Hungary Logistics and Warehousing Market Outlook to 2029

By Service Segments (Freight Forwarding, Warehousing, Courier Express Parcel, and Value-added Services), By End Users (Retail, Automotive, Electronics, Pharmaceuticals, and Others), By Domestic vs International, and By Region

- Product Code: TDR0280

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Hungary Logistics and Warehousing Market Outlook to 2029 – By Service Segments (Freight Forwarding, Warehousing, Courier Express Parcel, and Value-added Services), By End Users (Retail, Automotive, Electronics, Pharmaceuticals, and Others), By Domestic vs International, and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Hungary. It includes an overview of market genesis, industry evolution, overall market size in terms of revenue, market segmentation, trends and developments, regulatory environment, customer preferences, issues and challenges, and competitive landscape including company profiles, comparative analysis, and growth opportunities. The report concludes with future projections based on revenue and volume, supported by key growth drivers, challenges, and case studies that illustrate successful strategies and potential pitfalls.

Hungary Logistics and Warehousing Market Overview and Size

The logistics and warehousing market in Hungary was valued at HUF 2,350 Billion in 2023, supported by the country’s strategic geographical location in Central Europe, strong infrastructure connectivity, and a robust manufacturing base. Major players in this sector include Waberer’s International, Trans-Sped, DB Schenker Hungary, Gebrüder Weiss, and GLS Hungary. These companies are known for their extensive distribution networks, tailored logistics services, and increasingly digitized supply chain operations.

In 2023, Hungary’s National Logistics Strategy 2030 initiative accelerated digital infrastructure development across logistics parks and border terminals, with increased focus on multimodal transport. Key logistics hubs such as Budapest, Győr, and Debrecen are emerging as core nodes for both domestic distribution and regional exports, particularly for the automotive and electronics sectors.

%2C%202019-2024_fJjoQDY.png)

What Factors are Leading to the Growth of Hungary Logistics and Warehousing Market:

Strategic Location and EU Integration: Hungary's position as a land-linked gateway to Western and Eastern Europe provides a competitive edge in trans-European trade. Around 70% of Hungary’s export volumes are directed to the EU, necessitating robust logistics infrastructure.

Booming E-commerce Sector: Hungary’s e-commerce market grew at a CAGR of 19% between 2019 and 2023, significantly boosting demand for third-party logistics (3PL), warehousing, and last-mile delivery solutions. By 2023, parcel delivery volumes exceeded 95 million units annually, spurring investments in automation and regional sorting centers.

Automotive and Electronics Manufacturing Base: Hungary serves as a manufacturing hub for global automotive OEMs (e.g., Audi, Mercedes-Benz, Suzuki) and electronics companies (e.g., Bosch, Samsung, Flextronics), which demand just-in-time warehousing, inventory management, and integrated freight forwarding services.

Which Industry Challenges Have Impacted the Growth of Hungary Logistics and Warehousing Market

Infrastructure Bottlenecks in Secondary Cities: While Budapest and a few major industrial zones are well-connected, several Tier 2 and Tier 3 regions in Hungary continue to face poor road and rail infrastructure. In 2023, over 35% of logistics firms cited delays and higher transportation costs due to inadequate connectivity outside major hubs. This imbalance limits the expansion of nationwide distribution networks and raises fulfillment times.

Labor Shortages in Logistics Workforce: The logistics sector in Hungary is grappling with a skilled labor shortage, particularly in warehouse operations and long-haul trucking. According to the Hungarian Logistics Association, approximately 20% of logistics companies faced staff shortages in 2023, leading to delayed shipments and increased reliance on contract labor, which inflated operational costs by up to 15%.

Rising Warehousing Costs and Limited Grade A Supply: The surge in demand from e-commerce, automotive, and manufacturing sectors has led to a supply-demand gap for modern Grade A warehouses. In 2023, prime rents in key logistics parks near Budapest rose by nearly 12% YoY, while vacancy rates dropped below 5%. Smaller firms struggle to secure adequate storage at affordable rates, limiting scalability.

What are the Regulations and Initiatives which have Governed the Market

National Logistics Strategy 2030: The Hungarian government launched this strategic framework to boost multimodal transport, digitize logistics corridors, and expand rail-road interconnectivity. By 2023, over HUF 250 Billion was allocated toward improving border logistics zones and integrating rail hubs with major industrial parks.

