Indonesia Corporate Wellness Market Outlook to 2030

By Service Type, By Delivery Model, By Funding/Contracting Model, By End-User Industry, By Enterprise Size, and By Region

- Product Code: TDR0315

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Indonesia Corporate Wellness Market Outlook to 2030 – By Service Type, By Delivery Model, By Funding/Contracting Model, By End-User Industry, By Enterprise Size, and By Region” provides a comprehensive analysis of the corporate wellness landscape in Indonesia. The report covers the overview and genesis of the industry, overall market size in terms of revenue, and market segmentation; trends and developments, the regulatory landscape, issues and challenges including compliance, multi-site logistics, and data governance; and the competitive landscape including competition scenario, cross-comparison (PEPM, enrolled employees, engagement rate, on-site city footprint, insurer/TPA integrations, claims-impact indicators, PDPL/ISO readiness, SLA/TAT), opportunities and bottlenecks, and detailed company profiling of major players. The report concludes with future market projections based on employee-coverage volumes, service-mix evolution, regional expansion, cause-and-effect relationships (policy shifts, urbanization, digitization), and success case studies highlighting the major opportunities and cautions.

Indonesia Corporate Wellness Market Overview and Size

The Indonesia corporate wellness market is valued at USD 300 million, based on a five‑year historical analysis. This growth has been driven by rising employer awareness of employee health's impact on productivity, with increasing investments in stress management, preventive screenings, and tele-health services. Broader urban labor force expansion and emerging HR strategies emphasizing mental and physical well-being have further fueled program adoption, resulting in a significant rise in vendor presence and annual spending.

Major urban centers like Jakarta, Surabaya, and Bandung dominate the Indonesia corporate wellness market, thanks to their dense corporate clusters and economic leadership. These cities host the bulk of multinational firms, large employers, and modern SMEs capable of funding comprehensive wellness programs. Additionally, their superior healthcare infrastructure, strong digital connectivity, and skilled HR talent pools make them especially fertile grounds for wellness providers to scale offerings rapidly.

What Factors are Leading to the Growth of the Indonesia Corporate Wellness Market:

Urban Workforce Concentration: Indonesia’s urbanization underpins corporate wellness demand. As of 2024, 52 percent of the population resides in urban areas, up from approximately 50 percent just a few years earlier—translating into over 148 million urban residents based on the national population estimate of 284 million in 2025. This shift concentrates corporate workforces in cities like Jakarta, Surabaya, and Bandung, where large employers and multinational offices are prevalent. These urban hubs drive higher demand for structured wellness initiatives—ranging from preventive health screenings to digital mental health support—due to increased employee density and corporate facility access. The deeper local presence of hospitals, labs, fitness centers, and telemedicine infrastructure further catalyzes uptake among corporates looking to support concentrated urban office populations.

Expanding Labor Force and Service Sector Employment: In 2024, Indonesia’s total labor force reached an estimated approximately 145 million workers, a discernible rise from previous years. Of this workforce, nearly 50 percent are employed in the services sector, reflecting a shift away from agriculture and industry. This expansion of service-sector employees—often in office-based roles prone to sedentary behavior, stress, and lifestyle-related health issues—stimulates demand for corporate wellness programs. Employers recognize the value of offering on-site clinics, mental health support, fitness access, and preventive health checks to mitigate rising health risks among an increasingly white-collar workforce concentrated in urban centers, especially when healthcare costs and employee absenteeism pose escalating economic concerns.

Rising Per Capita Income and Consumer Health Awareness: Indonesia’s nominal GDP per capita rose to approximately USD 4,958 in 2024 and is projected to reach USD 5,027 by 2025. With rising income, employees and employers alike are increasingly prioritizing well-being. Higher purchasing power allows companies to invest in wellness offerings and individuals to value health-centric benefits. This trend is reinforced by a Human Development Index (HDI) of 0.728 in 2023, reflecting rising education and life expectancy, factors that jointly heighten health awareness among the populace. Consequently, wellness offerings—ranging from preventive screenings to digital health tools—are gaining traction as businesses align benefits with elevated employee expectations and evolving lifestyle needs.

