India Hot Beverages Market Outlook to 2029

By Product Type (Tea, Coffee and Other Hot Beverages), By Distribution Channel, By Price Point, By Region

- Product Code: TDR0111

- Region: Asia

- Published on: January 2025

- Total Pages: 80

Report Summary

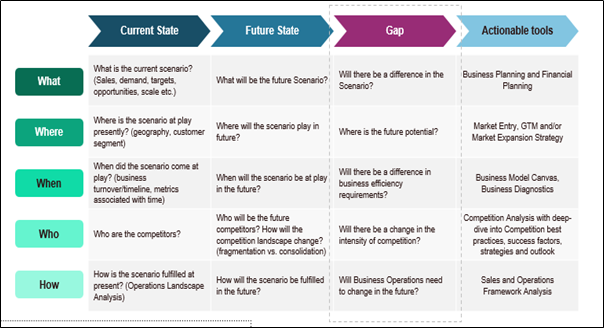

The report titled “India Hot Beverages Market Outlook to 2029 - By Product Type (Tea, Coffee and Other Hot Beverages), By Distribution Channel, By Price Point, By Region” provides a comprehensive analysis of the hot beverages market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Hot Beverages Market. The report concludes with future market projections based on sales revenue, segmented by product type, distribution channel, region, cause-and-effect relationship, and success case studies highlighting the major opportunities and cautions.

India Hot Beverages Market Overview and Size

The Indian hot beverages market reached a valuation of INR 500 billion in 2023, driven by increasing urbanization, rising disposable incomes, and evolving consumer preferences for premium and diverse flavors. The market is characterized by major players such as Tata Consumer Products, Hindustan Unilever, Nestlé India, and ITC. These companies are recognized for their broad distribution networks, diverse product offerings, and consumer-focused strategies.

In 2023, Tata Consumer Products launched a new line of premium teas to cater to health-conscious consumers. This initiative aligns with the growing demand for wellness-oriented products in India. Key urban areas such as Mumbai, Delhi, and Bangalore are crucial markets due to high population density, modern retail infrastructure, and a strong café culture.

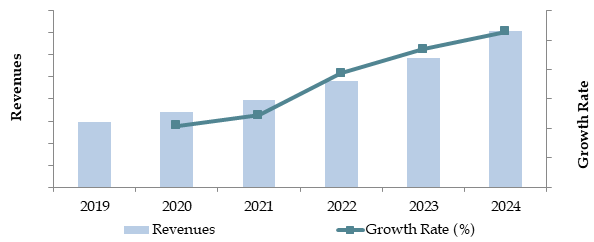

Market Size for India Hot Beverages Industry on the Basis of Revenues in USD Billion, 2018-2024

What Factors are Leading to the Growth of India Hot Beverages Market:

Rising Health Awareness: With increasing health awareness, there is a growing shift toward herbal and wellness-oriented teas and coffees. Green tea, in particular, has seen a rise in popularity, with sales growing by 15% in 2023. Consumers are increasingly choosing beverages that provide health benefits, such as aiding digestion or reducing stress, over traditional options.

Digital Transformation in Retail: The growth of online retail has revolutionized the way consumers purchase hot beverages. In 2023, about 30% of hot beverage sales in India were made through digital channels, reflecting a shift in consumer buying patterns towards online marketplaces. Digital platforms allow consumers access to a wider range of brands, price comparisons, and convenient home delivery.

Youth Demographic & Café Culture: India's large youth demographic, especially in urban areas, is driving the demand for premium coffee and tea experiences. Café chains and specialty tea houses have gained significant traction as social hubs, influencing the younger generation’s preference for higher-quality, branded hot beverages.

Which Industry Challenges Have Impacted the Growth for India Hot Beverages Market

Price Sensitivity and Competition: The Indian hot beverages market faces intense competition and high price sensitivity, particularly in the tea segment. Smaller, local brands often offer competitive pricing, which can impact the market share of larger, established brands. According to industry reports, nearly 60% of consumers are likely to switch brands based on price changes, leading to high churn rates and challenging profit margins for premium brands.

Quality and Safety Concerns: Concerns over quality and potential adulteration, especially in loose tea and coffee products, continue to affect consumer trust. In a recent survey, approximately 45% of Indian consumers expressed concerns about the quality of non-branded loose tea, citing health risks and lack of quality assurance. This issue has created challenges for market growth, as consumers are increasingly seeking reliable and certified brands.

