India Proton Exchange Membrane (PEM) Fuel Cell Market Outlook to 2030

By Fuel Cell Type, By Application, By End-User Sector, By Power Rating, and By Region

- Product Code: TDR0387

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The Report Title “India PEM Fuel Cell Market Outlook to 2030 – By Fuel Cell Type, By Application, By End-User Sector, By Power Rating, and By Region” provides a comprehensive analysis of the Proton Exchange Membrane (PEM) fuel cell industry in India. It covers an overview and genesis of the sector, overall market size in terms of installed capacity and value, detailed market segmentation, emerging trends and developments, policy landscape, end-user profiling, issues and challenges, and a competitive landscape that includes competition scenario, cross-comparison, opportunities and constraints, and profiling of major players in the Indian fuel cell ecosystem. The report concludes with future market projections segmented by fuel cell type, application, sector, power rating, and region. It also incorporates cause-and-effect relationships and success case studies, highlighting major opportunities, bottlenecks, and strategic considerations shaping the India PEM Fuel Cell Market through 2030.

India PEM Fuel Cell Market Overview and Size

India’s PEM fuel cell market remains in its early-commercialization phase but is rapidly expanding due to national decarbonization commitments, emerging hydrogen ecosystems, and early-stage deployments in mobility, stationary backup, and material-handling applications. India’s evolving hydrogen infrastructure under the National Green Hydrogen Mission has unlocked demonstration projects in buses, trucks, telecom tower backup, distributed generation, and defence-grade applications. In 2024, total PEM fuel cell deployments crossed the threshold of approximately 8.5–10 MW cumulative, driven by pilots supported by central PSUs, automotive OEMs, and private technology developers. While commercial volumes remain modest, the market has entered a scale-up phase driven by regulatory push, OEM-led R&D, and rising interest in indigenous stack manufacturing.

Mobility remains the most visible demand driver. India conducted its first dedicated fuel-cell electric bus (FCEB) operations through NTPC’s structured trial program in 2023–24 using 350-bar compressed hydrogen. State governments in Himachal Pradesh, Delhi NCR, Maharashtra, and Gujarat have initiated fuel-cell bus feasibility assessments aligned with green mobility corridors. On the stationary side, telecom backup power has re-emerged as a promising initial commercial segment, with trials underway in distributed towers requiring high-availability, low-downtime power. Industrial microgrids, mall complexes, data centres, and commercial buildings are testing PEM-based systems for peak-shaving and reliability, especially in regions with unstable grid quality.

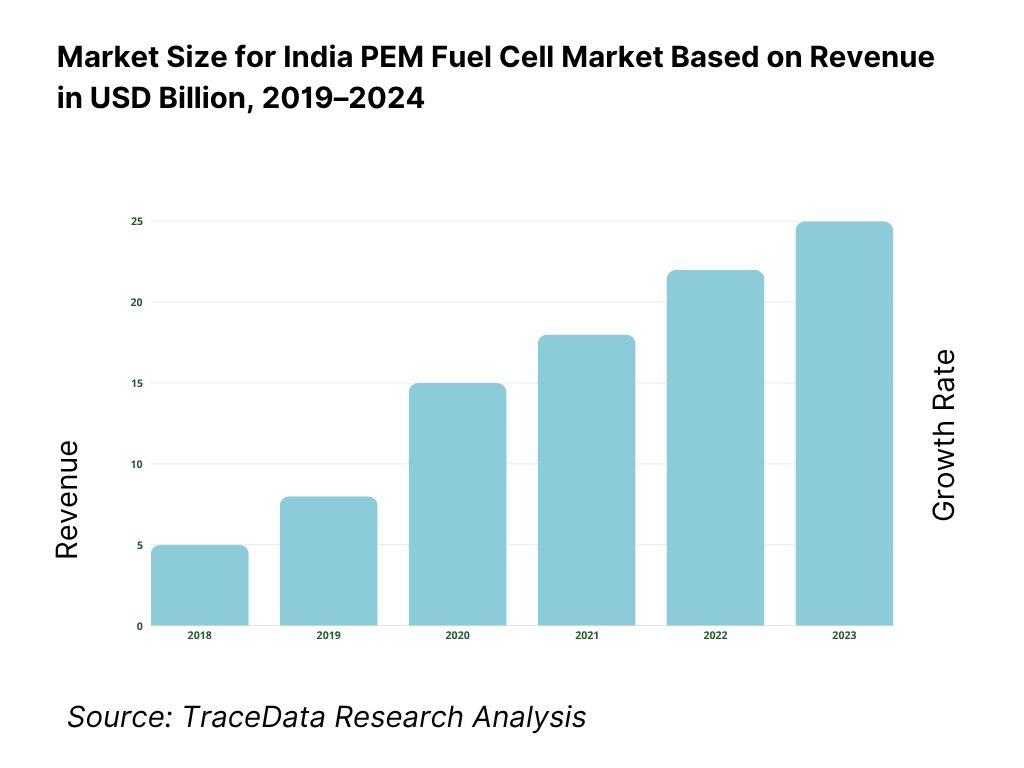

In value terms, the India PEM fuel cell market surpassed an estimated USD 21–25 million in 2024 across propulsion stacks, power modules, balance-of-plant components, and integration services. Import dependence remains high for membranes, catalyst-coated membranes (CCMs), and platinum group metal (PGM)-based catalysts, but domestic assembly capabilities are strengthening through partnerships between global stack makers and Indian integrators. This emerging supply chain, coupled with India’s expanding green hydrogen production pipeline, signals a transition toward early-stage commercialization by 2027 and broader market adoption by 2030.

