Indonesia E-Health Market Outlook to 2035

By Solution Type, By Healthcare Application, By End-User, By Delivery & Engagement Model, and By Region

- Product Code: TDR0438

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Indonesia E-Health Market Outlook to 2035 – By Solution Type, By Healthcare Application, By End-User, By Delivery & Engagement Model, and By Region” provides a comprehensive analysis of the e-health and digital healthcare ecosystem in Indonesia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and policy landscape, buyer-level demand profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Indonesia e-health market.

The report concludes with future market projections based on healthcare access gaps, public healthcare digitization initiatives, smartphone and internet penetration, chronic disease burden, insurer-led digital adoption, hospital digitization cycles, regional healthcare disparities, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the Indonesia e-health market through 2035.

Indonesia E-Health Market Overview and Size

The Indonesia e-health market is valued at approximately ~USD ~ billion, representing the value generated from digital health platforms, telemedicine services, electronic medical records (EMR/EHR), health information systems, mobile health (m-health) applications, e-pharmacy platforms, remote patient monitoring solutions, and AI-enabled clinical and administrative tools deployed across the healthcare ecosystem.

E-health adoption in Indonesia is driven by structural healthcare access gaps across its vast archipelagic geography, uneven distribution of healthcare professionals, rising out-of-pocket healthcare expenditure, and the rapid penetration of smartphones and mobile internet. Digital health solutions have emerged as critical enablers for extending healthcare access beyond urban centers, improving care continuity, and optimizing healthcare delivery costs.

The market is anchored by strong consumer uptake of teleconsultation and digital pharmacy services, increasing digitization initiatives by private hospitals and clinics, and growing integration of e-health platforms with Indonesia’s national health insurance system (JKN). Public and private stakeholders increasingly view e-health as a scalable solution to address doctor shortages, long patient wait times, and fragmented healthcare data across providers.

Java represents the largest demand center for e-health solutions due to its population density, concentration of private hospitals, higher digital literacy, and greater purchasing power. Major urban regions such as Greater Jakarta, Bandung, Surabaya, and Yogyakarta dominate platform usage and enterprise health IT spending. Secondary demand growth is observed in Sumatra, Kalimantan, and Sulawesi as connectivity improves and telemedicine becomes a primary access point for specialist care. Eastern Indonesia remains underpenetrated but represents a long-term growth opportunity as government-led digital health infrastructure expands.

What Factors are Leading to the Growth of the Indonesia E-Health Market

Structural healthcare access gaps accelerate reliance on digital care delivery: Indonesia faces persistent challenges related to healthcare accessibility, including a shortage of doctors and specialists, uneven hospital distribution, and long travel times for patients in non-urban regions. E-health platforms enable remote consultations, digital triage, and follow-up care without requiring physical travel, making them especially valuable for primary care, chronic disease management, and post-treatment monitoring. Telemedicine has increasingly shifted from a convenience offering to a necessity in many regions, strengthening sustained demand for digital health services.

Rising smartphone penetration and digital consumer behavior support m-health adoption: Indonesia has one of the largest smartphone user bases globally, with mobile devices serving as the primary internet access point for a majority of the population. This has created a favorable environment for mobile-first health applications, including teleconsultation apps, digital appointment booking, medication ordering, wellness tracking, and preventive health engagement. Familiarity with digital payments and app-based services further lowers adoption barriers for consumer-facing e-health platforms.

Integration of digital health with national insurance and private payers improves scalability: The gradual integration of digital health platforms with the national health insurance ecosystem and private insurers has improved reimbursement visibility and patient trust. Digital registration, claims processing, e-referrals, and teleconsultations aligned with insurance coverage have expanded the addressable user base beyond self-pay consumers. As payer-provider-platform interoperability improves, e-health solutions gain stronger institutional relevance and long-term revenue stability.

Which Industry Challenges Have Impacted the Growth of the Indonesia E-Health Market:

Fragmented healthcare infrastructure and uneven digital readiness constrain uniform platform adoption: Indonesia’s healthcare system is characterized by wide variation in infrastructure maturity across regions, facility types, and ownership models. While large private hospitals in urban centers have adopted hospital information systems and digital workflows, many clinics and primary healthcare centers continue to rely on paper-based records and manual processes. This fragmentation limits interoperability, complicates data sharing, and reduces the effectiveness of end-to-end digital care pathways. E-health platforms often need to customize integrations or operate in parallel with legacy systems, increasing implementation complexity and slowing scalable rollout across the broader healthcare ecosystem.