Regulatory Challenges: Stringent food safety regulations, including compliance with FSSAI (Food Safety and Standards Authority of India) standards, can pose challenges, particularly for smaller or local producers. In 2023, around 18% of hot beverage products failed to meet FSSAI quality standards, resulting in limited product availability and increased operational costs for producers.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety and Standards Regulations: The Indian government, through the Food Safety and Standards Authority of India (FSSAI), mandates stringent quality checks for hot beverage products to ensure safety and consistency. All packaged tea and coffee products must comply with FSSAI standards, which include periodic inspections and quality certifications. In 2023, over 80% of hot beverage brands met FSSAI standards on their first inspection, indicating strong compliance within the industry.

Import Tariffs on Coffee Beans: The Indian government enforces import tariffs on coffee beans to support local producers and control market prices. Tariffs on imported coffee beans range from 30% to 40%, which impacts the pricing and availability of premium imported coffees in the market. In 2023, coffee bean imports saw a slight decline of 5% due to these tariffs, encouraging domestic production and boosting local sourcing.

Incentives for Organic and Herbal Beverages: To promote the production and consumption of organic and herbal beverages, the government provides subsidies and tax reductions to certified organic hot beverage producers. These incentives are intended to increase the availability of health-focused hot beverages in the market. In 2023, organic and herbal teas accounted for approximately 10% of the total hot beverage market, a figure anticipated to grow due to these government initiatives.

India Hot Beverages Market Segmentation

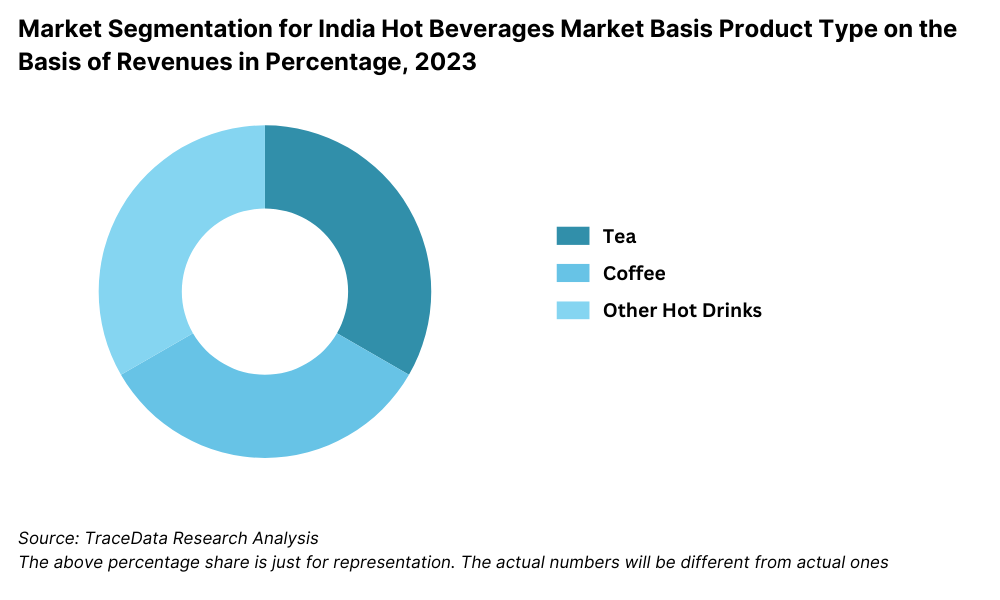

By Product Type: The Indian hot beverages market is primarily segmented into tea, coffee, and herbal infusions. Tea holds the dominant share, driven by its cultural significance, affordability, and extensive rural and urban consumption. Within the tea segment, black tea leads due to its widespread popularity, followed by green tea, which has gained traction among health-conscious consumers. Coffee follows, with significant demand for instant coffee in urban areas, while herbal infusions have seen steady growth due to rising health awareness and preference for natural ingredients.

