India Peer-to-Peer (P2P) Lending Market Outlook to 2035

By Borrower Type, By Loan Purpose, By Ticket Size, By Platform Business Model, and By Geography

- Product Code: TDR0433

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Peer-to-Peer Lending Market Outlook to 2035 – By Borrower Type, By Loan Purpose, By Ticket Size, By Platform Business Model, and By Geography” provides a comprehensive analysis of the peer-to-peer lending industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and supervisory landscape, borrower- and lender-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the India P2P lending market.

The report concludes with future market projections based on digital credit adoption, financial inclusion initiatives, evolution of alternative credit scoring, regulatory clarity under RBI oversight, platform-level risk management sophistication, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the Indian P2P lending market through 2035.

India Peer-to-Peer Lending Market Overview and Size

The India peer-to-peer lending market is valued at approximately ~INR ~ billion, representing loan disbursements facilitated through RBI-registered digital platforms that directly connect individual lenders with individual or small-business borrowers. P2P platforms operate as marketplaces rather than balance-sheet lenders, earning revenues through borrower fees, lender commissions, or servicing charges while enabling credit access without traditional banking intermediation.

The market has emerged as a structural component of India’s alternative lending ecosystem, supported by rapid digitization of financial services, widespread smartphone penetration, Aadhaar-enabled KYC infrastructure, UPI-based payment rails, and growing comfort among retail investors with digital investment products. P2P lending primarily serves borrower segments that are under-served or selectively served by banks and NBFCs, including self-employed individuals, gig workers, small traders, professionals, and micro-entrepreneurs.

India’s P2P lending growth has been shaped by a clear regulatory framework introduced by the Reserve Bank of India (RBI), which mandates platform registration, exposure caps, escrow-based fund flows, and disclosure norms. This regulatory oversight has differentiated compliant P2P platforms from unregulated digital lending apps and has improved lender confidence over time.

From a geographic perspective, Tier-1 and large Tier-2 cities account for the majority of loan origination volumes due to higher digital adoption, credit awareness, and income visibility. However, Tier-3 cities and semi-urban regions are emerging as incremental growth pockets as digital onboarding costs decline and alternative data-based underwriting models mature. Southern and Western India lead in platform penetration and lender participation, while Northern and Eastern regions show faster borrower growth driven by MSME and personal credit demand.

What Factors are Leading to the Growth of the India Peer-to-Peer Lending Market

Persistent credit gaps for individuals and micro-entrepreneurs strengthen demand for alternative lending channels: Despite improvements in formal financial inclusion, a significant share of India’s population and small businesses continues to face limited access to timely, unsecured credit from banks and traditional NBFCs. Self-employed individuals, freelancers, gig-economy workers, and small traders often lack formal income documentation or collateral, resulting in delayed approvals or outright rejection from institutional lenders. P2P lending platforms address this gap by leveraging alternative data sources, cash-flow proxies, and technology-enabled risk assessment to underwrite borrowers who fall outside conventional credit models. This structural mismatch between credit demand and supply remains a foundational growth driver for P2P lending in India.

Rapid digital adoption lowers acquisition and servicing costs for P2P platforms: India’s digital public infrastructure—including Aadhaar-based identity verification, e-KYC, e-signatures, and real-time payments—has significantly reduced the cost and complexity of onboarding borrowers and lenders. P2P platforms can acquire customers digitally, automate loan documentation, and manage repayments through standing instructions and escrow mechanisms. These efficiencies enable platforms to operate profitably at relatively small ticket sizes and scale across geographies without heavy physical infrastructure. As digital financial behavior becomes mainstream, especially among younger borrowers and retail investors, P2P lending benefits from higher engagement and repeat usage.

Search for higher yields among retail lenders expands supply-side participation: Low real returns on traditional savings instruments such as fixed deposits and savings accounts have encouraged retail investors to explore alternative asset classes. P2P lending offers lenders the potential for higher risk-adjusted returns by allowing diversification across multiple borrowers, tenures, and risk grades. Platforms provide portfolio construction tools, automated allocation options, and transparent performance dashboards, making credit investing more accessible to non-institutional lenders. This growing pool of digitally savvy retail lenders is a key enabler of sustained P2P lending volumes.

Which Industry Challenges Have Impacted the Growth of the India Peer-to-Peer Lending Market:

Credit risk volatility and borrower repayment uncertainty impact lender confidence and platform growth: While peer-to-peer lending platforms provide access to higher-yield credit investments compared to traditional savings instruments, they are inherently exposed to borrower credit risk, particularly in unsecured personal and micro-business lending segments. Economic slowdowns, income volatility among self-employed and gig workers, and sector-specific disruptions can lead to elevated delinquency and default rates. Periodic spikes in non-performing loans reduce lender confidence, slow reinvestment cycles, and compel platforms to tighten underwriting norms. This risk sensitivity directly affects platform growth momentum, as lenders become cautious during periods of macroeconomic uncertainty or adverse portfolio performance.

