India Savory Snacks Market Outlook to 2035

By Product Type, By Processing Method, By Distribution Channel, By Price Segment, and By Region

- Product Code: TDR0430

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Savory Snacks Market Outlook to 2035 – By Product Type, By Processing Method, By Distribution Channel, By Price Segment, and By Region” provides a comprehensive analysis of the savory snacks industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and food safety landscape, consumer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the India savory snacks market.

The report concludes with future market projections based on evolving consumer snacking habits, urbanization and income growth, premiumization and health-led reformulation trends, expansion of modern retail and e-commerce channels, regional taste preferences, and cause-and-effect relationships supported by case-based illustrations highlighting the major opportunities and risks shaping the market through 2035.

India Savory Snacks Market Overview and Size

The India savory snacks market is valued at approximately ~INR ~ billion, representing the production and sale of packaged and unpackaged savory food products consumed as between-meal or accompaniment snacks. The market includes traditional Indian snacks such as namkeen, bhujia, mixtures, chakli, sev, murukku, and mathri, as well as western-style snacks such as potato chips, extruded snacks, popcorn, pellets, and baked savory products. These products are sold across organized and unorganized channels, spanning small neighborhood kirana stores to modern trade, quick-commerce platforms, and foodservice outlets.

The market is anchored by India’s large and diverse consumer base, deep-rooted snacking culture, increasing preference for convenient packaged foods, and the coexistence of traditional regional tastes alongside modern and global flavors. Savory snacks enjoy high frequency of consumption across age groups and income segments, driven by affordability, availability in small pack sizes, and suitability for both urban and rural consumption occasions.

Regionally, North and West India represent the largest savory snacks demand centers due to strong traditional namkeen consumption, high density of regional manufacturers, and established taste preferences for fried and spicy snack formats. South India contributes significantly through rice-based and extruded snack varieties, with strong local brands and high penetration of packaged snacks in urban markets. East India, while smaller in overall value, is witnessing faster growth driven by urban expansion, rising disposable incomes, and increasing availability of national and regional brands through modern retail and e-commerce channels.

What Factors are Leading to the Growth of the India Savory Snacks Market:

Large population base and high-frequency consumption sustaining structural demand: India’s population of over ~1.4 billion provides an exceptionally large and repeat-driven consumer base for savory snacks, which are embedded in daily eating habits across age groups and income levels. Savory snacks in India are not limited to discretionary indulgence but are consumed as routine accompaniments to tea, travel, work breaks, and social interactions. High purchase frequency—often multiple times per week—combined with low unit price points and availability of single-serve SKUs ensures consistent volume throughput across urban and rural markets. This scale effect allows manufacturers to operate high-capacity production lines and supports continuous expansion of both organized and regional players.

Urbanization, workforce participation, and time-constrained lifestyles increasing packaged snack reliance: Rapid urbanization and rising workforce participation, particularly among dual-income households, are reshaping food consumption patterns toward convenience-oriented products. Long commuting hours, extended work schedules, and reduced time for fresh food preparation are accelerating dependence on ready-to-eat savory snacks. Urban consumers increasingly substitute freshly prepared snacks with packaged alternatives that offer consistent taste, hygiene assurance, and shelf stability. This shift is especially pronounced in Tier I and Tier II cities, where modern retail, quick-commerce, and office-centric consumption occasions reinforce demand for packaged savory formats.

Affordable price architecture and SKU-level accessibility widening market penetration: The India savory snacks market benefits from a highly granular pricing structure, with products available across sub-INR ~ price points through small sachets and pillow packs. This affordability enables penetration across income segments and geographies, including rural and semi-urban markets. Manufacturers strategically design SKUs to align with daily cash spending behavior, allowing high-volume sales even among price-sensitive consumers. This micro-packaging strategy significantly expands the addressable consumer base and supports sustained volume growth despite income volatility and inflationary pressures.

Which Industry Challenges Have Impacted the Growth of the India Savory Snacks Market:

Health perceptions and regulatory scrutiny on fried and high-sodium products: A large share of India’s savory snacks portfolio remains dominated by fried products with high salt and fat content. Rising awareness around lifestyle diseases and nutrition has increased scrutiny from consumers, regulators, and advocacy groups. Labeling norms, potential front-of-pack disclosures, and public discourse around unhealthy snacking introduce reputational and reformulation pressures for manufacturers. While healthier alternatives are emerging, mass-market consumers remain price-sensitive, creating a tension between nutritional improvement and cost competitiveness that can slow category transition.

