India Dialysis Market Outlook to 2035

By Dialysis Type, By Modality, By Provider Type, By Care Setting, and By Region

- Product Code: TDR0462

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Dialysis Market Outlook to 2035 – By Dialysis Type, By Modality, By Provider Type, By Care Setting, and By Region” provides a comprehensive analysis of the dialysis industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and reimbursement landscape, patient- and provider-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the India dialysis market. The report concludes with future market projections based on the rising chronic kidney disease (CKD) burden, expansion of public and private dialysis infrastructure, government-backed dialysis programs, technological adoption across hemodialysis and peritoneal dialysis, regional healthcare capacity disparities, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

India Dialysis Market Overview and Size

The India dialysis market is valued at approximately ~USD ~ billion, representing the provision of renal replacement therapy services and related consumables to patients suffering from chronic kidney disease and end-stage renal disease (ESRD). The market encompasses in-center hemodialysis, hospital-based dialysis units, standalone dialysis chains, public–private partnership (PPP) centers, limited home hemodialysis offerings, and peritoneal dialysis therapies, along with associated equipment, dialyzers, disposables, water treatment systems, and clinical support services.

The market is anchored by India’s rapidly growing CKD and ESRD patient base, driven by the rising prevalence of diabetes, hypertension, cardiovascular diseases, and aging population segments. Structural demand is further reinforced by improved disease awareness, higher diagnosis rates, and increasing penetration of dialysis services beyond Tier-1 cities into Tier-2 and Tier-3 regions. Dialysis remains a life-sustaining, recurring therapy for a large patient pool, making service continuity, geographic accessibility, and affordability critical determinants of market growth.

Southern and Western India represent the largest dialysis demand centers in the country. Southern states lead due to higher healthcare penetration, stronger private hospital networks, early adoption of organized dialysis chains, and relatively better patient awareness and referral pathways. Western India shows strong demand supported by urban concentration, higher insurance coverage, and a dense network of private providers. Northern India represents a mix of high-volume public-sector dialysis load and growing private participation, while Eastern and North-Eastern regions remain underpenetrated, with demand constrained by limited infrastructure, workforce shortages, and access barriers—creating long-term expansion opportunities for both government-backed and private dialysis operators.

What Factors are Leading to the Growth of the India Dialysis Market:

Rising burden of chronic kidney disease and lifestyle-related disorders strengthens long-term dialysis demand: India continues to witness a steady increase in chronic kidney disease incidence, largely linked to the growing prevalence of diabetes, hypertension, obesity, and cardiovascular conditions. Late diagnosis remains common, resulting in a large proportion of patients progressing to ESRD and requiring long-term dialysis support. Dialysis is a non-discretionary, recurring therapy, typically requiring multiple sessions per week over extended periods, which structurally expands treatment volumes and sustains demand for dialysis centers, consumables, and trained clinical personnel. This epidemiological shift forms the foundational demand driver for the India dialysis market.

Expansion of public dialysis programs and PPP models accelerates access and capacity creation: Government initiatives, including state-level dialysis schemes and national programs aimed at providing free or subsidized dialysis in public hospitals, have significantly expanded treatment access for economically vulnerable populations. Public–private partnership (PPP) models enable private dialysis operators to set up and manage units within government hospitals, combining public infrastructure with private operational efficiency. These programs increase patient throughput, improve geographic coverage—especially in district hospitals—and create a stable volume base for organized dialysis providers, directly contributing to market expansion.

Growth of organized private dialysis chains and hospital networks improves service standardization: India has seen the rapid growth of organized dialysis service providers and large hospital chains that emphasize standardized clinical protocols, better infection control, predictable pricing, and scalable center rollouts. These players benefit from centralized procurement of consumables, trained technician pools, and hub-and-spoke expansion strategies. As patients and referring physicians increasingly prefer reliable, professionally managed dialysis centers, organized providers continue to gain share from unorganized and hospital-dependent setups, driving overall market formalization and growth.

Which Industry Challenges Have Impacted the Growth of the India Dialysis Market:

High out-of-pocket expenditure and affordability gaps limit consistent treatment adherence: Despite the life-sustaining nature of dialysis, a significant proportion of Indian patients face financial stress due to recurring treatment costs, including session charges, medicines, diagnostics, and transportation. While government schemes and insurance coverage have improved access, reimbursement rates often do not fully cover operational costs, leading to variability in service quality across centers. For patients outside government-supported programs, out-of-pocket expenses remain high, resulting in delayed treatment initiation, skipped sessions, or early dropouts—directly impacting treatment outcomes and long-term market utilization.