Regulatory exposure limits constrain scale and unit economics for platforms: RBI-imposed caps on lender exposure per borrower and aggregate borrowing limits per borrower, while essential for systemic risk control, restrict the ability of platforms to scale large-ticket lending efficiently. These limits necessitate higher transaction volumes to achieve meaningful disbursement growth, increasing operational complexity and customer acquisition costs. Additionally, platforms must rely on a continuously expanding lender base to fund growing borrower demand, making growth dependent on sustained retail investor participation rather than balance-sheet leverage.

High customer acquisition and servicing costs affect profitability sustainability: P2P lending platforms operate in a competitive digital lending environment where customer acquisition costs are elevated due to advertising intensity, referral incentives, and repeated borrower onboarding efforts. While digital processes reduce physical infrastructure costs, platforms still incur expenses related to credit assessment, data sourcing, collections, customer support, and compliance reporting. Rising servicing and recovery costs—especially for delinquent accounts—can compress platform margins and delay breakeven timelines, particularly for players focused on smaller ticket sizes and mass-market borrower segments.

What are the Regulations and Initiatives which have Governed the Market:

RBI NBFC-P2P regulatory framework governing platform operations and risk containment: Peer-to-peer lending platforms in India are regulated by the Reserve Bank of India under the NBFC-P2P category. The framework defines eligibility criteria, minimum capital requirements, permissible activities, and governance standards. Platforms are prohibited from taking balance-sheet exposure, providing credit guarantees, or offering assured returns. Borrower and lender exposure caps, mandatory reporting, and audit requirements are designed to limit systemic risk and ensure that P2P platforms function strictly as intermediaries rather than lenders.

Escrow-based fund flow and transparency requirements protecting lender and borrower interests: Regulations mandate that all funds be routed through escrow accounts operated by trustee-managed bank arrangements, ensuring separation of platform operational funds from lender and borrower monies. This structure enhances transparency, prevents fund misuse, and protects participants in the event of platform distress. Platforms are also required to provide detailed disclosures related to borrower profiles, credit grading methodologies, default statistics, and grievance redressal mechanisms, shaping how trust and credibility are built in the ecosystem.

Digital KYC, data privacy, and customer protection initiatives influencing platform compliance: P2P lending platforms must comply with India’s evolving digital KYC norms, data protection expectations, and customer consent frameworks. Requirements around secure handling of personal data, transparent communication of loan terms, and fair recovery practices influence platform design and operating processes. Regulatory emphasis on borrower protection, ethical collections, and responsible lending practices continues to raise compliance standards, increasing operating discipline while also elevating entry barriers for weaker or non-compliant players.

