India Executive Education Market Outlook to 2029

By Mode of Learning (Company-Sponsored and Self-Funded), By Duration (0-12 Months, 12-24 Months, >24 Months), By Type of institutions and others

- Product Code: TDR006

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled "India Executive Education Market Outlook to 2029 - By Mode of Learning (Company-Sponsored and Self-Funded), By Duration (0-12 Months, 12-24 Months, >24 Months), By Type of institutions and others" provides a comprehensive analysis of the executive education market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Executive Education Market. The report concludes with future market projections based on revenue, by market, program types, region, cause and effect relationships, and success case studies highlighting major opportunities and cautions.

India Executive Education Market Overview and Size

The India executive education market reached a valuation of INR 45 Billion in 2023, driven by the increasing demand for skill enhancement, leadership development, and the growing importance of continuous learning in a rapidly changing business environment. The market is characterized by major players such as Indian Institutes of Management (IIMs), XLRI, ISB, and various global universities and corporate academies. These institutions are recognized for their diverse program offerings, flexible delivery modes, and strong industry connections.

In 2023, IIM Ahmedabad launched a new online executive education program focused on digital transformation. This initiative aims to address the growing need for digital skills in India and provide executives with the tools to lead in the digital age. Key markets such as Mumbai, Bangalore, and Delhi NCR are prominent due to their large corporate presence and strong demand for leadership development programs.

Market Size for India Executive Education Market on the Basis of Revenue in USD Billion, FY’2018-FY’2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of India Executive Education Market:

Economic Factors: The rapid economic growth in India and the increasing complexity of business environments have significantly driven the demand for executive education. In 2023, executive education programs accounted for a significant share of the higher education market, as companies invested more in upskilling their leadership teams to maintain competitive advantage. This trend is particularly strong among large corporations and multinational companies operating in India.

Corporate Need for Leadership Development: The growing need for effective leadership in a fast-paced business environment has made executive education a critical component of professional development. In recent years, the number of mid-level and senior executives enrolling in leadership programs has increased by 20%, driven by the desire to enhance strategic thinking, decision-making, and leadership skills.

Digital Transformation: The rise of digitalization across industries has led to an increased demand for executive education programs focused on digital skills and innovation. In 2023, approximately 35% of executive education programs in India were centered around digital transformation, reflecting the market's shift towards preparing leaders for a technology-driven future. This has been facilitated by the growing popularity of online and hybrid learning models, which provide greater flexibility and accessibility to busy professionals.

Which Industry Challenges Have Impacted the Growth for India Executive Education Market

High Program Costs: The significant costs associated with executive education programs are a major barrier, especially for smaller companies and individual executives. According to industry surveys, around 45% of potential participants are deterred by the high tuition fees, which can limit access to these programs. This challenge is particularly pronounced in sectors with tighter budgets, leading to lower enrollment rates among mid-sized companies.

Quality and Relevance of Content: Ensuring that executive education programs meet the specific needs of different industries is a critical challenge. Approximately 30% of executives have expressed concerns that the content of available programs does not align with the current demands of their industries. This mismatch can reduce the perceived value of these programs, affecting enrollment and overall satisfaction.

Regulatory Compliance and Accreditation: Stringent regulatory requirements and the need for accreditation can slow down the introduction of new programs and increase operational costs for education providers. In 2023, several new programs faced delays due to complex accreditation processes, which hindered their market entry and growth potential.

What are the Regulations and Initiatives which have Governed the Market:

Accreditation and Quality Standards: The Indian government mandates stringent accreditation and quality standards for executive education providers to ensure that programs meet the required educational benchmarks. Accreditation bodies like the AICTE (All India Council for Technical Education) and NBA (National Board of Accreditation) play a critical role in maintaining the quality of executive programs. In 2023, approximately 80% of executive education programs offered by major institutions were accredited, ensuring high standards of delivery and content.

Skill Development Initiatives: Under the Skill India mission, the Indian government has launched various initiatives to promote continuous learning and skill development among professionals. These initiatives encourage partnerships between educational institutions and industry to develop relevant and up-to-date executive education programs. In 2023, government-supported programs saw a 10% increase in enrollments, reflecting the growing emphasis on skill development.

Digital Education Policies: The government’s push towards digital education through initiatives like Digital India has significantly influenced the executive education market. The government has provided funding and resources to enhance digital infrastructure, making online and hybrid executive education programs more accessible. In 2023, digital programs accounted for 40% of the total executive education market, supported by these favorable policies.

India Executive Education Market Segmentation

By Market Structure: The executive education market in India is dominated by premier business schools such as the Indian Institutes of Management (IIMs) and the Indian School of Business (ISB), which command a significant share due to their established reputation, strong industry ties, and comprehensive program offerings. Corporate academies also hold a considerable portion of the market as they provide tailored programs that address specific organizational needs, often designed in collaboration with these leading institutions.

