India Multi-Brand Car Service Market Outlook to 2029

By Market Structure, By Service Providers, By Types of Services Offered, By Age of Vehicles, By Age of Consumers, and By Region

- Product Code: TDR007

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled "India Multi-Brand Car Service Market Outlook to 2029 - By Market Structure, By Service Providers, By Types of Services Offered, By Age of Vehicles, By Age of Consumers, and By Region" provides a comprehensive analysis of the multi-brand car service market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the market. The report concludes with future market projections based on revenue, service types, region, cause and effect relationship, and success case studies highlighting major opportunities and cautions.

India Multi-Brand Car Service Market Overview and Size

The India multi-brand car service market had gained a value of INR 15,000 Crore during 2023 driven by key factors such as gaining high vehicle ownership in the country and improving the number of out of warranty vehicles on-road. Moreover, it is predicted to rise owing to adopting cost-effective solution angles in repair and maintenance. Besides, the companies leading in offering these services also have a wide outreach towards their customers across networks, services offering, and business models. Names such as GoMechanic, Mahindra First Choice, Bosch Car Service, MyTVS that enjoy excellent wide networks, various services on offer, and serve customer-oriented models respectively.

In 2023, GoMechanic launched a subscription-based service program, with which customers will remain glued by making the servicing of their cars easier and cheaper, especially in metro cities like Delhi, Mumbai, and Bangalore.

Market Size for India Multi-Brand Car Service Industry on the Basis of Revenue, 2018-2024

What Factors are Leading to the Growth of India Multi-Brand Car Service Market:

Economic Factors: The rise in the cost of maintaining automobiles from authorized service centers has shifted consumer preference to less expensive alternatives. Multi-brand car service contributed approximately 55% to the total car service market in India in 2023, thus saving approximately 30% as compared to the authorized dealership. This therefore stands as a hot trend due to the price-sensitive nature of consumers who seek ways of cutting down costs related to maintaining vehicles.

Increasing Vehicle Ownership: There has been a continuous rise in vehicle ownership in India; the more substantial chunk lies with Tier 2 and Tier 3 cities. All these factors collectively create demand for affordable and trustworthy car service options. More vehicles are moving beyond their warranty, thus encouraging their owners to make a shift for multi-brand workshops. Around 60% of vehicles in India were past their warranty by 2023, creating a reasonably huge market for independent service providers.

Digitalization: The advent of different types of online platforms on which customers can book car services has made it relatively easy for customers to access this market. As of the end of 2023, around 35% of bookings were digitally driven, from apps and websites, indicating further digitalization. This provided multi-brand car service providers with opportunities to scale up their offerings, improve customer interaction, and manage back-office operations much more efficiently, driving a substantial growth impetus in the market.

Which Industry Challenges Have Impacted the Growth for India Multi-Brand Car Service Market:

Quality and Trust Issues: Concerns regarding the quality of service and the use of genuine parts at multi-brand service centers remain significant challenges. In fact, a survey conducted in 2023 showed that about 45% of car owners were skeptical of using multi-brand services due to the fear of receiving low-quality service and lack of standardization. This has resulted in lower trust levels, which may prevent as many as 25% of potential customers from abandoning authorized service centers.

Regulatory Compliance: Severe government regulations concerning the use of certified spare parts and scientific methods for waste disposal have put a lot of pressure on the service providers, mainly the small multi-brand service centers. In 2023, approximately 15% of the service centers were fined or temporarily shut owing to non-compliance with such regulations. This has increased the cost of operations for most of the players, mainly those desiring expansion.

Price Competition: High fragmentation in the multi-brand car service market has induced intense price competition, especially from the local garages and smaller workshops. About 30% of the consumers preferred a local workshop over larger multi-brand service centers due to lower prices in 2023. This has affected the profitability of organized players who cannot compete on cost without compromising on the service quality.

What are the Regulations and Initiatives which have Governed the Market:

Service Center Certification Standards: The Indian government demands that multi-brand service centers be accredited with safety and quality standards, so that the vehicles are serviced and maintained to meet the set industry regulations. This covers the certification of spare parts used, hazardous material disposals, and adequate safety during the service operations. By 2023, around 70% of multi-brand service centers were in full compliance with such regulations, indicating the growing orientation toward quality and safety.

Waste Management Regulations: The multi-brand service centers in India are under a bind to adhere to environmental regulations for the disposal of automotive waste, such as oil, batteries, and other hazardous materials. In 2023, around 15% of the service centers were fined due to improper waste management; therefore, the regulatory bodies have started to enforce stringent, increasing the operational cost of service providers.

