India Neuromodulation Devices Market Outlook to 2035

By Device Type, By Application Area, By Technology, By End-User, and By Region

- Product Code: TDR0483

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Neuromodulation Devices Market Outlook to 2035 – By Device Type, By Application Area, By Technology, By End-User, and By Region” provides a comprehensive analysis of the neuromodulation devices landscape in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; technology trends and clinical developments, regulatory and reimbursement environment, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players active in the Indian neuromodulation ecosystem.

The report concludes with future market projections based on neurological disease burden, chronic pain prevalence, mental health awareness, healthcare infrastructure expansion, adoption of minimally invasive therapies, public and private investment in advanced medical devices, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the Indian neuromodulation devices market through 2035.

India Neuromodulation Devices Market Overview and Size

The India neuromodulation devices market is valued at approximately ~USD ~ billion, representing the supply of implantable and non-implantable medical devices designed to modulate neural activity through targeted electrical or magnetic stimulation. These devices include spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, sacral nerve stimulators, transcranial magnetic stimulation systems, and related peripheral nerve stimulation technologies used across chronic pain, neurological disorders, psychiatric conditions, and functional impairments.

The market is anchored by India’s large and growing burden of neurological and neuropsychiatric conditions, increasing life expectancy, rising diagnosis rates of movement disorders and chronic pain syndromes, and gradual acceptance of device-based therapies as complements or alternatives to long-term pharmacological treatment. Neuromodulation devices are increasingly positioned as precision therapies offering symptom control, functional improvement, and quality-of-life enhancement for patients with refractory or drug-resistant conditions.

Private tertiary hospitals and specialty neuroscience centers form the core demand base for neuromodulation devices in India. These institutions drive early adoption due to their access to trained neurologists, neurosurgeons, and pain specialists, as well as their ability to invest in high-value capital equipment and implant programs. Public hospitals and medical colleges are gradually expanding neuromodulation capabilities through selective government funding, pilot programs, and partnerships with device manufacturers, although adoption remains uneven across regions.

From a regional perspective, South India and select Western metros represent the largest neuromodulation demand clusters due to higher healthcare penetration, concentration of multispecialty hospitals, stronger medical tourism inflows, and greater patient awareness. Northern India shows expanding demand driven by large urban populations and growing private hospital networks, while Eastern and Central regions remain underpenetrated but offer long-term volume potential as healthcare access improves and referral pathways mature.

What Factors are Leading to the Growth of the India Neuromodulation Devices Market

Rising burden of neurological disorders and chronic pain conditions strengthens clinical demand: India faces a growing incidence of Parkinson’s disease, epilepsy, dystonia, chronic back pain, neuropathic pain, depression, and treatment-resistant psychiatric disorders. Lifestyle changes, aging demographics, diabetes prevalence, and increased survival rates following trauma and stroke contribute to a larger pool of patients requiring long-term symptom management. Neuromodulation devices address unmet needs where conventional drug therapies offer limited efficacy or unacceptable side effects, directly expanding the addressable patient base for device-based interventions.

Shift toward minimally invasive and reversible therapies improves adoption: Neuromodulation therapies are increasingly favored due to their minimally invasive nature, programmability, and reversibility compared to ablative neurosurgical procedures. Devices such as spinal cord stimulators and deep brain stimulators allow clinicians to fine-tune stimulation parameters based on patient response, reducing long-term risk and improving outcomes. This clinical flexibility strengthens physician confidence and supports broader adoption across pain management and movement disorder specialties.

Expansion of private healthcare infrastructure and centers of excellence accelerates market penetration: India’s private hospital sector continues to invest in advanced neuroscience and pain management capabilities as part of differentiation strategies. Dedicated neurology institutes, movement disorder clinics, and pain centers increasingly include neuromodulation programs as part of comprehensive care offerings. These centers also serve as referral hubs, training sites, and demonstration platforms that influence adoption beyond tier-1 cities.

Which Industry Challenges Have Impacted the Growth of the India Neuromodulation Devices Market:

High upfront device costs and limited reimbursement reduce therapy accessibility and adoption velocity: Neuromodulation devices—particularly implantable systems such as spinal cord stimulators and deep brain stimulators—carry high upfront costs encompassing the device, surgical procedure, hospital stay, and long-term follow-up programming. In India, reimbursement coverage for neuromodulation remains limited and fragmented, with most procedures funded through out-of-pocket payments or selective private insurance policies. This cost burden restricts adoption largely to affluent patient segments and private tertiary hospitals, slowing volume growth despite strong clinical need. Budget sensitivity often leads to delayed treatment decisions or prolonged reliance on pharmacological therapies even in drug-resistant cases.

