India Night Vision Devices Market Outlook to 2035

By Device Type, By Technology, By End-Use Sector, By Deployment Platform, and By Region

- Product Code: TDR0455

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Night Vision Devices Market Outlook to 2035 – By Device Type, By Technology, By End-Use Sector, By Deployment Platform, and By Region” provides a comprehensive analysis of the night vision devices (NVD) industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; technology trends and product developments, regulatory and procurement landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the India night vision devices market.

The report concludes with future market projections based on defense modernization cycles, internal security and border surveillance requirements, paramilitary and police force modernization programs, indigenous manufacturing and import substitution initiatives, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

India Night Vision Devices Market Overview and Size

The India night vision devices market is valued at approximately ~USD ~ billion, representing the supply of electro-optical and imaging systems designed to enable visibility and target detection under low-light and no-light conditions. These systems include image intensifier–based night vision devices, thermal imaging systems, and hybrid fusion devices delivered in the form of monoculars, binoculars, goggles, weapon sights, scopes, and vehicle- or platform-mounted systems.

Night vision devices are widely deployed across defense, paramilitary, homeland security, law enforcement, border surveillance, and select civilian applications due to their critical role in enhancing situational awareness, operational effectiveness, and personnel safety during nighttime and adverse visibility conditions. Demand is driven by India’s extensive land and maritime borders, persistent internal security requirements, counter-insurgency operations, and the increasing emphasis on technology-enabled surveillance and force multiplication.

The market is anchored by India’s sustained defense capital expenditure, modernization of infantry and special forces equipment, large paramilitary and central armed police forces, and increasing investment in border fencing, smart surveillance, and integrated command-and-control systems. Night vision devices also benefit from India’s push toward indigenization and local manufacturing, as domestic suppliers expand capabilities across optics, sensors, electronics, and system integration under structured defense procurement programs.

Northern and Western India represent the largest demand centers for night vision devices, driven by active land borders, high troop deployment intensity, and concentration of defense and paramilitary formations. Northern regions account for sustained demand due to mountainous terrain, low-temperature operations, and continuous border surveillance requirements. Western India shows strong demand linked to desert terrain operations, coastal security, and naval and air force installations. Eastern regions see steady demand tied to internal security operations and border monitoring, while Southern India plays a critical role as a manufacturing, testing, and integration hub due to the presence of defense public sector units, private manufacturers, and R&D ecosystems.

What Factors are Leading to the Growth of the India Night Vision Devices Market:

Modernization of infantry, special forces, and paramilitary equipment strengthens baseline demand: India continues to upgrade soldier-level equipment and surveillance capabilities as part of broader force modernization programs. Night vision goggles, weapon sights, and handheld thermal imagers are increasingly viewed as essential rather than optional equipment for infantry units, special forces, and paramilitary formations. These devices significantly improve operational effectiveness during night patrols, ambush operations, border monitoring, and counter-insurgency missions. As replacement cycles accelerate and legacy-generation devices are phased out, procurement volumes remain structurally strong across multiple forces and units.

Persistent border surveillance and internal security requirements sustain long-term procurement: India’s extensive and diverse borders—spanning mountainous, desert, riverine, and coastal terrains—require continuous monitoring under challenging visibility conditions. Night vision and thermal imaging systems are integral to fixed and mobile surveillance posts, border outposts, vehicle-mounted systems, and unattended ground sensor networks. In parallel, internal security operations and urban policing increasingly rely on portable night vision devices for raids, checkpoints, and rapid response scenarios. These operational realities create recurring demand for both handheld and mounted NVD systems across multiple agencies.

Transition toward advanced thermal and fusion technologies increases market value: While image intensifier–based devices continue to see demand due to cost and familiarity, procurement is gradually shifting toward thermal imaging and fusion systems that offer superior detection, longer ranges, and better performance in fog, smoke, and adverse weather conditions. Thermal imagers are increasingly preferred for surveillance, vehicle-mounted applications, and long-range observation, while fusion devices combining image intensification and thermal sensing are gaining traction among elite units. This technology transition drives higher average selling prices and increases overall market value even when unit volumes grow at a measured pace.

Which Industry Challenges Have Impacted the Growth of the India Night Vision Devices Market:

High dependence on imported core components constrains cost competitiveness and supply reliability: While system-level assembly and integration capabilities have expanded within India, the night vision devices market remains heavily dependent on imported critical components such as image intensifier tubes, uncooled thermal sensors, microbolometers, and certain optical elements. These components are subject to export controls, supplier concentration risks, and foreign currency exposure. Sudden changes in geopolitical relations, licensing requirements, or supplier lead times can disrupt procurement cycles and delay deliveries to defense and security forces. Cost volatility driven by exchange rate movements further impacts budget predictability, especially for large-volume government tenders with fixed-price structures.

