Indonesia Convenience Store Market Outlook to 2029

By Store Format, By Ownership Type, By Product Categories, By Consumer Age Groups, and By Region

- Product Code: TDR0088

- Region: Asia

- Published on: December 2024

- Total Pages: 80-100

Report Summary

The report titled “Indonesia Convenience Store Market Outlook to 2029 - By Store Format, By Ownership Type, By Product Categories, By Consumer Age Groups, and By Region” provides a comprehensive analysis of the convenience store market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Convenience Store Market. The report concludes with future market projections based on revenue, store formats, regions, consumer preferences, and success case studies highlighting the major opportunities and cautions.

Indonesia Convenience Store Market Overview and Size

The Indonesia convenience store market reached a valuation of IDR 45 Trillion in 2023, driven by rapid urbanization, growing disposable incomes, and increasing demand for accessible and convenient shopping options. The market is characterized by major players such as Alfamart, Indomaret, Circle K, Lawson and other players. These companies are recognized for their extensive store networks, diverse product categories, and innovative customer engagement strategies.

In 2023, Alfamart introduced AI-driven inventory management systems to optimize stock levels and reduce waste. This initiative aims to enhance operational efficiency and customer satisfaction by ensuring product availability. Jakarta and Surabaya are key markets due to their high population density and well-developed retail infrastructure.

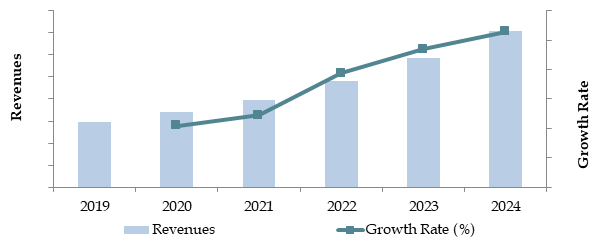

Market Size for Indonesia Convenience Store Industry on the Basis of Revenues and Number of Stores, 2018-2024

What Factors are Leading to the Growth of Indonesia Convenience Store Market?

Urbanization and Changing Lifestyles: The increasing urban population, accounting for over 56% of Indonesia’s total population in 2023, has significantly driven demand for convenience stores offering quick access to essential products. Busy lifestyles and the growing need for time-saving shopping options are key factors fueling growth.

Rising Disposable Income: Indonesia’s middle class has expanded by 15% in the past five years, boosting demand for premium and imported goods available in convenience stores. Higher disposable incomes have led to a shift in consumer preferences towards modern retail formats offering enhanced shopping experiences.

Technological Integration: The adoption of digital payment systems and loyalty programs has revolutionized the convenience store shopping experience in Indonesia. By 2023, approximately 35% of convenience store transactions were conducted using digital wallets, reflecting the impact of Indonesia’s digital economy. Leading players have also invested in e-commerce platforms, enabling online ordering and home delivery to cater to tech-savvy consumers.

Which Industry Challenges Have Impacted the Growth for Indonesia Convenience Store Market

Intense Competition: The market is highly competitive, with dominant players such as Alfamart and Indomaret competing on pricing, product variety, and store accessibility. This intense competition creates challenges for smaller and regional players who struggle to match the scale and operational efficiencies of market leaders. In 2023, smaller retailers accounted for less than 10% of total convenience store sales.

High Operating Costs: Rising rental and utility costs have posed challenges to profitability, particularly in urban centers like Jakarta and Surabaya. On average, store operational expenses increased by 12% in 2023, reducing the net margins for convenience store operators.

Supply Chain Disruptions: The COVID-19 pandemic and subsequent global supply chain issues have led to inventory shortages and price volatility. In 2023, approximately 20% of convenience stores reported stockouts for essential items, impacting customer satisfaction and loyalty.

Changing Consumer Preferences: A growing focus on health-conscious products and sustainability is challenging for traditional convenience stores that are slower to adapt. In 2023, health-conscious products accounted for only 8% of total sales, signaling a gap in meeting emerging consumer demands.

What are the Regulations and Initiatives Which Have Governed the Market

Zoning Laws for Retail Outlets: Indonesian government regulations mandate specific zoning restrictions for retail outlets to avoid market saturation in urban areas. In 2023, approximately 15% of new convenience store applications were rejected due to non-compliance with these zoning laws.

Minimum Wage Policies: The implementation of minimum wage policies directly affects the labor costs for convenience store operators. For instance, in 2023, labor costs for convenience stores rose by 10% following a hike in minimum wages across key regions.

E-Commerce and Digital Payment Regulations: The Indonesian government has introduced regulations to streamline digital payment systems and ensure consumer data security. By 2023, all major convenience stores were compliant with these regulations, facilitating the adoption of cashless payments, which accounted for 40% of transactions.