EV Service Initiatives: With the growing electric vehicle adoption, the Indian government has rolled out training programs and incentives that have compelled many multi-brand service chains to announce plans for the expansion of their capabilities to handle EV maintenance. Less than 10% in 2023, the small structure will further grow as the adoption accelerates across India.

India Multi-Brand Car Service Market Segmentation

- By Market Structure: The local garages, due to their good penetration at the community level, besides feasibility and affordability of their services, dominate the market. Most often, they also provide customized services, flexibility in prices, and greater sensitivity to the needs of the local market. The organized multi-brand service chains enjoy a sizable market share since they guarantee standardized services, use genuine spare parts, and follow transparent pricing policies. Such an assurance towards quality and reliability draws those customers who are willing to pay more but need peace of mind.

By Service Type: Routine maintenance services, such as oil changes and tire replacements, have the largest share due to the routine nature of the demand for such services. Repair services, primarily those related to engines and transmissions, also have a significant market share due to these being services that are badly needed for older vehicles. Car detailing and cleaning services have gained popularity, particularly among urban consumers who pay great attention to the appearance and protection of their vehicle. Market.

By Mileage: The range of 50,000-80,000 KM is a sweet spot for price and remaining lifespan. Vehicles in this range are perceived to have reasonable wear and tear, thus making them affordable for many buyers looking for regular maintenance. Higher mileage vehicles, especially in the range of 80,000-150,000 KM, need more extensive repairs and part replacements, thereby increasing demand for major service work at multi-brand centers.

Competitive Landscape in India Multi-Brand Car Service Market

In such, India's multi-brand car service is highly fragmented: dominated by scores of big ones along with large numbers of their small and lesser-known regional sub-franchisers. However, entry of new organized chain players and expansions of online services like GoMechanic, Mahindra First Choice, Bosch Car Service and MyTVS had resulted in segment variation before consumers and ensured ease of hassle-free services to all consumer groupings.

| Name | Founding Year | Headquarters |

| Mahindra First Choice | 1998 | Mumbai, Maharashtra |

| GoMechanic | 2016 | Gurugram, Haryana |

| Pitstop | 2015 | Bengaluru, Karnataka |

| Carz | 2008 | Hyderabad, Telangana |

| MFC Services | 2015 | Bengaluru, Karnataka |

| MyTVS | 2003 | Chennai, Tamil Nadu |

| CarzSpa | 2007 | Surat, Gujarat |

| Speed Car Wash | 2011 | Noida, Uttar Pradesh |

| ServiceMyCar | 2018 | Ahmedabad, Gujarat |

| Carpathy | 2017 | New Delhi, Delhi |

| 3M Car Care | 1902 | Bengaluru, Karnataka |

| Bosch Car Service | 1921 | Bengaluru, Karnataka |

| Castrol Auto Service | 1899 | Mumbai, Maharashtra |

Some of the recent competitor trends and key information about competitors include:

GoMechanic: It is India's leading booking platform for multi-brand car services, and on its platform alone in 2023, they noted over three million service bookings-up 35% from 2022-with more than nine new subscriptions every two minutes. Offering these services on such an easy subscription model may have been major contributors to what the platform believes have made it a favorite of urban users.

Mahindra First Choice: With its pan-India franchise network, Mahindra First Choice reported a 28% increase in customer footfall in the year 2023. The company's strategy of expanding into Tier 2 and Tier 3 cities has created significant gains in market share.

Bosch Car Service: Its powerful reputation for the application of high-standard spare parts makes Bosch Car Service report a full 20% net return in 2023. Thanks to the never-ending efforts carried out by itself in terms of service quality improvements and customer concerns, Bosch further strengthened its company position in said market.

MyTVS: Specializing in car detailing and maintenance, MyTVS reported a 15% increase in sales in 2023, driven primarily by southern India. The company has emerged as the preferred choice of many customers, thanks to its convenience-oriented approach, such as door-to-door service.

What's in Store for India Multi-Brand Car Service Market?

The multi-brand car service market in India is likely to witness steady growth by 2029, growing at a healthy CAGR throughout the forecast period. This could partly be attributed to some factors such as an increase in out-of-warranty vehicles, vehicle ownership, and demand for affordable service options.

- Shift to Electric Vehicles: In all probabilities, the Indian government will continue to incentivize electric vehicle adoption through a raft of incentives and policies, and hence EV maintenance demand would increase gradually. Multi-brand car servicing companies that expand their offerings toward repair and servicing of EVs will be gainfully positioned to exploit this growth trend.

