Indonesia Blood Pressure Monitors Market Outlook to 2030

By Device Type, By Connectivity, By End User, By Price Tier, By Distribution Channel, and By Region

- Product Code: TDR0314

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Indonesia Blood Pressure Monitors Market Outlook to 2030 – By Device Type, By Connectivity, By End User, By Price Tier, By Distribution Channel, and By Region” provides a comprehensive analysis of Indonesia’s blood pressure monitoring ecosystem. The study covers the market’s overview and genesis, overall market size in terms of revenue and unit volumes, and a granular market segmentation by device type, connectivity, end user, price tier, distribution channel, and region. It details trends and developments; the regulatory landscape; and customer-level profiling. The report also examines issues and challenges, and presents the competitive landscape including competition scenario, cross-comparison of leading brands on Indonesia-specific parameters, and detailed company profiling of major players. The report concludes with future market projections based on unit volumes, feature mix and connectivity penetration, channel mix, and regional rollout, employing cause-and-effect relationships and success case studies that highlight the major opportunities and cautions for stakeholders.

Indonesia Blood Pressure Monitors Market Overview and Size

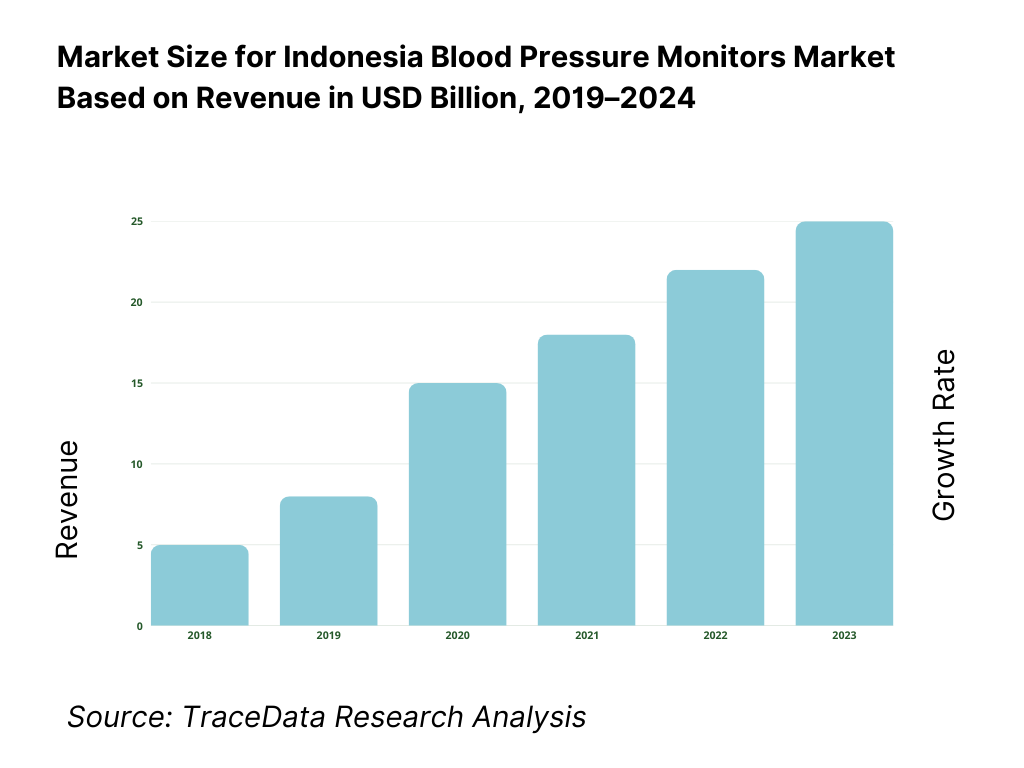

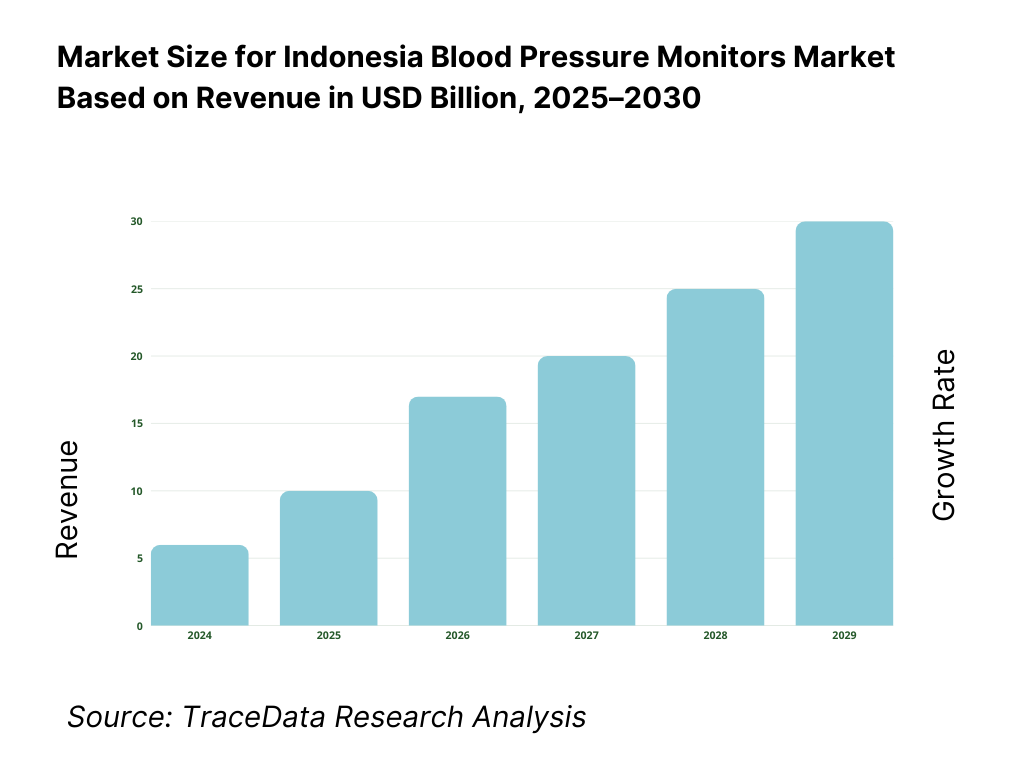

The Indonesia blood pressure monitors market is valued at USD 10 million in 2024, advanced smart device adoption has significantly expanded retail and clinical demand for upper‑arm and wrist models. This growth is driven by rising hypertension diagnoses, digitization of home health, expanded e‑commerce availability across Indonesia’s archipelago, and government NCD screening initiatives.

Several cities and provinces dominate market adoption—particularly Jakarta, Surabaya, and Bandung, owing to their dense populations, greater disposable healthcare income, and concentration of modern hospitals, clinics, pharmacies, and e‑commerce logistics hubs. These urban centers also benefit from higher health awareness, better healthcare infrastructure, and easier access to digital devices.

What Factors are Leading to the Growth of the Indonesia Blood Pressure Monitors Market:

