Indonesia Aspherical Lens Market Outlook to 2035

By Lens Type, By Material, By Application, By End-Use Industry, and By Distribution Channel

- Product Code: TDR0487

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Indonesia Aspherical Lens Market Outlook to 2035 – By Lens Type, By Material, By Application, By End-Use Industry, and By Distribution Channel” provides a comprehensive analysis of the aspherical lens industry in Indonesia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and standards landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Indonesia aspherical lens market. The report concludes with future market projections based on optical device penetration, healthcare and imaging infrastructure expansion, electronics manufacturing growth, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

Indonesia Aspherical Lens Market Overview and Size

The Indonesia aspherical lens market is valued at approximately ~USD ~ million, representing the supply of precision-engineered optical lenses designed with non-spherical surfaces to reduce optical aberrations such as spherical distortion, coma, and astigmatism. Aspherical lenses are increasingly used across imaging, vision correction, medical diagnostics, industrial optics, and consumer electronics due to their ability to deliver higher image quality with fewer optical elements, reduced system size, and improved light transmission efficiency.

The market is anchored by Indonesia’s expanding healthcare infrastructure, rising penetration of ophthalmic and vision-care solutions, growing domestic consumption of smartphones and imaging devices, and the gradual integration of advanced optical components in industrial inspection, security, and automation systems. Aspherical lenses are gaining preference over traditional spherical lenses in applications where compact form factors, precision performance, and weight reduction are critical.

Indonesia’s optical demand is further supported by rising urbanization, increasing middle-income population, higher awareness of vision health, and government investments in healthcare and diagnostic capacity across tier-1 and tier-2 cities. While domestic manufacturing remains limited and import dependence is relatively high, the country functions as a fast-growing consumption market for optical components used in finished devices assembled locally or imported as complete systems.

Java remains the dominant demand center for aspherical lenses, driven by its concentration of hospitals, diagnostic centers, electronics assembly units, research institutions, and consumer electronics distribution hubs. Greater Jakarta leads in ophthalmic and medical imaging demand, while West and Central Java support industrial and electronics-related optical usage. Secondary demand clusters are emerging in Sumatra and parts of Eastern Indonesia, supported by healthcare infrastructure expansion, telecom rollout, and security surveillance installations, although adoption remains uneven due to cost sensitivity and procurement constraints.

What Factors are Leading to the Growth of the Indonesia Aspherical Lens Market:

Expansion of ophthalmic care and diagnostic imaging strengthens structural demand: Indonesia is witnessing a steady rise in vision-related disorders, driven by aging demographics, increased screen usage, and lifestyle changes. Hospitals, eye clinics, and optical retail chains are upgrading diagnostic and corrective equipment, including slit lamps, fundus cameras, OCT systems, and high-precision ophthalmic lenses. Aspherical lenses play a critical role in improving image clarity and reducing distortions in both diagnostic instruments and corrective eyewear. The growing penetration of organized optical retail and vision-care chains further accelerates adoption, particularly in urban and semi-urban markets where consumers increasingly prefer thinner, lighter, and higher-performance lenses.

Growth in consumer electronics and imaging devices increases optical component consumption: Indonesia is one of Southeast Asia’s largest consumer markets for smartphones, cameras, and imaging-enabled devices. As smartphone cameras evolve toward higher megapixel counts, wider apertures, and compact multi-lens modules, aspherical lenses are increasingly integrated to improve image sharpness while maintaining slim device profiles. Beyond smartphones, demand is rising from CCTV systems, biometric devices, drones, and smart home products, where optical performance directly affects system accuracy. This broad-based electronics consumption creates sustained downstream demand for aspherical lenses, primarily fulfilled through imports embedded within finished optical modules.

Medical, industrial, and security applications drive higher-value lens adoption: Beyond consumer electronics and vision care, aspherical lenses are gaining traction in medical imaging equipment, laboratory instruments, industrial inspection systems, and security surveillance. These applications prioritize optical precision, low distortion, and system reliability over cost, supporting demand for higher-specification glass and molded aspherical lenses. In Indonesia, expanding public and private healthcare investments, industrial quality-control adoption, and nationwide surveillance and smart-city initiatives contribute to gradual but steady uptake of advanced optical components, particularly in institutional and B2B procurement channels.

Which Industry Challenges Have Impacted the Growth of the Indonesia Aspherical Lens Market:

Dependence on imports and exposure to global supply chain volatility impacts cost stability and lead times: The Indonesia aspherical lens market remains heavily dependent on imported optical components, particularly precision glass and molded aspherical lenses sourced from Japan, China, South Korea, and parts of Europe. Fluctuations in global raw material prices, logistics costs, currency movements, and shipping lead times can directly affect landed costs and procurement schedules for distributors, device manufacturers, and healthcare equipment suppliers. Periods of global supply disruption or strong demand in larger markets can tighten availability, delay deliveries, and reduce pricing predictability, making it difficult for buyers to plan equipment upgrades or large-volume procurement with confidence.