What Factors Are Leading to the Growth of the India PEM Fuel Cell Market

Policy-driven ecosystem development accelerating commercialization: India’s hydrogen and fuel cell ecosystem has gained momentum under the National Green Hydrogen Mission, which aims to establish domestic production, support electrolyser capacity, and encourage end-use applications. The mission is supported by viability gap funding, pilot project backing, and procurement frameworks that promote hydrogen utilization across mobility, power, and heavy industry. These signals have increased investor confidence in PEM fuel cells as enabling technologies within hydrogen value chains. State-level EV policies in Gujarat, Maharashtra, Karnataka, and Haryana have included hydrogen mobility corridors, enabling OEMs to plan fuel-cell pilots with clearer demand pathways.

Decarbonization requirements across mobility and logistics: India’s logistics sector is pursuing zero-emission pathways across long-haul trucking, electric bus fleets, mining vehicles, and heavy-duty transportation segments. PEM fuel cells, with their fast refuelling and long-range capability, are increasingly considered for routes where battery-electric vehicles face limitations due to weight penalties, payload losses, or insufficient charging infrastructure. Trials in long-distance trucking and intercity buses are encouraging market momentum, as PSU-led procurement plans increasingly incorporate hydrogen-based drive trains for next-generation mobility. These shifts support steady demand growth for PEM stacks and power modules through 2030.

Corporate sustainability and early commercial adoption in stationary power: Commercial complexes, large office parks, and critical infrastructure operators such as data centers and telecom tower firms are exploring PEM fuel cells as reliable substitutes for diesel gensets, especially in Tier-I cities implementing emissions restrictions. India’s data center boom, with high uptime requirements and rising energy demand, is creating a niche for PEM-based combined heat and power (CHP) systems. Green building certifications, corporate net-zero commitments, and diesel-ban directives in Delhi NCR support higher adoption of low-emission backup power technologies.

Rise of indigenous technology innovation and localization: India’s R&D ecosystem has matured, with domestic companies actively developing PEM stack designs, localizing balance-of-plant components, and optimizing system integration for Indian climatic conditions. Collaborative research involving PSU research labs, private engineering firms, and global technology developers is accelerating local production of membrane electrode assemblies (MEAs), bipolar plates, humidifiers, thermal management subsystems, and power electronics. This localization push reduces BOM costs, improves serviceability across regions, and increases system life for high-humidity, high-temperature operation typical in India.

Which Industry Challenges Have Impacted the Growth of the India PEM Fuel Cell Market

Cost barriers and supply-chain limitations: High system cost remains the single biggest constraint. Imported membranes, catalyst materials, and stack components significantly increase the price of PEM systems, especially at sub-100 kW scales. Platinum-based catalysts and CCMs contribute disproportionately to per-kilowatt cost, limiting widespread commercial deployments. While localization is improving, the supply ecosystem for high-precision balance-of-plant components such as compressors, hydrogen recirculation devices, and thermal management subsystems remains nascent.

Hydrogen availability and refueling infrastructure constraints: India’s hydrogen refueling network is in early stages, with only a limited number of high-pressure dispensing stations operational across major industrial corridors. For mobility applications such as buses and trucks, the geographical mismatch between hydrogen production clusters and intended operating routes has slowed adoption. The absence of a standardized 350-bar and 700-bar refueling station network creates uncertainty for OEMs planning FCEV rollouts. These infrastructure gaps make early operations reliant on captive hydrogen supply logistics, increasing operational complexity.

Durability and performance challenges under Indian conditions: India’s climatic conditions — high humidity, high temperatures, suspended particulate matter, and varied load cycles — stress PEM systems when operated continuously. Degradation of catalysts, membrane hydration imbalance, and thermal cycling issues affect lifetime and performance. Operators require enhanced cooling systems, dust-resistant filtration, and advanced humidification subsystems to maintain stable stack operation. These environmental factors add cost and necessitate system modifications compared to fuel cells used in colder or more stable climates.

Need for skilled workforce and technical training: Designing, integrating, and maintaining PEM fuel cells requires specialized skills in electrochemistry, power electronics, hydrogen safety, and process engineering. India’s fuel cell workforce is still developing, with limited certified training programs available. For commercial operations and mobility depots, training in hydrogen handling, stack diagnostics, and failure management becomes essential. The skill gap influences serviceability, O&M cost, and operational uptime for early adopters.