High Burden of Cardiovascular Disease and Large Population Base: Indonesia’s adult population is approximately 281 million in 2023, offering a large potential pool for hypertension screening and home monitoring devices. Cardiovascular diseases account for 35% of all deaths in Indonesia. This significant mortality share underscores urgent need for blood pressure control tools such as blood pressure monitors. With over 200 million people covered by the national health insurance scheme (JKN/BPJS), institutional and home monitoring solutions are increasingly relevant. The sheer scale of non‑communicable disease burden combined with a massive insured population driving preventive health adoption makes demand for BP monitors robust and sustained.

Telemedicine & Remote Patient Monitoring Expansion: Telehealth uptake is rapidly climbing: Indonesia’s digital health revenue is projected to reach USD 2.64 billion in 2025, supported by over 30 million monthly active users accessing telehealth platforms and more than 40,000 licensed doctors delivering remote consultation services. Such scale of digital health utilization necessitates reliable home diagnostic tools, particularly validated blood pressure monitors for remote monitoring of hypertensive patients. This creates a favorable ecosystem for integration of BP monitors with telemedicine—not only to measure but to transmit data securely and accurately—cementing BP monitors as key enablers of virtual care models.

Low Digital Literacy but Rising ICT Access: According to a 2023 digital health landscape review, only less than 1% of Indonesian workers possess advanced digital skills, whereas basic to intermediate digital competencies reach about 50%. As national ICT infrastructure and digital literacy gradually expand, more individuals can adopt even semi-connected health devices like Bluetooth-enabled monitors. This transitional digital readiness supports gradual uptake of smarter BP monitors, especially as consumers become more accustomed to digital health tools, bridging the gap between analog and full digital adoption.

Which Industry Challenges Have Impacted the Growth of the Indonesia Blood Pressure Monitors Market:

Low Density of Healthcare Professionals and Infrastructure Gaps: Indonesia has only 0.4 doctors per 1,000 population, indicating limited access to regular clinical hypertension screening. With over 26,000 healthcare facilities including 2,000 hospitals and 9,000 community health centers (Puskesmas), uneven distribution across Indonesia’s many islands limits access. This infrastructure constraint means many remote or under-served areas remain under-monitored, curbing demand for BP monitors due to lack of awareness, clinical recommendation, and support network—even as the need is high.