Regulatory interpretation gaps and compliance uncertainty increase operational risk for platforms: Although Indonesia has progressively clarified telemedicine and digital health guidelines, regulatory interpretation can vary across institutions, professional bodies, and local authorities. Issues related to clinical accountability, cross-platform referrals, prescription validity, data localization, and platform liability remain areas of active evolution. For e-health providers, this creates compliance ambiguity, particularly when expanding services beyond basic teleconsultation into diagnostics, chronic disease management, or AI-assisted decision support. As a result, some platforms adopt conservative service scopes or delay innovation until regulatory clarity improves, moderating growth momentum.

Trust barriers and clinical confidence challenges limit adoption for complex care use cases: While teleconsultation has gained acceptance for general and follow-up care, patient and provider confidence remains lower for complex diagnoses, specialist consultations, and long-term disease management delivered remotely. Concerns around diagnostic accuracy, lack of physical examination, continuity of care, and medico-legal accountability influence both patient willingness and physician participation. These trust-related barriers constrain usage intensity and reduce the average value per user, particularly for higher-acuity and higher-margin digital health services.

What are the Regulations and Initiatives which have Governed the Market:

Telemedicine practice guidelines and digital health governance frameworks defining scope and accountability: Indonesia’s health authorities have introduced guidelines governing telemedicine practices, outlining requirements related to licensed practitioner participation, patient consent, documentation standards, and clinical responsibility. These frameworks aim to ensure patient safety while enabling digital service delivery. Compliance with these guidelines shapes platform design, doctor onboarding processes, clinical workflows, and audit mechanisms. While supportive of growth, the need to align with evolving rules increases compliance costs and places emphasis on governance capabilities rather than pure technology scale.

Health data protection, cybersecurity, and patient privacy requirements influencing platform architecture: Growing focus on personal data protection and cybersecurity has increased regulatory expectations around data storage, access control, encryption, and breach response protocols. E-health platforms handling sensitive medical data must invest in secure infrastructure, local data hosting where required, and robust governance frameworks. These requirements influence technology stack decisions, vendor partnerships, and operating costs, particularly for platforms scaling rapidly across multiple regions and healthcare partners.

National health insurance digitization initiatives shaping integration priorities and reimbursement pathways: Government-led efforts to digitize health administration, including patient registration, referrals, and claims processing under the national health insurance system, have a direct impact on e-health platform relevance and scalability. Platforms that align with these initiatives gain stronger institutional legitimacy and access to a broader insured population, while those operating outside formal reimbursement pathways remain dependent on self-pay users. As integration deepens, regulatory alignment increasingly determines competitive positioning, partnership opportunities, and long-term sustainability in the Indonesia e-health market.

