Indonesia Diabetes Care Devices Market Outlook to 2035

By Product Type, By Diabetes Type, By End-User, By Distribution Channel, and By Region

- Product Code: TDR0457

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Indonesia Diabetes Care Devices Market Outlook to 2035 – By Product Type, By Diabetes Type, By End-User, By Distribution Channel, and By Region” provides a comprehensive analysis of the diabetes care devices industry in Indonesia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and reimbursement landscape, patient-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Indonesia diabetes care devices market. The report concludes with future market projections based on diabetes prevalence trends, healthcare infrastructure expansion, device penetration rates, technology adoption, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

Indonesia Diabetes Care Devices Market Overview and Size

The Indonesia diabetes care devices market is valued at approximately ~USD ~ billion, representing the supply of medical devices used for the monitoring, management, and treatment of diabetes, including blood glucose monitoring (BGM) devices, continuous glucose monitoring (CGM) systems, insulin delivery devices, insulin pumps, pen needles, lancets, and related consumables. These devices form a critical component of long-term diabetes management, enabling patients and healthcare providers to monitor glycemic levels, optimize insulin therapy, and reduce the risk of diabetes-related complications.

The market is anchored by Indonesia’s large and growing diabetic population, increasing urbanization and lifestyle-related health risks, expanding access to primary and secondary healthcare, and rising awareness of diabetes management among patients and physicians. Type 2 diabetes accounts for the majority of device demand, supported by a steady increase in screening, diagnosis rates, and treatment initiation across both urban and semi-urban regions. Public healthcare programs and private insurance coverage play a growing role in improving access to essential monitoring and insulin delivery devices, particularly for middle-income patient segments.

Java represents the largest demand center for diabetes care devices in Indonesia, driven by high population density, concentration of hospitals and specialty clinics, stronger purchasing power, and higher diagnosis rates. Greater Jakarta, West Java, Central Java, and East Java together account for a significant share of national device consumption. Sumatra follows as the second-largest regional market, supported by urban centers and improving healthcare access, while Kalimantan, Sulawesi, and Eastern Indonesia represent emerging demand regions where penetration remains lower but is expected to improve with healthcare infrastructure expansion and government health initiatives.

What Factors are Leading to the Growth of the Indonesia Diabetes Care Devices Market:

Rising diabetes prevalence and earlier diagnosis expand the addressable patient base: Indonesia has witnessed a sustained increase in diabetes prevalence over the past decade, driven by changing dietary habits, sedentary lifestyles, obesity, and population aging. Improved screening at primary healthcare centers and increased health awareness campaigns have led to earlier diagnosis, bringing more patients into long-term monitoring and treatment pathways. This directly increases recurring demand for glucose monitoring devices, consumables, and insulin delivery products across both public and private healthcare channels.

Expansion of healthcare infrastructure and private clinics improves device access: The growth of hospitals, diabetes clinics, diagnostic centers, and private physician practices across urban and secondary cities has improved access to diabetes care devices. Private hospitals and specialty clinics are increasingly adopting advanced glucose monitoring systems and insulin delivery solutions to improve treatment outcomes and patient compliance. At the same time, government investment in primary healthcare facilities supports basic blood glucose monitoring device distribution, particularly in public health programs.

Increasing patient awareness and shift toward self-monitoring of blood glucose: Patients in Indonesia are becoming more proactive in managing chronic conditions, supported by physician recommendations and digital health awareness. Self-monitoring of blood glucose (SMBG) has become a standard component of diabetes management, especially for insulin-dependent patients. This behavioral shift supports sustained demand for glucose meters, test strips, lancets, and pen needles, with repeat purchase cycles driving market value growth.