India Peer-to-Peer Lending Market Segmentation

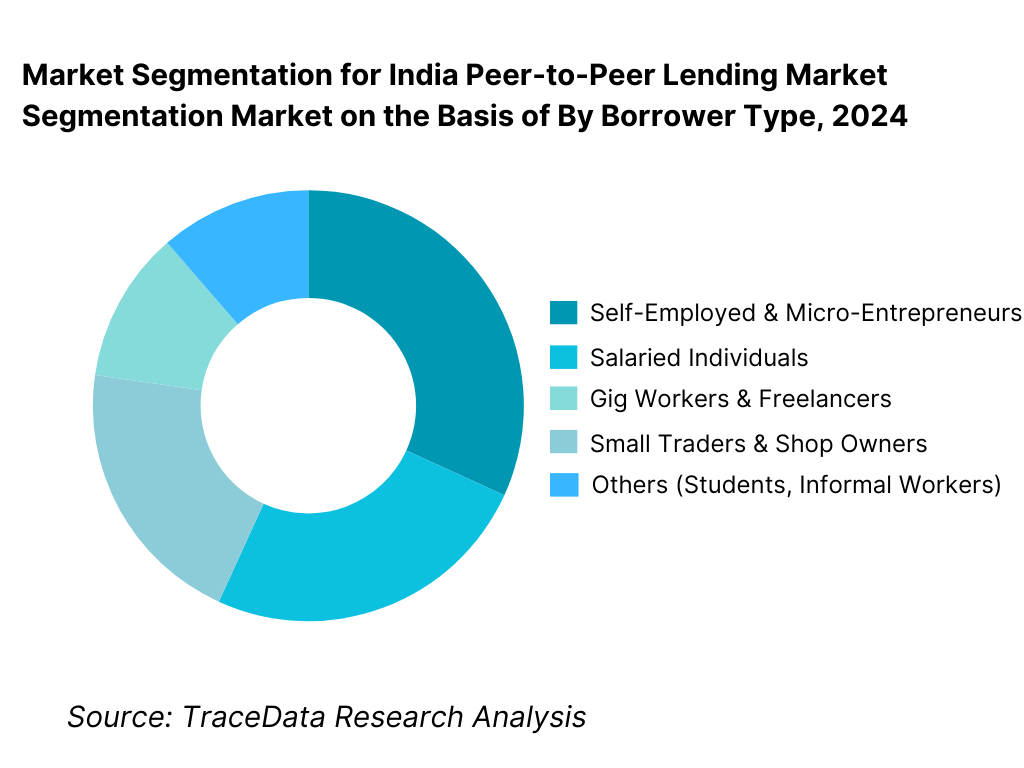

By Borrower Type: The self-employed and micro-entrepreneur segment holds dominance in the India peer-to-peer lending market. This is because small traders, professionals, gig workers, and micro-business owners face persistent credit access gaps from banks and traditional NBFCs due to limited formal income documentation and collateral constraints. P2P platforms are structurally suited to serve these segments by leveraging alternative data, cash-flow proxies, and digital underwriting models. While salaried personal loans and consumption-led borrowing continue to grow, self-employed and small business borrowers drive higher ticket sizes, repeat borrowing behavior, and sustained platform engagement.

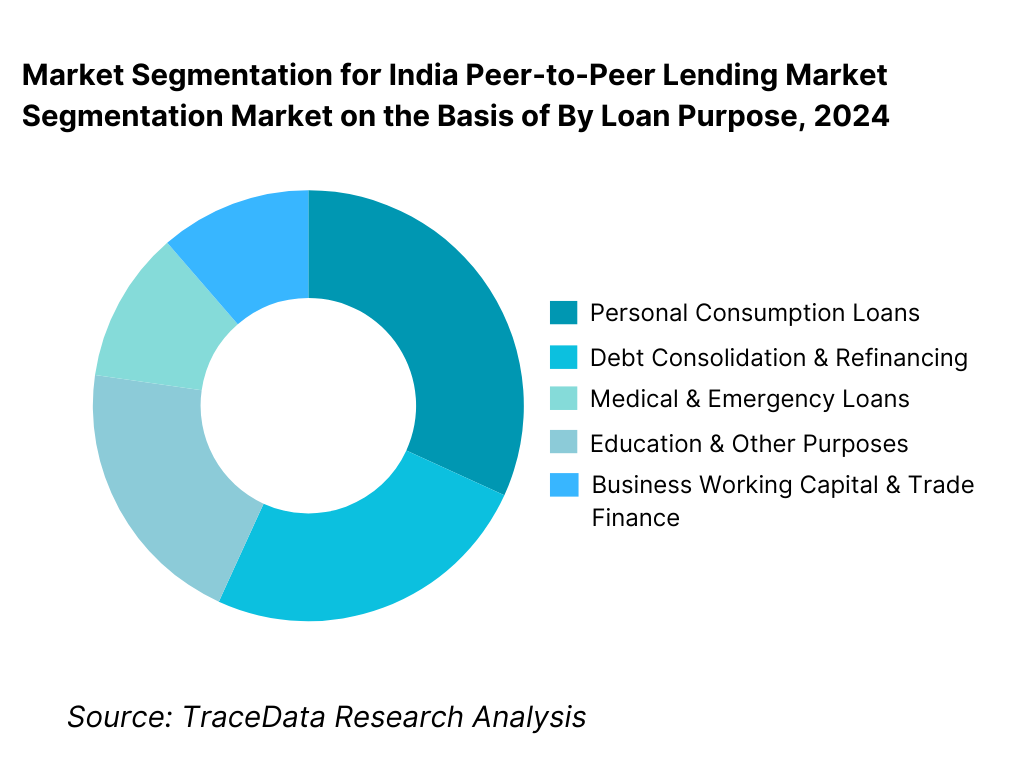

By Loan Purpose: Business and income-generating loans dominate the India P2P lending market. Borrowers increasingly use P2P platforms for working capital, inventory financing, and short-term liquidity needs, particularly in small businesses where speed and flexibility are critical. Personal consumption loans remain significant, especially for medical emergencies, education, and lifestyle spending, but business-linked loans are preferred by lenders due to relatively better repayment visibility and cash-flow linkage.