Lengthy defense procurement cycles and evolving qualitative requirements delay order execution: Night vision devices procured by the armed forces and paramilitary units must pass through multi-stage procurement processes involving trials, technical evaluations, field testing, and commercial negotiations. Qualitative requirements often evolve over time as operational doctrines change or new technologies become available, leading to re-tendering or specification revisions. These prolonged cycles can delay revenue realization for suppliers and create uncertainty in production planning. Smaller domestic manufacturers are particularly impacted, as long gestation periods strain working capital and limit their ability to scale manufacturing capacity ahead of confirmed orders.

Performance variability across terrains and climatic conditions complicates standardization: India’s diverse operating environments—ranging from high-altitude cold regions and deserts to humid coastal and jungle terrain—place varying demands on night vision devices. Image clarity, thermal contrast, battery performance, and ruggedization requirements differ significantly across deployment zones. Designing and qualifying devices that perform consistently across these conditions increases engineering complexity and testing timelines. In some cases, forces prefer multiple device variants tailored to specific terrains, which limits standardization benefits and raises per-unit costs for procurement and lifecycle support.

What are the Regulations and Initiatives which have Governed the Market:

Defense procurement policies and indigenization frameworks shaping supplier eligibility and sourcing decisions: India’s defense procurement ecosystem is governed by structured acquisition procedures that emphasize transparency, competitive bidding, and increasing preference for domestically manufactured systems. Indigenization frameworks encourage local production, technology transfer, and progressive reduction of import content in night vision devices. These policies influence vendor qualification criteria, offset obligations, and the structure of long-term supply contracts. While they create opportunities for domestic players, they also require compliance with localization thresholds, documentation standards, and audit requirements that increase entry barriers for new suppliers.

Technical standards, trial protocols, and certification requirements influencing product design and timelines: Night vision devices must meet stringent technical standards related to optical performance, detection range, resolution, environmental durability, electromagnetic compatibility, and safety. Field trials often include extended operational testing under real-world conditions, including night exercises, extreme temperatures, and sustained usage cycles. Compliance with these protocols affects device architecture, component selection, and ruggedization strategies. Certification timelines and repeat trials, particularly when design changes are introduced, can extend time-to-market and delay induction into active service.

Export controls, import licensing, and technology access restrictions affecting capability development: Advanced night vision technologies—especially high-performance image intensifier tubes and thermal sensors—are subject to international export controls and licensing regimes. Access to these technologies often requires government-to-government approvals or long-term supplier relationships, limiting sourcing flexibility. These constraints influence product roadmap decisions for Indian manufacturers and slow the transition toward higher-generation devices. While domestic R&D initiatives aim to reduce reliance on restricted technologies, near-term market growth remains partially governed by external regulatory environments and technology access conditions.

