India Industrial Automation Market Outlook to 2035

By Automation Level, By Product Type, By Industry Vertical, By Deployment Architecture, and By Region

- Product Code: TDR0432

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Industrial Automation Market Outlook to 2035 – By Automation Level, By Product Type, By Industry Vertical, By Deployment Architecture, and By Region” provides a comprehensive analysis of the industrial automation ecosystem in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; technology and adoption trends, regulatory and standards landscape, buyer-level demand profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major automation solution providers operating in India.

The report concludes with future market projections based on manufacturing capex cycles, industrial digitization and Industry 4.0 adoption, expansion of discrete and process manufacturing capacity, infrastructure and utilities modernization, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the India industrial automation market through 2035.

India Industrial Automation Market Overview and Size

The India industrial automation market is valued at approximately ~USD ~ billion, representing the supply of automation hardware, software, and integrated control systems deployed across manufacturing plants, utilities, infrastructure assets, and process industries. The market includes programmable logic controllers (PLCs), distributed control systems (DCS), supervisory control and data acquisition (SCADA), human-machine interfaces (HMIs), industrial robots, sensors and actuators, drives and motors, safety systems, manufacturing execution systems (MES), and industrial software platforms that enable monitoring, control, optimization, and autonomous operations.

Industrial automation adoption in India is driven by the country’s expanding manufacturing base, rising labor cost pressures in organized manufacturing, increasing focus on productivity and quality consistency, and the need to improve energy efficiency and asset utilization. Automation solutions are increasingly deployed not only in large greenfield plants but also in brownfield facilities where manufacturers seek incremental efficiency gains through retrofits, digital controls, and data-driven process optimization.

The market is anchored by strong demand from automotive and auto components manufacturing, metals and mining, oil and gas, chemicals, power generation, cement, pharmaceuticals, food and beverage processing, and fast-growing segments such as electronics manufacturing, renewable energy equipment, and warehousing automation. Government-led initiatives such as “Make in India,” Production Linked Incentive (PLI) schemes, and infrastructure investment programs further reinforce long-term demand for industrial automation technologies.

Western and Southern India represent the largest demand centers for industrial automation due to their concentration of automotive hubs, process industries, export-oriented manufacturing clusters, and industrial corridors. States such as Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Andhra Pradesh account for a significant share of automation investments driven by both domestic manufacturing and multinational production bases. Northern India is emerging as a key growth region, supported by electronics manufacturing, food processing, and logistics-driven industrial development, while Eastern India shows selective automation demand linked to metals, mining, power, and heavy industries.

What Factors are Leading to the Growth of the India Industrial Automation Market

Expansion of manufacturing capacity and industrial capex strengthens baseline automation demand: India continues to witness sustained investment in manufacturing capacity across automotive, electronics, pharmaceuticals, chemicals, and heavy engineering, supported by policy incentives and supply-chain diversification away from single-country dependence. New manufacturing facilities increasingly incorporate automation at the design stage to ensure scalability, repeatability, and compliance with global quality standards. Automation systems enable manufacturers to standardize production lines across multiple plants, reduce commissioning time, and support rapid ramp-up of output, directly increasing demand for PLCs, robotics, drives, and integrated control systems.

Rising focus on productivity, quality consistency, and cost optimization accelerates automation adoption: Manufacturers in India face increasing pressure to improve throughput, reduce defects, and manage input cost volatility while operating in competitive domestic and export markets. Industrial automation allows tighter process control, real-time monitoring, and data-driven optimization, leading to improved yield, reduced downtime, and lower operational costs over the asset lifecycle. In sectors such as automotive components, pharmaceuticals, and food processing, automation is increasingly viewed as a strategic necessity rather than a discretionary investment, especially where regulatory compliance and traceability are critical.

Labor availability, safety, and skill constraints increase reliance on automated systems: While India has a large labor pool, organized manufacturing increasingly encounters challenges related to skilled labor availability, attrition, safety compliance, and productivity variability. Automation reduces dependence on manual intervention for repetitive, hazardous, or precision-intensive tasks and improves workplace safety outcomes. Industrial robots, automated material handling systems, and safety-integrated control architectures are gaining traction in welding, packaging, palletizing, and high-risk process environments, supporting broader automation penetration across industries.