Limited domestic manufacturing capability constrains customization and local value addition: Indonesia has limited domestic capacity for high-precision optical fabrication, especially for advanced aspherical lenses requiring tight surface tolerances, specialized coatings, and high-quality optical glass. As a result, most local players operate as distributors or assemblers rather than manufacturers. This limits the ability to customize lenses for niche medical, industrial, or research applications and reduces responsiveness to project-specific requirements. The absence of a strong local optical manufacturing ecosystem also constrains technology transfer, skill development, and long-term cost optimization within the country.

High sensitivity to pricing and budget constraints slows adoption of premium optical solutions: Many end-users in Indonesia—particularly public hospitals, smaller clinics, educational institutions, and mid-sized industrial operators—remain highly price sensitive. While aspherical lenses offer superior optical performance, their higher upfront cost compared to conventional spherical lenses can slow adoption, especially in budget-constrained procurement environments. In healthcare and public-sector tenders, purchasing decisions often prioritize cost compliance over long-term performance benefits, which can limit penetration of higher-specification aspherical optics despite their clinical or operational advantages.

What are the Regulations and Initiatives which have Governed the Market:

Medical device regulations and product registration requirements governing optical equipment usage: Aspherical lenses used in medical and ophthalmic applications are subject to Indonesia’s medical device regulatory framework, which governs product registration, safety, performance, and labeling requirements. Optical components integrated into diagnostic and therapeutic devices must comply with applicable standards and be registered with the national regulatory authorities before commercial use. These requirements influence time-to-market for new optical technologies and add documentation and compliance costs for manufacturers and importers supplying medical-grade aspherical lenses.

Standards related to optical performance, quality assurance, and safety compliance: Aspherical lenses used across healthcare, industrial, and security applications are expected to meet international optical and quality standards related to surface accuracy, transmission efficiency, coating durability, and mechanical stability. Compliance with globally recognized standards is particularly important for lenses used in precision imaging, diagnostics, and inspection systems. Ensuring consistent quality and traceability across imported optical components adds to procurement complexity and places emphasis on supplier certification, testing documentation, and quality assurance processes.

Import regulations, customs duties, and localization initiatives influencing market economics: Indonesia’s import regulations, customs duties, and taxation structures directly affect the landed cost of aspherical lenses and optical modules. While certain initiatives encourage local assembly and value addition for electronic and medical devices, the lack of domestic optical fabrication capability limits the immediate impact of localization policies for standalone lens manufacturing. Nevertheless, long-term industrial development programs and incentives aimed at strengthening electronics, healthcare equipment, and precision manufacturing ecosystems may gradually influence sourcing strategies and encourage partial localization of optical assembly and integration activities.