India Night Vision Devices Market Segmentation

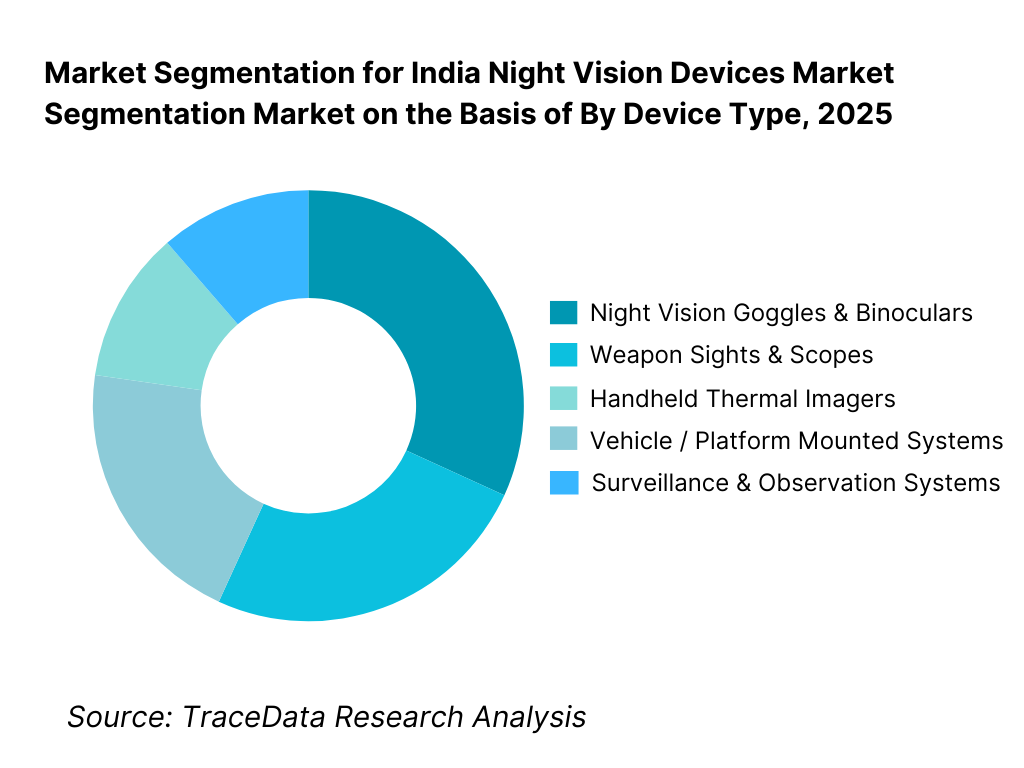

By Device Type: The night vision goggles and weapon-mounted sights segment holds dominance in the India night vision devices market. This is because soldier-level deployment remains the primary driver of procurement volumes across the Indian Army, paramilitary forces, and special units. Goggles and weapon sights are issued in large numbers to infantry units to enhance nighttime mobility, target acquisition, and close-combat effectiveness. These devices align strongly with operational doctrines emphasizing decentralized patrols, border dominance, and night operations. While vehicle-mounted and long-range surveillance systems command higher unit values, handheld and wearable devices continue to account for the bulk of unit demand.

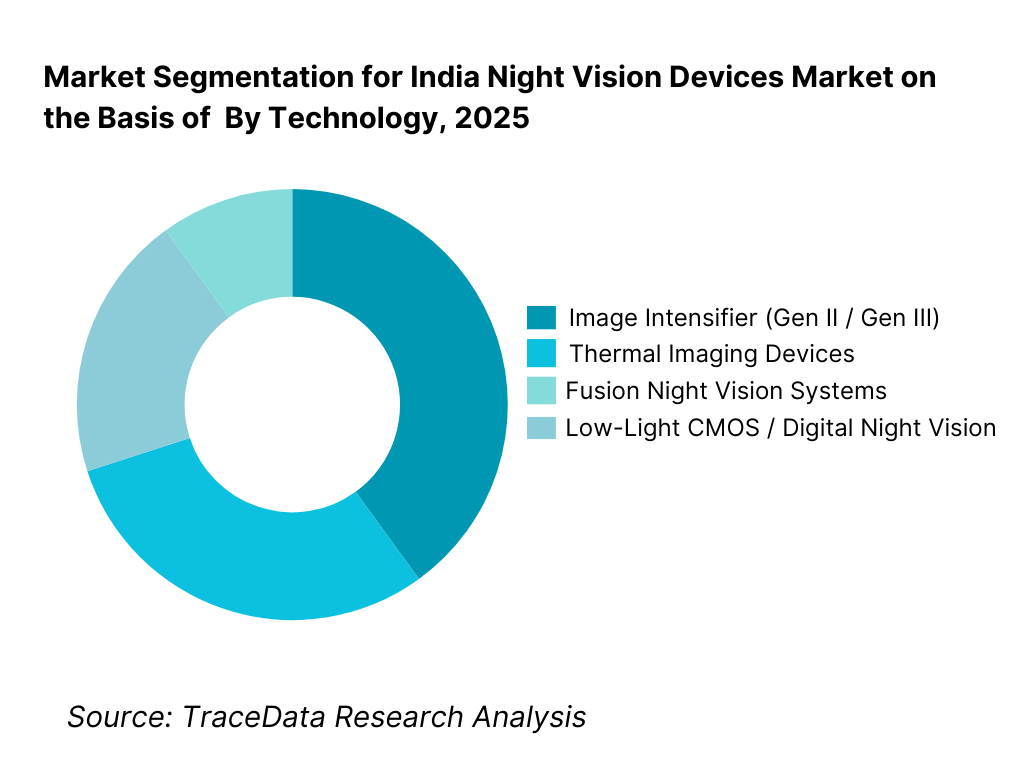

By Technology: Image intensifier–based night vision devices continue to dominate by volume, driven by cost sensitivity, established user familiarity, and suitability for short- to mid-range operations. However, thermal imaging systems dominate value share growth, particularly for border surveillance, vehicle-mounted platforms, and long-range observation. Fusion systems combining image intensification and thermal sensing are gaining traction among elite forces but remain limited by cost and sourcing constraints. Over time, the technology mix is shifting steadily toward thermal and fusion systems as operational requirements evolve.