Raw material price volatility impacting margins and pricing stability: The savory snacks industry is exposed to fluctuations in key inputs such as edible oils, potatoes, pulses, cereals, and packaging materials. Volatility in agricultural output, import dependence for certain oils, and energy-linked logistics costs directly impact production economics. Given intense price competition, especially in mass segments—manufacturers face limited ability to pass on cost increases to consumers. Margin compression during inflationary cycles can constrain marketing spend, innovation investment, and expansion plans, particularly for smaller regional players.

Highly fragmented market structure intensifying price-led competition: India’s savory snacks market remains highly fragmented, with a large unorganized sector alongside national and regional brands. Unorganized players often operate with lower compliance costs and localized sourcing advantages, enabling aggressive pricing. This fragmentation intensifies competition in traditional retail channels and limits pricing power for organized players in mass segments. Sustaining brand differentiation and distribution discipline in such an environment requires continuous investment in marketing, trade incentives, and supply-chain efficiency.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety and Standards Act, 2006 and FSSAI regulations: India’s savory snacks market is primarily governed under the Food Safety and Standards Act, 2006, administered by the Food Safety and Standards Authority of India (FSSAI). The framework defines standards for ingredients, additives, contaminants, hygiene practices, and manufacturing processes applicable to packaged savory snacks. Compliance with product approvals, licensing of manufacturing units, and periodic inspections is mandatory for organized players. These regulations have gradually increased formalization in the sector, favoring manufacturers with scalable compliance and quality control systems while raising entry barriers for informal producers.

Food Safety and Standards (Packaging and Labelling) Regulations: Mandatory labeling norms require disclosure of nutritional information, ingredient lists, allergen statements, vegetarian/non-vegetarian symbols, shelf life, and manufacturer details. Recent regulatory emphasis on clearer nutritional disclosure, including fat, sugar, and salt content, has increased reformulation pressure on savory snack manufacturers. These requirements directly influence packaging design, SKU economics, and product positioning, particularly for mass-market fried snacks with high sodium and oil content.

Edible oil standards and quality controls: Savory snacks rely heavily on edible oils, which are regulated through standards governing permitted oil types, blending rules, and quality specifications. Periodic government interventions on edible oil imports, pricing, and quality testing impact cost structures and sourcing strategies for snack manufacturers. Compliance with oil reuse and degradation norms is especially relevant for fried snack producers, increasing monitoring requirements at the manufacturing level.