Indonesia Aspherical Lens Market Segmentation

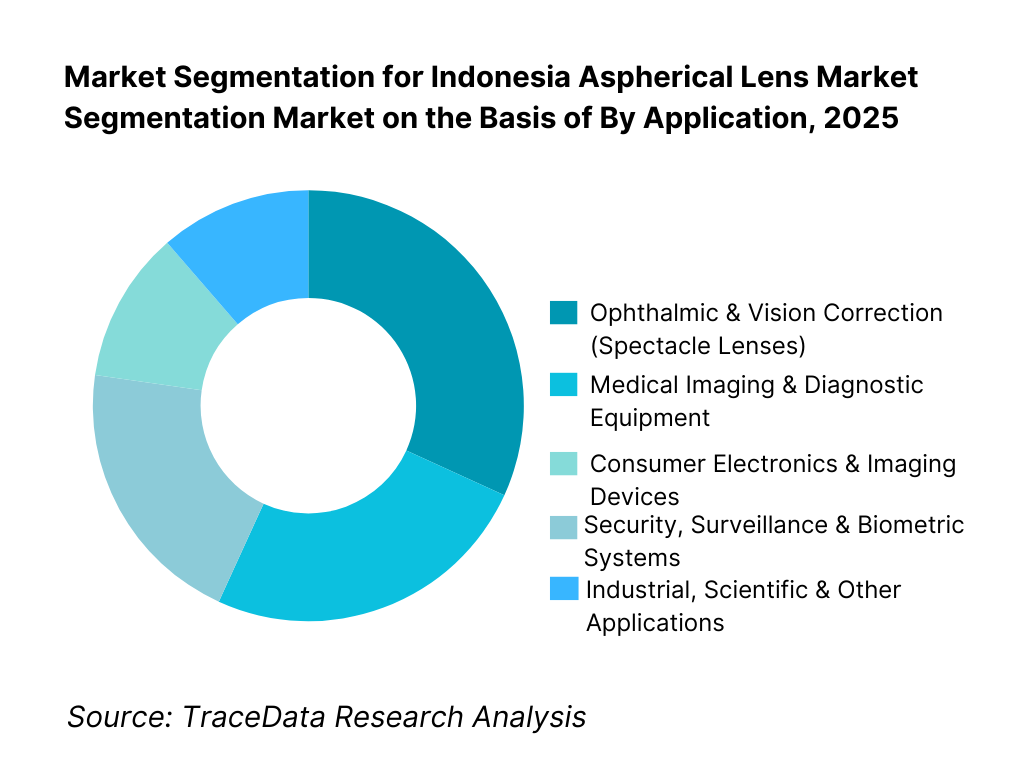

By Application: Ophthalmic and vision correction applications hold dominance. This is because corrective eyewear and ophthalmic diagnostics represent the most consistent and volume-driven use of aspherical lenses in Indonesia. Rising screen exposure, increasing prevalence of refractive errors, and growing awareness of premium vision correction solutions have driven adoption of thinner, lighter, and distortion-minimized lenses. Optical retail chains and private eye clinics increasingly specify aspherical lenses to differentiate offerings and improve wearer comfort. While demand from imaging electronics and industrial optics is expanding, ophthalmic applications continue to benefit from repeat consumer replacement cycles and broad urban penetration.

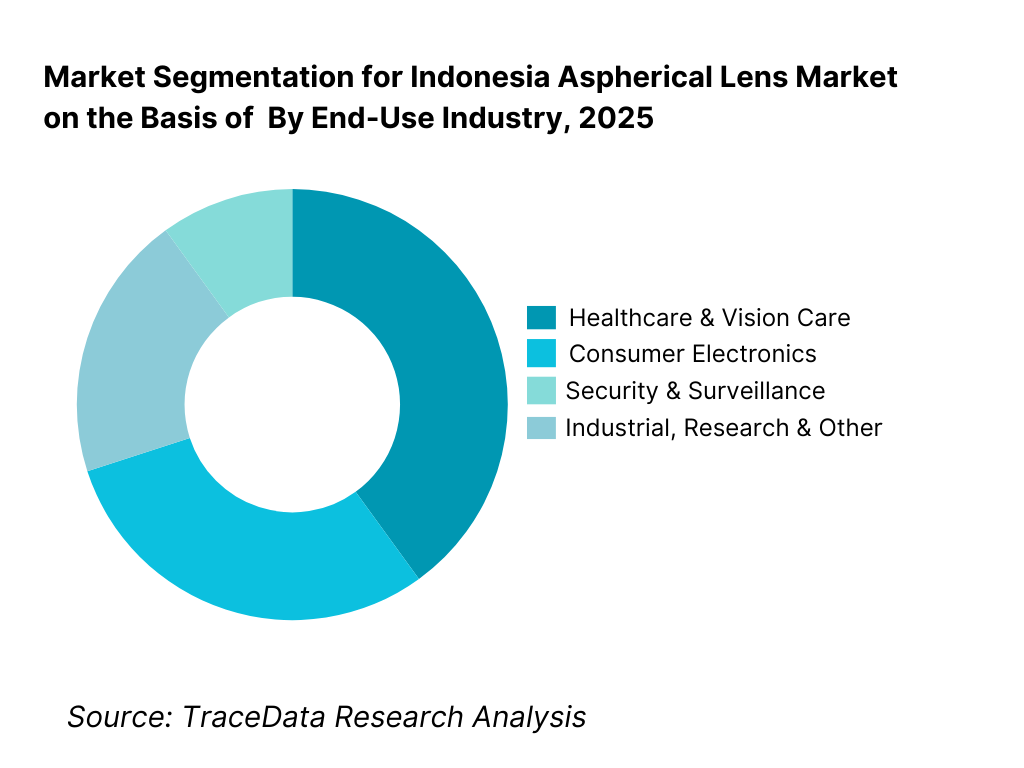

By End-Use Industry: Healthcare and vision care dominate the Indonesia aspherical lens market. Healthcare buyers—including hospitals, eye clinics, diagnostic centers, and optical retail chains—prioritize optical precision, reliability, and patient comfort, making them the largest consumers of aspherical lenses. Consumer electronics remains a strong secondary segment, driven by smartphone imaging, cameras, and surveillance systems. Industrial and institutional demand is growing steadily but remains comparatively smaller due to longer replacement cycles and higher procurement scrutiny.