Competitive Landscape in India Night Vision Devices Market

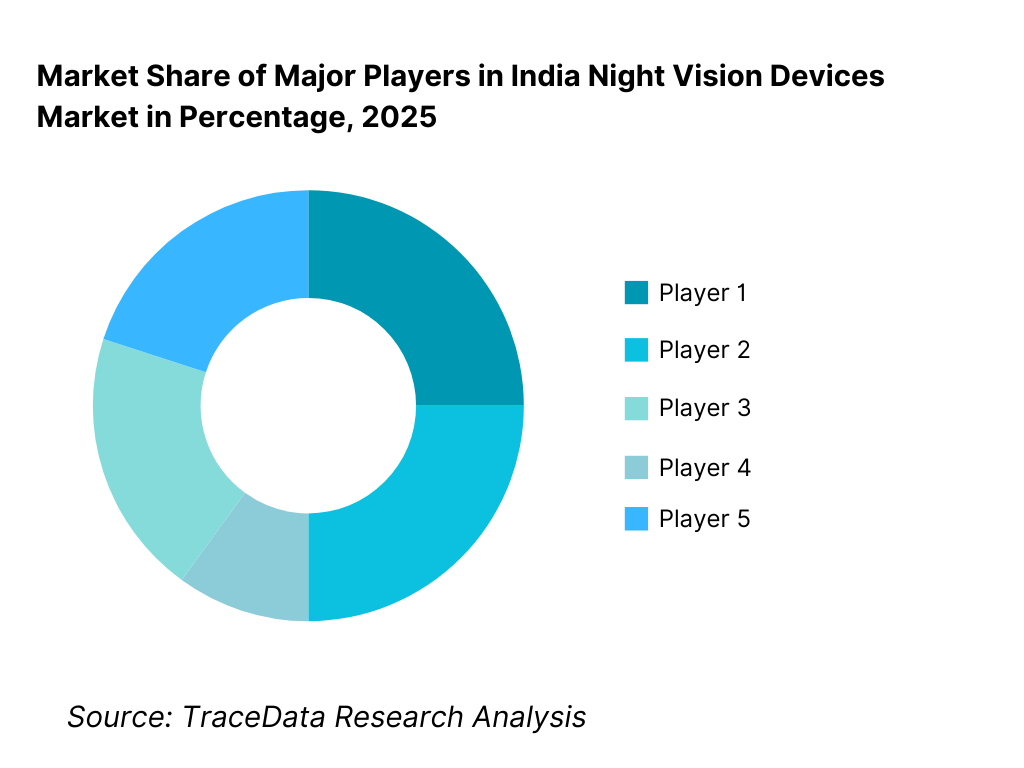

The India night vision devices market exhibits moderate concentration, characterized by a mix of defense public sector undertakings (DPSUs), established domestic private manufacturers, and select global technology providers operating through partnerships, licensed production, or imports. Competitive positioning is driven by technology access, compliance with defense procurement norms, field-proven performance, lifecycle support capability, and localization depth. While DPSUs retain strength in legacy supply and institutional relationships, private Indian firms are increasingly competitive due to faster innovation cycles, cost efficiency, and alignment with indigenization priorities.

Name | Founding Year | Original Headquarters |

Bharat Electronics Limited | 1954 | Bengaluru, India |

Tonbo Imaging | 2012 | Bengaluru, India |

MKU Limited | 1985 | New Delhi, India |

Paras Defence and Space Technologies | 2009 | Navi Mumbai, India |

Alpha Design Technologies | 2003 | Bengaluru, India |

Hindustan Aeronautics Limited | 1940 | Bengaluru, India |

L3Harris Technologies | 2019 | Melbourne, Florida, USA |

Thales Group | 1893 | Paris, France |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Bharat Electronics Limited (BEL): BEL remains the anchor supplier for night vision and thermal imaging systems to Indian defense forces, leveraging long-standing institutional relationships, certified production facilities, and integration capabilities across surveillance and command systems. The company continues to benefit from large-volume orders and lifecycle support contracts, particularly for border and platform-mounted systems.

Tonbo Imaging: Tonbo Imaging has emerged as a leading private-sector innovator in thermal imaging and fused night vision systems. Its competitive strength lies in modular product architecture, software-driven imaging enhancements, and strong engagement with special forces and export markets. The company is well positioned in higher-value, technology-intensive segments.