Indonesia E-Health Market Segmentation

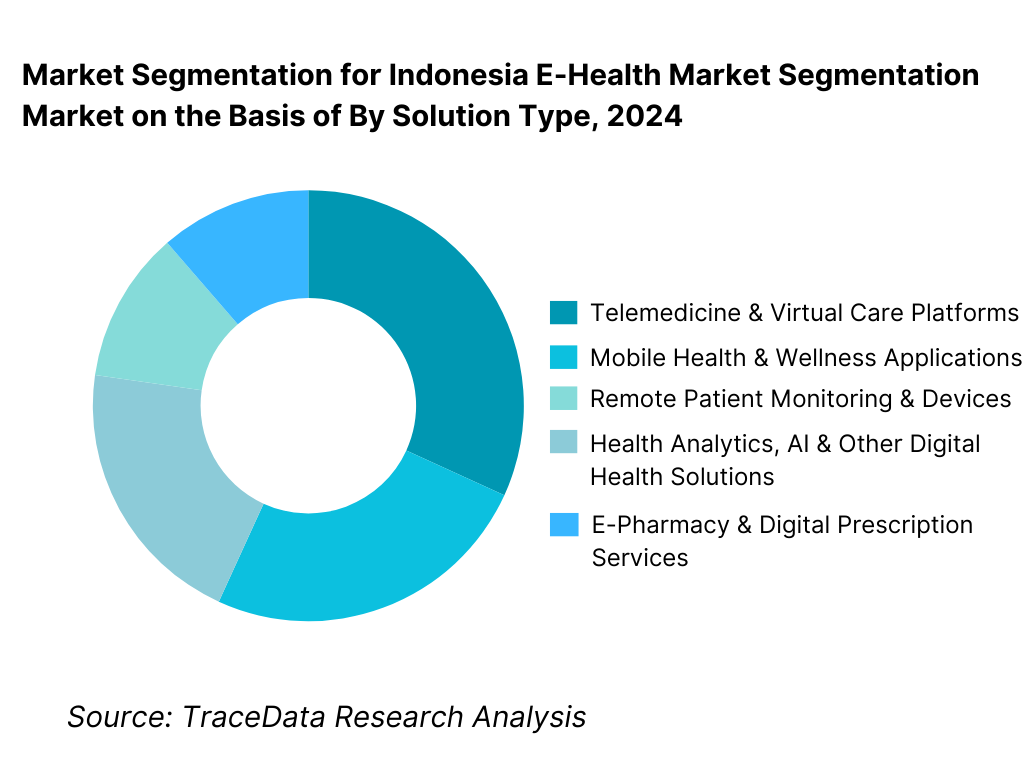

By Solution Type: Telemedicine and virtual care platforms hold dominance in the Indonesia e-health market. This is because general consultations, follow-ups, and first-level triage align strongly with Indonesia’s healthcare access gaps and mobile-first consumer behavior. Teleconsultation platforms benefit from high repeat usage, low infrastructure dependency, and strong integration with digital payments and e-pharmacy services. While hospital information systems, EMR/EHR, and health analytics are expanding steadily, particularly among private hospitals and clinic chains, telemedicine continues to account for the largest share due to volume-driven consumer demand and insurer-supported programs.

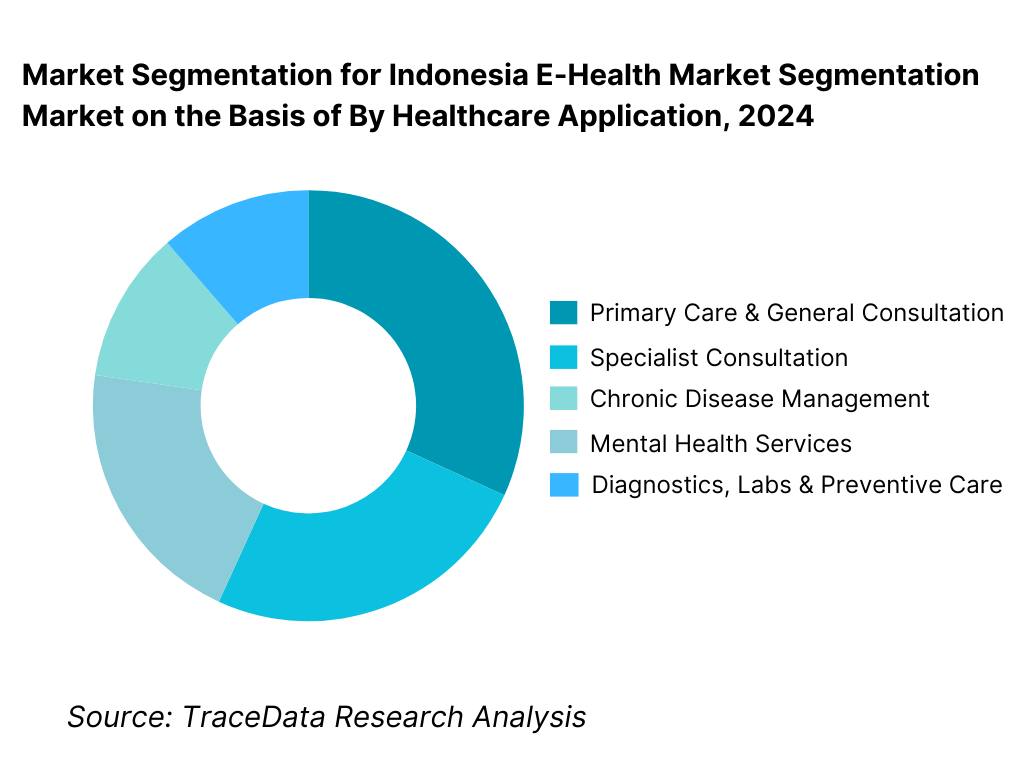

By Healthcare Application: Primary care and general consultation dominate the Indonesia e-health market. These services address common conditions, minor illnesses, and follow-up needs where digital consultation is considered acceptable by both patients and providers. Chronic disease management and mental health services are growing rapidly as awareness increases and insurers begin to support longer-term digital engagement models.