Which Industry Challenges Have Impacted the Growth of the India Industrial Automation Market:

High upfront capital costs and ROI sensitivity slow adoption among small and mid-sized manufacturers: While industrial automation delivers long-term productivity, quality, and cost benefits, the initial capital expenditure required for PLCs, robotics, control systems, industrial software, and system integration remains a key adoption barrier—particularly for small and mid-sized enterprises (SMEs). Many Indian manufacturers operate with tight capital budgets and short payback expectations, making them cautious about large automation investments unless demand visibility is strong. This sensitivity to return-on-investment timelines often leads to phased or partial automation deployments rather than full-scale plant-wide automation, slowing overall market penetration.

Integration complexity in brownfield plants increases implementation risk and project timelines: A significant portion of India’s manufacturing base consists of legacy or brownfield facilities with heterogeneous equipment, outdated control systems, and limited digital readiness. Integrating modern automation platforms with legacy machinery, proprietary protocols, and fragmented data architectures increases engineering effort, commissioning time, and execution risk. These challenges can lead to production disruptions during retrofits, making manufacturers hesitant to undertake automation upgrades unless supported by strong vendor capabilities and proven integration track records.

Skilled workforce gaps in automation engineering and operations constrain effective utilization: Although India has a large engineering talent pool, there remains a shortage of experienced automation professionals capable of designing, commissioning, operating, and maintaining advanced automation and digital control systems. Gaps in skills related to robotics programming, industrial networking, cybersecurity, advanced PLC/DCS configuration, and data analytics can limit the effective utilization of deployed systems. As a result, some end-users underutilize automation capabilities or rely heavily on external vendors for ongoing support, increasing operating costs and dependency risks.

What are the Regulations and Initiatives which have Governed the Market:

National manufacturing and industrial policy initiatives driving automation-led competitiveness: Government-led programs such as Make in India, Atmanirbhar Bharat, and Production Linked Incentive (PLI) schemes aim to strengthen domestic manufacturing, improve productivity, and enhance global competitiveness. While these initiatives do not mandate automation directly, they incentivize scale, quality consistency, export readiness, and cost efficiency—all of which favor higher adoption of industrial automation. Manufacturers participating in PLI-linked sectors such as electronics, automotive, pharmaceuticals, and specialty chemicals increasingly integrate automation to meet output and performance thresholds.

Industrial safety, quality, and compliance standards shaping automation requirements: Regulatory frameworks related to worker safety, process safety, product quality, and environmental compliance influence automation deployment across industries. Requirements linked to hazardous operations, precision manufacturing, contamination control, and traceability encourage the use of automated control systems, safety PLCs, interlocks, and monitoring solutions. In sectors such as pharmaceuticals, food processing, chemicals, and power generation, compliance expectations indirectly drive automation adoption to reduce human error and ensure consistent process control.

Energy efficiency and sustainability policies influencing process optimization and control systems: India’s focus on energy efficiency, emissions reduction, and resource optimization has increased the relevance of automation in monitoring and optimizing energy consumption, process efficiency, and asset utilization. Regulatory expectations around energy audits, efficiency benchmarking, and sustainability reporting encourage industries to deploy automation and digital control systems that enable real-time measurement, optimization, and reporting. This trend is particularly visible in power, cement, metals, and large process industries.