Limited Telemedicine Awareness Among Consumers: A study indicates 58.2% of Indonesians remain unaware of telemedicine’s existence. Although telemedicine infrastructure is growing, the limited public awareness constrains demand for integrated remote monitoring devices such as blood pressure monitors. Without broader familiarity and trust in telehealth services, consumers may continue relying solely on in-clinic measurements rather than home monitoring solutions—even where such tools could provide better continuity of care.

Regulatory Ambiguity in Telehealth Infrastructure Integration: While Indonesia's Ministry of Health mandates that teleconsultation systems be registered, interoperable, and data-secure, regulatory frameworks remain vague in implementation—for instance, not specifying device validation standards or integration protocols for peripheral diagnostics like blood pressure monitors. This lack of explicit regulation around connected medical devices introduces uncertainty for manufacturers regarding compliance, device approval, or reimbursement through clinical telehealth channels, potentially slowing innovations and investments.

What are the Regulations and Initiatives which have Governed the Market:

Ministry of Health Registration Requirement for Teleconsultation Systems: Health Ministerial regulations require all teleconsultation platforms to be registered with the Ministry of Health, support interoperability with existing health systems, and ensure protection of patient data. Although focused on platforms, BP monitors used in telehealth must align with these systems and data security requirements, effectively making registration and interoperability prerequisites for any connected devices seeking use in official teleconsultation workflows.

Universal Health Coverage via JKN/BPJS Kesehatan: Indonesia’s JKN/BPJS program covers over 200 million people under a universal health insurance scheme. For blood pressure monitors to be deployed or reimbursed under this system—especially in Puskesmas or hospital settings—they must meet the procurement, licensing, and pricing requirements set by BPJS/Kemenkes. Devices must therefore align with government procurement standards and eligibility criteria tied to this vast public insurance system.

Digital Health Literacy and ICT Integration Policies: National digital health policy emphasizes increasing digital competence—currently, less than 1% of workers have advanced digital skills with 50% having basic to intermediate levels. Regulatory push to improve digital literacy and ICT integration impacts licensing for medical devices: connected BP monitors must be usable by populations with varying digital capability, and must comply with government training or usability guidelines as digital health initiatives expand.

Indonesia Blood Pressure Monitors Market Segmentation

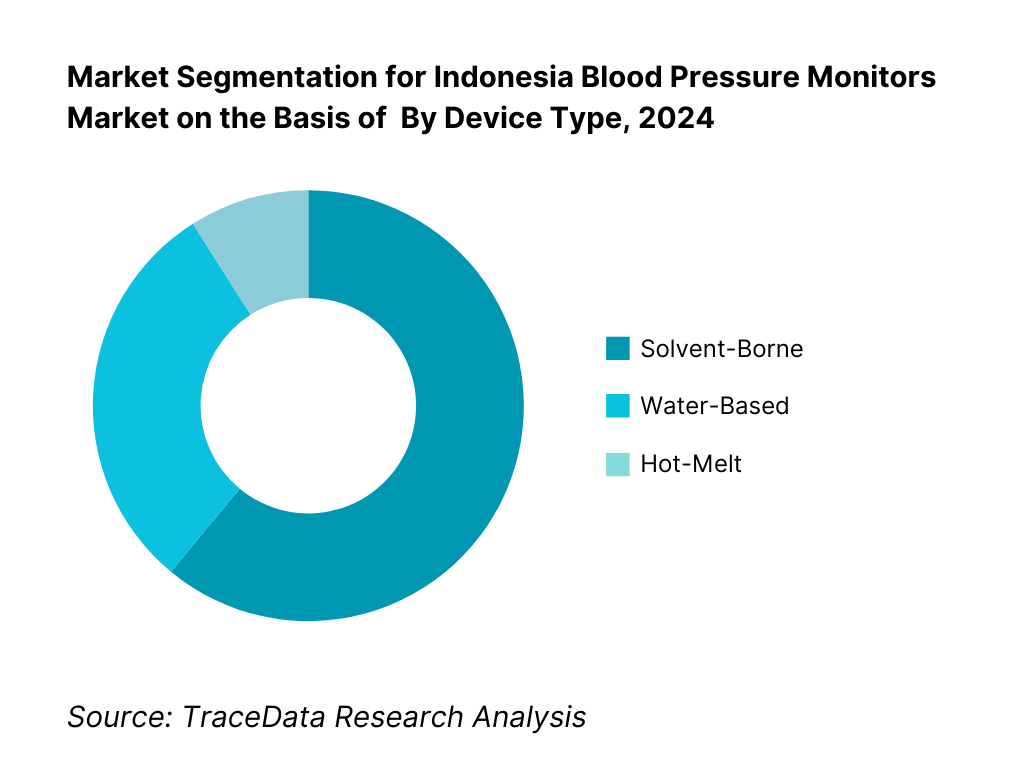

By Device Type: Indonesia’s blood pressure monitors are segmented by type into upper‑arm digital, wrist digital, and finger monitors. The upper‑arm digital segment dominates, thanks to better clinical acceptance, validation against health standards, and widespread physician recommendations. It remains trusted in both home and clinical settings. In contrast, wrist and finger monitors, though convenient, face accuracy concerns.