MKU Limited: MKU has expanded from personal protection equipment into electro-optics by integrating night vision devices into soldier system offerings. Its competitiveness is rooted in system-level bundling, cost efficiency, and close coordination with defense procurement programs emphasizing indigenous content.

Paras Defence and Space Technologies: Paras Defence operates across optics, optronics, and defense electronics, with growing relevance in precision optical components and night vision subsystems. The company benefits from its role as both a component supplier and system integrator, supporting indigenization across multiple platforms.

Global OEMs (L3Harris, Thales): International players remain active in high-performance and specialized night vision segments, particularly for aviation, naval, and elite force applications. Their participation is increasingly shaped by partnership models, technology transfer arrangements, and selective imports aligned with Indian regulatory and procurement frameworks.

What Lies Ahead for India Night Vision Devices Market?

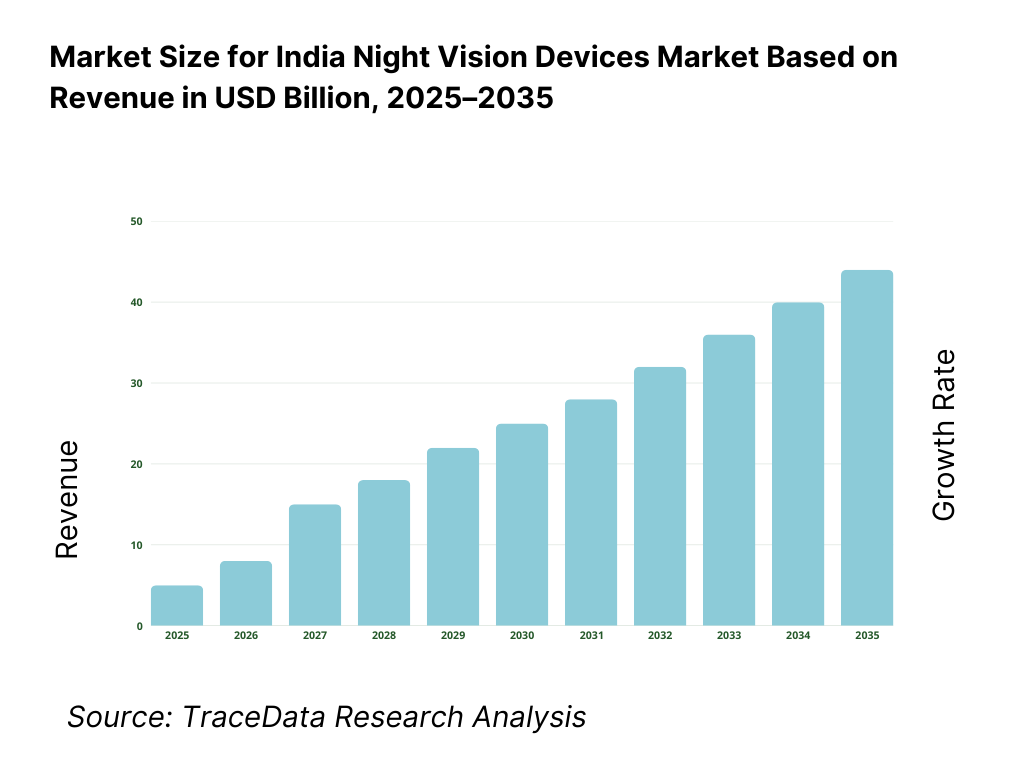

The India night vision devices market is expected to expand steadily through 2035, supported by sustained defense modernization programs, persistent border and internal security requirements, and the increasing recognition of night-fighting capability as a core operational necessity rather than an auxiliary advantage. Growth momentum is reinforced by recurring replacement cycles for legacy devices, rising adoption of advanced thermal and fused systems, and India’s long-term focus on technology-enabled surveillance across land, maritime, and urban security environments. As night operations become more central to doctrine across the armed forces and paramilitary units, night vision devices will remain a foundational capability within India’s defense and homeland security ecosystem.

Transition Toward Advanced Thermal and Fusion-Based Night Vision Systems: The future trajectory of the Indian market will see a gradual but definitive shift away from basic image intensifier–only devices toward thermal imaging and fusion-based night vision systems. Thermal devices offer superior detection performance in fog, smoke, dust, and adverse weather conditions, making them increasingly relevant for border surveillance, vehicle-mounted platforms, and long-range observation roles. Fusion systems that combine image intensification with thermal overlays are expected to gain traction among special forces and high-readiness units. Suppliers capable of delivering reliable, ruggedized, and power-efficient advanced systems will capture higher-value demand and establish long-term positioning.