Indonesia Convenience Store Market Segmentation

By Store Format: Standalone convenience stores dominate the market due to their accessibility and adaptability to both urban and suburban locations. These stores provide a wide range of products and services, making them popular among a diverse customer base. Mini-marts hold a significant share as they cater to consumers looking for quick purchases with a smaller store format, often located within residential areas. Hyperlocal convenience stores, focused on specific communities, are emerging as a niche segment, providing customized product assortments based on local preferences.

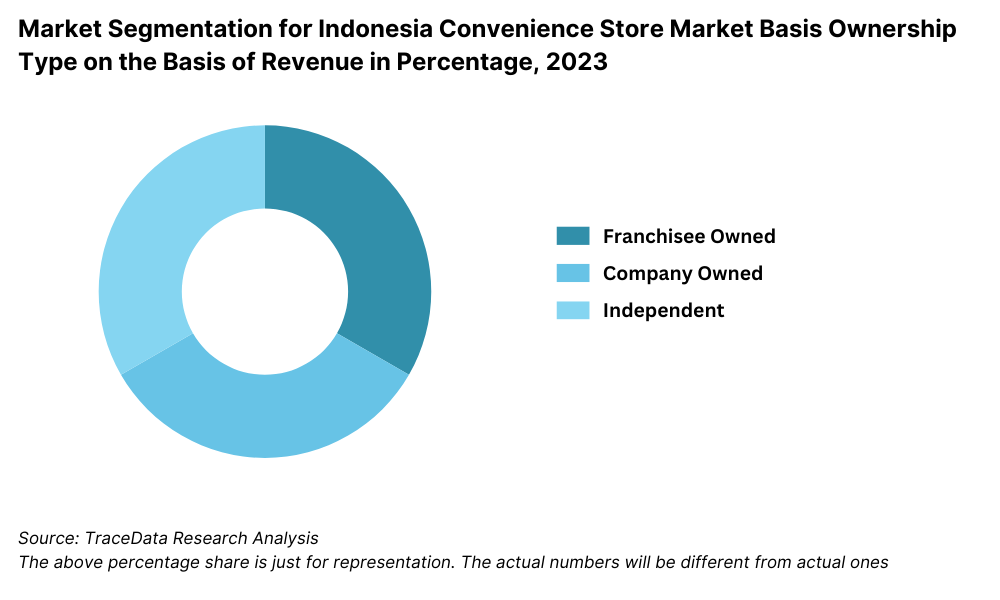

By Ownership Type: Franchise-operated convenience stores lead the market due to their extensive networks and standardized operations, which ensure consistent customer experience. Corporate-owned stores account for a significant share, focusing on strategic locations in high-footfall areas to maximize revenue. Independent stores face challenges in competing with organized players but continue to serve niche markets with customized offerings.

By Product Categories: Packaged food and beverages are the leading product categories, accounting for the highest revenue share, driven by consumer demand for snacks and ready-to-eat meals. Personal care products follow, benefiting from the growing consumer focus on hygiene and wellness. Tobacco and alcohol sales contribute significantly, especially in urban areas with higher spending capacity and nightlife culture.

