India ISO Tank Container Market Outlook to 2035

By Cargo Type, By Tank Specification, By End-Use Industry, By Leasing vs Owned Model, and By Trade Route

- Product Code: TDR0405

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India ISO Tank Container Market Outlook to 2035 – By Cargo Type, By Tank Specification, By End-Use Industry, By Leasing vs Owned Model, and By Trade Route” provides a comprehensive analysis of the ISO tank container industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and safety landscape, shipper-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the India ISO tank container market. The report concludes with future market projections based on chemical trade flows, bulk liquid logistics demand, manufacturing expansion, regulatory shifts, infrastructure readiness, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and risks shaping the market through 2035.

India ISO Tank Container Market Overview and Size

The India ISO tank container market is valued at approximately ~USD ~ billion, representing the movement of bulk liquid cargo using standardized stainless-steel tank containers across domestic, export, and import trade lanes. ISO tank containers are increasingly preferred over traditional drums, flexitanks, and intermediate bulk containers due to superior safety, higher payload efficiency, lower contamination risk, and improved sustainability performance.

The market is anchored by India’s expanding chemical and petrochemical manufacturing base, rising exports of specialty chemicals, food-grade liquids, and pharmaceuticals, and increasing compliance with global safety and quality standards. ISO tanks are widely used for transporting hazardous and non-hazardous liquid cargo including specialty chemicals, solvents, edible oils, food ingredients, acids, alcohols, lubricants, and pharmaceutical intermediates.

Western India dominates the ISO tank container market, led by Maharashtra and Gujarat, which together account for the majority of India’s chemical production, bulk liquid handling terminals, and port-based export activity. Ports such as Nhava Sheva, Mundra, Hazira, and Kandla serve as major gateways for ISO tank movements. Southern India, particularly Tamil Nadu and Andhra Pradesh, represents a growing market driven by specialty chemicals, pharmaceuticals, and food processing exports. Northern and Eastern India primarily contribute through domestic repositioning, inland container depots (ICDs), and consumption-driven imports.

What Factors are Leading to the Growth of the India ISO Tank Container Market:

Expansion of India’s chemical and specialty chemical exports strengthens ISO tank demand:

India has emerged as a key global supplier of specialty chemicals, agrochemicals, pharmaceuticals intermediates, and performance chemicals. These products often require controlled, contamination-free, and internationally compliant transportation solutions. ISO tank containers provide a globally accepted, safe, and efficient mode of bulk liquid transport, making them the preferred choice for exporters supplying regulated markets such as Europe, North America, and East Asia. As India’s chemical export basket continues to diversify and move up the value chain, ISO tank usage is expanding in parallel.

Shift from drums and flexitanks to safer and more sustainable bulk liquid logistics:

Shippers are increasingly transitioning from drums and flexitanks to ISO tanks due to higher payload efficiency, reduced packaging waste, and lower handling risk. ISO tanks eliminate the need for disposable packaging, reduce labor and handling costs, and minimize product loss due to leakage or contamination. From a sustainability perspective, ISO tanks offer significantly lower carbon footprint per ton-kilometer, aligning with global ESG commitments of multinational chemical and food companies operating in India.

Growth of food-grade and pharmaceutical liquid logistics:

Beyond chemicals, ISO tanks are gaining traction in food-grade applications such as edible oils, liquid sweeteners, beverages, dairy derivatives, and food ingredients. Pharmaceutical companies increasingly use ISO tanks for transporting solvents, intermediates, and liquid APIs that require high hygiene standards and temperature control. The rising focus on traceability, quality assurance, and regulatory compliance is reinforcing ISO tanks as a preferred logistics solution in these segments.

Which Industry Challenges Have Impacted the Growth of the India ISO Tank Container Market:

High capital cost and limited domestic tank manufacturing base:

ISO tank containers require significant upfront capital investment due to stringent design, material, and certification requirements. India has limited domestic manufacturing capacity for ISO tanks, leading to heavy dependence on imported tanks. This raises acquisition costs and extends lead times, particularly during periods of global equipment shortages. Smaller logistics players often face barriers to entry due to the capital-intensive nature of tank ownership.

