India Toys and Games Market Outlook to 2029

By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region

- Product Code: TDR0058

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “India Toys and Games Market Outlook to 2029 - By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region” provides a comprehensive analysis of the toys and games market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Toys and Games Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

India Toys and Games Market Overview and Size

The India toys and games market reached a valuation of INR 20,000 Crore in 2024, driven by factors such as the growing middle-class population, increasing disposable income, and evolving consumer preferences for educational and interactive toys. The market is characterized by major players such as Funskool, Mattel, Lego, Hasbro, and Hamleys. These companies are recognized for their extensive distribution networks, innovative product offerings, and focus on safety and quality standards.

In 2023, Lego introduced a new range of educational toys to promote STEM learning among children. This initiative aims to tap into the growing demand for educational toys in India and foster an environment of learning through play. Key regions such as Maharashtra, Delhi NCR, and Karnataka have emerged as significant markets due to their high population density and robust retail infrastructure.

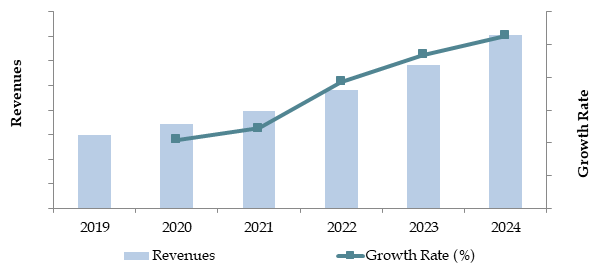

Market Size for India Toys and Games Market on the Basis of Revenue in INR Crores, FY’2018-FY’2024

What Factors are Leading to the Growth of India Toys and Games Market:

Rising Disposable Income: The increase in disposable income has shifted consumer preference towards premium and branded toys, especially in urban areas. In 2023, premium toys accounted for approximately 35% of the total market revenue, reflecting a growing trend towards higher-quality products.

Educational and Skill Development Focus: The growing emphasis on skill development and early learning has driven demand for educational toys. Parents are increasingly seeking toys that contribute to cognitive and motor skill development. In 2023, educational toys represented around 25% of the total market.

Expansion of Organized Retail Channels: The rise of organized retail and e-commerce platforms has made toys more accessible to a wider audience. In 2023, around 45% of toy sales were conducted through online channels, highlighting a shift towards digital purchasing behavior.

Which Industry Challenges Have Impacted the Growth of India Toys and Games Market

Quality and Safety Concerns: Concerns about the safety and quality of toys remain significant challenges. According to industry surveys, around 45% of parents are hesitant to purchase toys due to fears of hazardous materials and non-compliance with safety standards. This issue has led to a stronger preference for established brands and compliance with the Bureau of Indian Standards (BIS) regulations, potentially deterring up to 20% of prospective buyers from purchasing unbranded or non-compliant toys.

Counterfeit Products: The prevalence of counterfeit and unbranded toys in India poses a substantial challenge to the growth of the organized market. In 2023, approximately 30% of toys sold in India were reported to be counterfeit or of substandard quality. These counterfeit products not only impact the revenue of legitimate players but also pose serious safety risks to children, thereby affecting consumer trust in the market.

Regulatory Compliance: Stringent regulations surrounding toy safety standards, including compliance with BIS norms, have increased the operational costs for both domestic and international players. In 2023, around 18% of imported toys failed to meet the regulatory standards, leading to increased compliance costs and delays in product launches.

What are the Regulations and Initiatives which have Governed the Market:

Bureau of Indian Standards (BIS) Certification: The Indian government mandates that all toys sold in the market must comply with the BIS certification to ensure safety and quality standards. These regulations include stringent checks on the use of hazardous materials, flammability, and mechanical safety aspects. In 2023, approximately 65% of toys sold in the market were BIS-certified, indicating a significant level of compliance among manufacturers and importers.

Import Restrictions on Toys: The Indian government has implemented strict regulations on toy imports to reduce dependency on foreign products and promote domestic manufacturing. These regulations include quality testing for compliance with BIS standards and restrictions on the import of toys that do not meet safety criteria. In 2023, imports of toys decreased by 12% due to increased scrutiny and stricter enforcement of these regulations.

‘Make in India’ Initiative: The government’s ‘Make in India’ initiative aims to boost local production by providing incentives such as subsidies, tax exemptions, and simplified compliance processes for toy manufacturers. This initiative has led to a 20% increase in domestic production of toys, contributing to the growth of the organized sector and reducing the reliance on imports.

India Toys and Games Market Segmentation

By Market Structure: The market is primarily divided into organized and unorganized sectors. The organized sector, which includes branded manufacturers and licensed retailers, accounts for a significant share of the market due to the assurance of quality, adherence to safety standards, and availability of diverse product categories. The unorganized sector, characterized by local manufacturers and unbranded products, continues to cater to price-sensitive consumers. However, increasing consumer awareness and stricter regulatory standards have led to a gradual shift towards organized players.

