India Autonomous Vehicle Market Outlook to 2035

By Level of Autonomy, By Vehicle Type, By Technology Stack, By Application, and By Region

- Product Code: TDR0434

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Autonomous Vehicle Market Outlook to 2035 – By Level of Autonomy, By Vehicle Type, By Technology Stack, By Application, and By Region” provides a comprehensive analysis of the autonomous vehicle (AV) ecosystem in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; technology and innovation trends, regulatory and policy landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players active in the Indian autonomous mobility ecosystem. The report concludes with future market projections based on urban mobility evolution, logistics automation, smart infrastructure investments, electric vehicle penetration, regulatory readiness, regional deployment dynamics, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

India Autonomous Vehicle Market Overview and Size

The India autonomous vehicle market is valued at approximately ~USD ~ billion, representing the development, testing, deployment, and commercialization of vehicles equipped with advanced driver assistance systems (ADAS) and autonomous driving capabilities ranging from Level 1 to Level 4 autonomy. The market includes passenger vehicles, commercial vehicles, logistics fleets, public transport systems, and controlled-environment autonomous platforms such as campus shuttles and industrial mobility solutions, supported by a complex technology stack comprising sensors, perception software, artificial intelligence algorithms, connectivity modules, and vehicle control systems.

The market remains at an early commercialization stage, with current value largely driven by ADAS adoption in passenger vehicles, pilot deployments in logistics and industrial environments, and sustained investment in autonomous software development, testing infrastructure, and validation programs. India’s autonomous vehicle ecosystem is shaped by its unique traffic conditions, mixed road usage, infrastructure variability, and cost-sensitive consumer base, which collectively influence the pace and pathway of autonomy adoption.

Growth in the market is anchored by rising vehicle electrification, increasing penetration of connected vehicle technologies, strong government emphasis on road safety and digital mobility, and growing interest from logistics, mobility-as-a-service, and industrial operators seeking productivity gains through automation. While fully autonomous public-road deployment remains limited, controlled and semi-controlled environments are emerging as key early adoption zones.

Regionally, autonomous vehicle activity is concentrated in Southern and Western India, led by technology hubs such as Bengaluru, Chennai, Hyderabad, Pune, and Mumbai, which host automotive OEMs, software development centers, testing facilities, and startup ecosystems. Northern India, particularly the NCR region, plays a critical role in policy formulation, pilot programs, and fleet-based mobility trials. Emerging activity in industrial corridors across Gujarat, Tamil Nadu, and Maharashtra further supports AV testing and deployment in logistics and manufacturing-linked applications.

What Factors are Leading to the Growth of the India Autonomous Vehicle Market

Increasing penetration of ADAS and semi-autonomous features in passenger vehicles strengthens the base for autonomy adoption: India’s passenger vehicle market is witnessing steady integration of advanced driver assistance systems such as adaptive cruise control, lane departure warning, automatic emergency braking, blind-spot detection, and parking assist features, particularly in mid-to-premium vehicle segments. These Level 1 and Level 2 autonomy features serve as foundational building blocks for higher levels of automation by familiarizing consumers, OEMs, and regulators with automated driving functions.

Growth of autonomous logistics, warehouse, and industrial mobility applications accelerates real-world deployment India’s rapidly expanding e-commerce, warehousing, and industrial manufacturing sectors are driving demand for autonomous solutions in controlled and semi-controlled environments. Autonomous mobile robots, self-driving yard trucks, autonomous forklifts, and pilot autonomous delivery vehicles are being deployed within warehouses, ports, factory campuses, and logistics hubs to improve efficiency, reduce labor dependency, and enhance safety.

Smart city initiatives, public transport modernization, and campus mobility projects create structured use cases for autonomous systems: India’s smart city programs and urban mobility initiatives are creating opportunities for autonomous shuttles, last-mile transit solutions, and intelligent transport systems within defined zones such as business parks, airports, educational campuses, and municipal corridors. These deployments emphasize safety, energy efficiency, and integration with digital infrastructure rather than full autonomy on open roads.

Which Industry Challenges Have Impacted the Growth of the India Autonomous Vehicle Market:

Fragmented road infrastructure and mixed traffic conditions limit real-world autonomy performance and scalability: India’s road environment is characterized by heterogeneous infrastructure quality, inconsistent lane markings, variable signage, and high levels of mixed traffic involving two-wheelers, pedestrians, non-motorized transport, animals, and informal driving behaviors. These conditions significantly increase the complexity of perception, prediction, and decision-making algorithms required for autonomous driving. While controlled and semi-controlled environments enable early deployment, scaling autonomous systems to open public roads remains technically demanding and cost-intensive. As a result, many autonomous vehicle initiatives remain confined to pilots, simulations, or restricted zones, slowing mass-market commercialization.