Shortage of trained nephrologists, dialysis technicians, and nursing staff constrains capacity utilization: The dialysis ecosystem in India is heavily dependent on skilled human resources, including nephrologists, trained dialysis technicians, and specialized nursing staff. However, workforce availability remains uneven across regions, with acute shortages in Tier-2, Tier-3, and rural areas. Limited training infrastructure, high attrition, and uneven distribution of specialists restrict the ability of providers to scale centers efficiently. Even where physical infrastructure is available, staffing gaps often cap operating hours and patient throughput, reducing effective capacity utilization and slowing market expansion.

Infrastructure variability and quality consistency challenges across public and PPP dialysis centers: While public-sector and PPP-led dialysis expansion has significantly improved geographic access, variations in infrastructure quality, water treatment systems, power backup reliability, and infection control protocols continue to affect service consistency. Older government hospitals and district facilities may face space constraints, equipment downtime, or maintenance delays, impacting patient experience and clinical outcomes. These operational inconsistencies can reduce patient trust and increase dependence on private centers, while also creating reputational and execution risks for operators managing multi-state PPP portfolios.

Low adoption of home-based dialysis modalities limits flexibility and decentralization: Peritoneal dialysis and home hemodialysis offer potential advantages in terms of patient convenience, reduced hospital load, and long-term cost optimization. However, adoption remains limited in India due to low awareness, patient education challenges, cultural preferences for in-center care, and concerns around home hygiene, training, and follow-up. Additionally, reimbursement structures and clinician familiarity tend to favor in-center hemodialysis, slowing diversification of care models and limiting innovation-led growth within the dialysis ecosystem.

What are the Regulations and Initiatives which have Governed the Market:

National dialysis programs and state-level schemes shaping access, pricing, and volume growth: Government-led initiatives aimed at providing free or subsidized dialysis services through public hospitals and district-level centers play a central role in shaping the dialysis market. These programs define reimbursement rates, patient eligibility, treatment frequency norms, and reporting requirements, directly influencing provider economics and operational models. While such schemes have expanded access and increased patient volumes, tight pricing structures require providers to optimize costs, standardize processes, and operate at scale to maintain sustainability.

Clinical standards, infection control guidelines, and quality protocols governing dialysis operations: Dialysis centers in India must adhere to established clinical guidelines related to water quality standards, dialyzer reuse protocols, infection control practices, waste management, and patient safety. Compliance with these standards affects equipment selection, facility design, staff training, and ongoing monitoring costs. As regulatory scrutiny increases and patient awareness improves, adherence to quality benchmarks becomes a key differentiator for organized providers, while non-compliance can lead to operational disruptions or reputational risk.

Medical device regulations and import dependency influencing equipment and consumables availability: Dialysis machines, dialyzers, tubing sets, and water treatment components are governed by medical device regulations and quality certification requirements. India remains partially dependent on imported equipment and consumables, exposing providers to currency fluctuations, import duties, and supply chain disruptions. Recent policy emphasis on domestic manufacturing and localization under broader healthcare self-reliance initiatives may gradually alter sourcing patterns, but in the near term, regulatory approvals and import dynamics continue to shape cost structures and procurement decisions.