What Are the Policies and Initiatives That Have Governed the Market:

National Green Hydrogen Mission and hydrogen adoption incentives: The mission provides the structural backbone for PEM fuel cell adoption, with incentives for green hydrogen production, electrolyser manufacturing, and demand creation in mobility and stationary power. Pilot projects supported through the mission encourage demonstration of fuel-cell buses, trucks, forklifts, and stationary backup systems. The mission’s focus on industrial clusters and green hydrogen hubs will unlock downstream demand for PEM fuel cells, especially in commercial fleets and industrial microgrids.

State-level hydrogen mobility programs and EV policies: Several states have integrated hydrogen mobility provisions into their EV policies, including incentives for fuel-cell buses, long-haul vehicles, and hydrogen-powered mining equipment. Government-supported trials in public transport fleets provide operational data and visibility to OEMs. State transport undertakings (STUs) have shown interest in hydrogen buses for mountainous routes and high-utilization corridors where battery-electric solutions face performance limitations.

Safety codes, standards, and infrastructure guidelines: India is progressively developing safety standards for hydrogen handling, storage, and dispensing, including guidelines for high-pressure cylinders, fueling stations, and mobile applications. These standards help reduce operational risk and create clear pathways for OEM certification. Regulatory clarity is critical for scaling PEM fuel cell deployments in commercial transport and industrial energy applications.

Incentives for clean backup power and emissions reduction in urban centers: Local regulations restricting diesel genset usage in regions such as Delhi NCR support PEM fuel cell adoption for rooftop and distributed backup power applications. Green building rating systems increasingly reward hydrogen-based power systems as part of sustainability compliance, enabling broader acceptance among commercial real estate developers.

India PEM Fuel Cell Market Segmentation

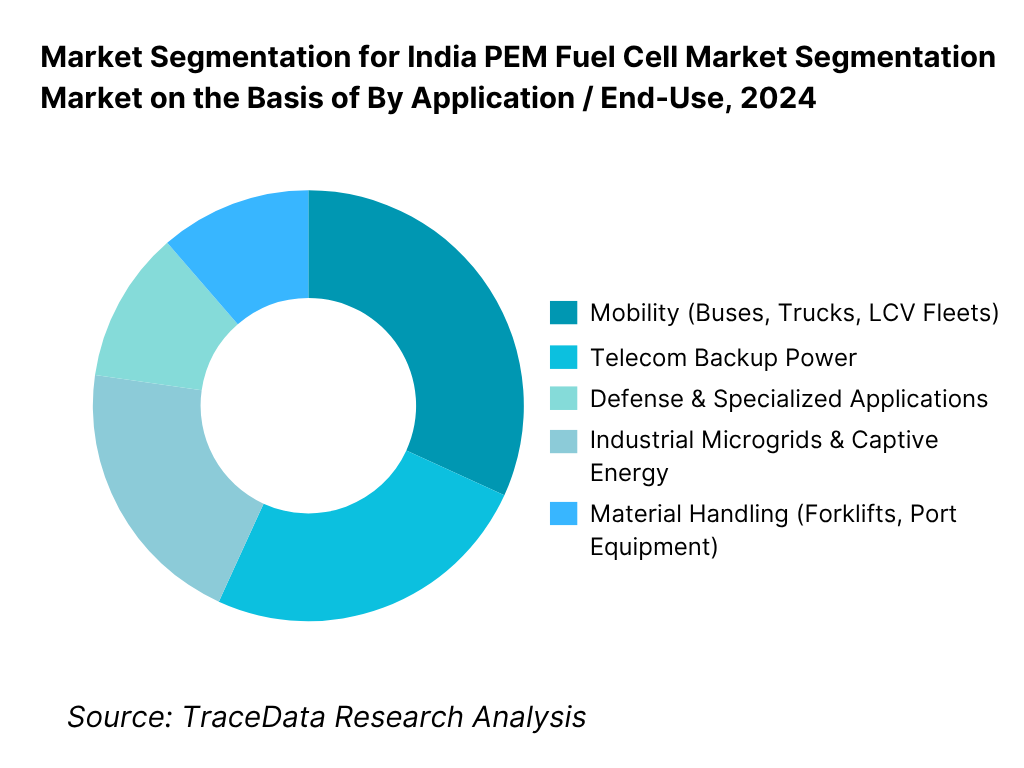

By Application / End-Use: In India, Mobility applications currently dominate share, driven by government-supported pilots for fuel-cell buses, long-haul trucks, and commercial fleet vehicles under the National Green Hydrogen Mission. State transport undertakings, PSUs, and logistics operators are increasingly prioritizing zero-emission long-range solutions, making mobility the earliest adopter of PEM fuel cells. Stationary power is emerging as a strong second pillar as telecom towers, commercial buildings, data centers, and industrial microgrids seek diesel-free, high-reliability backup systems. Defense applications, while smaller in volume, represent high-value use cases with specialized reliability and durability requirements.