India Savory Snacks Market Segmentation

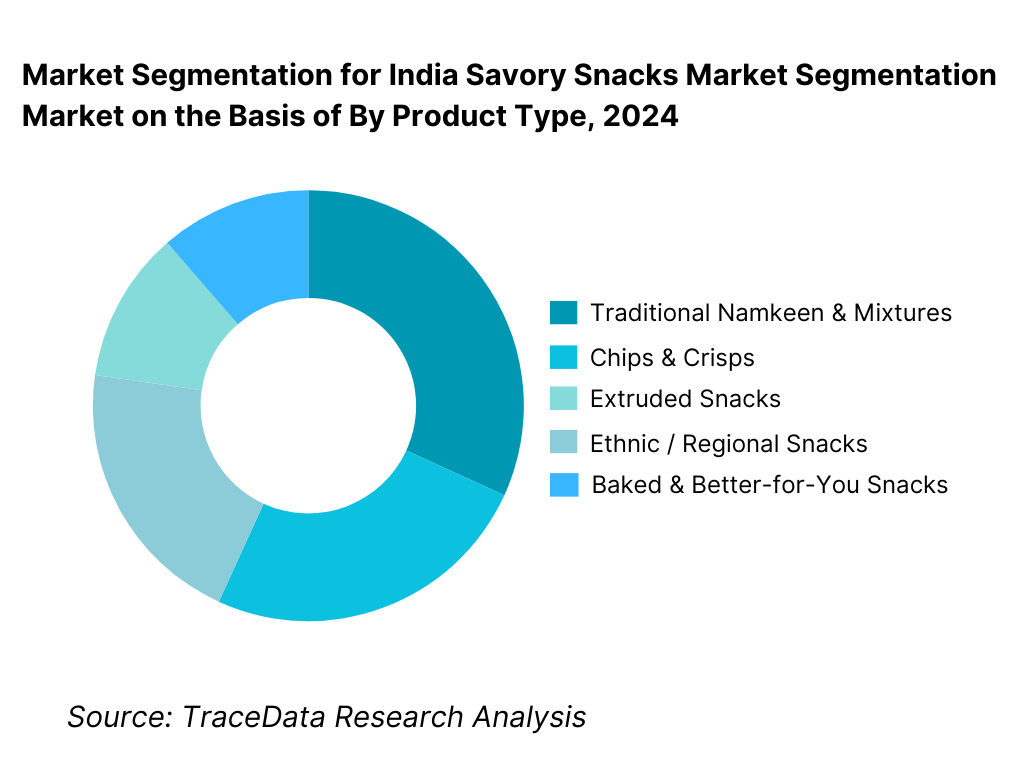

By Product Type: Among product categories, Traditional Namkeen and Mixtures hold the dominant share in 2024 (around ~40 %) due to their deep cultural acceptance, regional flavor diversity, and high consumption frequency across income groups. Chips and Crisps (~25 %) form the second-largest segment, driven by western snack adoption, youth consumption, and strong branding by national players. Extruded Snacks (~20 %) benefit from low-cost production, flavor versatility, and high penetration in small pack sizes. Ethnic Regional Snacks (~10 %) include region-specific products increasingly entering packaged formats, while Baked and Better-for-You Snacks (~5 %) represent a smaller but fast-growing premium segment.

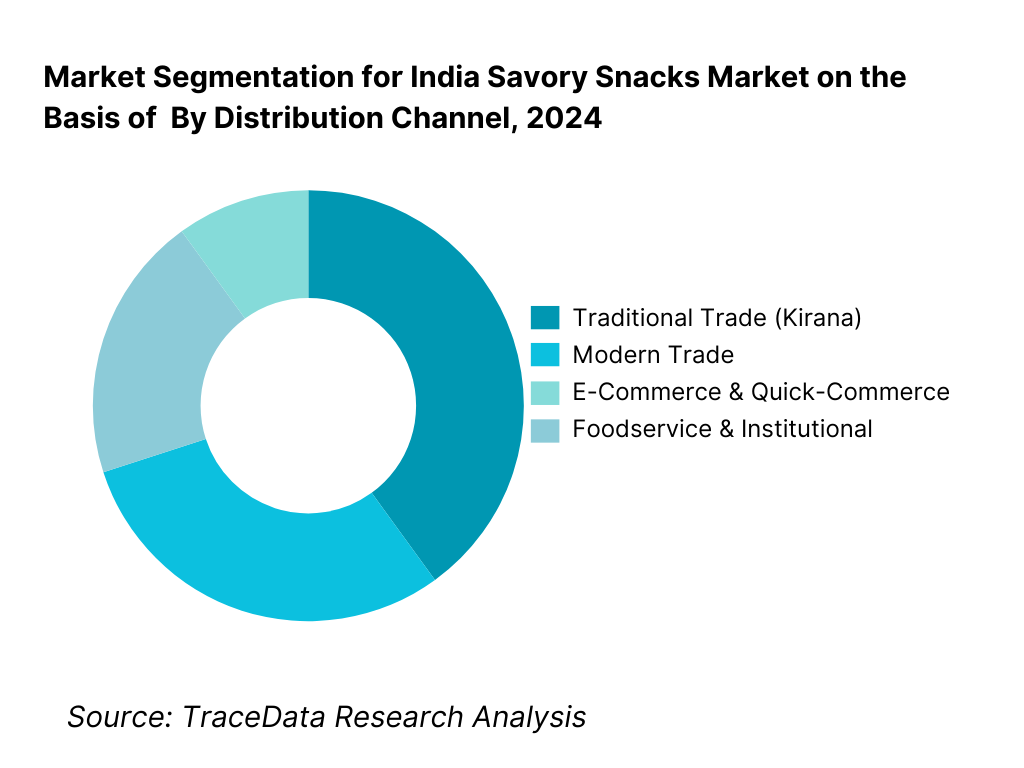

By Distribution Channel: In 2024, Traditional Trade (Kirana Stores) leads the market (~60 % share) due to its extensive reach, high purchase frequency, and dominance in small-ticket snack sales. Modern Trade (~15 %) plays a key role in premiumization, bulk packs, and new product discovery. E-Commerce and Quick-Commerce (~15 %) are the fastest-growing channels, driven by urban demand, impulse purchases, and rapid delivery models. Foodservice and Institutional Channels (~10 %) include cinemas, cafés, vending, and workplace consumption, contributing incremental volume and brand visibility.