India Industrial Automation Market Segmentation

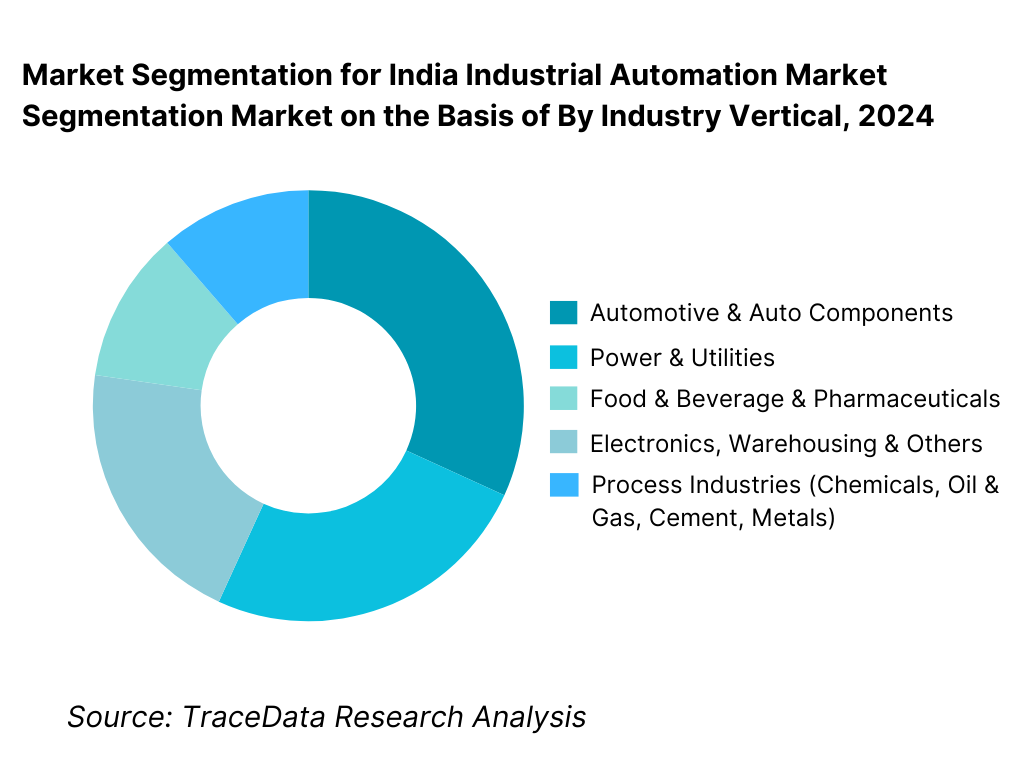

By Industry Vertical: Discrete and process manufacturing segments hold dominance. Automotive, auto components, metals, chemicals, power, and large-scale manufacturing facilities account for the majority of industrial automation demand in India. These industries operate high-throughput, capital-intensive plants where productivity, uptime, quality consistency, and safety are critical. Automation systems are deeply embedded in core production processes, material handling, utilities management, and quality control. While sectors such as food & beverage, pharmaceuticals, electronics, and warehousing automation are growing rapidly, heavy manufacturing and process industries continue to drive volume-led demand due to scale, complexity, and long asset lifecycles.