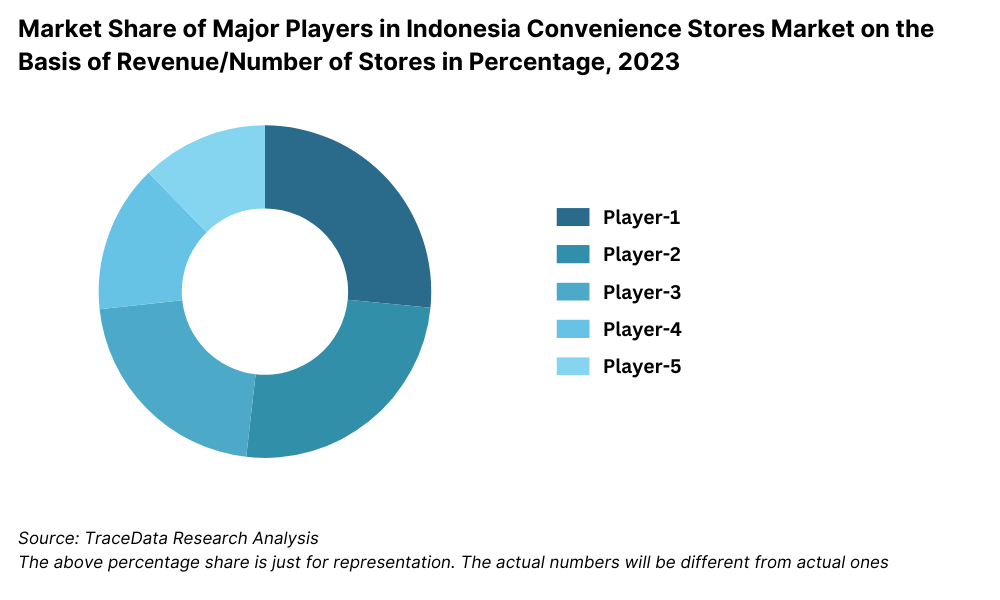

Competitive Landscape in Indonesia Convenience Store Market

The Indonesia convenience store market is moderately consolidated, with a few dominant players leading the market. The sector has also witnessed the entry of new brands and the adoption of innovative business models, further diversifying consumer options. Key players such as Alfamart, Indomaret, Circle K, and Lawson have established strong market positions through extensive store networks and customer-focused strategies.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Indomaret | 1988 | Jakarta, Indonesia |

Alfamart | 1999 | Tangerang, Indonesia |

Circle K | 1986 | Jakarta, Indonesia |

FamilyMart | 2012 | Jakarta, Indonesia |

Lawson | 2011 | Jakarta, Indonesia |

Alfamidi | 2007 | Tangerang, Indonesia |

7-Eleven | 2009 (Exited in 2017) | Jakarta, Indonesia |

Yomart | 1997 | Bandung, Indonesia |

Ceriamart | 2010 | Jakarta, Indonesia |

M-Mart | 2015 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

Alfamart: One of Indonesia's largest convenience store chains, Alfamart reported a 15% increase in revenue in 2023, driven by its aggressive store expansion strategy, particularly in suburban and rural areas. The company has also embraced digital payment systems, with over 50% of transactions now cashless.

Indomaret: Known for its wide product selection and extensive store network, Indomaret introduced an in-house e-commerce platform in 2023, allowing customers to place online orders for delivery or in-store pickup. This move contributed to a 12% growth in sales.

Circle K: Circle K focuses on urban markets and younger demographics, with its stores emphasizing a modern shopping experience. In 2023, the company saw a 10% increase in sales of ready-to-eat meals and beverages, a key revenue driver for the brand.

Lawson: Lawson targets niche markets with its emphasis on Japanese-style products and premium offerings. In 2023, the company expanded its product range to include more local snacks and beverages, leading to a 20% increase in customer footfall in suburban stores.

What Lies Ahead for Indonesia Convenience Store Market?

The Indonesia convenience store market is projected to experience steady growth by 2029, demonstrating a significant CAGR during the forecast period. This growth will be driven by increasing urbanization, evolving consumer lifestyles, and technological advancements within the retail sector.

Expansion of Digital Integration: The continued adoption of digital payment systems and e-commerce platforms is expected to play a critical role in the market’s growth. By 2029, it is anticipated that over 60% of convenience store transactions will be cashless, driven by Indonesia's digital economy initiatives and the growing use of mobile wallets.

Focus on Health and Wellness Products: With increasing awareness of health and wellness among Indonesian consumers, the demand for organic, low-calorie, and sustainable product options is expected to grow. Convenience stores are likely to expand their offerings in these categories to cater to the changing preferences of health-conscious customers.

Geographic Expansion into Rural Areas: The market is expected to see significant growth in rural areas, where convenience store penetration is currently low. Major players like Alfamart and Indomaret are anticipated to continue their store expansion strategies to tap into underserved markets, providing accessibility to modern retail in these regions.

Rise of Private Label Products: The introduction and growth of private label products by convenience store chains will cater to cost-sensitive consumers seeking affordable yet reliable alternatives. This trend will also enhance profitability for store operators by increasing margins on proprietary products.

Future Outlook and Projections for Indonesia Convenience Stores Market on the Basis of Revenues in USD Billion, 2024-2029

Indonesia Convenience Store Market Segmentation

- By Store Format:

- Standalone Stores

- Mini-Marts

- Hyperlocal Stores

- Specialty Convenience Stores

- By Ownership Type:

- Franchise-Owned Stores

- Corporate-Owned Stores

- Independently Owned Stores

- By Product Categories:

- Packaged Food and Beverages

- Ready-to-Eat Meals

- Personal Care Products

- Tobacco and Alcohol

- Household Essentials

- By Consumer Age Groups:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Bali and Nusa Tenggara

Players Mentioned in the Report:

- Indomaret

- Alfamart

- Circle K

- FamilyMart

- Lawson

- Alfamidi

- 7-Eleven

- Yomart

- Ceriamart

- M-Mart

Key Target Audience:

- Convenience Store Chains

- Retail Franchising Companies

- FMCG Manufacturers

- Technology Providers for Retail Solutions

- Regulatory Bodies (e.g., Ministry of Trade and Industry)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Indonesia Convenience Store Market