Growing Emphasis on Soldier-Centric Modernization and Force Multiplication: India’s defense and paramilitary forces are placing increasing emphasis on individual soldier effectiveness, with night vision devices viewed as a critical force multiplier for patrols, ambushes, and rapid-response operations. Programs focused on upgrading infantry kits, special forces equipment, and integrated soldier systems will continue to drive volume demand for goggles, weapon sights, and handheld imagers. This trend supports sustained procurement even in periods of moderated capital expenditure, as night vision capability is tightly linked to survivability and mission success rather than discretionary upgrades.

Expansion of Border Surveillance, Static Installations, and Platform Integration: Beyond dismounted soldier use, a growing share of demand through 2035 will come from vehicle-mounted, fixed surveillance, and integrated platform applications. Night vision and thermal systems are increasingly deployed as part of layered border security architectures, including observation towers, mobile patrol vehicles, naval craft, and unmanned or semi-autonomous monitoring systems. This shift favors suppliers with system integration capability, software expertise, and the ability to interface with command-and-control networks rather than standalone device manufacturers alone.

Strengthening Role of Indigenization and Domestic Manufacturing Ecosystems: India’s push toward indigenous defense manufacturing will play a defining role in shaping the competitive landscape. Domestic manufacturers are expected to deepen capabilities across optics, sensors, electronics, firmware, and system integration, supported by structured procurement preferences and long-term supply visibility. While dependence on imported critical components will persist in the near term, progressive localization and co-development initiatives are likely to improve cost competitiveness and supply resilience. Companies that align product roadmaps with indigenization thresholds and certification requirements will be better positioned to secure repeat orders.

India Night Vision Devices Market Segmentation

By Device Type

• Night Vision Goggles & Binoculars

• Weapon Sights & Scopes

• Handheld Thermal Imagers

• Vehicle / Platform Mounted Systems

• Surveillance & Observation Systems

By Technology

• Image Intensifier (Gen II / Gen III)

• Thermal Imaging Devices

• Fusion Night Vision Systems

• Low-Light CMOS / Digital Night Vision

By Deployment Platform

• Dismounted / Soldier-Borne Systems

• Vehicle-Mounted Systems

• Fixed / Static Surveillance Installations

By End-Use Sector

• Defense (Army, Navy, Air Force)

• Paramilitary / CAPFs

• Police & Homeland Security

• Civilian / Commercial / Others

By Region

• Northern India

• Western India

• Eastern India

• Southern India

Players Mentioned in the Report:

• Bharat Electronics Limited

• Tonbo Imaging

• MKU Limited

• Paras Defence and Space Technologies

• Alpha Design Technologies

• Hindustan Aeronautics Limited

• L3Harris Technologies

• Thales Group

• Other domestic optics manufacturers, system integrators, and licensed technology partners

Key Target Audience

• Night vision and electro-optics manufacturers

• Defense public sector units and private defense OEMs

• Armed forces, paramilitary, and police procurement agencies

• Border security and homeland security planners

• System integrators and surveillance solution providers

• Defense-focused investors and strategic partners

• R&D organizations and optics technology developers

Time Period:

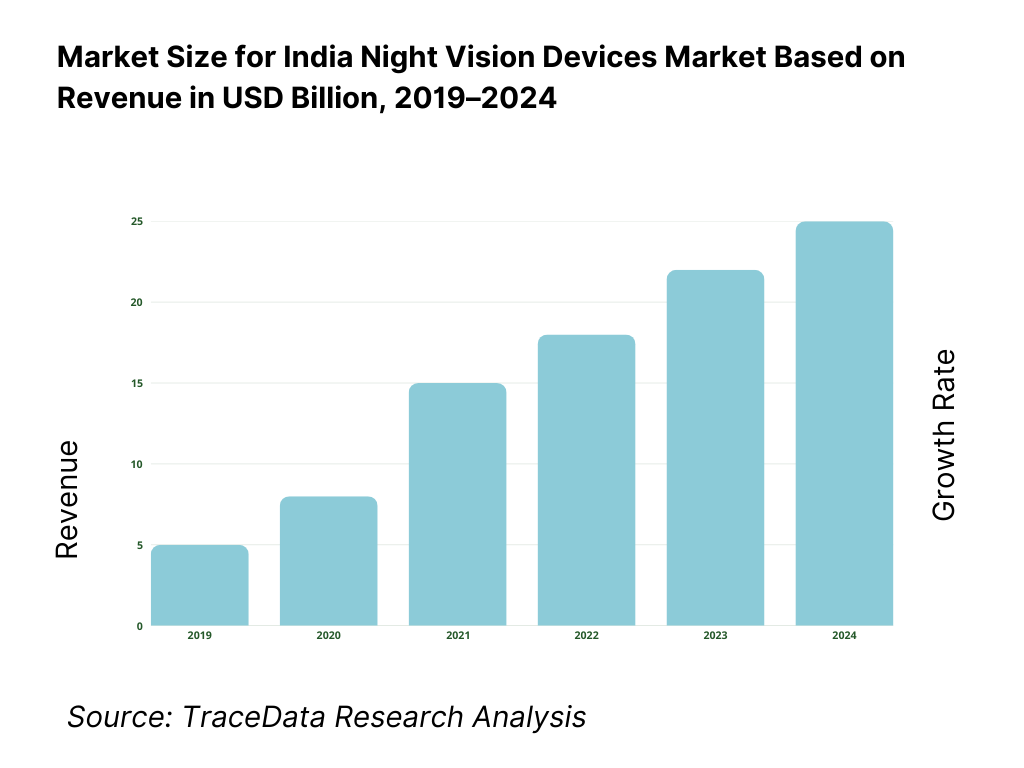

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Research Methodology

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Night Vision Devices-Indigenously Manufactured, Licensed Production, Imports, System Integration [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for India Night Vision Devices Market [Device Sales, System Integration, Upgrades & Retrofits, Maintenance & Lifecycle Support]

4. 3 Business Model Canvas for India Night Vision Devices Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]

5. 1 Local Players vs Global Vendors [BEL/Tonbo Imaging vs L3Harris/Thales etc.]

5. 2 Investment Model in India Night Vision Devices Market [Government Defense Budgets, DPSU Capex, Private Defense Investments, Strategic Partnerships]

5. 3 Comparative Analysis of Night Vision Adoption in Defense vs Homeland Security Organizations [Procurement Models, Use Cases, Performance Benchmarks]

5. 4 Budget Allocation by Force Type [Armed Forces, Paramilitary Forces, Police & Internal Security Agencies]

8. 1 Revenues (Historical Trend)

9. 1 By Market Structure (Indigenous Manufacturing vs Imports vs Licensed Production)

9. 2 By Technology (Image Intensifier, Thermal Imaging, Fusion Night Vision, Digital Night Vision)

9. 3 By End-Use Sector (Defense, Paramilitary/CAPFs, Police & Homeland Security, Others)

9. 4 By Deployment Platform (Dismounted/Soldier-Borne, Vehicle-Mounted, Fixed Surveillance)

9. 5 By Device Type (Goggles & Binoculars, Weapon Sights, Handheld Thermal Imagers, Mounted Systems)

9. 6 By Procurement Mode (Capital Procurement, Replacement Cycles, Emergency & Fast-Track Procurement)

9. 7 By Standard vs Customized Night Vision Systems

9. 8 By Region (Northern India, Western India, Eastern India, Southern India)

10. 1 Defense & Internal Security Buyer Landscape and Cohort Analysis

10. 2 Night Vision Adoption Drivers & Decision-Making Process

10. 3 Operational Effectiveness & ROI Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in India Night Vision Devices Market

11. 2 Growth Drivers for India Night Vision Devices Market

11. 3 SWOT Analysis for India Night Vision Devices Market

11. 4 Issues & Challenges for India Night Vision Devices Market

11. 5 Government Regulations for India Night Vision Devices Market

12. 1 Market Size and Future Potential for Thermal & Fusion Night Vision Systems in India

12. 2 Business Models & Revenue Streams [System Sales, Integration, AMC, Upgrades]

12. 3 Delivery Models & Applications Offered [Soldier Systems, Border Surveillance, Vehicle Platforms]

15. 1 Market Share of Key Players in India Night Vision Devices Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Manufacturing Capability, Revenues, Pricing Strategy, Technology Used, Key Products, Major Clients, Strategic Tie-ups, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Competitive Positioning Matrix for Night Vision Device Providers

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Market Structure (Indigenous, Licensed, Imported Systems)

17. 2 By Technology (Image Intensifier, Thermal, Fusion, Digital)

17. 3 By End-Use Sector (Defense, Paramilitary, Police, Others)

17. 4 By Deployment Platform (Dismounted, Vehicle-Mounted, Fixed Surveillance)

17. 5 By Device Type (Goggles, Weapon Sights, Handheld, Mounted Systems)

17. 6 By Procurement Mode (Capital, Replacement, Emergency)

17. 7 By Standard vs Customized Systems

17. 8 By Region (Northern, Western, Eastern, Southern India)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Night Vision Devices Market across demand-side and supply-side entities. On the demand side, entities include the Indian Army, Navy, and Air Force; Central Armed Police Forces (BSF, CRPF, ITBP, CISF, SSB); state police and special tactical units; coastal security agencies; and select homeland security and surveillance authorities. Demand is further segmented by deployment role (soldier-borne, vehicle-mounted, fixed surveillance), operational environment (border, counter-insurgency, urban security, maritime), and procurement pathway (capital procurement, replacement cycles, modernization programs, and emergency acquisitions).