Which Industry Challenges Have Impacted the Growth of the Indonesia Corporate Wellness Market:

Economic Inequality and Regional Fragmentation: While urban corporate hubs flourish, Indonesia remains highly uneven in wealth distribution and regional development. In 2024, the Gini index stood at 37.9, signaling persistent inequality. Rural areas and secondary cities lag considerably—posing challenges for wellness providers in achieving nationwide scalability. Corporate wellness uptake remains concentrated among firms in Jakarta and Java, where infrastructure and employer willingness to invest are strong. In contrast, less developed eastern regions like Papua or Maluku are underserved due to weaker healthcare networks, lower disposable income, and limited corporate wellness awareness. This fragmentation hampers market consolidation and challenges providers attempting to expand beyond core urban centers.

Informal Employment and Limited Employer Reach: Indonesia’s labor market includes a significant informal employment segment. Although national labor force is around 145 million, formal employment (service and industrial sectors) comprises a smaller share, given agriculture and informal work persist especially outside urban zones. Employers in informal or small‑scale enterprises—common in rural or micro-urban settings—rarely offer structured wellness programs. The high ratio of informal workers means wellness providers must tailor offerings and pricing to gain traction beyond corporate clients, creating barriers in service delivery, scalability, and consistent program impact across the broader workforce.

Fiscal Constraints in Public Sector and Regulatory Overheads: While corporate wellness is widely adopted in private sector hubs, government-linked entities and SOEs face budgetary constraints and must comply with extensive regulatory oversight. In 2024, national poverty rate under the multidimensional poverty index remained at 1.6 percent, indicating limited fiscal room in social spending despite economic growth. Departments such as the Ministry of Manpower must balance occupational health mandates (e.g. K3 compliance) with broader public responsibilities. The dual challenge of limited budgets and regulatory compliance burdens—without sufficient incentive structures—has slowed adoption of voluntary wellness initiatives in public-sector settings. This limits overall market penetration and innovation across state-linked organizations.

What are the Regulations and Initiatives which have Governed the Market:

Occupational Health & Safety (K3) Regulations: Indonesia’s Ministry of Manpower enforces occupational health and safety standards under the K3 framework, requiring employers to facilitate medical check‑ups, workplace ergonomics, and injury prevention programs. Companies must maintain records for workplace-related illnesses and injuries, and larger enterprises in manufacturing or services are subject to regular K3 audits. Though these are compliance‑oriented mandates—not wellness initiatives per se—they lay a regulatory foundation that incentivizes corporate wellness providers to offer K3-aligned screening and occupational health services. By linking wellness programs to compliance support, providers can deliver tangible value in helping companies meet mandatory regulatory requirements.

National Health Insurance System (BPJS Kesehatan): Under the National Social Security System, employers contribute to BPJS Kesehatan to finance universal basic healthcare access. While BPJS coverage ensures primary care access, corporate wellness programs must add differentiated value—such as periodic screenings, mental health, and fitness integration—to complement government coverage. Employers and providers must ensure wellness services do not duplicate BPJS services, and coordinate where possible to streamline referrals. Providers who align offerings with BPJS pathways—notably by focusing on preventive or diagnostic services that reduce BPJS claims—position corporate wellness offerings as cost-savings enablers rather than healthcare substitute services.

Personal Data Protection Regulation (PDPL Law No. 27/2022): Indonesia’s Personal Data Protection Law, enacted in 2022, governs the collection, processing, and storage of personal and health data. Corporate wellness providers must secure explicit consent to collect health and biometric information, safeguard this data, and enable individuals’ data rights such as access and correction. Non‑compliance risks substantial fines and reputational harm. Wellness program design—especially those involving digital apps, HRA, and biometric tracking—must embed privacy by design. Compliance burdens, including data disclosures and consent flows, increase implementation complexity but also raise trust—an essential factor when delivering health‑related corporate services.