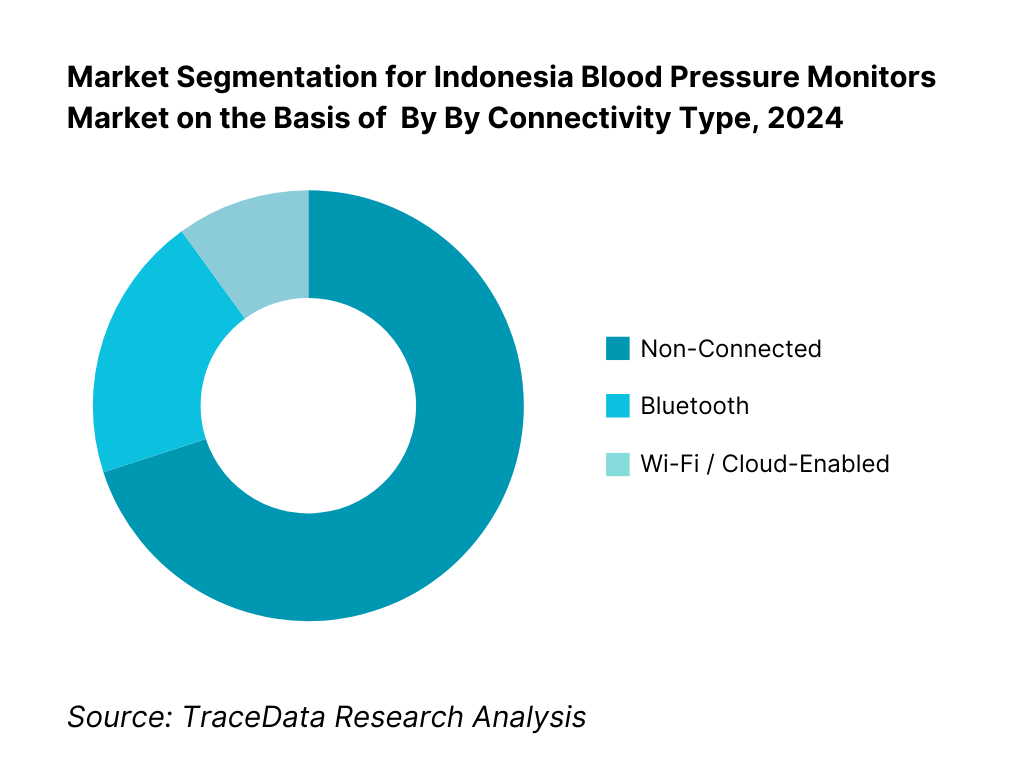

By Connectivity Type: Blood pressure monitors are segmented into non-connected, Bluetooth-enabled, and Wi-Fi/cloud-enabled models. The non-connected category holds the largest share, due to affordability, lower complexity, and mass-market familiarity—especially in rural and price-sensitive markets. Connected models (Bluetooth, Wi-Fi) are growing but are still premium.