India Dialysis Market Segmentation

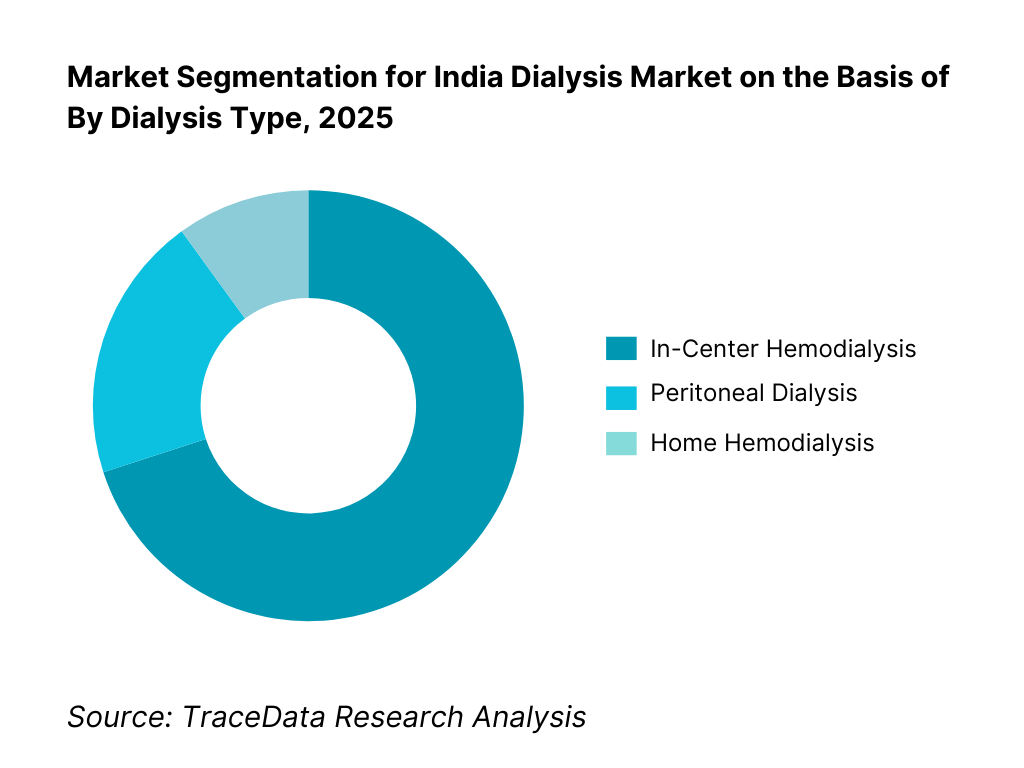

By Dialysis Type: In-center hemodialysis holds dominance. This is because in-center hemodialysis remains the most clinically established and widely prescribed renal replacement therapy in India, particularly for patients with end-stage renal disease requiring supervised care. Hemodialysis centers benefit from centralized infrastructure, trained clinical staff, reliable water treatment systems, and standardized infection control protocols, which are critical in a high-volume, resource-constrained healthcare environment. While peritoneal dialysis and home-based therapies are gradually expanding, especially for selected patient groups, in-center hemodialysis continues to dominate due to physician preference, patient familiarity, and reimbursement alignment under public and private healthcare schemes.

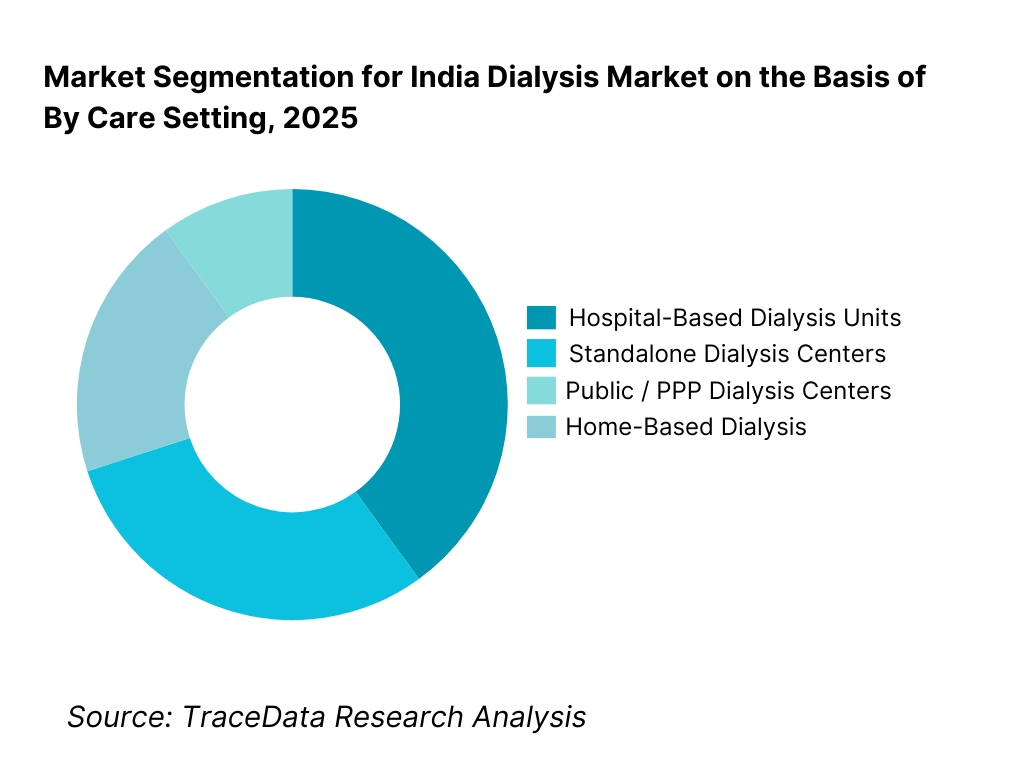

By Care Setting: Hospital-based and standalone dialysis centers dominate the market. Hospitals and organized standalone dialysis centers account for the majority of dialysis volumes due to their ability to manage high patient throughput, handle complications, and integrate nephrology consultation, diagnostics, and emergency care. Standalone dialysis chains have expanded rapidly by focusing on standardized care delivery, predictable pricing, and geographic accessibility, particularly in urban and semi-urban locations. Home-based care settings remain limited due to low awareness, training complexity, and monitoring challenges, although they present long-term decentralization potential.