Limited availability of trained specialists and uneven clinical expertise constrain procedural scalability: Neuromodulation therapies require specialized expertise across neurology, neurosurgery, pain management, psychiatry, and post-implant device programming. In India, the availability of clinicians trained in patient selection, implantation techniques, and long-term neuromodulation management remains concentrated in select metro-based centers of excellence. Many hospitals lack multidisciplinary teams and experienced programming support, creating variability in outcomes and limiting confidence in broader adoption. This uneven skill distribution constrains expansion beyond tier-1 cities and increases dependence on manufacturer-led clinical support.

Awareness gaps among referring physicians and patients delay diagnosis and referral pathways: While awareness of neurological and mental health conditions is improving, familiarity with neuromodulation as a treatment option remains limited among general practitioners and first-line specialists. As a result, patients are often referred late in the disease progression cycle, after prolonged medication trials, reducing the perceived value of device-based intervention. Patient-level awareness is similarly constrained by limited public education, contributing to hesitation around implantable therapies and surgical intervention. These awareness gaps reduce referral volumes and slow market penetration despite growing disease prevalence.

What are the Regulations and Initiatives which have Governed the Market:

Medical device regulatory framework governing approval, import licensing, and quality compliance: Neuromodulation devices in India are regulated under the national medical device framework, with implantable neurostimulation systems classified under higher-risk categories. These devices require import licensing, conformity to quality standards, and submission of clinical and technical documentation. While regulatory clarity has improved compared to earlier periods, approval timelines, documentation requirements, and post-market compliance obligations continue to influence market entry strategies. These regulatory processes shape pricing, time-to-market, and manufacturer investment decisions, particularly for newer technologies.

Clinical practice guidelines and hospital-level protocols influencing therapy adoption: Adoption of neuromodulation therapies is strongly influenced by clinical guidelines, institutional protocols, and internal review committees within hospitals. Many institutions require evidence of international clinical validation, peer-reviewed outcomes, and long-term safety data before approving neuromodulation programs. While these protocols ensure patient safety and clinical rigor, they can slow adoption of newer therapies or indications, particularly in conservative institutional settings or public hospitals.

Public healthcare initiatives and selective government funding supporting advanced neurological care: Government-led initiatives aimed at strengthening tertiary healthcare infrastructure and specialty care capacity indirectly support neuromodulation adoption, particularly in academic medical centers and large public hospitals. Select funding programs, pilot projects, and equipment procurement initiatives have enabled limited deployment of advanced neurology and neurosurgery technologies. However, coverage remains uneven across states, and neuromodulation is not yet embedded as a standard offering within most public healthcare systems, limiting large-scale impact.