Competitive Landscape in Indonesia Blood Pressure Monitors Market

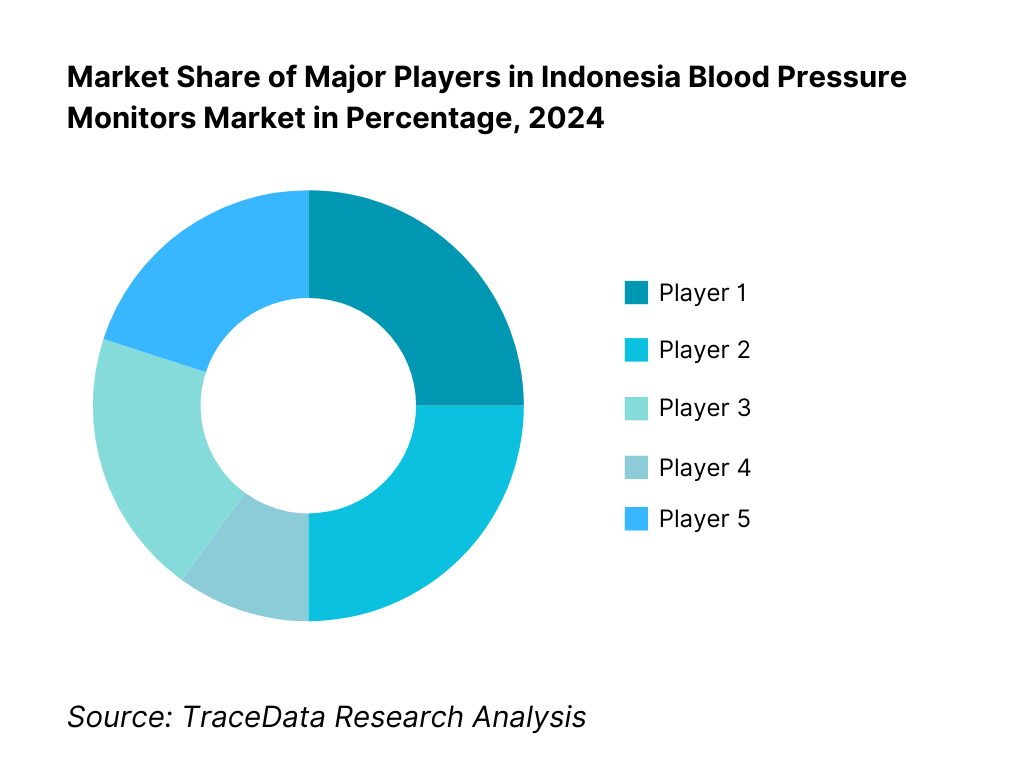

The Indonesia blood pressure monitors market features a blend of global and regional brands. Market competition is moderate, with a few well-entrenched players primarily focusing on validated devices, distribution via pharmacies and e-commerce, and public procurement via e-Katalog. The Indonesia blood pressure monitors market is shaped by a few dominant global suppliers (Omron, Microlife, Beurer) alongside strong regional and local players (Rossmax, OneMed). These companies secure their position through validated device offerings, connectivity features, tailored distribution, and public-sector listings.

Name | Founding Year | Original Headquarters |

Omron Healthcare | 1933 | Kyoto, Japan |

Microlife | 1981 | Widnau, Switzerland |

Beurer | 1919 | Ulm, Germany |

Rossmax | 1990s | Taipei, Taiwan |

OneMed (PT Jayamas Medica Industri) | 1980s | Surabaya, Indonesia |

A&D Company (A&D Medical) | 1977 | Tokyo, Japan |

Braun Healthcare | 1921 | Kronberg, Germany |

Citizen Systems | 1918 | Tokyo, Japan |

Yuwell | 1998 | Jiangsu, China |

GEA Medical | 1994 | Jakarta, Indonesia |

Nesco | 2004 | Jakarta, Indonesia |

BION | 2000s | Singapore |

Withings | 2008 | Paris, France |

Medisana | 1981 | Neuss, Germany |

ABN (PT Sugih Instrumendo Abadi) | 1980s | Jakarta, Indonesia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Omron Healthcare: As the leading player in Indonesia, Omron Healthcare has expanded its official online presence on Tokopedia and Shopee in 2024, ensuring wider availability of validated upper-arm monitors. The company also strengthened partnerships with pharmacies and hospitals, focusing on Bluetooth-enabled models to support home monitoring.

Microlife: Microlife has reinforced its positioning in the clinical and professional segment by increasing distribution through hospital suppliers and specialist clinics in Jakarta and Surabaya. In 2024, the company emphasized its validated WatchBP series to meet physician demand for AFib detection.

Beurer: Known for its strong reputation in consumer healthcare, Beurer launched localized product bundles in Indonesia combining blood pressure monitors with thermometers and wellness devices. The strategy in 2024 focused on targeting urban middle-class households via e-commerce campaigns.

Rossmax: Rossmax expanded its footprint in Indonesia through public procurement channels, securing new e-Katalog listings in 2024. The company positioned its value-driven digital monitors for Puskesmas and regional hospitals, emphasizing affordability without compromising clinical accuracy.

OneMed (PT Jayamas Medica Industri): As a prominent domestic brand, OneMed scaled up production of its aneroid and entry-level digital blood pressure monitors in 2024 to cater to growing rural demand. The company also leveraged its strong institutional sales network to strengthen its share in government tenders.

What Lies Ahead for Indonesia Blood Pressure Monitors Market?

The Indonesia blood pressure monitors market is set for sustained expansion across the medium term, underpinned by the country’s large hypertensive population, deeper primary-care coverage through Puskesmas, and widening device access via e-commerce and LKPP e-Katalog procurement. Continued integration with telemedicine/remote-patient-monitoring (RPM), rising clinical validation standards (ISO 81060-2/ESH), and growing localization/assembly initiatives should keep momentum robust. As household self-monitoring becomes standard care for chronic disease management, value, mid, and connected premium tiers will each find clear, defensible demand pockets.