Competitive Landscape in India Savory Snacks Market

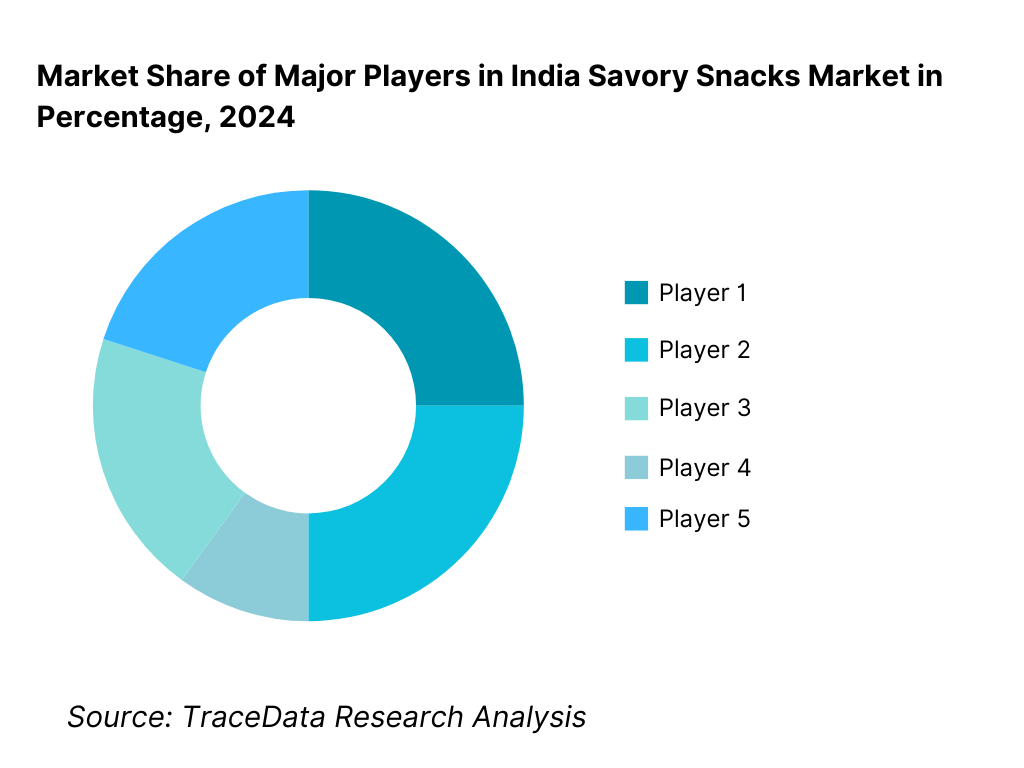

The India savory snacks ecosystem is characterized by a mix of established Indian snack champions, scaled regional specialists, and global FMCG snack leaders. Indian incumbents such as Haldiram’s, Bikaji, Balaji Wafers, and Gopal Snacks leverage deep regional taste understanding, dense kirana distribution networks, and high-velocity value packs across namkeen, bhujia, mixtures, wafers, and extruded snacks. Large FMCG players such as ITC (Bingo!) have built national scale through strong distribution, brand investments, and continuous format innovation, while global snack companies like PepsiCo bring category expertise, manufacturing scale, and brand-led growth strategies, particularly in chips and extruded snack segments.

Alongside these players, a growing set of health-positioned and premium snack brands are intensifying competition in baked, roasted, and “better-for-you” categories, pushing incumbents to diversify portfolios and experiment with new formats and claims.

Name | Founding Year | Original Headquarters |

Haldiram’s | 1937 | Noida, Uttar Pradesh, India |

Balaji Wafers | 1974 | Rajkot, Gujarat, India |

Bikaji Foods International | 1986 | Bikaner, Rajasthan, India |

ITC (Bingo!) | 2007 (brand launch) | Kolkata, India |

Prataap Snacks (Yellow Diamond) | 2009 | Indore, Madhya Pradesh, India |

Gopal Snacks | 1999 | Rajkot, Gujarat, India |

PepsiCo (Lay’s / Snacks Portfolio in India) | 1965 | Purchase, New York, USA |

Too Yumm! (Guiltfree Industries) | 2017 | Kolkata, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Haldiram’s: Haldiram’s continues to strengthen its leadership in traditional namkeen and savory snack categories through extensive product breadth, strong brand equity, and deep penetration across both traditional and modern trade channels. The company’s focus on capacity expansion, packaging upgrades, and national distribution reinforces its position as a dominant organized player in India’s savory snacks market.

ITC (Bingo!): ITC has steadily expanded the Bingo! brand across chips, extruded snacks, and fusion formats, leveraging its FMCG distribution backbone to improve availability in Tier II and Tier III cities. Continuous flavor innovation and competitive pricing have enabled ITC to maintain relevance in both mass and premium snack segments.

