India AI in Healthcare Market Outlook to 2030

By Clinical Domain, By Deployment Model, By Function, By End User, and By Region

- Product Code: TDR0375

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “India AI in Healthcare Market Outlook to 2030 – By Clinical Domain, By Deployment Model, By Function, By End User, and By Region” provides a comprehensive analysis of the AI-driven transformation within India’s healthcare ecosystem. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and detailed segmentation; trends and developments such as adoption of generative AI, clinical documentation automation, and multimodal diagnostic platforms; regulatory landscape including ABDM, DPDP Act, and CDSCO SaMD frameworks; customer-level profiling of hospitals, diagnostic networks, insurers, and government programs; issues and challenges related to interoperability, data privacy, and clinical validation; and an in-depth competitive landscape featuring competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the India AI in Healthcare Market. The report concludes with future market projections based on healthcare digitization levels, AI adoption maturity across clinical functions, regional healthcare investment trends, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

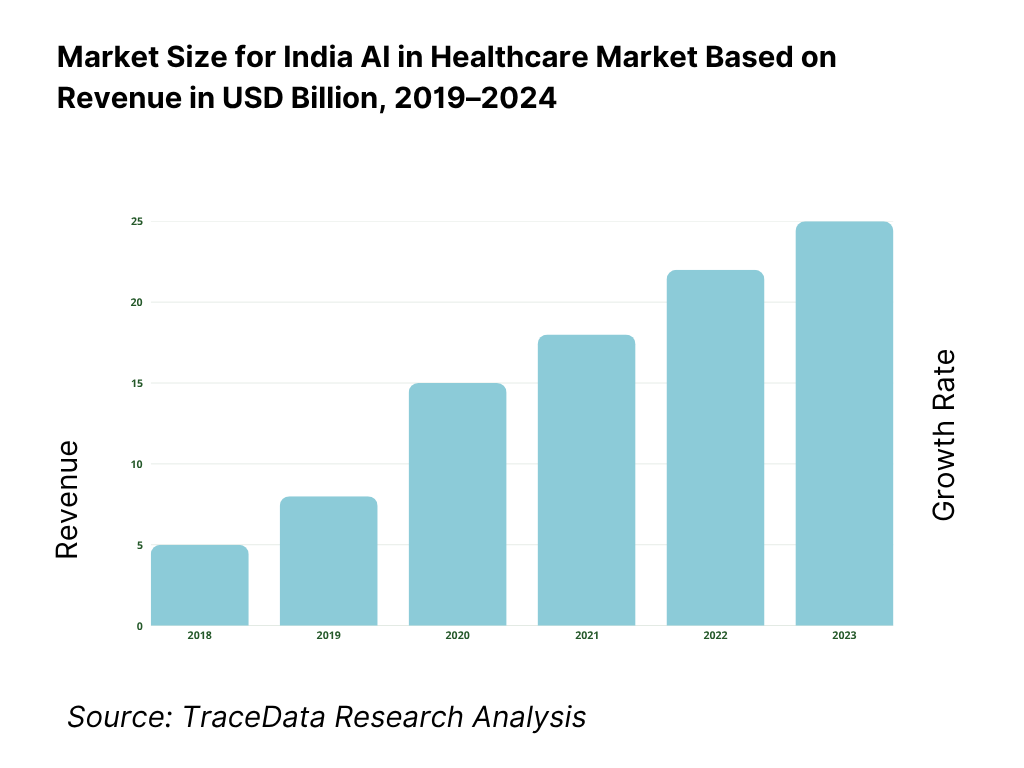

India AI in Healthcare Market Overview and Size

The India AI in healthcare market is valued at USD 758.8 million, based on a five-year historical analysis. Adoption is catalyzed by national digital rails and data liquidity: ABDM has created over 6.7×10^8 ABHA IDs and is enrolling model facilities across states, accelerating interoperable data exchange that feeds AI triage, imaging and claims-automation engines. Policy guardrails under the Digital Personal Data Protection Act (No. 22 of 2023) further standardize consent and lawful processing, de-risking enterprise deployments and hospital pilots at scale.

Bengaluru, Hyderabad, Delhi-NCR, Mumbai and Chennai dominate due to dense deep-tech/start-up ecosystems and anchor hospital chains that run high-volume diagnostics and EHR modernization. Bengaluru’s ecosystem value touched USD 158 billion, reflecting deep AI talent and venture density; Hyderabad’s large tertiary centers and integrated diagnostics push real-world deployment; Delhi-NCR and Mumbai concentrate payors, regulators and corporate hospitals that shape commercialization; Chennai adds strong med-engineering programs and OEM partnerships. ABDM’s 4.0×10^8+ ABHA enrollments earlier in the cycle and later scale-up underpin metro-first rollouts.