Infrastructure constraints and limited bulk liquid handling facilities:

While major ports in India are equipped to handle ISO tanks, inland infrastructure remains uneven. Limited availability of tank cleaning stations, repair facilities, and specialized bulk liquid terminals restricts deeper penetration of ISO tank logistics into inland manufacturing clusters. Congestion at ports and ICDs can further increase dwell times and repositioning costs, impacting asset utilization.

Regulatory complexity and safety compliance requirements:

ISO tank operations are governed by stringent international and domestic regulations related to hazardous materials handling, periodic testing, and certification. Compliance with IMDG, ADR, RID, and domestic safety norms adds operational complexity and cost. Smaller operators often struggle to maintain consistent compliance standards, creating variability in service quality and risk exposure across the market.

What are the Regulations and Initiatives which have Governed the Market:

International maritime and dangerous goods regulations:

ISO tank containers used in international trade must comply with global regulations governing the transport of dangerous goods and bulk liquids. These regulations dictate tank design, material specifications, testing intervals, labeling, and documentation requirements. Compliance ensures safety and interoperability across shipping lines, ports, and inland transport networks.

Indian port authority and customs regulations:

Indian ports and customs authorities impose operational guidelines related to handling, storage, inspection, and clearance of ISO tanks. These regulations impact turnaround times, terminal handling charges, and documentation processes. Alignment with international standards is gradually improving, supporting smoother integration of ISO tanks into global supply chains.

Government focus on chemical sector growth and export promotion:

Broader policy initiatives aimed at strengthening India’s chemical and pharmaceutical manufacturing base indirectly support ISO tank market growth. Export incentives, port modernization programs, and logistics efficiency improvements contribute to increased bulk liquid trade volumes and higher adoption of ISO tanks.

India ISO Tank Container Market Segmentation

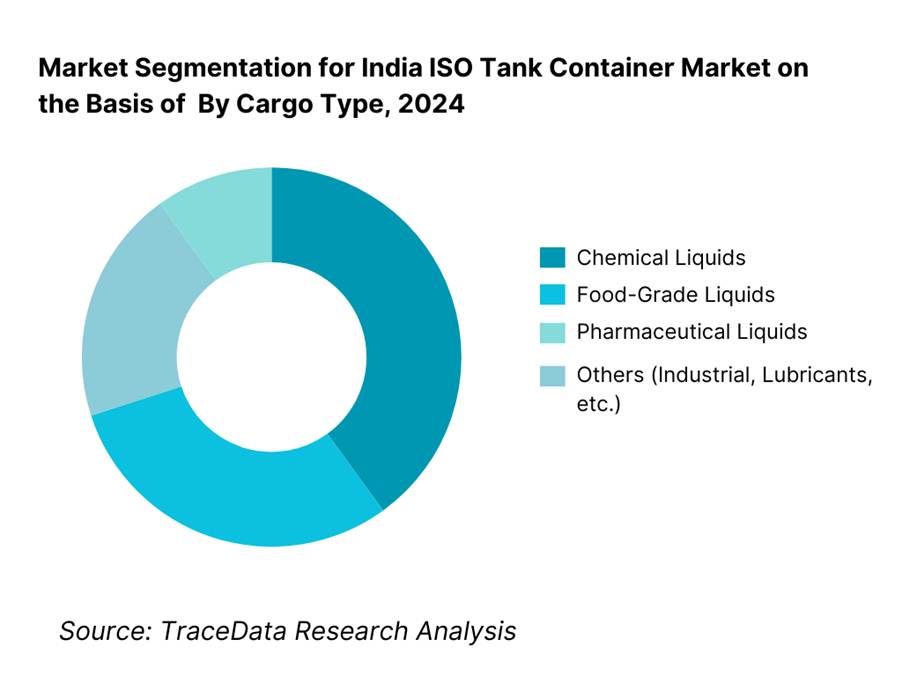

By Cargo Type: Chemical cargo dominates the India ISO tank container market, accounting for the largest share of movements. This includes specialty chemicals, solvents, acids, and industrial liquids. Food-grade liquids represent a growing segment, driven by edible oil imports and exports, food ingredient trade, and beverage logistics. Pharmaceutical liquids and other industrial applications contribute a smaller but high-value share.