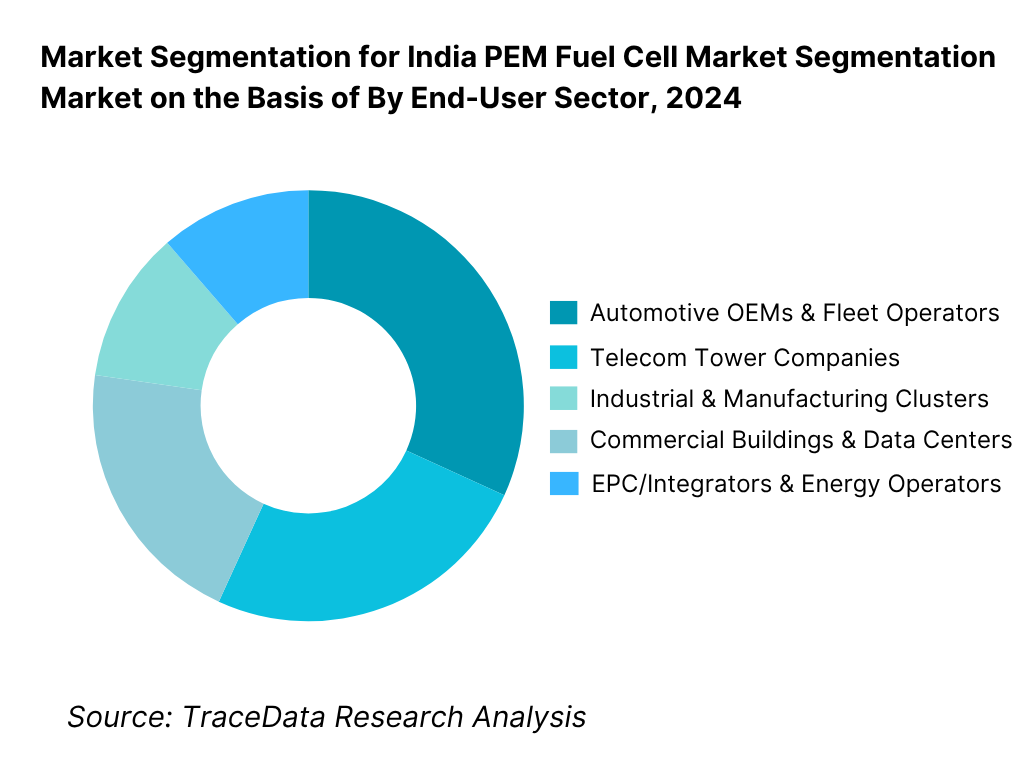

By End-User Sector: Automotive OEMs and fleet operators lead adoption due to large-scale bus and truck pilots. Telecom tower firms represent an important high-volume stationary opportunity as they shift away from diesel gensets. Industrial users, commercial real-estate developers, and data centers follow closely as part of their long-term decarbonization and reliability strategies.

