Indonesia Consumer Appliances Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances

- Product Code: TDR0060

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Indonesia Consumer Appliances Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer appliances market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Consumer Appliances Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Indonesia Consumer Appliances Market Overview and Size

The Indonesia consumer appliances market reached a valuation of IDR 75 Trillion in 2023, driven by increasing urbanization, rising disposable income, and a growing middle class. The market is characterized by major players such as LG Electronics, Sharp, Panasonic, and Samsung. These companies are recognized for their innovative product offerings, extensive distribution networks, and strong brand presence.

In 2023, LG Electronics launched new energy-efficient refrigerators and air conditioners, focusing on reducing energy consumption. This initiative aligns with the government's sustainability goals and targets environmentally conscious consumers. Key markets such as Jakarta, Surabaya, and Bandung are driving demand due to their high population density and increasing adoption of modern home appliances.

Market Size for Indonesia Consumer Appliances Industry on the Basis of Volume Sales in Units, 2018-2024

What Factors are Leading to the Growth of Indonesia Consumer Appliances Market

Economic Factors: Increasing disposable income and higher living standards have significantly shifted consumer preference towards premium appliances. In 2023, consumer appliances accounted for approximately 45% of total household expenditure in Indonesia, as they offer convenience and time-saving features. This trend is particularly pronounced among urban households looking to upgrade their living standards.

Growing Middle Class: The expanding middle class, with limited disposable income, is increasingly opting for affordable yet quality consumer appliances. In recent years, the middle-income population in Indonesia has grown by 18%, and this demographic shift has driven demand for high-quality, energy-efficient appliances that cater to modern needs.

Technological Advancements: The rise of smart home appliances and integration of IoT technology has revolutionized the way consumers purchase and use home appliances. In 2023, around 35% of consumer appliance transactions in Indonesia were conducted online, reflecting a growing trend towards digital channels. These platforms offer comprehensive product listings, price comparisons, and customer reviews, which have significantly boosted market growth by making the buying process more accessible and user-friendly.

Which Industry Challenges Have Impacted the Growth for Indonesia Consumer Appliances Market

High Import Dependency: The Indonesian consumer appliances market is heavily reliant on imported goods, with over 70% of appliances sourced from countries like China, South Korea, and Japan. This dependency exposes the market to fluctuations in exchange rates and changes in import regulations, which can lead to pricing instability and supply chain disruptions. In 2023, the volatility in exchange rates resulted in a 5% increase in the average retail price of imported appliances.

Low Consumer Awareness: Despite the growing availability of energy-efficient appliances, consumer awareness about their long-term cost savings and environmental benefits remains low, especially in rural areas. This lack of awareness has slowed down the adoption rate of energy-efficient products. In a 2023 survey, it was found that only 40% of consumers in rural Indonesia were familiar with energy efficiency labels, compared to 75% in urban areas.

Inadequate After-Sales Service: After-sales service infrastructure in Indonesia is underdeveloped, particularly in rural and remote regions. Limited availability of spare parts and insufficient service centers lead to longer repair times and increased maintenance costs for consumers. According to industry data, approximately 30% of consumers expressed dissatisfaction with the after-sales service provided by major appliance brands, which affects overall customer retention and brand loyalty.

What are the Regulations and Initiatives which have Governed the Market

Energy Efficiency Standards: The Indonesian government has implemented mandatory energy efficiency labeling for major home appliances such as refrigerators, air conditioners, and washing machines. These labels provide information on energy consumption, helping consumers make informed purchasing decisions. In 2023, approximately 85% of all new appliances in the market complied with the energy efficiency standards, reflecting the effectiveness of this regulation in promoting energy conservation.

Import Restrictions on Consumer Appliances: To maintain product quality and safety standards, the Indonesian government enforces strict import regulations on consumer appliances. These include mandatory testing for safety and performance standards before products are allowed into the market. In 2023, the implementation of stricter import regulations led to a 10% reduction in the entry of non-compliant appliances, ensuring better safety and quality for consumers.

Government Incentives for Energy-Efficient Appliances: To encourage the adoption of energy-efficient and environmentally friendly appliances, the government has introduced various incentives, including tax reductions and subsidies for manufacturers that produce energy-saving products. In 2023, these incentives contributed to a 15% increase in the production and sale of energy-efficient appliances across the country, aligning with the government’s sustainability goals.