What Factors are Leading to the Growth of the India AI in Healthcare Market:

Nationwide digital rails and care access at scale: India’s health-data infrastructure is rapidly expanding, providing the essential foundation for large-scale AI deployment across hospitals and clinics. The Ayushman Bharat Digital Mission has generated over 6.7 billion ABHA IDs, enabling seamless interoperability between healthcare facilities. More than 40 million OPD visits have already been processed through the ABHA “Scan & Share” system, and eSanjeevani has facilitated over 360 million teleconsultations—demonstrating both adoption and data depth. With 913.34 million wireless data subscribers nationwide, India’s connectivity footprint supports real-time AI-enabled workflows, remote diagnostics, and mobile-based decision support in even rural health environments.

High disease burden and a vast, distributed care network: AI adoption is strongly driven by India’s large and diverse healthcare load. The National TB program registered 2.55 million notifications one year and 2.607 million the next—levels that necessitate algorithmic triage, diagnostic support, and adherence monitoring at scale. On the provider side, India operates 169,615 Sub-Centres, 31,882 Primary Health Centres, 6,359 Community Health Centres, 1,340 Sub-Divisional/District Hospitals, 714 District Hospitals, and 362 Medical Colleges. Each facility represents a node for deploying AI-enabled imaging, pathology, and monitoring systems. Backed by a USD 4.19 trillion economy, India has both fiscal and private investment capacity to sustain digital health modernization and national AI rollouts.

Digitized patient–provider interactions that generate machine-learnable exhaust: Digitization across India’s healthcare system is creating massive, labeled datasets ideal for AI training and inference. The eSanjeevani telehealth network alone has recorded 360 million structured consultations, providing a rich source of medical dialogues and outcome data. Over 6.7 billion ABHA identifiers are now being used across care points, and 40 million OPD encounters have been linked through QR-based registration systems. With 913.34 million wireless data subscribers supporting connected care, India’s healthcare infrastructure is producing continuous, machine-readable data streams that directly accelerate model development, validation, and deployment across public and private health networks.

Which Industry Challenges Have Impacted the Growth of the India AI in Healthcare Market:

Infrastructure intensity versus load: beds and primary care touchpoints: Despite India’s scale, infrastructure limitations pose significant barriers to AI adoption. The public health system manages 860,688 hospital beds across state and local facilities, a finite capacity that must handle both emergency and chronic cases. While 169,615 Sub-Centres, 31,882 PHCs, and 6,359 CHCs extend nationwide reach, this vast network creates logistical complexity for standardized AI deployment, model training, and quality assurance. Fragmented EHR usage, inconsistent connectivity, and hardware disparities between metro and rural hospitals further challenge seamless integration of AI platforms into the national healthcare framework.

Cybersecurity exposure and data-security operational load: AI systems rely on vast data exchanges that expand the cyberattack surface in healthcare. Recorded cybersecurity incidents in India rose from 1,391,457 to 1,592,917 to 2,041,360 in successive years, highlighting escalating threats to hospital and insurer networks. Mitigation requires large-scale encryption, network segmentation, and real-time monitoring—raising compliance costs. Additionally, telecom infrastructure blocking 13.5 million spoofed calls in one day shows the magnitude of malicious digital activity that can similarly target health APIs. Hospitals now face continuous cybersecurity obligations, adding operational strain to clinical and IT teams responsible for safeguarding sensitive medical data.

Uneven digital-readiness across facilities and programmes: Digital maturity differs widely among healthcare facilities, impeding uniform AI adoption. Only 131 model hospitals under the ABDM programme have achieved full digitization, a small subset of the country’s thousands of institutions. Even among these, many still standardize OPD, lab, and imaging modules. So far, 40 million OPD visits have used the ABHA QR-based system—an impressive figure but still a fraction of India’s total patient traffic. A significant portion of hospitals remain dependent on paper-based workflows, creating data silos and inconsistencies that reduce the quality of datasets required for robust AI model training and clinical validation.

What are the Regulations and Initiatives which have Governed the Market:

ABDM (Ayushman Bharat Digital Mission): identifiers, registries and exchange rails: The ABDM establishes the digital foundation for data exchange and patient identity management across India’s health system. Over 6.7 billion ABHA numbers have been issued, creating interoperable linkages between patients, hospitals, and diagnostic centers. More than 40 million OPD registrations have been processed through “Scan & Share” workflows, embedding patient metadata into hospital systems for analytics and AI integration. The 131 ABDM model facilities serve as regulatory benchmarks for compliance, interoperability, and consent frameworks, ensuring that AI solution providers align with standardized data protocols and ethical usage policies during integration into clinical practice.