Competitive Landscape in Indonesia Aspherical Lens Market

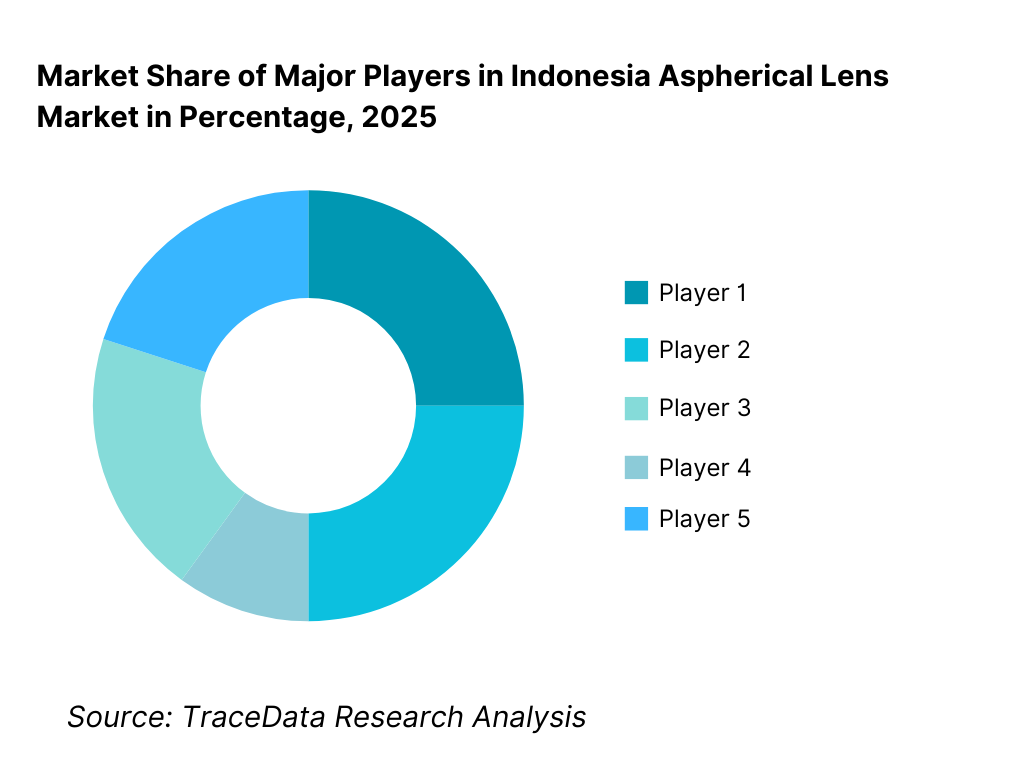

The Indonesia aspherical lens market is moderately fragmented, characterized by a mix of global optical manufacturers, multinational ophthalmic brands, and regional suppliers operating primarily through distributors and local partners. Market leadership is driven by optical performance consistency, coating technology, brand credibility, supply reliability, and integration with finished optical systems such as eyewear, diagnostic devices, and imaging equipment. While global brands dominate premium and medical-grade segments, cost-competitive Asian suppliers hold strong positions in consumer electronics and volume eyewear categories.

Name | Founding Year | Original Headquarters |

EssilorLuxottica | 1849 / 2018 (merger) | Paris, France |

HOYA Corporation | 1941 | Tokyo, Japan |

Carl Zeiss AG | 1846 | Oberkochen, Germany |

Nikon Corporation | 1917 | Tokyo, Japan |

Canon Inc. | 1937 | Tokyo, Japan |

Hoya Vision Care | 1941 | Tokyo, Japan |

Shenzhen Sunny Optical | 1984 | Zhejiang, China |

Schneider Kreuznach | 1913 | Bad Kreuznach, Germany |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

EssilorLuxottica: The group continues to strengthen its presence in Indonesia through premium ophthalmic lens offerings, emphasizing aspherical designs that improve visual comfort, reduce edge distortion, and enable thinner lens profiles. Its competitive strength lies in brand recognition, integration with optical retail networks, and continuous innovation in lens coatings and digital lens personalization.

HOYA Corporation: HOYA maintains a strong position in the medical and vision-care segments, supplying high-quality aspherical lenses for both corrective eyewear and diagnostic equipment. The company’s emphasis on optical precision, durability, and clinical-grade performance supports demand from private hospitals, eye clinics, and professional optometry networks.

Carl Zeiss AG: Zeiss competes in the high-end segment of the Indonesia aspherical lens market, particularly in medical imaging, diagnostics, and premium ophthalmic applications. Its positioning is reinforced by advanced coating technologies, strict quality control, and strong credibility among healthcare professionals and institutional buyers.

Nikon Corporation: Nikon remains relevant in both ophthalmic lenses and imaging-related optical components, leveraging its expertise in optical engineering and precision manufacturing. The brand benefits from strong recognition in imaging and camera-related applications, supporting downstream demand for high-performance aspherical optics.