By Product Type: Educational toys dominate the market, driven by a growing focus on skill development and early learning. This segment is followed closely by electronic toys, which have gained popularity due to the increasing use of technology and interactive features. Action figures and dolls also hold a substantial share, particularly among children in the 3-5 years and 6-8 years age groups.

By Age Group: The 3-5 years age group represents the largest segment, accounting for a major share of the market. Parents in this demographic are increasingly opting for toys that promote cognitive and motor skill development. The 6-8 years age group is the next largest segment, with demand driven by educational and STEM-based toys.

Competitive Landscape in India Toys and Games Market

The India toys and games market is relatively fragmented, with both domestic and international players competing for market share. The entrance of new companies and the expansion of online platforms such as FirstCry, Hopscotch, Amazon India, and Flipkart have diversified the market, offering consumers a wider range of products and improved access to branded and educational toys.

Company | Establishment Year | Headquarters |

Funskool | 1987 | Chennai, India |

Lego | 1932 | Billund, Denmark |

Mattel | 1945 | El Segundo, USA |

Hasbro | 1923 | Pawtucket, USA |

Hamleys | 1760 | London, United Kingdom |

FirstCry | 2010 | Pune, India |

Green Gold Animation | 2001 | Hyderabad, India |

Funride Toys | 2001 | New Delhi, India |

Some of the recent competitor trends and key information about competitors include:

Funskool: As one of the leading domestic toy manufacturers, Funskool recorded a 15% increase in sales in 2023, driven by its focus on educational and STEM-based toys. The company has also partnered with international brands to manufacture toys locally, strengthening its position in the Indian market.

Lego: Known for its high-quality construction toys, Lego introduced a new range of STEM educational toys in 2023, leading to a 20% growth in sales. The brand's focus on promoting learning through play has resonated well with parents seeking educational products for their children.

Mattel: Mattel has expanded its presence in India by launching new product lines under popular brands such as Barbie and Hot Wheels. In 2023, Mattel reported a 12% increase in sales, supported by its strong distribution network and strategic partnerships with major retail chains.

Hasbro: Hasbro’s emphasis on licensed toys and family-oriented board games has strengthened its market position. In 2023, Hasbro saw a 10% growth in sales of its licensed toys, including popular franchises like Marvel and Disney Princess.

Hamleys: With its focus on experiential retail, Hamleys has continued to expand its footprint in India, opening 8 new stores in 2023. The company’s premium offerings and in-store experiences have attracted high-income consumers and families.

FirstCry: FirstCry, India’s leading online platform for baby and kids' products, reported a 25% increase in toy sales in 2023. The platform’s extensive product range and focus on customer experience have made it a go-to destination for parents seeking high-quality toys.

Green Gold Animation: Known for its animated series characters such as Chhota Bheem, Green Gold Animation has successfully leveraged its IPs to launch a wide range of licensed toys. In 2023, the company saw a 30% growth in sales of its character-based toys.

Funride Toys: Specializing in ride-on toys and outdoor play equipment, Funride Toys has focused on expanding its product portfolio and strengthening its distribution network. In 2023, the company reported a 12% growth in revenue, supported by increasing demand for outdoor toys.

What Lies Ahead for India Toys and Games Market?

The India toys and games market is projected to grow steadily by 2029, exhibiting a healthy CAGR during the forecast period. This growth is expected to be driven by increasing disposable incomes, evolving consumer preferences, and a growing emphasis on educational and sustainable toys.

Rising Demand for Educational and STEM Toys: As parents become more focused on their children’s development, the demand for educational toys that promote cognitive skills, creativity, and problem-solving is expected to increase significantly. STEM-based toys, in particular, are anticipated to experience high growth, with an increasing number of schools and educational institutions incorporating them into their learning programs.

Expansion of E-Commerce Platforms: The growth of online retail channels is expected to continue, driven by the increasing penetration of the internet and the convenience offered by online shopping. E-commerce platforms will remain a key distribution channel, providing consumers with access to a wider range of products, competitive pricing, and quick delivery options.

Integration of Technology in Toys: The integration of advanced technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) in toys is likely to attract tech-savvy consumers and create new growth opportunities in the market. These technological innovations will enhance the interactivity and educational value of toys, making them more appealing to both children and parents.

Focus on Sustainability and Eco-Friendly Toys: With growing environmental awareness, consumers are expected to show a preference for sustainable and eco-friendly toys made from biodegradable and non-toxic materials. Manufacturers are increasingly adopting sustainable practices, such as using recycled materials and reducing plastic content, to align with consumer expectations and regulatory guidelines.