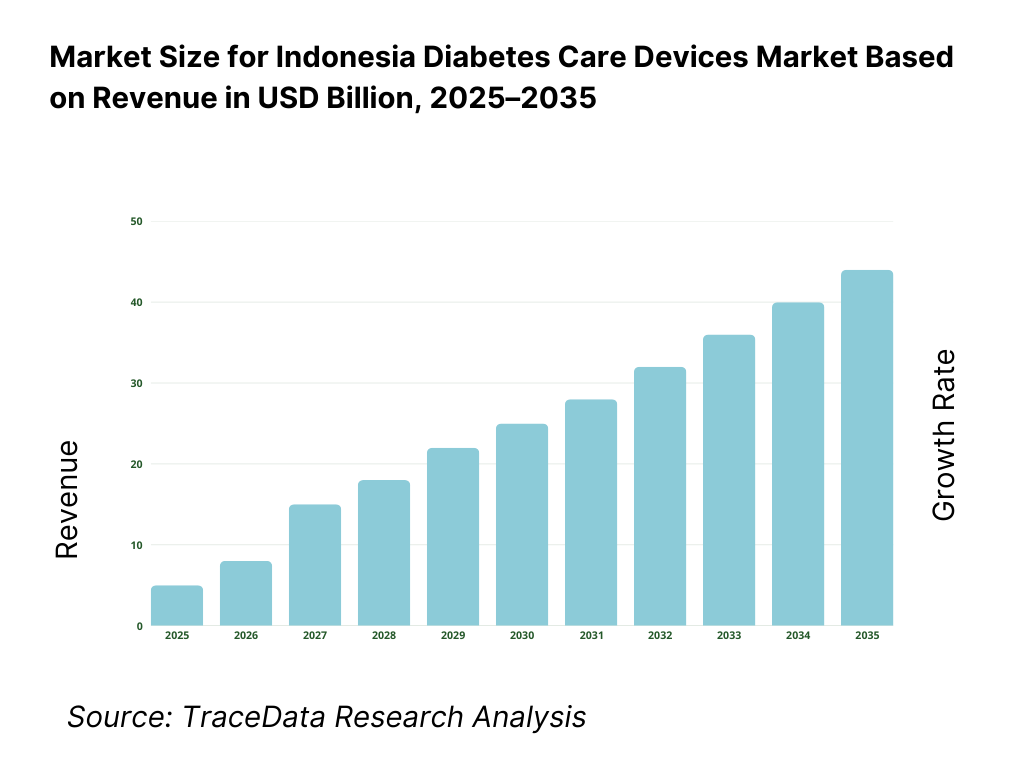

Which Industry Challenges Have Impacted the Growth of the Indonesia Diabetes Care Devices Market:

Affordability constraints and high out-of-pocket expenditure limit adoption of advanced diabetes devices: While basic blood glucose monitoring devices are widely available, the adoption of advanced diabetes care solutions—such as continuous glucose monitoring (CGM) systems and insulin pumps—remains constrained by high upfront and recurring costs. A large share of diabetes patients in Indonesia rely on out-of-pocket spending, and reimbursement coverage for advanced devices remains limited. Price sensitivity leads many patients to opt for lower-cost glucose meters and reduce testing frequency, impacting long-term disease management outcomes and slowing penetration of higher-value devices.

Uneven healthcare access and regional disparities affect diagnosis and device utilization rates: Diabetes care device demand is heavily concentrated in urban and semi-urban regions with stronger healthcare infrastructure, higher physician density, and better access to pharmacies and hospitals. In rural and remote regions, limited access to endocrinologists, diagnostic facilities, and consistent device supply constrains both diagnosis rates and ongoing monitoring adherence. These regional disparities create uneven market development and restrict nationwide penetration, despite rising diabetes prevalence at the population level.

Limited patient education and inconsistent self-monitoring compliance reduce device effectiveness: Effective diabetes management requires regular monitoring, correct device usage, and sustained behavioral compliance. However, gaps in patient education, limited counseling time in clinical settings, and variable health literacy levels affect proper device usage and long-term adherence. Inconsistent self-monitoring reduces consumable usage volumes and limits the clinical and economic value derived from diabetes care devices, particularly in mass-market segments.

What are the Regulations and Initiatives which have Governed the Market:

Medical device registration, quality standards, and import approval requirements shaping market entry: Diabetes care devices marketed in Indonesia must comply with national medical device regulations governing product registration, quality certification, labeling, and post-market surveillance. Imported devices, which account for a significant share of the market, are subject to local registration timelines and documentation requirements prior to commercialization. These regulatory processes influence time-to-market, portfolio selection, and pricing strategies for multinational manufacturers and local distributors.

Public healthcare programs and selective reimbursement influencing device accessibility: Government healthcare initiatives support basic diabetes diagnosis and management through primary healthcare facilities, including limited coverage for essential glucose monitoring. However, reimbursement support remains selective and typically excludes premium monitoring and insulin delivery technologies. This framework shapes demand toward essential, cost-efficient devices while limiting broader adoption of advanced solutions unless supported by private insurance or self-pay capacity.