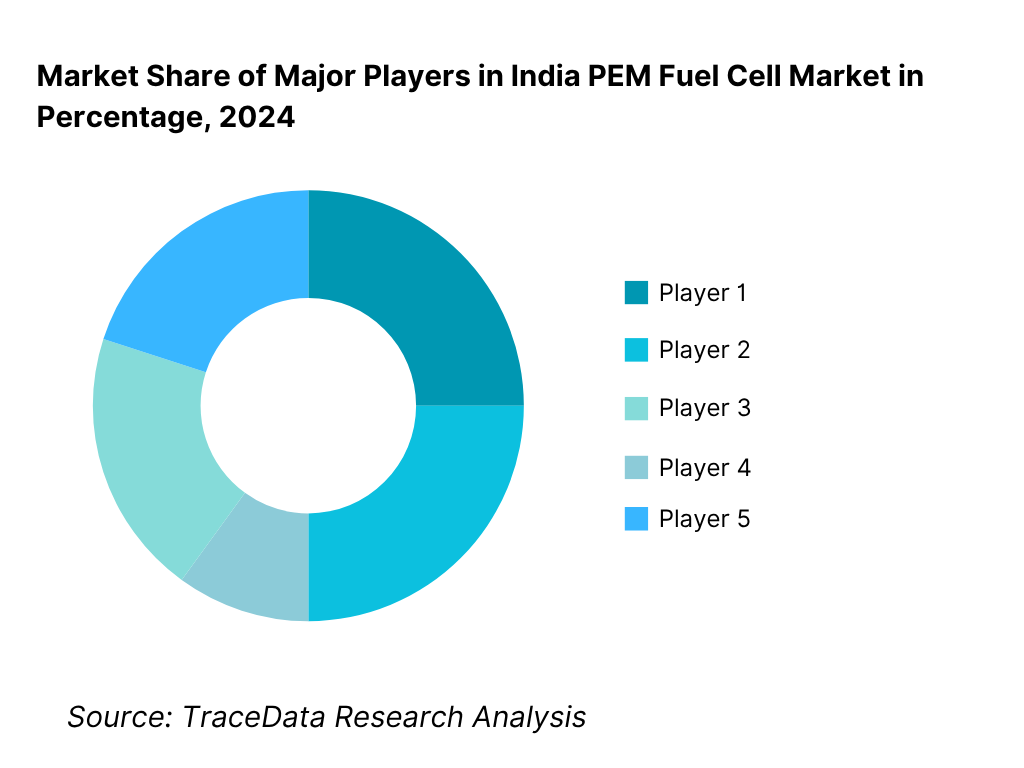

Competitive Landscape in India’s PEM Fuel Cell Market

India’s PEM fuel cell market is shaped by domestic technology developers, global stack manufacturers partnering with Indian integrators, PSU-led pilots, and multinational engineering firms exploring hydrogen ecosystems. Domestic capabilities are expanding across stack assembly, power electronics, hydrogen storage systems, and vehicle integration. PSU tenders and corporate decarbonization programs enable early visibility for solution providers.

Name | Founding Year | Original Headquarters |

|---|---|---|

Tata Motors (FCEV division) | 1945 | Mumbai, India |

KPIT Technologies (Fuel Cell Integration) | 1990 | Pune, India |

Ashok Leyland (Fuel-Cell CV Program) | 1948 | Chennai, India |

NTPC Energy Technology Research Alliance | 1975 | India |

Indian Oil R&D (Fuel Cell & Hydrogen) | 1959 | India |

Reliance New Energy (Hydrogen & FC Initiatives) | 1973 | Mumbai, India |

Bosch India (Fuel-cell components) | 1951 | Stuttgart, Germany |

Cummins India (PEM Power Modules) | 1962 | Columbus, U.S. |

Hyundai (FCEVs) | 1967 | Seoul, South Korea |

Toyota Kirloskar (Fuel-cell Trials) | 1937 | Toyota City, Japan |

Ballard Power (Stacks) | 1979 | Burnaby, Canada |

Plug Power (Stack modules & forklifts) | 1997 | New York, U.S. |

AVL (Engineering & Integration) | 1948 | Austria |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Tata Motors: Tata has intensified development of fuel-cell buses and long-haul truck platforms through partnerships with PSUs. The company’s next-generation PEM buses are being evaluated for mountainous and intercity routes. In 2024, Tata strengthened fuel-cell module integration with optimized thermal and water management tailored for Indian climatic conditions.

Ashok Leyland: Ashok Leyland accelerated its hydrogen fuel-cell truck development under strategic collaborations with technology firms. Recent prototypes incorporate high-efficiency PEM stacks designed for heavy-haul logistics. The company continues to explore captive fleet use cases with logistics operators in industrial belts.

KPIT: KPIT has deepened engineering capabilities in fuel-cell system integration, stack diagnostics, control software, and powertrain calibration. In 2024, it expanded its hydrogen mobility engineering center to support OEM fuel-cell platforms, improving durability and transient load handling.

Indian Oil: Indian Oil increased its focus on high-pressure hydrogen dispensing, storage solutions, and fuel-cell R&D infrastructure. The company’s R&D center is working on indigenous fuel-cell stack designs and catalyst alternatives to reduce platinum dependency. Pilot FCEVs supported by the company created valuable operational datasets across varied routes.

Hyundai & Toyota: Global OEMs extended their presence by collaborating on demonstration fleets, hydrogen corridor pilots, and stack technology evaluation. Their emphasis on durability, international standards alignment, and lifecycle cost optimization contributes to competitive benchmarking in the Indian market.

What Lies Ahead for India’s PEM Fuel Cell Market?