Rise of Hybrid Monitoring Models: Indonesia will shift decisively toward hybrid monitoring—home self-measurement synchronized with clinic workflows. Upper-arm digital devices remain the clinical anchor, while Bluetooth/Wi-Fi models sync readings to clinician dashboards and chronic-care apps. Hospitals and Puskesmas will deploy ABPM/professional spot monitors for diagnosis and titration, with households maintaining adherence between visits. Corporate wellness programs and insurers are likely to bundle devices with coaching, improving control rates and creating recurring replacement/accessory demand (universal cuffs, adapters).

Focus on Outcome-Based Hypertension Management: Procurement and reimbursement conversations will move from unit pricing to outcomes: target blood-pressure control, reduction in hypertensive crises, and improved adherence. Vendors that pair validated devices with onboarding, education micro-content, multi-user memory, and automated reminders will be favored. Expect KPI-linked pilots where device partners commit to activation, weekly-reading cadence, and data quality thresholds. In this model, calibration/service SLAs, cuff-fit inclusivity (S–XL), and integration with electronic medical records/RPM platforms become core differentiators.

Expansion of Segment-Specific Channels: Channel strategies will specialize: (1) Public sector via e-Katalog for Puskesmas and hospitals; (2) Retail pharmacies and modern trade for entry and mid tiers; (3) Marketplaces for nationwide reach and official-store trust; (4) Corporate/insurer programs for cohort roll-outs; and (5) Cardiology/renal clinics for ABPM and professional devices. Local brands and global leaders will both leverage provincial distributors for after-sales coverage, while urban hubs (Jakarta, Surabaya, Bandung) incubate premium connected adoption that later diffuses to Tier-2/3 cities.

Leveraging AI, Data, and Analytics: Next-gen devices will lean on signal-processing and AI features—irregular pulse/AFib flags, motion-artifact handling, and cuff-fit guidance—to reduce false readings and improve triage. Companion apps will auto-trend averages, annotate medication events, and surface clinician-friendly summaries. Open, secure APIs for RPM platforms will matter as health systems demand interoperable data flows. Privacy-by-design, Bahasa localization, and low-friction onboarding (QR pairing, single-tap sharing) will separate winners as connected fleets scale.

Localization, Validation, and After-Sales Depth: With demand scaling, policymakers’ push for local value addition will favor CKD/IKM assembly and Indonesian-language packaging/support. Brands that maintain stringent clinical validation (ISO 81060-2/ESH), broaden cuff ranges for local anthropometrics, and guarantee spare-parts availability will earn institutional trust. Warranty reliability and province-level turnaround times become as critical as sticker price, particularly for framework agreements and hospital networks.

Indonesia Blood Pressure Monitors Market Segmentation

By Device Type (form factor & measurement method)

Upper-arm digital (oscillometric)

Wrist digital (oscillometric)

Aneroid sphygmomanometer (manual)

Ambulatory BP Monitor (ABPM, 24-hour)

Professional spot-check/kiosk monitors (clinic use)

By Connectivity & Data Flow (integration depth)

Non-connected (stand-alone memory)

Bluetooth app-enabled (mobile syncing)

Wi-Fi / cloud-synced (RPM/telemedicine ready)

Clinic/EHR-connected stations (USB/LAN middleware, hospital use)

By End-User (point of care)

Households / home-care users

Puskesmas / primary care centers

Hospitals & specialist clinics (cardiology, nephrology)

Pharmacies & health corners (in-store screening)

Corporate wellness & insurance programs

By Distribution & Procurement Channel (route-to-market)

E-commerce marketplaces (Tokopedia, Shopee, Lazada)

Retail pharmacies & modern trade

Medical distributors / hospital suppliers

Government procurement via LKPP e-Katalog

Direct B2B (corporates, insurers, occupational health)

By Price / Feature Tier (positioning)

Value/basic (core oscillometric, limited memory)

Mid-range (enhanced memory, universal cuff options)

Premium connected (Bluetooth/Wi-Fi, app analytics, AFib flags)

Professional-grade (clinic stations, AC adapter, multi-patient)

ABPM systems

Players Mentioned in the Report:

Omron Healthcare Indonesia

Microlife

Beurer

Rossmax

OneMed (PT Jayamas Medica Industri)

A&D Medical

Braun Healthcare

Citizen Systems

Yuwell

GEA Medical

Nesco

Bion

Withings

Medisana

ABN (PT Sugih Instrumendo Abadi)

Key Target Audience

Device Manufacturers / Brands

E-commerce Marketplaces & Retail Chains

Healthcare Distributors & Pharmacies

Public Health Procurement Agencies (e.g., LKPP, Ministry of Health – Kemenkes)