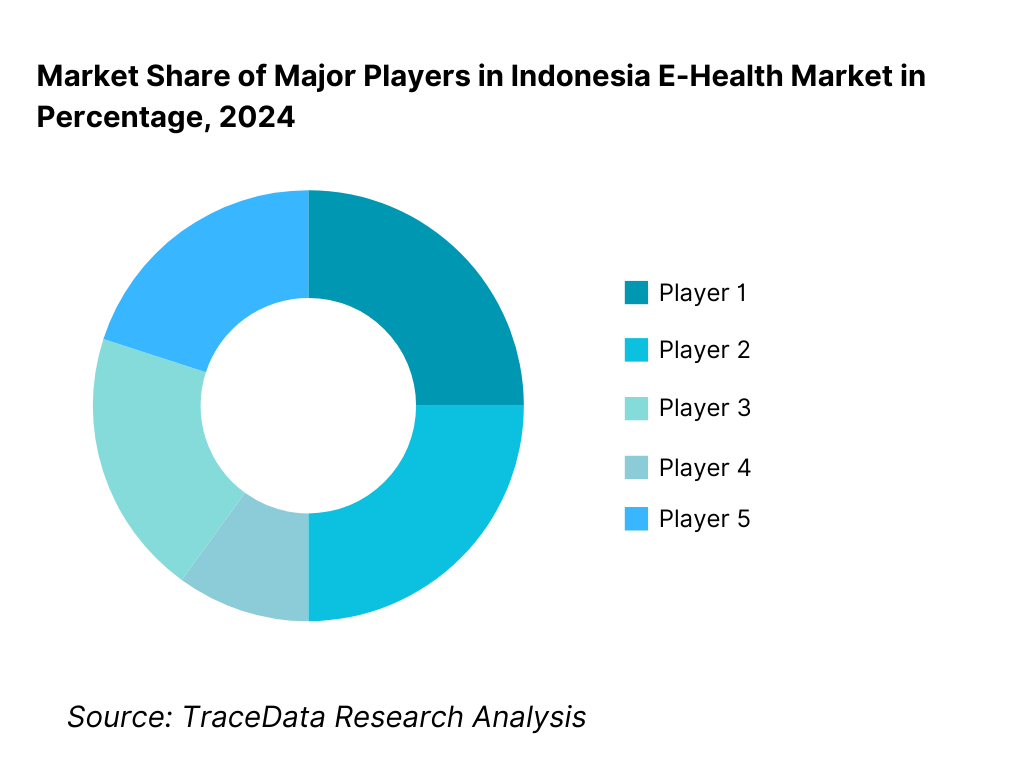

Competitive Landscape in Indonesia E-Health Market

The Indonesia e-health market exhibits moderate concentration, characterized by a small group of large multi-service platforms with strong consumer brands and doctor networks, alongside a long tail of specialized telemedicine, wellness, and enterprise health IT providers. Competitive positioning is shaped by platform usability, doctor availability, service breadth, insurer partnerships, regulatory compliance capability, and trust among users and healthcare professionals. Large platforms dominate consumer-facing telemedicine and e-pharmacy services, while smaller and niche players focus on mental health, chronic care, or hospital IT deployments.

Name | Founding Year | Original Headquarters |

Halodoc | 2016 | Jakarta, Indonesia |

Alodokter | 2014 | Jakarta, Indonesia |

SehatQ | 2018 | Jakarta, Indonesia |

KlikDokter | 2008 | Jakarta, Indonesia |

Good Doctor | 2018 | Jakarta / Singapore |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Halodoc: Halodoc remains one of the most prominent digital health platforms in Indonesia, with a strong focus on teleconsultation, integrated e-pharmacy, and partnerships with hospitals, insurers, and corporate clients. Its competitive strength lies in a large doctor network, high brand recall, and deep integration across consultation, prescription fulfillment, and last-mile medicine delivery. The platform continues to position itself as a full-stack digital healthcare ecosystem rather than a single-service app.

Alodokter: Alodokter differentiates through a strong combination of health content, symptom checking, and teleconsultation services. The platform has built trust through medically reviewed information and broad consumer reach, which supports user acquisition and engagement. Its growing collaboration with insurers and healthcare providers strengthens its role in both consumer and institutional digital health journeys.

SehatQ: SehatQ has focused on creating an integrated health services marketplace, combining teleconsultation, appointment booking, and digital pharmacy offerings. Its positioning emphasizes accessibility and ease of use for urban consumers, while gradually expanding partnerships with clinics and healthcare providers to deepen service coverage.

KlikDokter: KlikDokter benefits from its early entry into online health services and strong association with trusted healthcare content. The platform maintains relevance through teleconsultation services and corporate health programs, with a competitive edge in credibility and informational depth rather than aggressive consumer promotions.

Good Doctor: Good Doctor has leveraged partnerships with large consumer ecosystems and corporate platforms to scale user access rapidly. Its model emphasizes B2B2C distribution, working closely with employers, insurers, and digital platforms to embed telemedicine services within broader consumer and employee benefit ecosystems.