Market Segmentation for India Hot Beverages Market Basis Product Type on the Basis of Revenues in Percentage, 2023

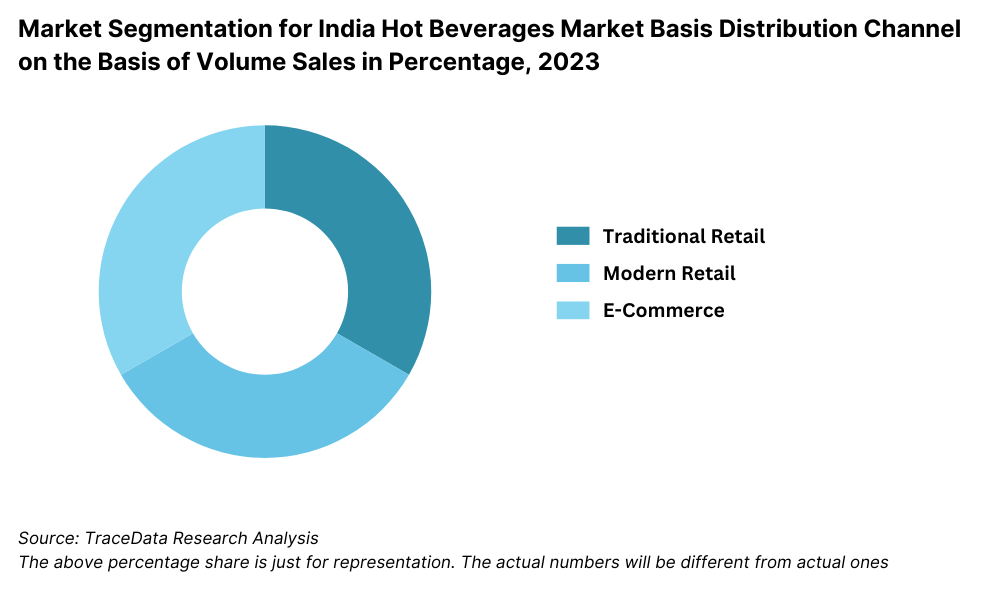

By Distribution Channel: The market is divided between traditional retail outlets and modern retail, including e-commerce platforms. Traditional retail, comprising kirana stores and local markets, remains the largest distribution channel, especially in rural areas where accessibility and familiarity drive sales. Modern retail, particularly online platforms, has been growing rapidly, capturing a significant share among urban consumers who prefer convenience and broader product choices. In 2023, approximately 25% of hot beverage sales were made through digital channels, a trend expected to rise with increasing internet penetration.

Market Segmentation for India Hot Beverages Market Basis Distribution Channel on the Basis of Volume Sales in Percentage, 2023

By Age Group: The primary consumers of hot beverages in India are adults aged 25-45, who represent the largest segment due to their purchasing power and lifestyle preferences. Young adults (18-24) also account for a significant share, especially in urban centers where coffee consumption and café culture are prevalent. Consumers aged 46 and above prefer traditional tea, often sourced from local markets, as it aligns with their cultural consumption habits.

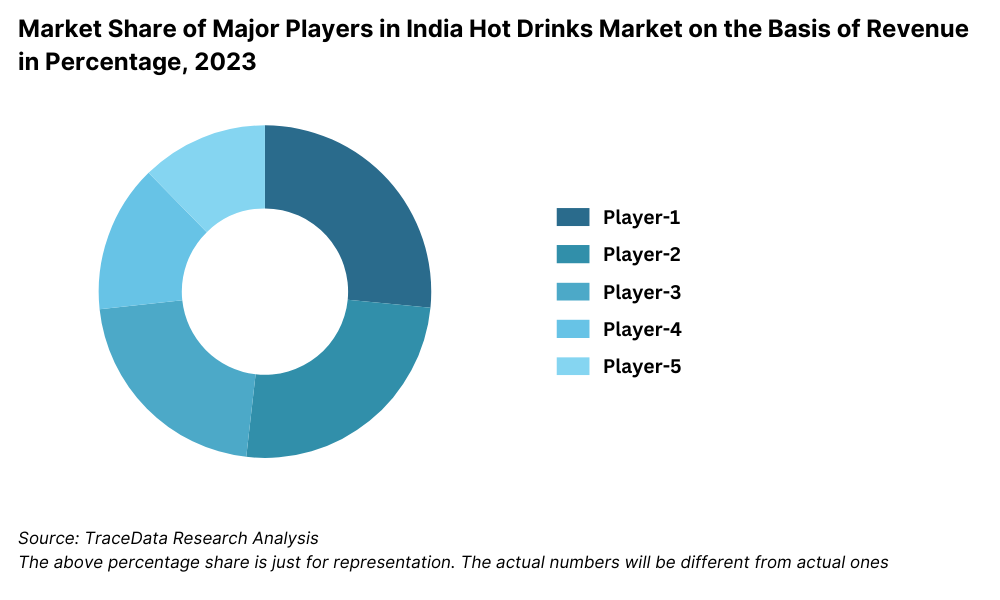

Competitive Landscape in India Hot Beverages Market

The Indian hot beverages market is moderately concentrated, with several major players holding a significant share. However, the increasing popularity of artisanal brands and online retail channels has diversified the market, providing consumers with a wide variety of choices and innovative products. Major players include Tata Consumer Products, Hindustan Unilever, Nestlé India, and ITC, alongside emerging brands such as Blue Tokai Coffee Roasters, Vahdam Teas, and Sleepy Owl Coffee, which cater to niche and premium segments.