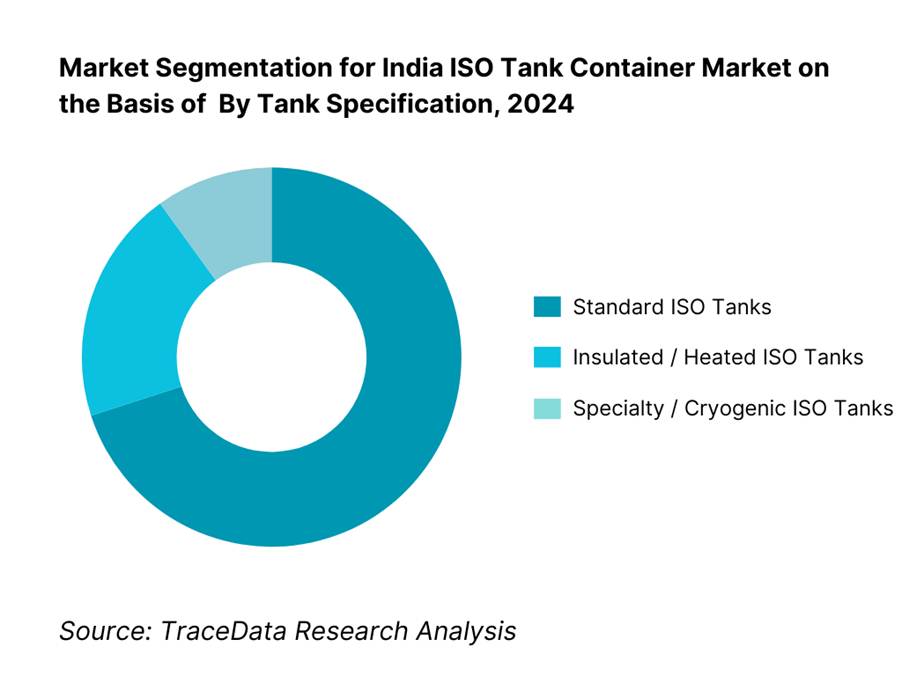

By Tank Specification: Standard ISO tanks are the most widely used, serving a broad range of non-temperature-sensitive cargo. Special tanks, including insulated, heated, and cryogenic tanks, are used for cargo requiring temperature control or specialized handling, though they represent a smaller share due to higher costs.

Competitive Landscape in India ISO Tank Container Market

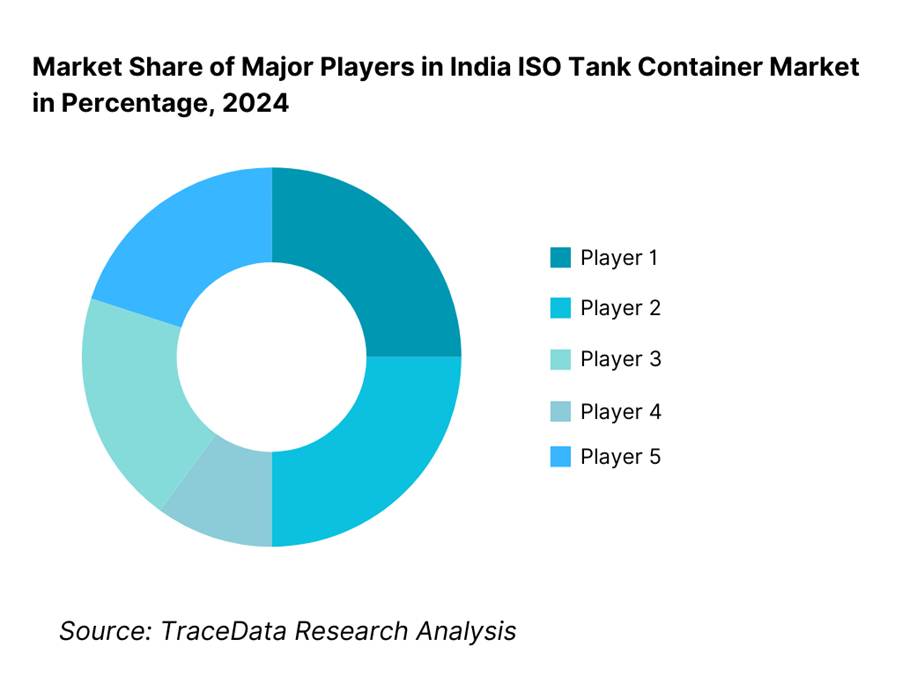

The India ISO tank container market exhibits moderate concentration, with a mix of global tank operators, leasing companies, and regional logistics providers. Market leadership is driven by fleet size, global network access, safety compliance track record, and relationships with chemical and pharmaceutical shippers. Leasing-based business models dominate, as most shippers and logistics providers prefer asset-light access to ISO tanks.

