Indonesia Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Segment, By End-User Industry, By Region

- Product Code: TDR0017

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

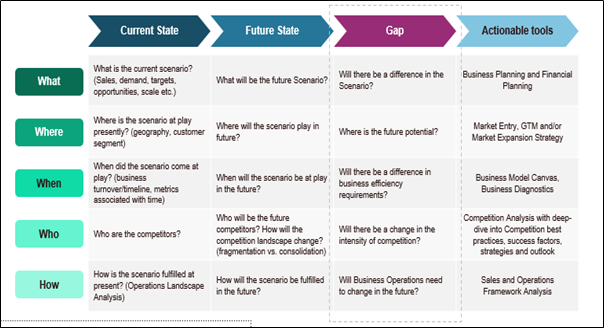

The report titled “Indonesia Logistics and Warehousing Market Outlook to 2029 - By Market Structure, By Segment, By End-User Industry, By Region.” provides a comprehensive analysis of the logistics and warehousing market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing market. The report concludes with future market projections based on revenue, by market, service types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

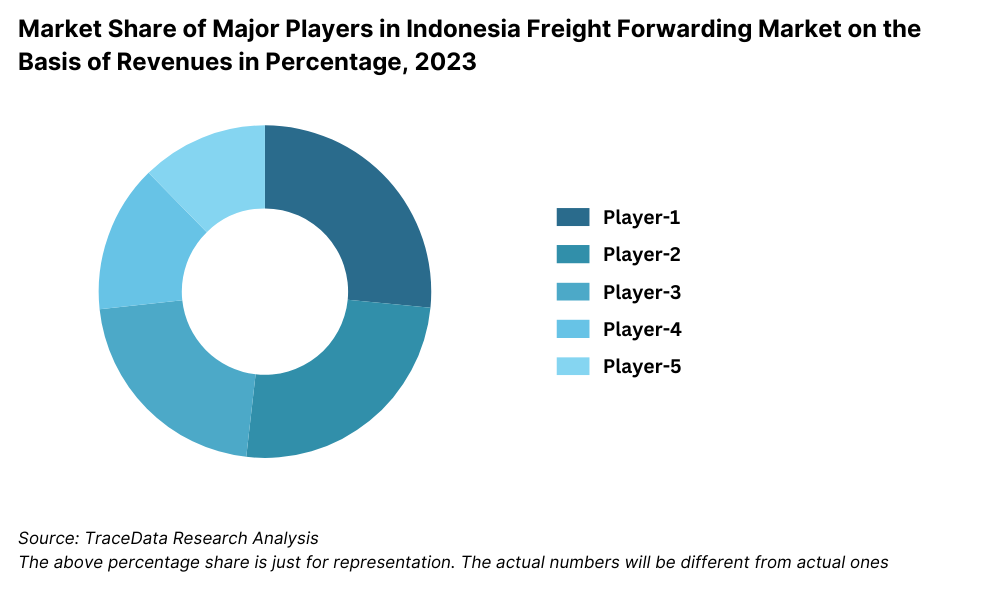

Indonesia Logistics and Warehousing Market Overview and Size

The Indonesia logistics and warehousing market reached a valuation of IDR 150 Trillion in 2023, driven by the growing demand for efficient supply chain solutions, rapid urbanization, and the expansion of e-commerce. The market is characterized by major players such as JNE Express, TIKI, DHL Supply Chain, Kuehne + Nagel, and Siba Surya. These companies are recognized for their extensive distribution networks, diverse service offerings, and customer-focused logistics solutions.

In 2023, DHL Supply Chain launched a new multi-client warehouse in Jakarta to enhance customer experience and streamline the logistics process for e-commerce and retail businesses. This initiative aims to tap into the growing digital market in Indonesia and provide a more convenient logistics solution. Jakarta and Surabaya are key markets due to their high population density and robust industrial infrastructure.

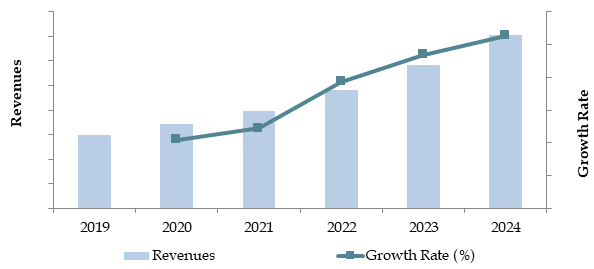

Market Size for Indonesia Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Indonesia Logistics and Warehousing Market:

Economic Growth: Indonesia's consistent GDP growth and increasing industrial activity have significantly boosted the demand for logistics and warehousing services. In 2023, the logistics sector accounted for approximately 8% of the country's GDP, driven by the need for efficient supply chain management to support various industries, including manufacturing, retail, and e-commerce.