Indonesia Corporate Wellness Market Segmentation

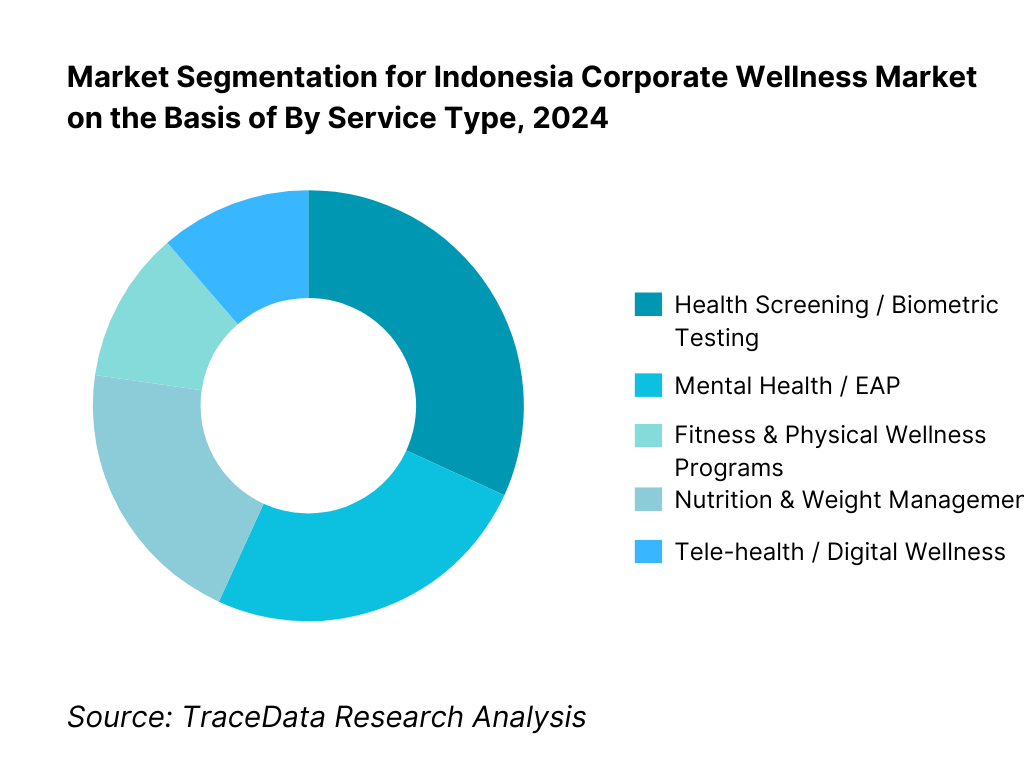

By Service Type: The Indonesia corporate wellness market is segmented into Health Screening/Biometric Testing, Mental Health/EAP, Fitness & Physical Wellness, Nutrition & Weight Management, and Tele-health/Digital Wellness. Health Screening Programs hold the dominant market share (30 %) because employers prioritize early detection of NCDs and see measurable ROI through reduced claims and absenteeism. Frequent onsite screenings and biometric health fairs remain trusted by organizations, reinforcing their leading position over newer but less universally adopted mental or digital offerings.