Competitive Landscape in India Dialysis Market

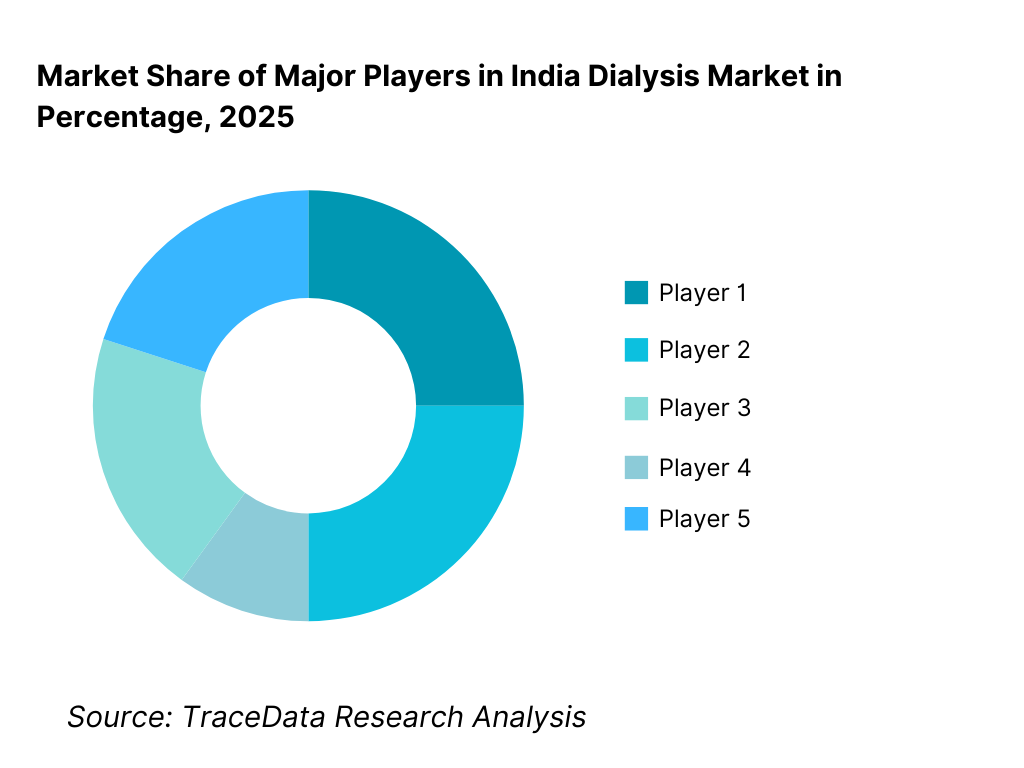

The India dialysis market exhibits moderate concentration, characterized by the presence of a few large organized dialysis chains alongside private hospital networks and government-supported PPP operators. Competitive positioning is driven by scale of operations, geographic footprint, clinical quality, cost efficiency, government scheme participation, and ability to operate profitably at low reimbursement rates. While large players dominate multi-city expansion and PPP contracts, regional operators and hospital-attached units remain relevant in localized markets due to physician relationships and patient trust.

Name | Founding Year | Original Headquarters |

NephroPlus | 2010 | Hyderabad, India |

Fresenius Medical Care India | 1996 | Bad Homburg, Germany |

DaVita Care India | 2015 | Denver, Colorado, USA |

B. Braun Avitum India | 1998 | Melsungen, Germany |

Apex Kidney Care | 2010 | Chennai, India |

Medica Dialysis | 2017 | Kolkata, India |

Ujala Cygnus / PPP Dialysis Platforms | 2016 | New Delhi, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

NephroPlus: NephroPlus has emerged as the largest organized dialysis network in India, with a strong presence across private hospitals, standalone centers, and government PPP facilities. Its competitive strength lies in standardized clinical protocols, strong technician training programs, and the ability to operate high-volume centers under cost-sensitive reimbursement frameworks. The company continues to expand aggressively in Tier-2 and Tier-3 cities.