EU Green Logistics Compliance: In line with EU Fit for 55 and Green Deal objectives, Hungary has adopted regulations mandating CO₂ emission reductions for heavy-duty vehicles and warehousing operations. By 2023, logistics companies operating fleets over 3.5 tons were required to submit annual emission reports, pushing investments into electric vehicles and eco-friendly warehouses.

Tax Incentives for Logistics Park Development: To encourage private investment in logistics infrastructure, the Hungarian government offers corporate tax reductions and VAT exemptions for certified logistics park developers. In 2023, five new logistics parks were approved under this scheme, adding over 150,000 sqm of warehousing space to the market.

Hungary Logistics and Warehousing Market Segmentation

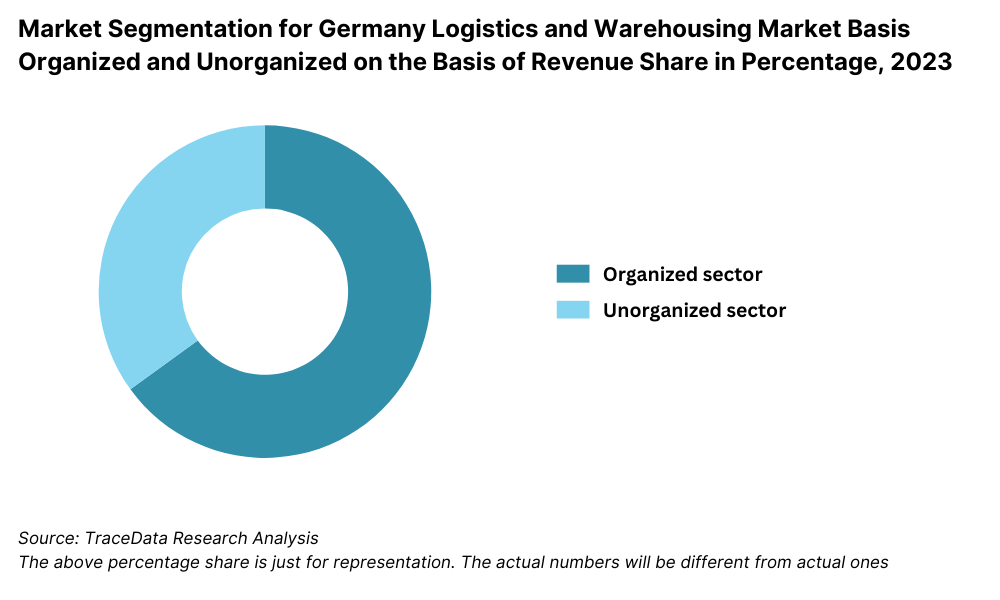

By Market Structure: The organized sector dominates Hungary’s logistics and warehousing landscape, led by international and regional players who offer end-to-end services, advanced inventory management systems, and compliance with EU logistics standards. Companies like Waberer’s, DB Schenker, and Kühne + Nagel operate within this structured ecosystem with robust warehousing, customs handling, and multimodal transport capabilities. The unorganized sector, comprising small local freight brokers, warehouse contractors, and regional couriers, remains active in domestic and last-mile delivery segments, especially in non-urban regions.

By End Users: The retail and e-commerce sectors are key drivers of the logistics market in Hungary, especially due to the rapid growth of online shopping platforms and omnichannel retailing. Automotive manufacturers rely heavily on logistics services for just-in-time deliveries, warehousing of components, and finished vehicle exports. The electronics and pharmaceutical sectors are also significant, requiring climate-controlled storage and high-security transportation due to the sensitive nature of goods. The FMCG and food sectors contribute to a growing demand for cold chain and last-mile delivery services.