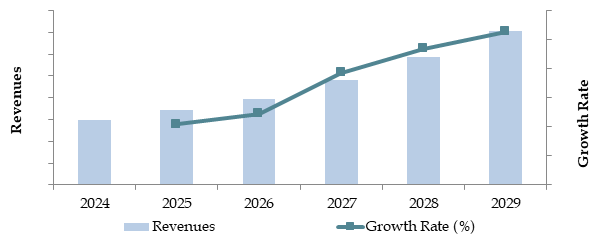

Future Outlook and Projections for India Toys and Games Market on the Basis of Revenue in INR Crores, 2024-2029

India Toys and Games Market Segmentation

By Market Structure:

Organized Sector

Unorganized Sector

By Product Type:

Action Figures

Dolls

Educational Toys

Electronic Toys

Games and Puzzles

Ride-ons

By Age Group:

0-2 years

3-5 years

6-8 years

9-14 years

By Distribution Channel:

Specialty Stores

Online Channels

Hypermarkets/Supermarkets

By Region:

North India

South India

East India

West India

Central India

Players Mentioned in the Report:

Mattel Inc.

Hasbro Inc.

LEGO Group

Takara Tomy Co. Ltd

Simba Dickie Group

Spin Master Ltd

Moose Toys Ltd

Funko Inc.

Funskool (India) Ltd

Toycraft India

Zephyr Toymakers

AOSHIMA BUNKA KYOZAI Co. Ltd

Bandai Namco Holdings Inc.

Key Target Audience:

Toy Manufacturers

Online Marketplaces

Retail Chains

Educational Institutions

Regulatory Bodies (e.g., Bureau of Indian Standards)

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the India Toys and Games Market

5.1. Population by Age Group

5.2. Estimated Time Spent by Age Group on Toys and Recreational Activities

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Action Figures, Ride-Ons and others), 2023-2024P

9.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2023-2024P

9.4. By Distribution Channel (Specialty Stores, Hypermarkets/ Supermarkets, Online Channels), 2023-2024P

9.5. By Region (North India, South India, West India, East India, Central India), 2023-2024P

9.6. By Price Range, 2023-2024P

9.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2023-2024P

10.1. Customer Segmentation and Profile

10.2. Customer Journey and Buying Decision Process

10.3. Key Motivations and Pain Points

10.4. Product Preferences and Buying Trends

11.1. Trends and Developments in India Toys and Games Market

11.2. Growth Drivers for India Toys and Games Market

11.3. SWOT Analysis for India Toys and Games Market

11.4. Issues and Challenges for India Toys and Games Market

11.5. Government Regulations for India Toys and Games Market

12.1. Market Size and Future Potential for Online Toys and Games Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Toy Platforms Basis Operational and Financial Parameters

15.1. Market Share of Key Organized Brands in India Toys and Games Market, FY2024

15.2. Market Share of Key Distributors in India Toys and Games Market, FY2024

15.3. Benchmark of Key Competitors in India Toys and Games Market Including Operational and Financial Parameters

15.4. Strength and Weakness Analysis

15.5. Operating Model Analysis Framework

15.6. Porters Five Forces Analysis for Competitor Strategy

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), 2025-2029

17.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2025-2029

17.4. By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels), 2025-2029

17.5. By Region (North India, South India, West India, East India, Central India), 2025-2029

17.6. By Price Range, 2025-2029

17.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2025-2029

17.8. Recommendation and Strategic Insights

17.9. Opportunity Analysis for India Toys and Games Market

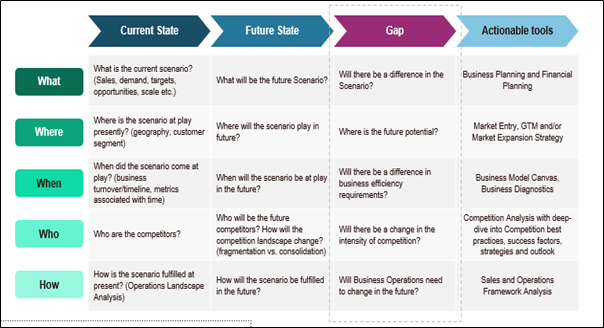

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the India Toys and Games Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based on their financial information, production capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the sales revenues, number of market players, price level, demand, and other variables.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various India Toys and Games Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the India Toys and Games Market?

The India toys and games market is poised for substantial growth, reaching a valuation of INR 20,000 Crore in 2023. This growth is driven by factors such as the increasing demand for educational toys, rising disposable incomes, and the expanding digital landscape.

2. Who are the Key Players in the India Toys and Games Market?

The India Toys and Games Market features several key players, including Funskool, Lego, and Mattel. These companies dominate the market due to their extensive distribution networks, strong brand presence, and innovative product offerings.

3. What are the Growth Drivers for the India Toys and Games Market?

The primary growth drivers include rising disposable incomes, increased focus on educational toys, and expanding online retail channels.

4. What are the Challenges in the India Toys and Games Market?

The India Toys and Games Market faces several challenges, including quality and safety issues, counterfeit products, and regulatory hurdles.