High development, testing, and validation costs constrain commercialization in a price-sensitive market: Autonomous vehicle development requires sustained investment in sensors, compute hardware, software engineering, simulation platforms, real-world testing, safety validation, and regulatory engagement. In India, where vehicle affordability and total cost of ownership are critical purchase drivers, these costs limit OEMs’ and fleet operators’ ability to deploy higher levels of autonomy at scale. The need for extensive localization and validation under Indian conditions further increases development timelines and capital requirements. This economic constraint pushes many players to focus on incremental ADAS adoption or enterprise-focused autonomous applications rather than full consumer-facing autonomy.

Regulatory ambiguity around liability, certification, and deployment slows large-scale adoption: India currently lacks a comprehensive regulatory framework governing autonomous vehicle certification, liability attribution, insurance coverage, and operational permissions for public-road deployment. While pilot programs and controlled trials are permitted under specific conditions, uncertainty around accountability in the event of accidents, system failures, or cybersecurity breaches discourages aggressive commercialization. OEMs, technology providers, and fleet operators often adopt a cautious approach, prioritizing technology readiness over market launch until clearer regulatory guidance emerges. This regulatory conservatism, while safety-oriented, delays broader ecosystem confidence and investment momentum.

What are the Regulations and Initiatives which have Governed the Market:

Road safety regulations and vehicle homologation standards influencing ADAS and autonomy deployment: India’s vehicle regulatory framework emphasizes road safety, driver responsibility, and compliance with automotive homologation standards administered by central and state authorities. Current regulations primarily support the deployment of advanced driver assistance systems rather than fully autonomous driving on public roads. Requirements related to braking systems, electronic stability control, collision warning systems, and driver alert mechanisms shape how autonomy-related features are introduced and validated. Autonomous functions are typically positioned as driver-assist technologies, with clear mandates for human override and supervision.

Smart mobility, electric vehicle, and digital infrastructure initiatives enabling controlled autonomous applications: Government-led initiatives promoting electric mobility, smart cities, and intelligent transport systems indirectly support autonomous vehicle development by improving digital infrastructure, connectivity, and data availability. Investments in smart traffic management systems, sensor-enabled intersections, and connected transport corridors create environments conducive to testing and deploying autonomous shuttles, buses, and logistics vehicles in defined zones. These initiatives encourage pilot-based adoption while allowing policymakers to evaluate safety, public acceptance, and operational feasibility before broader rollout.

Testing permissions, pilot frameworks, and institutional collaborations guiding early-stage deployments: Autonomous vehicle activity in India is largely governed through case-specific testing approvals, institutional partnerships, and pilot frameworks involving government agencies, research institutions, and private-sector players. These mechanisms define operating boundaries such as geofencing, speed limits, supervision requirements, and data reporting obligations. While not yet standardized into a nationwide autonomous vehicle code, these frameworks provide a controlled pathway for technology validation and ecosystem learning. Over time, insights from these pilots are expected to inform more formalized regulations covering deployment, certification, and commercialization.