National health awareness initiatives and chronic disease management programs supporting early diagnosis: Public health campaigns focused on non-communicable diseases, including diabetes, play a role in improving awareness, screening, and early diagnosis. These initiatives contribute indirectly to diabetes care device demand by expanding the diagnosed patient pool and encouraging routine monitoring. While such programs support long-term market fundamentals, their impact on device adoption depends on follow-through in treatment access, patient education, and affordability at the household level.

Indonesia Diabetes Care Devices Market Segmentation

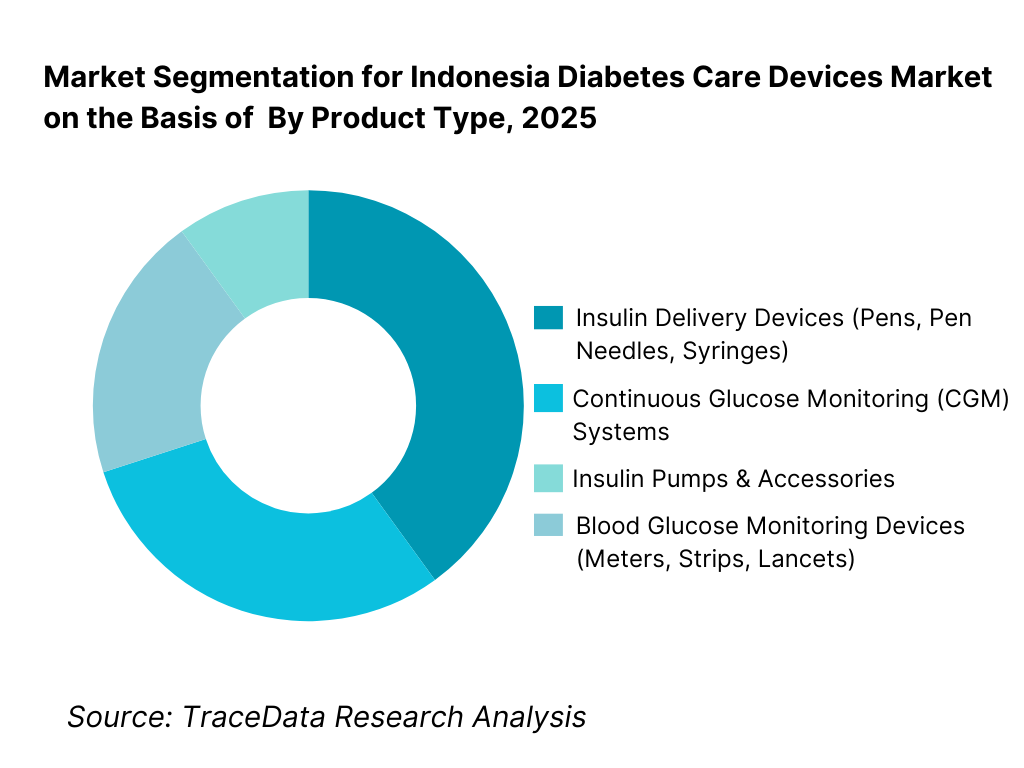

By Product Type: The blood glucose monitoring (BGM) devices segment holds dominance in the Indonesia diabetes care devices market. This is because routine glucose monitoring forms the foundation of diabetes management across both Type 1 and Type 2 patients. Glucose meters, test strips, and lancets are widely prescribed by physicians, supported by relatively lower unit costs and broader availability through hospitals and retail pharmacies. While advanced solutions such as continuous glucose monitoring systems and insulin pumps are gradually gaining awareness, their adoption remains limited to urban, higher-income patient segments due to affordability and reimbursement constraints. As a result, consumable-intensive BGM products continue to drive volume-led demand and recurring revenue.