DPDP Act (No. 22 of 2023): lawful processing and accountability for digital personal data: The Digital Personal Data Protection Act governs how healthcare organizations and AI vendors collect, store, and process sensitive patient data. It mandates explicit consent, breach disclosure, and strict accountability for Data Fiduciaries and Processors handling health information. In parallel, cybersecurity incidents have reached 2,041,360 annually, underscoring the need for compliance-ready encryption, audit logging, and access-control systems. This law introduces India’s first unified framework for privacy-preserving data processing, directly impacting how AI algorithms are trained, deployed, and monitored across the country’s clinical and administrative health environments.

CDSCO Medical Devices Rules (MDR-2017) and SaMD oversight: The Central Drugs Standard Control Organisation (CDSCO) regulates software that performs medical functions under the Medical Devices Rules (MDR-2017). Its compliance network includes 6 zonal offices, 4 sub-zonal offices, 13 port offices, and 7 testing laboratories, ensuring supervision of imports, manufacturing, and post-market surveillance. AI software qualifying as SaMD (Software as a Medical Device) must meet stringent standards for quality management, clinical validation, and labelling. CDSCO’s online device portal and lists of approved testing labs ensure traceability and transparency, creating a structured pathway for AI developers to obtain clearances and maintain regulatory compliance throughout product life cycles.

India AI in Healthcare Market Segmentation

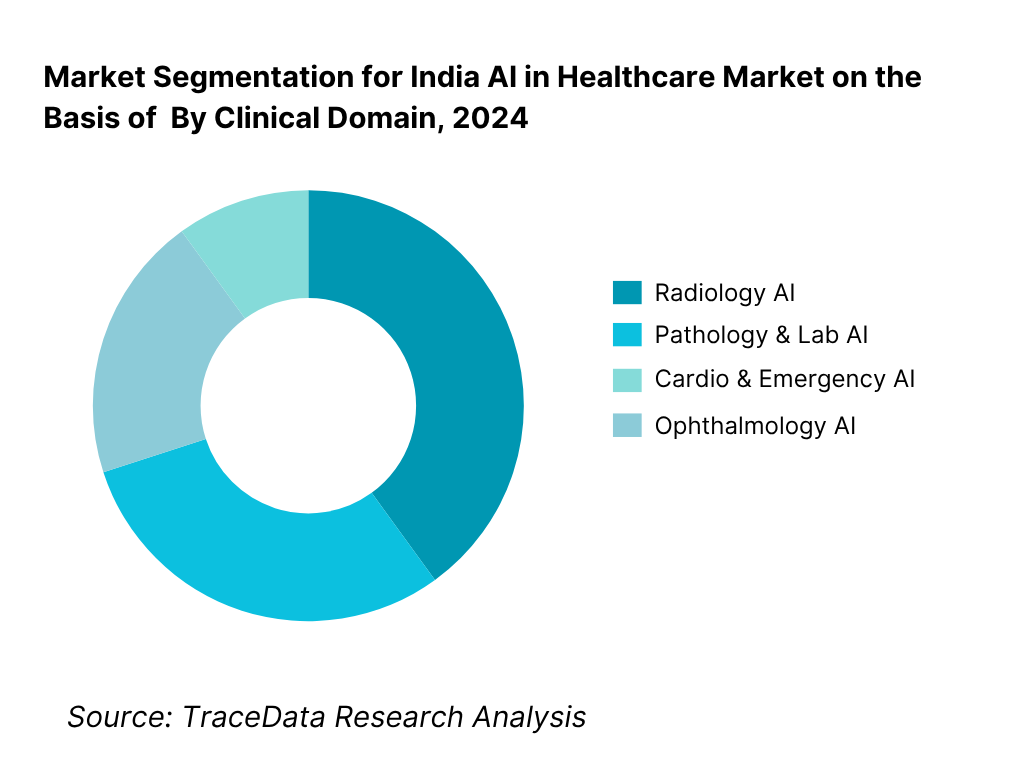

By Clinical Domain: India AI in healthcare market is segmented by clinical domain into radiology AI, pathology & lab AI, cardio & emergency AI, ophthalmology AI, oncology decision-support, and primary-care triage & documentation. Recently, radiology AI holds a dominant market share in India under this segmentation, due to its clear regulatory pathways, DICOM/PACS interoperability, and immediate ROI on turnaround-time reduction across CT, X-ray and mammography. High image throughput in diagnostic chains and teleradiology hubs, plus OEM console integrations and proven TB/CXR and stroke workflows, keeps radiology AI ahead of other domains in clinical adoption and budget prioritization.