What Lies Ahead for Indonesia E-Health Market?

The Indonesia e-health market is expected to expand steadily through 2035, supported by persistent healthcare access gaps, rising healthcare demand from a growing and aging population, and the continued normalization of digital-first healthcare engagement. Growth momentum will be reinforced by smartphone-led service consumption, gradual integration of digital platforms with national health insurance and private payers, and sustained investment by hospitals and clinics in digital infrastructure. As digital healthcare shifts from episodic use to a core component of care delivery, e-health platforms are likely to become embedded within Indonesia’s broader healthcare ecosystem rather than operating as standalone convenience services.

Transition from Episodic Teleconsultation to Longitudinal and Managed Care Models: The future of the Indonesia e-health market will see a gradual shift from one-off teleconsultations toward longitudinal care models that emphasize continuity, monitoring, and outcomes. Chronic disease management, mental health care, maternal health, and post-hospitalization follow-up are expected to gain prominence as platforms develop capabilities around patient tracking, remote monitoring, and structured care pathways. E-health providers that move beyond transactional consultations and support ongoing engagement with patients and providers will capture higher-value use cases and improve monetization sustainability.

Deeper Integration with National Health Insurance and Institutional Care Pathways: Integration with Indonesia’s national health insurance system and large private insurers will increasingly shape platform relevance and scale. Digital referral management, claims processing, eligibility verification, and insurer-approved teleconsultation pathways are expected to expand. Platforms that align closely with payer requirements and public health priorities will benefit from access to a broader insured population, while purely self-pay models may face pricing pressure and slower growth over time. This shift will favor e-health providers with strong regulatory alignment and institutional partnerships.

Expansion of Hospital Digitization and Enterprise Health IT Demand: Beyond consumer-facing applications, steady growth is expected in hospital information systems, EMR/EHR platforms, digital billing, and analytics solutions. Private hospital groups and clinic networks will continue investing in digital systems to improve operational efficiency, clinical documentation, and patient experience. Over time, data-driven decision support and interoperability between hospitals and e-health platforms will become more important, positioning enterprise-focused digital health vendors as long-term growth beneficiaries.

Indonesia E-Health Market Segmentation

By Solution Type

- Telemedicine & Virtual Care Platforms

- E-Pharmacy & Digital Prescription Fulfillment

- Hospital Information Systems (HIS) & EMR/EHR Solutions

- Mobile Health (mHealth) & Wellness Applications

- Remote Patient Monitoring (RPM) & Connected Devices

- Health Analytics, AI, and Clinical Decision Support Tools

- Digital Diagnostics, Appointment Booking, and Other E-Health Solutions

By Healthcare Application

- Primary Care & General Consultation

- Specialist Consultation (Dermatology, Pediatrics, Cardiology, etc.)

- Chronic Disease Management (Diabetes, Hypertension, Respiratory, etc.)

- Mental Health & Behavioral Therapy

- Maternal & Child Health (ANC, Postnatal, Nutrition)

- Diagnostics & Lab Coordination

- Preventive Health, Wellness & Lifestyle Management

- Post-Hospitalization Follow-Up & Rehabilitation Support

By Delivery & Engagement Model

- Direct-to-Consumer (D2C) App-Based Model

- B2B Hospital / Clinic Integrated Model

- Insurer-Integrated / Reimbursement-Linked Model

- Employer-Sponsored Digital Health Programs

- Marketplace / Aggregator Model (Doctors, Labs, Pharmacies)

- Hybrid Care Model (Online + Offline Provider Network)

By End-User

- Individual Consumers / Patients

- Hospitals (Private and Public)

- Clinics and Primary Healthcare Centers

- Pharmacies and Medicine Distribution Partners

- Diagnostic Labs and Imaging Centers

- Health Insurers and TPAs

- Corporate Employers and Employee Benefit Providers

- Government and Public Health Programs

By Region

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Bali & Nusa Tenggara

- Eastern Indonesia (Maluku, Papua and Other Provinces)

Players Mentioned in the Report:

- Halodoc

- Alodokter

- SehatQ

- KlikDokter

- Good Doctor

- Hospital IT vendors (HIS / EMR solution providers), pharmacy aggregators, telemedicine startups, and niche mental health / chronic care platforms

Key Target Audience

- E-health platform operators and digital health startups

- Hospitals, clinic chains, and healthcare administrators

- Health insurers, TPAs, and payer-led care management teams

- Pharmacy chains, distributors, and last-mile healthcare logistics providers

- Diagnostic labs and home sample collection players

- Corporate HR and employee benefits decision-makers

- Government health agencies and digital health program stakeholders

- Investors (VC/PE) and strategic healthcare/tech partners

- IT vendors providing EMR/HIS, cybersecurity, and interoperability solutions

Time Period:

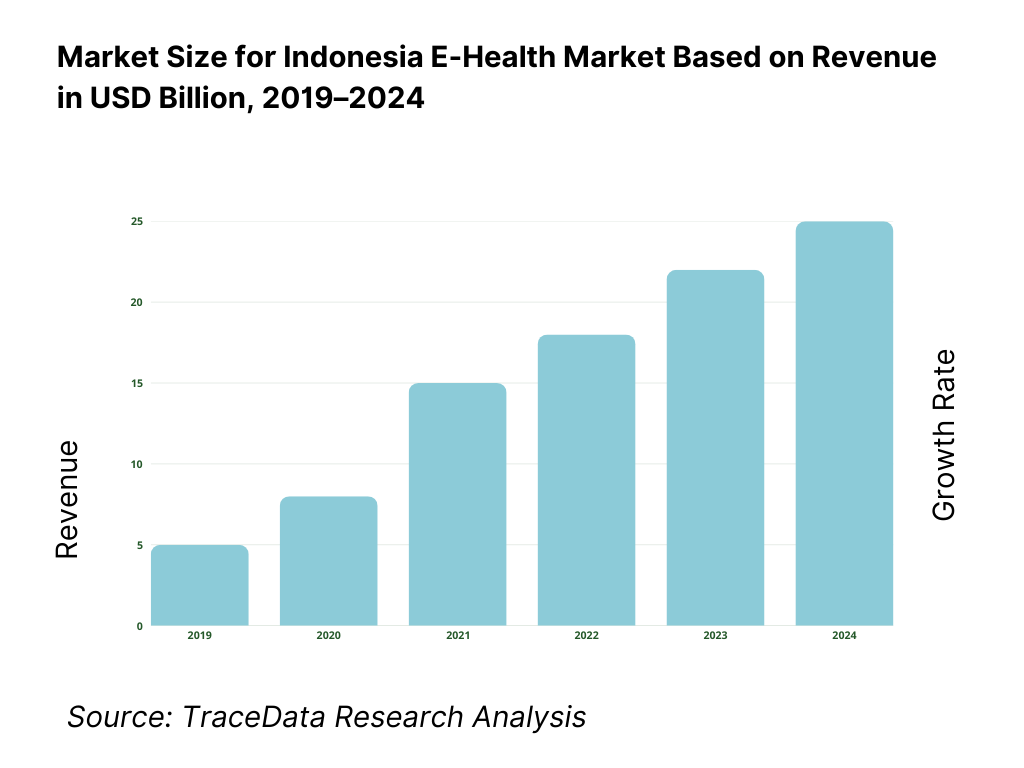

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in Indonesia E-Health Market

Value Chain Analysis

4.1 Delivery Model Analysis for E-Health Solutions-Telemedicine, Hybrid Care, Platform-Based, Enterprise Health IT [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for Indonesia E-Health Market [Consultation Fees, Subscriptions, Platform Commissions, Enterprise Licensing, Value-Added Services]

4.3 Business Model Canvas for Indonesia E-Health Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Vendors [Halodoc vs Global Health IT Vendors etc.]

5.2 Investment Model in Indonesia E-Health Market [Government Programs, VC Funding, PE Investments, Corporate Venturing]

5.3 Comparative Analysis of E-Health Adoption in Public vs Private Healthcare Organizations [Procurement Models, Use Cases, ROI Benchmarks]

5.4 E-Health Budget Allocation by Healthcare Organization Size [Large Hospital Groups, Mid-Sized Providers, Clinics & SMEs]Market Attractiveness for Indonesia E-Health Market