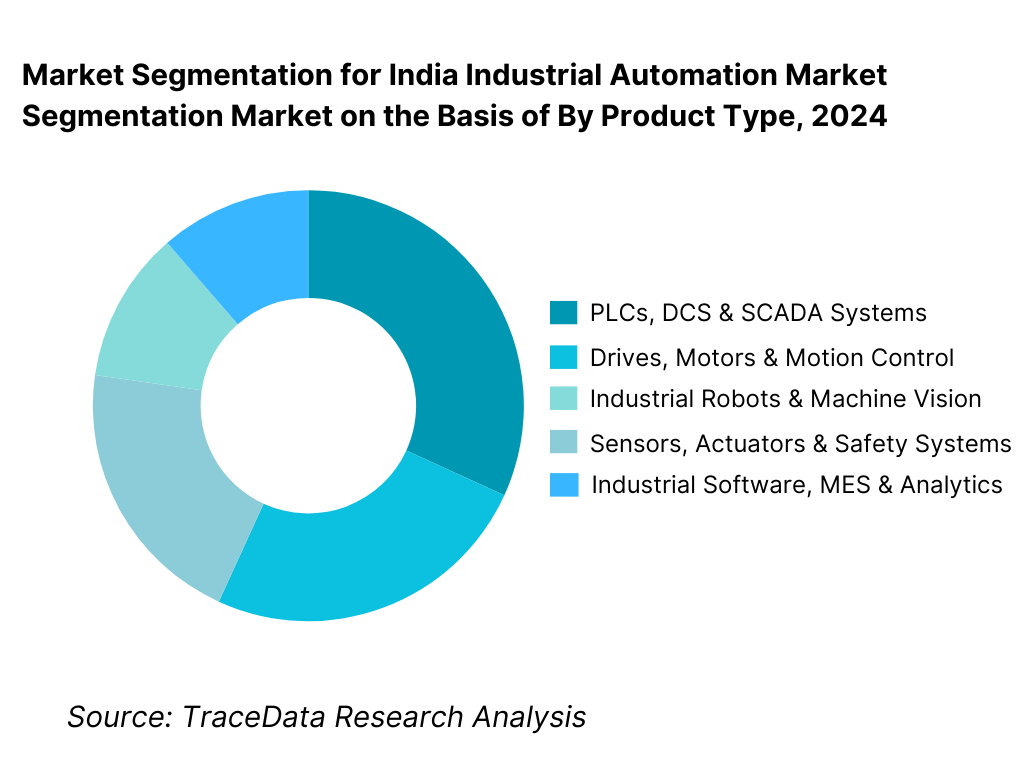

By Product Type: Control systems and industrial software form the core spend categories. PLCs, DCS, SCADA, and associated software account for a significant share of automation spending, as they serve as the central nervous system of industrial operations. Drives, motors, and motion control systems are critical in energy-intensive industries, while industrial robots and vision systems are expanding in automotive, electronics, and packaging. Industrial software and analytics are increasingly embedded within automation projects, increasing solution value per installation.

Competitive Landscape in India Industrial Automation Market

The India industrial automation market exhibits moderate concentration, led by global automation majors with strong local manufacturing, engineering, and service footprints, alongside domestic conglomerates and specialized system integrators. Market leadership is driven by technology breadth, installed base strength, lifecycle service capability, domain expertise, and the ability to execute complex greenfield and brownfield projects.

Global players dominate high-end PLCs, DCS, robotics, and industrial software, while Indian firms compete effectively in system integration, EPC-linked automation, panels, and project execution. Long-term customer relationships, service responsiveness, and the ability to support digital transformation initiatives increasingly differentiate competitors beyond hardware pricing.

Key Players Operating in the India Industrial Automation Market

Name | Founding Year | Original Headquarters |

Siemens | 1847 | Munich, Germany |

ABB | 1883 | Zurich, Switzerland |

Schneider Electric | 1836 | Rueil-Malmaison, France |

Rockwell Automation | 1903 | Milwaukee, Wisconsin, USA |

Mitsubishi Electric | 1921 | Tokyo, Japan |

Honeywell | 1906 | Charlotte, North Carolina, USA |

Emerson Electric | 1890 | St. Louis, Missouri, USA |

Larsen & Toubro | 1938 | Mumbai, India |

Yokogawa | 1915 | Tokyo, Japan |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Siemens: Siemens continues to strengthen its position in India through integrated automation and digitalization offerings spanning PLCs, DCS, industrial software, and digital twins. Its competitive advantage lies in deep Industry 4.0 capabilities and strong penetration in automotive, electronics, and large process industries where digital integration and lifecycle optimization are key procurement drivers.

ABB: ABB maintains a strong footprint across power, process industries, and robotics, with competitiveness rooted in reliability, domain expertise, and energy-efficient automation solutions. The company benefits from India’s infrastructure modernization and energy transition projects, where automation, electrification, and digital monitoring converge.

Schneider Electric: Schneider Electric competes strongly in industrial automation by combining control systems with energy management, sustainability, and digital platforms. Its positioning is particularly strong among manufacturers and utilities seeking integrated solutions for operational efficiency, energy optimization, and regulatory compliance.

Rockwell Automation: Rockwell remains a preferred automation partner for discrete manufacturing, particularly automotive, FMCG, and packaging segments. Its strength lies in PLC-centric architectures, manufacturing execution systems, and strong ecosystem partnerships that support scalable, standardized plant automation programs.

Larsen & Toubro: L&T plays a differentiated role as an engineering-led automation provider, leveraging its EPC capabilities, domain expertise, and project execution strength. The company is well positioned in large infrastructure, power, oil & gas, and industrial projects where automation is embedded within turnkey delivery models.

What Lies Ahead for India Industrial Automation Market?