Canon Inc.: Canon’s optical systems and imaging devices incorporate aspherical lenses to enhance image quality and system compactness. In Indonesia, Canon’s presence is closely tied to medical imaging equipment, cameras, and security systems, where optical reliability and brand trust are critical procurement factors.

Shenzhen Sunny Optical: Sunny Optical represents the growing influence of cost-competitive Asian suppliers in consumer electronics and imaging modules. Its strength lies in scale manufacturing, competitive pricing, and integration with smartphone and electronics supply chains, which indirectly drives aspherical lens demand embedded within finished devices sold in Indonesia.

What Lies Ahead for Indonesia Aspherical Lens Market?

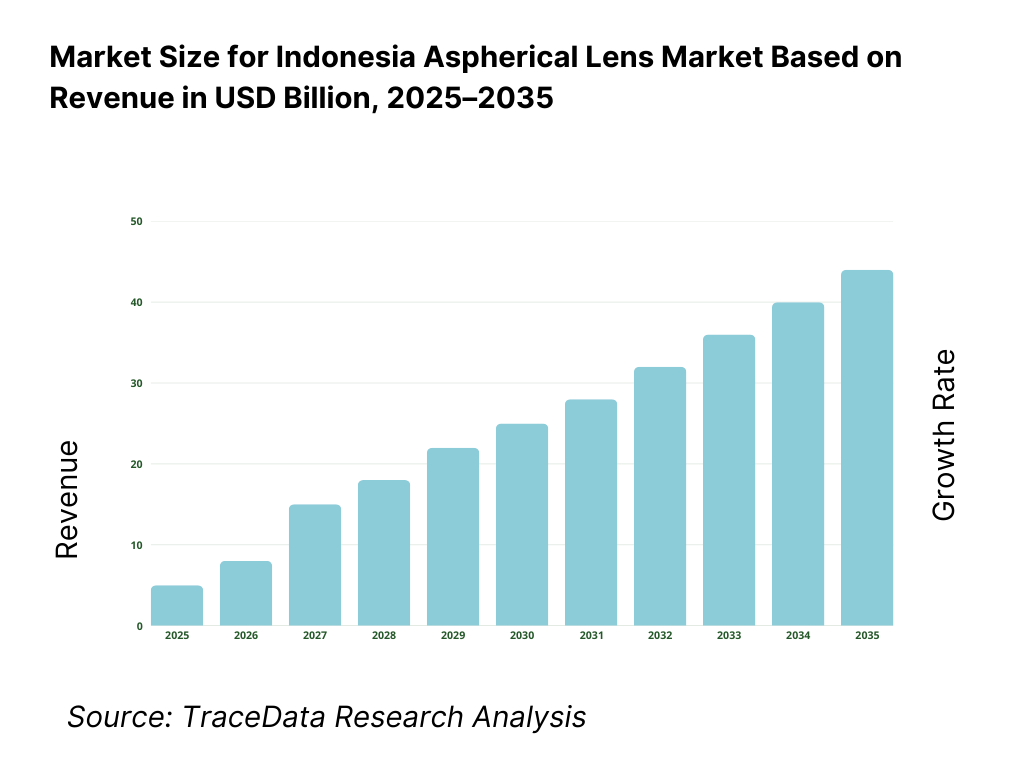

The Indonesia aspherical lens market is expected to expand steadily through 2035, supported by rising demand for vision correction, expansion of healthcare and diagnostic infrastructure, and increasing integration of advanced optical components in consumer electronics and imaging systems. Growth momentum is further reinforced by urbanization, rising disposable incomes, and improving access to eye care and medical diagnostics across tier-1 and tier-2 cities. As end-users increasingly prioritize optical performance, compact system design, and long-term reliability, aspherical lenses will continue to gain preference over conventional spherical optics across multiple applications.

Transition Toward Higher-Performance and Application-Specific Aspherical Optics: The future of the Indonesia aspherical lens market will see a gradual shift from basic corrective and standard imaging lenses toward higher-performance, application-specific optical solutions. Demand is increasing for lenses optimized for medical diagnostics, high-resolution imaging, and premium ophthalmic correction, where reduced aberration, higher transmission efficiency, and improved edge clarity are critical. Medical imaging devices, advanced ophthalmic instruments, and precision inspection systems will increasingly specify tighter optical tolerances and specialized coatings, supporting value growth even where unit volumes remain moderate.

Growing Emphasis on Vision Care Quality and Premium Eyewear Adoption: Vision correction will remain the backbone of aspherical lens demand in Indonesia, with increasing consumer preference for thinner, lighter, and more comfortable eyewear. Rising screen exposure among younger populations and greater awareness of eye health are accelerating adoption of premium lens designs offered by organized optical retail chains and private clinics. Through 2035, replacement cycles and product upgrades in corrective eyewear are expected to drive stable, repeat demand, reinforcing the role of aspherical lenses in the mainstream ophthalmic market.