E-Commerce Boom: The rapid expansion of the e-commerce sector has been a major driver of the logistics and warehousing market. In 2023, online retail sales in Indonesia grew by 35%, creating a high demand for warehousing space and last-mile delivery services. This growth is particularly pronounced in urban areas where consumer demand for quick and reliable delivery services is increasing.

Infrastructure Development: The Indonesian government's investment in infrastructure development, including the construction of new ports, highways, and industrial parks, has facilitated the growth of the logistics and warehousing market. In 2023, the government allocated IDR 400 Trillion for infrastructure projects aimed at improving connectivity and reducing logistics costs, thereby boosting the sector's overall efficiency.

Which Industry Challenges Have Impacted the Growth for Indonesia Logistics and Warehousing Market:

Regulatory Complexity: Navigating Indonesia's complex regulatory environment, particularly in relation to customs and import/export procedures, poses significant challenges for logistics providers. In 2023, approximately 30% of logistics companies reported delays in shipments due to regulatory issues, which can increase operational costs and impact service levels.

Infrastructure Bottlenecks: Despite ongoing infrastructure improvements, Indonesia still faces significant challenges related to its vast and diverse geography. Remote and underdeveloped regions experience limited access to quality logistics services, resulting in higher transportation costs and longer delivery times.

Skilled Labor Shortage: The logistics and warehousing sector in Indonesia is facing a shortage of skilled labor, particularly in areas requiring specialized knowledge such as supply chain management and warehouse automation. In 2023, around 40% of logistics companies reported difficulties in recruiting qualified personnel, impacting their ability to scale operations and maintain service quality.

What are the Regulations and Initiatives which have Governed the Market:

National Logistics System (Sislognas): The Indonesian government has implemented the Sislognas initiative to create an integrated national logistics system. This includes regulatory reforms aimed at improving logistics efficiency, reducing costs, and enhancing the overall competitiveness of the logistics sector. By 2023, these reforms contributed to a 5% reduction in logistics costs as a percentage of GDP.

Investment Incentives for Logistics Facilities: To attract foreign and domestic investment in the logistics sector, the Indonesian government offers various incentives, including tax breaks and subsidies for the development of logistics facilities such as warehouses and distribution centers. In 2023, these incentives led to a 15% increase in the construction of new warehousing facilities across the country.

Digitalization of Customs Procedures: The Indonesian government has made significant strides in digitalizing customs and trade procedures to streamline logistics operations. In 2023, the implementation of the National Single Window (NSW) for customs clearance reduced the average clearance time by 20%, improving the efficiency of import/export activities.

Indonesia Logistics and Warehousing Market Segmentation

By Services: The market is segmented by various logistics services, including transportation, warehousing, distribution, and value-added services. Transportation services, encompassing road, rail, air, and sea freight, hold the largest market share due to Indonesia's archipelagic geography and the need for multi-modal transportation solutions.

Freight Forwarding: Indonesia's F&B, FMCG, and industrial sectors have significantly contributed to the growth of the country's freight forwarding market, especially in international trade. With the expansion of road networks, freight by road has emerged as the most preferred mode of transportation, followed by air and sea freight. Indonesia's unique geography, with its many islands and remote regions, presents logistical challenges that are often best addressed by road transport. In terms of revenue, the Asia flow corridor has been identified as the largest source for Indonesia’s freight forwarding industry

Warehousing: Indonesia’s warehousing industry has experienced gradual growth due to the shortage of high-quality, modern warehouse facilities. Warehousing remains one of the key areas for further logistics development, requiring increased investment and technological advancement. The adoption of automation technologies and advanced inventory management systems is expected to fuel the growth of the warehousing market in Indonesia

CEP Market: CEP logistics market in Indonesia expanded at a positive CAGR from 2018 to 2023. As e-commerce grows, online shoppers are increasingly demanding faster delivery options and more convenient return processes. While many consumers still consider express delivery a premium service and prefer standard delivery, the rise of e-commerce is pushing demand for quicker logistics solutions. Several global players, including DHL, Aramex, and FedEx-TNT, have entered Indonesia’s CEP market, and future growth is expected to be driven by the continued expansion of e-commerce and the increasing demand for rapid delivery services.