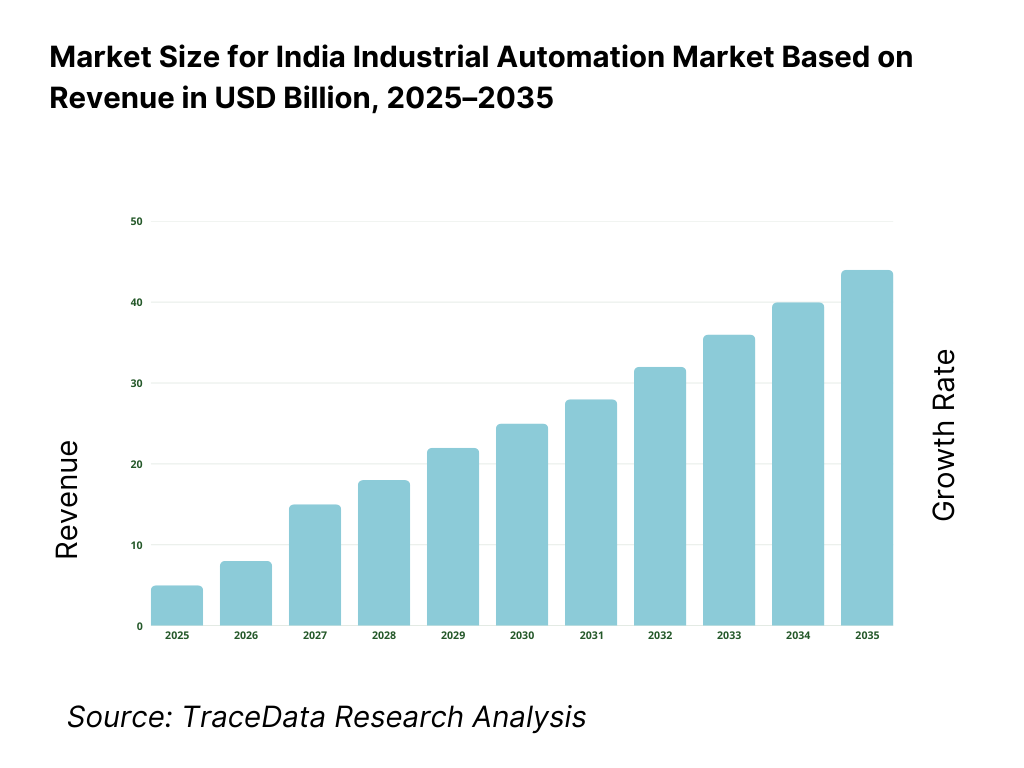

The India industrial automation market is expected to expand steadily through 2035, supported by sustained manufacturing capacity expansion, increasing emphasis on productivity and quality consistency, and the gradual transition of Indian industry toward digitally enabled and globally competitive operations. Growth momentum is reinforced by ongoing investments in automotive, electronics, pharmaceuticals, chemicals, power, and infrastructure, alongside policy initiatives that encourage scale, efficiency, and export readiness. As manufacturers increasingly seek predictable output, reduced operational variability, and improved asset utilization, industrial automation will remain a foundational enabler across both discrete and process industries.

Transition Toward Higher-Level and Purpose-Specific Automation Architectures: The future trajectory of India’s automation market will see a gradual shift from basic and intermediate automation toward more advanced, application-specific architectures. Manufacturers are increasingly designing automation solutions around operational needs such as high-speed throughput, precision control, traceability, safety compliance, and energy optimization. Advanced process control, robotics, machine vision, and software-led orchestration will gain prominence in sectors such as automotive components, electronics assembly, pharmaceuticals, and specialty chemicals. Vendors that offer modular, scalable, and industry-tailored automation packages will be better positioned to capture higher-value deployments and long-term customer engagement.

Growing Emphasis on Standardization and Multi-Plant Automation Programs: Large manufacturing groups and multinational operators in India are increasingly pursuing standardized automation frameworks across multiple plants to simplify operations, maintenance, and workforce training. Standardized PLC platforms, common control philosophies, and unified data architectures enable faster commissioning, easier replication, and improved governance across distributed manufacturing footprints. Through 2035, this trend will favor automation suppliers with strong local engineering depth, lifecycle service capability, and the ability to support consistent execution across diverse geographies and plant types.

Integration of Digitalization, Analytics, and Industry 4.0 Capabilities: Industrial automation in India will increasingly extend beyond machine-level control toward connected, data-driven manufacturing ecosystems. Integration of MES, industrial IoT platforms, edge computing, and analytics will become more common as manufacturers seek predictive maintenance, real-time performance visibility, and faster decision-making. While adoption will remain phased due to cost and skill considerations, digital automation layers will progressively become embedded within new projects and major retrofits. Automation providers that successfully combine control hardware with software, analytics, and cybersecurity frameworks will gain a strategic advantage.