Corporate Wellness Program Teams

Telemedicine Platform Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (BPJS-K, Kemenkes)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Blood Pressure Monitors (Retail Pharmacy, E-commerce, Institutional Supply, Public Procurement, Corporate Wellness Programs-Margins, Preference, Strengths & Weaknesses)

4.2. Revenue Streams for Blood Pressure Monitor Companies (Device Sales, Accessories, Extended Warranty, Calibration/Servicing, Telemedicine Integration, Wellness Program Bundles)

4.3. Business Model Canvas for Blood Pressure Monitors in Indonesia (Key Partners, Key Activities, Value Proposition, Customer Segments, Channels, Cost Structure, Revenue Streams)

5.1. Public Procurement (e-Katalog, Puskesmas, Hospitals) vs Private Retail (Pharmacies, E-commerce)

5.2. Investment Model in Indonesia Blood Pressure Monitors Market (Foreign Direct Imports, Local Assembly/IKM, Joint Ventures, Distributor Partnerships)

5.3. Comparative Analysis of Procurement Funnel (Government e-Katalog vs Private Distribution-Pricing, Bidding, After-Sales Obligations)

5.4. Household Health Budget Allocation (Chronic Disease Monitoring Devices-Share of Spend, Affordability & Financing Models)

8.1. Revenues (Historic & Current)

9.1. By Market Structure (Public Procurement vs Private Retail)

9.2. By Device Type (Upper Arm Digital, Wrist Digital, Aneroid, Ambulatory, Professional Monitors)

9.3. By End-User (Households, Puskesmas, Hospitals, Corporate Wellness, Pharmacies)

9.4. By Price Tier (Value, Mid, Premium, Professional Grade)

9.5. By Connectivity (Non-Connected, Bluetooth, Wi-Fi, RPM Integrated)

9.6. By Distribution Channel (E-commerce Marketplaces, Pharmacies, Modern Trade, B2B, Government)

9.7. By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali & Nusa Tenggara, Papua & Maluku)

10.1. Patient & Household Cohort Analysis (Awareness, Usage Frequency, Willingness to Pay)

10.2. Purchase Decision-Making Process (Doctor Recommendation, E-commerce Reviews, Pharmacy Influence)

10.3. Device Effectiveness & ROI Analysis (Accuracy, Durability, Warranty, Healthcare Cost Savings)

10.4. Gap Analysis Framework (Demand vs Supply, Validated vs Non-Validated Devices, Urban vs Rural Coverage)

11.1. Trends and Developments (Connected Devices, AFib Detection, Universal Cuffs, Local Assembly)

11.2. Growth Drivers (Hypertension Burden, BPJS Programs, Telemedicine Integration, E-commerce Growth)

11.3. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

11.4. Issues and Challenges (Counterfeit Devices, Price Sensitivity, Limited After-Sales, Import Dependency)

11.5. Government Regulations (Kemenkes Classification, AKD/AKL Certification, e-Katalog Procurement Rules, Calibration Standards)

12.1. Market Size and Future Potential (E-commerce GMV, Official Stores, Marketplace Penetration)

12.2. Business Model and Revenue Streams (Direct-to-Consumer, Marketplace Fees, Warranty Add-ons)

12.3. Delivery Models (Home Delivery, Pharmacy Pickup, Bundled with Chronic Care Kits)

12.4. Cross Comparison of Leading Online Blood Pressure Monitor Companies (Company Overview, e-Katalog Presence, Revenues, Official Stores, Product Range, Price Bands, Validation Status, Number of SKUs, Customer Ratings, Warranty Policies)

15.1. Market Share of Key Players (Omron, Beurer, Microlife, Rossmax, OneMed, A&D, Braun, Citizen, Yuwell, GEA, Nesco, Bion, Withings, Medisana, ABN)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Product Portfolios, Validation & Certifications, Pricing Tiers, Connectivity Features, Distribution Networks, Strategic Partnerships, Marketing Strategy, Recent Developments)