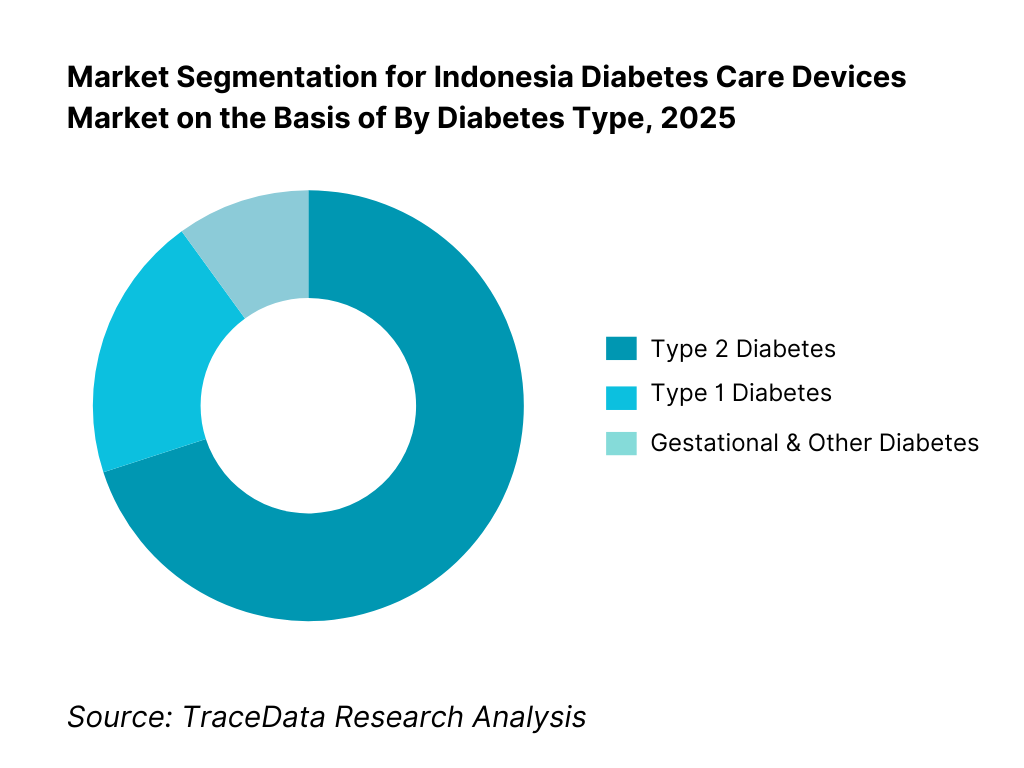

By Diabetes Type: Type 2 diabetes dominates device demand in Indonesia, reflecting the country’s epidemiological profile and lifestyle-driven disease burden. The majority of diagnosed patients require regular glucose monitoring and oral medication, with insulin therapy introduced progressively as the disease advances. Type 1 diabetes accounts for a smaller but clinically intensive segment, characterized by higher per-patient device usage and greater dependence on insulin delivery solutions. Gestational and other secondary diabetes categories represent a limited share but contribute incremental monitoring demand during treatment periods.