Name | Founding Year | Original Headquarters |

|---|---|---|

Bertschi Group | 1956 | Switzerland |

Stolt Tank Containers | 1962 | Netherlands |

Hoyer Group | 1946 | Germany |

Den Hartogh Logistics | 1927 | Netherlands |

Suttons Group | 1926 | United Kingdom |

Bulkhaul | 1981 | United Kingdom |

Mitsui O.S.K. Lines (Tank Division) | 1884 | Japan |

EXSIF Worldwide | 1993 | United States |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Bertschi Group: Bertschi continues to strengthen its India presence through long-term contracts with multinational chemical companies. The company focuses on integrated door-to-door ISO tank logistics, combining maritime, rail, and road transport with strong compliance and safety standards.

Stolt Tank Containers: Stolt maintains a large global ISO tank fleet serving Indian export-import routes. The company emphasizes digital fleet monitoring, predictive maintenance, and high-quality tank cleaning standards to support food-grade and pharmaceutical cargo growth.

Hoyer Group: Hoyer has expanded its presence in India through partnerships and dedicated chemical logistics solutions. Its focus on specialized tanks and value-added services positions it well for premium cargo segments.

What Lies Ahead for India ISO Tank Container Market?

The India ISO tank container market is expected to expand steadily through 2035, supported by rising bulk liquid trade, increasing chemical exports, and growing emphasis on safety, sustainability, and supply chain efficiency. As India integrates further into global manufacturing networks, ISO tanks will play a critical role in enabling compliant and cost-efficient liquid logistics.

Increasing preference for leasing and asset-light access models:

Leasing will continue to dominate the market as shippers seek flexibility, lower capital commitment, and access to specialized tank specifications. Leasing companies with large global fleets and strong repositioning capabilities will gain competitive advantage.

Expansion of ISO tank usage beyond chemicals into food and pharma:

Food-grade and pharmaceutical liquid logistics are expected to grow faster than traditional chemical cargo, driven by export demand and quality assurance requirements. This will increase demand for insulated, heated, and high-specification ISO tanks.

Digitalization and safety-led differentiation:

Fleet monitoring, digital documentation, and real-time tracking will become increasingly important as shippers demand greater transparency and risk mitigation. Operators investing in digital platforms and compliance automation will strengthen customer stickiness and operational efficiency.

.png)