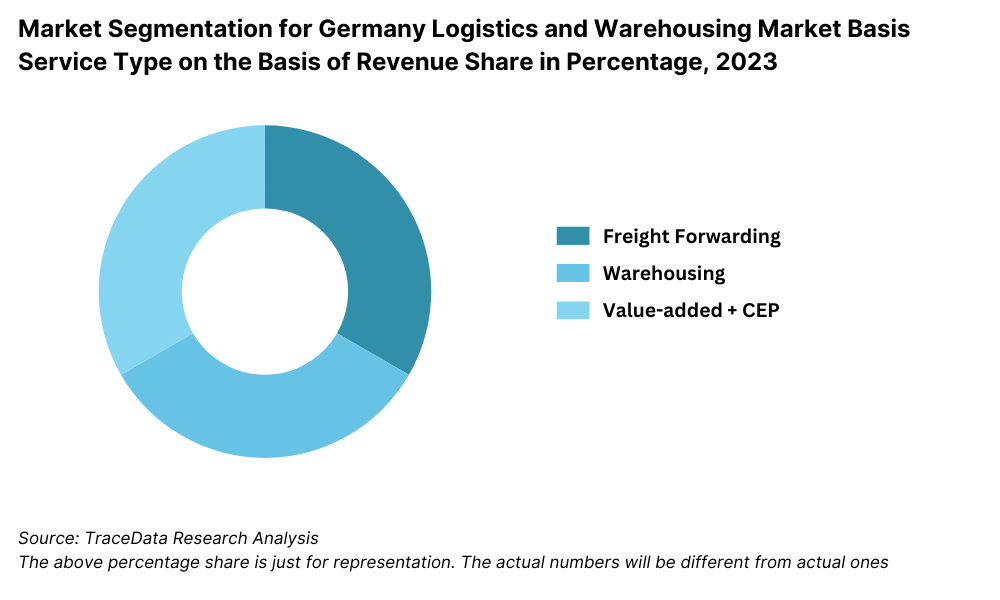

By Service Offering: Freight forwarding, including road and rail transport, represents the largest share of logistics services in Hungary, primarily due to the country's cross-border trade volume within the EU. Warehousing services, including storage, inventory handling, and cold storage, form the second-largest segment. Courier, Express, and Parcel (CEP) services are gaining traction due to the growth in B2C e-commerce, while value-added services such as reverse logistics, packaging, and customs brokerage are emerging as differentiators for full-service providers.

Competitive Landscape in Hungary Logistics and Warehousing Market

The Hungary logistics and warehousing market is moderately consolidated, with a strong presence of both international 3PL giants and domestic players. Companies such as Waberer’s International, Trans-Sped, DB Schenker Hungary, Gebrüder Weiss, and GLS Hungary have established robust infrastructure networks, diversified service offerings, and growing digital capabilities. In recent years, increased demand from automotive, e-commerce, and industrial sectors has pushed these players to expand their capacities and integrate advanced technologies into their operations.

Company | Establishment Year | Headquarters |

Waberer’s International | 1994 | Budapest, Hungary |

Trans-Sped | 1990 | Debrecen, Hungary |

DB Schenker Hungary | 1872 (Global), Hungary arm since 1992 | Budapest, Hungary |

Gebrüder Weiss Hungary | 1823 (Global), Hungary arm since 1990s | Dunaharaszti, Hungary |

GLS Hungary | 1999 | Budapest, Hungary |

Some of the recent competitor trends and key information about competitors include:

Waberer’s International: As one of Central Europe’s largest road transport and logistics companies, Waberer’s handled over 320,000 international freight consignments in 2023. The company is expanding its warehousing footprint near Budapest and has recently launched a fleet modernization program aimed at reducing emissions and improving last-mile efficiency.

Trans-Sped: With over 20 logistics facilities across Hungary, Trans-Sped has positioned itself as a leader in end-to-end warehousing and 3PL services. In 2023, the company reported a 17% YoY increase in fulfillment services for e-commerce clients, driven by its investment in automated sorting systems and robotics.

DB Schenker Hungary: Leveraging its global parent network, DB Schenker has expanded its multimodal offerings in Hungary. In 2023, it launched an integrated rail-road service between Budapest and Duisburg, reducing transit time by 25%. The company also enhanced its digital freight booking and cargo tracking systems.

Gebrüder Weiss Hungary: Known for high-quality warehousing and reliable cross-border logistics, the company added 15,000 sqm of warehouse space near the M0 ring road in 2023. Its strength lies in integrated B2B solutions and its early adoption of green logistics initiatives such as solar-powered warehouses and electric delivery vans.