India Autonomous Vehicle Market Segmentation

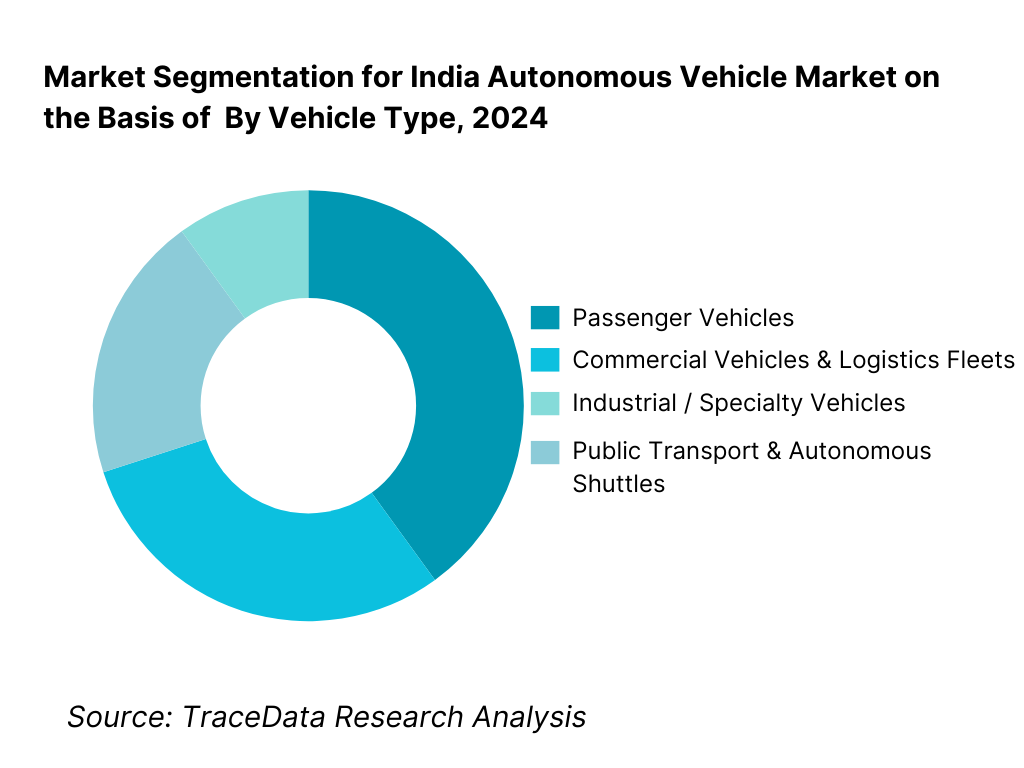

By Vehicle Type: Passenger vehicles dominate the India autonomous vehicle market due to rising ADAS integration in mid-to-premium cars and SUVs. OEMs increasingly position safety and convenience features as differentiators, driving steady adoption across urban consumer segments. Commercial vehicles and logistics fleets represent a fast-growing segment, particularly for autonomous applications in warehouses, ports, mining, and closed logistics parks. Public transport and specialty vehicles such as autonomous shuttles and industrial mobility platforms remain niche but strategically important for pilot deployments and policy-led initiatives.

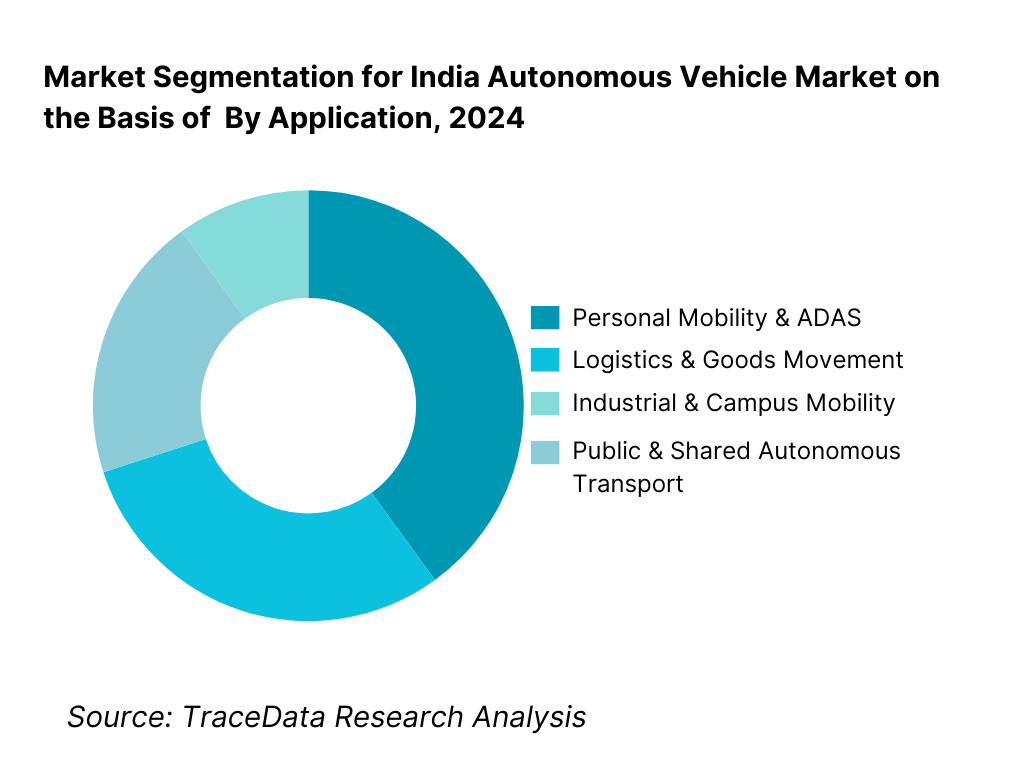

By Application: Personal mobility and assisted driving applications account for the largest share of the market, driven by consumer-facing ADAS adoption. Logistics and goods movement is emerging as a critical growth area, where autonomous solutions deliver measurable efficiency, safety, and labor optimization benefits. Campus mobility, industrial transport, and last-mile delivery pilots are expanding gradually, supported by geofenced deployment models and institutional partnerships.