Supply-Demand Gap Analysis

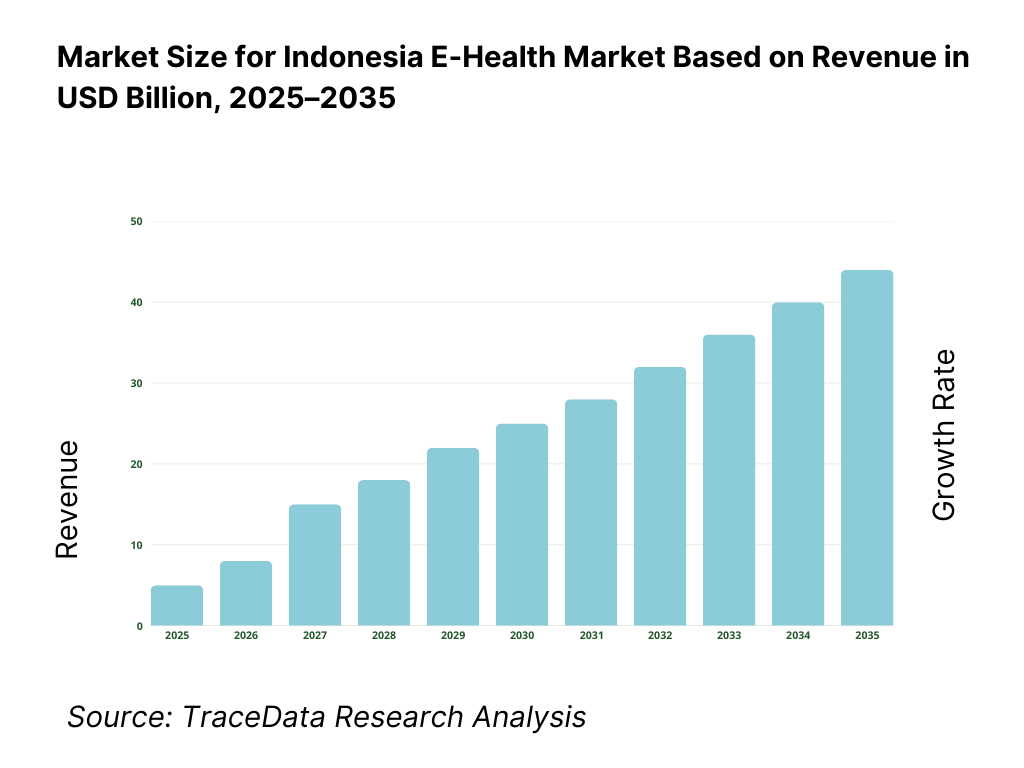

Market Size for Indonesia E-Health Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for Indonesia E-Health Market Basis

9.1 By Market Structure (In-House Digital Health Systems vs Outsourced E-Health Platforms)

9.2 By Solution Type (Telemedicine, E-Pharmacy, EMR/EHR, Remote Monitoring, Health Analytics)

9.3 By Healthcare Application (Primary Care, Specialist Care, Chronic Disease Management, Mental Health, Preventive Care)

9.4 By End-User (Hospitals, Clinics, Insurers, Corporates, Individual Consumers)

9.5 By Use Case/Function (Consultation, Diagnosis Support, Prescription Fulfillment, Care Management, Wellness Monitoring)

9.6 By Delivery Mode (Mobile App, Web Platform, Integrated Hospital Systems, Hybrid Care)

9.7 By Open vs Customized E-Health Solutions

9.8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia)Demand-Side Analysis for Indonesia E-Health Market

10.1 Patient, Provider & Institutional Client Landscape and Cohort Analysis

10.2 E-Health Adoption Drivers & Decision-Making Process

10.3 E-Health Effectiveness & ROI Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in Indonesia E-Health Market

11.2 Growth Drivers for Indonesia E-Health Market

11.3 SWOT Analysis for Indonesia E-Health Market

11.4 Issues & Challenges for Indonesia E-Health Market

11.5 Government Regulations for Indonesia E-Health MarketSnapshot on Online & Digital Healthcare Services Market in Indonesia

12.1 Market Size and Future Potential for Digital & Telemedicine Services in Indonesia

12.2 Business Models & Revenue Streams [Teleconsultation Fees, Subscriptions, Platform Commissions]

12.3 Delivery Models & E-Health Applications Offered [Telemedicine Apps, Digital Pharmacy, Remote Monitoring]Opportunity Matrix for Indonesia E-Health Market

PEAK Matrix Analysis for Indonesia E-Health Market

Competitor Analysis for Indonesia E-Health Market

15.1 Market Share of Key Players in Indonesia E-Health Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Doctor Network Size, Revenues, Pricing Models, Technology Stack, Key Services, Major Clients, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant for Digital Health & E-Health Providers

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for Indonesia E-Health Market Basis

16.1 Revenues (Projections)

Market Breakdown for Indonesia E-Health Market Basis

17.1 By Market Structure (In-House and Outsourced E-Health Solutions)

17.2 By Solution Type (Telemedicine, E-Pharmacy, EMR/EHR, Remote Monitoring, Health Analytics)

17.3 By Healthcare Application (Primary Care, Specialist Care, Chronic Disease, Mental Health, Preventive Care)

17.4 By End-User (Hospitals, Clinics, Insurers, Corporates, Consumers)

17.5 By Use Case/Function (Consultation, Diagnosis, Prescription, Care Management, Wellness)

17.6 By Delivery Mode (Mobile, Web, Integrated Systems, Hybrid)

17.7 By Open vs Customized Programs

17.8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Indonesia E-Health Market across demand-side and supply-side entities. On the demand side, entities include individual consumers and patients, private hospitals, public hospitals, clinic networks and primary healthcare centers, diagnostic labs, pharmacies, health insurers, corporate employers offering digital health benefits, and government/public health programs. Demand is further segmented by healthcare use case (primary care, specialist care, chronic disease management, mental health, preventive care), payment model (self-pay, insurer-paid, employer-sponsored), and engagement mode (one-time consultation vs ongoing care management).