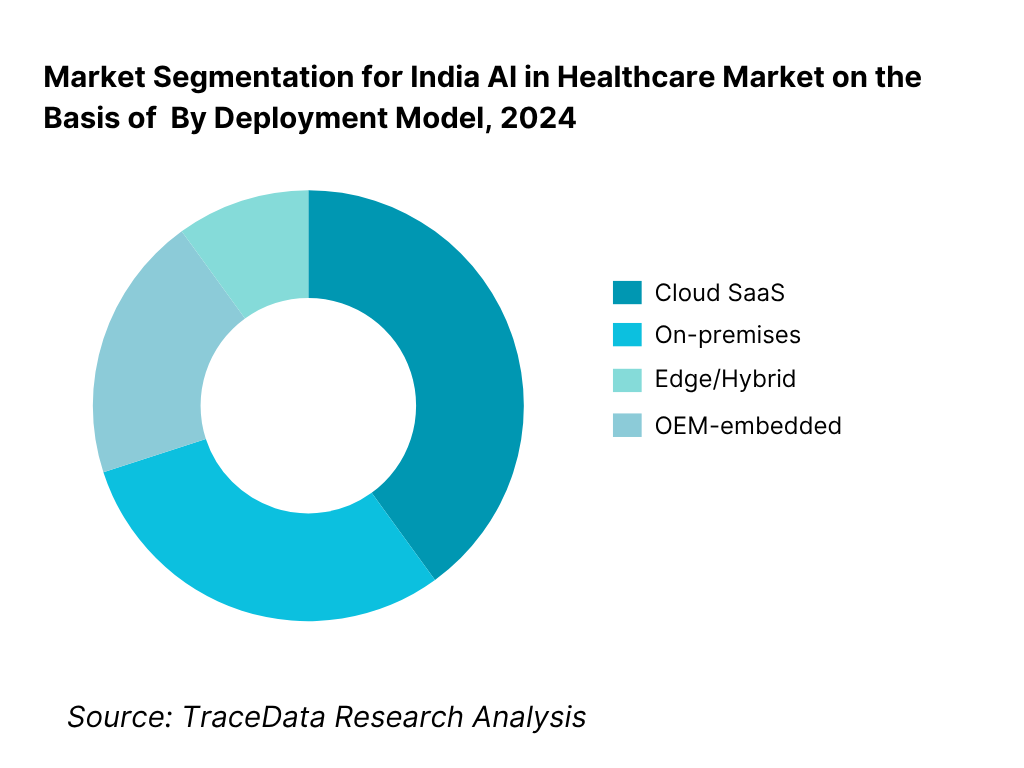

By Deployment Model: India AI in healthcare market is segmented by deployment model into cloud SaaS, on-premises, edge/hybrid and OEM-embedded. Recently, cloud SaaS has a dominant market share in India under this segmentation, because it compresses time-to-value, lowers capex, and scales across multi-site networks with centralized MLOps, audit logs and model-versioning. ABDM/FHIR-compatible APIs and DICOM routing from existing PACS enable fast integrations, while usage-based pricing (per-study/per-bed/month) aligns spend with volume. Hospitals also prefer managed updates for cybersecurity and DPDP compliance, keeping SaaS above on-prem despite some sovereign-cloud and bandwidth constraints.