India ISO Tank Container Market Segmentation

By Cargo Type

• Chemical Liquids

• Food-Grade Liquids

• Pharmaceutical Liquids

• Industrial and Others

By Tank Specification

• Standard ISO Tanks

• Insulated ISO Tanks

• Heated ISO Tanks

• Specialty and Cryogenic Tanks

By Business Model

• Leasing-Based

• Owned Fleet

By End-Use Industry

• Chemicals and Petrochemicals

• Food & Beverage

• Pharmaceuticals

• Industrial Manufacturing

By Trade Route

• Export

• Import

• Domestic / Coastal

Players Mentioned in the Report

• Bertschi Group

• Stolt Tank Containers

• Hoyer Group

• Den Hartogh Logistics

• Suttons Group

• Bulkhaul

• Mitsui O.S.K. Lines

• EXSIF Worldwide

• Regional ISO tank operators and leasing companies

Key Target Audience

• Chemical and specialty chemical manufacturers

• Pharmaceutical companies

• Food and beverage exporters and importers

• ISO tank leasing companies

• Bulk liquid logistics providers

• Shipping lines and freight forwarders

• Private equity and infrastructure investors

• Port authorities and logistics policymakers

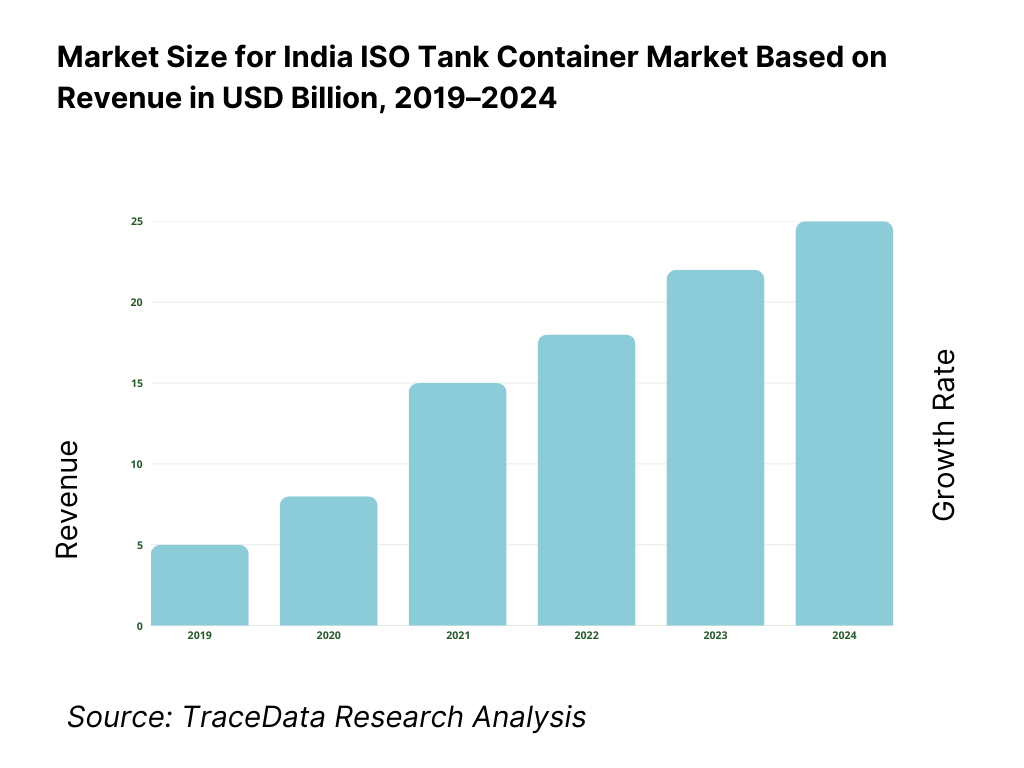

Time Period

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

ISO Tank Container Manufacturers, ISO Tank Leasing Companies, Chemical & Specialty Chemical Manufacturers, Pharmaceutical Companies, Food & Beverage Producers, Shipping Lines, Freight Forwarders, Port & Terminal Operators, Inland Container Depots (ICDs), Tank Cleaning & Maintenance Service Providers, Inspection & Certification Agencies, Government & Regulatory Bodies

4.1. Delivery Model Analysis for ISO Tank Containers (Leasing-Based, Owned Fleet, Dedicated Contract, Spot Hire)-Margins, Preference, Strength & Weakness

4.2. Revenue Streams for India ISO Tank Container Market (Leasing Fees, Transportation Charges, Cleaning & Maintenance, Storage & Demurrage, Value-Added Services)

4.3. Business Model Canvas for India ISO Tank Container Market5.1. Global ISO Tank Operators vs Regional Tank Operators

5.2. Investment Model in India ISO Tank Container Market (Fleet Acquisition, Maintenance & Testing, Digital Tracking Systems, Compliance & Safety Infrastructure)

5.3. Comparative Analysis of Go-to-Market Models by Global vs Regional Players (Integrated Door-to-Door vs Port-to-Port Services)

5.4. Bulk Liquid Logistics Cost Allocation by Cargo Type and Trade RouteChemical Export Growth, Specialty Chemicals Manufacturing, Food-Grade Liquid Trade, Pharmaceutical Production Expansion, Port Infrastructure Readiness, Sustainability & ESG Adoption

Bulk Liquid Trade Demand vs ISO Tank Availability, Leasing Fleet vs Owned Fleet Penetration, Export vs Import Imbalances, Port-Based vs Inland Infrastructure Coverage