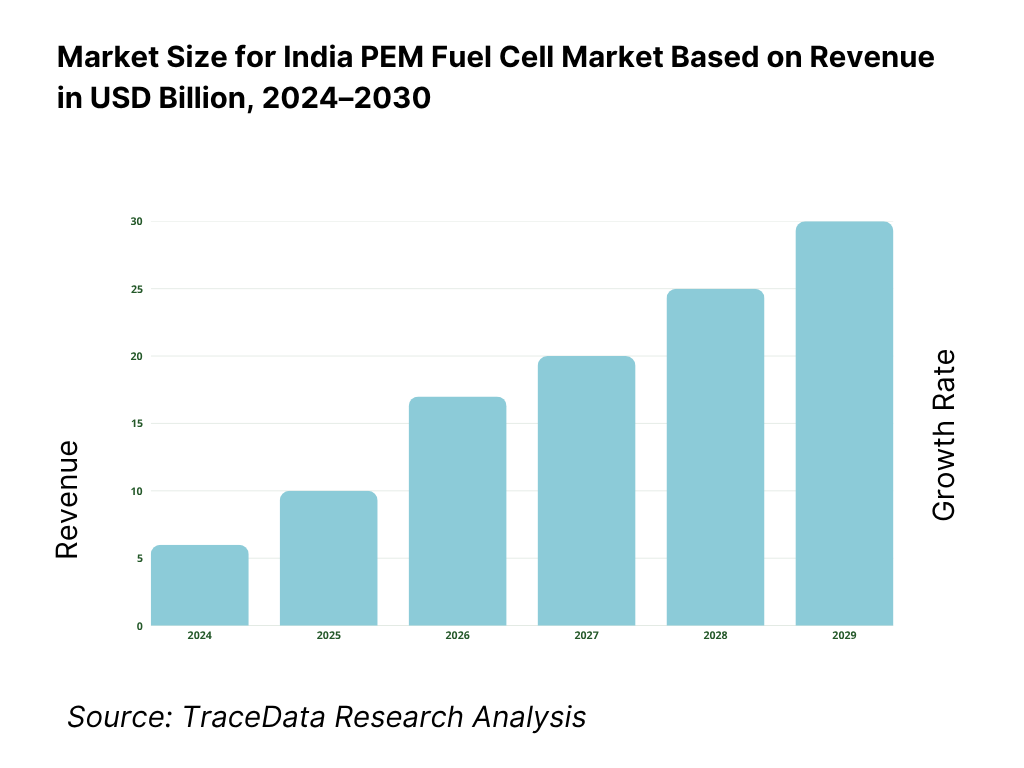

India’s PEM fuel cell market is entering a formative growth phase driven by decarbonization mandates, state-supported hydrogen pilots, expanding industrial hydrogen clusters, and maturing domestic technology capabilities. By 2030, PEM fuel cell deployments are expected to increase sharply across mobility, stationary power, telecom backup, and high-value industrial applications.

Scaling of Mobility Applications: Fuel-cell buses and trucks will lead the scale-up phase between 2026 and 2030 as hydrogen corridors and refueling infrastructure develop. OEMs are preparing multi-platform FCEV lineups, supported by PSUs procuring hydrogen-powered fleets for urban and intercity routes.

High Uptake in Stationary Power and Telecom Backup: Commercial buildings, data centers, and telecom tower operators will increasingly adopt PEM fuel cells as diesel genset alternatives. As sustainability-linked financing expands and air-quality restrictions tighten, PEM-based backup and CHP systems will gain traction in metropolitan markets.

Rise of Distributed Hydrogen Ecosystems: Industrial clusters across Gujarat, Maharashtra, Karnataka, and Tamil Nadu are setting up green hydrogen hubs that will anchor regional fuel-cell applications. Distributed hydrogen production lowers logistics costs and supports localized PEM deployments.

Localization of Key Components: Domestic manufacturing of membranes, bipolar plates, and power electronics will reduce BOM costs and improve affordability. India’s engineering ecosystem will play a central role in enhancing durability and performance under local climatic loads.

Integration with Renewable Energy and Storage Systems: Hybrid systems combining PEM fuel cells, solar power, and battery storage will emerge as viable options for microgrids, remote locations, and critical infrastructure with high uptime requirements.

India PEM Fuel Cell Market Segmentation:

By Fuel Cell Type

Low-Temperature PEM

High-Temperature PEM

By Application

Mobility

Stationary Power

Telecom Backup

Material Handling

Industrial Microgrids

Defense

By End-User

Automakers

Logistics Fleets

Telecom Operators

Commercial Buildings

Data Centers

Industrial Clusters

Defense Agencies

By Power Rating

<5 kW

5–20 kW

20–100 kW

100 kW

By Region

North India

West India

South India

East India

Central India

Key Target Audience

Automotive OEM fuel-cell divisions

Logistics fleet operators

Hydrogen production companies

Refueling station developers

Telecom tower companies

Data centers & commercial buildings

EPC contractors & system integrators

Hydrogen storage and cylinder suppliers

Government bodies (energy, heavy industries, transport)

Investors & clean-tech venture funds

PSU energy and transport undertakings

Time Period

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for PEM Fuel Cell Systems in India-Mobility, Stationary Power, Telecom Backup, Industrial Microgrids, and Defense Applications

4.2. Revenue Streams in India PEM Fuel Cell Market

4.3. Business Model Canvas for India PEM Fuel Cell Market5.1. Mobility vs. Stationary vs. Telecom vs. Industrial Use Cases

5.2. Ownership and Investment Models (OEM-Led, PSU-Led, Private Developers, Technology Integrators)

5.3. Comparative Analysis of System Integration and Deployment Models (Domestic vs. Imported Stacks)

5.4. Hydrogen Production & Refueling Infrastructure Allocation by State and Industrial Cluster8.1. Installed Capacity and Revenue Flow (Historical Trend-Mobility, Stationary, Telecom)

8.2. Share of Fuel Cell Adoption in India’s Hydrogen Economy and Per Capita Energy Transition Indicators

8.3. Mobility vs. Stationary Power Market Contribution Split9.1. By Application (Mobility, Stationary, Telecom Backup, Material Handling, Industrial Microgrids, Defense)

