrigerated delivery solutions. Logistics firms are anticipated to expand urban micro-warehouses and invest in last-mile cold transport.

Digitalization and Automation of Cold Chain Operations: The future of Hungary’s cold chain sector lies in the adoption of advanced technologies such as IoT-enabled sensors, AI-based inventory forecasting, and automated cold storage systems. By 2029, it is expected that over 50% of large cold chain operators will implement real-time tracking and temperature alerts to reduce spoilage and meet stringent audit requirements.

Emphasis on Green Logistics and Energy Efficiency: Environmental sustainability will become a major priority for cold chain operators in Hungary. As energy costs remain volatile, there will be a growing focus on solar-powered cold storage, electric refrigerated trucks, and energy-efficient cooling systems. The adoption of these practices will not only reduce operational costs but also align with the EU’s Green Deal objectives.

%2C%202024-2030.png)

Hungary Cold Chain Market Segmentation

• By Service Type:

o Cold Storage

o Cold Transportation

o Last-Mile Refrigerated Delivery

o Reefer Container Services

o Cross-Border Pharma Logistics

• By Temperature Type:

o Chilled (0°C to 8°C)

o Frozen (Below -18°C)

o Deep Frozen (-25°C and below)

• By End User Industry:

o Food & Beverage (Meat, Dairy, Bakery, Frozen Foods)

o Pharmaceutical & Biotech

o Fruits & Vegetables

o Quick Commerce & Online Grocery

o HoReCa (Hotels, Restaurants, Catering)

o Floral and Specialty Chemicals

• By Infrastructure Type:

o Standalone Cold Storage Facilities

o Integrated Cold Chain Warehouses

o Reefer Truck Fleets

o Intermodal Reefer Transport Units

o Urban Micro Cold Storage Units

• By Ownership Model:

o Third-Party Logistics (3PL)

o Captive/In-House Cold Chain Operators

o Public Cold Storage Infrastructure

o Contract-Based Cold Chain Services

• By Region:

o Central Hungary (Budapest)

o Northern Hungary (Miskolc, Salgótarján)

o Southern Great Plain (Szeged, Kecskemét)

o Northern Great Plain (Debrecen, Nyíregyháza)

o Western Transdanubia (Győr, Sopron)

o Southern Transdanubia (Pécs, Kaposvár)

Players Mentioned in the Report:

• Waberer’s International

• Nagel Hungaria

• Kühne + Nagel

• Hűtőházak Zrt.

• Interfrigo

• Cool Logistics Hungary

• Raben Logistics Hungary

• Transdanubia Logistics

• DB Schenker Hungary

• Ghibli Ltd.

Key Target Audience:

• Cold Chain Logistics Providers

• Frozen and Processed Food Manufacturers

• Pharmaceutical and Vaccine Manufacturers

• E-commerce and Grocery Delivery Companies

• Government Regulatory Bodies (e.g., NÉBIH, Ministry of Agriculture)