India Neuromodulation Devices Market Segmentation

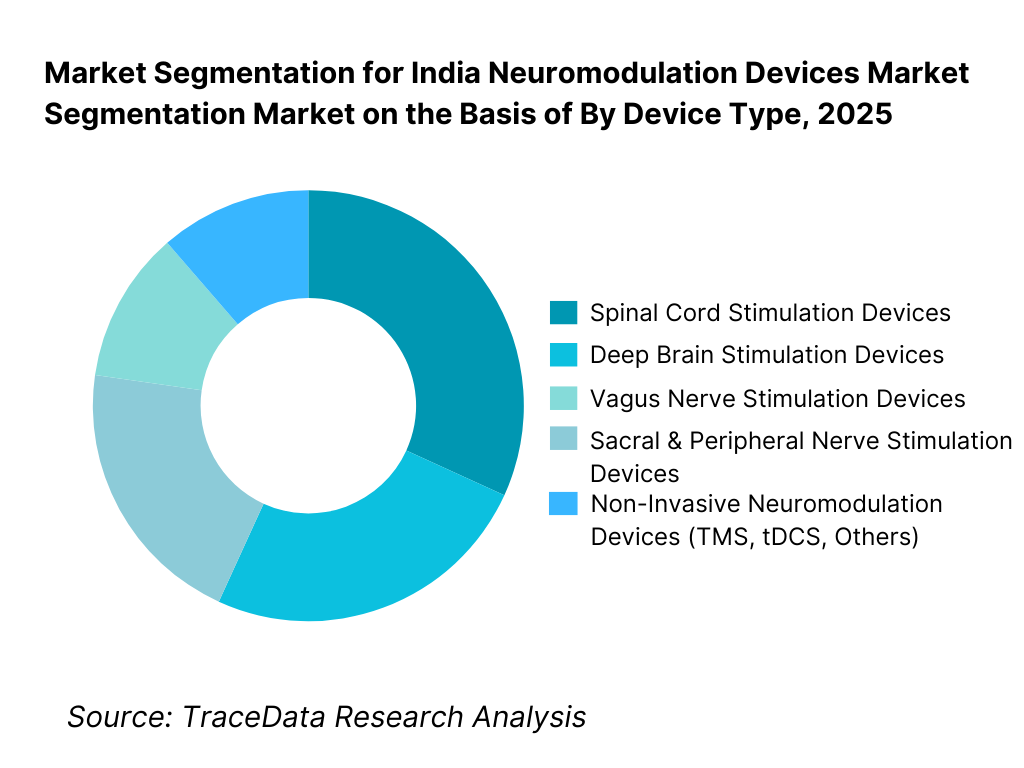

By Device Type: The spinal cord stimulation and deep brain stimulation segments dominate the India neuromodulation devices market. These device categories address high-burden, clinically complex conditions such as chronic pain, Parkinson’s disease, dystonia, and essential tremor, where long-term symptom control and quality-of-life improvement justify higher procedure and device costs. Implantable neuromodulation systems account for the majority of market value due to their premium pricing, procedural complexity, and ongoing programming requirements. While non-invasive neuromodulation devices are witnessing faster volume growth, their contribution remains lower in value terms compared to implantable systems.

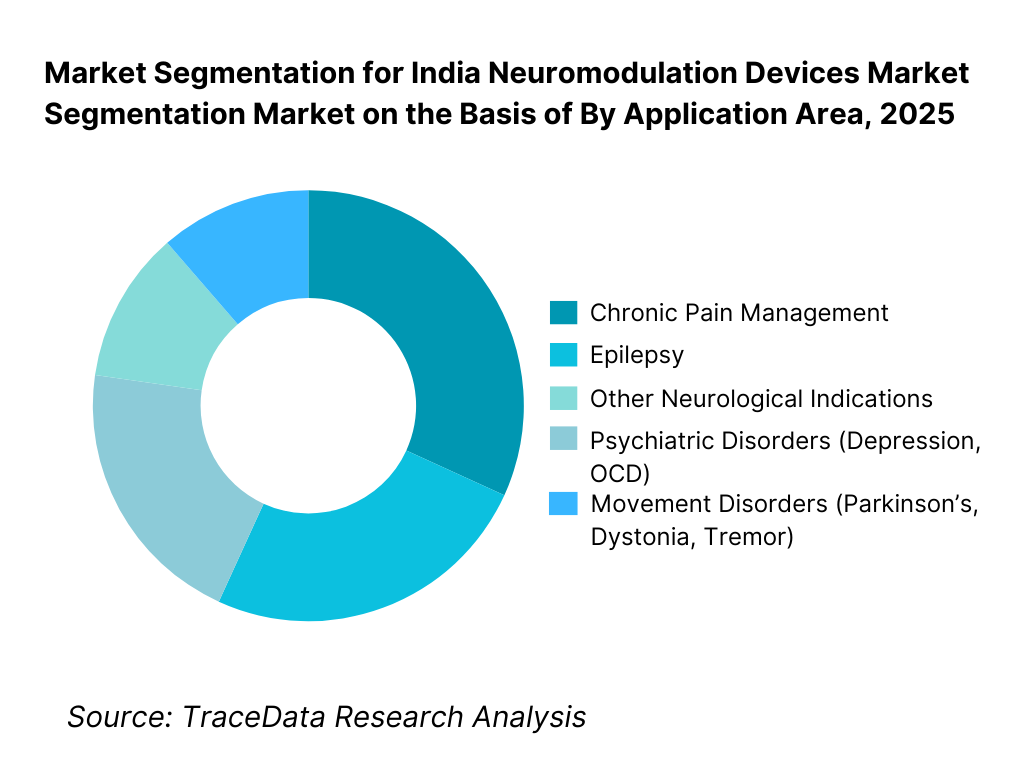

By Application Area: Chronic pain management represents the largest application segment in the Indian neuromodulation devices market, driven by high prevalence of neuropathic pain, failed back surgery syndrome, and pain conditions resistant to pharmacological therapy. Movement disorders form the second-largest segment due to growing diagnosis of Parkinson’s disease and increasing acceptance of deep brain stimulation in advanced cases. Psychiatric and epilepsy-related applications are expanding steadily but remain constrained by referral patterns, reimbursement limitations, and therapy awareness levels.