India Industrial Automation Market Segmentation

By Automation Level

- Basic Automation (Sensors, Relays, Standalone Controllers)

- Intermediate Automation (PLCs, HMIs, SCADA, Drives)

- Advanced Automation (DCS, Robotics, MES, Industrial IoT, Analytics)

By Product Type

- Programmable Logic Controllers (PLC)

- Distributed Control Systems (DCS)

- SCADA & HMI Systems

- Industrial Robots & Machine Vision

- Drives, Motors & Motion Control

- Sensors, Actuators & Safety Systems

- Industrial Software, MES & Digital Platforms

By Deployment Architecture

- Standalone / Machine-Level Automation

- Integrated Plant-Wide Automation Systems

- Hybrid Architectures (On-Premise + Edge / Cloud)

- Remote Monitoring and SCADA-Based Control Systems

By End-Use Industry

- Automotive & Auto Components

- Process Industries (Chemicals, Oil & Gas, Cement, Metals)

- Power & Utilities

- Food & Beverage and Pharmaceuticals

- Electronics Manufacturing

- Warehousing, Logistics & Others

By Region

- West India

- South India

- North India

- East India

Players Mentioned in the Report:

- Siemens

- ABB

- Schneider Electric

- Rockwell Automation

- Mitsubishi Electric

- Honeywell

- Emerson Electric

- Yokogawa

- Larsen & Toubro

- Domestic system integrators, panel builders, automation EPCs, and industrial software partners

Key Target Audience

- Industrial automation OEMs and component manufacturers

- System integrators and automation solution providers

- Manufacturing companies and owner-operators

- Process industry operators and utility companies

- EPC contractors and industrial project developers

- Smart factory and Industry 4.0 solution providers

- Industrial consultants and engineering firms

- Private equity, infrastructure, and manufacturing-focused investors

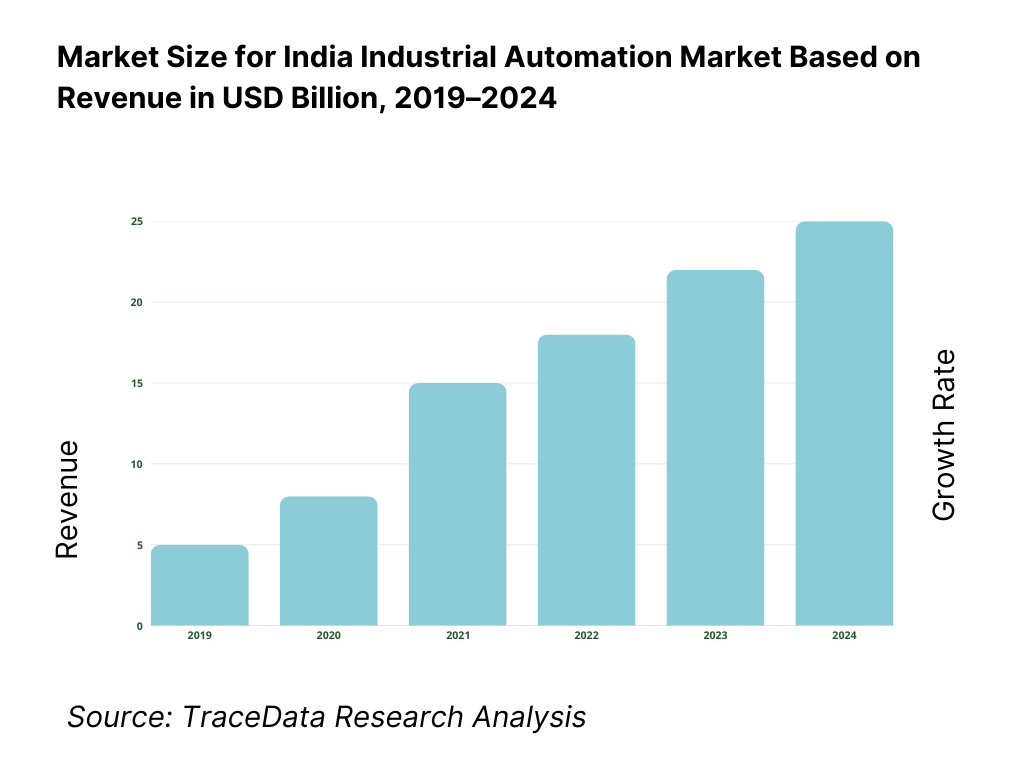

Time Period:

- Historical Period: 2019–2024

- Base Year: 2025

- Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in India Industrial Automation Market