9.2. By Fuel Cell Type (Low-Temperature PEM, High-Temperature PEM)

9.3. By End-User Sector (Automotive OEMs, Fleet Operators, Telecom, Industrial, Commercial Buildings, Defense)

9.4. By System Ownership (OEM-Owned, PSU-Owned, Captive Industrial, EPC-Integrated)

9.5. By Power Rating (<5 kW, 5-20 kW, 20-100 kW, >100 kW)

9.6. By Company Size (Large OEMs, Technology Integrators, Emerging Startups)

9.7. By User Category (Public Sector Entities, Private Sector, Industrial Users)

9.8. By Region (North, West, South, East, Central India)10.1. End-User Adoption Landscape & Usage Patterns

10.2. Technology Selection and Deployment Determinants

10.3. Hydrogen Infrastructure Access and Cost Implications

10.4. Performance, Reliability & Downtime Indicators

10.5. Sectoral Decarbonization Mapping (Mobility, Industry, Distributed Energy)

10.6. Effectiveness of Early Pilots and Demonstration Projects11.1. Trends and Developments in India PEM Fuel Cell Market

11.2. Growth Drivers

11.3. SWOT Analysis for India PEM Fuel Cell Market

11.4. Issues and Challenges

11.5. Government Regulations & Hydrogen Mission Framework12.1. Market Size and Future Potential for Hydrogen Refueling Stations

12.2. Business Models and Revenue Streams for Hydrogen Supply

12.3. Delivery Models and Key Use Cases (Onsite Production, Centralized Hubs, Mobile Refueling, Industrial Clusters)15.1. Market Share of Key Players by Installed Capacity and Demonstration Scale

15.2. Operating Model Analysis Framework

15.3. Cross Comparison Parameters (Stack Efficiency, Durability, Hydrogen Consumption, System Integration Capability, Local Content Share, Cost/kW)

15.4. Technology Positioning Matrix for Fuel Cell Providers

15.5. Bowman’s Strategic Clock for Competitive Advantage16.1. Installed Capacity and Revenue Projections (2025-2030)

16.2. Hydrogen Consumption Forecast by Sector

16.3. Infrastructure Expansion and Capex Outlook for Mobility and Stationary Applications17.1. By Application (Mobility, Stationary, Telecom, Microgrids, Defense)

17.2. By Fuel Cell Type (LT-PEM, HT-PEM)

17.3. By End-User (OEMs, PSUs, Private Fleets, Industrial Users)

17.4. By Ownership Type (Public Sector, PPP Models, Private Sector)

17.5. By Region (North, West, South, East, Central)

17.6. By Adoption Stage (Pilot, Early Commercial, Scaling, Mature Use Case)

17.7. By Technology Maturity (Imported Stack, Local Stack, Hybrid Integration)

17.8. By Infrastructure Availability (Hydrogen Clusters vs. Non-Cluster Regions)

Research Methodology

Step 1: Ecosystem Creation

The research begins with a structured mapping of the India PEM Fuel Cell Market ecosystem, identifying all major demand- and supply-side participants. On the demand side, we include automotive OEMs deploying fuel-cell buses and trucks, commercial fleet operators exploring long-haul decarbonization, telecom companies evaluating hydrogen-based backup systems, data centers and commercial real-estate developers assessing low-emission reliability solutions, industrial microgrids, mining operators, and defense agencies. On the supply side, the mapping spans PEM stack manufacturers, MEA and catalyst suppliers, bipolar plate producers, balance-of-plant component makers, hydrogen producers, refueling station developers, EPC integrators, and storage-cylinder manufacturers. Key enablers include central ministries, state hydrogen cells, and PSUs supporting early pilots. Based on this mapping, we shortlist leading technology developers and OEMs—such as Tata Motors, Ashok Leyland, KPIT, Indian Oil, NTPC, and Reliance New Energy—using indicators like deployment capability, system integration expertise, and technology maturity. Secondary research from PSU announcements, hydrogen mission documents, OEM briefs, and proprietary databases is used to construct an initial understanding of stakeholder roles and market structure.

Step 2: Desk Research

Following ecosystem creation, an extensive desk research exercise is undertaken using secondary and proprietary data sources to establish industry context and validate preliminary hypotheses. This includes analysis of PEM fuel-cell deployments across mobility, stationary backup, telecom power, industrial microgrids, and commercial building applications. We examine trends in stack import volumes, BoP component availability, hydrogen production clusters, refueling corridor development, and component localization initiatives. Industry announcements, technical papers, PSU tenders, state hydrogen policy updates, technology partnership disclosures, and infrastructure rollout documents are evaluated to assess market readiness and the operational feasibility of PEM systems in India.

A detailed company-level review is conducted through press releases, investor presentations, deployment case studies, hydrogen ecosystem MoUs, and progress updates on pilot projects. Technical literature and tender documents offer insight into stack design parameters, durability considerations, catalyst loading levels, and thermal–water management systems adapted for high-temperature, high-humidity Indian conditions. This desk analysis establishes the baseline required for market sizing, competitive benchmarking, and primary research validation.

Step 3: Primary Research

Primary interviews constitute a core pillar of the methodology. We conduct structured interactions with leadership teams, engineering heads, program managers, hydrogen infrastructure operators, fleet integrators, telecom energy decision-makers, EPC firms, and R&D specialists across India’s fuel cell ecosystem. These interviews help validate secondary insights, verify system-level cost assumptions, understand operational challenges, and quantify realistic deployment volumes. A bottom-to-top approach is used to assess revenue contributions across stacks, balance-of-plant components, power modules, hydrogen storage, installation services, and long-term O&M packages.