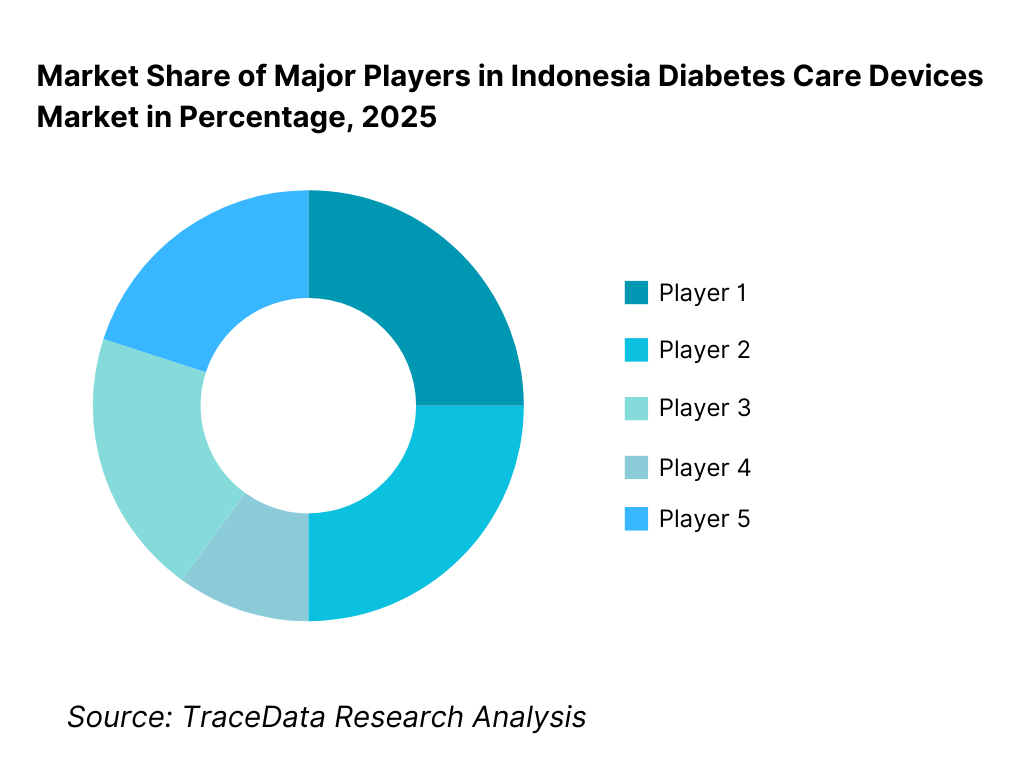

Competitive Landscape in Indonesia Diabetes Care Devices Market

The Indonesia diabetes care devices market exhibits moderate concentration, characterized by the presence of multinational medical device manufacturers supported by local distributors and import partners. Market leadership is driven by brand trust, clinical validation, product accuracy, distribution reach, and strong relationships with hospitals, physicians, and pharmacy networks. Global brands dominate premium and mid-tier segments, particularly in insulin delivery and advanced monitoring, while cost-competitive products cater to mass-market glucose monitoring demand. Competition is shaped by pricing strategies, consumable availability, physician education initiatives, and after-sales support.

Name | Founding Year | Original Headquarters |

Roche Diabetes Care | 1896 | Basel, Switzerland |

Abbott Diabetes Care | 1888 | Illinois, USA |

Medtronic | 1949 | Dublin, Ireland |

Sanofi (Diabetes Care) | 1973 | Paris, France |

Novo Nordisk | 1923 | Bagsværd, Denmark |

Ascensia Diabetes Care | 2016 | Basel, Switzerland |

Terumo Corporation | 1921 | Tokyo, Japan |

B. Braun | 1839 | Melsungen, Germany |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Abbott Diabetes Care: Abbott continues to strengthen its position in glucose monitoring through a focus on accuracy, ease of use, and growing awareness of continuous glucose monitoring technologies. While CGM adoption in Indonesia remains limited, Abbott’s long-term strategy emphasizes physician education and patient awareness to expand penetration in urban and private healthcare segments.

Roche Diabetes Care: Roche maintains a strong presence in blood glucose monitoring through its established meter and consumables portfolio. The company’s competitive position is reinforced by brand credibility, broad pharmacy availability, and sustained demand from patients prioritizing reliability and ease of testing.

Novo Nordisk: Novo Nordisk remains a dominant player in insulin delivery, supported by its strong insulin portfolio and complementary pen and needle systems. The company benefits from deep physician engagement and long-standing relationships with hospitals and diabetes specialists across Indonesia.

Sanofi: Sanofi competes through a combination of insulin therapies and associated delivery devices, targeting both public and private healthcare segments. Its strategy emphasizes affordability, treatment continuity, and integration with broader diabetes management programs.

Medtronic: Medtronic operates primarily in the premium segment, with insulin pumps and advanced diabetes management solutions. While current penetration is limited by cost, the company maintains a strategic presence to capture long-term growth as awareness, reimbursement, and affordability improve.

What Lies Ahead for Indonesia Diabetes Care Devices Market?

The Indonesia diabetes care devices market is expected to expand steadily through 2035, supported by rising diabetes prevalence, earlier diagnosis rates, and the gradual strengthening of chronic disease management within the healthcare system. Growth momentum is reinforced by increasing urbanization, lifestyle-related health risks, expanding healthcare infrastructure, and improving patient awareness around long-term glucose monitoring and treatment adherence. As diabetes transitions from episodic treatment toward continuous disease management, demand for monitoring devices, insulin delivery solutions, and consumables will remain structurally resilient across economic cycles.

Transition Toward More Regular and Structured Self-Monitoring Practices: The future of the Indonesia diabetes care devices market will be shaped by a gradual shift from irregular testing toward more structured self-monitoring routines. Physicians and healthcare programs are increasingly emphasizing consistent glucose tracking to prevent complications and optimize therapy outcomes. This transition supports sustained growth in glucose meters, test strips, lancets, and pen needles, particularly among Type 2 diabetes patients managing disease progression. Suppliers that offer reliable, easy-to-use, and cost-efficient monitoring solutions will benefit from higher repeat usage and long-term patient retention.