Bikaji Foods International: Bikaji has scaled from a regional namkeen specialist to a nationally visible brand by standardizing traditional snack formats, strengthening exports, and expanding modern trade presence. Its focus on ethnic Indian snacks positions it well to benefit from growing demand for packaged traditional foods.

Balaji Wafers and Gopal Snacks: These strong regional players maintain leadership in western India through sharp price-pack architecture, high-volume manufacturing, and loyalty in traditional retail. Their gradual expansion into neighboring regions reflects the potential of regional champions to scale nationally without heavy reliance on premium positioning.

PepsiCo (India Snacks): PepsiCo remains a key competitor in the chips and extruded snacks segment, supported by high brand recall, large-scale manufacturing, and strong presence across modern trade and quick-commerce platforms. Its focus on flavor localization and portfolio refresh continues to drive urban demand.

Too Yumm!: Too Yumm! represents the growing “better-for-you” snack segment, with products positioned around baked and lower-oil claims. The brand’s growth highlights increasing consumer interest in healthier snacking alternatives, particularly among urban and younger demographics.

What Lies Ahead for India Savory Snacks Market?

The India savory snacks market is expected to expand steadily through 2035, supported by sustained population growth, deep-rooted snacking habits, rising urbanization, and increasing penetration of packaged foods across Tier I, Tier II, and rural markets. The presence of large domestic snack manufacturers such as Haldiram’s, Bikaji, Balaji Wafers, and ITC (Bingo!), alongside global players like PepsiCo, will continue to strengthen the competitive ecosystem. Expansion of modern retail, e-commerce, and quick-commerce channels, combined with ongoing product innovation, is expected to be the primary catalyst driving the next phase of market growth.

Shift toward Premium and Better-for-You Snack Formats: The future of the India savory snacks market is expected to gradually tilt toward premium and health-positioned offerings, including baked, roasted, air-fried, and reduced-oil products. While mass-market fried snacks will continue to dominate volumes, urban consumers are increasingly seeking snacks with cleaner labels, portion control, and perceived nutritional benefits. This shift will encourage manufacturers to balance taste, price, and health claims while expanding higher-margin portfolios.

Greater Emphasis on Regional Flavor Localization at National Scale: India’s diversity in taste preferences will continue to shape product development strategies. Companies are expected to increasingly localize flavors and spice profiles to align with regional palates, while leveraging national manufacturing and distribution platforms. This approach will allow large brands to compete more effectively with regional and unorganized players, strengthening brand relevance without relying solely on price competition.

Acceleration of Modern Trade and Quick-Commerce Influence: Modern retail and quick-commerce platforms are likely to play a growing role in shaping consumption patterns, particularly in metropolitan and Tier I cities. Quick-commerce, with its focus on impulse purchases and rapid delivery, will increasingly influence new product launches, promotional strategies, and pack-size innovation. Brands will use these channels as testing grounds for new flavors and formats before scaling them nationally.

India Savory Snacks Market Segmentation

By Product Type

- Traditional Namkeen & Mixtures

- Chips & Crisps (Potato, Multigrain, Vegetable-based)

- Extruded Snacks

- Ethnic & Regional Savory Snacks

- Baked, Roasted & Better-for-You Snacks

- Others (Popcorn, Pellets, Fryums)

By Processing Method

- Fried

- Baked

- Roasted

- Extruded / Puffing-based Processing

By Flavor Profile

- Spicy & Masala-Based

- Salted / Plain

- Sour & Tangy

- Sweet & Savory Fusion

- Regional / Ethnic Spice Blends

By Price Segment

- Economy / Value (Low-price sachets and small packs)

- Mass / Mid-Priced

- Premium / Gourmet

By Distribution Channel

- Traditional Trade (Kirana Stores)

- Modern Trade (Supermarkets / Hypermarkets)

- E-Commerce & Quick-Commerce

- Foodservice & Institutional

- Direct-to-Consumer (Brand Websites / Subscriptions)

By Consumer Group

- Children & Teenagers

- Young Adults / Working Professionals

- Families & Household Consumption

- Health-Conscious & Premium Consumers

By Region

- North India

- West India

- South India

- East India

- North-East India

Players Mentioned in the Report:

- Haldiram’s

- Bikaji Foods International

- Balaji Wafers

- Gopal Snacks

- ITC (Bingo!)