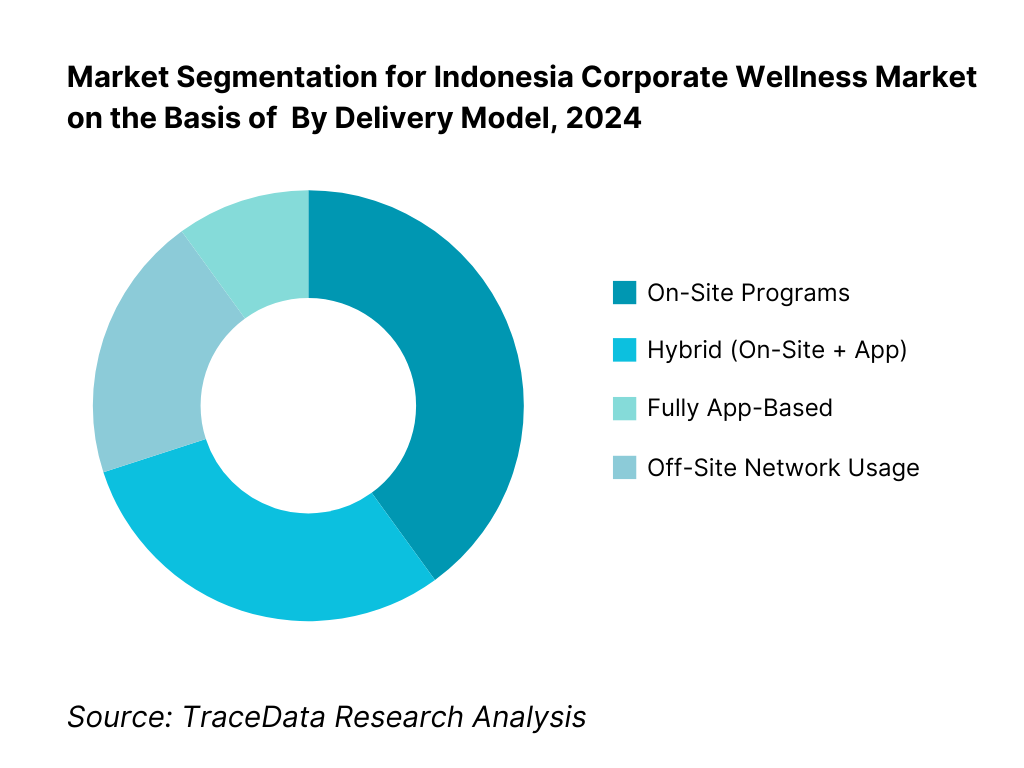

By Delivery Model: Segmentation includes On-Site Programs, Hybrid (On-Site + App), Fully App-Based, and Off-Site Network Usage. On-Site Programs lead the market (40 %) due to strong corporate tradition and clarity on quality control and employee engagement; companies favor programs they can supervise directly. Hybrid models follow (30 %), offering flexibility plus human interaction—this model’s rising popularity stems from blending traditional clinic access with digital tracking, satisfying both employer control and user convenience.

Competitive Landscape in Indonesia Corporate Wellness Market

The Indonesia corporate wellness market is led by a handful of prominent players with diverse delivery models, including tele-health platforms, hospital-based MCU providers, and insurer-embedded wellness services. This concentration reflects the need for broad infrastructure, data integration, and existing corporate relationships to support scalable wellness offerings. Providers with national lab networks, digital engagement tools, or insurer partnerships benefit from superior reach and value propositions.

Name | Founding Year | Original Headquarters |

Halodoc (corporate wellness) | 2016 | Jakarta, Indonesia |

Alodokter (Aloproteksi) | 2014 | Jakarta, Indonesia |

Good Doctor | 2019 | Jakarta, Indonesia |

SehatQ / Klinik SehatQ | 2018 | Jakarta, Indonesia |

KlikDokter (Kalbe Group) | 2008 | Jakarta, Indonesia |

Prodia OHI | 1973 | Jakarta, Indonesia |

Siloam Hospitals (Corporate Health) | 1996 | Jakarta, Indonesia |

Kimia Farma Lab & Clinic | 1971 | Jakarta, Indonesia |

AIA Indonesia (AIA Vitality) | 1990 | Jakarta, Indonesia |

Mandiri Inhealth | 1992 | Jakarta, Indonesia |

AdMedika (Telkom Group) | 2002 | Jakarta, Indonesia |

Mercer Marsh Benefits Indonesia | 2007 | Jakarta, Indonesia |

Aon Indonesia | 1995 | Jakarta, Indonesia |

Celebrity Fitness | 2003 | Jakarta, Indonesia |

Mindtera (EAP solutions) | 2020 | Jakarta, Indonesia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Halodoc: A leading digital health and corporate wellness provider in Indonesia, Halodoc expanded its corporate telemedicine bundles and annual medical check-up programs in 2024. The company reported strong adoption of its hybrid model (app + onsite services), with corporates seeking cost-effective preventive healthcare options for employees.

Alodokter (Aloproteksi): Positioned as an insurance-embedded wellness solution, Alodokter strengthened its collaboration with insurers in 2024, offering corporates bundled plans that include digital health access, mental health support, and chronic disease management. This integration has boosted its penetration among large employers.

Good Doctor: Known for its tech-driven approach, Good Doctor partnered with Grab for Work in 2024 to expand access to preventive healthcare programs. Their focus has been on scaling digital consultations and nutrition counseling, responding to the growing demand for affordable remote wellness services.