| Company Name | Establishment Year | Headquarters |

|---|---|---|

| Tata Consumer Products | 1964 | Mumbai, Maharashtra |

| Hindustan Unilever (Brooke Bond, Lipton) | 1933 | Mumbai, Maharashtra |

| Nestlé India (Nescafé) | 1961 | Gurgaon, Haryana |

| Coffee Day Enterprises (Café Coffee Day) | 1996 | Bengaluru, Karnataka |

| Wagh Bakri Tea Group | 1892 | Ahmedabad, Gujarat |

| Goodricke Group | 1977 | Kolkata, West Bengal |

| Girnar Tea | 1978 | Mumbai, Maharashtra |

| Saffron Cup | 2014 | Bangalore, Karnataka |

| TGL Co. (The Good Life Company) | 2016 | Mumbai, Maharashtra |

| Blue Tokai Coffee Roasters | 2012 | New Delhi, Delhi |

Some of the recent competitor trends and key information about competitors include:

Tata Consumer Products: Tata leads the market with a broad product portfolio in tea and coffee. In 2023, the company saw a 15% increase in sales of its premium tea range due to growing demand for health-oriented and herbal teas. Tata’s focus on expanding its wellness product line and reaching rural consumers through improved distribution has solidified its market presence.

Hindustan Unilever: Known for its popular tea brand Brooke Bond, Hindustan Unilever reported a 10% rise in market share in 2023. The company’s strategy of introducing more sustainable and eco-friendly packaging resonated well with environmentally-conscious consumers. Additionally, its premium tea offerings have gained traction among urban buyers.

Nestlé India: Nestlé, a leading coffee brand with Nescafé, recorded a 20% increase in coffee sales in 2023, largely driven by its instant coffee and ready-to-drink coffee range. Nestlé’s digital campaigns and collaborations with café chains have further boosted its brand visibility and customer engagement.

ITC: ITC, with its Sunbean coffee brand and a diverse tea portfolio, achieved a 12% growth in sales in 2023. The company’s expansion into the premium tea segment and focus on digital marketing have strengthened its position in urban markets. ITC’s commitment to locally sourced ingredients has also contributed to its brand appeal.

Blue Tokai Coffee Roasters: Blue Tokai, known for its specialty coffee, has seen a 30% increase in sales, driven by the rising demand for artisanal and single-origin coffee among young urban consumers. Its emphasis on transparency, quality, and direct trade with farmers has resonated strongly with a niche but growing market segment.

Vahdam Teas: Vahdam, an emerging player specializing in premium teas, reported a 25% sales increase in 2023, with strong growth in the export market. Vahdam’s focus on sustainability and direct sourcing from Indian tea estates has attracted both domestic and international consumers looking for authentic and high-quality tea products.

Sleepy Owl Coffee: Known for its innovative cold brew and ready-to-drink coffee options, Sleepy Owl saw a 20% growth in 2023, particularly among younger consumers in metro areas. The brand’s strong digital presence and emphasis on convenience have made it a popular choice for on-the-go coffee lovers.

Market Share of Major Players in India Hot Drinks Market on the Basis of Revenue in Percentage, 2023

What Lies Ahead for India Hot Beverages Market?

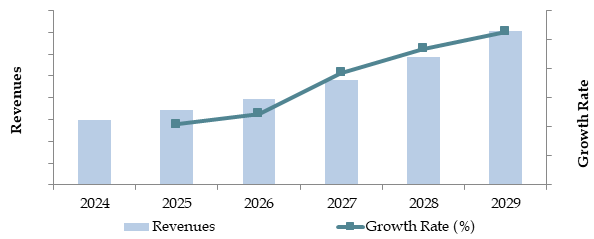

The India hot beverages market is projected to grow steadily by 2029, demonstrating a healthy CAGR during the forecast period. This growth is anticipated to be driven by increased consumer demand for premium products, health-oriented offerings, and the convenience of online purchasing options.