4.3. Business Model Canvas for Indonesia Convenience Store Market

4.4. Sourcing and Supply Chain Model Adopted by Convenience Stores

4.5. Gross Margins by Product Segment for Convenience Stores in Indonesia

5.1. Store Distribution by Format and Location, 2018-2024

5.2. Spend on Convenience Goods in Indonesia, 2024

5.3. Number of Convenience Stores by Ownership Type (Franchise vs. Corporate), 2024

8.1. Revenues, 2018-2024

8.2. Store Count, 2018-2024

9.1. By Store Format (Standalone, Mini-Marts, Hyperlocal), 2023-2024P

9.2. By Ownership Type (Franchise-Owned, Corporate-Owned, Independent), 2023-2024P

9.3. By Product Category (Packaged Food, Ready-to-Eat, Beverages, Personal Care, Tobacco), 2023-2024P

9.4. By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali and Nusa Tenggara), 2023-2024P

10.1. By Age, Gender and Income Split

10.2. Customer Landscape and Cohort Analysis

10.3. Customer Journey and Decision-Making

10.4. Need, Desire, and Pain Point Analysis

10.5. Gap Analysis Framework

11.1. Trends and Developments for Indonesia Convenience Store Market

11.2. Growth Drivers for Indonesia Convenience Store Market

11.3. SWOT Analysis for Indonesia Convenience Store Market

11.4. Issues and Challenges for Indonesia Convenience Store Market

11.5. Government Regulations for Indonesia Convenience Store Market

12.1. Market Size and Future Potential for Online Delivery from Convenience Stores Basis Revenues and Number of Orders, 2018-2029

12.2. Business Model and Revenue Streams

15.1. Market Share of Key Players in Indonesia Convenience Store Market Basis Revenues/Number of Stores, 2023-2024P

15.2. Benchmark of Key Competitors in Indonesia Convenience Store Market, Basis Operational and Financial Parameters

15.3. Strengths and Weaknesses of Key Players

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Store Count, 2025-2029

17.1. By Store Format (Standalone, Mini-Marts, Hyperlocal), 2025-2029

17.2. By Ownership Type (Franchise-Owned, Corporate-Owned, Independent), 2025-2029

17.3. By Product Category (Packaged Food, Ready-to-Eat, Beverages, Personal Care, Tobacco), 2025-2029

17.4. By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali and Nusa Tenggara), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Indonesia Convenience Store Market. This includes mapping major players such as Alfamart, Indomaret, Circle K, and Lawson, as well as suppliers, distributors, and consumer groups.

Shortlist leading 5-6 key players in the market based on factors like market share, financial performance, store network size, and product offerings.

Source information through industry articles, secondary research, and proprietary databases to create a foundational understanding of the market ecosystem.

Step 2: Desk Research

Conduct exhaustive desk research using diverse secondary and proprietary data sources. This includes analyzing store revenue, customer demographics, market segmentation, pricing, and competition.

Collect company-level data from press releases, annual reports, and financial statements to gain insights into the operational strategies of key players.

Supplement findings with data from market studies, government reports, and news articles to construct a detailed understanding of market dynamics.

Step 3: Primary Research

Conduct in-depth interviews with executives, franchise owners, and other stakeholders in the Indonesia Convenience Store Market. This process validates desk research data, gathers first-hand insights, and captures industry-specific nuances.

Adopt a bottom-to-top approach to assess store-level revenue and aggregate findings to estimate the overall market size.

Perform disguised interviews by posing as potential investors or customers to validate operational and financial claims made by companies and cross-check them against secondary data.

Step 4: Sanity Check

- Perform top-to-bottom and bottom-to-top analysis to ensure data accuracy and consistency. Market modeling and size estimation exercises are carried out as part of this sanity check process to verify findings.

FAQs

1. What is the potential for the Indonesia Convenience Store Market?

The Indonesia convenience store market is projected to grow significantly, with an expected valuation of IDR 70 trillion by 2029. Key drivers include rapid urbanization, increased disposable incomes, and the expanding adoption of digital payment solutions.

2. Who are the Key Players in the Indonesia Convenience Store Market?

The market is dominated by major players such as Alfamart, Indomaret, Circle K, and Lawson. These companies lead the market due to their expansive store networks, diverse product offerings, and focus on customer convenience.

3. What are the Growth Drivers for the Indonesia Convenience Store Market?

Key growth drivers include rising urbanization and busy lifestyles driving demand for quick and convenient shopping options. Technological advancements like the integration of digital payments and loyalty programs, as well as the increasing popularity of ready-to-eat meals and beverages, also contribute to the market's expansion.

4. What are the Challenges in the Indonesia Convenience Store Market?

Challenges include intense competition among established players, rising operational costs due to rental and utility expenses, and supply chain disruptions impacting inventory availability. Additionally, changing consumer preferences for health-conscious and sustainable products require retailers to adapt their offerings quickly.