- Prataap Snacks (Yellow Diamond)

- PepsiCo India (Lay’s, Kurkure, Uncle Chipps)

- Too Yumm! (Guiltfree Industries)

- Regional and unorganized snack manufacturers

Key Target Audience

- Indian and international FMCG investors tracking packaged food growth

- Private equity and venture capital firms evaluating snack and food brands

- Domestic and multinational snack manufacturers planning capacity expansion

- Food processing and packaging companies supplying the snack ecosystem

- Modern trade retailers and quick-commerce platforms expanding snack assortments

- Ingredient suppliers (edible oils, spices, grains) supporting snack production

- Distributors and logistics providers focused on FMCG and food delivery

- Regulatory bodies and food safety authorities involved in processed food oversight

Time Period:

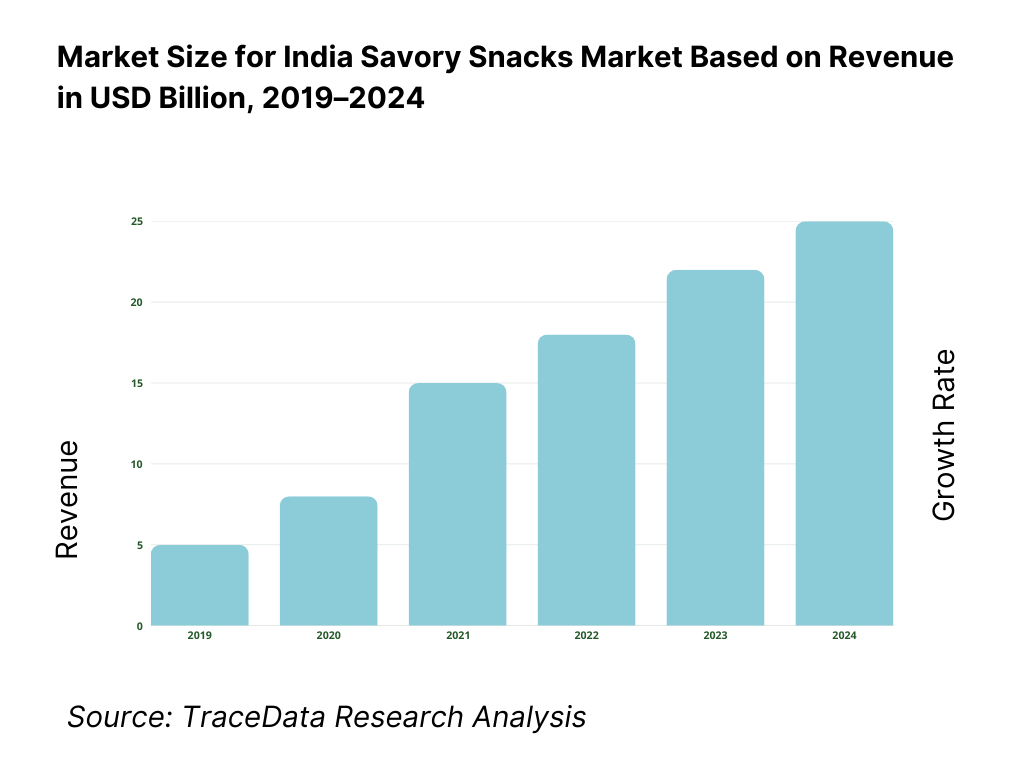

- Historical Period: 2019–2024

- Base Year: 2025

- Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in India Savory Snacks Market

Value Chain Analysis

4.1 Delivery Model Analysis for Savory Snacks-In-House Manufacturing, Contract Manufacturing, Regional Co-Packers [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for India Savory Snacks Market [Packaged Retail Sales, Bulk & Institutional Sales, Private Label Manufacturing, Exports]

4.3 Business Model Canvas for India Savory Snacks Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs National & Global Brands [Haldiram’s vs PepsiCo/ITC etc.]

5.2 Investment Model in India Savory Snacks Market [Internal Accruals, PE Investments, Strategic Investors, IPO-led Expansion]

5.3 Comparative Analysis of Snack Consumption in Urban vs Rural Markets [Purchase Channels, Price Sensitivity, Brand Preference]

5.4 Marketing & Promotion Spend Allocation by Company Size [Large FMCG, Regional Players, Emerging Brands]Market Attractiveness for India Savory Snacks Market