Indonesia Consumer Appliances Market Segmentation

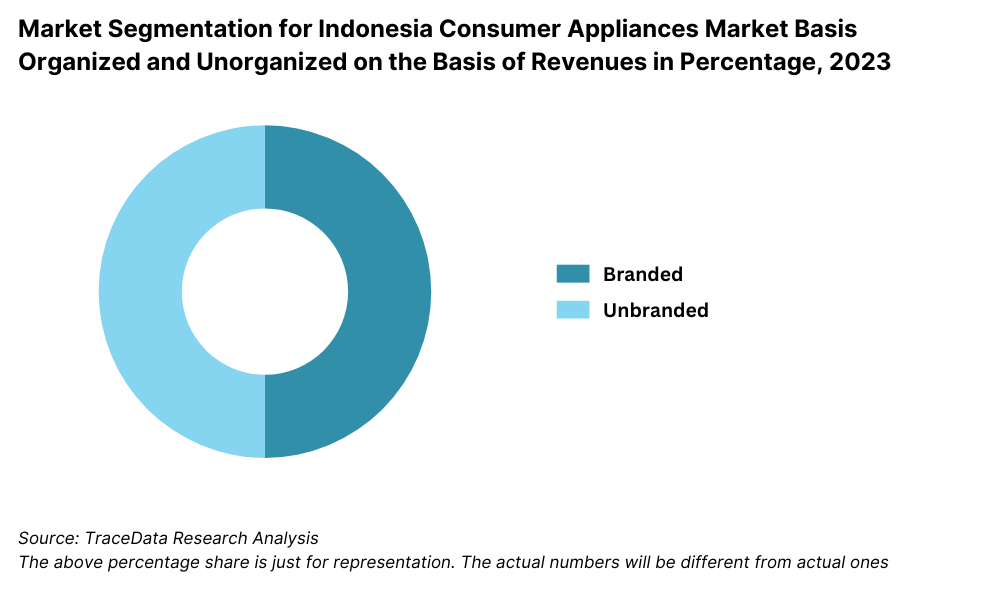

- By Market Structure: The market is segmented into organized and unorganized sectors. Organized players dominate the market, driven by their strong brand presence, extensive distribution networks, and well-established after-sales service. They typically offer a diverse product range, advanced technology, and reliable quality, which appeals to urban consumers. The unorganized sector holds a significant share in rural areas due to its focus on affordability and locally sourced products, making it a preferred choice for budget-conscious buyers.