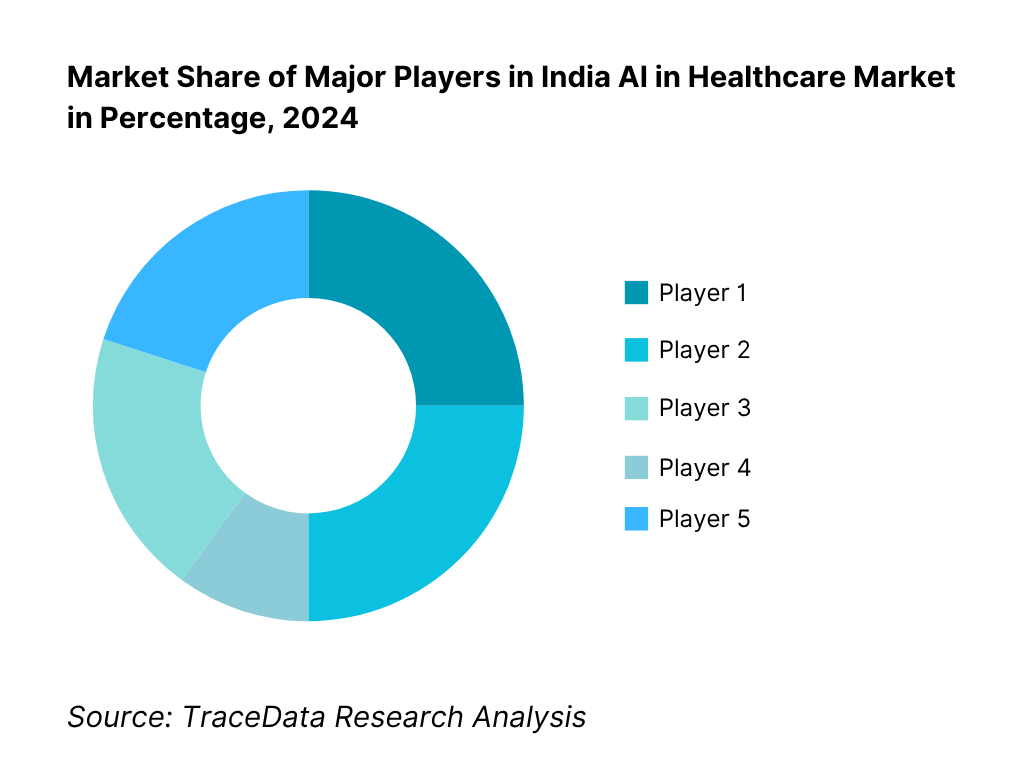

Competitive Landscape in India AI in Healthcare Market

The India AI in healthcare market is anchored by a set of high-traction domestic innovators alongside global OEM platform suites. Competition clusters around radiology AI, cardiology/ICU prediction, pathology automation, ambient scribing, and payer/claims AI. Scale advantages accrue to vendors with ABDM/UHI readiness, HL7-FHIR/DICOM interoperability, and reference deployments across diagnostic chains and tertiary hospitals; OEM tie-ups and teleradiology networks further concentrate share in imaging-led use-cases.

Name | Founding Year | Original Headquarters |

Qure.ai | 2016 | Mumbai, India |

DeepTek | 2017 | Pune, India |

Niramai | 2016 | Bengaluru, India |

Tricog | 2014 | Bengaluru, India |

SigTuple | 2015 | Bengaluru, India |

Synapsica | 2018 | Gurugram, India |

5C Network | 2016 | Bengaluru, India |

Predible | 2016 | Bengaluru, India |

Artelus | 2015 | Mumbai, India |

Dozee (Turtle Shell Technologies) | 2015 | Bengaluru, India |

HealthPlix | 2014 | Bengaluru, India |

Innovaccer | 2014 | San Francisco, USA |

AIRA Matrix | 2003 | Mumbai, India |

Spectral Insights | 2014 | Bengaluru, India |

Onward Assist | 2016 | Hyderabad, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Qure.ai: Qure.ai, a leading radiology AI company from Mumbai, expanded its partnerships with hospitals and public health programs in 2024, deploying its chest X-ray and CT-based AI systems across government TB screening and stroke care initiatives. The company also advanced its U.S. FDA-cleared algorithms and entered new collaborations with global medical device manufacturers to embed AI into imaging workflows, strengthening its dominance in clinical-grade radiology automation.

DeepTek: Pune-based DeepTek has enhanced its AI-powered teleradiology and image management platforms, integrating with national digital health initiatives under the Ayushman Bharat Digital Mission. The company has rolled out new managed AI-radiology services in multiple Indian states, improving diagnostic access in tier-2 and tier-3 cities. DeepTek also secured institutional funding in 2024 to expand its overseas presence across Southeast Asia and the Middle East.

Niramai: Bengaluru-based Niramai, specializing in AI-driven thermal imaging for early breast cancer detection, launched additional screening programs with CSR and public-sector partners in 2024. Its privacy-preserving, radiation-free solution is now deployed in both urban diagnostic centers and rural camps. Niramai’s continuous research collaborations with ICMR and NABH-accredited hospitals reinforce its credibility in preventive healthcare innovation.

Tricog: Tricog, an AI-driven cardiac diagnostics company headquartered in Bengaluru, expanded its remote ECG monitoring network to over 12,000 healthcare centers across India. In 2024, it integrated predictive analytics for cardiac arrest prevention and enhanced its real-time triage platform. Tricog’s partnerships with device manufacturers and global health programs have positioned it as a key player in emergency cardiac care digitization.

SigTuple: SigTuple, also based in Bengaluru, introduced automation upgrades for its AI-powered hematology and digital pathology systems in 2024, enabling faster and more accurate slide analysis for large lab networks. The company deepened collaborations with leading diagnostic chains and focused on scaling its AI quality-control platform to meet clinical-grade reliability standards under Indian regulatory frameworks.

What Lies Ahead for India AI in Healthcare Market?