Integrating Technology: The servicing of cars will be reborn with the help of advanced technologies, such as artificial intelligence and predictive maintenance tools. AI-powered diagnostics and big data analytics will come in handy to enhance the accuracy of service, reduce repair times, and gain customer trust through transparent pricing and recommendations for service.

Subscription-based Service Programs to Grow: A car subscription model, wherein consumers pay a fixed fee for periodic maintenance and repairs, would see increased adoption in urban cities. The subscription model would bring convenience and cost predictability that would definitely strike a chord with people who look for hassle-free car ownership.

Focus on Sustainable Practices: Sustainable practices will also be of essence as more and more customers are becoming aware of environmental issues. These range from ecological workshops to using environmentally friendly materials in repairs, among other activities aimed at ensuring minimal environmental damage caused by car servicing. This is very likely to affect consumer preferences for choice of service providers, especially among the younger and more environmentally conscious car owners.

Future Outlook and Projections for India Multi Brand Car Service Market on the Basis of Revenues in USD Million, 2024-2029

India Multi-Brand Car Service Market Segmentation

By Market Structure:

- Local Garages

- Organized Multi-Brand Service Chains

- OEM Certified Service Centers

- Mobile Repair Services

- Independent Mechanics

- Commercial Vehicle Service Providers

By Service Type:

- Periodic Maintenance Service

- Mechanical and Electrical Repair

- Car Detailing and Car Care

- Collision Repair

- Electrical and Diagnostics

- Tire and Battery Services

By Vehicle Manufacturer:

- Maruti Suzuki

- Hyundai

- Honda

- Tata Motors

- Mahindra

- Toyota

- Ford

- Renault

By Type of KMs Driven:

- <50,000

- 50,000-80,000

- 80,000-150,000

- 150,000

By Age of Vehicle:

- Less than 1 year

- 1-3 years

- 3-5 years

- More than 5 years

By Age of Consumer:

- 18-34

- 35-54

- 55+

By Region:

- Northern India

- Southern India

- Western India

- Eastern India

- Central India

Players Mentioned in the Report:

- GoMechanic

- Mahindra First Choice

- Bosch Car Service

- MyTVS

- Pitstop

- Carpathy

- Fixcraft

- CarzSpa

Key Target Audience:

- Multi-Brand Car Service Providers

- Automotive Spare Parts Manufacturers

- Vehicle Owners and Fleet Operators

- Automotive Insurance Companies

- Regulatory Bodies (e.g., Ministry of Road Transport and Highways)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross and Net Margins and Challenges they Face

4.2. Sourcing of Spare Parts and how the supply chain works in India with Multi Brand Car Service Market in India

4.3. Cross Comparison of Major Spare Parts Aggregators/ Online Marketplaces

4.4. Revenue Streams for India Multi-Brand Car Service Market

4.5. Business Model Canvas for India Multi-Brand Car Service Market

4.6. Buying Decision Making Process

4.7. Franchisee Requirements for Operating a Multi-Brand Car Service Center

5.1. New Car Sales in India, 2018-2024

5.2. Number of Cars on Road with Split Basis 0-1 Year, 1-3 Years, 3-5 Years and 5 Years above

5.3. Spend on Automotive Services in India, 2024

5.4. Number of Multi-Brand Car Service Providers in India by Location

8.1. Revenues, 2018-2024

8.2. Number of Cars Serviced, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Organized Split (Multi Brand Organized and OEM Organized), 2023-2024P

9.3. By Service Type (Routine Maintenance, Repairs, Car Detailing, Crash Repair and Others), 2023-2024P

9.4. By Region, 2023-2024P

9.5. By Vehicle Manufacturer (Maruti, Hyundai, Honda, Tata, and Others), 2023-2024P

9.6. By Age of Vehicle (Less than 1 year, 1-3 years, 3-5 years, and more than 5 years), 2023-2024P

9.7. By Mileage (Less than 50k, 50k-80k, 80k-150k, Above 150k KMs), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Needs, Desires, and Pain Points Analysis