Fresenius Medical Care India: As part of a global dialysis leader, Fresenius combines equipment manufacturing, consumables supply, and dialysis service delivery. Its positioning in India is reinforced by strong clinical credibility, integrated supply chain capabilities, and long-standing relationships with hospitals. The company remains particularly strong in hospital-based dialysis units and higher-acuity patient segments.

DaVita Care India: DaVita focuses on clinical quality, patient-centric care models, and physician alignment. Its India operations emphasize premium-quality dialysis services, robust training systems, and partnerships with private hospitals. While its footprint is smaller than local leaders, DaVita competes strongly in metro and Tier-1 city markets where quality differentiation is valued.

B. Braun Avitum India: B. Braun leverages its global expertise in dialysis technology and consumables to support its service operations in India. The company’s competitive edge lies in process discipline, equipment reliability, and infection control standards. Its presence is more selective, focusing on high-quality hospital partnerships and institutional clients.

Apex Kidney Care: Apex Kidney Care has built a strong regional presence, particularly in South India, by focusing on physician-led growth, affordable pricing, and deep hospital integration. The company benefits from strong nephrologist relationships and localized execution, enabling steady expansion in mid-sized cities.

What Lies Ahead for India Dialysis Market?

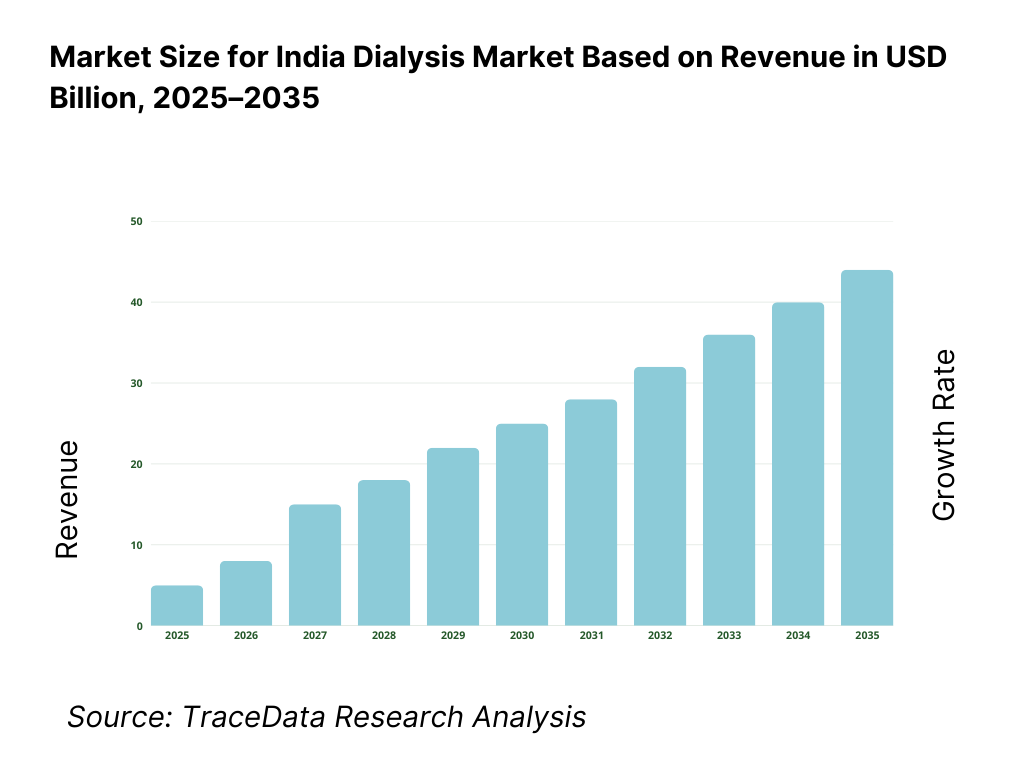

The India dialysis market is expected to expand steadily through 2035, supported by the rising burden of chronic kidney disease, increasing life expectancy, and the continued expansion of dialysis infrastructure across public and private healthcare systems. Growth momentum is further reinforced by government-backed dialysis schemes, public–private partnership (PPP) models, and the gradual formalization of dialysis service delivery through organized providers. As dialysis remains a non-discretionary, recurring therapy for end-stage renal disease patients, demand visibility remains structurally strong, positioning dialysis as a critical component of India’s long-term healthcare services landscape.

Transition Toward Organized, Scalable, and Standardized Dialysis Delivery Models: The future of the India dialysis market will see a continued shift away from fragmented, hospital-dependent units toward organized dialysis chains and standardized PPP platforms. Providers are increasingly focusing on replicable center designs, centralized procurement, uniform clinical protocols, and technician-led operating models to manage high patient volumes at controlled costs. This transition is particularly important in Tier-2 and Tier-3 cities, where scale, operational discipline, and cost efficiency determine the viability of dialysis services under capped reimbursement structures.