Competitive Landscape in India Autonomous Vehicle Market

The India autonomous vehicle market exhibits low-to-moderate concentration, characterized by a mix of automotive OEMs, global technology providers, domestic software startups, Tier-1 component suppliers, and system integrators. Market leadership is driven by software capabilities, sensor integration expertise, validation under Indian driving conditions, partnerships with OEMs and fleet operators, and alignment with regulatory and pilot frameworks. While global players bring mature technology stacks and capital strength, domestic firms compete through localization, cost optimization, and adaptation to complex Indian traffic environments. Collaboration rather than pure competition defines much of the ecosystem, with joint development programs, pilot deployments, and co-innovation models being common.

Key Companies Active in the India Autonomous Vehicle Ecosystem

Name | Founding Year | Original Headquarters |

Tata Motors (ADAS & Autonomous Programs) | 1945 | Mumbai, India |

Mahindra & Mahindra (Autonomous & EV Platforms) | 1945 | Mumbai, India |

Bosch India (ADAS & Mobility Solutions) | 1951 | Bengaluru, India |

Continental Automotive India | 2008 | Bengaluru, India |

NVIDIA (Automotive AI & AV Compute) | 1993 | Santa Clara, USA |

Qualcomm (Automotive & Connected Systems) | 1985 | San Diego, USA |

KPIT Technologies (Autonomous Software) | 1990 | Pune, India |

Minus Zero Robotics | 2020 | Bengaluru, India |

Swaayatt Robots | 2015 | Bhopal, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Tata Motors: Tata Motors continues to focus on progressive ADAS integration across its passenger and commercial vehicle portfolio, leveraging in-house engineering, group-level technology partnerships, and India-specific validation. The company’s approach emphasizes safety-led autonomy, cost efficiency, and gradual scaling aligned with regulatory readiness.

Mahindra & Mahindra: Mahindra remains active in autonomous and semi-autonomous mobility through a combination of ADAS deployment, electric vehicle platforms, and research-driven pilot programs. Its positioning is particularly strong in SUVs, commercial vehicles, and mobility services, where autonomous capabilities are tested in structured operating environments.

Bosch India: Bosch plays a critical role as a technology enabler, supplying sensors, control units, software platforms, and system integration capabilities for ADAS and autonomous applications. Its competitive advantage lies in deep OEM relationships, local engineering capacity, and the ability to adapt global technologies to Indian use cases.

KPIT Technologies: KPIT has emerged as a key software partner for autonomous and connected vehicle development, with strengths in perception algorithms, middleware, simulation, and validation. The company benefits from long-standing relationships with global and Indian OEMs and a strong focus on software-defined mobility.

Indian Autonomous Startups (Minus Zero, Swaayatt): Domestic startups are differentiating themselves through AI-first, vision-based autonomy approaches designed specifically for unstructured and mixed-traffic environments. Their competitiveness is rooted in software innovation, lower hardware dependency, and the ability to operate under Indian road conditions where traditional rule-based autonomy struggles.

What Lies Ahead for India Autonomous Vehicle Market?

The India autonomous vehicle market is expected to expand steadily through 2035, supported by gradual ADAS penetration, growth in autonomous logistics and industrial mobility applications, and increasing alignment between digital infrastructure, electric vehicle adoption, and smart mobility initiatives. While large-scale deployment of fully autonomous passenger vehicles on public roads is likely to remain limited in the near-to-medium term, the market will continue to evolve through incremental autonomy, application-specific deployments, and controlled-environment use cases. As OEMs, fleet operators, and public agencies increasingly prioritize safety, efficiency, and data-driven mobility solutions, autonomous technologies will become an integral layer within India’s broader transportation ecosystem rather than a standalone disruption.