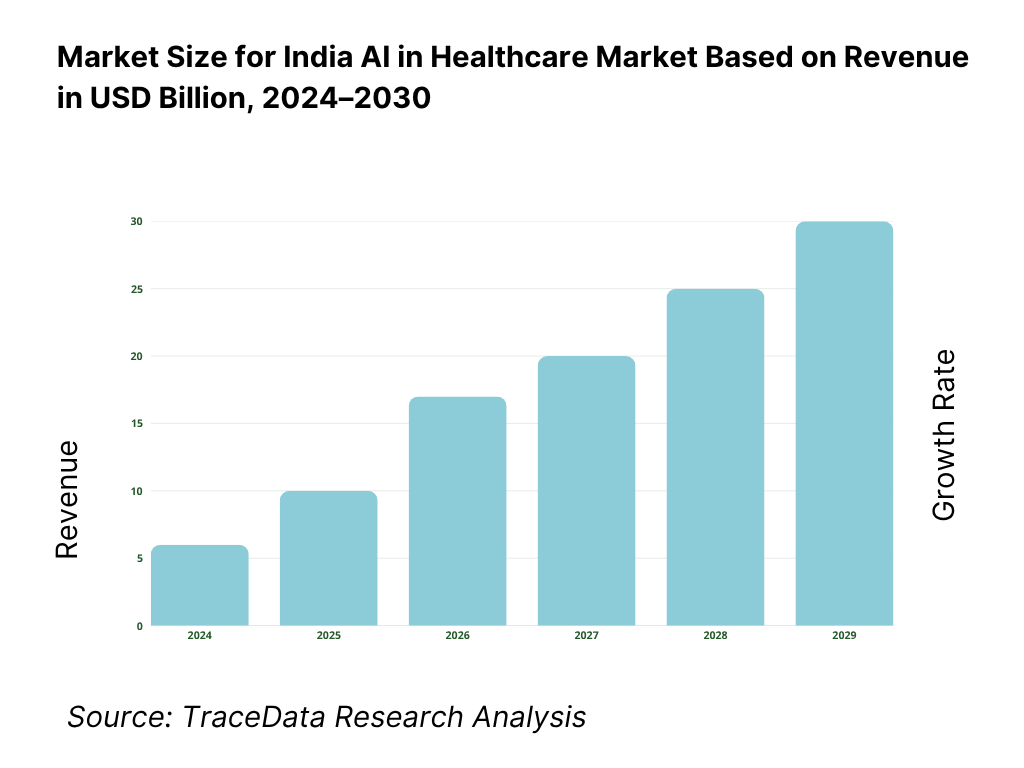

The India AI in Healthcare Market is poised for sustained expansion through 2030, supported by nationwide digital health infrastructure, rising clinical workloads, and expanding public–private partnerships. Growth will be catalyzed by increasing integration of AI into diagnostics, hospital automation, and population health management, as India’s health digitization base deepens through the Ayushman Bharat Digital Mission and the Digital Personal Data Protection Act. The combination of policy, data, and technology capacity provides a solid foundation for the next growth phase.

Rise of Hybrid Clinical-AI Delivery Models: The future of India’s AI healthcare ecosystem will be shaped by hybrid deployment models blending cloud-based AI inference and on-device edge computation. This shift is underpinned by India’s high connectivity—913.34 million wireless broadband users as reported by the Telecom Regulatory Authority of India (TRAI, 2024)—which ensures real-time model updates and rural accessibility. With 169,615 Sub-Centres, 31,882 PHCs, and 6,359 CHCs in operation nationwide according to the Ministry of Health and Family Welfare (MoHFW), hybrid AI deployment allows hospitals to process sensitive data locally while maintaining centralized learning for model improvement, striking a balance between accessibility and data protection.

Focus on Outcome-Based and Evidence-Linked AI Implementations: Hospitals and insurers are increasingly prioritizing AI solutions with measurable clinical and operational outcomes. The National Health Authority (NHA) has facilitated over 6.7 billion Ayushman Bharat Health Account (ABHA) IDs for traceable patient outcomes, while 40 million Outpatient Department (OPD) visits have been digitally linked to ABHA for performance and outcome evaluation. The IMF projects India’s nominal GDP at USD 4.19 trillion, underscoring the fiscal room for health-tech performance-based contracting models. These developments pave the way for pay-for-performance AI adoption, where real-world evidence and measurable patient impact drive purchasing and policy priorities.

Expansion of Sector-Specific AI Solutions Across Clinical Verticals: Sectoral digitization and disease-specific programs will create strong pull factors for AI healthcare adoption in imaging, cardiology, and pathology. India’s 2.55 million tuberculosis notifications in one year and 2.607 million the next demonstrate large diagnostic volumes that demand AI-enabled triage and case management systems, according to the Central TB Division, MoHFW. The diagnostic infrastructure—comprising 714 District Hospitals and 1,340 Sub-Divisional/District Facilities—forms a vast base for radiology and pathology AI implementation. This sectoral spread will enable AI solutions to be specialized for each clinical workflow—radiology, cytology, cardiology, or oncology—improving both accuracy and scalability.

Leveraging AI, Analytics, and Federated Data Learning Frameworks: The next phase of AI healthcare in India will rely on secure data sharing and federated learning to train models without centralizing sensitive data. The Digital Personal Data Protection Act, 2023 (No. 22 of 2023) lays down principles of consent, accountability, and lawful processing for medical datasets. Concurrently, the Computer Emergency Response Team (CERT-In) reported 2,041,360 cybersecurity incidents in the most recent year, emphasizing the need for privacy-first AI models. Combined with 360 million eSanjeevani teleconsultations under MoHFW, this volume of structured and secure data allows continuous model refinement for outcome prediction and resource optimization.