Rising Demand for Health and Wellness Beverages: As consumer health awareness increases, demand for wellness-oriented hot beverages, such as green tea, herbal infusions, and organic coffee, is expected to rise. This trend is supported by shifting consumer preferences toward natural ingredients and functional health benefits, pushing brands to innovate with health-focused products.

Expansion of Premium and Artisanal Coffee Culture: With the growth of café culture in urban areas, there is an increasing demand for premium and artisanal coffee options, catering to a segment of consumers willing to pay for high-quality experiences. The entry of specialty coffee brands and the expansion of premium coffee chains are expected to boost market growth in this segment.

Integration of E-Commerce and Subscription Models: The adoption of e-commerce and subscription-based models is forecasted to grow, providing consumers with more convenient ways to access a variety of hot beverage products. With digital channels, brands are able to reach a broader audience, and subscription services are especially popular among younger consumers seeking convenience and regular deliveries of their favorite beverages.

Focus on Sustainable and Ethical Sourcing: Sustainability practices are becoming a priority, with major brands emphasizing ethically sourced ingredients, eco-friendly packaging, and reduced carbon footprints. This trend is likely to attract environmentally conscious consumers, as brands that prioritize sustainability are expected to build stronger customer loyalty and engagement.

Future Outlook and Projections for India Hot Drinks Market on the Basis of Revenues in USD Billion, 2024-2029

India Hot Beverages Market Segmentation

- By Product Type:

- Tea

- Coffee

- Other Hot Drinks

- Tea

- Black Tea

- Fruit/Herbal Tea

- Green Tea

- Instant Tea

- Other Tea

- Coffee

- Fresh Coffee

- Instant Coffee

- Other Hot Drinks

- Flavoured Powder Drinks

- Chocolate-based Flavoured Powder Drinks

- Malt-based Hot Drinks

- Non-Chocolate-based Flavoured Powder Drinks

- Other Plant-based Hot Drinks

- Flavoured Powder Drinks

- By Distribution Channel:

- Traditional Retail (Kirana Stores, Local Markets)

- Modern Retail (Supermarkets, Hypermarkets)

- E-commerce Platforms

- Cafés and Specialty Stores

- By Consumer Age Group:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Northern India

- Southern India

- Central India

- Western India

- Eastern India

Players Mentioned in the Report:

- Hindustan Unilever Limited

- Tata Global Beverages Limited

- Nestlé India

- GlaxoSmithKline Consumer Healthcare Ltd.

- ITC Limited

- Dabur India Ltd.

- Wagh Bakri Tea Group

- Coffee Day Enterprises Ltd.

- Twinings India

- BRU (by Hindustan Unilever)

Key Target Audience:

- Hot Beverage Manufacturers

- Online Beverage Marketplaces

- Retail Chains and Distributors

- Health and Wellness Institutions

- Regulatory Bodies (e.g., FSSAI, Ministry of Food Processing Industries)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for India Hot Beverages Market