By Program Type and Duration of Courses: Short-term programs are the most popular in the Indian executive education market, providing intensive learning experiences that fit into busy schedules. Long-term programs, often leading to certifications or degrees, cater to executives looking for a comprehensive learning journey. The growing acceptance of online and hybrid formats has further expanded the reach and accessibility of these programs.

Competitive Landscape in India Executive Education Market

The India executive education market is relatively concentrated, with a few major institutions dominating the space. However, the entrance of new players and the expansion of online platforms such as Coursera, Simplilearn, and collaborations with international universities have diversified the market, offering executives more choices and flexible learning options.

| Name | Founding Year | Original Headquarters |

| Indian School of Business (ISB) | 2001 | Hyderabad, India |

| Indian Institute of Management (IIMs) | 1961 | Kolkata, India |

| XLRI - Xavier School of Management | 1949 | Jamshedpur, India |

| Amity Global Business School | 2008 | Noida, India |

| Great Lakes Institute of Management | 2004 | Chennai, India |

| SP Jain School of Global Management | 2004 | Mumbai, India |

| MDI (Management Development Institute) | 1973 | Gurgaon, India |

| TAPMI (T. A. Pai Management Institute) | 1980 | Manipal, India |

| NIIT Imperia | 2006 | Gurgaon, India |

| Harvard Business School Online (India operations) | 2014 | Boston, USA |

Some of the recent competitor trends and key information about competitors include:

IIM Ahmedabad: As one of the premier management institutes in India, IIM Ahmedabad reported a 20% increase in enrollments for its executive education programs in 2023, driven by new offerings in digital transformation and leadership.

ISB: Known for its strong industry connections, ISB saw a 25% growth in its executive education segment, particularly in short-term certificate programs. The institution’s focus on practical, industry-relevant content has been a key driver of its success.

XLRI: XLRI’s focus on leadership and ethics has positioned it as a top choice for executives in the manufacturing and services sectors. In 2023, the institute launched new programs in strategic management, contributing to a 15% increase in enrollments.

Coursera (India Operations): Coursera’s entry into the Indian executive education market has been marked by partnerships with leading universities to offer online executive programs. The platform saw a 30% increase in executive enrollments in 2023, reflecting the growing acceptance of online education.

Simplilearn: Specializing in digital and tech-driven executive education, Simplilearn recorded a 40% increase in enrollments, particularly in programs related to data science, AI, and digital marketing. The company’s focus on upskilling for the digital economy has resonated well with tech professionals.

What Lies Ahead for India Executive Education Market?

The India executive education market is projected to grow steadily by 2029, exhibiting a strong CAGR during the forecast period. This growth is expected to be fueled by increasing demand for leadership development, the rise of digital learning platforms, and the expanding corporate focus on continuous professional development.

Shift Towards Digital Learning: As the adoption of digital technologies continues to accelerate, there is expected to be a significant increase in the demand for online and hybrid executive education programs. This trend is supported by the growing need for flexible learning options that allow executives to balance work and education.

Focus on Leadership and Strategic Skills: With the evolving business landscape, there will be a greater emphasis on programs that develop leadership and strategic thinking skills. As companies face complex global challenges, the demand for advanced management and leadership training is expected to rise, particularly among senior executives.

Expansion of Customized Programs: The market is likely to see an increase in the demand for customized executive education programs tailored to the specific needs of companies. These programs are expected to cater to industry-specific challenges and provide targeted learning outcomes, making them highly attractive to organizations seeking to develop their leadership pipelines.

Sustainability and Social Responsibility: There is an increasing focus on incorporating sustainability and social responsibility into executive education curricula. As businesses become more attuned to environmental and social governance (ESG) factors, programs that address these issues are expected to gain traction among executives who aim to lead with a purpose-driven approach.

Future Outlook and Projections for India Executive Education Market on the Basis of Revenues in USD Billion, 2024-2029

Source: TraceData Research Analysis

India Executive Education Market Segmentation

- By Program Type:

- Executive MBA

- Management Development Programs

- By Duration of Courses:

- 0-6 Months

- 6-12 Months

- 12-24 Months

- More than 24 Months

- By Program Type:

- Short-term Programs

- Long-term Programs

- Certification Programs

- Degree Programs

- Customized Corporate Programs

- By Target Audience:

- Mid-level Executives

- Senior Executives

- C-suite Executives

- Entrepreneurs

- Functional Heads

- By Delivery Mode:

- Online

- Offline (In-person)

- Hybrid

- By Region:

- North India

- South India

- West India

- East India

- Central India

Players Mentioned in the Report:

- Indian School of Business (ISB)

- Indian Institute of Management (IIMs)

- XLRI - Xavier School of Management

- Amity Global Business School

- Great Lakes Institute of Management

- SP Jain School of Global Management

- MDI (Management Development Institute)

- TAPMI (T. A. Pai Management Institute)

- NIIT Imperia

- Harvard Business School Online (India operations)

Key Target Audience:

- Corporations (HR and Learning & Development Departments)

- Business Schools and Universities

- Executive Education Providers

- Industry Associations

- Government Bodies (e.g., Ministry of Education, Skill Development)

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Ecosystem of Key Stakeholders in India Executive Education Market

3.2. Business Cycle and Genesis for India Executive Education Market

3.3. Macroeconomic Analysis with Focus on Coverage on Industry Overview in Terms of Number of Higher Education Institutes-2024, Total Population, 2015-2024, English Speaking Population, Working Population by Sector-2015-2024, Pay Scale of Employees, Size of Gig Economy, Migrant Population, Higher Education Enrollment-2015-2024 and other Aspects

3.4. Undergraduate and Post Graduate Enrolments in India Basis Specialization, 2023-2024

4.1. Revenue Streams for India Executive Education Market

4.2. Business Model Canvas for Players in India Executive Education Market

5.1. Growth of Higher Education in India, FY2018-FY2024

5.2. Share of Executive Education in the Overall Higher Education Market, FY2018-FY2024

5.3. Corporate Spending on Executive Education in India, FY2024

5.4. Number of Universities and Colleges offering Executive Education in India

8.1. Revenues, FY2018-FY2024

8.2. Enrolments, FY2018-FY2024

8.3. Number of Institutes, FY2018-FY2024

8.4. Number of Programs, FY2018-FY2024

9.1. By Program Type (Part time, Full Time and Others), FY2018-FY2024

9.2. By Target Audience (Mid-level, Senior Executives, C-suite, Entrepreneurs), FY2018-FY2024

9.3. By Mode of Mode of Funding (Company-Sponsored and Self-Funded), FY2018-FY2024

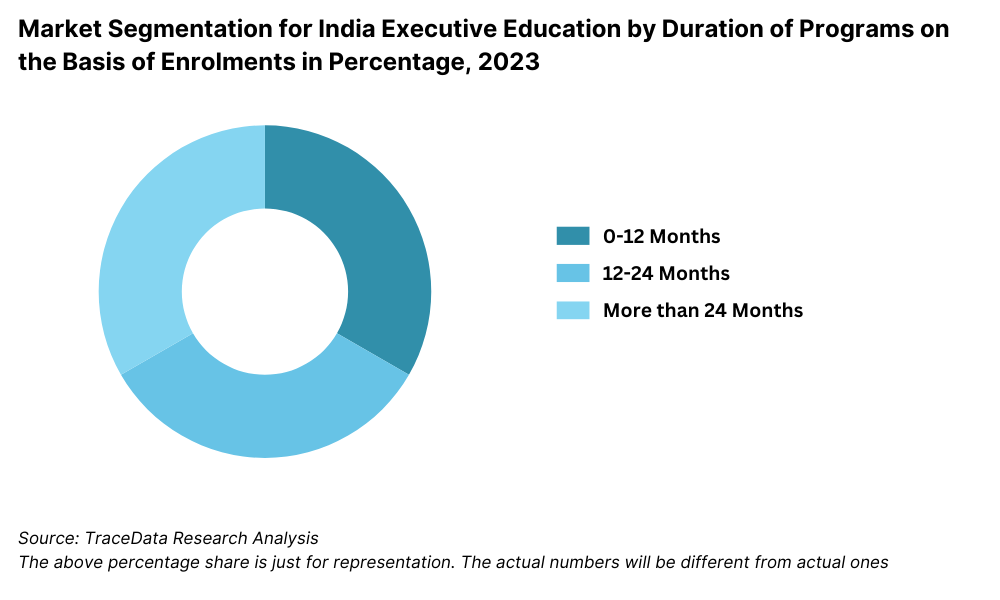

9.4. By Duration of Courses (0-12 Months, 12-24 Months, >24 Months), FY24

9.5. By Type of Institution (Government and Private Institutions), FY24

9.6. By Mode of Learning (Virtual, In-Person, and Hybrid), FY24

9.7. By Industry Focus (IT, BFSI, Manufacturing, Healthcare, etc.), FY2018-FY2024

10.1. Customer Landscape and Cohort Analysis-Target Addressable Market

10.2. Customer Journey and Decision-Making Process

10.3. Needs, Desires, and Pain Points Analysis

10.4. Gap Analysis Framework

10.5. Customer Segmentation of the E-MBA Space, By Age Group, FY2024

10.6. Customer Segmentation of the E-MBA Space, By Work Experience (3-5 Years, 6-9 Years, 10-15 Years, >15 Years), FY24

10.7. Customer Segmentation of the E-MBA Space, By Gender

11.1. Trends and Developments for India Executive Education Market

11.2. Growth Drivers for India Executive Education Market

11.3. SWOT Analysis for India Executive Education Market

11.4. Issues and Challenges for India Executive Education Market

11.5. Government Regulations for India Executive Education Market

12.1. Market Size and Future Potential for E-Learning Players offering Executive Education Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Executive Education Platforms based on Inception Year, Headquarters, Footprints (Number of Centers), Geographic Reach, Affiliations, Academic Partners, Alumni Network/Students Registered, Type of Courses Offered, Average Fees, Duration of Courses, Mode of Delivery, Eligibility Criteria, Key Target Audience, USP, Revenue, Academic Staff, Inception, Footprints, USP, Average Batch Size and Number of Enrolments

15.1. Market Share of Major Players in India Executive Education Market basis

15.1.1. Revenues, FY2024

15.1.2. Number of Enrolments, FY2024

15.2. Benchmark of Key Competitors in India Executive Education Market including variables Year of Establishment, Type of Institute, Location, Number of Programs, Type of Programs, Duration of Courses, Revenue, Number of Batches, Average Batch Size, USP, Course Fees, Number of Enrolment, Mode of Learning and others

15.3. Strengths and Weaknesses

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, FY2025-FY2029

16.2. Enrolments, FY2025-FY2029

17.1. By Program Type (Part time, Full Time and Others), FY2025-FY2029