Competitive Landscape in India Peer-to-Peer Lending Market

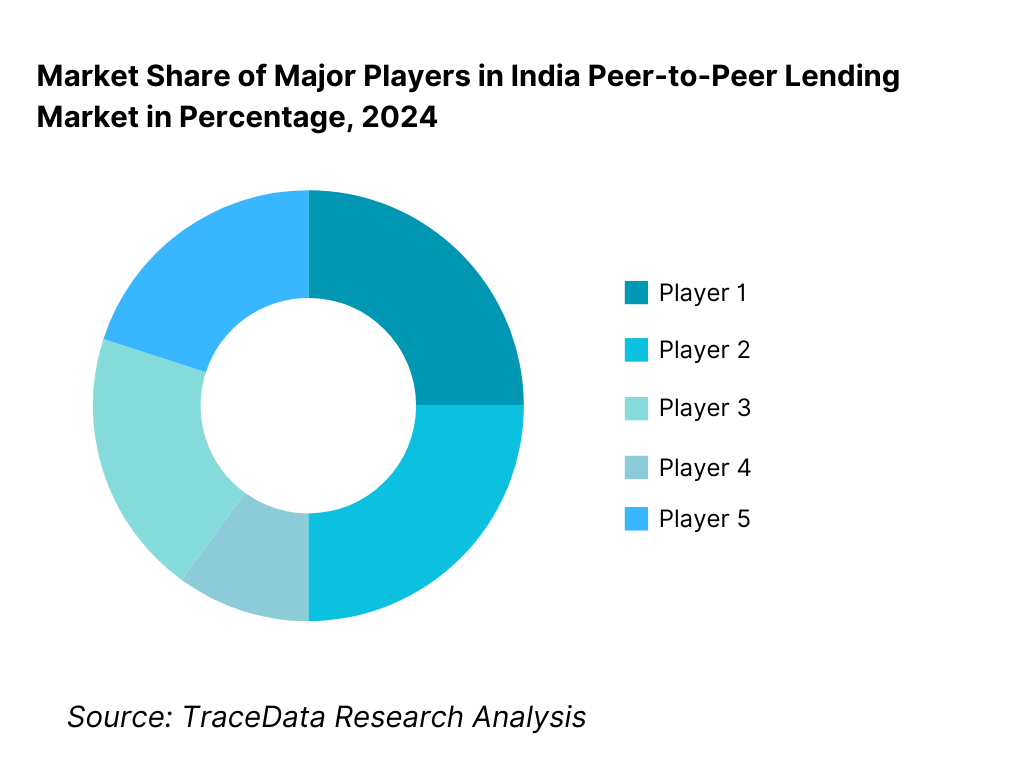

The India peer-to-peer lending market exhibits moderate concentration, characterized by a limited number of RBI-registered platforms with established borrower-lender ecosystems, underwriting frameworks, and compliance track records. Market leadership is driven by credit performance consistency, transparency of borrower grading, ease of lender portfolio diversification, recovery efficiency, and regulatory discipline.

While early-mover platforms dominate scale and brand recall, smaller and niche players remain competitive by focusing on specific borrower profiles, regional markets, or curated lender communities. Competitive intensity is shaped less by pricing and more by default rates, trust, platform stability, and quality of post-disbursement servicing.

Name | Founding Year | Original Headquarters |

Faircent | 2014 | New Delhi, India |

Lendbox | 2015 | Ahmedabad, India |

i2iFunding | 2015 | Noida, India |

LenDenClub | 2016 | Mumbai, India |

RupeeCircle | 2018 | Mumbai, India |

LiquiLoans | 2016 | Mumbai, India |

Finzy | 2017 | Bengaluru, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Faircent: As one of the earliest entrants in the India P2P lending market, Faircent has built scale through a diversified borrower base and strong emphasis on credit assessment frameworks. The platform’s positioning is reinforced by early regulatory compliance, brand trust, and a broad mix of personal and business loans catering to retail lenders seeking portfolio diversification.

Lendbox: Lendbox differentiates through technology-driven portfolio allocation tools and structured lender participation models. The platform emphasizes automation, data-driven underwriting, and ease of reinvestment, appealing to digitally savvy retail investors seeking passive exposure to P2P credit assets.

i2iFunding: i2iFunding maintains a strong focus on credit discipline and borrower quality, positioning itself toward lenders prioritizing risk management over rapid volume growth. The platform has emphasized compliance transparency, borrower verification, and recovery processes to maintain stable portfolio performance.

LenDenClub: LenDenClub has gained traction through simplified onboarding, consumer-friendly interfaces, and aggressive borrower acquisition strategies. Its growth has been driven by small-ticket personal loans and strong app-based engagement, particularly among younger borrower segments.