Value Chain Analysis

4.1 Delivery Model Analysis for Industrial Automation Solutions-On-Premise, Cloud-Connected, Hybrid, Edge Automation [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for India Industrial Automation Market [Hardware Sales, Software Licensing, SaaS Subscriptions, System Integration, Lifecycle Services, Automation-as-a-Service]

4.3 Business Model Canvas for India Industrial Automation Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Vendors [Indian System Integrators vs Global Automation OEMs]

5.2 Investment Model in India Industrial Automation Market [Government Incentives, Capex Investments, OEM Localization, Private Equity, Corporate Investments]

5.3 Comparative Analysis of Automation Adoption in Public vs Private Organizations [Procurement Models, Use Cases, ROI Benchmarks]

5.4 Automation Budget Allocation by Enterprise Size [Large Enterprises, Medium Enterprises, SMEs]Market Attractiveness for India Industrial Automation Market

Supply-Demand Gap Analysis

Market Size for India Industrial Automation Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for India Industrial Automation Market Basis

9.1 By Market Structure (In-House Automation Teams vs Outsourced Automation & System Integrators)

9.2 By Technology (PLCs, DCS, SCADA, Robotics, Industrial IoT, MES, Analytics)

9.3 By Industry Verticals (Automotive, Process Industries, Power & Utilities, Pharmaceuticals, Food & Beverage, Electronics, Others)

9.4 By Enterprise Size (Large Enterprises, Medium Enterprises, SMEs)

9.5 By Use Case/Function (Process Control, Discrete Manufacturing, Material Handling, Quality Inspection, Predictive Maintenance, Energy Management)

9.6 By Deployment Mode (On-Premise, Hybrid, Cloud-Connected, Edge Automation)

9.7 By Standardized vs Customized Automation Solutions

9.8 By Region (North India, West India, South India, East India)Demand-Side Analysis for India Industrial Automation Market

10.1 Corporate & Industrial Client Landscape and Cohort Analysis

10.2 Automation Adoption Drivers & Decision-Making Process

10.3 Automation Effectiveness & ROI Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in India Industrial Automation Market

11.2 Growth Drivers for India Industrial Automation Market

11.3 SWOT Analysis for India Industrial Automation Market

11.4 Issues & Challenges for India Industrial Automation Market

11.5 Government Regulations for India Industrial Automation MarketSnapshot on Industrial Software, Digital Automation & Connected Systems Market in India

12.1 Market Size and Future Potential for Industrial Software & Digital Automation in India

12.2 Business Models & Revenue Streams [Software Licensing, SaaS, Subscription, Automation-as-a-Service]

12.3 Delivery Models & Automation Applications Offered [MES, SCADA, Industrial IoT Platforms, Digital Twins]Opportunity Matrix for India Industrial Automation Market

PEAK Matrix Analysis for India Industrial Automation Market

Competitor Analysis for India Industrial Automation Market

15.1 Market Share of Key Players in India Industrial Automation Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Engineers, Revenues, Pricing Models, Technology Used, Best-Selling Automation Solutions, Major Clients, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant for Industrial Automation Providers

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for India Industrial Automation Market Basis

16.1 Revenues (Projections)

Market Breakdown for India Industrial Automation Market Basis

17.1 By Market Structure (In-House and Outsourced Automation Services)

17.2 By Technology (PLCs, DCS, SCADA, Robotics, Industrial IoT, MES, Analytics)

17.3 By Industry Verticals (Automotive, Process Industries, Power & Utilities, Pharmaceuticals, Food & Beverage, Electronics, Others)

17.4 By Enterprise Size (Large Enterprises, Medium-Sized Enterprises, SMEs)

17.5 By Use Case/Function (Process Control, Discrete Manufacturing, Quality, Maintenance, Energy Optimization)

17.6 By Deployment Mode (On-Premise, Hybrid, Cloud-Connected, Edge)

17.7 By Standardized vs Customized Automation Programs

17.8 By Region (North India, West India, South India, East India)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Industrial Automation Market across demand-side and supply-side entities. On the demand side, entities include discrete manufacturing companies (automotive, auto components, electronics), process industry operators (chemicals, cement, metals, oil & gas), power and utility operators, food & beverage and pharmaceutical manufacturers, infrastructure and utilities operators, and public-sector industrial undertakings. Demand is further segmented by plant type (greenfield vs brownfield), automation maturity (basic, intermediate, advanced), functional requirement (process control, discrete automation, material handling, safety, energy optimization), and procurement model (direct OEM purchase, system integrator–led delivery, EPC-linked automation, public tender-based procurement).