Competitive Landscape in India Neuromodulation Devices Market

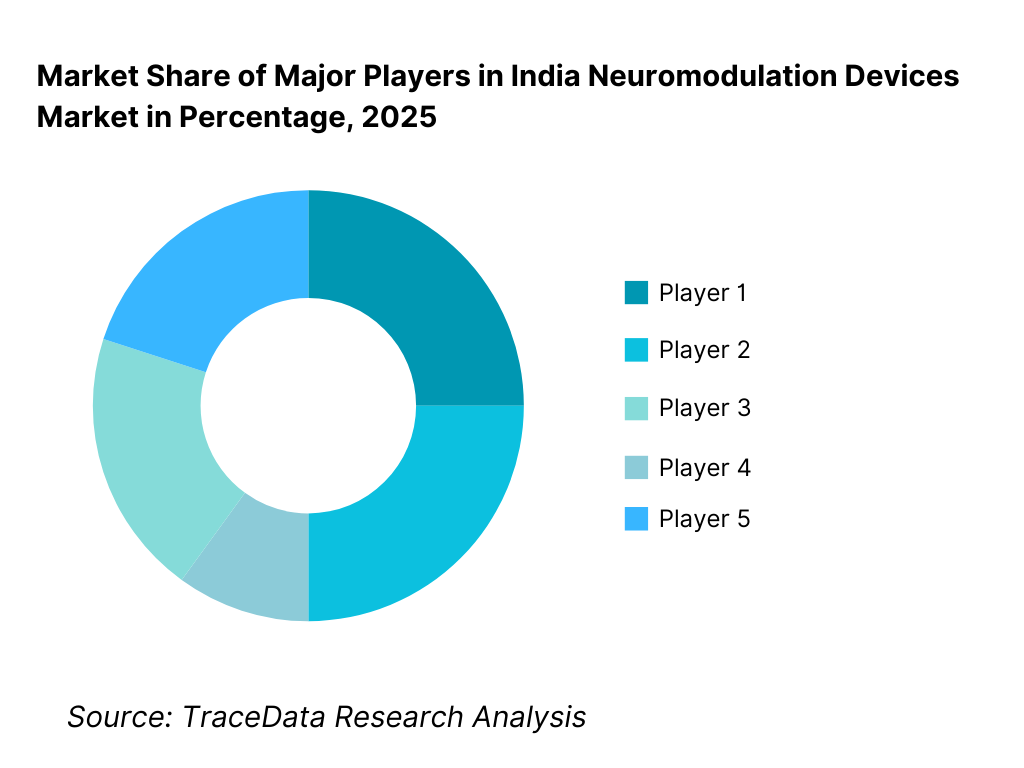

The India neuromodulation devices market exhibits high concentration, dominated by global medical device manufacturers with established implant portfolios, strong clinical evidence, and long-standing relationships with neurologists, neurosurgeons, and pain specialists. Market leadership is driven by product reliability, long-term clinical outcomes, physician training programs, post-implant support infrastructure, and brand credibility in high-risk implantable therapies.

Competition is less price-driven and more outcome- and trust-driven, given the critical nature of neuromodulation procedures. Entry barriers remain high due to regulatory complexity, requirement for specialist adoption, and dependence on continuous clinical support. While multinational players dominate implantable segments, niche and emerging players are gradually expanding presence in non-invasive neuromodulation and adjunct therapy areas.

Name | Founding Year | Original Headquarters |

Medtronic | 1949 | Minneapolis, Minnesota, USA |

Abbott Laboratories | 1888 | Chicago, Illinois, USA |

Boston Scientific | 1979 | Marlborough, Massachusetts, USA |

LivaNova | 2015 | London, United Kingdom |

NeuroPace | 1997 | Mountain View, California, USA |

BrainsWay | 2003 | Jerusalem, Israel |

Magstim | 1987 | Whitland, United Kingdom |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Medtronic: Medtronic remains the clear market leader in India’s neuromodulation devices space, particularly in deep brain stimulation and spinal cord stimulation. Its competitive strength lies in extensive clinical evidence, long-term physician trust, and robust post-implant programming and training support. The company benefits from strong penetration in leading private hospitals and academic medical centers, where complex neuromodulation procedures are concentrated.

Abbott Laboratories: Abbott has strengthened its position through advanced spinal cord stimulation systems emphasizing patient comfort, MRI compatibility, and therapy personalization. Its strategy in India focuses on selective center-of-excellence development and clinician education, positioning the brand strongly within pain management segments that demand long-term reliability and patient satisfaction.

Boston Scientific: Boston Scientific competes through innovation in neuromodulation platform design and expanding application coverage. The company continues to focus on differentiated technology features and targeted physician engagement, particularly in pain and movement disorder segments, where therapy outcomes and device adaptability influence procurement decisions.

LivaNova: LivaNova maintains a focused presence in vagus nerve stimulation, particularly for epilepsy management. Its position in India is shaped by selective adoption in advanced epilepsy centers and academic hospitals, where therapy effectiveness in drug-resistant cases supports continued clinical relevance despite narrower application scope.

BrainsWay and Magstim: These players are strengthening their presence in the non-invasive neuromodulation segment, particularly transcranial magnetic stimulation for psychiatric and neurological applications. Their growth is supported by rising mental health awareness, outpatient therapy models, and expanding private clinic networks, although market value contribution remains lower than implantable systems.