SehatQ: Specializing in on-site wellness and digital integration, SehatQ launched new employee assistance and occupational health services in 2024. Corporates adopted these packages to meet compliance standards under K3 regulations, strengthening SehatQ’s role as a partner for occupational safety and preventive care.

KlikDokter (Kalbe Group): Leveraging Kalbe Pharma’s healthcare ecosystem, KlikDokter launched digital wellness campaigns and integrated lab test bookings for corporates in 2024. Their strategy has been to drive employee engagement through seamless access to preventive care and wellness education tools.

What Lies Ahead for Indonesia Corporate Wellness Market?

The Indonesia corporate wellness market is set to expand steadily on the back of accelerating HR digitization, normalization of mental-health support at work, and stronger payer–provider–platform partnerships. Employers are rebundling annual medical check-ups with telemedicine, EAP, fitness, and nutrition into integrated programs, while BPJS coordination and K3 compliance keep preventive care front-and-center. As vendors mature from activity-led perks to outcome-linked programs with clear SLAs, purchasing will increasingly shift to multi-year, hybrid contracts that tie engagement and health improvements to commercial terms.

Rise of Hybrid Wellness Models: The future stack is unmistakably hybrid: on-site clinics and pop-up health camps for high-touch screenings and ergonomics, combined with app-based journeys for daily nudges, EAP access, and teleconsults. Employers with multi-site operations—from industrial parks in Java to logistics hubs across Sumatra and Sulawesi—will prioritize models that balance physical presence with scalable digital delivery. Expect wider use of mobile MCU units, pharmacy and lab tie-ups for last-mile testing, and fitness partnerships that bundle gym access with wearable-ready activity challenges, all stitched together by HRIS single sign-on and role-based eligibility.

Focus on Outcome-Based Wellness: Procurement is moving beyond “activities completed” toward programs contracted on measurable outcomes. Buyers will demand clear baselines and quarterly reporting on absenteeism days avoided, return-to-work timelines, risk-score migration from HRA/biometrics, and conversion from screening to care pathways. Vendors that can evidence claims-trend moderation with insurer/TPA data, publish engagement cohort analytics (active users, repeat sessions, completion ratios), and commit to response-time SLAs for EAP and telehealth will win longer, larger mandates. Expect more pilots to graduate into outcomes-linked pricing, with bonuses for adherence and penalties for missed service levels.

Expansion of Sector-Specific Wellness: Sector lenses will sharpen. Manufacturing and mining will double down on occupational health (K3 alignment), fatigue and musculoskeletal prevention, and substance-risk protocols. BFSI and tech/BPO will emphasize stress, burnout, and sleep programs paired with confidential counseling and resilience training. Logistics and retail—heavy on distributed, shift-based workforces—will seek mobile check-ups, hydration/heat-stress protocols, and injury-prevention micro-learning. Women’s health, metabolic reset programs, and tobacco cessation will scale across sectors as employers respond to workforce demographics and productivity hot spots.

Leveraging AI and Analytics: AI will power risk stratification from EMR/PHR-consented data, HRA responses, and lab panels to route employees into the right care pathway—telemedicine, EAP, chronic-care coaching, or on-site clinician follow-ups. Predictive models will flag drop-off risk and trigger engagement nudges; anomaly detection will improve fraud/waste controls in benefit usage; and de-identified benchmarking will help HR compare outcomes by industry and region. Privacy-by-design under Indonesia’s PDPL will be non-negotiable: vendors that operationalize consent, data minimization, and auditable reporting will gain trust and preferential placement in insurer and broker ecosystems.

Indonesia Corporate Wellness Market Segmentation

By Service Type

Health Risk Assessment (HRA) & Biometric Screenings

Mental Health & EAP

Telemedicine & Digital Care

Fitness & Activity Programs

Nutrition & Weight Management

Vaccinations & Preventive Clinics

Chronic Condition Management

K3/OSH & Workplace Safety

By Delivery Model

On-Site

Hybrid

App-Only / Virtual-First

Off-Site Network

Mobile MCU Units

By Funding / Contracting Structure

Employer-Funded (PEPM subscriptions, bundled wellness packs)

Insurer / TPA-Embedded (wellness tied to group medical benefits)