Integration with National Digital Health and Policy Frameworks: The integration of AI systems with public digital infrastructure ensures long-term sustainability and scalability. The Ayushman Bharat Digital Mission has certified 131 model health facilities for complete end-to-end digitization, serving as live environments for AI and interoperability pilots. Moreover, 40 million OPD registrations have already been executed via ABHA QR-code workflows, embedding structured data into clinical systems. These macro-level initiatives, underpinned by India’s USD 4.19 trillion GDP (IMF), will enhance both domestic R&D investment capacity and clinical data quality, establishing India as a key global hub for AI-enabled healthcare transformation.

India AI in Healthcare Market Segmentation

By Clinical Domain

Radiology AI

Pathology & Laboratory AI

Cardiology & Emergency Care AI

Oncology Decision Support

Ophthalmology & Screening AI

By Deployment Model

Cloud SaaS

On-premises

Edge / Hybrid

OEM-Embedded

By Function

Screening & Triage

Diagnostic Decision Support

Prognostic / Risk Prediction

Operational Optimization

Documentation & Coding Automation

By End User

Tertiary Hospital Chains

Diagnostic Imaging Centers

Laboratories & Pathology Networks

Payors & TPAs

Public Health Programs / Government Hospitals

By Region

North India

South India

West India

East India

Central India

Players Mentioned in the Report:

Key Target Audience

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for AI in Healthcare (Cloud SaaS, On-Premises, Edge / Hybrid)

4.2 Revenue Streams in India AI in Healthcare

4.3 Business Model Canvas for India AI in Healthcare

5.1 Freelance / Specialist AI Vendors vs Full-Suite AI Platform Providers

5.2 Investment Models in India AI in Healthcare (bootstrapped vs VC growth vs OEM JV vs public-private partnership)

5.3 Comparative Analysis of the Funneling / Procurement Process in Private vs Government / Public Health Organizations (RFP cycles, pilot-> scale, clinical validation gatekeeping)

5.4 AI / Digital Health Budget Allocation by Hospital / Chain Size, Latest Year

8.1 Revenues, Historical Period (2019-latest)

9.1 By Deployment Model (Cloud, On-Premises, Edge/Hybrid)

9.2 By Clinical Domain (Radiology, Pathology, Cardiology, Ophthalmology, Critical Care, Oncology, etc.)

9.3 By Function (Screening/Triage, Diagnostic Support, Prognostic Prediction, Operational AI, Documentation / Coding)

9.4 By End User / Buyer Type (Tertiary Hospitals, Diagnostic Chains, PHCs / HWCs, Payors / TPAs, Research / Pharma)

9.5 By Company Size / Buyer Scale (Large chains, mid-tier hospitals, single hospitals)

9.6 By Mode of Integration / AI Model Type (plug-in modules, API, embedded in OEM device, full platform)

9.7 By Open vs Customized Solutions

9.8 By Region / State (North, South, East, West, Central)

10.1 Healthcare Client Landscape & Cohort Segmentation

10.2 Decision-Making Process & Buyer Criteria for AI Solutions

10.3 Program Effectiveness, ROI Metrics & Post-Deployment Impact

10.4 Gap Analysis Framework (expectations vs delivered performance)

11.1 Trends & Developments in India AI Healthcare

11.2 Growth Drivers

11.3 SWOT Analysis for India AI in Healthcare

11.4 Issues & Challenges (regulatory uncertainty, data quality, clinician acceptance, liability risk)

11.5 Government Policies & Regulations (ABDM, DPDP, CDSCO SaMD, ethics guidelines, public health AI mandates)

12.1 Market Size & Future Potential of AI-First / Cloud-Native Healthcare Models

12.2 Business Models & Revenue Streams in AI Platforms

12.3 Delivery Models, Solution Types & Use-Cases

15.1 Market Share of Key Players (by revenue, domain coverage, deployment)

15.2 Benchmarking Key Competitors (company overview, USPs, strategy, tech stack, client base, pricing, deployments, funding)