8.1. Revenues (INR Mn, USD Mn)

9.1. By Cargo Type (Chemical Liquids, Food-Grade Liquids, Pharmaceutical Liquids, Industrial Liquids)

9.2. By Tank Specification (Standard ISO Tanks, Insulated Tanks, Heated Tanks, Specialty/Cryogenic Tanks)

9.3. By Business Model (Leasing-Based, Owned Fleet)

9.4. By End-Use Industry (Chemicals, Pharmaceuticals, Food & Beverage, Industrial Manufacturing)

9.5. By Trade Route (Export, Import, Domestic/Coastal)

9.6. By Hazard Class (Hazardous, Non-Hazardous)

9.7. By Region (West India, North India, South India, East India)10.1. Shipper Profiling and Cargo Characteristics Analysis

10.2. ISO Tank Selection and Adoption Decision-Making Process (Safety, Compliance, Cost, Availability, Trade Route)

10.3. Cost-Benefit and ROI Analysis of ISO Tank Containers vs Drums and Flexitanks

10.4. Gap Analysis Framework11.1. Trends and Developments (Shift to Leasing, Food-Grade ISO Tanks, Digital Fleet Monitoring, Sustainability-Led Logistics)

11.2. Growth Drivers (Chemical Exports, Safety Regulations, ESG Compliance, Bulk Liquid Trade Expansion)

11.3. SWOT Analysis

11.4. Issues and Challenges (High Capital Cost, Infrastructure Gaps, Compliance Complexity, Repositioning Inefficiencies)

11.5. Government Regulations (Dangerous Goods Regulations, Port Authority Guidelines, Safety & Testing Standards)12.1. Market Size and Future Potential of ISO Tank Leasing in India

12.2. Business Models & Revenue Streams (Short-Term Lease, Long-Term Contract, Dedicated Fleet Models)

12.3. Operational Models and Customer Experience (Door-to-Door Logistics, Cleaning & Certification, Digital Tracking)15.1. Market Share of Key Players (Fleet Size, Trade Route Coverage, Industry Focus)

15.2. Benchmark of Key Competitors (Company Overview, Fleet Profile, USP, Pricing Strategy, Geographic Presence, Safety & Compliance, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant-Positioning of ISO Tank Operators

15.5. Bowman’s Strategic Clock-Competitive Advantage Mapping16.1. Revenues (INR Mn, USD Mn)

17.1. By Cargo Type

17.2. By Business Model

17.3. By End-Use Industry

17.4. By Trade Route

17.5. By Hazard Class

17.6. By Region

Research Methodology

Step 1: Ecosystem Creation

The research process begins with mapping the complete ecosystem of the India ISO Tank Container Market across demand-side and supply-side stakeholders. On the demand side, the ecosystem includes chemical manufacturers, specialty chemical exporters, pharmaceutical companies, food and beverage producers, edible oil traders, bulk liquid importers, and multinational corporations operating liquid supply chains in India. Demand is further segmented by cargo type (hazardous vs non-hazardous), temperature sensitivity, trade orientation (export, import, domestic), and shipment frequency. On the supply side, the ecosystem comprises global ISO tank leasing companies, logistics service providers, tank operators, shipping lines, port and terminal operators, inland container depots (ICDs), tank cleaning and maintenance service providers, inspection agencies, and regulatory authorities. From this ecosystem mapping, leading global ISO tank operators and regional service providers are shortlisted based on fleet size, geographic coverage, safety compliance record, industry focus, and presence across key Indian ports and industrial clusters. This step establishes the structural framework of the market and clarifies value flows across manufacturing, logistics, and trade interfaces.

Step 2: Desk Research

An extensive desk research exercise is conducted to analyze the India ISO Tank Container Market using industry publications, trade flow indicators, port throughput statistics, chemical and pharmaceutical production data, company disclosures, logistics reports, and sector-specific policy updates. This stage focuses on understanding bulk liquid trade volumes, export-import patterns, end-use industry growth, and shifts in preferred logistics modes. Tank-level dynamics such as fleet composition, tank specifications, leasing penetration, utilization rates, and repositioning challenges are assessed. Company-level analysis includes review of fleet expansion announcements, service offerings, global network integration, and India-specific operational strategies. Regulatory frameworks governing hazardous materials handling, port operations, and safety certifications are also analyzed to understand compliance-driven demand dynamics. The outcome of this stage is a robust base of assumptions related to market structure, segmentation logic, pricing frameworks, and operational economics.