Competitive Landscape in Indonesia Logistics and Warehousing Market

The Indonesia logistics and warehousing market is relatively fragmented, with a mix of local and international players operating in the space. However, the market is witnessing increasing consolidation, particularly with the rise of digital logistics platforms and third-party logistics (3PL) providers. Key players such as JNE Express, TIKI, DHL Supply Chain, Kuehne + Nagel, and Siba Surya dominate the market, offering a wide range of logistics services across various industries. The entrance of new firms and the expansion of e-commerce logistics platforms have diversified the market, providing businesses with more options for logistics solutions.

Freight Forwarding Companies

| Name | Founding Year | Headquarters |

| Samudera Indonesia | 1964 | Jakarta, Indonesia |

| Agility Logistics Indonesia | 1979 | Jakarta, Indonesia |

| DB Schenker Indonesia | 1872 | Jakarta, Indonesia |

| Kuehne + Nagel Indonesia | 1890 | Jakarta, Indonesia |

| Bolloré Logistics Indonesia | 1822 | Jakarta, Indonesia |

| DHL Global Forwarding | 1969 | Jakarta, Indonesia |

| Maersk Indonesia | 1904 | Jakarta, Indonesia |

Warehousing Companies

| Name | Founding Year | Headquarters |

| Mega Integrated Logistics | 1982 | Jakarta, Indonesia |

| Kerry Logistics | 1981 | Jakarta, Indonesia |

| Kiat Ananda Cold Storage | 1997 | Jakarta, Indonesia |

| PT Kamadjaja Logistics | 1968 | Surabaya, Indonesia |

| Nippon Express Indonesia | 1937 | Jakarta, Indonesia |

| DHL Supply Chain Indonesia | 1969 | Jakarta, Indonesia |

| PT Wahana Prestasi Logistik | 1998 | Jakarta, Indonesia |

CEP Companies

| Name | Founding Year | Headquarters |

| JNE (Jalur Nugraha Ekakurir) | 1990 | Jakarta, Indonesia |

| Pos Indonesia | 1746 | Bandung, Indonesia |

| TIKI (Titipan Kilat) | 1970 | Jakarta, Indonesia |

| SiCepat Express | 2014 | Jakarta, Indonesia |

| J&T Express | 2015 | Jakarta, Indonesia |

| Ninja Van Indonesia | 2014 | Singapore (Operations in Indonesia) |

| GO-SEND (GoJek) | 2010 | Jakarta, Indonesia |

| SAP Express | 2014 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

JNE Express: As one of the leading logistics companies in Indonesia, JNE Express handled over 500 million shipments in 2023, marking a 25% increase in volume compared to the previous year. The company's extensive network and investment in digital technologies have strengthened its position in the market, particularly in e-commerce logistics.

TIKI: A pioneer in the Indonesian logistics industry, TIKI saw a 20% growth in its e-commerce delivery services in 2023. The company's focus on expanding its same-day and next-day delivery options has made it a preferred choice for online retailers across the country.

DHL Supply Chain: Known for its comprehensive supply chain solutions, DHL Supply Chain reported a 30% growth in its warehousing operations in 2023. The company's strategic investments in multi-client warehouses in Jakarta and Surabaya have significantly boosted its service capacity, catering to the growing demand from the retail and FMCG sectors.

Kuehne + Nagel: A global logistics provider, Kuehne + Nagel expanded its footprint in Indonesia by opening new distribution centers in key industrial zones. The company reported a 15% increase in revenue from its contract logistics services in 2023, driven by its ability to offer end-to-end supply chain solutions for multinational clients.

Siba Surya: Specializing in road transportation, Siba Surya saw a 10% increase in its logistics revenue in 2023, particularly in the FMCG and manufacturing sectors. The company’s focus on fleet expansion and enhancing its inter-island logistics services has positioned it as a key player in the Indonesian market.

Rise of Smart Warehousing: The integration of advanced technologies such as IoT, AI, and robotics in warehousing is expected to enhance operational efficiency and reduce costs. Smart warehousing solutions will enable real-time inventory tracking, predictive maintenance, and automated processes, providing a competitive edge to logistics providers.