Transition Toward Application-Specific and Controlled-Environment Autonomous Deployments: The future trajectory of the Indian autonomous vehicle market will be defined less by universal self-driving cars and more by purpose-specific autonomy tailored to operating environments. Logistics hubs, warehouses, ports, mining sites, industrial campuses, airports, and large institutional facilities will remain the primary adoption centers for higher levels of autonomy. These environments allow predictable routes, geofencing, and centralized supervision, significantly reducing technical and regulatory complexity. Suppliers and integrators that design autonomous systems around specific operational needs—such as material handling, yard management, or last-mile delivery within defined zones—will capture early and recurring demand.

Gradual Progression from ADAS to Higher Autonomy in Passenger Vehicles: Passenger vehicle autonomy in India will continue to follow an evolutionary rather than disruptive path. Level 1 and Level 2 systems will expand from premium segments into upper-mid and select mass-market vehicles as costs decline and safety awareness increases. Over time, conditional automation features such as traffic jam assist, highway pilot functions, and advanced parking automation may gain traction in well-mapped urban corridors and expressways. However, widespread Level 4 adoption in personal vehicles will depend on long-term improvements in infrastructure consistency, regulatory clarity, and consumer trust.

Increasing Role of Software-Defined Vehicles and AI-Led Autonomy Architectures: Autonomous vehicle development in India will increasingly shift toward software-defined architectures, where perception, decision-making, and control capabilities are upgraded through software rather than hardware-heavy redesigns. AI-driven perception models trained on Indian traffic scenarios, simulation-based validation, and cloud-connected fleet learning will become critical competitive differentiators. Companies that prioritize scalable software platforms, hardware-agnostic designs, and continuous learning systems will be better positioned to adapt autonomy solutions across vehicle types and applications.

India Autonomous Vehicle Market Segmentation

By Level of Autonomy

- Level 1 – Driver Assistance

- Level 2 – Partial Automation

- Level 3 – Conditional Automation

- Level 4 – High Automation (Controlled / Geofenced Environments)

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses)

- Logistics & Delivery Vehicles

- Public Transport & Autonomous Shuttles

- Industrial & Specialty Vehicles (Ports, Mining, Campuses)

By Technology Stack

- Sensor Systems (Camera, Radar, LiDAR, Ultrasonic)

- Perception & Computer Vision Software

- AI / Machine Learning & Decision-Making Algorithms

- Connectivity & V2X Systems

- Vehicle Control Units & Drive-by-Wire Systems

By Application

- Personal Mobility & ADAS

- Logistics & Goods Movement

- Industrial & Warehouse Automation

- Campus & Closed-Environment Mobility

- Public & Shared Autonomous Transport

By Deployment Environment

- Controlled / Geofenced Environments

- Semi-Controlled Industrial & Logistics Zones

- Urban Roads (Pilot & Assisted Driving)

- Highways & Expressways

By Region

- North India

- West India

- South India

- East & North-East India

Players Mentioned in the Report:

- Tata Motors

- Mahindra & Mahindra

- Bosch India

- Continental Automotive India

- NVIDIA (Automotive AI & AV Compute)

- Qualcomm (Automotive & Connected Systems)

- KPIT Technologies

- Minus Zero Robotics

- Swaayatt Robots

- Other autonomous mobility startups, Tier-1 suppliers, and system integrators operating in India

Key Target Audience

- Automotive OEMs and EV manufacturers

- ADAS and autonomous technology providers

- Logistics, warehousing, and fleet operators

- Mobility-as-a-Service (MaaS) providers

- Public transport authorities and smart city agencies

- Industrial and campus infrastructure developers

- Technology investors and venture capital firms

- Policy makers, regulators, and research institutions

Time Period:

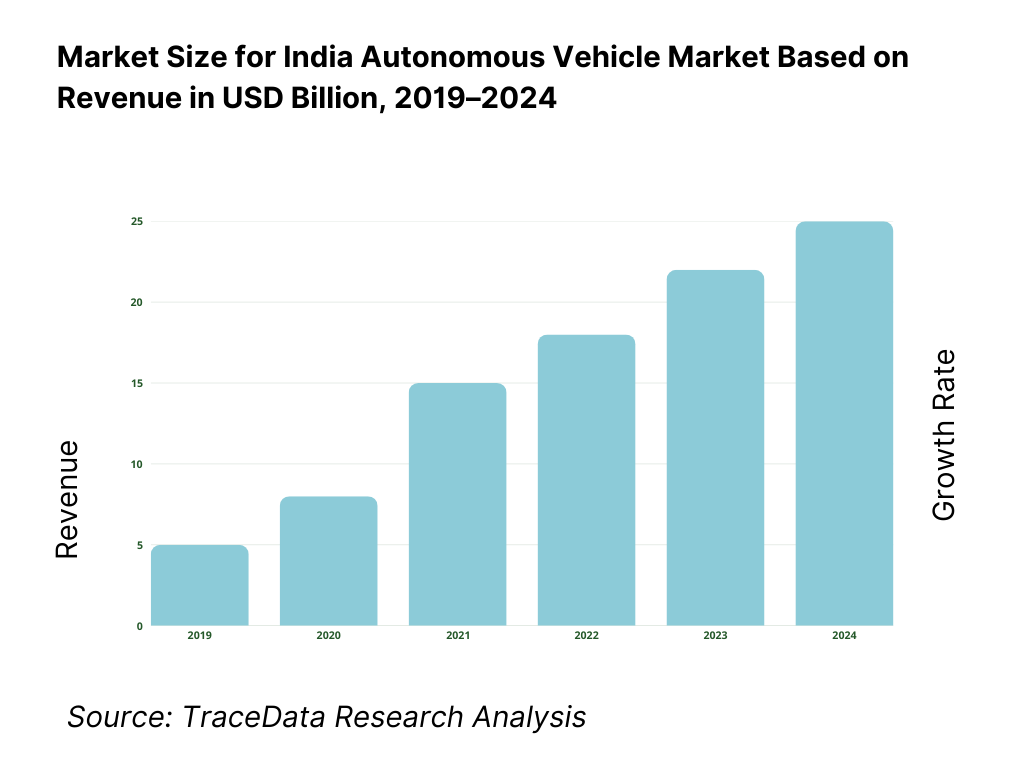

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in India Autonomous Vehicle Market

Value Chain Analysis

4.1 Delivery Model Analysis for Autonomous Vehicle Solutions-In-House Development, OEM-Led, Technology Partnership, System Integrator-Led [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for India Autonomous Vehicle Market [Vehicle Sales with ADAS, Software Licensing, Autonomous Fleet Services, Testing & Validation Services, Data & Analytics]

4.3 Business Model Canvas for India Autonomous Vehicle Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Vendors [Tata Motors / Mahindra vs NVIDIA / Bosch / Qualcomm etc.]

5.2 Investment Model in India Autonomous Vehicle Market [Government Grants, VC Funding, PE Investments, Corporate Venturing]

5.3 Comparative Analysis of Autonomous Vehicle Adoption in Public vs Private Organizations [Procurement Models, Use Cases, ROI Benchmarks]

5.4 Autonomous Vehicle Budget Allocation by Enterprise Size [Large Enterprises, SMEs, Startups]Market Attractiveness for India Autonomous Vehicle Market