Broker-Designed Programs (Mercer/Aon-style plan design, partner orchestration)

Pay-As-You-Go (PAYG) (per-visit, per-campaign pricing)

Outcomes-Linked Contracts (SLA/OKR-based with bonuses/penalties)

By End-User Industry

Manufacturing & Industrial (automotive, FMCG plants, mining, palm oil)

BFSI (banks, insurance, fintech)

Technology, BPO & Shared Services

Logistics, E-commerce & Transport (3PLs, last-mile fleets, ports)

Retail, Hospitality & Tourism

SOEs & Large Conglomerates (multi-site, multi-sector)

By Enterprise Size

SMEs (≤250 employees)

Mid-Market (≈251–1,000 employees)

Large Enterprise (≈1,001–10,000 employees)

Mega Employers (>10,000 employees; multi-region operations)

By Workforce / Role Archetype

White-Collar / Office-Based (HQs, regional offices)

Blue-Collar / Plant-Floor (shift-based, high MUSK risk)

Field & Drivers (sales, delivery, long-haul logistics)

Customer-Facing Retail / Hospitality Staff (rotational shifts)

Players Mentioned in the Report:

Halodoc (tele-health bundles)

Alodokter (Aloproteksi)

Good Doctor

SehatQ / Klinik SehatQ

KlikDokter (Kalbe Group)

Prodia OHI

Siloam Hospitals (CHI)

Kimia Farma Lab & Clinic

AIA Indonesia (AIA Vitality)

Mandiri Inhealth

AdMedika (Telkom Group)

Mercer Marsh Benefits Indonesia

Aon Indonesia

Celebrity Fitness

Mindtera

Key Target Audience

Chief Human Resources Officers (CHROs) of large and mid-market Indonesian corporations

Employee Benefits Directors at major employers

Heads of Corporate Health or Well-Being Programs

Heads of Workplace Health for SOEs or Government-linked Companies

Investment and venture capitalist firms (e.g., health-tech VC arms in Southeast Asia)

Government and regulatory bodies (e.g., Ministry of Manpower, BPJS Kesehatan, Ministry of Health)

Insurance & TPA strategic decision-makers

Corporate Strategy Leads in digital health startups

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis [On-Site Clinics, Hybrid Programs, App-Based, Off-Site Networks]-Margins, Employer Preference, Strengths & Weaknesses

4.2. Revenue Streams [PEPM Subscriptions, Per-Session Fees, Insurer-Embedded Wellness, Pay-as-You-Go, MCU Bundling]

4.3. Business Model Canvas [Wellness Tech Startups, Hospital-Led Programs, Insurer-Led Models, Broker-Consulting Hybrid]

5.1. Freelance Wellness Coaches vs Full-Time Corporate Wellness Staff

5.2. Investment Model [Insurer-Driven, Employer Self-Funded, Public-Private Partnerships]

5.3. Comparative Analysis of Funneling Process [Private Enterprises vs SOEs vs Government Programs]

5.4. Corporate Wellness Budget Allocation by Company Size [SMEs, Mid-Market, Large Enterprises, Mega Employers]

6.1. Sectoral Adoption Potential

6.2. TAM/SAM/SOM Analysis

6.3. Opportunity Hotspots (Mental Health, Telemedicine, Preventive Labs, Fitness)

8.1. Revenues (Historical Growth & CAGR)

8.2. Year-on-Year Growth Analysis

8.3. Key Milestones & Developments

9.1. By Market Structure [In-House Wellness Units vs Outsourced Wellness Providers]

9.2. By Service Type [Mental Health/EAP, Preventive Health Checkups, Fitness & Activity, Nutrition, Telemedicine & Digital Health]