17.2. By Target Audience (Mid-level, Senior Executives, C-suite, Entrepreneurs), FY2025-FY2029

17.3. By Mode of Mode of Funding (Company-Sponsored and Self-Funded), FY2025-FY2029

17.4. By Duration of Courses (0-12 Months, 12-24 Months, >24 Months), FY2025-FY2029

17.5. By Type of Institution (Government and Private Institutions), FY2025-FY2029

17.6. By Mode of Learning (Virtual, In-Person, and Hybrid), FY2025-FY2029

17.7. By Industry Focus (IT, BFSI, Manufacturing, Healthcare, etc.), FY2025-FY2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities within the India Executive Education Market. Based on this ecosystem, we will shortlist leading 5-6 providers in the country, considering their reputation, program offerings, and market reach.

Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market, collating industry-level information.

Step 2: Desk Research

We engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach allows us to conduct a thorough analysis of the market, aggregating insights on revenue trends, the number of market players, price levels, demand, and other key variables. We supplement this with detailed examinations of provider-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to build a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various India Executive Education Market providers and participants. This interview process serves multiple purposes: to validate market hypotheses, authenticate statistical data, and extract valuable operational and strategic insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate the reach and effectiveness of each provider, thereby aggregating the data to reflect the overall market dynamics.

As part of our validation strategy, our team executes disguised interviews wherein we approach each provider under the guise of potential clients. This approach enables us to validate the operational and strategic information shared by executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing strategies, and other critical factors.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, are undertaken to ensure the accuracy and reliability of the research findings. This step includes rigorous cross-verification processes to ensure that the final data reflects a true and comprehensive picture of the India Executive Education Market.

FAQs

01 What is the potential for the India Executive Education Market?

The India executive education market is poised for significant growth, projected to reach a valuation of INR 45 Billion by 2029. This growth is driven by the increasing need for leadership development, digital skills training, and continuous professional education. The market's potential is further enhanced by the growing corporate focus on upskilling employees to navigate the complexities of a rapidly evolving business environment.

02 Who are the Key Players in the India Executive Education Market?

The India Executive Education Market features several key players, including the Indian Institutes of Management (IIMs), Indian School of Business (ISB), and XLRI. These institutions dominate the market due to their established reputation, comprehensive program offerings, and strong industry connections. Other notable players include international universities operating through online platforms like Coursera and Simplilearn.

03 What are the Growth Drivers for the India Executive Education Market?

The primary growth drivers include the increasing demand for leadership and strategic skills as businesses in India continue to expand. The rise of digital transformation has also spurred demand for executive programs focused on technology and innovation. Additionally, the expanding availability of online and hybrid learning platforms has made executive education more accessible, driving market growth.

04 What are the Challenges in the India Executive Education Market?

The India Executive Education Market faces several challenges, including high program costs, which can be prohibitive for some participants. Ensuring the quality and relevance of program content to meet specific industry needs is another challenge. Regulatory hurdles, such as the stringent accreditation process, can also impact the introduction of new programs, while limited access to high-quality online education in remote areas remains a barrier.