15.3. Operating Model Analysis Framework (Direct Sales, Distributor-led, Marketplace Focused)

15.4. Gartner Magic Quadrant (Market Leaders, Challengers, Visionaries, Niche Players)

15.5. Bowman’s Strategic Clock for Competitive Advantage (Price-Value Positioning in Indonesia)

16.1. Revenues (Forecast)

17.1. By Market Structure (Public Procurement vs Private Retail)

17.2. By Device Type (Upper Arm Digital, Wrist Digital, Aneroid, Ambulatory, Professional Monitors)

17.3. By End-User (Households, Puskesmas, Hospitals, Corporate Wellness, Pharmacies)

17.4. By Price Tier (Value, Mid, Premium, Professional Grade)

17.5. By Connectivity (Non-Connected, Bluetooth, Wi-Fi, RPM Integrated)

17.6. By Distribution Channel (E-commerce Marketplaces, Pharmacies, Modern Trade, B2B, Government)

17.7. By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali & Nusa Tenggara, Papua & Maluku)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the ecosystem of the Indonesia Blood Pressure Monitors Market, identifying all demand-side and supply-side entities. On the demand side, this includes households, hospitals, Puskesmas (community health centers), pharmacies, e-commerce marketplaces, insurers, and corporate wellness programs. On the supply side, it encompasses global manufacturers, local assemblers, importers, distributors, and service providers. Based on this ecosystem mapping, we shortlist 5–6 leading device providers in the country—such as Omron, Microlife, Rossmax, OneMed, and Beurer—using parameters like product validation, distribution footprint, government e-Katalog presence, and institutional client coverage.

Step 2: Desk Research

Our process then engages in rigorous desk research, drawing insights from public health statistics (e.g., Ministry of Health, BPJS), trade data (import/export via HS 9018), and trusted global databases such as WHO and World Bank. We analyze market fundamentals such as hypertension burden, household adoption trends, digital penetration, and institutional procurement. At the company level, we review press releases, annual reports, e-Katalog procurement lists, and regulatory filings (AKD/AKL). This stage helps us build a foundational understanding of device penetration, supply-chain structures, and pricing tiers across retail, e-commerce, and institutional channels.

Step 3: Primary Research

Next, we conduct in-depth interviews with industry stakeholders including senior executives of medical device companies, distributors, and decision-makers in hospitals, pharmacies, and procurement agencies. These interviews validate our market hypotheses, authenticate key statistics, and surface operational insights on product adoption, after-sales service challenges, and channel margins. We apply a bottom-to-top approach by aggregating revenue contributions of individual players and cross-validating this with top-down demand indicators like population health coverage under BPJS. To enhance validation, our team also conducts disguised interviews under the guise of potential clients, verifying operational and financial claims against secondary records.

Step 4: Sanity Check

Finally, we execute both top-to-bottom and bottom-to-top analyses, alongside market size modeling, to ensure robustness of findings. This includes triangulating device distribution numbers with hypertension prevalence data, procurement volumes, and consumer adoption across regions. By integrating these approaches, we achieve a balanced and accurate representation of the Indonesia Blood Pressure Monitors Market, ensuring consistency between demand estimates, supply-side data, and financial performance of leading competitors.

FAQs

1. What is the potential for the Indonesia Blood Pressure Monitors Market?

The Indonesia Blood Pressure Monitors Market is poised for strong growth, with revenues crossing USD 10 million in 2024. This potential is being fueled by the rising burden of hypertension, which contributes to 35% of all deaths in Indonesia, along with greater health awareness, national screening initiatives through Puskesmas, and broader device availability via e-commerce and government e-Katalog procurement. These drivers ensure continued expansion in both consumer and institutional markets.

2. Who are the Key Players in the Indonesia Blood Pressure Monitors Market?

The Indonesia Blood Pressure Monitors Market features several leading players, including Omron Healthcare, Microlife, Beurer, Rossmax, and OneMed. These companies dominate the market due to their validated product portfolios, strong distribution networks across pharmacies and hospitals, and official presence on e-commerce marketplaces. Other notable competitors include A&D Medical, Braun Healthcare, Citizen Systems, Yuwell, GEA Medical, Nesco, Bion, Withings, Medisana, and ABN. Their strategies include offering Bluetooth-enabled models, localized cuff sizes, and government procurement alignment, enabling them to cater to diverse consumer and institutional needs.

3. What are the Growth Drivers for the Indonesia Blood Pressure Monitors Market?

The primary growth drivers include Indonesia’s rising hypertension burden, with over 200 million citizens covered by the BPJS health insurance scheme, expanding the demand for monitoring devices at both household and clinical levels. Telemedicine and remote patient monitoring uptake, with more than 30 million monthly active users on digital health platforms, further accelerates connected device adoption. Additionally, strong ICT penetration and growing digital literacy support the gradual shift towards Bluetooth and Wi-Fi monitors for integrated care.

4. What are the Challenges in the Indonesia Blood Pressure Monitors Market?

The Indonesia Blood Pressure Monitors Market faces several challenges. First, healthcare infrastructure gaps, with only 0.4 doctors per 1,000 people, limit clinical promotion and patient education on home monitoring. Second, consumer awareness barriers, with 58.2% of Indonesians still unaware of telemedicine services, restrict integration of connected devices. Third, regulatory ambiguity in device interoperability with national telehealth systems creates uncertainty for manufacturers, slowing innovation and uptake in the connected monitoring segment.