Expansion of Imaging, Security, and Smart Infrastructure Applications: Beyond healthcare and eyewear, aspherical lenses will see expanding use in security surveillance, biometric systems, and smart infrastructure projects. Government-led initiatives related to urban security, transportation hubs, and digital identity systems are expected to support demand for imaging devices where optical clarity and reliability are essential. While price sensitivity remains a constraint, gradual technology adoption and system upgrades will create incremental demand for aspherical optics embedded within finished equipment.

Continued Reliance on Imports with Gradual Localization of Assembly and Integration: Through the forecast period, Indonesia will continue to rely largely on imported aspherical lenses and optical components. However, there is potential for gradual localization in downstream assembly, coating, and integration activities linked to medical devices and electronics manufacturing. This shift may not significantly reduce import dependence for precision optics but could improve supply responsiveness, after-sales support, and customization for local applications, strengthening the overall market ecosystem.

Indonesia Aspherical Lens Market Segmentation

By Application

• Ophthalmic & Vision Correction

• Medical Imaging & Diagnostic Equipment

• Consumer Electronics & Imaging Devices

• Security, Surveillance & Biometric Systems

• Industrial, Scientific & Other Applications

By Material

• Glass Aspherical Lenses

• Plastic / Polymer Aspherical Lenses

By End-Use Industry

• Healthcare & Vision Care

• Consumer Electronics

• Security & Surveillance

• Industrial, Research & Others

By Distribution Channel

• Direct OEM Supply

• Authorized Distributors

• Optical Retail & Vision Care Chains

• Institutional & Tender-Based Procurement

Players Mentioned in the Report:

• EssilorLuxottica

• HOYA Corporation

• Carl Zeiss AG

• Nikon Corporation

• Canon Inc.

• Hoya Vision Care

• Sunny Optical Technology

• Schneider Kreuznach

• Regional optical distributors and medical equipment suppliers

Key Target Audience

• Aspherical lens manufacturers and optical component suppliers

• Ophthalmic lens companies and vision care brands

• Medical device and diagnostic equipment manufacturers

• Consumer electronics and imaging system OEMs

• Optical distributors and system integrators

• Hospitals, eye clinics, and diagnostic centers

• Government and institutional procurement bodies

• Investors and stakeholders in healthcare and electronics value chains

Time Period:

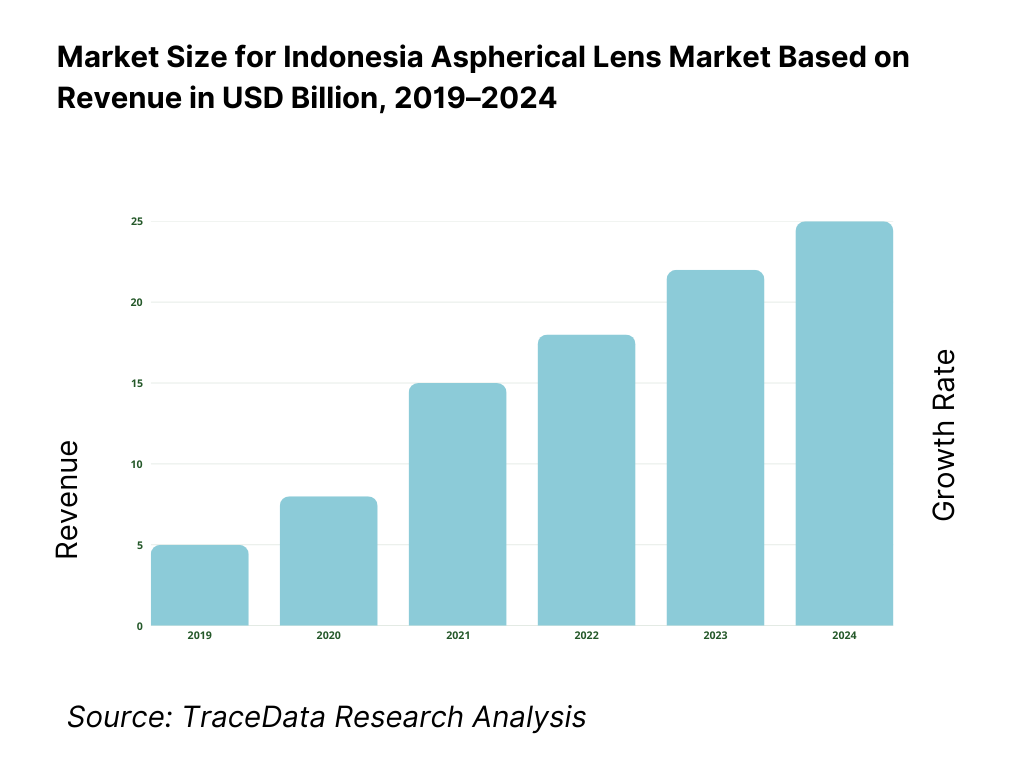

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Aspherical Lenses including direct OEM supply, distributor-led channels, optical retail chains, institutional procurement, and module integrators with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for Aspherical Lens Market including ophthalmic lens sales, medical imaging equipment, consumer electronics modules, security and surveillance optics, and industrial application components