LiquiLoans: LiquiLoans focuses on structured P2P lending models and partnerships, including co-lending-style arrangements within regulatory boundaries. The platform positions itself toward higher-value lenders and emphasizes institutional-grade processes, governance, and reporting standards.

What Lies Ahead for India Peer-to-Peer Lending Market?

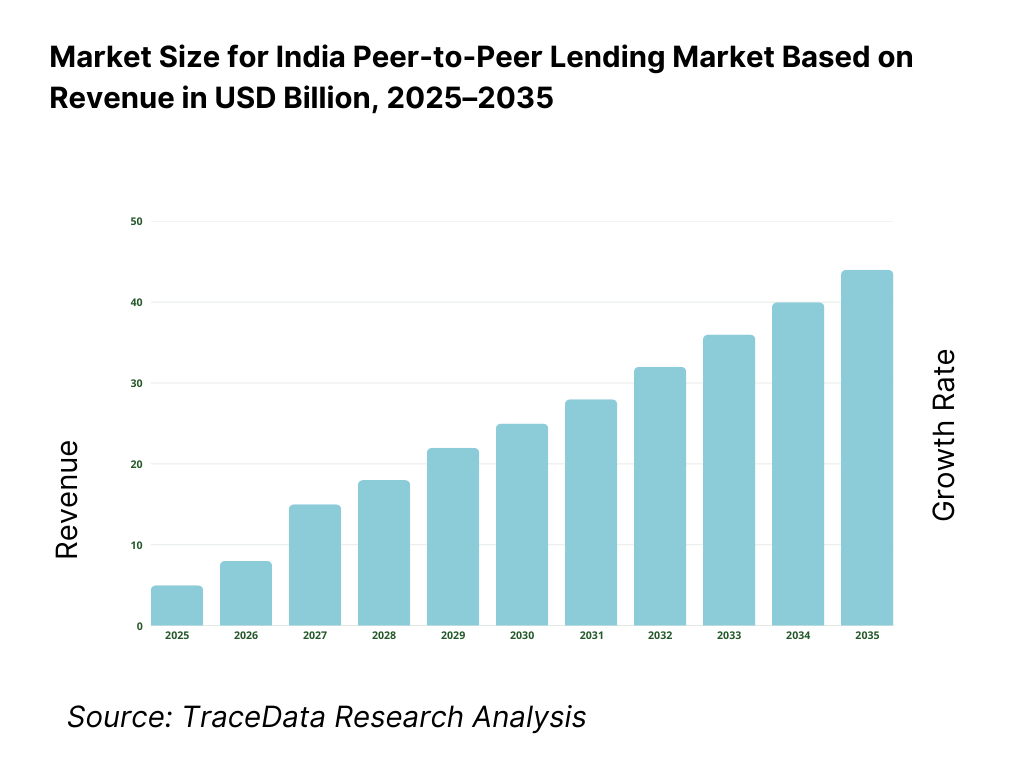

The India peer-to-peer lending market is expected to expand steadily by 2035, supported by structural credit gaps in the retail and micro-business segments, continued digitization of financial services, and growing acceptance of alternative lending platforms among both borrowers and retail investors. Growth momentum will be reinforced by improving regulatory clarity, deeper integration with India’s digital public infrastructure, and the increasing need for flexible, fast-turnaround credit solutions outside traditional banking channels. As borrowers seek speed, convenience, and accessibility, and lenders look for diversified yield-generating assets, P2P lending will remain a relevant and complementary layer within India’s broader credit ecosystem.

Shift Toward Higher-Quality Borrower Segments and Risk-Calibrated Portfolios: The future evolution of India’s P2P lending market will be characterized by a gradual shift from volume-driven growth toward higher-quality, better-underwritten borrower cohorts. Platforms are expected to increasingly focus on borrowers with clearer income visibility, repeat borrowing behavior, and stronger cash-flow linkages, such as small business owners, professionals, and established self-employed individuals. Credit models will become more granular, with tighter risk segmentation, differentiated pricing, and portfolio-level risk balancing to improve lender outcomes and reduce volatility in default cycles.

Increasing Role of Automation, Alternative Data, and Technology-Led Underwriting: Technology will play a central role in shaping the next phase of P2P lending growth. Platforms are expected to expand the use of alternative data sources such as bank statement analysis, transaction behavior, GST data proxies, and digital payment histories to enhance credit assessment. Greater automation in credit scoring, loan matching, and collections will improve operational efficiency while enabling faster decision-making. Through 2035, platforms that successfully combine data depth with transparent risk communication will strengthen lender trust and borrower retention.