• Real Estate Developers for Logistics Parks

• Transport Fleet Operators

• Cold Storage Equipment Manufacturers

• International Logistics Investors

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Hungary Cold Chain Market

4.3. Business Model Canvas for Hungary Cold Chain Market

4.4. Cold Chain Logistics Decision-Making Process (Storage & Transport)

4.5. End-User Logistics Partnership Selection Criteria

5.1. Refrigerated Storage Capacity by Type and Region in Hungary, 2018-2024

5.2. Reefer Truck Fleet Growth in Hungary, 2018-2024

5.3. Cold Chain Infrastructure Distribution by Urban and Rural Hungary, 2024

5.4. Number of Cold Chain Operators by Region in Hungary

8.1. Revenues, 2018-2024

8.2. Refrigerated Storage Volume, 2018-2024

8.3. Refrigerated Transport Shipments, 2018-2024

9.1. By Service Type (Storage, Transportation, Last-Mile, Reefer Container), 2023-2024P

9.2. By Temperature Type (Chilled and Frozen), 2023-2024P

9.3. By Ownership Model (3PL, Captive, Public, Contract-Based), 2023-2024P

9.4. By End-User Industry (F&B, Pharma, Agri, Q-Commerce), 2023-2024P

9.5. By Region (Central, Northern, Southern, Western, Eastern Hungary), 2023-2024P

10.1. End-User Segmentation and Logistics Needs

10.2. End-User Procurement Process for Cold Chain Services

10.3. Service Expectations, Gaps, and Pain Points

10.4. GAP Analysis Framework

11.1. Trends and Developments for Hungary Cold Chain Market

11.2. Growth Drivers for Hungary Cold Chain Market

11.3. SWOT Analysis for Hungary Cold Chain Market

11.4. Issues and Challenges for Hungary Cold Chain Market

11.5. Government Regulations and EU Guidelines Impacting Cold Chain

12.1. Adoption of IoT, Sensors, and Temperature Tracking

12.2. Investment in Warehouse Management Systems and Automation

12.3. Cross-Comparison of Technology Adoption by Leading Players

13.1. Cold Chain Demand from Vaccine, Biologic & API Logistics

13.2. Storage and Compliance Requirements under EU GDP

13.3. Pharma Cold Chain Players, Hubs, and Regulatory Audits

13.4. Growth Trends and Future Projections for Pharma Logistics

16.1. Benchmark of Key Competitors in Hungary Cold Chain Market including Company Overview, Strengths, Business Models, Operating Regions, Fleet Size, Storage Capacity, Revenue Streams, Service Segments

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Cold Storage Volume and Reefer Shipment Forecast, 2025-2029

18.1. By Service Type (Storage, Transportation, Last-Mile, Reefer Container), 2025-2029

18.2. By Temperature Type (Chilled and Frozen), 2025-2029

18.3. By Ownership Model (3PL, Captive, Public, Contract-Based), 2025-2029

18.4. By End-User Industry (F&B, Pharma, Agri, Q-Commerce), 2025-2029

18.5. By Region (Central, Northern, Southern, Western, Eastern Hungary), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Hungary Cold Chain Market. Basis this ecosystem, we will shortlist leading 5–6 players in the country based upon their financial information, infrastructure capacity (cold storage and transportation), and service offerings.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market size (in HUF Billion), number of market players, infrastructure capacity, demand segmentation, and pricing trends. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Hungary Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate capacity, utilization, and service volumes for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service pricing, value chain, delivery models, and infrastructure challenges.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Hungary Cold Chain Market?

The Hungary cold chain market is poised for consistent growth, reaching a valuation of HUF 138 Billion in 2023. This growth is fueled by rising demand from the pharmaceutical sector, expanding frozen and chilled food segments, and increasing compliance with EU food and drug safety regulations. The market’s potential is further enhanced by growing investments in temperature-controlled infrastructure and the adoption of digital cold chain technologies.

2. Who are the Key Players in the Hungary Cold Chain Market?

The Hungary Cold Chain Market features several key players, including Waberer’s International, Nagel Hungaria, and Hűtőházak Zrt. These companies lead the market due to their robust storage capacity, expansive transportation fleets, and integrated service models. Other notable players include Kühne + Nagel, Interfrigo, and Cool Logistics Hungary.

3. What are the Growth Drivers for the Hungary Cold Chain Market?

Key growth drivers include the rising demand for biologics and temperature-sensitive pharmaceuticals, increasing consumption of frozen and ready-to-eat foods, and technological advancements in cold storage and reefer transportation. Additionally, EU funding support for logistics infrastructure and the growing influence of quick commerce and online grocery delivery are expected to boost the cold chain market in Hungary.

4. What are the Challenges in the Hungary Cold Chain Market?

The Hungary Cold Chain Market faces several challenges, including high operational costs due to energy price volatility, insufficient cold storage and last-mile delivery capacity in rural areas, and a shortage of trained cold chain professionals. Regulatory compliance and maintenance of cold chain integrity during cross-border transport also remain critical hurdles for market players.