15.3 Operating Model Analysis (centralized AI lab, federated, hybrid, managed services)

15.4 Gartner / Thought Leadership Quadrant for AI in Healthcare

15.5 Strategic Positioning Framework (e.g. Bowman's Clock or similar)

16.1 Projected Revenues over Forecast Period

17.1 By Deployment Model

17.2 By Clinical Domain

17.3 By Function

17.4 By Buyer Type

17.5 By Company / Buyer Scale

17.6 By Mode of Integration / Solution Type

17.7 By Open vs Customized

17.8 By Region

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the India AI in Healthcare Market. Based on this ecosystem, we will shortlist leading 5–6 AI healthcare solution providers in the country based on their product portfolio, deployment maturity, regulatory readiness, and hospital network penetration. Sourcing is conducted through government portals (MoHFW, NHA, MeitY, CDSCO), industry reports, company filings, press releases, and multiple proprietary and secondary databases to perform desk research and collate comprehensive industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables a deep analysis of the AI healthcare market, aggregating insights on adoption levels, number of AI-deployed hospitals, digital infrastructure readiness, regulatory approvals (SaMD), and interoperability maturity. We assess both macro and micro factors—such as hospital density (714 district hospitals, 31,882 PHCs, 6,359 CHCs) and the extent of ABDM enrollment (6.7 billion ABHA IDs)—to determine AI readiness. Further, company-level data is analyzed using verified filings and public disclosures, covering revenues, funding rounds, number of deployments, strategic collaborations, and compliance certifications (ISO 13485, HIPAA, DPDP). The goal is to construct a foundational understanding of the ecosystem and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with CXOs, clinical directors, CIOs, AI engineers, and regulatory experts representing hospitals, AI startups, payors, and device OEMs. This process serves multiple objectives—validating market hypotheses, authenticating hospital adoption metrics, and extracting operational and financial insights from industry leaders. A bottom-to-top approach is followed to evaluate revenue and deployment contributions for each player, aggregated to form the overall market structure. As part of the validation strategy, our team executes disguised interviews with select hospitals and health-tech integrators posing as enterprise clients. This approach helps validate claims on AI integration, model accuracy, compliance readiness, and pricing models (per-study, per-bed, or subscription). These insights are then corroborated with secondary sources such as CDSCO registration data, ABDM model-facility listings, and government partnership announcements to ensure precision and reliability.

Step 4: Sanity Check

A comprehensive bottom-to-top and top-to-bottom analysis is performed to test the consistency of findings and market size modeling exercises. In the bottom-up approach, we aggregate validated data from AI solution providers and hospitals, including active deployments, contract values, and clinical domains. The top-down approach aligns this with macro indicators such as the total hospital count, diagnostic volumes (2.6 million TB notifications), and digitized OPD registrations (40 million via ABHA Scan & Share). Cross-verification ensures the resulting market structure reflects real-world adoption potential and operational capacity. The sanity process also assesses supply–demand alignment, ensuring interoperability maturity, cybersecurity obligations, and compliance timelines under ABDM and DPDP Act (2023) are consistent with ground-level realities.

FAQs

01 What is the potential for the India AI in Healthcare Market?

The India AI in Healthcare Market has immense growth potential, driven by a rapidly digitizing healthcare ecosystem and rising demand for automation across clinical and administrative workflows. The market is valued at USD 758.8 million, supported by initiatives such as the Ayushman Bharat Digital Mission (ABDM), which has generated over 6.7 billion ABHA IDs and connected 131 model facilities nationwide. The integration of AI into diagnostics, claims processing, and hospital operations demonstrates the sector’s strategic importance in improving healthcare delivery and efficiency across India.

02 Who are the Key Players in the India AI in Healthcare Market?

The India AI in Healthcare Market features several prominent players, including Qure.ai, DeepTek, Niramai, Tricog, and SigTuple. These companies dominate through clinically validated AI solutions across radiology, cardiology, and pathology. Other significant contributors include Synapsica, 5C Network, Innovaccer, HealthPlix, and Dozee, known for data-driven EMRs, AI-enabled diagnostics, and real-time patient monitoring. Multinational participants such as GE HealthCare, Philips, and Siemens Healthineers further enhance India’s ecosystem with hardware-integrated AI and large-scale hospital collaborations.

03 What are the Growth Drivers for the India AI in Healthcare Market?

Key growth drivers include strong macroeconomic and healthcare infrastructure indicators. India’s GDP stood at USD 4.19 trillion (IMF, 2024), supporting large-scale healthcare digitization. The government’s ABDM initiative has created over 6.7 billion digital health IDs and enabled 40 million OPD registrations via ABHA, facilitating AI adoption in data-driven diagnostics. Moreover, the Ministry of Health and Family Welfare (MoHFW) reported 360 million eSanjeevani teleconsultations, indicating expanding digital interaction layers for machine learning applications. These macro and digital foundations collectively drive scalable AI integration across healthcare functions.

04 What are the Challenges in the India AI in Healthcare Market?

Despite rapid advancement, the market faces critical challenges in data standardization, infrastructure readiness, and compliance. India’s public healthcare network operates across 169,615 Sub-Centres, 31,882 PHCs, and 6,359 CHCs, reflecting deep structural diversity that complicates uniform AI deployment (MoHFW). Cybersecurity is a major barrier—CERT-In reported 2,041,360 cybersecurity incidents in 2024, necessitating robust data protection protocols under the Digital Personal Data Protection Act, 2023. Additionally, gaps in clinical validation and lack of qualified AI-health specialists continue to slow enterprise-wide adoption.