Gradual Expansion Beyond Metro Markets Into Tier-2 and Tier-3 Regions: While metro and Tier-1 cities will continue to anchor lender participation and loan values, borrower growth is expected to increasingly originate from Tier-2 and Tier-3 cities. Rising smartphone penetration, improved digital literacy, and regional entrepreneurial activity will drive demand for small-ticket and working-capital loans in these markets. Platforms investing in vernacular interfaces, localized borrower onboarding, and region-specific risk models will be better positioned to capture this next wave of geographic expansion.

India Peer-to-Peer Lending Market Segmentation

By Borrower Type

Salaried Individuals

Self-Employed Professionals

Gig Workers & Freelancers

Small Traders & Micro-Entrepreneurs

Students and Other Informal Borrowers

By Loan Purpose

Business Working Capital & Trade Finance

Personal Consumption Loans

Medical & Emergency Financing

Education Loans

Debt Consolidation & Refinancing

By Ticket Size

Micro Loans (Low Ticket, Short Tenure)

Small Ticket Loans

Mid-Ticket Loans

High Ticket Loans

By Platform Business Model

Pure Marketplace (Borrower–Lender Matching)

Assisted Investment / Automated Allocation Model

Hybrid Model with Value-Added Services

Partner-Led / Co-Lending-Style Structures (Within Regulatory Limits)

By Geography

Metro Cities

Tier-1 Cities

Tier-2 Cities

Tier-3 Cities & Semi-Urban Regions

Players Mentioned in the Report

Faircent

Lendbox

i2iFunding

LenDenClub

LiquiLoans

RupeeCircle

Finzy

Other RBI-registered NBFC-P2P platforms and niche P2P players

Key Target Audience

Peer-to-peer lending platforms and fintech operators

Retail lenders and high-net-worth individual investors

Self-employed professionals and micro-entrepreneurs

Small businesses and informal sector borrowers

Digital payment and fintech ecosystem partners

Banks and NBFCs exploring alternative credit partnerships

Credit analytics, underwriting, and collections technology providers

Private equity and fintech-focused investors

Time Period

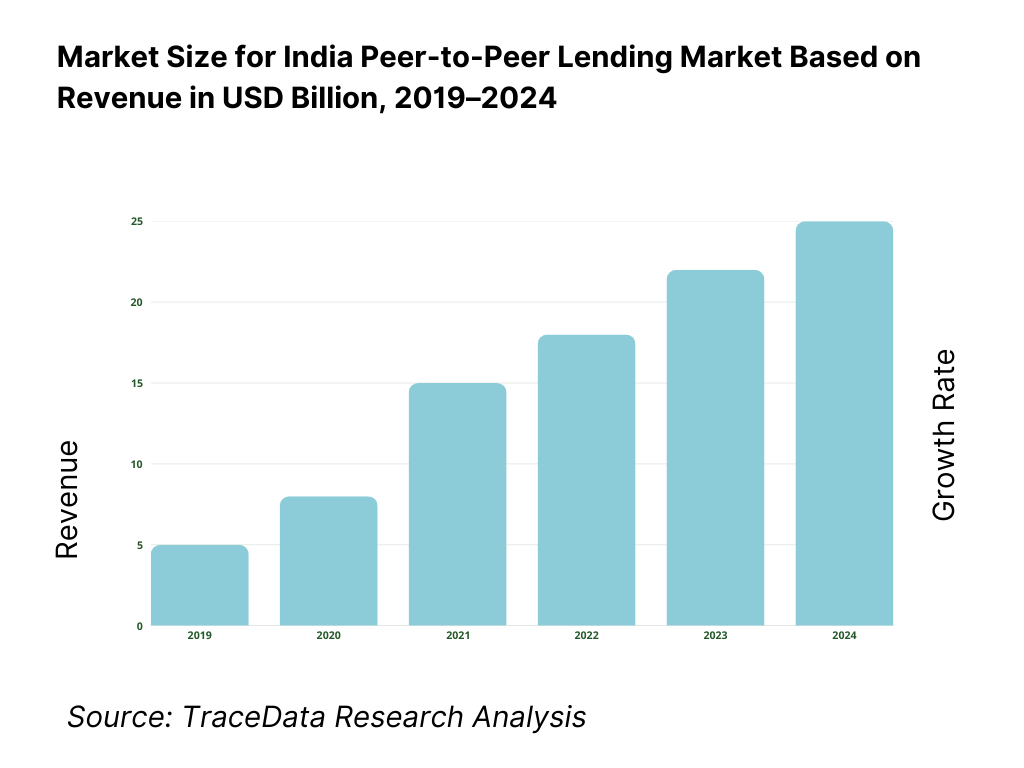

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in India Peer-to-Peer Lending Market