On the supply side, the ecosystem includes global automation OEMs, domestic automation manufacturers, system integrators, automation EPC contractors, panel builders, robotics integrators, industrial software providers, sensor and drive suppliers, industrial networking and cybersecurity solution providers, and after-sales service and lifecycle support partners. From this mapped ecosystem, we shortlist 6–10 leading automation OEMs and a representative set of system integrators based on technology breadth, installed base, local engineering strength, industry coverage, service footprint, and execution capability across greenfield and brownfield projects. This step establishes how value is created and captured across hardware supply, system integration, commissioning, digital enablement, and lifecycle services.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the India industrial automation market structure, demand drivers, and segment behavior. This includes reviewing manufacturing investment trends, industrial corridor development, sector-wise capex cycles, infrastructure and utilities modernization programs, and adoption of Industry 4.0 and digital manufacturing initiatives. We assess buyer preferences around automation depth, scalability, reliability, lifecycle cost, and integration with existing systems.

Company-level analysis includes review of OEM product portfolios, localization strategies, manufacturing and engineering footprints in India, partner and integrator ecosystems, service offerings, and typical industry focus areas. We also examine regulatory and standards frameworks related to industrial safety, quality, energy efficiency, and digitalization that indirectly shape automation demand. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and future outlook modeling.

Step 3: Primary Research

We conduct structured interviews with automation OEMs, system integrators, EPC contractors, plant managers, maintenance heads, digital transformation leaders, and procurement teams across key industries. The objectives are threefold: (a) validate assumptions around sector-wise demand concentration, automation budgets, and procurement decision-making, (b) authenticate market splits by technology, automation level, deployment architecture, and end-use industry, and (c) gather qualitative insights on pricing behavior, implementation challenges, integration risks, skill availability, and customer expectations around reliability, cybersecurity, and ROI.

A bottom-to-top approach is applied by estimating automation spend per plant, by function and industry, which is then aggregated across regions and sectors to build the overall market view. In selected cases, solution-level discussions are conducted with system integrators to validate real-world deployment timelines, commissioning challenges, brownfield constraints, and post-installation support requirements.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as industrial production growth, manufacturing capex trends, infrastructure spending, and energy transition investments. Assumptions related to automation penetration, digital adoption rates, and retrofit acceleration are stress-tested to understand their impact on market outcomes. Sensitivity analysis is conducted across key variables including manufacturing growth intensity, labor and skill availability, technology cost trends, and pace of Industry 4.0 adoption. Market models are refined until alignment is achieved between supplier capacity, system integrator throughput, and end-user investment behavior, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the India Industrial Automation Market?

The India Industrial Automation Market holds strong long-term potential, supported by sustained expansion in manufacturing capacity, increasing focus on productivity and quality consistency, and the gradual shift toward digitally enabled and globally competitive industrial operations. Automation is becoming a strategic necessity across both discrete and process industries as manufacturers seek predictable output, improved safety, and better asset utilization. These fundamentals are expected to support steady growth through 2035.

02 Who are the Key Players in the India Industrial Automation Market?

The market features a mix of global automation OEMs with strong local manufacturing and engineering presence, domestic conglomerates, and a wide ecosystem of system integrators and automation EPC players. Competition is shaped by technology breadth, installed base, service responsiveness, and the ability to execute complex greenfield and brownfield projects. System integrators play a critical role in solution customization, integration, and lifecycle support across industries.

03 What are the Growth Drivers for the India Industrial Automation Market?

Key growth drivers include expansion of manufacturing capacity across automotive, electronics, pharmaceuticals, and process industries; increasing adoption of Industry 4.0 and digital manufacturing concepts; rising emphasis on energy efficiency and sustainability; and growing need to address labor, safety, and quality challenges. Infrastructure and utilities modernization further reinforces demand for process automation and control systems.

04 What are the Challenges in the India Industrial Automation Market?

Challenges include high upfront investment costs, integration complexity in brownfield plants, skill gaps in advanced automation and digital technologies, and concerns around cybersecurity in connected environments. Price sensitivity among small and mid-sized manufacturers can slow adoption, while fragmented legacy systems increase implementation risk. Addressing these challenges requires strong vendor capability, localized engineering support, and phased, ROI-driven automation strategies.