What Lies Ahead for India Neuromodulation Devices Market?

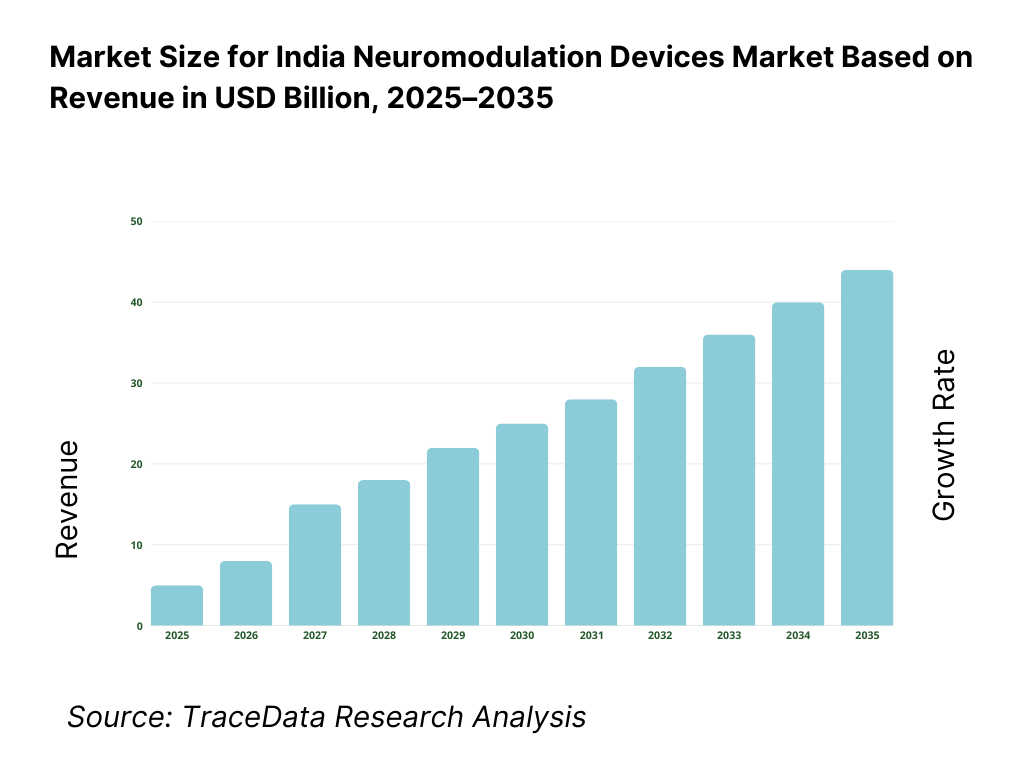

The India neuromodulation devices market is expected to expand steadily through 2035, supported by rising neurological disease burden, increasing diagnosis of chronic pain and movement disorders, gradual normalization of device-based therapies, and continued expansion of tertiary and quaternary healthcare infrastructure across India. Growth momentum is further strengthened by improving clinical confidence in neuromodulation outcomes, wider availability of trained specialists in leading metros, and increasing patient willingness to consider minimally invasive and programmable therapies for drug-resistant conditions. As neurological and mental health care shifts toward long-term disease management rather than episodic treatment, neuromodulation devices are expected to play a more central role in advanced clinical pathways.

Transition Toward Broader Clinical Acceptance and Earlier Intervention in Treatment Pathways: The future of the India neuromodulation devices market will see a gradual shift from last-resort usage toward earlier-stage intervention for select patient cohorts. As clinical evidence accumulates and physician familiarity increases, neuromodulation therapies are expected to be considered sooner in treatment algorithms for chronic pain, Parkinson’s disease, epilepsy, and select psychiatric disorders. Earlier intervention improves functional outcomes and long-term quality of life, strengthening the clinical and economic rationale for device adoption. This transition will be most visible in private tertiary hospitals and centers of excellence before diffusing into broader healthcare networks.

Expansion of Centers of Excellence and Structured Neuromodulation Programs: Growth through 2035 will be driven by the expansion of structured neuromodulation programs within large private hospital chains and academic medical centers. These programs integrate patient selection protocols, multidisciplinary case reviews, standardized implantation workflows, and long-term programming and follow-up infrastructure. Hospitals that invest in dedicated neuromodulation teams and referral networks will capture higher procedure volumes and strengthen regional leadership in neuroscience care. This model also improves outcome consistency, which is critical for broader acceptance by clinicians, patients, and payers.