Expansion of Cold Chain Logistics: With the growing demand for temperature-sensitive goods, particularly in the pharmaceutical and food industries, the cold chain logistics segment is expected to witness significant growth. This trend is supported by investments in refrigerated transportation and cold storage facilities.

Growth of E-commerce Logistics: The e-commerce sector will continue to drive demand for logistics and warehousing services, particularly in urban areas. The focus will be on enhancing last-mile delivery services, optimizing delivery routes, and expanding warehousing capacity to meet the increasing consumer demand for fast and reliable deliveries.

Sustainability Initiatives: There is a rising trend towards sustainable practices within the logistics and warehousing sector, including the use of eco-friendly transportation methods, green warehouses, and efforts to reduce carbon emissions. These practices are becoming increasingly important as companies and consumers prioritize environmental responsibility.

_2Uxqqtz.png)

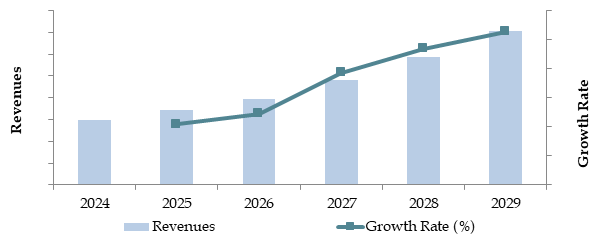

What Lies Ahead for Indonesia Logistics and Warehousing Market?

The Indonesia logistics and warehousing market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by economic expansion, increasing e-commerce penetration, and continued investment in infrastructure.

Future Outlook and Projections for Indonesia Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Indonesia Logistics and Warehousing Market Segmentation

Freight Forwarding Market

By Mode of Transportation

- Road Freight (Fleets, Volume, FTK, Price/ton/km and Revenue)

- Sea Freight (Fleets, Volume, Average Distance, Price/ton/km and Revenue)

- Air Freight (Volume, Average Distance, Price/ton/km and Revenue)

- By Road transportation

- Less than Truck load (Revenue and Volume)

- Full truck load (Revenue and Volume)

- By End Users (Revenues)

- Food & Beverages

- Textiles and Footwear

- Chemicals

- Pharmaceuticals and Medical consumables

- Electronics

- Others include agricultural products, frozen meat and more

Warehousing Market

By Business Model (Revenue, Price/sqm, warehousing space, Occupancy rate)

Industrial/Retail

CFS/ICD

Cold Storage

Agriculture

By Industrial warehouses (Revenues)

Grade A

Grade B

Grade C and others

By End Users (Revenues)

Food & Beverages

Textiles and Footwear

Chemicals

Pharmaceuticals and Medical consumables

Electronics

Others include agricultural products, frozen meat and more

CEP Market

By Channel

3PL Players

E-Commerce Merchants

By Type of Shipments

Domestic Shipments

International Shipments

By Area of Delivery

Intercity

Intracity

By Mode

Air Shipments

Ground Shipments

By Delivery Period

Same Day Delivery

1-2 Day Delivery

3-4 Day Delivery

More than 4 Day Delivery

By Type of Products

Consumer Electronics & Media

Fashion & Accessories

Foods & Personal Care

Home Care & Furniture

Toys & Baby Products

Others (Video Games, Digital Music, Pet Care, Home Gardening, etc.)

Players Mentioned in the Report (Freight):

Samudera Indonesia

Agility Logistics Indonesia

DB Schenker Indonesia

Kuehne + Nagel Indonesia

Bolloré Logistics Indonesia

DHL Global Forwarding

Maersk Indonesia

Players Mentioned in the Report (Warehousing):

Mega Integrated Logistics

Kerry Logistics

Kiat Ananda Cold Storage

PT Kamadjaja Logistics

Nippon Express Indonesia

DHL Supply Chain Indonesia

PT Wahana Prestasi Logistik

Players Mentioned in the Report (CEP):

JNE (Jalur Nugraha Ekakurir)

Pos Indonesia

TIKI (Titipan Kilat)

SiCepat Express

J&T Express

Ninja Van Indonesia

GO-SEND (GoJek)

SAP Express

Key Target Audience:

Logistics Service Providers

E-commerce Companies

Manufacturers

Retail Chains

Pharmaceutical Companies

FMCG Companies

Government Regulatory Bodies

Investment Firms

Industry Associations

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Macroeconomic Framework for Indonesia Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2 Logistics Sector Contribution to GDP and Its Changes in the Historical Assessment