9.3. By Industry Verticals [Manufacturing, BFSI, IT & BPO, Healthcare, Retail/Consumer, Logistics & Transport]

9.4. By Company Size [Large Enterprises, Medium Enterprises, SMEs]

9.5. By Employee Designation [Executives, Managers, White-Collar Staff, Blue-Collar Workforce]

9.6. By Mode of Program Delivery [On-Site, Hybrid, App-Based, Off-Site Networks]

9.7. By Program Customization [Standardized vs Customized Wellness Programs]

9.8. By Region [Java (Jabodetabek, West/Central/East), Sumatra, Kalimantan, Sulawesi, Bali & Nusa Tenggara, Papua]

10.1. Corporate Client Landscape & Cohort Analysis [Industry-Specific Wellness Needs]

10.2. Decision-Making Process [HR & C-Suite Prioritization]

10.3. Program Effectiveness & ROI Analysis [Absenteeism Reduction, Productivity Gains, Claims Cost Savings]

10.4. Gap Analysis Framework [Adoption Barriers vs Employer Expectations]

11.1. Trends & Developments [Digital Health Apps, Incentive-Based Programs, Halal-Compliant Nutrition, Hybrid Models]

11.2. Growth Drivers [NCD Burden, BPJS Pressure, Talent Retention, Digital Transformation]

11.3. SWOT Analysis [Strengths, Weaknesses, Opportunities, Threats]

11.4. Issues & Challenges [Low Budget Allocation, Engagement Drop-Off, Data Privacy Concerns, Multi-Site Coverage]

11.5. Government Regulations [K3, BPJS, PDPL (Data Protection), Telemedicine Guidelines]

12.1. Market Size & Future Potential

12.2. Business Models & Revenue Streams [Subscription, Per-Session, Embedded Insurance]

12.3. Delivery Models & Services Offered [Telemedicine, Fitness Apps, Online Therapy, Nutrition Platforms]

12.4. Cross-Comparison of Leading Digital Wellness Companies [Company Overview, Funding, Subscribers, Revenues, Engagement Metrics, Partnerships, Pricing Models, Technology Adoption]

15.1. Market Share of Key Players [By Service Type & Revenues]

15.2. Benchmark of Key Competitors [Company Overview, USP, Service Offerings, PEPM Pricing, No. of Employees Covered, Tech Platforms, Engagement Rates, Major Clients, Strategic Tie-Ups, Recent Developments]

15.3. Operating Model Analysis Framework [Hospital-Led, Insurer-Led, Digital-First, Broker-Consulting Models]

15.4. Gartner Magic Quadrant Mapping [Leaders, Challengers, Visionaries, Niche Players]

15.5. Bowman’s Strategic Clock for Competitive Advantage [Pricing vs Differentiation Strategies]

16.1. Revenues (Forecast Growth & CAGR)

17.1. By Market Structure [In-House vs Outsourced]

17.2. By Service Type [EAP, Telemedicine, Fitness, Nutrition, Preventive Checkups]

17.3. By Industry Verticals [Manufacturing, BFSI, IT & BPO, Healthcare, Retail/Consumer]

17.4. By Company Size [Large, Medium, SMEs]

17.5. By Employee Designation [Executives, Managers, White-Collar, Blue-Collar]

17.6. By Mode of Program Delivery [On-Site, App, Hybrid, Off-Site]

17.7. By Customization [Standardized vs Bespoke Programs]

17.8. By Region [Java, Sumatra, Kalimantan, Sulawesi, Bali/NTT, Papua]

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the ecosystem of the Indonesia Corporate Wellness Market, capturing both demand-side and supply-side entities. On the demand side, this includes large enterprises, SMEs, state-owned enterprises, insurance companies (BPJS Kesehatan, private insurers), and HR leaders who procure wellness programs. On the supply side, we map telemedicine providers (Halodoc, Alodokter, Good Doctor), hospital networks (Siloam, Prodia, Kimia Farma), fitness and nutrition providers (Celebrity Fitness, wellness startups), and brokers/consultants (Mercer Marsh, Aon). Based on this ecosystem scan, we shortlist the top 5–6 corporate wellness providers in Indonesia according to financial data, geographic reach, number of corporate clients, and scale of service portfolios. Sourcing relies on government portals, industry articles, and proprietary databases to establish a comprehensive ecosystem view.

Step 2: Desk Research

An exhaustive desk research process is then conducted using multiple secondary and proprietary databases. This involves compiling macro-level data on Indonesia’s labor force, healthcare expenditure, and occupational health compliance to contextualize wellness demand. We aggregate industry-level insights on number of wellness providers, penetration among corporates, pricing models (PEPM, per-session, bundled MCU), and demand concentration in key urban hubs. At the company level, we analyze press releases, annual reports, investor disclosures, and regulatory filings from wellness providers, hospital groups, and insurance companies. This provides a baseline understanding of revenues, service diversification, client bases, strategic partnerships, and operating models in the Indonesian corporate wellness space.