4.3. Consumer Buying Decision Process

5.1. Market Overview and Genesis

5.2. Number of Quick Service Restaurants serving Hot Drinks in India, 2018-2024

5.3. Rural vs. Urban Consumption Ratio in India, 2018-2024

8.1. Revenues, 2018-2024

9.1. By Product Type (Tea, Coffee, Other Hot Drinks), 2023-2024P

9.1.1. By Tea (Black Tea, Herbal Tea, Green Tea, Instant Tea and other Tea), 2023

9.1.2. By Coffee (Fresh Coffee, Instant Coffee), 2023

9.1.3. By Other Hot Drinks (Flavoured Powder Drinks and Other Plant-based Hot Drinks), 2023

9.2. By Distribution Channel (Traditional Retail, Modern Retail, E-commerce), 2023-2024P

9.3. By Region (North, South, Central, East, West), 2023-2024P

9.4. By Price Category (Economy, Premium, Super-Premium), 2023-2024P

10.1. Customer Landscape and Target Customer Cohort

10.2. Customer Journey and Decision-Making Process

10.3. Needs, Desires, and Pain Point Analysis

10.4. Market Gap Analysis Framework

10.5. By Consumer Age Group (18-24, 25-34, 35-54, 55+), 2023-2024P

11.1. Trends and Developments in India Hot Beverages Market

11.2. Growth Drivers for India Hot Beverages Market

11.3. SWOT Analysis for India Hot Beverages Market

11.4. Issues and Challenges in India Hot Beverages Market

11.5. Government Regulations Affecting India Hot Beverages Market

12.1. Presented through Radar Chart Analysis

14.1. Market Share of Key Players in Hot Drinks Market, 2023

14.2. Market Share of Key Players in Tea Market, 2023

14.3. Market Share of Key Players in Coffee Market, 2023

14.4. Benchmarking Key Competitors across 15-20 Operational and Financial Indicators

14.5. Strength and Weakness Comparison

14.6. Operating Model Analysis Framework

14.7. Strategic Analysis Tools (Gartner Magic Quadrant, Bowmans Strategic Clock)

15.1. Revenues, 2025-2029

16.1. By Product Type (Tea, Coffee, Other Hot Drinks), 2025-2029

16.1.1. By Tea (Black Tea, Herbal Tea, Green Tea, Instant Tea and other Tea), 2025-2029

16.1.2. By Coffee (Fresh Coffee, Instant Coffee), 2025-2029

16.1.3. By Other Hot Drinks (Flavoured Powder Drinks and Other Plant-based Hot Drinks), 2025-2029

16.2. By Distribution Channel (Traditional Retail, Modern Retail, E-commerce), 2025-2029

16.3. By Region (North, South, Central, East, West), 2025-2029

16.4. By Price Category (Economy, Premium, Super-Premium), 2025-2029

17.1. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: We identify all demand- and supply-side entities for the India Hot Beverages Market. Based on this ecosystem analysis, we shortlist the leading 5-6 companies in the country using criteria like financial information, production capacity, and market share.

Data Sourcing: Research is conducted through industry articles, multiple secondary sources, and proprietary databases to perform comprehensive desk research, collating essential industry-level information.

Step 2: Desk Research

Comprehensive Desk Research: We conduct in-depth desk research by referencing secondary and proprietary databases to perform a detailed market analysis. This includes reviewing market dynamics like sales revenue, number of market players, price levels, demand trends, and other critical variables. We supplement this analysis with company-specific data from press releases, annual reports, financial statements, and related documents, creating a foundational understanding of the market and key entities.

Step 3: Primary Research

Stakeholder Interviews: We conduct a series of interviews with C-level executives and key stakeholders from companies within the India Hot Beverages Market and related end-user industries. These in-depth interviews serve multiple purposes, including validating market assumptions, confirming statistical data, and obtaining valuable insights into operational and financial aspects. A bottom-to-top approach is utilized to evaluate volume sales for each player, which is then aggregated to the overall market.

Disguised Validation Strategy: To validate company-provided data, our team conducts disguised interviews, approaching each company as potential customers. This strategy allows us to corroborate operational and financial information from executives with secondary database data. These interactions also provide insights into revenue streams, the value chain, processes, pricing, and other market variables.

Step 4: Sanity Check

- Market Size Modeling and Validation: Both bottom-to-top and top-to-bottom analysis approaches are applied, along with market size modeling exercises, to ensure data consistency and accuracy in the overall assessment of the India Hot Beverages Market.

FAQs

1. What is the Potential for the India Hot Beverages Market?

The India hot beverages market is projected to experience steady growth, with a valuation of INR 500 billion in 2023. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a shift in consumer preferences toward premium and health-oriented hot beverage options. The market potential is further enhanced by the growing popularity of e-commerce platforms, making it easier for consumers to access a wide variety of products.

2. Who are the Key Players in the India Hot Beverages Market?

Key players in the India hot beverages market include Tata Consumer Products, Hindustan Unilever (Brooke Bond, Taj Mahal), Nestlé India (Nescafé), and ITC (Sunbean). Emerging brands like Blue Tokai Coffee Roasters, Vahdam Teas, and Sleepy Owl Coffee have also gained market share by catering to niche and premium segments, particularly among urban and health-conscious consumers.

3. What are the Growth Drivers for the India Hot Beverages Market?

The primary growth drivers for the market include an increasing focus on health and wellness, rising consumer interest in premium products, and the convenience of online shopping. The café culture in urban areas is also driving demand for artisanal and specialty coffee options. Additionally, the growth of digital retail platforms has made it easier for consumers to explore and purchase diverse hot beverage options, further fueling market expansion.

4. What are the Challenges in the India Hot Beverages Market?

The India hot beverages market faces challenges such as price sensitivity, especially in rural areas, and concerns over quality and authenticity, particularly for loose tea and coffee products. Regulatory challenges, including compliance with FSSAI standards, and fluctuations in raw material costs also impact the industry. Furthermore, rising competition from both domestic and international brands requires companies to innovate continually to maintain market share.