4.3 Ease of Doing Business in Indonesia (Regulatory Reforms, Administrative Processes, Business Environment)

4.4 LPI Index of Indonesia and Improvements Over the Last 10-15 Years

4.5 Customs Procedures and Customs Charges in Indonesia Logistics Market

5.1 Landscape of Investment Parks and Free Trade Zones in Indonesia (SEZs, FTZs, Industrial Estates, Bonded Logistics Centers)

5.2 Current Scenario for Logistics Infrastructure in Indonesia

5.3 Road Infrastructure in Indonesia

5.4 Air Infrastructure in Indonesia

5.5 Sea Infrastructure in Indonesia

5.6 Rail Infrastructure in Indonesia

6.1. Basis Revenues, 2018-2024P

7. Indonesia Logistics and Warehousing Market Segmentation

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

7.1 By Segment (Freight Forwarding, Warehousing, CEP, Value-Added Services), 2018-2024P

7.2 By End User Industries, 2018-2024P

8.1 Market Overview and Genesis

8.2 Indonesia Freight Forwarding Market Size (Revenues), 2018-2024P

8.3 Indonesia 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1 By Mode of Freight Transport (Road, Sea, Air, Rail)

8.3.1.1 Price per FTK for Road/Air/Sea/Rail

8.3.1.2 Road Freight-Domestic & International (Volume, FTK, Revenues; Number of Registered Vehicles)

8.3.1.3 Road Freight-Domestic & International Corridors

8.3.1.4 Ocean Freight-Domestic & International (Volume, FTK, Revenues; Commodity Split; Sea Port Statistics)

8.3.1.5 Air Freight-Domestic & International (Volume, FTK, Revenues)

8.3.1.6 Rail Freight-Domestic & International (Volume, FTK, Revenues; Volume by Commodity & Region)

8.3.1.7 Export-Import Scenario (Value by Mode, Commodity, Country; Principal Commodities-Volume Share)

8.3.2 By Intercity Road Freight Corridors, 2018-2024P

8.3.3 By International Road Freight Corridors (China, Thailand, India), 2018-2024P

8.3.4 By End User (Industrial, FMCG, F&B, Retail, Others), 2018-2024P

8.4 Snapshot of Freight Truck Aggregators in Indonesia (Company Overview, USP, Strategies, Future Plans, Business Model, Fleet Size, Margins/Commissions, Monthly Bookings, Key Clients, Booking Value, Major Routes, Technology Stack)

8.5 Competitive Landscape in Indonesia Freight Forwarding Market

8.5.1 Heat Map of Major Players by Service Offering

8.5.2 Market Share of Major Players, 2024

8.5.3 Cross-Comparison of Major Players (Volume of Road Freight, Inception Year, Fleet Size-Owned/Subcontracted, Fleet Mix, Occupancy Rate, No. of Employees, Route Network, Key Clients, Revenues, Sea Freight Volume, Air Freight Volume, USP, Strategy, Technology), 2024

8.6 Indonesia Freight Forwarding Future Market Size, 2025-2029

8.7 Indonesia Freight Forwarding Market Future Segmentation, 2025-2029

8.7.1 By Mode of Freight Transport (Road, Sea, Air, Rail)

8.7.2 By International Road Corridors (China, Thailand, India)

8.7.3 By End User (Industrial, FMCG, F&B, Retail, Others)

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Indonesia CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Indonesia CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Indonesia CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in Indonesia CEP Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Indonesia CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Indonesia E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Indonesia CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Indonesia CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Indonesia CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

10.1 Market Overview and Genesis

10.2 Value Chain Analysis (Entities, Margins, Process Flow, Challenges)

10.3 Revenue Composition: First Mile, Mid Mile, Last Mile (Domestic & International)

10.4 Indonesia CEP Market Size (Revenues & Shipments), 2018-2024P

10.5 Indonesia CEP Market Segmentation, 2024

10.5.1 Mails & Documents, Ecommerce Shipments, Express Cargo (2023-2024P)

10.5.2 International vs Domestic Express (2023-2024P)

10.5.3 B2B, B2C, C2C (2023-2024P)

10.5.4 Segmentation by Delivery Period (2023-2024P)

10.6 Competitive Landscape in Indonesia CEP Market

10.6.1 Market Nature, Stage, Competing Parameters

10.6.2 Market Share by Revenues/Shipments, 2024

10.6.3 Market Share of Top 5 Players in Ecommerce Shipments, 2024

10.6.4 Cross Comparison of Top 10 CEP Players (Overview, USP, Strategy, Future Plans, Technology, Last-Mile Shipments, Revenues, Clients, Fleet Size, Employees, Riders, Coverage, Service Mix)