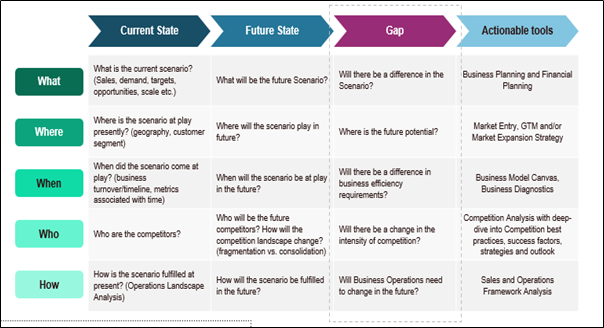

10.4. Gap Analysis Framework

11.1. Trends and Developments for India Multi-Brand Car Service Market

11.2. Growth Drivers for India Multi-Brand Car Service Market

11.3. SWOT Analysis for India Multi-Brand Car Service Market

11.4. Issues and Challenges for India Multi-Brand Car Service Market

11.5. Government Regulations for India Multi-Brand Car Service Market

12.1. Market Size and Future Potential for Doorstep Car Service Platforms based on Revenues, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross-Comparison of Leading Doorstep Car Service Platforms based on Company Overview, Revenue Streams, Service Volume, Pricing, Number of Cars Serviced, Infrastructure, Operating Cities, Number of Centers and other variables

15.1. Benchmark of Key Competitors in India Multi-Brand Car Service Market, including Founding

Year, Headquarters, Number of Workshops, Number of Cars Serviced/ Order Intake, Service Lead, Time, Geographical Presence, Employees and Sourcing for Spare Parts

15.2. Strength and Weakness Analysis

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowmans Strategic Clock for Competitive Advantage

15.6. Pricing Analysis (Multi-Brand Service Companies & Authorized OEM Service Companies)

15.7. Unorganized Car Service in India Overview including Inventory Management, Adoption of Technology, Marketing Activities and Key Statistics including Number of Cars Serviced in 1 Day, Average Price Charged, Average Monthly Revenue, Margin, Average Turnaround Time and Number of Employees

16.1. Revenues, 2025-2029

16.2. Service Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Service Type (Routine Maintenance, Repairs, Car Detailing, and Others), 2025-2029

17.3. By Average Ticket Size, 2025-2029

17.4. By Region, 2025-2029

17.5. By Vehicle Manufacturer (Maruti, Hyundai, Honda, Tata, and Others), 2025-2029

17.6. By Age of Vehicle (Less than 1 year, 1-3 years, 3-5 years, and More than 5 years), 2025-2029

17.7. By Mileage (Less than 50k, 50k-80k, 80k-150k, Above 150k KMs), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the India Multi-Brand Car Service Market. Based on this ecosystem, we will shortlist leading 5-6 service providers in the country using financial information, service capacity, and coverage.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

We engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We explore aspects such as market revenues, number of service centers, price levels, demand trends, and other variables. We supplement this with detailed examinations of company-level data, using sources like press releases, annual reports, financial statements, and similar documents to construct a foundational understanding of the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various India Multi-Brand Car Service Market companies and end-users. This interview process serves multiple purposes: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from industry representatives. A bottom-to-top approach is undertaken to evaluate service volumes for each player, thereby aggregating the overall market.

As part of our validation strategy, our team conducts disguised interviews where we approach each company under the guise of potential customers. This method enables us to validate the operational and financial information shared by company executives and cross-check it with available secondary data. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing strategies, and other factors.

Step 4: Sanity Check

- A top-to-bottom and bottom-to-top analysis, combined with market size modeling exercises, is undertaken to perform a sanity check of the gathered data.

FAQs

01 What is the potential for the India Multi-Brand Car Service Market?

The India Multi-Brand Car Service Market is poised for significant growth, driven by rising vehicle ownership, increasing out-of-warranty vehicles, and the demand for affordable maintenance solutions. The market is expected to grow at a healthy CAGR during the forecast period.

02 Who are the Key Players in the India Multi-Brand Car Service Market?

Key players in the India Multi-Brand Car Service Market include GoMechanic, Mahindra First Choice, Bosch Car Service, and MyTVS. These companies dominate the market with extensive service networks, strong brand presence, and diverse service offerings.

03 What are the Growth Drivers for the India Multi-Brand Car Service Market?

The primary growth drivers include the growing number of out-of-warranty vehicles, the rising demand for cost-effective repair services, and the increasing digitalization of service bookings. Additionally, the expansion of organized service chains into Tier 2 and Tier 3 cities is contributing to market growth.

04 What are the Challenges in the India Multi-Brand Car Service Market?

Challenges include quality and trust issues related to service consistency and the use of genuine parts, regulatory compliance burdens, and intense price competition from local garages. Additionally, limited reach in rural areas and the rising cost of spare parts pose significant barriers to market expansion.