Supply-Demand Gap Analysis

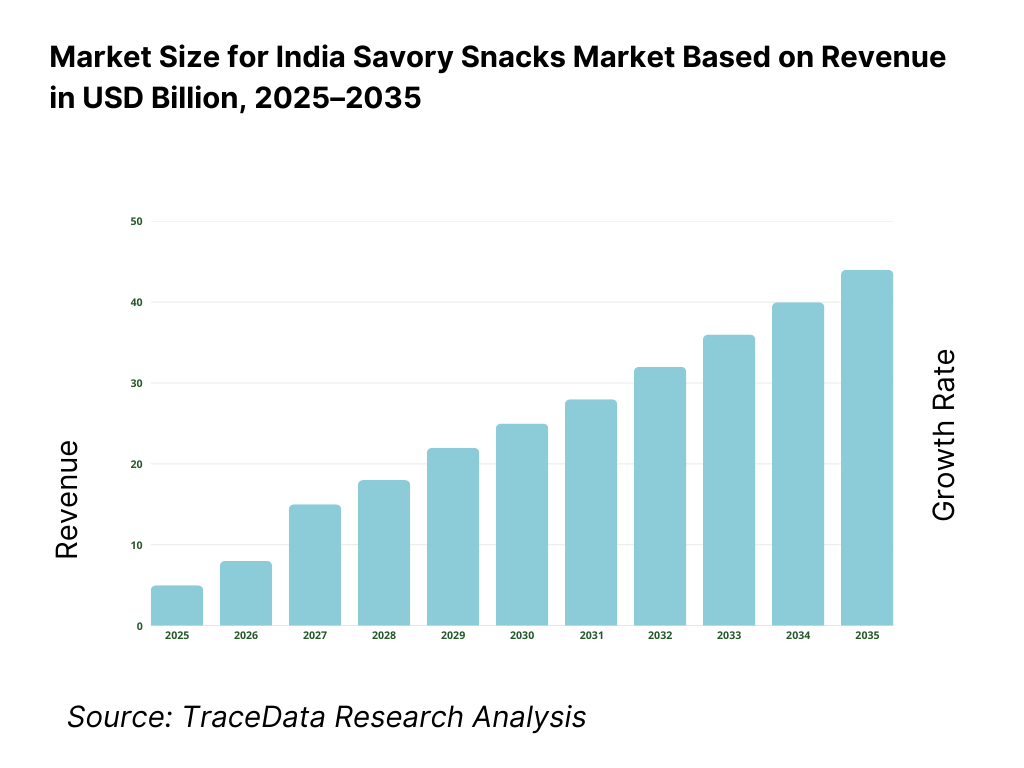

Market Size for India Savory Snacks Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for India Savory Snacks Market Basis

9.1 By Market Structure (Organized vs Unorganized)

9.2 By Product Type (Namkeen, Chips, Extruded Snacks, Baked & Others)

9.3 By Distribution Channel (Traditional Trade, Modern Trade, E-Commerce, Foodservice)

9.4 By Price Segment (Economy, Mass, Premium)

9.5 By Consumer Group (Children, Youth, Families, Health-Conscious Consumers)

9.6 By Processing Method (Fried, Baked, Roasted, Extruded)

9.7 By Branded vs Private Label Products

9.8 By Region (North India, West India, South India, East India, North-East India)Demand-Side Analysis for India Savory Snacks Market

10.1 Consumer & Household Consumption Patterns and Cohort Analysis

10.2 Snack Purchase Drivers & Decision-Making Process

10.3 Brand Loyalty, Trial Rates & Value-for-Money Perception

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in India Savory Snacks Market

11.2 Growth Drivers for India Savory Snacks Market

11.3 SWOT Analysis for India Savory Snacks Market

11.4 Issues & Challenges for India Savory Snacks Market

11.5 Government Regulations for India Savory Snacks MarketSnapshot on Packaged & Branded Snacks Market in India

12.1 Market Size and Future Potential for Organized Savory Snacks in India

12.2 Business Models & Revenue Streams [Branded Sales, Contract Manufacturing, Private Labels]

12.3 Delivery Models & Product Formats Offered [Single-Serve Packs, Family Packs, Institutional Packs]Opportunity Matrix for India Savory Snacks Market

PEAK Matrix Analysis for India Savory Snacks Market

Competitor Analysis for India Savory Snacks Market

15.1 Market Share of Key Players in India Savory Snacks Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Manufacturing Footprint, Revenues, Pricing Strategy, Product Portfolio, Best-Selling SKUs, Distribution Reach, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Competitive Positioning Matrix for Savory Snack Brands

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for India Savory Snacks Market Basis