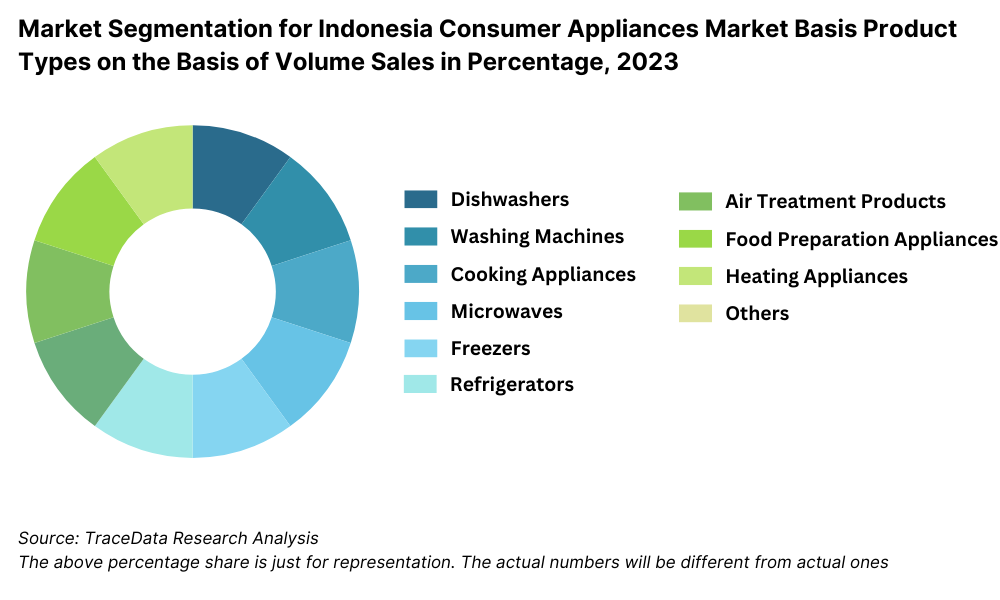

By Product Type: Refrigerators account for the largest share in the Indonesian consumer appliances market, driven by the rising need for food preservation and storage solutions among urban households. Washing machines and air conditioners follow closely, supported by increased adoption due to growing urbanization and changing consumer lifestyles. Kitchen appliances and small home appliances like microwaves and vacuum cleaners are witnessing rapid growth, driven by increased consumer interest in convenience and automation.

By Sales Channel: Offline channels such as retail stores and large-format electronics outlets remain the dominant sales channel, contributing to over 70% of the market revenue in 2023. However, online channels are growing rapidly, driven by the increased penetration of e-commerce platforms and consumer preference for convenience and competitive pricing. In 2023, online channels contributed around 30% of total sales, reflecting a significant shift towards digital buying behavior.

Competitive Landscape in Indonesia Consumer Appliances Market

The Indonesian consumer appliances market is relatively concentrated, with a few major players holding a significant share. Companies such as LG Electronics, Sharp, Panasonic, and Samsung dominate the market, leveraging their strong brand reputation and innovative product offerings. The emergence of Chinese brands like Haier and Midea has further intensified competition, offering affordable alternatives with comparable quality.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Sharp Electronics | Refrigerators, Washing machines, Air conditioners, Cooking appliances | 1912 | Osaka, Japan |

Panasonic | Refrigerators, Washing machines, Microwaves, Air conditioners | 1918 | Osaka, Japan |

LG Electronics | Refrigerators, Washing machines, Air conditioners, Cooking appliances | 1958 | Seoul, South Korea |

Electrolux | Dishwashers, Refrigerators, Washing machines, Microwaves, Vacuum cleaners | 1919 | Stockholm, Sweden |

Samsung Electronics | Refrigerators, Washing machines, Air conditioners, Cooking appliances | 1938 | Suwon, South Korea |

Hitachi | Refrigerators, Washing machines, Air conditioners, Vacuum cleaners | 1910 | Tokyo, Japan |

ASKO | Dishwashers, Washing machines, Cooking appliances, Refrigerators | 1950 | Vara, Sweden |

Toshiba | Refrigerators, Washing machines, Microwaves, Rice cookers | 1939 | Tokyo, Japan |

Sanken Algadwija | Washing machines, Refrigerators, Air conditioners | 1995 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

LG Electronics: Known for its innovative technology and focus on energy efficiency, LG Electronics reported a 20% growth in appliance sales in Indonesia in 2023. The company’s emphasis on developing smart and eco-friendly appliances has positioned it as a leader in the premium segment.

Sharp: Sharp’s extensive distribution network and focus on mid-range appliances have helped it maintain a strong market presence. In 2023, Sharp introduced a new range of air purifiers designed specifically for Indonesia’s climate, addressing local air quality concerns.

Panasonic: Panasonic has focused on expanding its product line with appliances tailored for smaller living spaces, reflecting the growing trend of urban living. The company saw a 15% increase in sales of compact washing machines and refrigerators in 2023.

Samsung: Leveraging its expertise in electronics, Samsung has introduced a range of smart appliances with advanced connectivity features. In 2023, Samsung’s smart washing machines accounted for 30% of the company’s total appliance sales in Indonesia.

What Lies Ahead for Indonesia Consumer Appliances Market?

The Indonesia consumer appliances market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by rising disposable incomes, urbanization, and increasing consumer preference for technologically advanced and energy-efficient home appliances.

Shift Towards Energy-Efficient Appliances: As environmental concerns become more prominent and electricity costs rise, consumers are expected to increasingly opt for energy-efficient appliances. This shift is supported by government policies promoting energy conservation and consumer awareness campaigns highlighting the benefits of energy-efficient products. The adoption of energy-efficient refrigerators, washing machines, and air conditioners is anticipated to grow significantly during the forecast period.