Step 3: Primary Research

We conduct in-depth interviews with C-suite executives, HR directors, and wellness program managers across leading Indonesian companies and service providers. These conversations validate hypotheses on program adoption drivers, budget allocations, and engagement outcomes. A bottom-up approach is used to collect revenue contributions and client counts per player, which are then aggregated into overall market assessments. As part of our validation strategy, we employ disguised interviews by approaching providers as potential corporate clients. This enables collection of sensitive insights on program pricing, utilization rates, value chain processes, engagement metrics, and ROI reporting practices, which are then triangulated with secondary datasets.

Step 4: Sanity Check

Finally, we apply both top-down and bottom-up sizing models to validate market figures and segmental splits. The top-down approach leverages macroeconomic and labor force statistics, while the bottom-up builds from individual provider revenue contributions. Cross-referencing the two ensures sanity of market estimates, eliminating outliers and harmonizing discrepancies. This dual validation strengthens confidence in final numbers and ensures alignment with Indonesia’s corporate wellness ecosystem realities.

FAQs

01 What is the potential for the Indonesia Corporate Wellness Market?

The Indonesia Corporate Wellness Market is poised for strong, sustained expansion as employers rebundle annual medical check-ups with telemedicine, EAP/mental-health, fitness and nutrition into integrated, hybrid programs. Demand is concentrated among multi-site enterprises and SOEs in Java and major metros, where HR digitization, BPJS cost-containment goals, and K3 compliance keep prevention front-and-center. As vendors shift from perk-led activities to outcomes-linked contracts with clear SLAs and reporting, wellness purchasing is moving to multi-year deals that tie engagement, risk-score shifts and absenteeism reduction to commercial terms—expanding the market’s long-run potential.

02 Who are the Key Players in the Indonesia Corporate Wellness Market?

Leading players include digital health platforms, hospital/lab networks, insurers/TPAs and benefits brokers that already own employer relationships and data pipes. Core names are Halodoc, Alodokter (Aloproteksi), Good Doctor, SehatQ/Klinik SehatQ, KlikDokter (Kalbe), Prodia OHI, Siloam Hospitals (Corporate Health Index), Kimia Farma Clinics & Labs, AIA Indonesia (AIA Vitality), Mandiri Inhealth, AdMedika (Telkom Group), Mercer Marsh Benefits Indonesia, Aon Indonesia, Celebrity Fitness, and Mindtera. They dominate through nationwide footprints, insurer and provider integrations, hybrid delivery (on-site + app), and the ability to evidence outcomes with claims and engagement analytics.

03 What are the Growth Drivers for the Indonesia Corporate Wellness Market?

Growth is propelled by a rapidly urbanizing, service-sector workforce and fierce competition for talent, pushing employers to invest in preventive and mental-health support that demonstrably protects productivity. Regulatory and payer tailwinds—K3 occupational-health requirements, PDPL-driven trust in digital health, and BPJS alignment—encourage structured programs with auditable data flows. Finally, HR tech and telehealth penetration enable hybrid models at scale: on-site screenings and clinics for high-touch services, stitched to apps for daily engagement, coaching and EAP, with dashboards that let HR track absenteeism days avoided, pathway conversions and risk-score improvements.

04 What are the Challenges in the Indonesia Corporate Wellness Market?

Key hurdles include tight budgets among SMEs and the need to prove ROI beyond activity counts—buyers expect quarterly evidence of absenteeism reduction, pathway adherence and claims moderation. Compliance adds cost and complexity: PDPL consent, secure EMR/PHR connections, and auditable data governance are mandatory for trust and enterprise-scale rollouts. Logistics remain uneven outside Java; fragmented provider networks, last-mile diagnostics, and variable on-site capacity can dilute outcomes and engagement, forcing vendors to invest in mobile MCU units, standardized SOPs and broker/insurer partnerships to deliver consistent service quality nationwide.