Rising Role of Non-Invasive Neuromodulation as an Entry and Adjunct Therapy: Non-invasive neuromodulation technologies, particularly in psychiatric and outpatient settings, are expected to grow faster in volume terms. These therapies lower the entry barrier for both providers and patients by avoiding surgery and reducing upfront costs. While they will remain lower in value contribution compared to implantable systems, non-invasive modalities will play an important role in expanding awareness, building therapy familiarity, and supporting long-term adoption of neuromodulation as a treatment category within India’s healthcare ecosystem.

Gradual Improvement in Reimbursement and Innovative Financing Models: Although reimbursement will remain a constraint, incremental improvements are expected through selective private insurance coverage, employer-backed health plans, and hospital-led financing solutions. Over time, greater recognition of neuromodulation’s ability to reduce long-term medication dependence, hospitalizations, and productivity loss may improve payer acceptance. Flexible payment models, bundled care packages, and outcome-linked pricing are likely to emerge as mechanisms to improve affordability and accelerate adoption.

India Neuromodulation Devices Market Segmentation

By Device Type

• Spinal Cord Stimulation Devices

• Deep Brain Stimulation Devices

• Vagus Nerve Stimulation Devices

• Sacral and Peripheral Nerve Stimulation Devices

• Non-Invasive Neuromodulation Devices (TMS, tDCS, Others)

By Application Area

• Chronic Pain Management

• Movement Disorders (Parkinson’s Disease, Dystonia, Tremor)

• Epilepsy

• Psychiatric Disorders (Depression, OCD)

• Other Neurological Indications

By Technology Type

• Implantable Neuromodulation Systems

• Non-Implantable / External Neuromodulation Systems

By End-User

• Private Multi-Specialty Hospitals and Tertiary Care Centers

• Specialty Neurology and Pain Clinics

• Public / Government Hospitals

• Research Institutes and Rehabilitation Centers

By Region

• North India

• South India

• West India

• East & Central India

Players Mentioned in the Report:

• Medtronic

• Abbott

• Boston Scientific

• LivaNova

• NeuroPace

• BrainsWay

• Magstim

• Other emerging neuromodulation technology providers and specialty device companies

Key Target Audience

• Neuromodulation device manufacturers and technology providers

• Neurologists, neurosurgeons, pain specialists, and psychiatrists

• Private hospital chains and tertiary care providers

• Specialty neuroscience and pain management clinics

• Medical device distributors and service partners

• Health insurance providers and third-party administrators

• Healthcare investors and private equity firms

• Medical education and research institutions

Time Period:

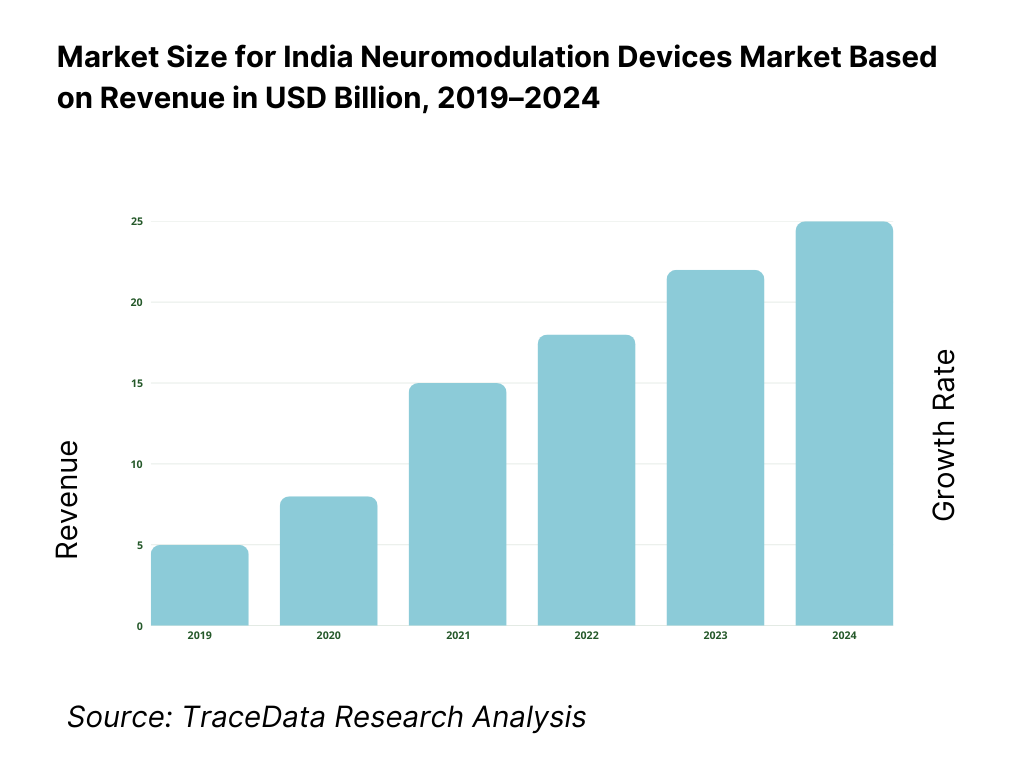

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Neuromodulation Devices including implantable systems, non-invasive devices, hospital-based programs, outpatient clinics, and therapy bundles with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for Neuromodulation Devices Market including device sales, procedure fees, therapy maintenance and programming, licensing of technology, and bundled hospital offerings