Expansion of Public Dialysis Infrastructure and District-Level Access: Government initiatives aimed at expanding dialysis access at district hospitals and secondary-care facilities will remain a key growth driver through 2035. PPP models allow private operators to deploy dialysis capacity rapidly within public hospitals, improving geographic coverage and reducing patient travel burden. While pricing remains tightly regulated, the volume stability and long-term contracts associated with public programs create predictable demand pipelines for providers capable of operating at scale and maintaining quality under cost constraints.

Gradual Diversification Toward Home-Based and Peritoneal Dialysis Modalities: Although in-center hemodialysis will continue to dominate, the long-term outlook includes gradual adoption of peritoneal dialysis and select home hemodialysis models. Rising patient awareness, physician education, and policy-level encouragement for home-based therapies may improve uptake, particularly for stable patients seeking flexibility and reduced hospital dependence. However, adoption will remain measured due to training requirements, monitoring challenges, and cultural preferences for supervised care, keeping in-center dialysis as the backbone of the market.

Increasing Focus on Cost Optimization, Outcomes, and Infection Control: As patient volumes grow, providers will increasingly prioritize operational efficiency, infection control, and outcome consistency. Investments in water treatment systems, standardized reuse protocols, digital patient tracking, and technician training will become critical differentiators. Providers that demonstrate low complication rates, high uptime, and strong compliance with clinical standards will be better positioned to retain government contracts, insurance partnerships, and physician referrals.

India Dialysis Market Segmentation

By Dialysis Type

• In-Center Hemodialysis

• Peritoneal Dialysis

• Home Hemodialysis

By Care Setting

• Hospital-Based Dialysis Units

• Standalone Dialysis Centers

• Public / PPP Dialysis Centers

• Home-Based Dialysis

By Provider Type

• Organized Private Dialysis Chains

• Private Hospitals and Hospital Networks

• Public Sector and PPP Operators

• Unorganized / Independent Dialysis Centers

By Patient Type

• End-Stage Renal Disease (ESRD) Patients

• Acute Kidney Injury (AKI) Patients

• Chronic Kidney Disease (Pre-ESRD) Patients

By Region

• South India

• West India

• North India

• East & North-East India

Players Mentioned in the Report:

• NephroPlus

• Fresenius Medical Care India

• DaVita Care India

• B. Braun Avitum India

• Apex Kidney Care

• Medica Dialysis

• State-level PPP dialysis operators and hospital-led dialysis platforms

Key Target Audience

• Dialysis service providers and organized dialysis chains

• Private hospitals and multi-specialty healthcare networks

• Government health departments and public procurement agencies

• PPP operators and healthcare infrastructure developers

• Medical device manufacturers and dialysis consumable suppliers

• Health insurance providers and healthcare financing institutions

• Private equity, healthcare-focused investors, and strategic partners

Time Period:

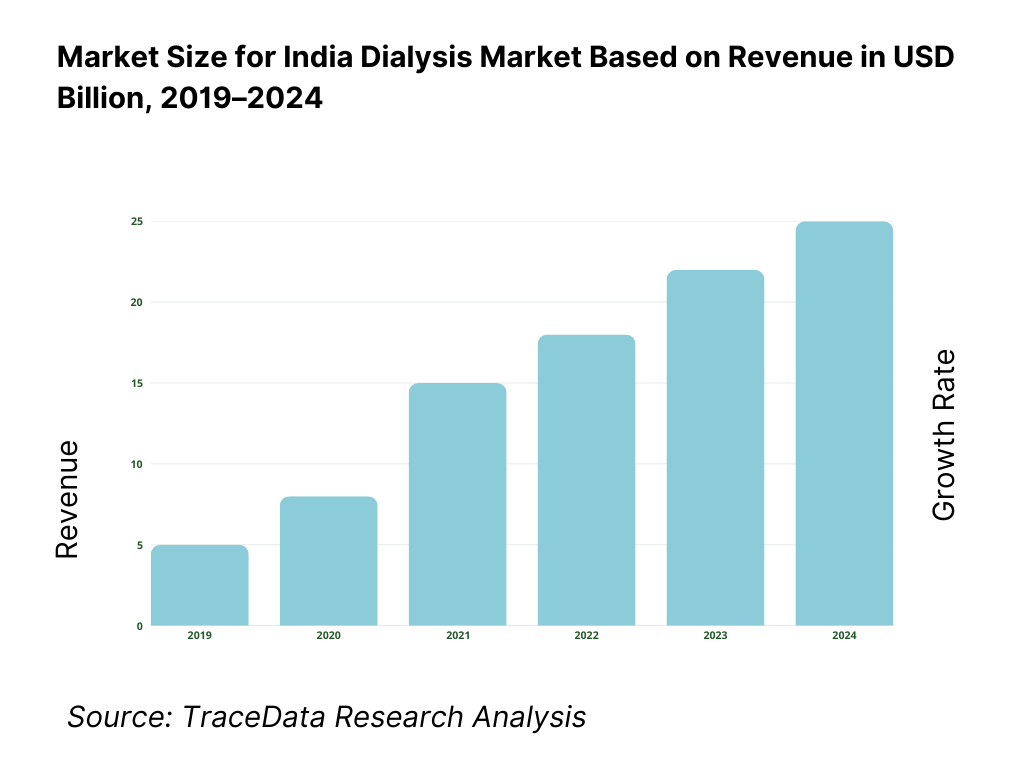

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Dialysis Services-In-Center Hemodialysis, Peritoneal Dialysis, Home Hemodialysis, PPP-Based Dialysis [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for India Dialysis Market [Per-Session Billing, Package Pricing, Government Reimbursement, Insurance Claims, Consumables & Ancillary Services]

4. 3 Business Model Canvas for India Dialysis Market [Key Partners, Key Activities, Value Propositions, Patient Segments, Cost Structure, Revenue Streams]

5. 1 Local Players vs Global Providers [NephroPlus vs Fresenius/DaVita etc.]

5. 2 Investment Model in India Dialysis Market [Government Funding, PPP Contracts, Private Equity, Strategic Healthcare Investments]

5. 3 Comparative Analysis of Dialysis Delivery in Public vs Private Settings [Procurement Models, Care Quality, Cost Efficiency, Outcomes]

5. 4 Dialysis Budget Allocation by Payer Type [Government-Funded, Insured Patients, Self-Pay Patients]

8. 1 Revenues (Historical Trend)

9. 1 By Market Structure (Hospital-Based Dialysis vs Standalone Dialysis Centers)

9. 2 By Dialysis Type (In-Center Hemodialysis, Peritoneal Dialysis, Home Hemodialysis)

9. 3 By Care Setting (Hospitals, Standalone Centers, PPP Facilities, Home-Based Care)

9. 4 By Patient Type (ESRD Patients, AKI Patients, CKD Patients)

9. 5 By Payer Type (Government Schemes, Insurance, Out-of-Pocket)

9. 6 By Treatment Frequency (Chronic Maintenance Dialysis vs Short-Term Dialysis)

9. 7 By Standardized vs Customized Dialysis Care Programs

9. 8 By Region (South India, West India, North India, East & North-East India)

10. 1 Patient & Provider Landscape and Cohort Analysis

10. 2 Dialysis Adoption Drivers & Treatment Decision-Making Process

10. 3 Dialysis Outcomes, Effectiveness & Cost Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in India Dialysis Market

11. 2 Growth Drivers for India Dialysis Market

11. 3 SWOT Analysis for India Dialysis Market

11. 4 Issues & Challenges for India Dialysis Market

11. 5 Government Regulations for India Dialysis Market

12. 1 Market Size and Future Potential for Home & PD Dialysis in India

12. 2 Business Models & Revenue Streams [Peritoneal Dialysis Programs, Home Care Packages, Subscription Models]

12. 3 Delivery Models & Dialysis Solutions Offered [CAPD, APD, Home HD Support Programs]

15. 1 Market Share of Key Players in India Dialysis Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Centers, Patient Volume, Revenues, Pricing Models, Technology Used, Service Portfolio, Major Hospital Tie-ups, Geographic Presence, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Care Quality & Clinical Benchmarking Matrix for Dialysis Providers

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Market Structure (Hospital-Based and Standalone Dialysis)

17. 2 By Dialysis Type (Hemodialysis, Peritoneal Dialysis, Home Hemodialysis)

17. 3 By Care Setting (Hospitals, Standalone Centers, PPP, Home Care)

17. 4 By Patient Type (ESRD, AKI, CKD)

17. 5 By Payer Type (Government, Insurance, Self-Pay)

17. 6 By Treatment Model (In-Center vs Home-Based)