4. 3 Business Model Canvas for Aspherical Lens Market covering lens manufacturers, distributors, optical retailers, medical device OEMs, consumer electronics OEMs, and system integrators

5. 1 Global Lens Manufacturers vs Regional and Local Players including EssilorLuxottica, HOYA Corporation, Carl Zeiss AG, Nikon Corporation, Canon Inc., and other regional or domestic suppliers

5. 2 Investment Model in Aspherical Lens Market including R&D investments, coating and molding technology, partnerships with medical and electronics OEMs, and integration with diagnostic or imaging systems

5. 3 Comparative Analysis of Lens Distribution by Direct-to-OEM and Distributor or Retail Channels including optical retail partnerships, hospital tenders, and electronics integration networks

5. 4 Consumer and Institutional Budget Allocation comparing expenditure on ophthalmic lenses versus medical devices, electronics imaging modules, and industrial optics with average spend per user or institution per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by lens type, material, and application

8. 3 Key Market Developments and Milestones including new product launches, technology partnerships, local distributor expansions, and regulatory approvals

9. 1 By Market Structure including global manufacturers, regional suppliers, and local distributors

9. 2 By Lens Type including glass, plastic/polymer, and hybrid lenses

9. 3 By Material including high-index, standard index, and specialty coatings

9. 4 By Application including vision correction, medical imaging, consumer electronics, security, and industrial uses

9. 5 By Consumer Demographics including age groups, income levels, and urban versus semi-urban users

9. 6 By Device or Product Type including eyewear, diagnostic equipment, cameras, surveillance systems, and industrial optics modules

9. 7 By Distribution Channel including OEM supply, authorized distributors, optical retail, and institutional tenders

9. 8 By Region including Java, Sumatra, Kalimantan, Sulawesi, and Eastern Indonesia

10. 1 Consumer and Institutional Landscape highlighting eyewear adoption, hospital and clinic usage, and electronics integration clusters

10. 2 Purchase Decision Making influenced by optical performance, brand reputation, pricing, and availability

10. 3 Engagement and ROI Analysis measuring replacement cycles, equipment utilization, and procurement frequency

10. 4 Gap Analysis Framework addressing supply constraints, pricing affordability, and performance differentiation

11. 1 Trends and Developments including rise of high-index lenses, medical imaging adoption, consumer electronics integration, and coating innovations

11. 2 Growth Drivers including healthcare infrastructure expansion, rising vision care awareness, electronics market growth, and government support for medical and optical devices

11. 3 SWOT Analysis comparing global manufacturer scale versus regional distribution strength and regulatory alignment

11. 4 Issues and Challenges including import dependence, pricing volatility, regulatory timelines, and technical awareness gaps

11. 5 Government Regulations covering optical device standards, medical device registration, import regulations, and quality certifications in Indonesia

15. 1 Market Share of Key Players by revenues and by units supplied

15. 2 Benchmark of 15 Key Competitors including EssilorLuxottica, HOYA Corporation, Carl Zeiss AG, Nikon Corporation, Canon Inc., Hoya Vision Care, Sunny Optical, Schneider Kreuznach, and regional distributors

15. 3 Operating Model Analysis Framework comparing global manufacturer models, regional supply-led models, and distributor-integrated networks

15. 4 Gartner Magic Quadrant positioning global leaders and regional challengers in optical components

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through differentiation via optical performance versus price-led mass supply

16. 1 Revenues with projections

17. 1 By Market Structure including global manufacturers, regional suppliers, and local distributors

17. 2 By Lens Type including glass, plastic/polymer, and hybrid lenses

17. 3 By Material including high-index, standard index, and specialty coatings

17. 4 By Application including vision correction, medical imaging, consumer electronics, security, and industrial uses

17. 5 By Consumer Demographics including age and income groups

17. 6 By Device or Product Type including eyewear, diagnostic equipment, cameras, surveillance systems, and industrial modules

17. 7 By Distribution Channel including OEM supply, authorized distributors, optical retail, and institutional tenders

17. 8 By Region including Java, Sumatra, Kalimantan, Sulawesi, and Eastern Indonesia

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Indonesia Aspherical Lens Market across demand-side and supply-side participants. On the demand side, entities include ophthalmic lens brands, optical retail chains, eye clinics and hospitals, medical diagnostic equipment manufacturers, consumer electronics OEMs, security and surveillance system integrators, and industrial inspection equipment users. Demand is further segmented by application type (vision correction, medical imaging, consumer imaging, security, industrial optics), performance requirement (standard optical correction vs high-precision aberration control), and procurement model (direct OEM supply, distributor-led sourcing, retail-driven replacement demand, and institutional tender-based procurement).