4. 3 Business Model Canvas for Neuromodulation Devices Market covering device manufacturers, distributors, hospital operators, clinical support teams, physician networks, and insurance partners

5. 1 Global Device Manufacturers vs Regional and Local Players including Medtronic, Abbott, Boston Scientific, LivaNova, NeuroPace, BrainsWay, and other domestic or regional providers

5. 2 Investment Model in Neuromodulation Devices Market including R&D investments, licensing-based models, clinical trials, and hospital partnership programs

5. 3 Comparative Analysis of Neuromodulation Device Distribution by Direct-to-Hospital, Clinic, and Insurance-Bundled Channels including hospital partnerships and specialist networks

5. 4 Healthcare Budget Allocation comparing neuromodulation spending versus traditional pharmacological therapy, physiotherapy, and rehabilitation with average spend per patient per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by device type and by therapy model

8. 3 Key Market Developments and Milestones including regulatory updates, new device launches, clinical approvals, and hospital program expansions

9. 1 By Market Structure including global manufacturers, regional players, and local providers

9. 2 By Device Type including spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, sacral/peripheral nerve stimulators, and non-invasive devices

9. 3 By Therapy Model including implantable, non-invasive, and hybrid therapy models

9. 4 By User Segment including hospital-based patients, outpatient clinic patients, and home-based therapy users

9. 5 By Patient Demographics including age groups, income levels, and urban versus semi-urban users

9. 6 By Healthcare Facility Type including tertiary hospitals, specialty clinics, rehabilitation centers, and public hospitals

9. 7 By Service Type including standalone device purchase, therapy bundles, and hospital-programmed packages

9. 8 By Region including North, South, West, East, and Central India

10. 1 Patient Landscape and Cohort Analysis highlighting chronic pain, movement disorders, epilepsy, and psychiatric condition clusters

10. 2 Therapy Selection and Purchase Decision Making influenced by clinical evidence, device efficacy, specialist recommendation, and cost considerations

10. 3 Engagement and ROI Analysis measuring treatment adherence, therapy outcomes, and patient satisfaction

10. 4 Gap Analysis Framework addressing specialist availability, device access, affordability, and clinical program differentiation

11. 1 Trends and Developments including rise of implantable systems, non-invasive therapies, remote programming, and digital health integration

11. 2 Growth Drivers including increasing disease prevalence, rising specialist numbers, expanding hospital infrastructure, and growing patient awareness

11. 3 SWOT Analysis comparing global manufacturer scale versus regional service coverage and local hospital adoption

11. 4 Issues and Challenges including high therapy costs, limited reimbursement, specialist scarcity, and patient follow-up compliance

11. 5 Government Regulations covering device approvals, import licensing, clinical trial requirements, and medical device governance in India

12. 1 Market Size and Future Potential of implantable and non-invasive devices, hospital programs, and therapy bundles

12. 2 Business Models including standalone device sales, hospital-programmed therapy, and hybrid clinical service models

12. 3 Delivery Models and Type of Solutions including surgical implantation, outpatient programming, and remote monitoring solutions

15. 1 Market Share of Key Players by revenues and by installed device base

15. 2 Benchmark of 15 Key Competitors including Medtronic, Abbott, Boston Scientific, LivaNova, NeuroPace, BrainsWay, Magstim, and other regional or local providers

15. 3 Operating Model Analysis Framework comparing global device platforms, regional service-led models, and hospital-integrated programs

15. 4 Gartner Magic Quadrant positioning global leaders and regional challengers in neuromodulation

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through differentiation via technology versus cost-led therapy models

16. 1 Revenues with projections

17. 1 By Market Structure including global manufacturers, regional players, and local providers

17. 2 By Device Type including implantable, non-invasive, and hybrid systems

17. 3 By Therapy Model including standalone device therapy, hospital-programmed therapy, and bundled care models

17. 4 By User Segment including hospital-based patients, outpatient clinics, and home-based therapy users

17. 5 By Patient Demographics including age and income groups

17. 6 By Healthcare Facility Type including tertiary hospitals, specialty clinics, and rehabilitation centers

17. 7 By Service Type including standalone, therapy bundles, and programmed packages

17. 8 By Region including North, South, West, East, and Central India

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Neuromodulation Devices Market across demand-side and supply-side stakeholders within India. On the demand side, entities include private multi-specialty hospitals, tertiary and quaternary care centers, specialty neurology and neurosurgery institutes, pain management clinics, psychiatric centers, academic medical colleges, and select public hospitals offering advanced neurological care. Demand is further segmented by clinical application (chronic pain, movement disorders, epilepsy, psychiatric disorders), therapy type (implantable vs non-implantable), and care setting (inpatient surgical programs vs outpatient therapy models).