Value Chain Analysis

4.1 Delivery Model Analysis for Peer-to-Peer Lending-Direct Marketplace, Assisted Investment, Hybrid Platforms [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for India Peer-to-Peer Lending Market [Borrower Fees, Lender Fees, Servicing Fees, Subscription Fees, Value-Added Services]

4.3 Business Model Canvas for India Peer-to-Peer Lending Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Platforms vs Platform-Led Ecosystems [Domestic P2P Platforms vs Bank/NBFC-Linked Models]

5.2 Investment Model in India Peer-to-Peer Lending Market [VC Funding, PE Investments, Strategic Investments, Corporate Venturing]

5.3 Comparative Analysis of Peer-to-Peer Lending Adoption in Individual vs Business Borrowers [Borrowing Behavior, Risk Appetite, ROI Benchmarks]

5.4 Platform Budget Allocation by Business Scale [Large Platforms, Mid-Sized Platforms, Emerging Platforms]Market Attractiveness for India Peer-to-Peer Lending Market

Supply-Demand Gap Analysis

Market Size for India Peer-to-Peer Lending Market Basis

8.1 Loan Disbursement Value (Historical Trend)

Market Breakdown for India Peer-to-Peer Lending Market Basis

9.1 By Market Structure (Pure Marketplace vs Assisted/Hybrid Platforms)

9.2 By Loan Type (Personal Loans, Business Loans, Consumption Loans, Emergency Loans)

9.3 By Borrower Segment (Salaried, Self-Employed, Gig Workers, Micro-Entrepreneurs)

9.4 By Ticket Size (Micro, Small, Mid, High Ticket Loans)

9.5 By Loan Purpose (Working Capital, Consumption, Medical, Education, Debt Consolidation)

9.6 By Platform Operating Model (Manual Allocation, Automated Allocation, Hybrid Allocation)

9.7 By Open Marketplace vs Curated Lending Programs

9.8 By Geography (Metro Cities, Tier-1 Cities, Tier-2 Cities, Tier-3 & Semi-Urban Regions)Demand-Side Analysis for India Peer-to-Peer Lending Market

10.1 Borrower & Lender Landscape and Cohort Analysis

10.2 Borrowing and Lending Drivers & Decision-Making Process

10.3 Credit Performance & Return on Investment Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in India Peer-to-Peer Lending Market

11.2 Growth Drivers for India Peer-to-Peer Lending Market

11.3 SWOT Analysis for India Peer-to-Peer Lending Market

11.4 Issues & Challenges for India Peer-to-Peer Lending Market

11.5 Government Regulations for India Peer-to-Peer Lending MarketSnapshot on Digital Lending & Fintech Credit Platforms Market in India

12.1 Market Size and Future Potential for Digital Credit Platforms in India

12.2 Business Models & Revenue Streams [Platform Fees, Credit Assessment Fees, Servicing Income]

12.3 Delivery Models & Lending Products Offered [Personal Loans, MSME Loans, Short-Term Credit]Opportunity Matrix for India Peer-to-Peer Lending Market

PEAK Matrix Analysis for India Peer-to-Peer Lending Market

Competitor Analysis for India Peer-to-Peer Lending Market

15.1 Market Share of Key Players in India Peer-to-Peer Lending Market (By Loan Disbursement Value)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Active Lenders, Loan Book Size, Pricing Models, Technology Used, Key Loan Products, Major User Segments, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Platform Positioning Matrix for Peer-to-Peer Lending Platforms

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for India Peer-to-Peer Lending Market Basis

- 16.1 Loan Disbursement Value (Projections)

Market Breakdown for India Peer-to-Peer Lending Market Basis

17.1 By Market Structure (Marketplace and Assisted/Hybrid Platforms)

17.2 By Loan Type (Personal, Business, Consumption, Emergency Loans)

17.3 By Borrower Segment (Salaried, Self-Employed, Gig Workers, Micro-Entrepreneurs)

17.4 By Ticket Size (Micro, Small, Mid, High Ticket Loans)

17.5 By Loan Purpose (Working Capital, Consumption, Medical, Education, Debt Consolidation)

17.6 By Platform Operating Model (Automated, Manual, Hybrid)

17.7 By Open vs Curated Lending Programs

17.8 By Geography (Metro, Tier-1, Tier-2, Tier-3 & Semi-Urban Regions)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the India Peer-to-Peer Lending Market across demand-side and supply-side entities. On the demand side, entities include salaried individuals, self-employed professionals, gig and freelance workers, small traders, micro-entrepreneurs, and borrowers seeking short-term personal, medical, education, or working-capital loans. Demand is further segmented by borrower profile, loan purpose (consumption vs income-generating), ticket size, credit risk band, and borrowing frequency (first-time vs repeat borrowers).