17. 7 By Standardized vs Customized Care Programs

17. 8 By Region (South, West, North, East & North-East India)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Dialysis Market across demand-side and supply-side entities. On the demand side, entities include end-stage renal disease (ESRD) patients, chronic kidney disease (CKD) patients requiring long-term renal replacement therapy, referring nephrologists and physicians, hospitals, government health departments, and insurance administrators. Demand is further segmented by dialysis modality (in-center hemodialysis, peritoneal dialysis, home hemodialysis), care setting (hospital-based, standalone center, PPP facility, home-based), patient type (chronic vs acute), and payer type (government-funded, insured, self-pay). On the supply side, the ecosystem includes organized dialysis chains, private hospitals, public hospitals, PPP operators, dialysis machine and consumables manufacturers, water treatment system providers, logistics and maintenance partners, technician training institutes, and regulatory bodies overseeing clinical standards and medical devices. From this mapped ecosystem, we shortlist leading dialysis service providers and representative regional operators based on center count, geographic coverage, participation in public schemes, operational scale, and clinical credibility. This step establishes how value is created and captured across infrastructure setup, clinical delivery, consumables management, staffing, and long-term patient care.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the India dialysis market structure, demand drivers, and segment behavior. This includes reviewing epidemiological trends related to diabetes, hypertension, and chronic kidney disease, public healthcare expenditure patterns, dialysis penetration rates, and regional healthcare infrastructure disparities. We assess policy-level initiatives supporting dialysis access, reimbursement structures under government schemes, and the role of PPP frameworks in capacity expansion. Company-level analysis includes review of provider expansion strategies, center rollout models, cost structures, consumable sourcing practices, and technology adoption. We also examine regulatory and compliance dynamics governing dialysis operations, including clinical quality norms, infection control guidelines, and medical device regulations. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes assumptions for market estimation and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with dialysis chain operators, hospital administrators, nephrologists, dialysis technicians, government health officials, and medical device suppliers. The objectives are threefold: (a) validate assumptions around patient volumes, modality mix, and care-setting preferences, (b) authenticate segment splits by provider type, region, and payer mix, and (c) gather qualitative insights on pricing structures, reimbursement adequacy, staffing challenges, consumable costs, and operational bottlenecks. A bottom-to-top approach is applied by estimating patient volumes, average sessions per patient, and average realization per session across key segments and regions, which are aggregated to develop the overall market view. In selected cases, provider-style interactions are conducted to validate on-ground realities such as center utilization rates, downtime issues, technician availability, and the operational impact of government pricing caps.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population demographics, disease prevalence trends, healthcare spending growth, and government dialysis budget allocations. Assumptions around reimbursement sustainability, consumable cost inflation, staffing availability, and infrastructure scalability are stress-tested to understand their impact on provider viability and patient access. Sensitivity analysis is conducted across key variables including public scheme expansion pace, private sector investment intensity, adoption of home-based dialysis, and regional infrastructure development. Market models are refined until alignment is achieved between patient demand, provider capacity, and policy-driven access pathways, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the India Dialysis Market?

The India Dialysis Market holds strong long-term potential, supported by a growing burden of chronic kidney disease, rising life expectancy, and increasing diagnosis rates linked to diabetes and hypertension. Dialysis is a non-discretionary, recurring therapy for ESRD patients, creating structurally stable demand. Continued expansion of government-funded dialysis programs, PPP-led capacity creation, and organized private provider networks is expected to significantly improve access and sustain market growth through 2035.

02 Who are the Key Players in the India Dialysis Market?

The market features a mix of organized dialysis chains, private hospital networks, multinational dialysis service providers, and public-sector PPP operators. Competition is shaped by scale of operations, geographic footprint, participation in government schemes, clinical quality standards, and cost efficiency. Organized players with standardized operating models and strong technician training capabilities are increasingly gaining share from fragmented and hospital-dependent setups.

03 What are the Growth Drivers for the India Dialysis Market?

Key growth drivers include rising prevalence of diabetes and hypertension, expansion of public dialysis infrastructure, increasing penetration of organized dialysis chains, and gradual improvement in insurance and reimbursement coverage. Additional momentum comes from improved disease awareness, earlier diagnosis, and the extension of dialysis services into Tier-2 and Tier-3 cities. The recurring nature of dialysis treatment ensures long-term demand visibility for providers.

04 What are the Challenges in the India Dialysis Market?

Challenges include high out-of-pocket costs for patients outside government schemes, shortage of trained nephrologists and dialysis technicians, infrastructure quality variability across regions, and pressure on provider margins due to capped reimbursement rates. Limited adoption of home-based dialysis modalities and uneven healthcare access in eastern and rural regions also constrain market expansion. Managing quality and sustainability at scale remains a critical challenge as patient volumes continue to rise.