On the supply side, the ecosystem includes global neuromodulation device manufacturers, India-focused distributors and channel partners, clinical training and proctoring teams, programming and after-sales service providers, implantable device logistics partners, and regulatory and compliance bodies. Supporting stakeholders such as referring physicians, diagnostic centers, insurers, and hospital procurement committees are also mapped to understand decision-making influence. From this ecosystem, we shortlist 6–10 leading neuromodulation device manufacturers active in India based on product breadth, installed base, clinical evidence, physician adoption, and support infrastructure. This step establishes how clinical value, procedural adoption, and long-term therapy management drive market structure and revenue realization.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the India neuromodulation devices market structure, clinical demand drivers, and adoption behavior. This includes reviewing epidemiological data on neurological and neuropsychiatric disorders, chronic pain prevalence, treatment-resistant patient populations, and referral patterns across regions. We assess healthcare infrastructure development, growth of private hospital chains, expansion of neuroscience centers, and availability of trained specialists.

Company-level analysis includes review of manufacturer product portfolios, technology platforms, approved indications, service models, and India-specific go-to-market strategies. Regulatory pathways, device classification norms, and import and compliance requirements are examined to understand market entry and scaling dynamics. The outcome of this stage is a robust industry foundation that defines segmentation logic, adoption assumptions, and baseline parameters for market sizing and forecast modeling.

Step 3: Primary Research

We conduct structured interviews with neurologists, neurosurgeons, pain specialists, psychiatrists, hospital administrators, and neuromodulation program leads across leading private and academic institutions. On the supply side, interviews are held with device manufacturers, distributors, and clinical support teams. The objectives are threefold: (a) validate assumptions around patient volumes, therapy selection, and adoption barriers, (b) authenticate segment splits by device type, application area, and end-user, and (c) gather qualitative insights on pricing behavior, procurement decision criteria, reimbursement influence, and long-term therapy management challenges.

A bottom-to-top approach is applied by estimating procedure volumes across key applications and regions, combined with average device and procedure values to develop the overall market view. In selected cases, discreet buyer-style interactions are conducted to validate field-level realities such as therapy recommendation thresholds, patient affordability constraints, and post-implant follow-up practices.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market size, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as disease burden trends, healthcare spending growth, expansion of private insurance coverage, and specialist availability. Assumptions around reimbursement evolution, technology adoption, and patient affordability are stress-tested to assess their impact on therapy uptake. Sensitivity analysis is conducted across variables including specialist training expansion, non-invasive therapy penetration, and policy-driven access improvements. Market models are refined until alignment is achieved between clinical capacity, supplier presence, and realistic adoption trajectories through 2035.

FAQs

01 What is the potential for the India Neuromodulation Devices Market?

The India Neuromodulation Devices Market holds strong long-term potential, supported by a growing burden of neurological and psychiatric disorders, increasing diagnosis rates of chronic pain and movement disorders, and gradual acceptance of device-based therapies for drug-resistant conditions. While current adoption is concentrated in leading private hospitals and metros, expanding healthcare infrastructure and specialist training are expected to broaden the addressable market through 2035.

02 Who are the Key Players in the India Neuromodulation Devices Market?

The market is dominated by global medical device manufacturers with established neuromodulation portfolios and strong clinical evidence. Competition is shaped by physician trust, technology reliability, post-implant support, and training capabilities rather than price alone. These players operate through a combination of direct presence and distributor-led models, with adoption concentrated in centers of excellence and high-volume neuroscience hospitals.

03 What are the Growth Drivers for the India Neuromodulation Devices Market?

Key growth drivers include rising prevalence of neurological disorders, increased awareness of minimally invasive and programmable therapies, expansion of private tertiary healthcare, and improving clinical confidence in neuromodulation outcomes. Additional momentum comes from technological advancements such as longer battery life, MRI compatibility, and non-invasive neuromodulation options that expand therapy access and acceptance.

04 What are the Challenges in the India Neuromodulation Devices Market?

Challenges include high upfront device and procedure costs, limited reimbursement coverage, uneven availability of trained specialists, and low awareness among referring physicians and patients. Long-term therapy management requirements and follow-up compliance also add complexity for providers. Addressing these constraints will be critical for scaling adoption beyond metro-centric centers and unlocking broader market potential.