16.1 Revenues (Projections)

Market Breakdown for India Savory Snacks Market Basis

17.1 By Market Structure (Organized and Unorganized)

17.2 By Product Type (Namkeen, Chips, Extruded Snacks, Baked & Others)

17.3 By Distribution Channel (Traditional Trade, Modern Trade, E-Commerce, Foodservice)

17.4 By Price Segment (Economy, Mass, Premium)

17.5 By Consumer Group (Children, Youth, Families, Health-Conscious Consumers)

17.6 By Processing Method (Fried, Baked, Roasted, Extruded)

17.7 By Branded vs Private Label Products

17.8 By Region (North, West, South, East, North-East India)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem for the India Savory Snacks Market and identifying all key demand-side entities (urban and rural households, children and youth consumers, working professionals, modern retail chains, kirana stores, foodservice outlets, institutional buyers, and e-commerce/quick-commerce platforms) and supply-side entities (organized national brands, regional snack manufacturers, unorganized players, contract manufacturers, ingredient suppliers, packaging vendors, distributors, and logistics providers). Based on this ecosystem mapping, we shortlist leading savory snack manufacturers operating at national and regional levels by evaluating their product portfolios, manufacturing footprint, distribution reach, and brand presence. Sourcing is conducted through industry publications, company disclosures, trade reports, government food processing portals, and proprietary databases to build an initial market framework and identify relevant stakeholders.

Step 2: Desk Research

An extensive desk research process is undertaken using a mix of secondary and proprietary data sources. This phase focuses on developing a comprehensive understanding of the India savory snacks market at an industry level. Key areas of analysis include overall market revenues, category-wise contribution (namkeen, chips, extruded snacks, baked snacks), organized versus unorganized market structure, distribution channel mix, pricing architecture, and regional consumption patterns. Company-level insights are derived from annual reports, press releases, investor presentations, regulatory filings, and media interviews. This step establishes the baseline assumptions for market sizing, segmentation, competitive intensity, and long-term growth dynamics.

Step 3: Primary Research

Primary research involves conducting in-depth interviews with senior executives, category heads, distributors, retailers, and industry experts across the savory snacks value chain. These interactions are designed to validate desk research findings, refine market assumptions, and gather qualitative insights on consumer behavior, pricing strategies, margin structures, and operational challenges. A bottom-to-top approach is adopted to estimate revenues across key product categories and channels, which are then aggregated to arrive at the overall market size. To enhance data reliability, the research team also undertakes disguised interactions by engaging companies as potential distributors or partners, allowing cross-verification of pricing, volumes, and channel dynamics against secondary data.

Step 4: Sanity Check

A rigorous sanity check is performed through triangulation of bottom-up and top-down market sizing approaches. Revenue estimates are cross-validated against macro indicators such as food processing output, FMCG consumption trends, urbanization rates, and household expenditure on packaged foods. Any inconsistencies or outliers are stress-tested through follow-up expert consultations and sensitivity analysis. This multi-layer validation ensures that the final market estimates, growth projections, and segment splits present a realistic and robust representation of the India savory snacks market.

FAQs

01 What is the potential for the India Savory Snacks Market?

The India Savory Snacks Market demonstrates strong long-term potential, supported by a large population base, deeply ingrained snacking habits, and rising penetration of packaged foods. With increasing urbanization, higher workforce participation, and expanding modern retail and quick-commerce infrastructure, savory snacks are transitioning from occasional indulgence to routine consumption. The market’s potential is further enhanced by affordable price points, high-frequency purchases, and the ability of manufacturers to cater to diverse regional taste preferences.

02 Who are the Key Players in the India Savory Snacks Market?

The India savory snacks market includes a mix of large national brands, strong regional players, and a sizeable unorganized segment. Key organized players include Haldiram’s, Bikaji Foods International, Balaji Wafers, ITC (Bingo!), Prataap Snacks (Yellow Diamond), Gopal Snacks, and PepsiCo India. In addition, several regional manufacturers dominate specific state-level markets through localized flavors and competitive pricing. Emerging health-focused and premium snack brands are also gaining traction in urban markets.

03 What are the Growth Drivers for the India Savory Snacks Market?

Major growth drivers include India’s expanding urban population, increasing disposable incomes, and time-constrained lifestyles that favor convenient, ready-to-eat foods. The availability of small, low-priced SKUs enables penetration across income groups, while continuous product innovation and flavor diversification drive value growth. Expansion of modern trade, e-commerce, and quick-commerce platforms has significantly improved product accessibility and impulse consumption, further accelerating market growth.

04 What are the Challenges in the India Savory Snacks Market?

The market faces challenges such as raw material price volatility, particularly in edible oils and agricultural inputs, which impacts margins and pricing stability. Growing health awareness and regulatory scrutiny around high-fat and high-salt products are increasing reformulation and compliance pressures. Additionally, intense competition from unorganized players and the complexity of India’s fragmented retail landscape create operational and pricing challenges for organized manufacturers seeking to scale nationally.