On the supply side, the ecosystem includes RBI-registered NBFC-P2P platforms, retail individual lenders, high-net-worth lenders, trustee banks managing escrow accounts, credit bureaus, data and analytics providers, KYC and identity verification partners, payment gateways, recovery and collections service providers, and regulatory oversight bodies. From this mapped ecosystem, we shortlist 6–10 leading P2P lending platforms based on loan disbursement scale, active lender base, credit performance history, underwriting frameworks, regulatory compliance track record, and geographic reach. This step establishes how value is created and captured across borrower acquisition, credit assessment, loan matching, servicing, collections, and platform monetization.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the India P2P lending market structure, demand drivers, and segment behavior. This includes reviewing digital lending adoption trends, unsecured credit penetration, MSME financing gaps, fintech ecosystem developments, and RBI regulatory circulars governing NBFC-P2P platforms. We assess borrower preferences around speed of disbursal, documentation requirements, pricing sensitivity, and repayment flexibility, as well as lender preferences around returns, diversification, and risk transparency.

Company-level analysis includes review of platform business models, onboarding journeys, credit grading methodologies, default and recovery disclosures, fee structures, and technology capabilities. We also examine macro-economic factors such as employment trends, self-employment growth, digital payments adoption, and credit bureau coverage that influence borrowing behavior. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with P2P lending platform founders, senior management teams, credit and risk heads, retail lenders, high-value lenders, fintech ecosystem partners, and selected borrowers. The objectives are threefold: (a) validate assumptions around borrower concentration, lender participation, and platform differentiation, (b) authenticate segment splits by borrower type, loan purpose, ticket size, and geography, and (c) gather qualitative insights on credit risk behavior, default cycles, recovery effectiveness, customer acquisition costs, and regulatory compliance challenges.

A bottom-to-top approach is applied by estimating borrower volumes, average ticket sizes, and loan frequency across key segments, which are aggregated to develop the overall market view. In selected cases, disguised borrower- and lender-style interactions are conducted to validate platform onboarding experiences, transparency of disclosures, turnaround times, and servicing quality, ensuring field-level realism in the analysis.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as unsecured credit growth, MSME financing needs, digital transaction penetration, and household borrowing trends. Assumptions around default rates, lender participation growth, regulatory constraints, and economic cycles are stress-tested to understand their impact on platform scalability and sustainability.

Sensitivity analysis is conducted across key variables including borrower risk mix, lender yield expectations, regulatory exposure limits, and geographic expansion into Tier-2 and Tier-3 markets. Market models are refined until alignment is achieved between borrower demand, lender supply, and platform operating capacity, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the India Peer-to-Peer Lending Market?

The India Peer-to-Peer Lending Market holds strong long-term potential, supported by persistent credit gaps among self-employed individuals and micro-entrepreneurs, rising digital adoption, and growing acceptance of alternative lending platforms. P2P lending is expected to remain a complementary credit channel alongside banks and NBFCs, particularly for small-ticket and short-tenure loans where speed and flexibility are critical. As underwriting models mature and lender awareness improves, the market is expected to scale steadily through 2035.

02 Who are the Key Players in the India Peer-to-Peer Lending Market?

The market consists of a limited number of RBI-registered NBFC-P2P platforms with established borrower-lender ecosystems and compliance track records, alongside smaller niche platforms focused on specific borrower segments or investment profiles. Competition is shaped by credit performance, transparency, technology robustness, recovery effectiveness, and trust rather than pricing alone. Platform credibility and regulatory discipline play a central role in sustaining lender participation.

03 What are the Growth Drivers for the India Peer-to-Peer Lending Market?

Key growth drivers include limited access to formal unsecured credit for self-employed and informal borrowers, rapid digitization of financial services, availability of alternative data for credit assessment, and increasing appetite among retail investors for higher-yield digital investment products. Regulatory clarity under RBI oversight and integration with India’s digital public infrastructure further reinforce market development.

04 What are the Challenges in the India Peer-to-Peer Lending Market?

Challenges include borrower credit risk volatility, sensitivity to economic slowdowns, regulatory exposure limits that constrain scale, and rising customer acquisition and servicing costs. Reputational spillover from unregulated digital lending apps and the need for continuous lender education around risk-return dynamics also present structural challenges. Platform sustainability depends on maintaining underwriting discipline while achieving operational scale.