Supply-Demand Gap Analysis

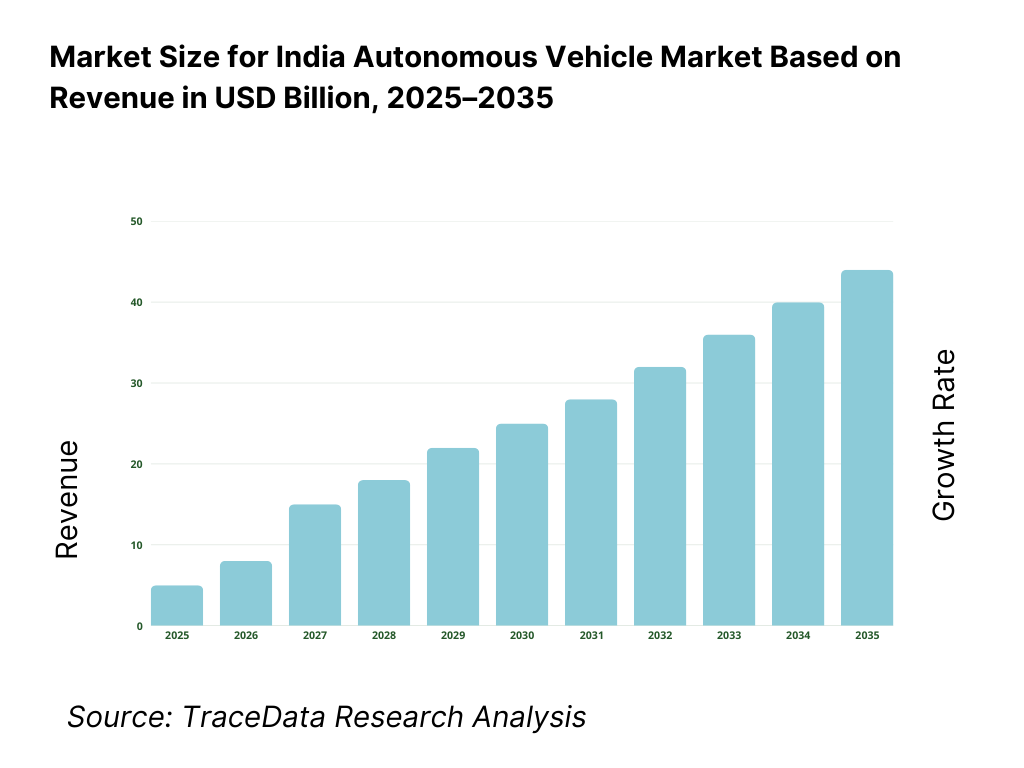

Market Size for India Autonomous Vehicle Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for India Autonomous Vehicle Market Basis

9.1 By Market Structure (In-House Autonomous Development vs Outsourced Technology & Platforms)

9.2 By Technology (ADAS, Computer Vision, Sensor Fusion, AI/ML Algorithms, Generative AI)

9.3 By Vehicle/Application Verticals (Passenger Vehicles, Commercial Vehicles, Logistics, Public Transport, Industrial Mobility)

9.4 By Enterprise Size (Large Enterprises, Medium Enterprises, SMEs)

9.5 By Use Case/Function (Driver Assistance, Autonomous Navigation, Fleet Optimization, Safety & Collision Avoidance, Last-Mile Delivery)

9.6 By Deployment Mode (On-Vehicle Edge, Cloud-Connected Systems, Hybrid Models)

9.7 By Open vs Customized Autonomous Solutions

9.8 By Region (North India, South India, West India, East & North-East India)Demand-Side Analysis for India Autonomous Vehicle Market

10.1 Corporate, Fleet Operator & Institutional Client Landscape and Cohort Analysis

10.2 Autonomous Vehicle Adoption Drivers & Decision-Making Process

10.3 Autonomous System Effectiveness & ROI Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in India Autonomous Vehicle Market

11.2 Growth Drivers for India Autonomous Vehicle Market

11.3 SWOT Analysis for India Autonomous Vehicle Market

11.4 Issues & Challenges for India Autonomous Vehicle Market

11.5 Government Regulations for India Autonomous Vehicle MarketSnapshot on Connected & Software-Defined Autonomous Vehicle Market in India

12.1 Market Size and Future Potential for Software-Defined & Connected Autonomous Vehicles in India

12.2 Business Models & Revenue Streams [Software-as-a-Service, Licensing, Subscription, Usage-Based Pricing]

12.3 Delivery Models & Autonomous Applications Offered [ADAS Platforms, Autonomous Driving Stacks, Fleet Management Systems]Opportunity Matrix for India Autonomous Vehicle Market

PEAK Matrix Analysis for India Autonomous Vehicle Market

Competitor Analysis for India Autonomous Vehicle Market

15.1 Market Share of Key Players in India Autonomous Vehicle Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Engineers, Revenues, Pricing Models, Technology Used, Key Autonomous Solutions, Major Clients, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant for Autonomous Vehicle Technology Providers

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for India Autonomous Vehicle Market Basis

16.1 Revenues (Projections)

Market Breakdown for India Autonomous Vehicle Market Basis

17.1 By Market Structure (In-House and Outsourced Autonomous Solutions)

17.2 By Technology (ADAS, Computer Vision, Sensor Fusion, AI/ML, Generative AI)

17.3 By Vehicle/Application Verticals (Passenger Vehicles, Commercial Vehicles, Logistics, Public Transport, Industrial Mobility)

17.4 By Enterprise Size (Large Enterprises, Medium-Sized Enterprises, SMEs)

17.5 By Use Case/Function (Driver Assistance, Autonomous Navigation, Safety Systems, Fleet Optimization, Last-Mile Delivery)