Gradual Adoption of Advanced Monitoring and Insulin Delivery Technologies: While advanced devices such as continuous glucose monitoring systems and insulin pumps currently account for a limited share of the market, their adoption is expected to increase gradually through 2035, particularly in urban and private healthcare settings. Growing physician familiarity, improved patient education, and selective private insurance support will expand the addressable base for higher-value devices. However, adoption will remain selective and income-segmented, reinforcing a two-tier market structure between essential and premium diabetes care solutions.

Expansion of Private Healthcare and Specialist Diabetes Clinics: Indonesia’s expanding network of private hospitals, specialty clinics, and diagnostic centers will play a central role in shaping future device demand. These facilities act as key touchpoints for diagnosis, treatment initiation, and device recommendation, particularly for insulin therapy and advanced monitoring. As private healthcare continues to grow in secondary cities, device penetration is expected to improve beyond major metropolitan areas, supporting more balanced regional market development.

Integration of Digital Health Tools and Data-Enabled Diabetes Management: Digitalization is expected to play an increasingly supportive role in diabetes care, with select monitoring devices integrating data tracking, mobile applications, and remote physician engagement. While digital diabetes management remains at an early stage in Indonesia, rising smartphone penetration and telemedicine usage will support incremental adoption. Over time, data-enabled devices may improve monitoring compliance, therapy optimization, and patient engagement, particularly among younger and urban populations.

Indonesia Diabetes Care Devices Market Segmentation

By Product Type

• Blood Glucose Monitoring Devices (Meters, Test Strips, Lancets)

• Insulin Delivery Devices (Pens, Pen Needles, Syringes)

• Continuous Glucose Monitoring (CGM) Systems

• Insulin Pumps & Accessories

By Diabetes Type

• Type 2 Diabetes

• Type 1 Diabetes

• Gestational & Other Diabetes

By End-User

• Individual Patients / Home Care

• Hospitals & Clinics

• Diagnostic Centers & Others

By Distribution Channel

• Retail Pharmacies

• Hospital Pharmacies

• Online & Direct Channels

• Others

By Region

• Java

• Sumatra

• Kalimantan

• Sulawesi

• Eastern Indonesia

Players Mentioned in the Report:

• Abbott Diabetes Care

• Roche Diabetes Care

• Novo Nordisk

• Sanofi

• Medtronic

• Ascensia Diabetes Care

• Terumo Corporation

• B. Braun

• Regional distributors, importers, and pharmacy-led device suppliers in Indonesia

Key Target Audience

• Diabetes care device manufacturers and consumable suppliers

• Medical device distributors and import partners

• Hospitals, specialty clinics, and diagnostic centers

• Retail and hospital pharmacy chains

• Endocrinologists, diabetologists, and primary care physicians

• Public healthcare administrators and policymakers

• Private insurers and healthcare program managers

• Healthcare-focused investors and strategic partners

Time Period:

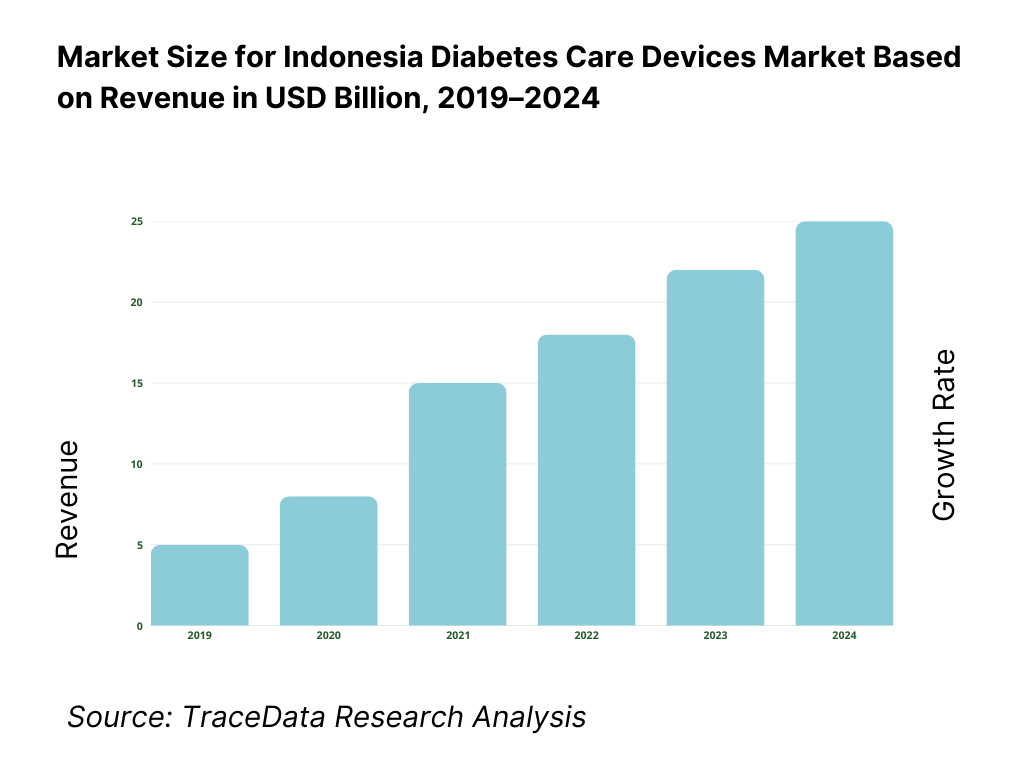

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Diabetes Care Devices-Hospital-Based, Retail Pharmacy, Online/Direct-to-Consumer, Home Care [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for Indonesia Diabetes Care Devices Market [Device Sales, Consumables, Service & Maintenance, Digital Monitoring Subscriptions]

4. 3 Business Model Canvas for Indonesia Diabetes Care Devices Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]

5. 1 Local Players vs Global Manufacturers [Local Distributors vs Multinational Device Companies]

5. 2 Investment Model in Indonesia Diabetes Care Devices Market [Public Healthcare Funding, Private Investment, Corporate Partnerships]

5. 3 Comparative Analysis of Diabetes Care Device Adoption in Public vs Private Healthcare Facilities [Procurement Models, Use Cases, Cost & Outcome Benchmarks]

5. 4 Diabetes Care Device Budget Allocation by Healthcare Provider Type [Large Hospitals, Specialty Clinics, Primary Healthcare Centers]

8. 1 Revenues (Historical Trend)

9. 1 By Product Type (Blood Glucose Monitoring Devices, Insulin Delivery Devices, Continuous Glucose Monitoring, Insulin Pumps)

9. 2 By Diabetes Type (Type 1 Diabetes, Type 2 Diabetes, Gestational & Other Diabetes)

9. 3 By End-User (Individual Patients/Home Care, Hospitals & Clinics, Diagnostic Centers)

9. 4 By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Channels, Others)

9. 5 By Technology (Conventional Monitoring, Sensor-Based Monitoring, Smart/Digital Devices)

9. 6 By Usage Type (Disposable Consumables vs Reusable Devices)

9. 7 By Branded vs Generic Devices

9. 8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia)

10. 1 Patient & Healthcare Provider Landscape and Cohort Analysis

10. 2 Device Adoption Drivers & Purchase Decision-Making Process

10. 3 Clinical Effectiveness & Cost-Benefit Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in Indonesia Diabetes Care Devices Market

11. 2 Growth Drivers for Indonesia Diabetes Care Devices Market

11. 3 SWOT Analysis for Indonesia Diabetes Care Devices Market

11. 4 Issues & Challenges for Indonesia Diabetes Care Devices Market

11. 5 Government Regulations for Indonesia Diabetes Care Devices Market

12. 1 Market Size and Future Potential for Smart & Connected Diabetes Devices in Indonesia

12. 2 Business Models & Revenue Streams [Device Sales, App-Based Monitoring, Subscription Services]

12. 3 Delivery Models & Diabetes Care Solutions Offered [Standalone Devices, App-Integrated Systems, Remote Monitoring Solutions]

15. 1 Market Share of Key Players in Indonesia Diabetes Care Devices Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Product Portfolio, Revenues, Pricing Models, Technology Used, Best-Selling Devices, Key Clients, Strategic Partnerships, Marketing Strategy, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Gartner Magic Quadrant for Diabetes Care Device Manufacturers

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Product Type (Blood Glucose Monitoring, Insulin Delivery, CGM, Insulin Pumps)

17. 2 By Diabetes Type (Type 1, Type 2, Gestational)

17. 3 By End-User (Patients, Hospitals, Clinics, Diagnostics)

17. 4 By Distribution Channel (Retail, Hospital, Online, Others)

17. 5 By Technology (Conventional vs Smart Devices)

17. 6 By Usage Type (Consumables vs Devices)