Integration of Smart Technologies: The integration of advanced technologies such as AI and IoT in home appliances is expected to revolutionize the market. Smart appliances that can be remotely controlled, monitored, and optimized for energy consumption are gaining popularity, particularly among urban consumers. This trend is anticipated to drive market growth as consumers seek greater convenience and connectivity in their homes.

Expansion of E-Commerce Channels: The rapid growth of e-commerce platforms in Indonesia is expected to contribute significantly to the consumer appliances market. Online sales channels are projected to witness robust growth due to factors such as increased internet penetration, competitive pricing, and convenience. E-commerce platforms are becoming a preferred channel for purchasing home appliances, particularly in urban areas.

Focus on Sustainability and Environmental Practices: With the increasing emphasis on sustainability, companies are focusing on developing eco-friendly appliances and adopting sustainable manufacturing practices. This includes using recycled materials, reducing carbon footprints, and introducing energy-efficient products. As consumers become more environmentally conscious, the demand for green products is expected to influence purchasing decisions in the coming years.

Future Outlook and Projections for Indonesia Consumer Appliances Market on the Basis of Revenues in USD Billion, 2024-2029

Indonesia Consumer Appliances Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Major Appliances

- Small Appliances

- By Major Appliances

- Dishwashers

- Washing Machines

- Cooking Appliances

- Microwaves

- Freezers

- Refrigerators

- Washing Machines:

- Semi Automatic

- Automatic Washing Machines

- Cooking Appliances:

- Built-In Hobs

- Ovens

- Cooker Hoods

- Cookers

- Freezers:

- Built-In

- Freestanding

- Small Appliances

- Air Treatment Products

- Food Preparation Appliances

- Heating Appliances

- Irons

- Personal Care Appliances

- Small Cooking Appliances

- Vacuum Cleaners and Small Appliances:

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

By Region:

Java

Sumatra

Sulawesi

Kalimantan

Papua

By Consumer Demographics:

Middle Class

High Income

Low Income

Players Mentioned in the Report:

Samsung Electronics

LG Electronics

Sharp Corporation

Panasonic

Electrolux

Toshiba

Modena

Haier Group

Midea

Bosch

Key Target Audience

Consumer Appliance Manufacturers

Online and Offline Retailers

Appliance Distributors

Regulatory Bodies (e.g., Ministry of Industry)

Research and Development Institutions

Time Period:

• Historical Period: 2018-2023

• Base Year: 2024

• Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for the Indonesia Consumer Appliances Market

4.3. Business Model Canvas for the Indonesia Consumer Appliances Market

4.4. Buying Decision-Making Process

4.5. Supply Decision-Making Process

5.1. New Appliance Sales in Indonesia, 2018-2024

5.2. Replacement vs. New Sales Ratio in Indonesia, 2018-2024

5.3. Spend on Home Appliances in Indonesia, 2024

5.4. Number of Consumer Appliance Deaers in the Indonesia by Region

8.1. Revenues, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Major and Small Appliances), 2018-2024

9.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2018-2024

9.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2018-2024

9.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2018-2024

9.2.1.3. By Freezers (Built-In and Freestanding), 2018-2024

9.2.1.4. By Refrigerator (Built-In and Freestanding), 2018-2024

9.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2018-2024

9.3. By Average Price Range, 2023-2024P

9.4. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.5. By Region (Northern, Southern, Western, Eastern, Central), 2023-2024P

9.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in the Indonesia Consumer Appliances Market

11.2. Growth Drivers for the Indonesia Consumer Appliances Market

11.3. SWOT Analysis for the Indonesia Consumer Appliances Market

11.4. Issues and Challenges for the Indonesia Consumer Appliances Market

11.5. Government Regulations for the Indonesia Consumer Appliances Market

12.1. Market Size and Future Potential for Online Consumer Appliances Market, 2018-2029

12.2. Business Model and Revenue Streams for Major Marketplace and Company Websites

12.3. Cross-Comparison of Leading Online Consumer Appliance Companies Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Down Payment for Consumer Appliances, 2018-2029