Step 3: Primary Research

Primary research involves structured interviews with senior executives from ISO tank leasing companies, bulk liquid logistics providers, shipping line representatives, port terminal operators, chemical logistics managers, and procurement heads from chemical, pharmaceutical, and food companies. The objectives of these interactions are to validate demand assumptions, confirm cargo mix and trade route splits, and gather insights on leasing preferences, turnaround times, repositioning costs, and service-level expectations. A bottom-to-top approach is applied by estimating ISO tank usage across key cargo categories and trade lanes, aggregating movement volumes to derive overall market dynamics. In select cases, disguised interactions are conducted with tank operators and logistics providers to validate commercial practices such as leasing rates, cleaning charges, detention norms, and operational constraints. These insights provide a realistic view of pricing behavior, asset utilization, and service differentiation in the Indian context.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down analytical approaches to cross-validate market assumptions, segmentation splits, and forecast trajectories. Bulk liquid trade estimates are reconciled with chemical production growth, export-import indicators, and port handling capacity. Fleet assumptions are benchmarked against observed utilization levels, repositioning cycles, and maintenance schedules. Sensitivity testing is conducted across key variables such as chemical export growth, regulatory enforcement intensity, infrastructure improvements, and adoption of ISO tanks in food-grade and pharmaceutical applications. Forecast models are iteratively refined until alignment is achieved between cargo demand, fleet availability, and operational feasibility, ensuring internal consistency and robustness of the final market outlook.

FAQs

01 What is the potential for the India ISO Tank Container Market?

The India ISO Tank Container Market holds strong potential, supported by the continued expansion of chemical and specialty chemical manufacturing, rising exports of regulated liquid products, and increasing adoption of safe and sustainable bulk liquid logistics solutions. As India strengthens its position in global chemical, pharmaceutical, and food ingredient supply chains, ISO tank containers are becoming an essential enabler of compliant and cost-efficient transportation. The market is well positioned to grow steadily through 2035 as trade volumes rise and shippers increasingly prioritize safety, quality assurance, and environmental performance.

02 Who are the Key Players in the India ISO Tank Container Market?

The market is characterized by the presence of large global ISO tank operators and leasing companies, supported by regional logistics service providers and tank operators. Key players typically include international firms with large fleets, global repositioning capabilities, and strong compliance frameworks, alongside regional players offering localized services at Indian ports and industrial hubs. Competitive differentiation is driven by fleet size, service reliability, safety record, and the ability to provide integrated door-to-door solutions.

03 What are the Growth Drivers for the India ISO Tank Container Market?

Key growth drivers include increasing exports of specialty chemicals and pharmaceutical intermediates, growing demand for food-grade bulk liquid transportation, and a structural shift away from drums and flexitanks toward safer and more sustainable logistics solutions. Rising regulatory scrutiny on hazardous cargo handling and increasing ESG commitments among multinational shippers further support ISO tank adoption. Improvements in port infrastructure and logistics integration also contribute to market expansion.

04 What are the Challenges in the India ISO Tank Container Market?

The market faces challenges such as high capital costs associated with ISO tank ownership, limited domestic manufacturing capacity, and dependence on imported equipment. Infrastructure gaps related to tank cleaning, maintenance, and inland handling constrain deeper market penetration. Regulatory complexity and stringent safety compliance requirements add operational costs and limit participation by smaller operators. Additionally, port congestion and repositioning inefficiencies can impact fleet utilization and service reliability.

05 How is the Business Model Evolving in the India ISO Tank Container Market?

The business model is increasingly shifting toward leasing-based and asset-light structures, as shippers and logistics providers seek flexibility and reduced capital exposure. Long-term leasing contracts, dedicated fleet arrangements, and integrated logistics offerings are becoming more prevalent. Digital fleet monitoring, predictive maintenance, and compliance automation are also gaining importance as operators focus on efficiency, transparency, and risk management across increasingly complex supply chains.