GLS Hungary: Focused on the parcel and express delivery segment, GLS handled over 50 million parcels in 2023, supported by its nationwide network and investment in last-mile delivery infrastructure. The company’s hybrid delivery options and real-time tracking tools have significantly improved customer satisfaction levels in both B2C and B2B segments.

_CgaMkyt.png)

What Lies Ahead for Hungary Logistics and Warehousing Market?

The Hungary logistics and warehousing market is projected to witness consistent growth through 2029, driven by strategic infrastructure investments, the rise of e-commerce, and integration into regional supply chains. The market is expected to grow at a healthy CAGR, supported by digitalization, demand from key sectors like automotive and pharma, and Hungary's position as a logistics gateway for Central and Eastern Europe.

Expansion of Multimodal Logistics and Rail Freight Corridors: With increasing EU emphasis on sustainability and efficiency, Hungary is expected to see a significant push toward rail-road intermodal logistics. Projects like the V0 freight railway bypass and the East-West Gate intermodal terminal will boost transit volumes and reduce dependency on road transport.

Surge in E-commerce Warehousing and Last-Mile Logistics: The continued rise of e-commerce will drive demand for urban distribution centers and automated last-mile delivery hubs. By 2029, parcel volumes are expected to nearly double from 2023 levels, prompting logistics players to expand express delivery networks and introduce micro-fulfillment centers across major cities.

Adoption of Smart Warehousing Technologies: Automation, AI-powered inventory systems, robotics, and warehouse management platforms will become central to operations. Hungary’s leading logistics firms are expected to invest heavily in smart warehousing to meet rising service level expectations and improve operational efficiency.

Green Logistics and Sustainability Integration: Environmental regulations and corporate ESG goals will push logistics providers to adopt eco-friendly practices. Electric fleet deployment, solar-powered warehouses, and carbon-offsetting programs are expected to become mainstream by 2029, especially among international 3PLs operating in Hungary.

%2C%202024-2030_Q6wkqC4.png)

Hungary Logistics and Warehousing Market Segmentation

• By Market Structure:

o Organized Sector

o Unorganized Sector

o Domestic Logistics Providers

o International 3PLs

o In-house Logistics Divisions

o Courier and Express Parcel Companies

o Freight Forwarders

o Warehousing Service Providers

• By End User:

o Retail and E-commerce

o Automotive and Auto Components

o Electronics and Electrical Equipment

o Pharmaceuticals and Healthcare

o FMCG and Food & Beverage

o Industrial and Machinery

o Agriculture and Chemicals

• By Service Type:

o Freight Forwarding (Road, Rail, Air, Sea)

o Warehousing and Storage

o Courier, Express and Parcel (CEP)

o Cold Chain Logistics

o Last-Mile Delivery

o Value-added Services (e.g., Packaging, Labelling, Reverse Logistics)

• By Region:

o Central Hungary (incl. Budapest)

o Western Transdanubia

o Northern Great Plain

o Southern Great Plain

o Northern Hungary

o Southern Transdanubia

o Central Transdanubia

Players Mentioned in the Report:

• Waberer’s International

• Trans-Sped

• DB Schenker Hungary

• Gebrüder Weiss Hungary

• GLS Hungary

• Kühne + Nagel Hungary

• Rail Cargo Hungaria

• DHL Supply Chain Hungary

Key Target Audience:

• Logistics and Warehousing Companies

• E-commerce Retailers and FMCG Distributors

• Automotive OEMs and Component Suppliers

• Industrial Park Developers and Investors

• Supply Chain Tech Providers

• Regulatory Authorities (e.g., Hungarian Ministry for Innovation and Technology)

• Transport and Freight Associations

• Research and Development Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Hungary Logistics and Warehousing Market

4.3. Business Model Canvas for Hungary Logistics and Warehousing Market

4.4. Logistics Service Provider Selection Decision Process

4.5. Warehousing Location Selection Decision Process

5.1. Export and Import Trade Volume in Hungary, 2018-2024

5.2. Logistics Spend as a % of GDP in Hungary, 2018-2024

5.3. Number of Logistics Parks and Warehouses by Region, 2024

5.4. Employment in Transport and Storage Sector in Hungary, 2018-2024

8.1. Revenues, 2018-2024

8.2. Volume of Freight Handled (Tons), 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Service Type (Freight Forwarding, Warehousing, CEP, Value-Added Services), 2023-2024P