13.2. Trends in Finance Penetration Rates Over the Years and Contributing Factors

13.3. Appliance Segments with Higher Finance Penetration

13.4. Finance Split by Banks/NBFCs/Private Finance Companies and Captive Entities, 2023-2024P

13.5. Average Finance Tenure for Consumer Appliances in the Indonesia

13.6. Finance Disbursement for Consumer Appliances in Indonesia, 2018-2024P

16.1. Market Share of Key Players in India Consumer Electronics Market, 2018-2024

16.1.1. Market Share of Key Players in India Washing Machine Market, 2018-2024

16.1.2. Market Share of Key Players in India Cooking Appliances Market, 2018-2024

16.1.3. Market Share of Key Players in India Refrigerator Market, 2018-2024

16.1.4. Market Share of Key Players in India Television Market, 2018-2024

16.2. Benchmarking of Key Competitors in India Consumer Electronics Market including Operational and Financial Parameters

16.3. Heat Map Analysis for Major Players in India Consumer Electronics Market

16.4. Strengths and Weaknesses Analysis

16.5. Operating Model Analysis Framework

19.1. Revenues, 2025-2029

20.1. By Market Structure (Branded and Local Brands), 2025-2029

20.2. By Type (Major and Small Appliances), 2025-2029

20.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2025-2029

20.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2025-2029

20.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2025-2029

20.2.1.3. By Freezers (Built-In and Freestanding), 2025-2029

20.2.1.4. By Refrigerator (Built-In and Freestanding), 2025-2029

20.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2025-2029

20.3. By Average Price Range, 2025-2029

20.4. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

20.5. By Region (Northern, Southern, Western, Eastern, Central), 2025-2029

20.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

20.7. Recommendation

20.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Indonesia Consumer Appliances Market. Basis this ecosystem, we will shortlist leading 5-6 manufacturers and distributors in the country based on their financial information, production capacity, distribution networks, and market presence.

Sourcing is made through industry articles, multiple secondary sources, and proprietary databases to perform desk research around the market to collate industry-level information and gain a comprehensive understanding of the market ecosystem.

Step 2: Desk Research

An exhaustive desk research process is conducted by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like sales revenue, market size, production capacity, key market players, price levels, demand, and other variables. We supplement this research with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and industry publications. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

A series of in-depth interviews with C-level executives, key opinion leaders, and other stakeholders representing various Indonesia Consumer Appliances Market companies and end-users is conducted. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate volume sales for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors impacting the market.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the research findings. This step ensures consistency and accuracy of the data, validating the market insights and projections provided in the report.

FAQs

1. What is the potential for the Indonesia Consumer Appliances Market?

The Indonesia consumer appliances market is poised for substantial growth, reaching a valuation of IDR 75 Trillion in 2023. This growth is driven by factors such as the rising disposable income, increased urbanization, and growing consumer preference for technologically advanced and energy-efficient home appliances. The market's potential is further bolstered by the increasing adoption of e-commerce platforms, which make it easier for consumers to access a diverse range of products.

2. Who are the Key Players in the Indonesia Consumer Appliances Market?

The Indonesia Consumer Appliances Market features several key players, including LG Electronics, Sharp, Panasonic, and Samsung. These companies dominate the market due to their extensive distribution networks, strong brand presence, and innovative product offerings. Other notable players include Haier, Midea, Polytron, Electrolux, and Toshiba.

3. What are the Growth Drivers for the Indonesia Consumer Appliances Market?

The primary growth drivers include economic factors such as increased consumer spending power and urbanization, which lead to a higher demand for home appliances. Technological advancements, such as the integration of AI and IoT in smart home appliances, are also contributing to market growth. Additionally, the rise of e-commerce platforms has expanded consumer access to a broader range of products, further enhancing market growth.

4. What are the Challenges in the Indonesia Consumer Appliances Market?

The Indonesia Consumer Appliances Market faces several challenges, including high import dependency, which can lead to supply chain disruptions and price volatility. Other challenges include low consumer awareness regarding the benefits of energy-efficient appliances, inadequate after-sales service infrastructure, and regulatory hurdles such as strict import regulations and compliance costs. These challenges can impact product availability and market growth, especially in rural and remote areas.