On the supply side, the ecosystem includes defense public sector undertakings, domestic private defense manufacturers, electro-optics specialists, system integrators, optics and sensor component suppliers, firmware and software providers, ruggedization and enclosure partners, calibration and testing laboratories, maintenance and lifecycle support providers, and certification and trial agencies. From this mapped ecosystem, we shortlist 6–10 leading night vision device suppliers based on technology capability, compliance track record, production scale, indigenization depth, and relevance across soldier systems and surveillance applications. This step establishes how value is created and captured across design, component sourcing, system integration, certification, deployment, and lifecycle support.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the structure, demand drivers, and technology mix of the India night vision devices market. This includes review of defense modernization programs, border surveillance initiatives, internal security requirements, and replacement cycles for legacy-generation night vision equipment. We analyze procurement priorities across armed forces and paramilitary units, including preferences around detection range, image clarity, ruggedization, power consumption, and interoperability with weapons and command systems.

Company-level analysis includes review of product portfolios, technology roadmaps (image intensifier vs thermal vs fusion), localization strategies, manufacturing footprints, and after-sales support capabilities. We also assess regulatory and procurement frameworks governing defense acquisitions, indigenization thresholds, trial and certification protocols, and import licensing constraints for critical components. The outcome of this stage is a robust industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with night vision device manufacturers, electro-optics system integrators, defense procurement consultants, retired and serving operational users (where permissible), and maintenance and support partners. The objectives are threefold: (a) validate assumptions around demand concentration by force and deployment role, (b) authenticate segment splits by device type, technology, and platform, and (c) gather qualitative insights on pricing behavior, lead times, technology reliability, trial outcomes, and buyer expectations around lifecycle support and upgrades.

A bottom-to-top approach is applied by estimating unit requirements across key forces, deployment categories, and replacement cycles, which are then aggregated to derive the overall market view. In selected cases, supplier and integrator discussions are used to validate field-level realities such as certification timelines, component sourcing constraints, customization requirements, and common gaps between tender specifications and operational expectations.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand projections are reconciled with macro indicators such as defense capital allocation trends, force deployment intensity, border infrastructure investments, and internal security spending. Assumptions around technology transition (image intensifier to thermal/fusion), indigenization progress, and component availability are stress-tested to assess their impact on adoption and procurement timing. Sensitivity analysis is conducted across key variables including procurement cycle length, localization thresholds, and replacement frequency. Market models are refined until alignment is achieved between supplier capacity, procurement pipelines, and operational demand, ensuring internal consistency and directional robustness through 2035.

FAQs

01 What is the potential for the India Night Vision Devices Market?

The India night vision devices market holds strong long-term potential, supported by sustained defense and paramilitary modernization, persistent border and internal security requirements, and the growing emphasis on night-fighting capability as a core operational necessity. Replacement of legacy devices, increasing deployment of thermal and fusion systems, and expansion of surveillance infrastructure collectively support steady growth through 2035.

02 Who are the Key Players in the India Night Vision Devices Market?

The market features a combination of defense public sector undertakings, established domestic private manufacturers, and select global technology providers operating through partnerships and licensed supply models. Competitive dynamics are shaped by technology access, compliance with defense procurement norms, field-proven performance, indigenization depth, and the ability to provide long-term lifecycle support and upgrades.

03 What are the Growth Drivers for the India Night Vision Devices Market?

Key growth drivers include modernization of infantry and paramilitary equipment, continuous border surveillance requirements, rising adoption of thermal imaging for adverse conditions, and increasing integration of night vision systems into vehicles and static surveillance infrastructure. Government-led indigenization initiatives and focus on domestic manufacturing further reinforce long-term demand.

04 What are the Challenges in the India Night Vision Devices Market?

Challenges include dependence on imported critical components, long and complex procurement cycles, evolving qualitative requirements, and the need to ensure consistent performance across diverse terrains and climatic conditions. Export controls and technology access restrictions can also influence product development timelines and sourcing flexibility.