To strengthen validation, our team also conducts disguised interviews by approaching stakeholders under the guise of potential buyers or technology collaborators. This technique helps cross-check lifespan estimates, catalyst degradation behavior, real-world fuel consumption patterns, onsite hydrogen logistics, service downtime risks, and integration constraints that may not be disclosed in formal conversations. Insights gathered from this process refine system cost modeling, calibrate performance assumptions, and clarify adoption behavior across mobility and stationary applications.

Step 4: Sanity Check

A comprehensive sanity-check process synthesizes top-down and bottom-up modeling to ensure internal consistency and realistic market sizing. The top-down model evaluates hydrogen production capacity, industrial cluster activities, refueling infrastructure rollout, PSU pilot scale, and sector-wise demand indicators such as heavy-duty fleet size, telecom tower counts, and commercial building stock. The bottom-up model aggregates primary insights to compute adoption volumes for buses, trucks, telecom backup systems, microgrids, and commercial CHP applications. Iterative reconciliation aligns macro-level hydrogen potential with micro-level deployment patterns, ensuring that final market outputs reflect technological feasibility, infrastructure availability, and stakeholder adoption readiness. This triangulated approach results in robust, field-verified projections for the India PEM Fuel Cell Market.

FAQs

01 What is the potential for the India PEM Fuel Cell Market?

The India PEM Fuel Cell Market presents strong long-term potential as the country accelerates its transition toward clean mobility, low-emission backup power, and hydrogen-based industrial energy systems. With cumulative deployments now crossing 8.5–10 MW through pilots in buses, trucks, telecom towers, and commercial complexes, India is entering an early commercialization phase supported by national hydrogen initiatives. The sector’s opportunity is reinforced by rising investments in green hydrogen production, the development of hydrogen mobility corridors, and the expansion of industrial microgrids seeking diesel-free reliability solutions. Growing participation from leading OEMs, PSUs, and technology firms indicates clear demand visibility across heavy mobility, stationary power, and distributed energy applications. As domestic manufacturing of PEM stacks and balance-of-plant components matures, India is poised to scale deployments significantly by 2030, benefiting from strong government support and a rapidly evolving hydrogen ecosystem.

02 Who are the key players in the India PEM Fuel Cell Market?

The India PEM Fuel Cell Market features a mix of domestic technology developers, automotive OEMs, public sector undertakings, and global fuel-cell companies actively collaborating through integration programs and pilot deployments. Key domestic players include Tata Motors and Ashok Leyland, which are advancing fuel-cell bus and truck platforms for intercity and heavy-haul applications. KPIT is a leading integrator specializing in stack control software, diagnostics, and thermal-water management systems. Indian Oil and NTPC play central roles through their R&D, hydrogen production, and demonstration projects. International companies such as Hyundai, Toyota, Ballard Power, Plug Power, Cummins, Bosch, and AVL contribute through stack technologies, engineering support, and component-level collaborations. Together, these entities are shaping a competitive, multi-layered ecosystem spanning stack design, power module integration, hydrogen infrastructure, and service capabilities across India.

03 What are the growth drivers for the India PEM Fuel Cell Market?

Growth in the India PEM Fuel Cell Market is driven by the convergence of policy momentum, decarbonization requirements, and expanding industrial hydrogen clusters. The National Green Hydrogen Mission supports fuel-cell adoption across mobility and stationary power through pilot funding, infrastructure incentives, and demand-creation programs. Heavy-duty mobility segments—including buses, long-haul trucks, and mining vehicles—are increasingly exploring PEM systems due to fast refueling, longer range, and operational consistency compared to battery-electric alternatives. Commercial and industrial establishments are adopting PEM fuel cells to transition away from diesel gensets, driven by emission restrictions in urban centers and the need for high-reliability backup power. Advancements in hydrogen production, state-level hydrogen corridors, and increasing private-sector investments in electrolyser and storage technologies further consolidate the sector’s growth trajectory.

04 What are the challenges in the India PEM Fuel Cell Market?

Despite strong potential, the India PEM Fuel Cell Market faces critical challenges that influence speed of adoption. High system costs driven by imported membranes, catalysts, and stack materials create barriers for large-scale commercial deployment. Limited hydrogen refueling infrastructure, particularly along long-haul corridors, restricts scalability in heavy mobility applications. India’s high-temperature, high-humidity climate presents durability and performance challenges requiring enhanced cooling, humidification, and dust-resistant filtration systems. Distribution of skilled technicians for hydrogen safety, system integration, and O&M remains limited, affecting service readiness. Additionally, the early-stage nature of hydrogen production and storage logistics increases operational uncertainty for fleet operators and industrial users. Addressing these challenges through localization, infrastructure expansion, and workforce development will be crucial for unlocking India’s full PEM fuel-cell potential by 2030.