On the supply side, the ecosystem includes global aspherical lens manufacturers, ophthalmic lens specialists, optical glass suppliers, coating and surface treatment providers, module integrators, regional distributors, medical equipment suppliers, electronics assemblers, and regulatory and certification bodies governing optical and medical devices. From this mapped ecosystem, we shortlist 6–10 leading global and regional aspherical lens suppliers based on optical performance capability, product range, application coverage, brand credibility, and presence in Indonesia’s healthcare and electronics value chains. This step establishes how value is created and captured across lens design, material selection, precision manufacturing, coating, distribution, and system integration.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Indonesia aspherical lens market structure, demand drivers, and segment behavior. This includes reviewing trends in vision care penetration, ophthalmic disorder prevalence, healthcare infrastructure expansion, medical imaging adoption, smartphone and imaging device consumption, and security system deployments. We assess buyer preferences related to optical performance, durability, cost sensitivity, brand trust, and regulatory compliance.

Company-level analysis includes review of product portfolios, material technologies, coating innovations, distribution models, pricing positioning, and application focus across ophthalmic, medical, and imaging segments. We also examine regulatory and compliance dynamics governing optical and medical device imports, product registration, and quality standards in Indonesia. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with ophthalmic lens distributors, optical retailers, eye care professionals, medical equipment suppliers, diagnostic device manufacturers, and electronics system integrators. The objectives are threefold:

(a) validate assumptions around application-wise demand concentration and procurement behavior,

(b) authenticate segment splits by application, material type, and end-use industry, and

(c) gather qualitative insights on pricing sensitivity, supply reliability, lead times, and buyer expectations related to optical performance and certification.

A bottom-to-top approach is applied by estimating unit consumption and average lens value across key applications such as vision correction, medical diagnostics, and imaging devices, which are then aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with optical distributors and equipment suppliers to validate field-level realities such as brand preference, replacement cycles, margin structures, and procurement bottlenecks.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market size, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as healthcare expenditure trends, population demographics, electronics consumption growth, and public-sector healthcare investments. Assumptions related to import dependence, pricing sensitivity, and regulatory timelines are stress-tested to assess their impact on adoption and market expansion.

Sensitivity analysis is conducted across key variables including premium eyewear adoption rates, diagnostic imaging penetration, security infrastructure rollout, and currency-driven import cost fluctuations. Market models are refined until alignment is achieved between supplier capacity, distributor throughput, and end-user consumption patterns, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Indonesia Aspherical Lens Market?

The Indonesia aspherical lens market holds strong long-term potential, supported by rising vision correction needs, expanding healthcare and diagnostic infrastructure, and increasing integration of advanced optical components in consumer electronics and security systems. Aspherical lenses are gaining preference due to their superior optical performance, compact design advantages, and improved user comfort. Continued urbanization, income growth, and healthcare access expansion are expected to sustain steady demand growth through 2035.

02 Who are the Key Players in the Indonesia Aspherical Lens Market?

The market is led by global optical and ophthalmic lens manufacturers, complemented by regional distributors and system integrators. Competition is shaped by optical precision, coating technology, product reliability, brand credibility, and the ability to support healthcare and electronics applications with consistent quality and regulatory compliance. Strong distributor networks and relationships with hospitals, clinics, and OEMs play a central role in market penetration.

03 What are the Growth Drivers for the Indonesia Aspherical Lens Market?

Key growth drivers include increasing prevalence of refractive errors, rising adoption of premium eyewear, expansion of medical imaging and diagnostic equipment, and growing use of imaging and surveillance systems. Consumer electronics demand, particularly for camera-enabled devices, further supports embedded aspherical lens consumption. Improving awareness of optical quality and performance continues to reinforce adoption across applications.

04 What are the Challenges in the Indonesia Aspherical Lens Market?

Challenges include high dependence on imports, exposure to global supply chain volatility, and strong price sensitivity among public-sector and mid-tier buyers. Regulatory approval timelines for medical-grade optical components can impact time-to-market, while uneven technical awareness across buyer groups affects consistent adoption. Limited domestic manufacturing capability also constrains customization and local value addition.