10.7 Indonesia CEP Market Size (Revenues & Shipments), 2025-2029

10.8 Indonesia CEP Future Segmentation

10.8.1 By Mail/Documents, Ecommerce, Express Cargo

10.8.2 International vs Domestic

10.8.3 B2B, B2C, C2C

10.8.4 Delivery Period

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

13.1 By Segment (Freight Forwarding, Warehousing, CEP, Value-Added Services), 2025-2029

13.2 By End User Industries, 2025-2029

13.3 Recommendation

13.4 Opportunity Analysis

6.1 Market Size Basis Revenues, 2018-2024P

9.1 Market Overview and Genesis

9.2 Value Chain Analysis (Entities, Margins, Role of Entities, Process Flow, Challenges)

9.3 Market Size (Revenues & Warehousing Space), 2018-2024P

9.4 Indonesia Warehousing Market Segmentation

9.4.1 Revenue by Business Model (Industrial/Retail, ICD/CFS, Cold Storage), 2018-2024P

9.4.2 By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient, Bonded), 2018-2024P

9.4.3 Revenue by End User (Industrial & Construction, FMCG, Retail, F&B, Others), 2018-2024P

9.4.4 3PL Warehousing Space by Region, 2024P

9.5 Competitive Landscape in Indonesia Warehousing Market

9.5.1 Market Share of Top 10 Companies, 2024

9.5.2 Cross Comparison of Top 10 Warehouse Operators (Overview, USP, Strategy, Future Plans, Technology, Warehousing Revenues, No. of Warehouses, Space, Locations, Warehouse Types, Occupancy Rate, Rentals, Key Clients), 2024

9.6 Indonesia Warehousing Future Market Size, 2025-2029

9.7 Future Segmentation

9.7.1 Revenue by Business Model, 2025-2029

9.7.2 Revenue by Type of Warehouse, 2025-2029

9.7.3 Revenue by End User, 2025-2029

11.1 Customer Cohort Analysis & End User Paradigm (Telecom, FMCG, Automotive, Apparel, F&B, Construction, Pharma)

11.2 Logistics Spend by End User, 2023-2024P

11.3 In-house vs Outsourced Logistics Preference (By Company Size)

11.4 Major Logistics Companies Specializing by End User Vertical

11.5 Detailed End-User Landscape

12.1 Market Size Basis Revenues, 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand and supply-side entities for the Indonesia Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 service providers in the country based on their financial information, service capacity, and volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the revenue, number of market players, service capacity, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various companies in the Indonesia Logistics and Warehousing Market and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate volume and revenue for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity check process.

FAQs

01 What is the potential for the Indonesia Logistics and Warehousing Market?

The Indonesia logistics and warehousing market is poised for substantial growth, reaching a valuation of IDR 150 Trillion in 2023. This growth is driven by factors such as the expansion of e-commerce, industrialization, and infrastructure development. The market's potential is further bolstered by government initiatives and increased investment in the sector.

02 Who are the Key Players in the Indonesia Logistics and Warehousing Market?

The Indonesia Logistics and Warehousing Market features several key players, including JNE Express, TIKI, and DHL Supply Chain. These companies dominate the market due to their extensive distribution networks, strong brand presence, and comprehensive logistics solutions. Other notable players include Kuehne + Nagel and Siba Surya.

03 What are the Growth Drivers for the Indonesia Logistics and Warehousing Market?

The primary growth drivers include the rapid expansion of the e-commerce sector, government infrastructure projects, and increasing demand from key industries such as retail, manufacturing, and FMCG. Additionally, the adoption of advanced technologies and the development of new logistics facilities are expected to further drive market growth.

04 What are the Challenges in the Indonesia Logistics and Warehousing Market?

The Indonesia Logistics and Warehousing Market faces several challenges, including regulatory complexity, infrastructure bottlenecks, and a shortage of skilled labor. Navigating the vast and diverse geography of Indonesia also poses significant logistical challenges, particularly in remote and underdeveloped regions.