On the supply side, the ecosystem includes telemedicine platform operators, e-pharmacy and medicine fulfillment providers, hospital information system (HIS) and EMR/EHR vendors, mobile health app developers, remote monitoring device providers, health analytics and AI solution providers, cloud and cybersecurity vendors, logistics partners for last-mile delivery, and licensed healthcare professionals participating on digital platforms. From this mapped ecosystem, we shortlist 6–10 leading e-health platforms and a representative set of enterprise health IT vendors based on user base, service breadth, regulatory compliance capability, insurer partnerships, and presence across consumer and institutional segments. This step establishes how value is created and captured across digital consultation, care delivery, data management, and platform monetization.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Indonesia e-health market structure, adoption drivers, and segment behavior. This includes reviewing healthcare access indicators, digital penetration trends, telemedicine usage patterns, hospital digitization initiatives, and insurer-led digital health programs. We assess consumer behavior related to teleconsultation frequency, e-pharmacy usage, and willingness to pay for digital services.

Company-level analysis includes review of platform service offerings, doctor network scale, pricing models, monetization strategies, funding activity, and partnership ecosystems with hospitals, insurers, and employers. We also examine the regulatory and policy environment governing telemedicine practice, data protection, patient privacy, and digital health governance. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and supports the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with e-health platform executives, hospital administrators, clinic operators, practicing doctors, insurers, corporate HR benefits managers, and healthcare IT vendors. The objectives are threefold: (a) validate assumptions around demand concentration, platform usage intensity, and payment pathways, (b) authenticate segmentation splits by solution type, application, end-user, and delivery model, and (c) gather qualitative insights on pricing sensitivity, user retention, regulatory challenges, trust barriers, and platform differentiation.

A bottom-to-top approach is applied by estimating user volumes, consultation frequency, and average revenue per user across key segments and regions, which are aggregated to build the overall market view. In selected cases, disguised user-style interactions with platforms are conducted to validate real-world experiences related to onboarding, consultation flow, prescription fulfillment, and follow-up care.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as healthcare expenditure growth, population demographics, insurance coverage expansion, and digital infrastructure development. Sensitivity analysis is conducted across key variables including telemedicine adoption rates, insurer integration depth, regulatory enforcement intensity, and regional connectivity improvements. Market models are refined until alignment is achieved between platform supply capacity, healthcare provider participation, and patient demand, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Indonesia E-Health Market?

The Indonesia E-Health Market holds strong long-term potential, supported by persistent healthcare access gaps, rising healthcare demand, and increasing acceptance of digital-first care models. Telemedicine, e-pharmacy, and hospital digitization are expected to remain central pillars of growth. As platforms evolve toward longitudinal care and insurer-integrated models, e-health is likely to become a structural component of Indonesia’s healthcare delivery system through 2035.

02 Who are the Key Players in the Indonesia E-Health Market?

The market features a mix of large, multi-service digital health platforms with strong consumer brands and doctor networks, alongside specialized telemedicine providers, mental health platforms, and enterprise health IT vendors. Competition is shaped by platform usability, regulatory compliance capability, insurer and hospital partnerships, service breadth, and user trust. Institutional partnerships and data governance strength increasingly differentiate leading players.

03 What are the Growth Drivers for the Indonesia E-Health Market?

Key growth drivers include uneven distribution of healthcare professionals, rising smartphone and internet penetration, increasing healthcare awareness, and gradual integration of digital health services with national health insurance and private payers. Additional momentum comes from hospital digitization, employer-sponsored digital health programs, and growing demand for chronic disease and mental health management solutions.

04 What are the Challenges in the Indonesia E-Health Market?

Challenges include fragmented healthcare infrastructure, interoperability limitations, regulatory interpretation variability, data privacy and cybersecurity requirements, and trust barriers for complex or high-acuity digital care. Monetization pressure in competitive consumer segments and uneven digital literacy across regions can also moderate adoption and usage intensity, particularly outside major urban centers.