9.3. By End User (Retail, Automotive, Electronics, Pharma, FMCG, Others), 2023-2024P

9.4. By Region (Central, Northern, Southern, Transdanubia Zones), 2023-2024P

9.5. By Mode of Freight (Road, Rail, Air, Sea), 2023-2024P

9.6. By Type of Warehouse (Cold Storage, Dry Storage, Bonded, E-commerce Fulfillment), 2023-2024P

10.1. Customer Landscape and Logistics Outsourcing Trends

10.2. Service Selection Criteria and Decision Making

10.3. Needs and Pain Point Analysis

10.4. Gaps in Service Offerings and Opportunity Mapping

11.1. Trends and Developments in Hungary Logistics and Warehousing Market

11.2. Growth Drivers for Hungary Logistics and Warehousing Market

11.3. SWOT Analysis for Hungary Logistics and Warehousing Market

11.4. Issues and Challenges in Hungary Logistics and Warehousing Market

11.5. Government Regulations and Incentives

12.1. Market Size and Growth Potential of B2C and D2C Fulfillment, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Competitive Landscape of Last-Mile Delivery Providers

13.1. Temperature-controlled Logistics Infrastructure Overview

13.2. Key End-User Demand Segments and Trends

13.3. Market Size and Revenue Share by Product Type, 2018-2029

13.4. Cold Chain Fleet and Storage Capacity Analysis

16.1. Benchmark of Key Competitors Including Overview, Services, Strengths, Business Model, Warehousing Area, Fleet Size, Technology Adoption, and Value-Added Services

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Volume of Freight Handled (Tons), 2025-2029

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Service Type (Freight Forwarding, Warehousing, CEP, Value-Added Services), 2025-2029

18.3. By End User (Retail, Automotive, Electronics, Pharma, FMCG, Others), 2025-2029

18.4. By Region (Central, Northern, Southern, Transdanubia Zones), 2025-2029

18.5. By Mode of Freight (Road, Rail, Air, Sea), 2025-2029

18.6. By Type of Warehouse (Cold Storage, Dry Storage, Bonded, E-commerce Fulfillment), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Hungary Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics and warehousing service providers in the country based upon their financial information, operational capacity, and service portfolio.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market size in terms of revenue, number of logistics operators, warehouse capacity, demand from key industries, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Hungary Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate revenue contribution for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service offerings, cost structures, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Hungary Logistics and Warehousing Market?

The Hungary logistics and warehousing market is poised for steady expansion, reaching a valuation of HUF 2,350 Billion in 2023. The country’s strategic location in Central Europe, its integration with EU trade corridors, and the continued rise of manufacturing and e-commerce sectors underscore the market's long-term growth potential. Investment in infrastructure, digital logistics, and sustainability practices is expected to further propel the industry through 2029.

2. Who are the Key Players in the Hungary Logistics and Warehousing Market?

The Hungary logistics and warehousing market is dominated by key players such as Waberer’s International, Trans-Sped, DB Schenker Hungary, Gebrüder Weiss, and GLS Hungary. These companies offer a wide range of services including freight forwarding, warehousing, last-mile delivery, and value-added logistics. Their extensive national and cross-border networks, along with technology integration, give them a competitive edge in the market.

3. What are the Growth Drivers for the Hungary Logistics and Warehousing Market?

The primary growth drivers include Hungary’s central geographic position in Europe, making it a logistics gateway for East-West trade. Rising e-commerce volumes, robust demand from automotive and pharmaceutical industries, and growing investment in rail-road intermodal infrastructure also contribute significantly. Additionally, digital transformation, automation in warehousing, and supportive government policies enhance the growth trajectory of the sector.

4. What are the Challenges in the Hungary Logistics and Warehousing Market?

Key challenges in the Hungary logistics market include labor shortages in warehousing and transportation, limited availability of modern Grade A warehouse space, and rising operational costs. Infrastructure disparities between regions and regulatory complexities in cross-border shipments also impact market efficiency. Furthermore, the sector faces pressure to comply with evolving EU environmental and carbon emission standards, requiring continual investments in green logistics solutions.