17. 7 By Branded vs Generic Devices

17. 8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Indonesia diabetes care devices market across demand-side and supply-side entities. On the demand side, entities include individual diabetes patients, hospitals, specialty diabetes clinics, primary healthcare centers, diagnostic laboratories, and home-care users managing long-term glycemic control. Demand is further segmented by diabetes type (Type 1, Type 2, gestational), treatment intensity (oral therapy vs insulin-dependent), monitoring frequency, and care setting (hospital-initiated vs self-managed). On the supply side, the ecosystem includes multinational diabetes care device manufacturers, insulin and device brand owners, local importers and distributors, hospital pharmacy networks, retail pharmacy chains, online health platforms, and medical device regulators. From this mapped ecosystem, we shortlist 8–12 leading diabetes care device companies and a representative set of local distributors based on portfolio breadth, brand presence, distribution reach, pricing tiers, and engagement with hospitals and physicians. This step establishes how value is created and captured across device manufacturing, importation, distribution, prescription influence, and recurring consumable sales.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Indonesia diabetes care devices market structure, demand drivers, and segment behavior. This includes reviewing diabetes prevalence trends, diagnosis rates, treatment pathways, healthcare infrastructure expansion, and patient affordability dynamics. We assess usage patterns for blood glucose monitoring, insulin delivery adoption, and the penetration of advanced technologies such as continuous glucose monitoring systems. Company-level analysis includes review of product portfolios, pricing positioning, distribution models, partnerships with hospitals and pharmacies, and patient education initiatives. We also examine regulatory frameworks governing medical device registration, import approvals, and reimbursement eligibility. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and creates the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with diabetes care device manufacturers, local distributors, hospital procurement managers, endocrinologists, diabetologists, pharmacists, and primary care physicians. The objectives are threefold: (a) validate assumptions around patient demand concentration, product mix, and purchasing behavior, (b) authenticate segment splits by product type, end-user, and distribution channel, and (c) gather qualitative insights on pricing sensitivity, brand preference, device adherence, and challenges in patient compliance. A bottom-to-top approach is applied by estimating patient volumes, average device and consumable usage, and annual spend per patient across key segments and regions, which are aggregated to develop the overall market view. In selected cases, pharmacist-level and distributor-level interactions are used to validate real-world sales velocity, inventory turnover, and regional availability constraints.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population demographics, diabetes prevalence growth, healthcare expenditure trends, and public health program coverage. Sensitivity analysis is conducted across key variables including diagnosis rates, monitoring frequency, insulin adoption, reimbursement expansion, and pricing pressure. Market models are refined until alignment is achieved between patient demand, distributor throughput, and supplier portfolio positioning, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Indonesia Diabetes Care Devices Market?

The Indonesia diabetes care devices market holds strong long-term potential, supported by a rising diabetic population, earlier diagnosis, and increasing emphasis on chronic disease management. Demand for blood glucose monitoring devices and consumables is structurally resilient, while gradual adoption of advanced monitoring and insulin delivery technologies offers upside potential through 2035. As healthcare access expands and patient awareness improves, diabetes care devices will remain a critical and recurring segment within Indonesia’s medical devices market.

02 Who are the Key Players in the Indonesia Diabetes Care Devices Market?

The market features a combination of global diabetes care device manufacturers and strong local distribution partners operating in Indonesia. Competition is shaped by brand trust, product accuracy, pricing, distribution reach, and physician engagement. Multinational companies dominate premium and mid-tier segments, while distributors and pharmacy-led players support mass-market penetration through essential monitoring and insulin delivery products.

03 What are the Growth Drivers for the Indonesia Diabetes Care Devices Market?

Key growth drivers include increasing diabetes prevalence, improved screening and diagnosis, expansion of hospitals and private clinics, and growing patient awareness of regular glucose monitoring. Additional momentum comes from the gradual shift toward insulin pens, repeat consumable demand, and selective adoption of digital and data-enabled diabetes management solutions. Urbanization and lifestyle-related health risks continue to reinforce long-term demand fundamentals.

04 What are the Challenges in the Indonesia Diabetes Care Devices Market?

Challenges include high out-of-pocket expenditure, limited reimbursement for advanced devices, regional disparities in healthcare access, and inconsistent patient adherence to monitoring routines. Price sensitivity constrains adoption of premium technologies such as CGM systems and insulin pumps. Distribution complexity across geographically dispersed regions and regulatory timelines for imported devices also influence market dynamics and speed of penetration.