17.6 By Deployment Mode (Edge, Cloud, Hybrid)

17.7 By Open vs Customized Autonomous Programs

17.8 By Region (North, South, West, East & North-East India)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Autonomous Vehicle Market across demand-side and supply-side entities. On the demand side, entities include passenger vehicle OEMs, commercial vehicle manufacturers, logistics and fleet operators, public transport authorities, smart city agencies, industrial operators (ports, mining, manufacturing campuses), and mobility-as-a-service providers. Demand is further segmented by application type (personal mobility, logistics, industrial automation, public transport), level of autonomy (ADAS to high automation), operating environment (public roads, highways, controlled and geofenced zones), and procurement model (OEM-integrated systems, technology partnerships, pilot-based deployments, fleet-led adoption). On the supply side, the ecosystem includes automotive OEMs, Tier-1 component suppliers, sensor manufacturers, autonomous software developers, AI and perception technology providers, connectivity and V2X solution vendors, system integrators, testing and validation service providers, mapping and simulation companies, and regulatory and certification bodies. From this mapped ecosystem, we shortlist 6–10 leading OEMs, technology providers, and autonomous solution developers based on deployment maturity, technology depth, partnerships, and relevance to Indian operating conditions. This step establishes how value is created and captured across system design, software development, vehicle integration, testing, deployment, and lifecycle support.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the India autonomous vehicle market structure, adoption drivers, and segment behavior. This includes reviewing trends in ADAS penetration, electric vehicle adoption, connected vehicle infrastructure, logistics automation, and smart mobility initiatives. We assess buyer preferences around safety enhancement, cost efficiency, scalability, regulatory compliance, and return on investment. Company-level analysis includes review of OEM autonomy roadmaps, technology supplier offerings, software architectures, pilot programs, and partnerships. We also examine regulatory developments related to road safety, vehicle homologation, testing permissions, and data governance, along with infrastructure readiness across regions. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and future outlook modeling.

Step 3: Primary Research

We conduct structured interviews with automotive OEMs, Tier-1 suppliers, autonomous technology providers, fleet operators, logistics companies, public transport authorities, and industry experts. The objectives are threefold: (a) validate assumptions around adoption timelines, application prioritization, and deployment environments, (b) authenticate segment splits by vehicle type, application, and autonomy level, and (c) gather qualitative insights on cost structures, technology readiness, validation challenges, regulatory bottlenecks, and customer expectations. A bottom-to-top approach is applied by estimating vehicle volumes, software penetration rates, and average system value across key segments and regions, which are aggregated to develop the overall market view. In select cases, pilot program reviews and operator-level discussions are used to validate real-world performance, operational constraints, and scalability considerations.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market size estimates, segmentation splits, and forecast assumptions. Demand projections are reconciled with macro indicators such as vehicle production trends, logistics growth, urban mobility investment, and digital infrastructure expansion. Assumptions related to technology cost decline, regulatory progression, infrastructure readiness, and safety validation timelines are stress-tested to understand their impact on adoption rates. Sensitivity analysis is conducted across key variables including ADAS penetration growth, fleet automation uptake, public-sector deployment pace, and regulatory clarity. Market models are refined until alignment is achieved between technology supply capability, deployment feasibility, and buyer demand pipelines, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the India Autonomous Vehicle Market?

The India Autonomous Vehicle Market holds long-term potential, supported by rising ADAS adoption, growth in autonomous logistics and industrial mobility applications, and increasing alignment between electric mobility, digital infrastructure, and smart transport initiatives. While fully autonomous passenger vehicles on public roads will evolve gradually, application-specific and controlled-environment deployments are expected to scale steadily. Autonomous technologies will increasingly function as an embedded layer within India’s broader mobility ecosystem through 2035.

02 Who are the Key Players in the India Autonomous Vehicle Market?

The market features a combination of domestic automotive OEMs, global and local technology providers, Tier-1 suppliers, and autonomous software startups. Competition is shaped by software capability, localization for Indian traffic conditions, system integration expertise, and partnerships with OEMs and fleet operators. Collaboration across the ecosystem plays a critical role in advancing pilots and early commercial deployments.

03 What are the Growth Drivers for the India Autonomous Vehicle Market?

Key growth drivers include increasing focus on road safety, gradual expansion of ADAS features in passenger and commercial vehicles, automation demand in logistics and industrial environments, and smart city–linked mobility initiatives. Additional momentum comes from electric vehicle adoption, software-defined vehicle architectures, and the need for efficiency and labor optimization in fleet operations.

04 What are the Challenges in the India Autonomous Vehicle Market?

Challenges include heterogeneous road infrastructure, mixed traffic conditions, high development and validation costs, regulatory ambiguity around liability and certification, and price sensitivity among end users. Scalability beyond pilots remains constrained by infrastructure readiness and policy clarity, requiring a phased and application-led approach to market development.